IRA contribution limits for 2024 by age are a crucial aspect of retirement planning, offering tax advantages and the potential for substantial savings. Understanding these limits, particularly how they vary with age, is essential for maximizing contributions and achieving financial security in retirement.

The annual contribution limit for traditional and Roth IRAs in 2024 is $6,500 for individuals under 50. However, those aged 50 and over can contribute an additional $1,000, bringing their total contribution limit to $7,500. These catch-up contributions are designed to help older individuals make up for lost time and build a more substantial retirement nest egg.

Contents List

IRA Contribution Limits for 2024

Individual Retirement Accounts (IRAs) are popular retirement savings vehicles that offer tax advantages. The annual contribution limit for IRAs is set by the IRS and can change from year to year. This article discusses the IRA contribution limits for 2024.

IRA contribution limits are important to understand, especially if you’re planning for retirement. You can find the latest information on this page.

IRA Contribution Limits for 2024

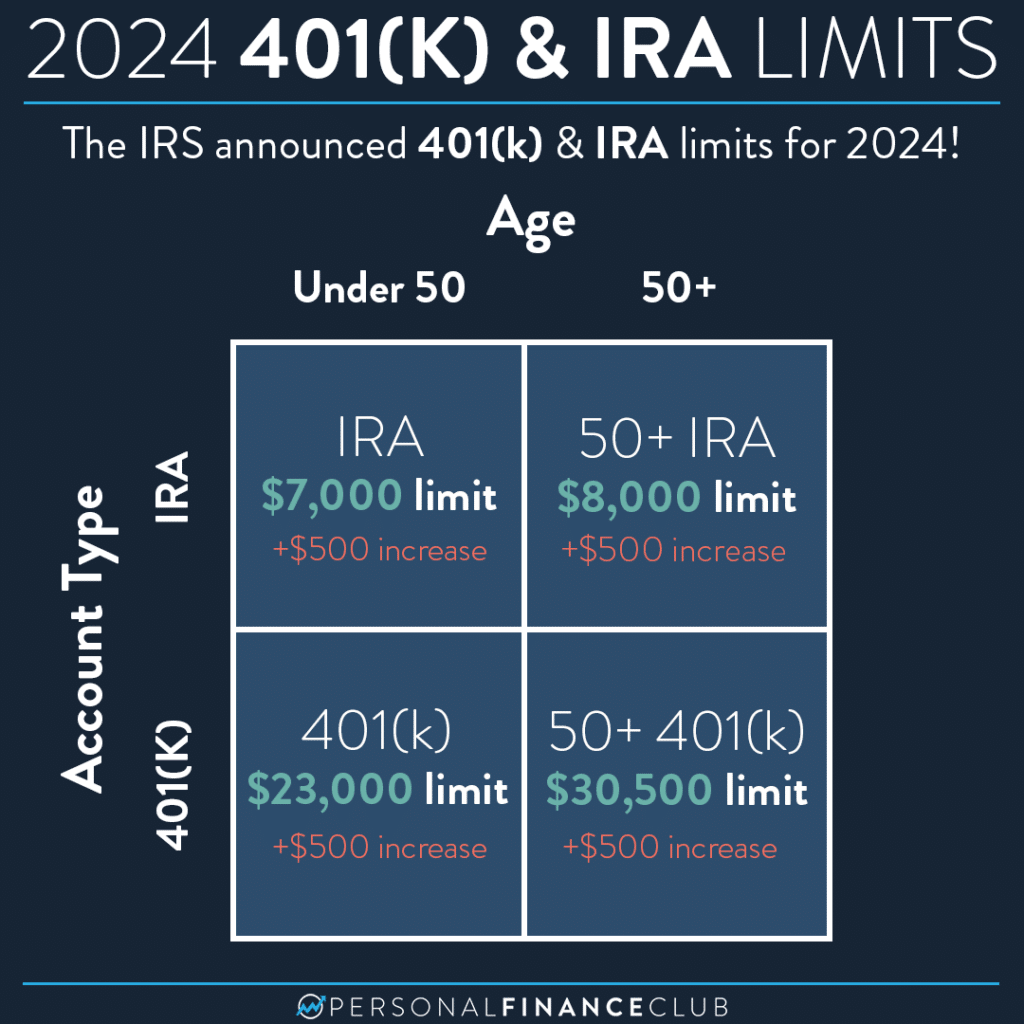

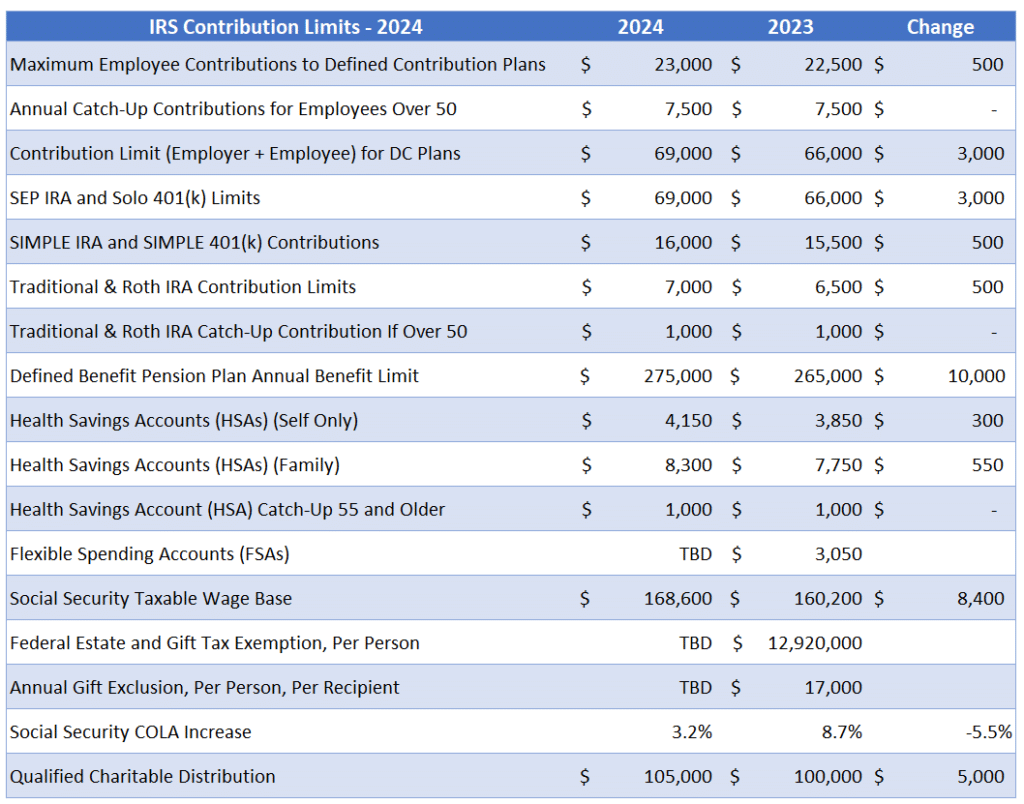

The annual contribution limit for traditional and Roth IRAs in 2024 is $7,000 for individuals and $14,000 for married couples filing jointly. These limits apply regardless of whether you are contributing to a traditional IRA or a Roth IRA.

The mileage rate for October 2024 is used for a variety of purposes, including business expenses and medical deductions. You can find the latest rate on this page.

Potential Changes to IRA Contribution Limits for 2024

While the contribution limits for 2024 have been announced, it is important to remember that these limits can change in the future. The IRS may adjust the contribution limits for inflation, and other factors can influence changes as well. It is always a good idea to stay informed about any changes to the contribution limits.

Age-Related Contribution Limits: Ira Contribution Limits For 2024 By Age

For individuals aged 50 and over, the IRA contribution limits are higher, allowing them to contribute more to their retirement savings. This provision aims to help older individuals catch up on their retirement savings, as they have fewer years to accumulate wealth.

Catch-up Contribution Rules

Individuals aged 50 and over in 2024 can contribute an additional $1,000 to their IRAs, on top of the regular contribution limit. This means that individuals aged 50 and over can contribute a total of $7,500 to their IRAs in 2024.

The mileage rate for October 2024 is determined by the IRS. You can find details on how the rate is calculated on this page.

The catch-up contribution limit is $1,000 for individuals aged 50 and over.

If you need to track your medical expenses, you’ll want to know the October 2024 mileage rate. Head over to this page for the latest information.

This additional contribution limit is designed to help older individuals save more for retirement, as they have fewer years to accumulate wealth. It’s important to note that this is an additional contribution limit, not a higher contribution limit. This means that individuals aged 50 and over can still contribute the regular contribution limit of $6,500, plus the additional $1,000 catch-up contribution.

Contribution Limits by Age

Here is a table summarizing the contribution limits for individuals of different ages in 2024:

| Age | Contribution Limit |

|---|---|

| Under 50 | $6,500 |

| 50 and over | $7,500 |

Income Limits for IRA Contributions

IRA contribution limits are based on your modified adjusted gross income (MAGI). These limits determine your eligibility to contribute to traditional and Roth IRAs.

Modified Adjusted Gross Income (MAGI) Limits, Ira contribution limits for 2024 by age

The MAGI limits for IRA contributions in 2024 vary based on your filing status. The limits for traditional and Roth IRAs are different, so it’s essential to understand these distinctions.

Tax filing extensions can provide you with more time to complete your taxes. For information on extensions in October 2024, visit this page.

MAGI is calculated by starting with your adjusted gross income (AGI) and adding back certain deductions, such as student loan interest and certain deductions for people with disabilities.

Curious about whether the mileage rate is changing in October 2024? You can find the latest information on this page.

| Income Level | Traditional IRA | Roth IRA |

|---|---|---|

| Single Filers | $73,000 | $153,000 |

| Married Filing Jointly | $146,000 | $228,000 |

Strategies for Maximizing IRA Contributions

Maximizing your IRA contributions can be a powerful way to build wealth for retirement. By understanding the contribution limits and strategies, you can make the most of this valuable tax-advantaged savings tool.

If you have a SIMPLE IRA, there are specific contribution limits you need to be aware of. Find the latest information on this page.

Understanding Contribution Limits

It’s crucial to understand the contribution limits for IRAs, as they vary based on age. For 2024, the maximum contribution limit is $6,500 for individuals under age 50 and $7,500 for those 50 and older. These limits apply to both traditional and Roth IRAs.

The tax brackets for 2024 have changed. To see how these changes might affect your taxes, check out this article.

Planning for Traditional and Roth IRA Contributions

- Traditional IRA:With a traditional IRA, you contribute pre-tax dollars, which lowers your taxable income in the current year. You’ll pay taxes on the withdrawals in retirement. This option can be advantageous if you expect to be in a lower tax bracket in retirement than you are currently.

The mileage rate for October 2024 is an important factor for many tax-related calculations. You can find the latest information on this page.

- Roth IRA:In contrast, a Roth IRA involves contributions made with after-tax dollars. This means you won’t receive a tax deduction in the current year. However, withdrawals in retirement are tax-free. This option is often beneficial if you expect to be in a higher tax bracket in retirement.

Self-employed individuals have a specific tax deadline. To see when you need to file your taxes in October 2024, visit this page.

Determining the Best IRA Type for Your Circumstances

The decision of whether to contribute to a traditional or Roth IRA depends on several factors, including your current income, expected future income, and anticipated tax bracket in retirement.

Individuals over 50 have higher IRA contribution limits. To see the latest figures, visit this page.

- Current Income:If you have a high income, you might be subject to income limits for Roth IRA contributions. In 2024, if your modified adjusted gross income (MAGI) exceeds $153,000 as a single filer or $228,000 as a married couple filing jointly, you can’t contribute to a Roth IRA.

If you’re filing taxes as married filing separately, you’ll need to know the tax brackets for 2024. You can find this information on this page.

For traditional IRAs, there are no income limits.

- Expected Future Income:Consider your anticipated income in retirement. If you expect to be in a lower tax bracket, a traditional IRA might be more advantageous. However, if you anticipate a higher tax bracket, a Roth IRA might be a better choice.

- Tax Bracket in Retirement:If you’re currently in a high tax bracket but expect to be in a lower one in retirement, a traditional IRA might be a better choice. You’ll receive a tax deduction now and pay taxes at a lower rate later.

Conversely, if you’re in a lower tax bracket now and expect to be in a higher one in retirement, a Roth IRA might be more beneficial. You’ll pay taxes now at a lower rate and enjoy tax-free withdrawals later.

Strategies for Maximizing Contributions

- Automate Contributions:Set up automatic contributions from your paycheck to your IRA. This ensures you consistently contribute, even if you forget or have other expenses.

- Make Catch-Up Contributions:If you’re 50 or older, you can contribute an additional $1,000 to your IRA in 2024, bringing your total contribution limit to $7,500. This can help accelerate your retirement savings.

- Consider a Backdoor Roth IRA:If you’re ineligible to contribute directly to a Roth IRA due to income limitations, you can consider a backdoor Roth IRA. This involves contributing to a traditional IRA and then converting it to a Roth IRA. While there are potential tax implications, it can be a way to take advantage of Roth IRA benefits.

Self-employed individuals have specific IRA contribution limits. You can find the latest information on this page.

- Use Tax-Loss Harvesting:If you have investment losses in your taxable account, consider selling them and using the losses to offset capital gains. This can free up capital for IRA contributions.

Resources for IRA Information

Finding reliable information about IRAs is crucial to making informed decisions about your retirement savings. The good news is that there are numerous resources available, both from government agencies and reputable financial institutions, to help you understand the rules and regulations surrounding IRAs.

The tax rates for each tax bracket in 2024 can vary depending on your income level. Check out this article to see how your income might be affected.

Official Government Websites

Official government websites provide accurate and up-to-date information about IRAs. Here are some key resources:

- Internal Revenue Service (IRS):The IRS website is your go-to source for information about IRA contribution limits, tax deductions, and other regulations. You can find detailed publications, forms, and FAQs on the IRS website.

- U.S. Department of Labor:The Department of Labor provides information about retirement plans, including IRAs, and their regulations.

They offer resources for individuals and employers.

Reputable Financial Institutions

Financial institutions, such as banks, brokerage firms, and mutual fund companies, often offer educational resources about IRAs. These resources can help you understand different IRA types, investment options, and account management.

The tax brackets for head of household in 2024 can affect your overall tax liability. You can find the details on this page.

- Vanguard:Vanguard offers a wealth of information about IRAs, including articles, videos, and calculators to help you plan your retirement savings.

- Fidelity Investments:Fidelity provides comprehensive resources about IRAs, covering topics like contribution limits, withdrawal rules, and investment strategies.

- Schwab:Schwab offers educational materials about IRAs, including guides, webinars, and tools to help you manage your retirement savings.

Financial Advisors

If you need personalized guidance about IRAs, consider consulting a financial advisor. They can help you develop a retirement savings plan tailored to your individual circumstances, including your financial goals, risk tolerance, and time horizon.

- Certified Financial Planner (CFP):CFPs are professionals who have met specific education and experience requirements and have passed a rigorous exam. They can provide comprehensive financial planning services, including advice on IRAs.

- Registered Investment Advisor (RIA):RIAs are fiduciaries, meaning they are legally obligated to act in your best interests.

They can offer personalized investment advice and help you choose the right IRA strategy.

Last Point

Navigating the complex world of IRA contributions can feel overwhelming, but understanding the age-related limits and income thresholds is a crucial step towards maximizing your retirement savings. Whether you’re just starting out or nearing retirement, taking advantage of these valuable tax benefits can significantly impact your financial future.

FAQ Summary

What happens if I contribute more than the IRA limit?

Contributing more than the annual limit results in a penalty, so it’s crucial to stay within the allowed amount.

Can I contribute to both a traditional and Roth IRA in the same year?

Yes, you can contribute to both, but your total contributions across both types cannot exceed the annual limit.

Are there any income limits for contributing to a Roth IRA?

Yes, there are income limits for Roth IRA contributions. If your modified adjusted gross income (MAGI) exceeds the limit, you may not be able to contribute to a Roth IRA or your contributions may be limited.

What is the difference between a traditional IRA and a Roth IRA?

Traditional IRA contributions are tax-deductible, meaning you can deduct your contributions from your taxable income, reducing your tax liability. Roth IRA contributions are made with after-tax dollars, but withdrawals in retirement are tax-free. The best type of IRA for you depends on your individual financial situation and tax bracket.