IRA contribution limits for 2024 by age are a crucial aspect of retirement planning, offering tax advantages and long-term growth potential. Understanding these limits, how they vary with age, and the strategies available can help you maximize your savings and achieve your financial goals.

This guide delves into the intricacies of IRA contributions for 2024, providing a comprehensive overview of contribution limits, income restrictions, and strategies for maximizing your contributions. We’ll explore the impact of age on contribution limits, highlighting the benefits of catch-up contributions for those 50 and over.

We’ll also discuss potential tax implications and how to make informed decisions about IRA contributions based on your individual circumstances.

Contents List

IRA Contribution Limits for 2024

Planning for retirement is crucial, and Individual Retirement Accounts (IRAs) offer a valuable tool to help you reach your financial goals. Understanding the contribution limits and income restrictions for IRAs is essential for maximizing your savings potential. Let’s explore the IRA contribution limits and income restrictions for 2024.

Thinking about your retirement savings? The IRA contribution limits for 2024 and 2025 can help you make informed decisions about your retirement planning.

IRA Contribution Limits for 2024

The maximum contribution amount for both Traditional and Roth IRAs in 2024 is $6,500. If you are 50 years old or older, you can contribute an additional $1,000 as a “catch-up” contribution, bringing your total contribution limit to $7,500.

If you’re considering contributing to a Roth IRA, you’ll want to check out the IRA contribution limits for Roth IRA in 2024. Knowing these limits can help you maximize your retirement savings.

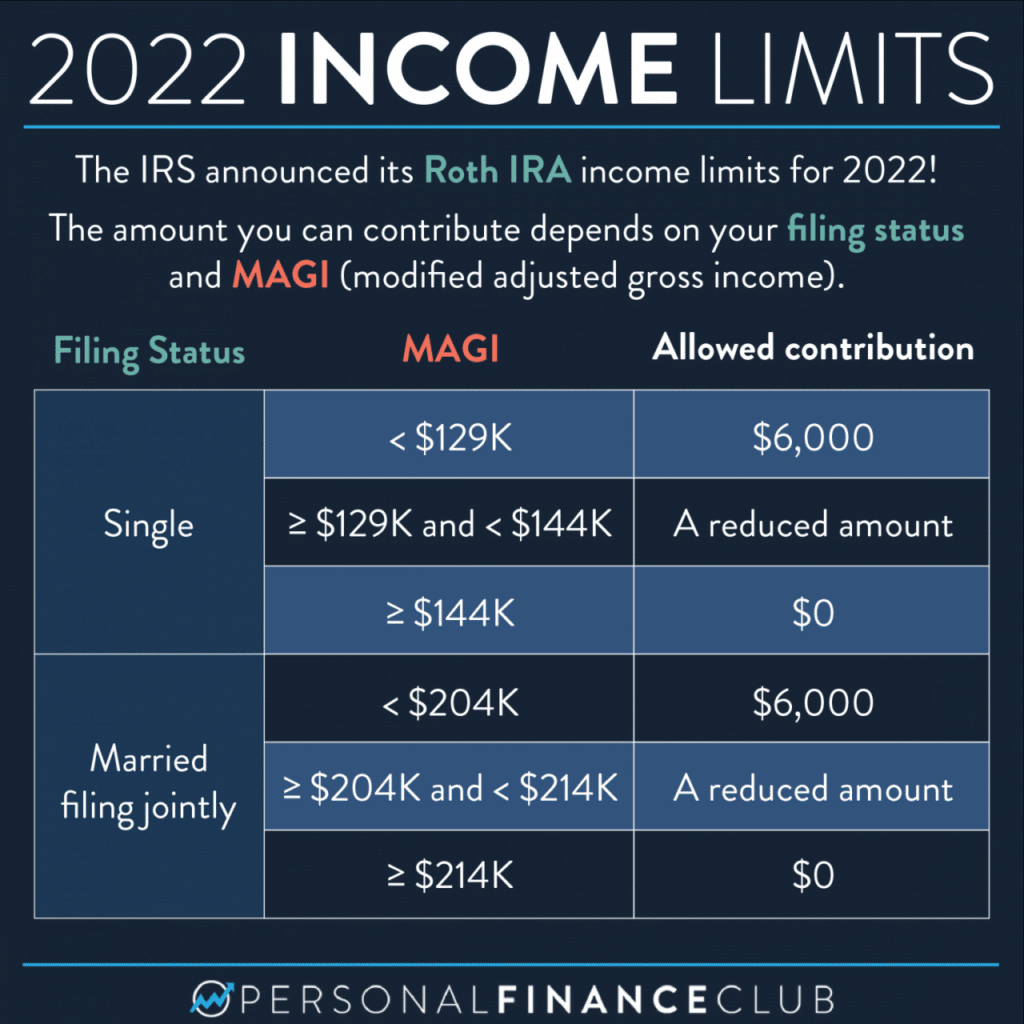

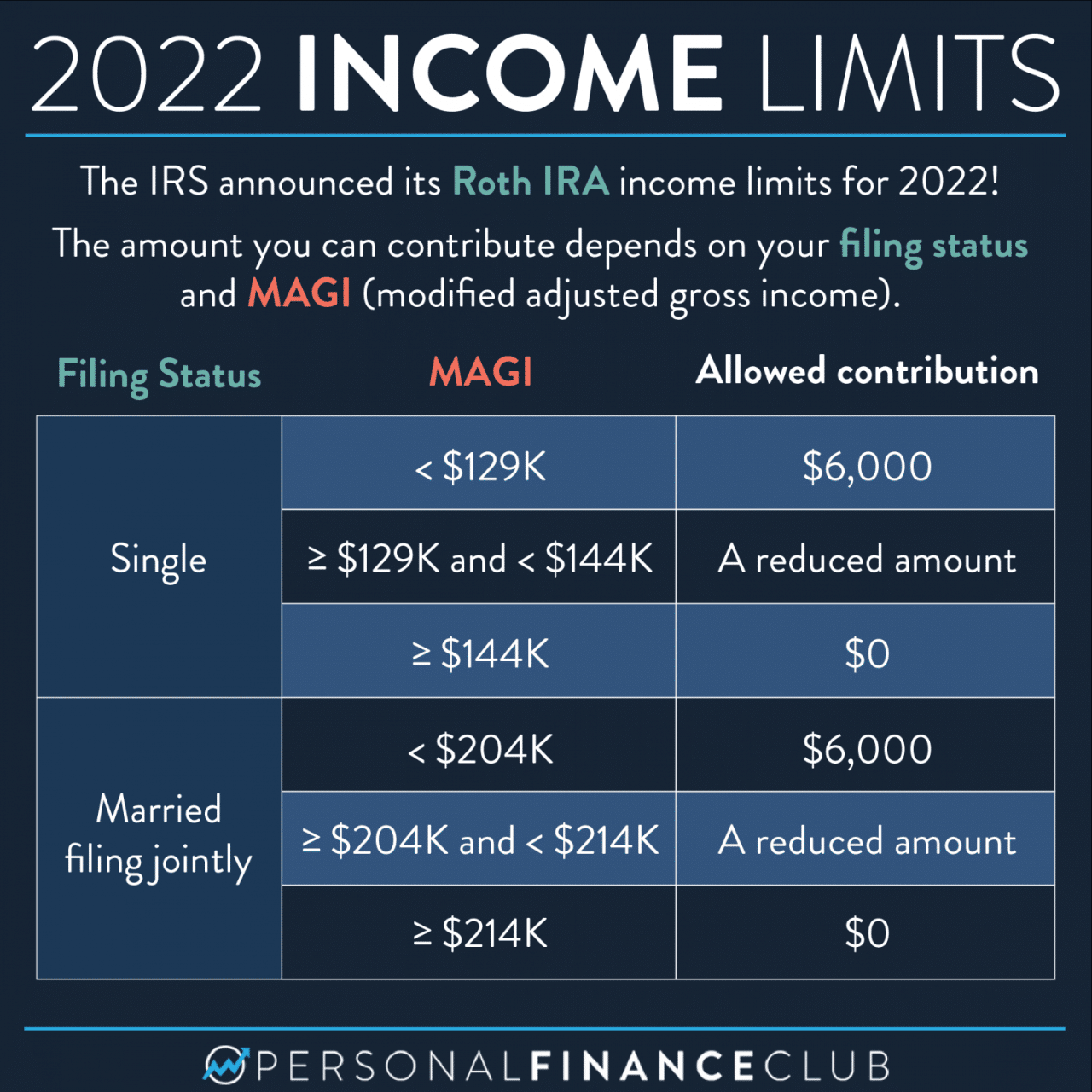

Income Limits for Roth IRA Contributions in 2024

Roth IRAs offer tax-free withdrawals in retirement, but there are income limitations for contributing to them. For 2024, if your modified adjusted gross income (MAGI) exceeds certain thresholds, you may not be able to contribute to a Roth IRA, or your contribution may be limited.

Did you know there are various tax credits available for the October 2024 deadline ? These credits can potentially reduce your tax liability.

The income limits for Roth IRA contributions in 2024 are as follows:

| Filing Status | Single Filers | Married Filing Jointly | Head of Household |

|---|---|---|---|

| Phase-Out Begins | $153,000 | $228,000 | $189,000 |

| Phase-Out Ends | $169,000 | $244,000 | $204,000 |

Comparison of Traditional and Roth IRA Contribution Limits and Income Limits for 2024

Here is a table comparing the contribution limits and income limits for Traditional and Roth IRAs in 2024:

| Type of IRA | Contribution Limit | Income Limits |

|---|---|---|

| Traditional IRA | $6,500 (+$1,000 catch-up for 50+) | No income limits |

| Roth IRA | $6,500 (+$1,000 catch-up for 50+) | Phase-out begins at $153,000 for single filers, $228,000 for married filing jointly, and $189,000 for head of household. Phase-out ends at $169,000 for single filers, $244,000 for married filing jointly, and $204,000 for head of household. |

Contribution Limits by Age

The maximum amount you can contribute to an IRA each year depends on your age. Generally, the contribution limit is the same for both Traditional and Roth IRAs, but there are some exceptions for those aged 50 and over.

Tax season is coming up, and it’s good to be prepared. Check out the new tax brackets for 2024 to see how they might affect your income.

Contribution Limits by Age

The contribution limit for 2024 is $6,500 for individuals under 50. Those aged 50 and over can contribute an additional $1,000 as a catch-up contribution, bringing their total contribution limit to $7,500. This catch-up contribution allows older individuals to save more for retirement, as they have fewer working years remaining to build up their retirement nest egg.

Don’t miss the October 2024 tax deadline! Missing it could result in tax penalties. Make sure you file your taxes on time to avoid any issues.

Here is a table summarizing the contribution limits for different age groups in 2024:

| Age | Traditional IRA Contribution Limit | Roth IRA Contribution Limit |

|---|---|---|

| Under 50 | $6,500 | $6,500 |

| 50 and Over | $7,500 | $7,500 |

It is important to note that these contribution limits are subject to change each year. It is always best to consult with a financial advisor or the IRS website for the most up-to-date information.

Understanding the tax brackets for 2024 in the United States is crucial for planning your finances effectively.

Understanding Contribution Limits

Contribution limits for IRAs, both traditional and Roth, represent the maximum amount you can contribute each year without facing penalties. Understanding these limits is crucial for maximizing your retirement savings while avoiding potential financial repercussions.

Planning your finances for 2024? It’s important to know how the tax bracket thresholds for 2024 might affect your income. Understanding these thresholds can help you make informed decisions about your investments and savings.

Exceeding Contribution Limits and Penalties

Exceeding the contribution limits for IRAs can result in penalties. The IRS imposes a 6% penalty on the amount exceeding the limit, calculated on the excess contribution amount each year. This penalty is applied to both traditional and Roth IRAs, and it can be a significant financial burden.

If you’re moving, you might be able to deduct your moving expenses. Find out the October 2024 mileage rate for moving expenses to help you calculate your deductions.

To avoid penalties, it’s essential to stay informed about the annual contribution limits and ensure your contributions remain within the allowed range.

Foreign nationals need to be aware of the October 2024 tax deadline for foreign nationals. It’s important to file your taxes on time to avoid any penalties.

Implications of Exceeding Contribution Limits

Exceeding the contribution limits for IRAs can have various implications for both traditional and Roth IRAs:

- Traditional IRA:Exceeding the contribution limit for a traditional IRA can lead to penalties, and the excess contribution amount may be considered taxable income. The IRS may also impose penalties for excess contributions, and it is important to note that the penalty applies to the entire excess contribution, not just the portion exceeding the limit.

Wondering where to find the latest mileage rate? You can easily find the mileage rate for October 2024 online, so you don’t have to search far and wide.

- Roth IRA:Exceeding the contribution limit for a Roth IRA can also result in penalties, and the excess contribution amount may be subject to a 6% tax penalty. The IRS may also impose penalties for excess contributions, and it is important to note that the penalty applies to the entire excess contribution, not just the portion exceeding the limit.

Need to track your mileage for business purposes? The mileage rate for October 2024 can help you calculate your deductions accurately.

IRA Contribution Considerations

Your IRA contribution strategy should be tailored to your unique financial circumstances, including your income level, tax bracket, and retirement goals.

Need a little extra time to file your taxes? Check out the tax filing extensions for October 2024. This could give you more time to gather all your documents.

Tax Implications of Traditional and Roth IRAs

The tax implications of Traditional and Roth IRAs differ significantly, influencing the optimal contribution strategy for individuals.

- Traditional IRA Contributions: Contributions are made with pre-tax dollars, reducing your taxable income in the current year. This results in lower taxes in the present, but you will be taxed on distributions in retirement.

- Roth IRA Contributions: Contributions are made with after-tax dollars, meaning you won’t receive a tax deduction in the year of contribution. However, qualified distributions in retirement are tax-free, providing significant tax advantages in the future.

Example:Consider two individuals, both earning $70,000 annually. One chooses a Traditional IRA and deducts $6,500 in contributions, lowering their taxable income to $63,500. The other individual opts for a Roth IRA, paying taxes on their $6,500 contribution but enjoying tax-free withdrawals in retirement.

Factors Influencing IRA Contribution Strategy, IRA contribution limits for 2024 by age

Several factors can influence your IRA contribution strategy, leading to informed decisions based on your specific situation.

- Income Level: The deductibility of Traditional IRA contributions may be phased out for individuals with higher incomes. For 2024, if your modified adjusted gross income (MAGI) is $73,000 or more ($146,000 for married couples filing jointly), you may not be eligible for a full deduction.

Working with government agencies? Make sure you’re up to date on the W9 Form requirements for October 2024 for government agencies. This form is essential for accurate tax reporting.

- Tax Bracket: If you anticipate being in a lower tax bracket in retirement than you are currently, a Traditional IRA might be more advantageous, allowing you to defer taxes to a time when your tax rate is lower. Conversely, if you expect to be in a higher tax bracket in retirement, a Roth IRA might be preferable, as qualified withdrawals will be tax-free.

- Retirement Goals: Your retirement goals, including the desired retirement income and expected lifespan, can influence your contribution strategy. For example, if you anticipate needing a substantial retirement income, maximizing contributions to both a Traditional and Roth IRA might be beneficial.

Concluding Remarks: IRA Contribution Limits For 2024 By Age

By understanding IRA contribution limits and strategies for 2024, you can make informed decisions that align with your retirement goals. Remember, maximizing your contributions within the allowed limits can provide significant tax advantages and help you build a secure financial future.

Consult with a financial advisor to create a personalized retirement plan that meets your unique needs and aspirations.

FAQ Resource

What happens if I exceed the IRA contribution limit?

Exceeding the IRA contribution limit can result in penalties. The IRS imposes a 6% penalty on the excess contribution each year until it’s corrected. You can avoid penalties by making a timely withdrawal of the excess amount, including any earnings on the excess contribution.

Can I contribute to both a Traditional and Roth IRA in the same year?

Yes, you can contribute to both a Traditional and Roth IRA in the same year, but the total contribution amount for both combined cannot exceed the annual limit. It’s important to consider your income, tax bracket, and future tax expectations when deciding how much to contribute to each type of IRA.

How do I know if I’m eligible for catch-up contributions?

If you are 50 or older, you are eligible for catch-up contributions. This allows you to contribute an additional amount to your IRA on top of the regular contribution limit. For 2024, the catch-up contribution limit is $1,000 for both Traditional and Roth IRAs.

Partnerships need to be aware of the W9 Form requirements for October 2024 for partnerships. Make sure you have the correct information for accurate tax reporting.

Not sure how to fill out the W9 Form? You can find step-by-step instructions on how to fill out the W9 Form for October 2024. It’s easier than you think!