IRA contribution limits for 2024 and Roth IRA are essential for retirement planning, offering tax advantages and flexibility. Understanding these limits, the distinctions between traditional and Roth IRAs, and the income thresholds for eligibility is crucial for maximizing your retirement savings.

Whether you’re a seasoned investor or just starting your retirement journey, this guide will provide insights into making informed decisions about your IRA contributions.

This guide will delve into the maximum contribution amounts for both traditional and Roth IRAs in 2024, highlighting the “catch-up” contributions available for individuals aged 50 and older. We’ll also explore the income limits for contributing to a Roth IRA and compare the tax benefits and implications of each type of IRA.

Contents List

Understanding IRA Contribution Limits for 2024

In 2024, you can contribute to both traditional and Roth IRAs, but there are some important limits to keep in mind. These limits are set by the IRS and can change annually.

Filling out a W9 Form can sometimes seem complicated, but it doesn’t have to be. You can find instructions on how to fill out the form for October 2024 here. With a little guidance, you can complete it easily.

Contribution Limits for Traditional and Roth IRAs in 2024

The maximum contribution amount for both traditional and Roth IRAs in 2024 is $7,000 for individuals under age 50.

The 401(k) contribution limits for 2024 are something many people are curious about. You can find the latest information on this page. It’s important to know how much you can contribute to your 401(k) to make the most of your retirement savings.

Catch-Up Contributions for Individuals Aged 50 and Older, IRA contribution limits for 2024 and Roth IRA

Individuals aged 50 and older can make additional “catch-up” contributions to their IRAs. In 2024, the catch-up contribution limit is $1,000, bringing the total maximum contribution to $8,000.

Are you over 50 and wondering about your 401(k) contribution limits for 2024? You can find the information here. Catch-up contributions can help you save even more for retirement.

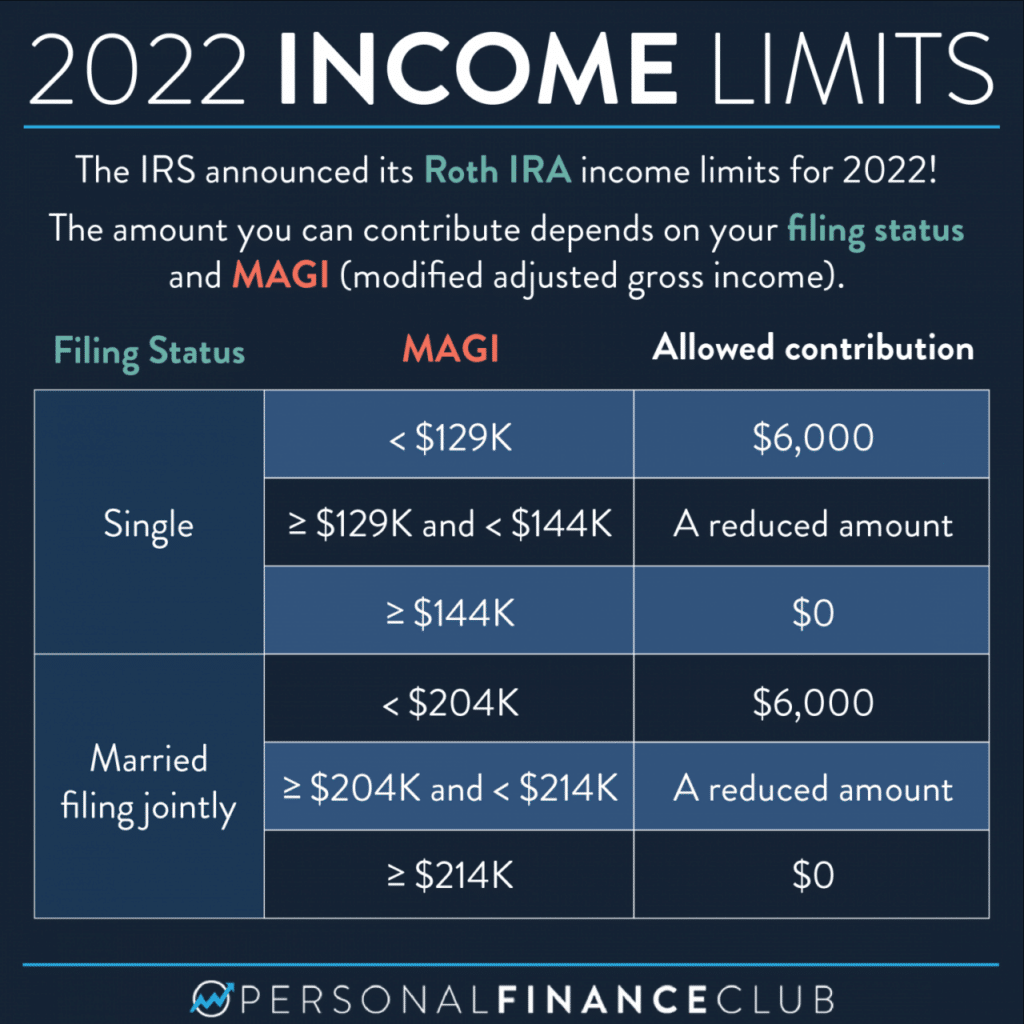

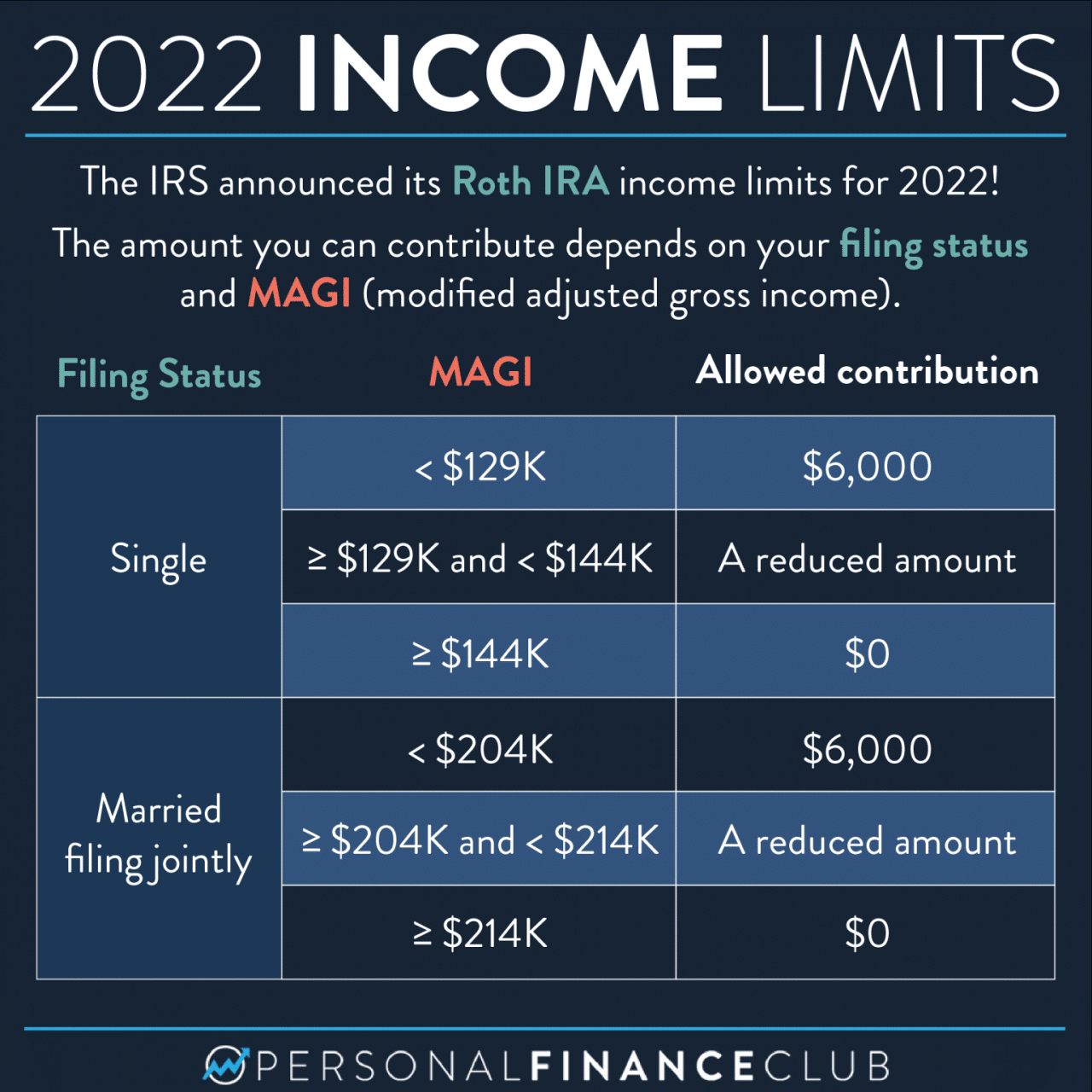

Income Limits for Contributing to a Roth IRA in 2024

There are income limits for contributing to a Roth IRA. If your modified adjusted gross income (MAGI) exceeds these limits, you cannot contribute to a Roth IRA. For 2024, the income limits are:

- Single filers: $153,000 or more

- Married filing jointly: $228,000 or more

- Head of household: $204,000 or more

It’s important to note that these income limits apply to your MAGI, which may differ from your adjusted gross income (AGI). MAGI is calculated by adding certain items back to your AGI, such as student loan interest, certain tax-exempt interest, and certain foreign income.

If you’re over 50, you might be able to contribute a little more to your IRA. Check out the contribution limits for those over 50 here. It’s a good way to catch up on your retirement savings.

Comparing Traditional and Roth IRAs

Choosing between a Traditional IRA and a Roth IRA is a crucial decision that depends on your individual financial situation and tax goals. Both types of IRAs offer tax advantages, but the timing of those benefits differs, impacting your overall retirement planning.

The Seahawks had a tough loss in Week 5, but they fought hard to come back. You can read about their efforts and the game’s outcome here. It was a close game, and the Seahawks showed some resilience.

Tax Benefits

The primary difference between Traditional and Roth IRAs lies in when you receive the tax benefits.

Planning for your retirement? It’s good to know how much you can contribute to your IRA each year. You can find the 2024 IRA contribution limits here. Knowing this information can help you make smart decisions about your savings.

- Traditional IRA:Contributions are tax-deductible in the year you make them, reducing your taxable income and potentially lowering your current tax bill. However, you’ll be taxed on your withdrawals in retirement.

- Roth IRA:Contributions are made with after-tax dollars, meaning you don’t receive a tax deduction in the year you contribute. However, your withdrawals in retirement are tax-free, providing a significant advantage in the long run.

Tax Implications of Withdrawals

The tax treatment of withdrawals in retirement is the most significant difference between Traditional and Roth IRAs.

The mileage rate is adjusted periodically, and many people are wondering when it will be updated for October 2024. You can find the latest information on the mileage rate here. It’s important to stay up-to-date on these changes.

- Traditional IRA:Withdrawals in retirement are taxed as ordinary income. This means your withdrawals will be taxed at your income tax rate at the time of withdrawal.

- Roth IRA:Withdrawals in retirement are tax-free, as long as you meet certain requirements, such as being at least 59 1/2 years old and having held the account for at least five years. This can be a significant advantage if you expect to be in a higher tax bracket in retirement.

Eligibility Requirements and Income Limitations

Both Traditional and Roth IRAs have income limitations that affect your eligibility to contribute.

If you’re wondering about the contribution limits for your traditional IRA in 2024, you can find the information here. These limits are set by the IRS and can change from year to year. It’s always good to stay informed about your retirement savings options.

- Traditional IRA:There are no income limitations for contributing to a Traditional IRA, but your tax deduction may be phased out if your income exceeds certain thresholds.

- Roth IRA:Income limitations apply to Roth IRA contributions. For 2024, if your modified adjusted gross income (MAGI) is above a certain threshold, you may not be able to contribute to a Roth IRA or your contribution may be limited.

Ending Remarks

Navigating the complexities of IRA contributions can feel daunting, but understanding the nuances and making informed choices can significantly impact your financial future. By carefully considering your individual circumstances, exploring the benefits of both traditional and Roth IRAs, and consulting with a financial advisor, you can create a retirement savings plan that aligns with your goals and aspirations.

Remember, the journey to a secure retirement starts with taking proactive steps today, and understanding IRA contribution limits is a crucial part of that journey.

FAQ Compilation: IRA Contribution Limits For 2024 And Roth IRA

What are the income limits for contributing to a Roth IRA in 2024?

The income limits for contributing to a Roth IRA in 2024 are based on your modified adjusted gross income (MAGI). If your MAGI is above a certain threshold, you may not be able to contribute to a Roth IRA, or you may be subject to a phase-out of the tax benefits.

Can I contribute to both a traditional and Roth IRA in the same year?

Yes, you can contribute to both a traditional and Roth IRA in the same year, but there are contribution limits that apply to both types of IRAs combined.

What happens if I withdraw money from my IRA before age 59 1/2?

Withdrawals from a traditional IRA before age 59 1/2 are generally subject to a 10% early withdrawal penalty, in addition to your regular income tax rate. However, there are some exceptions to this rule, such as for certain medical expenses or first-time home purchases.

What are the tax implications of withdrawing funds from a Roth IRA in retirement?

Withdrawals from a Roth IRA in retirement are generally tax-free, as long as the contributions were made after the Roth IRA was established and the withdrawals are considered qualified distributions.

If you’re dealing with an estate, you’ll need to know how to fill out a W9 Form. You can find specific instructions for estates on the W9 Form for October 2024 here. It’s important to follow the guidelines for estates to ensure accuracy.

Tax brackets can vary depending on your filing status. If you’re filing as head of household, you can find the tax brackets for 2024 here. Understanding your tax bracket can help you plan your finances.

The tax deadline for self-employed individuals can be different than for those who work for someone else. You can find the deadline for October 2024 here. It’s important to meet this deadline to avoid penalties.

If you’re over 50, you might be eligible for catch-up contributions to your IRA. You can find the IRA contribution limits for those over 50 in 2024 here. These contributions can help you boost your retirement savings.

Foreign entities may have different requirements when filling out a W9 Form. You can find specific instructions for foreign entities on the W9 Form for October 2024 here. It’s essential to complete the form correctly to avoid any issues.

If you’re donating to charity and using your car for transportation, you’ll need to know the mileage rate. You can find the October 2024 mileage rate for charitable donations here. This rate can help you determine the value of your contribution.

The tax brackets for single filers can impact your tax liability. You can find the tax brackets for single filers in 2024 here. Understanding your tax bracket can help you make informed financial decisions.