IRA contribution limits for self-employed in 2024 present a unique opportunity for those seeking to secure their financial future. Whether you’re a freelancer, consultant, or small business owner, understanding these limits and the various retirement plan options available is crucial for maximizing your savings and minimizing your tax burden.

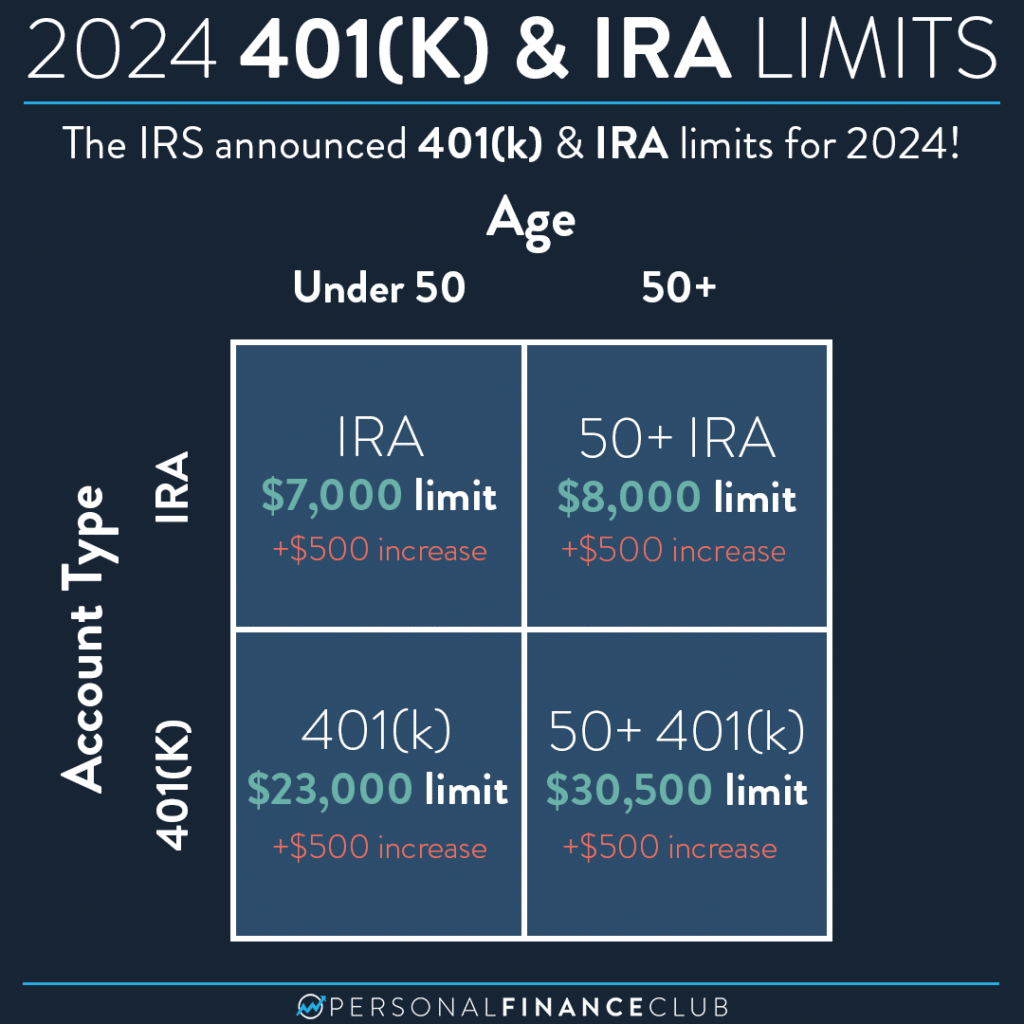

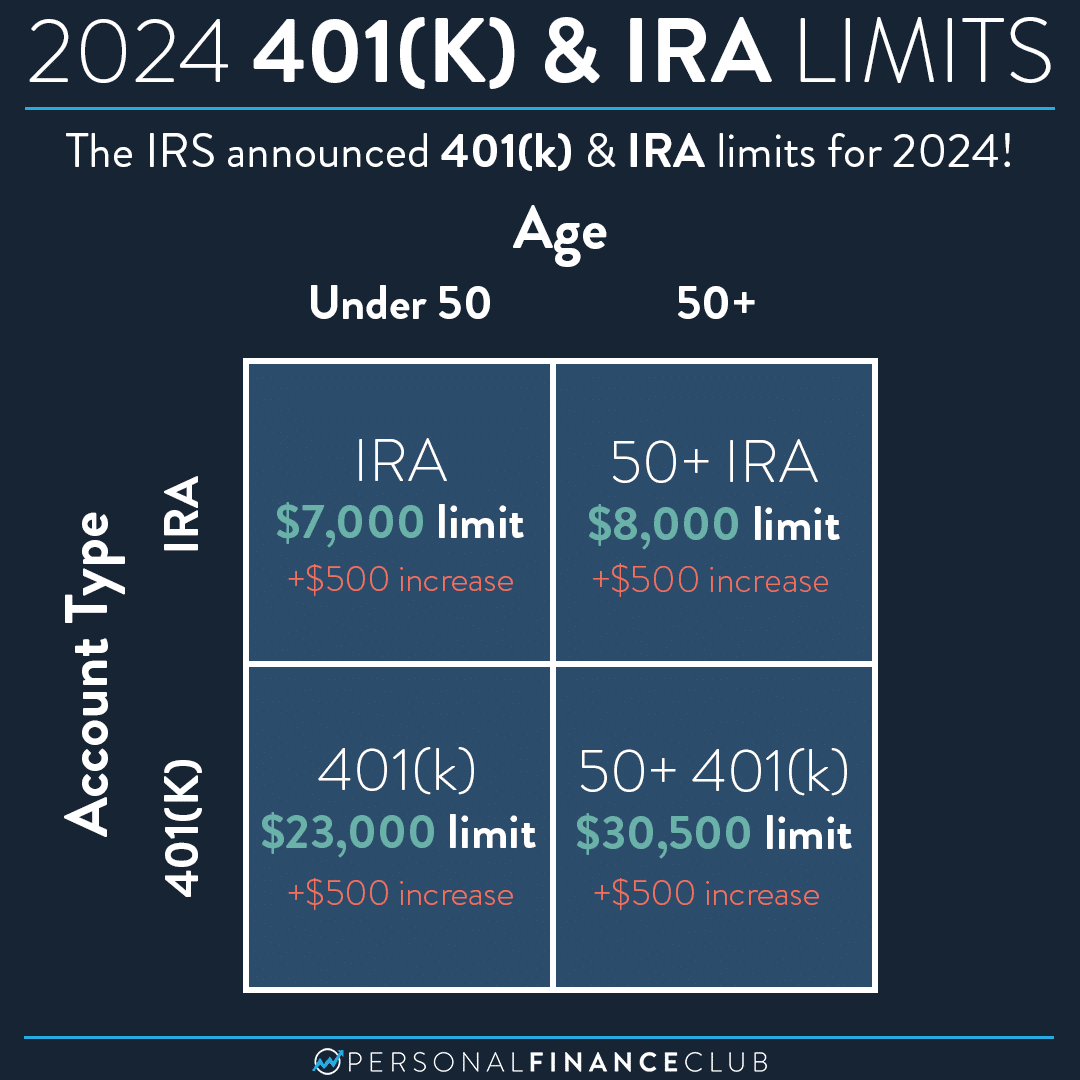

This guide explores the specific contribution limits for self-employed individuals in 2024, highlighting the key differences between traditional and Roth IRAs. We’ll delve into the maximum contribution amount, including the “catch-up” contribution for individuals aged 50 and over. Furthermore, we’ll examine the various retirement plan options tailored for the self-employed, such as Solo 401(k), SEP IRA, and SIMPLE IRA, comparing their contribution limits, eligibility requirements, and tax advantages.

Contents List

Self-Employed Retirement Plan Options

Self-employed individuals have unique retirement planning needs, as they are responsible for both contributions and employer matching. Fortunately, there are several retirement plan options specifically designed for the self-employed, each with its own contribution limits, tax advantages, and eligibility requirements.

If you’re filing as head of household in 2024, it’s important to know the tax brackets that apply to you. You can find the specific tax brackets for head of household filers here: Tax Brackets for Head of Household in 2024.

Solo 401(k)

The Solo 401(k) is a retirement plan designed for self-employed individuals and small business owners with no employees or only a spouse working in the business. This plan allows you to contribute as both the employee and the employer.

Contribution Limits

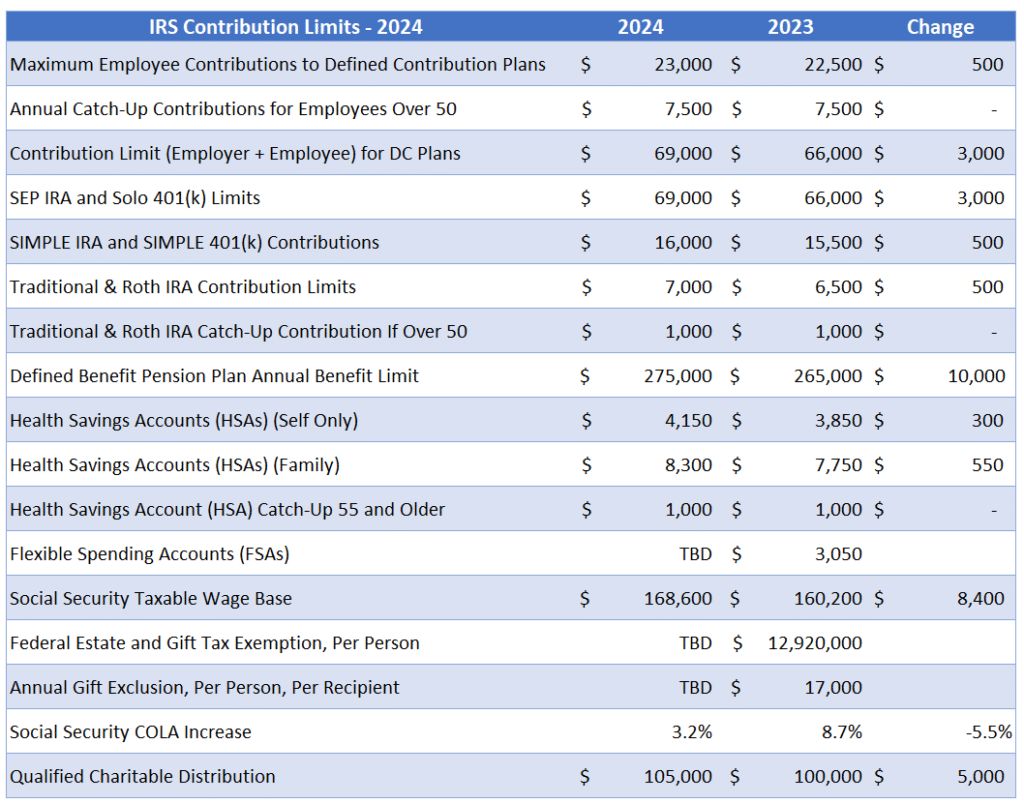

For 2024, the total contribution limit for a Solo 401(k) is $66,000, or $73,500 if you are 50 or older. This limit is divided into two parts: * Employee Contributions:You can contribute up to $22,500 in 2024, or $30,000 if you are 50 or older.

Wondering about the standard mileage rate for October 2024? You can find the latest information on the IRS website. This rate is used for calculating deductions for business travel, charitable donations, and medical expenses.

Employer Contributions

The tax brackets for single filers in 2024 can vary based on income levels. Find a breakdown of the tax brackets for single filers in 2024 here: Tax Brackets for Single Filers in 2024.

You can contribute up to 25% of your net adjusted self-employed income.

Tax Advantages

Solo 401(k) contributions are tax-deductible, meaning you can reduce your taxable income by the amount you contribute. The earnings on your contributions grow tax-deferred, and you won’t pay taxes on the money until you withdraw it in retirement.

Knowing the highest tax bracket in 2024 can help you plan your finances. This article will tell you what the highest tax bracket is for 2024: What Is the Highest Tax Bracket in 2024?.

Eligibility Requirements

To be eligible for a Solo 401(k), you must be self-employed or a small business owner with no employees or only a spouse working in the business.

SEP IRA

A SEP IRA (Simplified Employee Pension IRA) is a retirement plan that allows self-employed individuals and small business owners to make contributions on their own behalf.

Want to know the current mileage rate for October 2024? This rate can be used for various tax deductions, so it’s important to be aware of it. You can find the mileage rate here: How Much Is the Mileage Rate for October 2024?

.

Contribution Limits

For 2024, the maximum contribution to a SEP IRA is 25% of your net adjusted self-employed income, up to $66,000.

If you’re planning on making charitable donations this October, you might be interested in the mileage rate for these contributions. Learn more about the October 2024 mileage rate for charitable donations here: October 2024 Mileage Rate for Charitable Donations.

Tax Advantages

SEP IRA contributions are tax-deductible, reducing your taxable income and potentially lowering your tax liability. Earnings on your contributions grow tax-deferred, and you won’t pay taxes on the money until you withdraw it in retirement.

With the October 2024 tax deadline approaching, it’s a good time to start preparing. Check out these helpful tax preparation tips to make the process easier: Tax Preparation Tips for the October 2024 Deadline.

Eligibility Requirements

Any self-employed individual or small business owner is eligible to open a SEP IRA.

If you’re planning on driving for business or charitable purposes, it’s important to know the current mileage rate. You can find the mileage rate for October 2024 here: What Is the Mileage Rate for October 2024?.

SIMPLE IRA

A SIMPLE IRA (Savings Incentive Match Plan for Employees) is a retirement plan available to small businesses with 100 or fewer employees.

Students often have unique tax situations. If you’re a student, it’s important to understand the tax deadline that applies to you. Check out this article for the October 2024 tax deadline for students: October 2024 Tax Deadline for Students.

Contribution Limits

For 2024, the maximum contribution to a SIMPLE IRA is $15,500, or $22,500 if you are 50 or older. Your employer can match your contributions up to 3% of your compensation.

There are various tax deductions you can claim when filing your taxes. Explore the different tax deductions available for the October 2024 deadline here: Tax Deductions for the October 2024 Deadline.

Tax Advantages

SIMPLE IRA contributions are tax-deductible, reducing your taxable income. Earnings on your contributions grow tax-deferred, and you won’t pay taxes on the money until you withdraw it in retirement.

The October 2024 tax deadline is fast approaching! If you’re looking for guidance on how to file your taxes by the deadline, check out this helpful resource: How to File Taxes by the October 2024 Deadline.

Eligibility Requirements

To be eligible for a SIMPLE IRA, you must be an employee of a small business with 100 or fewer employees.

The Seahawks had a tough loss in Week 5, but their comeback attempt was still exciting to watch. Read more about the game and the team’s performance in this article: Rapid Reactions: Seahawks Comeback Falls Short In Week 5 Loss.

Retirement Plan Comparison

| Plan Option | Contribution Limit (2024) | Tax Deductibility | Distribution Rules |

|---|---|---|---|

| Solo 401(k) | $66,000 ($73,500 if 50 or older) | Tax-deductible | Traditional: Taxes paid at withdrawalRoth: Tax-free withdrawals in retirement |

| SEP IRA | 25% of net adjusted self-employed income (up to $66,000) | Tax-deductible | Taxes paid at withdrawal |

| SIMPLE IRA | $15,500 ($22,500 if 50 or older) | Tax-deductible | Taxes paid at withdrawal |

Resources and Guidance

Navigating self-employed retirement planning can be complex, but numerous resources and guidance are available to help you make informed decisions.

The October 2024 tax deadline is quickly approaching! Make sure you’re aware of the exact date so you can file your taxes on time. You can find the tax deadline for October 2024 here: What Is the Tax Deadline for October 2024.

Reliable Resources and Websites, Ira contribution limits for self-employed in 2024

To effectively plan for your retirement, it’s crucial to access reliable information and guidance. Several websites provide comprehensive resources and tools for self-employed individuals.

It’s helpful to understand how tax rates are structured for each income bracket. Find a breakdown of the tax rates for each tax bracket in 2024 here: Tax Rates for Each Tax Bracket in 2024.

- Internal Revenue Service (IRS):The IRS website offers comprehensive information on retirement plans, contribution limits, and tax deductions. You can find detailed information on traditional and Roth IRAs, SEP IRAs, and Solo 401(k) plans.

- U.S. Department of Labor:The Department of Labor’s website provides information on retirement planning, including retirement savings, investment options, and retirement security.

- Financial Industry Regulatory Authority (FINRA):FINRA offers resources and guidance on retirement planning, including information on choosing the right retirement plan and understanding investment options.

- American Retirement Association (ARA):The ARA provides educational resources and professional development opportunities for retirement plan professionals.

- National Institute on Retirement Security (NIRS):The NIRS conducts research and advocacy on retirement security issues.

Expert Advice and Assistance

Seeking advice from qualified professionals can significantly enhance your retirement planning journey.

Understanding how tax brackets work is crucial for planning your finances. Find out how the different tax brackets will affect your 2024 income by reading this article: How Will Tax Brackets Affect My 2024 Income?.

- Financial Advisor:A financial advisor can help you create a personalized retirement plan, choose appropriate investment options, and manage your retirement savings.

- Certified Public Accountant (CPA):A CPA can provide tax advice and help you understand the tax implications of your retirement plan choices.

- Retirement Plan Administrator:A retirement plan administrator can help you set up and manage your retirement plan, including contributions, distributions, and rollovers.

- Employee Benefits Consultant:An employee benefits consultant can provide guidance on choosing the right retirement plan for your business and employees.

Relevant Websites and Organizations

| Organization | Website | Contact Information |

|---|---|---|

| Internal Revenue Service (IRS) | https://www.irs.gov/ | (800) 829-1040 |

| U.S. Department of Labor | https://www.dol.gov/ | (202) 693-7000 |

| Financial Industry Regulatory Authority (FINRA) | https://www.finra.org/ | (202) 728-8000 |

| American Retirement Association (ARA) | https://www.americanretirementassociation.org/ | (703) 739-0100 |

| National Institute on Retirement Security (NIRS) | https://www.nirs.org/ | (202) 775-0400 |

Wrap-Up: Ira Contribution Limits For Self-employed In 2024

Navigating the world of self-employed retirement planning can feel overwhelming, but with a clear understanding of IRA contribution limits, available plan options, and the associated tax benefits, you can make informed decisions to build a secure financial future. By carefully considering your income level, financial goals, and risk tolerance, you can develop a personalized strategy that aligns with your unique circumstances.

Remember to seek professional advice from a financial advisor to ensure your plan is tailored to your individual needs and aspirations.

General Inquiries

What is the difference between a traditional IRA and a Roth IRA for self-employed individuals?

A traditional IRA allows for pre-tax contributions, reducing your taxable income in the present. You’ll pay taxes on withdrawals during retirement. A Roth IRA involves after-tax contributions, meaning you won’t pay taxes on withdrawals in retirement.

Can I contribute to both a traditional and Roth IRA if I’m self-employed?

Yes, you can contribute to both a traditional and Roth IRA, but the total contribution amount cannot exceed the annual limit.

What are the penalties for early withdrawal from a self-employed IRA?

Generally, withdrawals before age 59 1/2 are subject to a 10% penalty, in addition to regular income tax. However, exceptions apply for certain circumstances, such as first-time home purchases or medical expenses.