Investment Property Mortgage Rates are a crucial factor for anyone looking to build a real estate portfolio. Understanding these rates is essential for making informed decisions and maximizing your returns. This guide will explore the intricacies of investment property mortgages, from the different types available to the factors that influence rates and how they impact your investment strategy.

Rocket Mortgage is a popular lender known for its online platform and streamlined process. You can easily check Rocket Mortgage rates and see if they align with your needs. Keep in mind that rates can fluctuate, so it’s always a good idea to compare offers from different lenders.

We’ll delve into current trends, analyze the impact of rates on profitability, and provide actionable strategies for securing competitive mortgage terms. Whether you’re a seasoned investor or just starting, this comprehensive guide will equip you with the knowledge and insights needed to navigate the world of investment property financing.

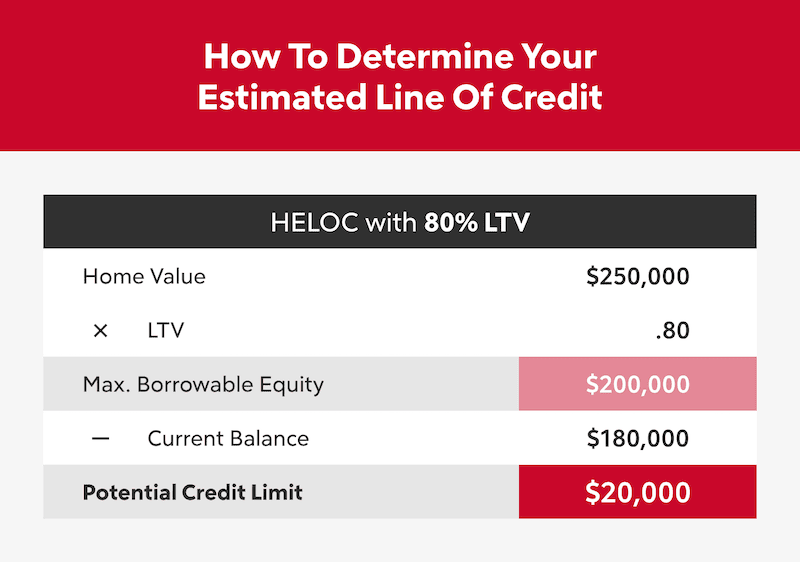

An equity loan allows you to borrow against the equity you’ve built in your home. This can be a valuable tool for home improvement projects, debt consolidation, or other financial needs. However, it’s important to carefully consider the terms and interest rates before taking on this type of loan.

Conclusion: Investment Property Mortgage Rates

In conclusion, understanding investment property mortgage rates is vital for successful real estate investing. By carefully analyzing market trends, considering your financial situation, and employing effective strategies, you can secure favorable financing terms and optimize your returns. Remember, staying informed and proactive is key to navigating the dynamic world of investment property mortgages.

Looking for a loan in your area? Finding personal loans near me can be as simple as searching online. Many lenders have a presence in local communities, offering a variety of loan options to suit your needs. Compare rates and terms to find the best fit for your situation.

Helpful Answers

What is the difference between a fixed-rate and an adjustable-rate mortgage?

Finding the best loan rates can be a challenge, but it’s essential for securing a loan that fits your financial goals. Consider factors like your credit score, loan type, and the lender’s reputation when making your decision. A little research can save you a lot of money in the long run.

A fixed-rate mortgage offers a consistent interest rate throughout the loan term, providing predictable monthly payments. An adjustable-rate mortgage (ARM) has an initial fixed rate that can change periodically based on market interest rates, potentially leading to fluctuations in your monthly payments.

For those seeking to leverage their home equity, best home equity loan rates can be found by shopping around and comparing offers. Look for lenders with competitive rates, flexible terms, and transparent fees. It’s also wise to consider your credit score and loan amount when searching for the best deals.

How do I qualify for a lower investment property mortgage rate?

When you’re looking to tap into your home’s equity, understanding home equity loan interest rates is crucial. These rates can vary greatly, so it’s important to compare offers from different lenders to find the best deal. Remember, a lower interest rate means you’ll pay less in the long run.

Improving your credit score, making a larger down payment, and demonstrating a strong financial history can all help you qualify for lower rates. Additionally, shopping around for different lenders and negotiating terms can lead to favorable financing.

What resources are available for researching current mortgage rates?

Several reputable sources provide up-to-date information on mortgage rates, including online mortgage calculators, financial news websites, and independent mortgage brokers.

Upstart is an online lender that utilizes an innovative approach to loan approval. They consider factors beyond just your credit score, allowing for more flexibility in their lending decisions. You can explore Upstart loans to see if they meet your financial requirements.

In a world of instant gratification, it’s no surprise that instant loans online are becoming increasingly popular. These loans offer quick access to funds, often with minimal paperwork. However, it’s crucial to understand the terms and interest rates before taking on an instant loan.

Dreaming of a sparkling pool in your backyard? Securing pool financing can make that dream a reality. Many lenders offer specialized loans for pool construction, allowing you to spread the cost over time. Be sure to compare rates and terms to find the best deal.

Tripoint Lending is a reputable lender that provides a range of financial services, including loans. If you’re considering a loan, you might want to explore Tripoint Lending options to see if they align with your needs. Remember to compare rates and terms with other lenders to find the best fit.

When you need a loan quickly, a fast loan advance can be a valuable option. These loans are designed to provide immediate access to funds, often with streamlined approval processes. However, it’s essential to understand the terms and interest rates before taking on a fast loan.

Hitting the open road in an RV is a dream for many. Securing RV loans can make that dream a reality. These loans are specifically designed for financing recreational vehicles, offering competitive rates and flexible terms. Compare offers from different lenders to find the best deal for your needs.

Sofi is a well-known financial services company that offers a variety of products, including loans. You can explore Sofi loans to see if they meet your requirements. They are known for their competitive rates and streamlined online application process.

When searching for the right home loan, finding the best home loan rates is essential. Compare offers from different lenders, considering factors like your credit score, loan type, and the lender’s reputation. A lower interest rate can save you a significant amount of money over the life of your loan.

Need a quick cash injection? A 5000 loan can provide the funds you need for unexpected expenses or short-term financial goals. Many lenders offer these types of loans, with varying interest rates and terms. Shop around to find the best deal for your situation.