Immediate Needs Annuity Examples provide a clear picture of how these financial products can be used to address immediate financial needs. An immediate needs annuity is a type of insurance contract that provides a guaranteed stream of income payments starting immediately after the purchase.

Choosing the right variable annuity can be a daunting task, but our guide on Best Variable Annuity Products 2024 can help you navigate the market. Before making a decision, get a personalized quote to see how these products fit your financial goals.

Check out our guide on Variable Annuity Quote 2024 for helpful tips.

These annuities can be a valuable tool for individuals seeking a secure and predictable income stream, particularly in retirement or during periods of unexpected financial hardship.

Immediate needs annuities offer a variety of features and benefits, including guaranteed payments, tax-deferred growth, and potential protection from market volatility. However, it’s crucial to carefully consider the terms and conditions of the annuity contract, as well as the potential risks and limitations, before making a decision.

Contents List

What is an Immediate Needs Annuity?

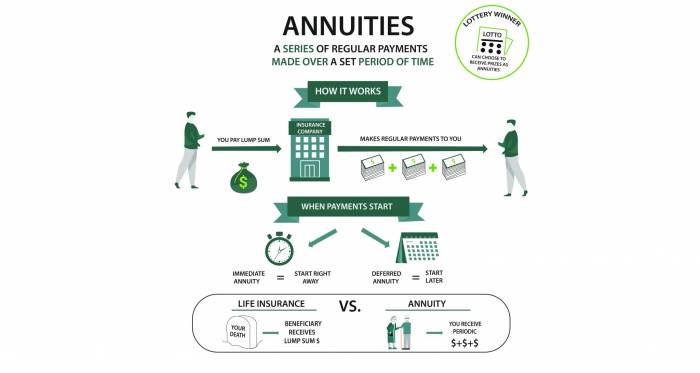

An immediate needs annuity, also known as an immediate annuity, is a type of insurance product that provides a guaranteed stream of income payments starting immediately after purchase. It’s designed for individuals who need a reliable source of income for living expenses, healthcare costs, or other financial obligations.

Immediate needs annuities are typically purchased with a lump sum of money, which is then converted into a series of regular payments. These payments can be structured to last for a fixed period, such as 10 years, or for the lifetime of the annuitant, the person receiving the payments.

A single premium variable annuity can be a great way to invest a lump sum. Our guide on G Purchased A $50 000 Single Premium 2024 provides helpful information. Annuity contracts have specific features and characteristics. Learn more about them in our guide on An Annuity Is Known 2024.

Immediate needs annuities are often used by retirees or individuals who have received a large sum of money, such as an inheritance or a life insurance payout, and need a predictable income stream.

Purpose and Features

Immediate needs annuities serve the primary purpose of providing a guaranteed income stream for a specified period or lifetime. Their key features include:

- Guaranteed Payments:The payments are guaranteed by the insurance company, regardless of market fluctuations or investment performance.

- Immediate Income:Payments begin immediately after the annuity is purchased, providing instant access to income.

- Flexible Payment Options:You can choose between various payment structures, such as fixed monthly payments, lump sum payments, or a combination of both.

- Tax-Deferred Growth:The earnings on the annuity are tax-deferred, meaning they are not taxed until the payments are received.

Comparison with Other Annuities

Immediate needs annuities differ from other types of annuities in several key ways:

- Deferred Annuities:Deferred annuities are purchased with a lump sum, but the payments are delayed until a later date, often during retirement. These annuities allow for potential investment growth before payments begin.

- Variable Annuities:Variable annuities offer the potential for higher returns, but the payments are not guaranteed and can fluctuate based on market performance.

- Indexed Annuities:Indexed annuities offer returns linked to a specific market index, such as the S&P 500. They provide some protection against market downturns, but their growth potential is limited.

Benefits and Drawbacks

Immediate needs annuities offer several benefits, but they also come with certain drawbacks:

- Benefits:

- Guaranteed income stream

- Immediate access to funds

- Tax-deferred growth

- Protection against market volatility

- Drawbacks:

- Lower potential returns compared to investments

- Loss of principal if the annuitant dies before receiving all payments

- Limited flexibility to withdraw funds

- Potential for higher fees than other annuity types

How Immediate Needs Annuities Work

Purchasing an immediate needs annuity involves a straightforward process:

- Contact an insurance company:You’ll need to contact an insurance company that offers immediate needs annuities.

- Provide information:You’ll provide information about your age, health, and desired payment structure.

- Choose a payment option:You’ll select the type of payment you want, such as a fixed monthly amount or a lump sum.

- Fund the annuity:You’ll make a lump sum payment to the insurance company to purchase the annuity.

- Receive payments:Once the annuity is purchased, you’ll begin receiving regular payments according to the agreed-upon schedule.

Payment Calculation

The amount of the immediate needs annuity payments is calculated based on several factors:

- Annuitant’s age:Younger annuitants receive lower payments because they are expected to live longer and receive more payments.

- Annuity purchase amount:The larger the lump sum invested, the higher the payments will be.

- Interest rates:Current interest rates influence the payout amount. Higher interest rates generally result in higher payments.

- Payment structure:The payment structure, such as a fixed period or lifetime payments, also affects the payout amount.

Factors Influencing Payout Amount

In addition to the factors mentioned above, other elements can influence the payout amount:

- Gender:Women typically receive lower payments than men because they tend to live longer.

- Health status:Individuals with health conditions may receive lower payments because they are expected to live shorter lives.

- Inflation:Inflation can erode the purchasing power of annuity payments over time.

Types of Immediate Needs Annuities

There are various types of immediate needs annuities available, each with its own features and benefits:

- Single Premium Immediate Annuity (SPIA):This is the most common type of immediate needs annuity. It involves a single lump sum payment in exchange for guaranteed payments for a fixed period or lifetime.

- Fixed Annuity:A fixed annuity provides a guaranteed fixed payment amount for a specified period or lifetime. The payment amount does not fluctuate with market conditions.

- Variable Annuity:A variable annuity offers the potential for higher returns, but the payments are not guaranteed and can fluctuate based on market performance. This type of annuity is not typically considered an immediate needs annuity.

- Indexed Annuity:An indexed annuity offers returns linked to a specific market index, such as the S&P 500. The payments are not guaranteed, but they provide some protection against market downturns. This type of annuity is not typically considered an immediate needs annuity.

Features and Benefits of Different Types

Each type of immediate needs annuity has its own unique features and benefits:

- SPIA:Offers guaranteed payments, immediate income, and tax-deferred growth. It’s suitable for individuals seeking a reliable income stream.

- Fixed Annuity:Provides a predictable income stream with guaranteed payments. It’s suitable for individuals who prefer stability and certainty.

- Variable Annuity:Offers the potential for higher returns, but payments are not guaranteed. It’s suitable for individuals with a higher risk tolerance and a longer time horizon.

- Indexed Annuity:Offers returns linked to a market index, providing some protection against market downturns. It’s suitable for individuals seeking a balance between potential growth and downside protection.

Examples of Specific Products

Insurance companies offer a wide range of immediate needs annuity products. Here are a few examples:

- XYZ Life Insurance Company:Offers a SPIA product with guaranteed payments for life or a fixed period. The product features a variety of payment options and a competitive interest rate.

- ABC Financial Group:Provides a fixed annuity product with a guaranteed fixed payment amount for a specified period. The product offers a higher interest rate compared to other fixed annuities.

Immediate Needs Annuity Examples

To illustrate how immediate needs annuities work, let’s consider a hypothetical scenario:

Case Study

John, a 65-year-old retiree, has received a $500,000 inheritance from his late aunt. He wants to use this money to supplement his retirement income and cover his living expenses. John decides to purchase a single premium immediate annuity (SPIA) with a guaranteed payment for life.

He chooses a payment option that provides him with a monthly income of $3,000.

Before committing to an annuity, it’s important to take advantage of the free look period. Our guide on Annuity 30 Day Free Look 2024 explains this important feature in detail.

In this case, John’s immediate needs annuity provides him with a reliable income stream that he can count on for the rest of his life. The guaranteed payments ensure that he has a steady source of income, regardless of market fluctuations or investment performance.

Hypothetical Scenario

Sarah, a 55-year-old woman, has been diagnosed with a chronic illness that requires expensive medical treatments. She has saved $200,000 over the years and wants to use this money to cover her medical expenses. Sarah decides to purchase a fixed annuity with a guaranteed payment for 10 years.

She chooses a payment option that provides her with a monthly income of $2,500.

Many people wonder if an annuity is the same as a pension. Our guide on Is Annuity Same As Pension 2024 can help clarify any confusion. Understanding the formula for annuity certain is essential for calculating annuity payments. Check out our guide on Formula Annuity Certain 2024 to learn more.

In this scenario, Sarah’s immediate needs annuity provides her with a predictable income stream to cover her medical expenses for the next 10 years. The guaranteed payments ensure that she has a steady source of income to pay for her medical treatments.

Table of Potential Payouts

| Age | Investment Amount | Interest Rate | Monthly Payment |

|---|---|---|---|

| 60 | $100,000 | 4% | $500 |

| 65 | $200,000 | 5% | $1,200 |

| 70 | $300,000 | 6% | $2,100 |

The table above shows the potential monthly payments for different immediate needs annuity options based on varying factors such as age, investment amount, and interest rates. It’s important to note that these are just hypothetical examples, and actual payouts may vary depending on the specific annuity product and the individual’s circumstances.

Understanding the life expectancy of the annuitant is crucial when purchasing an annuity. Our guide on When An Annuity Is Written Whose Life 2024 provides valuable insights. Variable annuities offer a range of options to suit your individual needs.

Explore our guide on Variable Annuity Options 2024 to learn more.

Considerations When Choosing an Immediate Needs Annuity

When choosing an immediate needs annuity, it’s essential to consider several key factors:

- Financial needs:Determine your current and future financial needs, such as living expenses, healthcare costs, or debt payments.

- Time horizon:Consider how long you need the income stream, such as for a fixed period or for the rest of your life.

- Risk tolerance:Assess your risk tolerance and whether you prefer a guaranteed income stream or the potential for higher returns.

- Fees and expenses:Compare the fees and expenses associated with different annuity products to ensure you’re getting a good value for your investment.

Financial Suitability, Immediate Needs Annuity Examples

It’s crucial to assess the financial suitability of an immediate needs annuity for your individual needs. Consider factors such as:

- Income sources:Evaluate your other sources of income, such as retirement savings, Social Security, or part-time work.

- Expenses:Determine your current and future expenses, including fixed expenses, variable expenses, and unexpected expenses.

- Financial goals:Consider your short-term and long-term financial goals and how an immediate needs annuity can help you achieve them.

Risks and Limitations

Immediate needs annuities come with certain risks and limitations:

- Loss of principal:If the annuitant dies before receiving all payments, the remaining principal is not returned to the beneficiaries.

- Limited flexibility:It can be difficult to withdraw funds from an immediate needs annuity without penalties.

- Inflation risk:Inflation can erode the purchasing power of annuity payments over time.

- Interest rate risk:Changes in interest rates can affect the payout amount.

Immediate Needs Annuity vs. Other Income Options

Immediate needs annuities are just one of many income options available to individuals. Here’s a comparison with other popular choices:

- Retirement savings withdrawals:This option provides flexibility but lacks the guaranteed income stream of an annuity. It’s also subject to market volatility and tax implications.

- Social Security:Social Security provides a guaranteed income stream, but it’s typically not enough to cover all living expenses. It’s also subject to changes in government policy.

- Part-time work:This option provides flexibility and income, but it can be physically demanding and may not be suitable for everyone.

Pros and Cons of Each Option

Each income option has its own pros and cons:

- Immediate needs annuities:

- Pros:Guaranteed income stream, immediate access to funds, tax-deferred growth.

- Cons:Lower potential returns, loss of principal if the annuitant dies before receiving all payments, limited flexibility to withdraw funds.

- Retirement savings withdrawals:

- Pros:Flexibility, potential for higher returns.

- Cons:Subject to market volatility, tax implications.

- Social Security:

- Pros:Guaranteed income stream, no investment risk.

- Cons:May not be enough to cover all living expenses, subject to changes in government policy.

- Part-time work:

- Pros:Flexibility, income, potential for new skills.

- Cons:Physically demanding, may not be suitable for everyone, limited time for other activities.

Advantages and Disadvantages

The advantages and disadvantages of each income source should be carefully considered before making a decision. It’s important to choose an option that aligns with your individual financial needs, risk tolerance, and goals.

If you’re using Excel to calculate annuity present values, you’ll want to make sure you’re using the correct formula. Our guide on Pv Annuity Excel 2024 provides helpful insights. It’s also important to understand the tax implications of annuity payments.

Check out our guide on Is Annuity Payments Taxable 2024 to learn more.

Summary

Immediate needs annuities can be a valuable tool for individuals seeking a secure and predictable income stream. Understanding the different types of immediate needs annuities available, the factors that influence payout amounts, and the potential risks and limitations associated with these products is essential for making an informed decision.

Quick FAQs

What are the tax implications of immediate needs annuities?

Annuity contracts can offer flexibility in how you receive payments. Learn more about the flexibility of annuities in our guide on Is Annuity Flexible 2024. Calculating annuity present values is a key step in understanding the value of your investment.

Our guide on Calculating Annuity Present Values 2024 provides helpful tips.

The income payments from an immediate needs annuity are generally taxed as ordinary income. However, the growth of the annuity contract is tax-deferred, meaning that you won’t pay taxes on the earnings until you start receiving payments.

Can I withdraw my principal investment from an immediate needs annuity?

You may be able to withdraw your principal investment from an immediate needs annuity, but there may be penalties or restrictions depending on the terms of the contract. It’s important to review the contract carefully before making any withdrawals.

Variable annuities are a popular investment option, but it’s important to understand how they compare to other options. Our guide on Variable Annuity Vs Variable Life Insurance 2024 can help you make an informed decision. You’ll also want to familiarize yourself with the different types of variable annuities available.

Explore our guide on 2 Types Of Variable Annuity 2024 to learn more.

What are some of the risks associated with immediate needs annuities?

Some risks associated with immediate needs annuities include the potential for lower-than-expected payouts, the possibility of outliving your annuity payments, and the risk of losing your principal investment if the insurance company becomes insolvent.