Interest Rates Mortgage Rates 2024 are a hot topic for anyone considering buying a home. The current landscape is dynamic, with interest rates fluctuating and impacting affordability. Understanding these fluctuations is crucial for making informed decisions in today’s market.

If you’re a veteran looking to purchase a home, you’re eligible for special financing options through the VA loan program. The VA loan program offers unique benefits and advantages, and you can learn more about the program and its current offerings by visiting Veteran Home Loan 2024.

This website provides a comprehensive overview of the VA loan program and its eligibility requirements.

This guide will explore the factors driving interest rate movements, analyze historical trends, and provide insights into potential future scenarios. We’ll also discuss strategies for navigating the current market, including tips for securing the best possible mortgage rates.

If you’re looking for information on reverse mortgages, you’ve come to the right place. AAG is a leading provider of reverse mortgages, and you can find out more about their offerings for 2024 by checking out Aag Reverse Mortgage 2024.

This website will give you all the details you need to make an informed decision about whether a reverse mortgage is right for you.

Contents List

Current Interest Rate Landscape

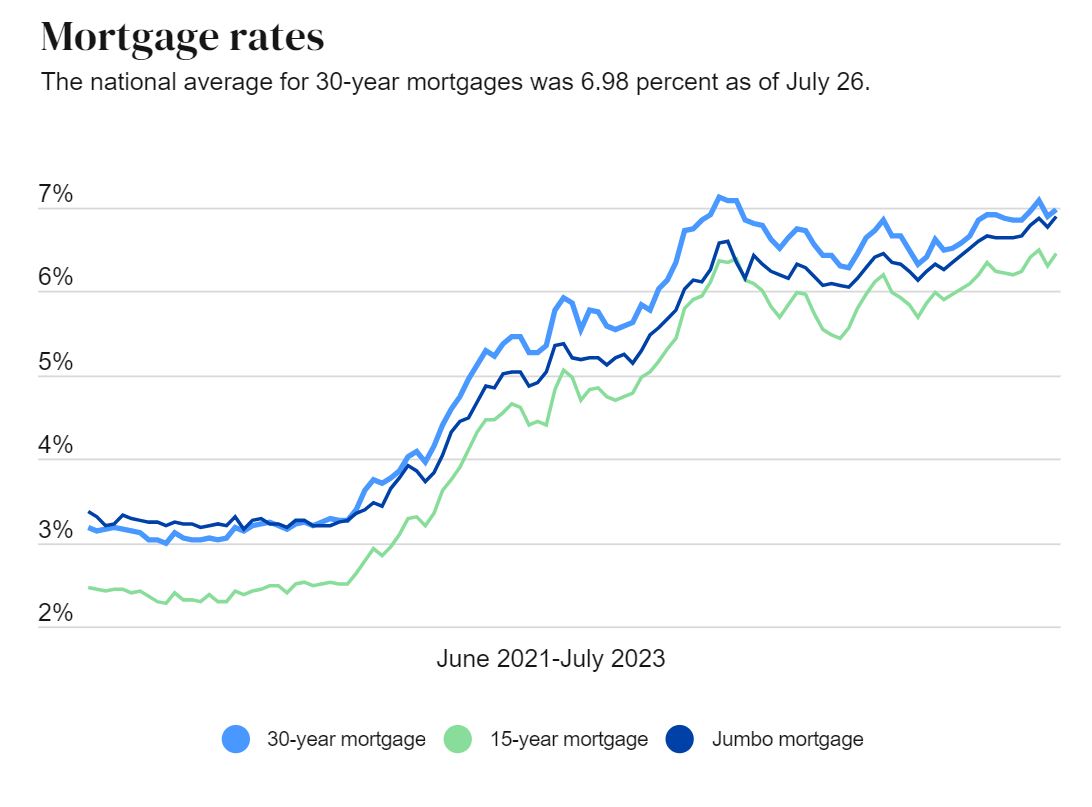

The mortgage rate landscape in 2024 is characterized by a dynamic interplay of economic factors. Interest rates have been on an upward trajectory, significantly impacting the cost of borrowing for homebuyers. This trend can be attributed to various factors, including inflation, Federal Reserve policy, and investor sentiment.

Navigating the home buying process can be a daunting task, especially for first-time buyers. Fortunately, there are many great mortgage lenders out there who cater specifically to first-time buyers. You can find a comprehensive list of the best mortgage lenders for first-time buyers in 2024 at Best Mortgage Lenders For First Time Buyers 2024 , so you can start your homeownership journey with confidence.

Fixed-Rate vs. Adjustable-Rate Mortgages

In this environment, homebuyers face a crucial decision: choosing between fixed-rate and adjustable-rate mortgages. Fixed-rate mortgages offer predictable monthly payments, providing certainty in a volatile market. However, they typically come with higher initial interest rates. Adjustable-rate mortgages, on the other hand, start with lower initial rates but can fluctuate over time, potentially leading to unpredictable payments.

Reverse mortgages can be a valuable option for seniors looking to access the equity in their homes. To get an understanding of the current reverse mortgage rates, you can check out Reverse Mortgage Rates 2024. This website provides detailed information on the current rates and terms, helping you make informed decisions about your reverse mortgage options.

- Fixed-Rate Mortgages:Offer stability with predictable monthly payments but often come with higher initial interest rates.

- Adjustable-Rate Mortgages:Start with lower initial rates, but rates can fluctuate over time, leading to potential payment increases.

Key Factors Influencing Interest Rates

The direction of interest rates in 2024 is influenced by several key factors:

- Inflation:High inflation rates often prompt the Federal Reserve to raise interest rates to cool down the economy and control price increases. Rising inflation generally leads to higher mortgage rates.

- Federal Reserve Policy:The Federal Reserve’s monetary policy decisions, including interest rate adjustments, play a crucial role in shaping the mortgage market.

- Economic Growth:Strong economic growth can lead to higher interest rates as investors demand higher returns on their investments.

- Investor Sentiment:Market sentiment and investor confidence can also influence interest rates. When investors are optimistic about the economy, they may be willing to accept lower returns, potentially leading to lower interest rates.

Mortgage Rate Trends and Predictions: Interest Rates Mortgage Rates 2024

Historical trends show that mortgage rates have fluctuated significantly over time, influenced by economic cycles and market conditions. Looking ahead, experts predict that interest rates will likely continue to rise in 2024, although the pace and magnitude of increases are subject to ongoing economic developments.

If you’re considering refinancing your existing mortgage, you’ll want to know the current refinance rates for a 30-year fixed mortgage. You can find this information on Refinance Rates 30 Year Fixed 2024 , which provides a detailed analysis of the current refinance rates and terms.

This website can help you determine if refinancing is a good option for your financial situation.

Historical Trends and Insights, Interest Rates Mortgage Rates 2024

Examining historical trends reveals that mortgage rates have typically followed a pattern of rising and falling in response to economic conditions. For example, during periods of economic expansion, rates have often increased as investors seek higher returns. Conversely, during economic downturns, rates have often declined as the Federal Reserve takes steps to stimulate economic growth.

Jumbo mortgages are designed for borrowers who need to finance homes exceeding the conforming loan limits. If you’re looking to purchase a high-value property, you’ll want to know the current jumbo mortgage rates. You can find this information on Jumbo Mortgage Rates 2024 , which provides a comprehensive overview of the current rates and terms for jumbo mortgages.

Expert Predictions and Forecasts

While predicting future mortgage rates with absolute certainty is impossible, experts offer insights based on current economic conditions and forecasts. Many economists anticipate that interest rates will continue to rise in 2024, but the pace and magnitude of increases are subject to ongoing economic developments.

Stay up-to-date on the latest mortgage interest rate trends by checking out Mortgage Interest Rates Today 2024. This website provides real-time updates on mortgage interest rates, allowing you to make informed decisions about your home financing. You can track the daily fluctuations and see how they impact your potential loan payments.

- Inflation Expectations:If inflation remains high or continues to rise, the Federal Reserve is likely to continue raising interest rates, which would push mortgage rates higher.

- Economic Growth:If economic growth remains strong, investors may demand higher returns, leading to higher interest rates.

- Global Economic Conditions:Global economic developments, such as geopolitical tensions or changes in international trade, can also impact interest rates.

Impact of Economic Indicators

Key economic indicators, such as inflation and unemployment, have a direct impact on mortgage rates. High inflation often leads to higher interest rates as the Federal Reserve attempts to control price increases. Conversely, low unemployment rates can indicate a strong economy, potentially leading to higher interest rates as investors demand higher returns.

An equity home loan can be a valuable tool for homeowners looking to access the equity they’ve built up in their homes. You can learn more about equity home loans and their current offerings for 2024 by visiting Equity Home Loan 2024.

This website provides a comprehensive overview of equity home loans, their eligibility requirements, and the potential benefits.

Impact of Interest Rates on Homebuyers

Rising interest rates have a significant impact on homebuyers, particularly those seeking to enter the market for the first time. Higher interest rates increase the cost of borrowing, making homeownership less affordable for many. This can create challenges for first-time homebuyers, who often face limited financial resources and may need to adjust their expectations.

When it comes to financing your dream home, understanding the different types of house loans available is crucial. You can find a comprehensive overview of the various house loans available in 2024 on House Loans 2024. This website provides information on conventional loans, FHA loans, VA loans, and more, helping you make an informed decision about the right loan for your needs.

Affordability Challenges

Higher interest rates directly impact affordability by increasing monthly mortgage payments. For example, a 1% increase in the interest rate can significantly increase the monthly payment on a 30-year fixed-rate mortgage. This can make it challenging for homebuyers to qualify for a mortgage or to afford their desired home.

Rocket Mortgage is a popular online lender known for its streamlined mortgage process and competitive rates. To stay informed about Rocket Mortgage’s current rates, you can visit Rocket Mortgage Rates Today 2024. This website provides real-time updates on Rocket Mortgage’s rates, allowing you to compare them with other lenders and make an informed decision.

First-Time Homebuyer Challenges

First-time homebuyers are particularly vulnerable to the impact of rising interest rates. They often have limited savings and may need to rely on larger mortgages. Higher interest rates can make it difficult for them to qualify for a loan or to afford the monthly payments.

Finding a reliable mortgage lender near you can be a crucial step in your home financing journey. To help you locate lenders in your area, you can use the online resource Mortgage Lenders Near Me 2024. This website allows you to search for lenders based on your location and specific needs, making it easier to find the right lender for your home financing.

Monthly Mortgage Payment Comparison

Here is a table comparing the monthly mortgage payments for different interest rates and loan amounts, assuming a 30-year fixed-rate mortgage:

| Loan Amount | Interest Rate | Monthly Payment |

|---|---|---|

| $250,000 | 5% | $1,342 |

| $250,000 | 6% | $1,500 |

| $300,000 | 5% | $1,610 |

| $300,000 | 6% | $1,800 |

Navigating the current mortgage market with high interest rates requires a strategic approach. Homebuyers can take steps to improve their financial position, explore different mortgage options, and secure the best possible rates.

Home interest rates are constantly fluctuating, making it crucial to stay informed about the current market trends. You can get a snapshot of the current home interest rates for 2024 by visiting Current Home Interest Rates 2024. This website provides valuable insights into the current market and can help you make strategic decisions for your home financing.

Tips for Securing the Best Rates

Here are some tips for homebuyers looking to secure the best possible mortgage rates:

- Improve Your Credit Score:A higher credit score typically qualifies you for lower interest rates.

- Shop Around for Rates:Compare rates from multiple lenders to find the most competitive offer.

- Consider a Shorter Loan Term:A shorter loan term, such as a 15-year mortgage, generally comes with a lower interest rate.

- Make a Larger Down Payment:A larger down payment can reduce the loan amount, potentially lowering the interest rate.

Fixed-Rate vs. Adjustable-Rate Mortgages

The choice between a fixed-rate and an adjustable-rate mortgage depends on individual circumstances and risk tolerance.

- Fixed-Rate Mortgages:Provide predictable monthly payments and protection against rising interest rates, but typically come with higher initial rates.

- Adjustable-Rate Mortgages:Offer lower initial rates, but rates can fluctuate over time, potentially leading to unpredictable payments.

Impact on the Housing Market

High interest rates have a significant impact on the housing market, potentially influencing home prices, sales volume, and inventory levels. The extent of the impact can vary depending on regional market dynamics and other economic factors.

When it comes to securing a home loan, choosing the right lender is crucial. There are many excellent home loan lenders out there, each with its unique offerings and strengths. To help you find the best lender for your specific needs, you can check out Best Home Loan Lenders 2024 , which provides an in-depth analysis of the top lenders in the market.

Potential Impact on Home Prices

Rising interest rates can slow down home price appreciation. As the cost of borrowing increases, fewer buyers are able to afford homes, potentially reducing demand and putting downward pressure on prices. However, the impact on home prices can be complex and influenced by factors such as supply and demand in specific markets.

Keeping track of current mortgage rates is essential for making informed decisions about your home financing. If you’re a veteran looking to take advantage of VA loan benefits, you’ll want to be aware of the current VA mortgage rates.

You can find up-to-date information on Current Va Mortgage Rates 2024 , which provides a detailed overview of the current rates and terms.

Effects on Sales Volume and Inventory

High interest rates can also lead to a decrease in sales volume. As fewer buyers qualify for mortgages or can afford monthly payments, the number of homes sold can decline. This can lead to an increase in inventory levels as homes remain on the market for longer periods.

Potential Shift in Market Dynamics

High interest rates can potentially shift the balance of power in the housing market. In a high-interest rate environment, sellers may need to be more flexible with pricing to attract buyers. This can create opportunities for buyers to negotiate favorable terms and find good deals.

Ultimate Conclusion

Navigating the world of interest rates and mortgage rates can be complex, but with a solid understanding of the factors at play and the strategies available, you can make informed decisions that align with your financial goals. By staying informed and seeking professional advice, you can position yourself for success in today’s dynamic housing market.

FAQ Corner

What are the main factors influencing interest rate changes in 2024?

Interest rate changes are primarily influenced by factors like inflation, economic growth, the Federal Reserve’s monetary policy, and global market conditions.

How do rising interest rates impact affordability for homebuyers?

Higher interest rates increase the cost of borrowing, leading to higher monthly mortgage payments. This can reduce the amount of home a buyer can afford, making it more challenging to enter the housing market.

What are some strategies for securing a favorable mortgage rate?

Strategies include improving your credit score, increasing your down payment, shopping around for lenders, and considering different mortgage options like fixed-rate or adjustable-rate mortgages.

For veterans seeking home financing, it’s essential to stay informed about the current VA home loan rates. You can find up-to-date information on Current Va Home Loan Rates 2024 , which provides a detailed overview of the current rates and terms for VA home loans.

This website can help you make informed decisions about your home financing options as a veteran.