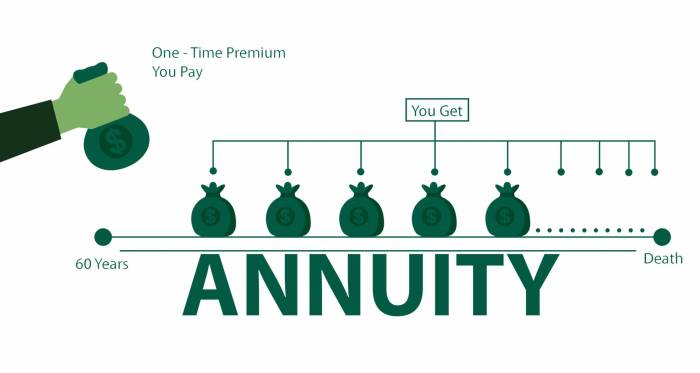

Immediate Lifetime Annuity – Immediate Lifetime Annuities offer a compelling solution for individuals seeking a secure and predictable income stream throughout their retirement years. This type of annuity provides a guaranteed stream of payments for life, regardless of how long you live, offering a sense of financial security and peace of mind.

L shares are a type of variable annuity that can be purchased through FINRA member firms. You can learn more about L Share Variable Annuity Finra by contacting a financial advisor.

Ima

It’s essential to understand the value of an annuity before investing. You can use an online annuity value calculator to get an estimate of the current value of your annuity.

gine receiving a regular, fixed payment every month, knowing that your income is protected from market fluctuations and longevity risk.

The Rava 5 Select Variable Annuity offers the potential for growth, but it also carries risk. It’s crucial to understand the risks and rewards before making any investment decisions.

Immediate Lifetime Annuities function by converting a lump sum of money into a series of regular payments, typically paid monthly. The amount of the payment is determined by factors such as the size of the lump sum, your age, health, and gender.

Once you purchase an Immediate Lifetime Annuity, you receive a guaranteed income for the rest of your life, regardless of how long you live. This makes it a particularly attractive option for those who are concerned about outliving their savings or experiencing market volatility in their retirement years.

Contents List

- 1 What is an Immediate Lifetime Annuity?

- 2 Benefits of an Immediate Lifetime Annuity

- 3 Considerations for an Immediate Lifetime Annuity

- 4 Types of Immediate Lifetime Annuities

- 5 Factors Influencing Annuity Payments

- 6 Tax Implications of Immediate Lifetime Annuities

- 7 Choosing the Right Immediate Lifetime Annuity

- 8 Closing Summary

- 9 FAQ Insights: Immediate Lifetime Annuity

What is an Immediate Lifetime Annuity?

An immediate lifetime annuity is a type of annuity that provides a guaranteed stream of income for the rest of your life, starting immediately after you purchase it. This means that you receive regular payments, typically monthly, for as long as you live.

Understanding the Concept

Imagine you have a lump sum of money that you want to turn into a reliable income stream. An immediate lifetime annuity allows you to do just that. You give the insurance company a lump sum, and in return, they promise to pay you a fixed amount of money each month, for the rest of your life.

Immediate annuities provide a guaranteed income stream for life, but they often come with fees. It’s important to be aware of the expenses, fees, or charges associated with an immediate annuity to make an informed decision.

This provides a predictable and secure source of income, regardless of how long you live.

Getting quotes from multiple providers can help you find the best annuity for your needs. You can find annuity quotes from Canadian providers online or by contacting an insurance broker.

Examples of How Immediate Lifetime Annuities Work

Let’s say you have $100,000 saved up. You can purchase an immediate lifetime annuity with that amount, and the insurance company might agree to pay you $5,000 per year, or roughly $417 per month, for the rest of your life.

The exact amount you receive will depend on factors like your age, health, and the current interest rates.

Comparison with Other Annuities

Immediate lifetime annuities differ from other types of annuities in several ways:

- Deferred Annuities:These annuities provide income payments at a future date, typically after a specified period. Immediate lifetime annuities, on the other hand, start paying out immediately.

- Variable Annuities:These annuities offer the potential for growth, but also carry the risk of losing money. Immediate lifetime annuities provide a guaranteed income stream, with no risk of losing your principal.

Benefits of an Immediate Lifetime Annuity

Immediate lifetime annuities offer several benefits, making them an attractive option for individuals looking for a secure and predictable income stream in retirement.

Guaranteed Income Stream, Immediate Lifetime Annuity

One of the key advantages of immediate lifetime annuities is the guaranteed income stream they provide. You can rest assured that you will receive regular payments, regardless of how long you live. This can be particularly beneficial for retirees who want to avoid the risk of outliving their savings.

Protection Against Longevity Risk

As people live longer, the risk of outliving their savings becomes a significant concern. Immediate lifetime annuities can help mitigate this risk by providing a lifelong income stream, ensuring that you have financial security even if you live to a very old age.

Peace of Mind

Knowing that you have a guaranteed income stream can provide peace of mind and reduce financial stress in retirement. You can focus on enjoying your retirement knowing that your basic needs are taken care of.

Considerations for an Immediate Lifetime Annuity

While immediate lifetime annuities offer several benefits, it’s essential to consider some potential downsides and risks before making a decision.

Factors to Consider

Before purchasing an immediate lifetime annuity, consider factors such as:

- Your financial goals:Determine whether an immediate lifetime annuity aligns with your overall financial plan and retirement objectives.

- Your age and health:Younger and healthier individuals generally receive lower annuity payments, as they are expected to live longer.

- Your risk tolerance:Immediate lifetime annuities are a conservative investment option, offering guaranteed income but limited growth potential.

- Your investment horizon:Consider how long you expect to live and whether the annuity payments will meet your needs over that time.

Potential Risks

There are some risks associated with immediate lifetime annuities:

- Interest rate risk:If interest rates rise after you purchase an annuity, the value of your annuity payments may decline.

- Inflation risk:The purchasing power of your annuity payments may erode over time due to inflation.

- Longevity risk:While immediate lifetime annuities offer lifelong income, the payments may not be sufficient if you live much longer than average.

Both variable and indexed annuities offer potential for growth, but they have different risk profiles. The Variable Annuity Vs Indexed Annuity page compares these two types of annuities to help you make the best choice for your needs.

Pros and Cons

Here’s a quick summary of the pros and cons of immediate lifetime annuities:

- Pros:

- Guaranteed income stream

- Protection against longevity risk

- Peace of mind

- Cons:

- Interest rate risk

- Inflation risk

- Limited growth potential

Annuity products are available in Hong Kong. If you’re considering purchasing an annuity in Hong Kong, you can learn more about Annuity Hk on the Hong Kong Insurance Authority website.

Types of Immediate Lifetime Annuities

There are various types of immediate lifetime annuities, each with its own features, benefits, and risks. Understanding these differences is crucial for choosing the right annuity for your specific needs.

The M&E Variable Annuity is a popular choice for investors seeking growth potential. However, it’s important to understand the risks involved before investing.

Comparison Table

Here’s a table comparing different types of immediate lifetime annuities:

| Type | Features | Benefits | Risks |

|---|---|---|---|

| Single Life Annuity | Payments continue for the life of the annuitant. | Higher payments compared to joint and survivor annuities. | Payments cease upon the death of the annuitant. |

| Joint and Survivor Annuity | Payments continue for the life of both annuitants, and then to the surviving annuitant. | Provides income for both spouses during their lifetimes. | Lower payments compared to single life annuities. |

| Guaranteed Period Annuity | Payments are guaranteed for a minimum period, even if the annuitant dies before the period ends. | Provides a safety net for beneficiaries. | Lower payments compared to single life annuities. |

| Indexed Annuity | Payments are linked to the performance of a specific index, such as the S&P 500. | Potential for growth to outpace inflation. | Limited upside potential compared to variable annuities. |

Payment Options

Immediate lifetime annuities offer various payment options, including:

- Monthly payments:The most common payment option, providing a steady income stream.

- Quarterly payments:Payments are made four times a year.

- Annual payments:Payments are made once a year.

- Lump sum payment:A single payment is made at the beginning of the annuity period.

You can use an online calculator to help you calculate your annuity income. This will give you a better understanding of how much you can expect to receive each year.

Joint and Survivor Annuities

A joint and survivor annuity provides payments for the lifetime of two individuals, typically a couple. Payments continue for the life of the first annuitant to die and then continue to the surviving annuitant for the rest of their life.

This option provides income security for both spouses.

Knowing how variable annuities are treated for tax purposes is important. The Variable Annuity Tax Qualification page provides information on how these annuities are taxed, so you can plan accordingly.

Factors Influencing Annuity Payments

Several factors influence the amount of annuity payments you receive. Understanding these factors can help you make informed decisions about purchasing an annuity.

If you have questions about annuities, there are plenty of resources available. The Annuity Questions And Answers page provides answers to common questions about annuities.

Interest Rates

Interest rates play a significant role in determining annuity payments. When interest rates are high, insurance companies can offer higher annuity payments, as they can earn a greater return on their investments. Conversely, when interest rates are low, annuity payments tend to be lower.

Age, Health, and Gender

Your age, health, and gender can also influence annuity payments. Younger and healthier individuals generally receive lower payments, as they are expected to live longer. Women tend to receive lower payments than men, as they typically have a longer life expectancy.

Tax Implications of Immediate Lifetime Annuities

Understanding the tax implications of immediate lifetime annuities is crucial for making informed financial decisions.

Tax Treatment of Annuity Payments

Annuity payments are generally taxed as ordinary income. The portion of each payment that represents a return of your principal is tax-free, while the remaining portion is taxable.

Annuity investments can be a great way to generate a steady income stream in retirement, but they aren’t right for everyone. To decide if an annuity is a good fit for you, consider your financial goals and risk tolerance.

Read more about whether an annuity is a good investment for you.

Tax Advantages and Disadvantages

Immediate lifetime annuities can offer some tax advantages, such as:

- Tax deferral:The growth of your annuity principal is generally tax-deferred until you start receiving payments.

- Favorable tax treatment of payments:The tax-free portion of your payments can help reduce your overall tax liability.

If you’re in the UK and considering an annuity, you might want to use the Annuity Calculator from Gov.UK. This free tool can help you compare different annuity options and see how much income you could receive.

Tax Implications for Different Types of Annuities

The tax implications of immediate lifetime annuities can vary depending on the type of annuity. For example, indexed annuities may have different tax treatment than single life annuities.

Choosing the Right Immediate Lifetime Annuity

Choosing the right immediate lifetime annuity requires careful consideration and research. Here’s a checklist of questions to ask when evaluating different annuity options:

Checklist of Questions

- What are the guaranteed payment amounts and durations?

- What are the interest rate assumptions used to calculate payments?

- What are the fees and expenses associated with the annuity?

- What are the tax implications of the annuity?

- What are the surrender charges and penalties for withdrawing funds before the annuity period ends?

- What are the death benefits provided by the annuity?

- What are the financial strength and reputation of the insurance company issuing the annuity?

Jackson National Life offers a variety of variable annuity products. You can learn more about the Variable Annuity Jackson offers on their website.

Resources for Research and Comparison

Several resources can help you research and compare immediate lifetime annuities:

- Financial advisors:A qualified financial advisor can provide personalized guidance and recommendations.

- Insurance companies:You can contact insurance companies directly to request quotes and information about their annuity products.

- Independent websites:Websites like Annuity.org and ImmediateAnnuities.com offer comprehensive information and comparison tools.

Figuring out how much you’ll receive from an annuity can be tricky, especially with all the different types available. Luckily, you can use an online tool to help you calculate annuity cash flows based on your specific needs and circumstances.

Consultation with a Financial Advisor

It’s highly recommended to consult with a financial advisor before purchasing an immediate lifetime annuity. A financial advisor can help you assess your individual needs, goals, and risk tolerance, and recommend the most appropriate annuity option for your situation.

Closing Summary

Immediate Lifetime Annuities offer a powerful tool for individuals seeking a secure and predictable income stream in retirement. By converting a lump sum into a guaranteed lifetime income stream, you can eliminate the worry of outliving your savings and protect yourself from market volatility.

While there are factors to consider, such as interest rates and potential tax implications, the benefits of a guaranteed income for life can be significant. If you are considering an Immediate Lifetime Annuity, consult with a financial advisor to determine if it aligns with your individual financial goals and risk tolerance.

FAQ Insights: Immediate Lifetime Annuity

How much income can I expect from an Immediate Lifetime Annuity?

The amount of income you receive will depend on several factors, including the size of your lump sum, your age, health, and gender. Consult with a financial advisor to get a personalized estimate of your potential income stream.

What happens if I die before I receive all of my annuity payments?

In most cases, the payments will cease upon your death. However, you can choose a joint and survivor annuity option, which guarantees payments to your beneficiary for a specific period of time or for the rest of their life.

Are there any fees associated with Immediate Lifetime Annuities?

Yes, there may be fees associated with purchasing and managing an Immediate Lifetime Annuity. These fees can vary depending on the provider and the specific annuity you choose. It is important to carefully review the fees associated with any annuity before purchasing it.