IRA Limits for October 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Understanding IRA contribution limits is crucial for maximizing your retirement savings potential.

This guide delves into the specifics of IRA limits for October 2024, exploring factors that influence them, contribution strategies, deadlines, and tax implications.

The information provided will equip you with the knowledge to make informed decisions about your IRA contributions, ensuring you’re on track to achieve your retirement goals. Whether you’re a seasoned investor or just starting your retirement planning journey, this comprehensive guide will serve as your roadmap to navigating the intricacies of IRA limits.

Contents List

IRA Contribution Strategies

Retirement savings are crucial for securing your financial future, and Individual Retirement Accounts (IRAs) offer valuable tax advantages to help you achieve your goals. Understanding the different IRA types and strategies for maximizing contributions can significantly impact your retirement savings.

If you’re a single filer, knowing your tax bracket is essential for accurate tax preparation. Tax brackets for single filers in 2024 are based on your income, and they determine the percentage of your income that will be taxed.

Traditional vs. Roth IRA

Traditional and Roth IRAs are the two primary IRA types, each offering unique tax benefits. Choosing the right IRA depends on your individual circumstances and financial goals.

Qualifying widow(er)s have their own set of tax brackets, which can offer some benefits. Tax brackets for qualifying widow(er)s in 2024 are designed to help those who have recently lost their spouse navigate their tax obligations.

- Traditional IRA:Contributions are tax-deductible, meaning you can reduce your taxable income in the year you make the contribution. However, withdrawals in retirement are taxed as ordinary income.

- Roth IRA:Contributions are made with after-tax dollars, so you don’t receive a tax deduction in the year you contribute. However, qualified withdrawals in retirement are tax-free.

The decision between a traditional and Roth IRA often hinges on your expected tax bracket in retirement. If you anticipate being in a lower tax bracket in retirement, a Roth IRA may be advantageous. However, if you expect to be in a higher tax bracket in retirement, a traditional IRA may be more beneficial.

It’s important to understand the potential consequences of missing the October 2024 tax deadline. Tax penalties for missing the October 2024 deadline can vary depending on the circumstances, so it’s best to file on time to avoid any potential issues.

Maximizing IRA Contributions

Maximizing your IRA contributions is a crucial step towards building a substantial retirement nest egg.

Freelancers have a different tax deadline than traditional employees. The October 2024 tax deadline for freelancers is important to keep in mind, as it can affect their income and tax obligations.

- Contribute the Maximum Allowed:The annual contribution limit for IRAs is $6,500 for individuals and $13,000 for married couples filing jointly in 2024. If you’re 50 or older, you can contribute an additional $1,000 per year as a catch-up contribution.

- Make Contributions Regularly:Consistency is key. Instead of making a lump-sum contribution at the end of the year, consider spreading out your contributions throughout the year. This can help reduce the impact of market fluctuations and make saving feel more manageable.

- Take Advantage of Automatic Contributions:If your employer offers a retirement plan with automatic contributions, consider setting up automatic transfers from your checking account to your IRA. This ensures that you consistently contribute without having to manually manage the process.

Strategies for High-Income Individuals

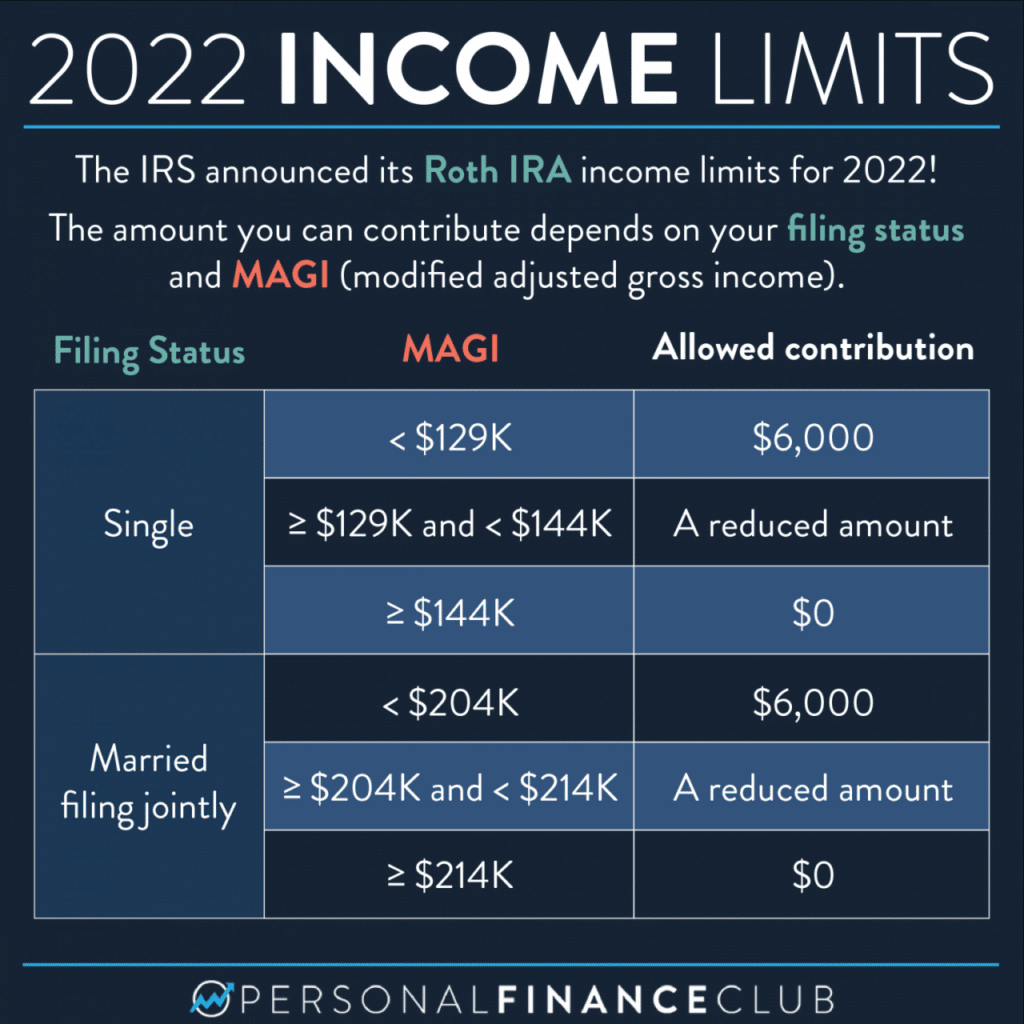

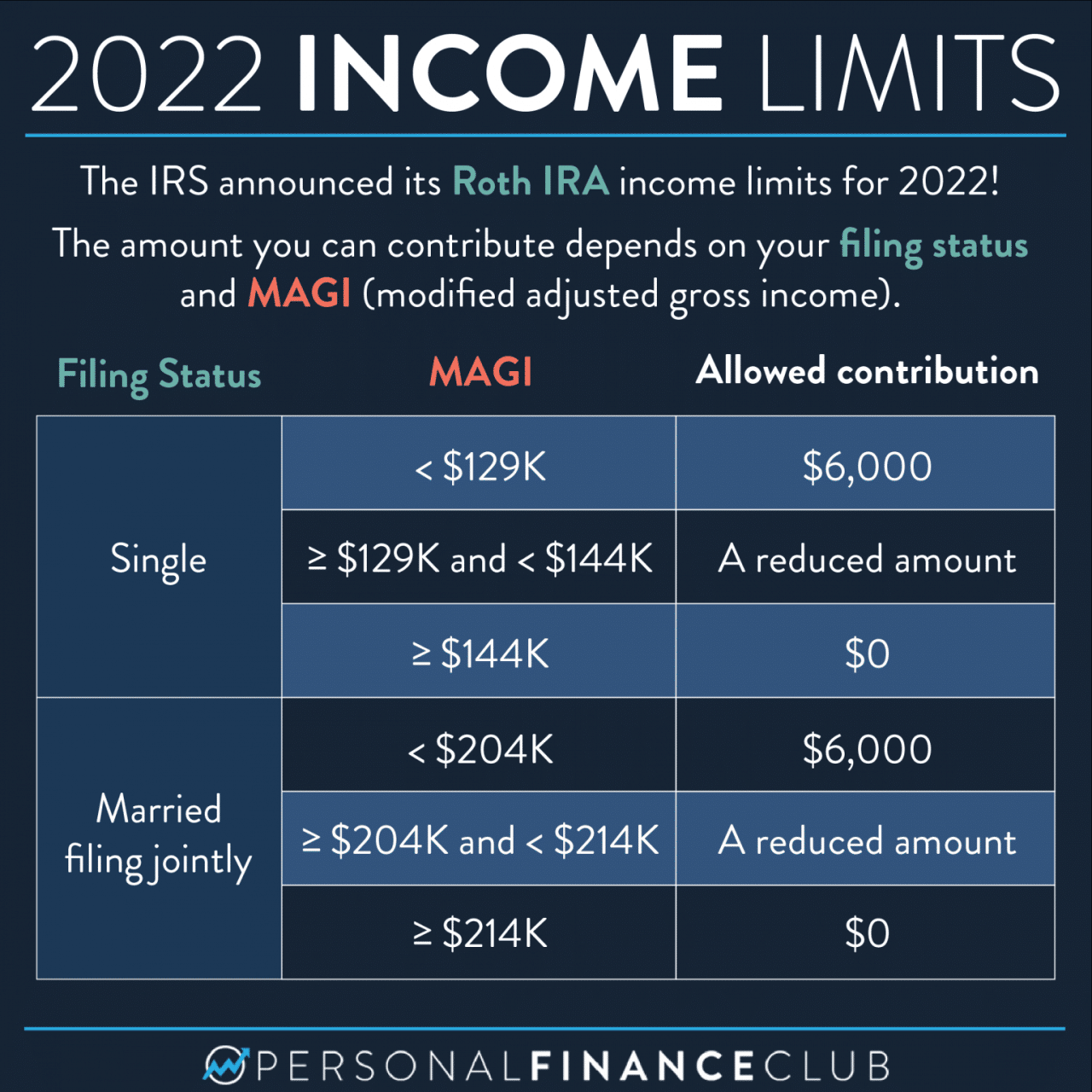

Individuals with high incomes may face limitations on their IRA contributions. This is because the ability to deduct traditional IRA contributions is phased out for those with adjusted gross income (AGI) above certain thresholds. For 2024, the phase-out range for single filers is between $73,000 and $83,000, while for married couples filing jointly, it’s between $146,000 and $166,000.

The standard mileage rate for October 2024 is set by the IRS and can be used to calculate deductions for business use of a personal vehicle. This rate can change throughout the year, so it’s important to use the correct rate for the relevant period.

- Consider a Roth IRA:While traditional IRA contributions may be limited, there are no income limitations for contributing to a Roth IRA. This makes it a viable option for high-income individuals.

- Explore Other Retirement Savings Options:High-income earners may also consider other retirement savings options like employer-sponsored 401(k) plans or Solo 401(k) plans, which often have higher contribution limits and may not be subject to the same income limitations as IRAs.

- Seek Professional Advice:Consulting with a financial advisor can provide personalized guidance on navigating IRA contribution strategies and other retirement savings options tailored to your specific financial situation.

IRA Contribution Planning: Ira Limits For October 2024

Planning for IRA contributions is a crucial step in securing your financial future. By strategically contributing to your IRA, you can maximize your retirement savings and enjoy greater financial independence later in life.

For those who frequently travel for work, the mileage rate can be a helpful deduction. What is the mileage rate for October 2024? is a question many business owners and employees ask, as it can impact their tax liability.

IRA Contribution Readiness Checklist

This checklist can help you determine if you are ready to start contributing to an IRA.

The tax bracket thresholds for 2024 are the income levels that determine which tax bracket you fall into. These thresholds can change from year to year, so it’s important to stay informed.

- Evaluate your current financial situation.Assess your income, expenses, and debt levels to understand your financial capacity.

- Define your retirement goals.Determine how much you want to save for retirement and how long you plan to work.

- Consider your risk tolerance.Determine your comfort level with investment risk, as this will influence your IRA investment choices.

- Review your existing retirement savings.If you have other retirement savings plans, such as a 401(k), factor those into your IRA contribution strategy.

Strategies for Managing IRA Contributions

- Maximize your contributions.Take advantage of the full annual contribution limit, which can help you build your retirement savings more quickly.

- Consider a Roth IRA.If you expect to be in a higher tax bracket in retirement, a Roth IRA may be a better option, as withdrawals are tax-free.

- Automate your contributions.Set up automatic transfers from your checking account to your IRA to ensure consistent contributions.

- Adjust your contributions based on your income.If your income fluctuates, adjust your contributions accordingly to maintain a sustainable savings plan.

Managing IRA Contributions Alongside Other Retirement Savings Plans, Ira limits for October 2024

- Prioritize contributions to employer-sponsored retirement plans.These plans often offer employer matching contributions, which essentially provide free money.

- Consider a “catch-up” contribution if you are 50 or older.You can contribute an additional amount to your IRA to make up for lost time.

- Review your overall retirement savings strategy periodically.Make sure your IRA contributions align with your overall financial goals and adjust them as needed.

Epilogue

As we conclude our exploration of IRA limits for October 2024, it’s evident that understanding these regulations is paramount to optimizing your retirement savings. By carefully considering your income level, contribution strategies, and tax implications, you can make informed decisions that align with your financial goals.

Remember, taking proactive steps towards your retirement security is an investment in your future well-being.

Helpful Answers

What happens if I exceed the IRA contribution limit?

Exceeding the IRA contribution limit can result in penalties. The IRS may impose a 6% excise tax on the excess contribution amount. It’s important to stay within the limits to avoid these penalties.

Can I contribute to both a traditional and Roth IRA in the same year?

Yes, you can contribute to both a traditional and Roth IRA in the same year, but your total contributions cannot exceed the annual limit. For example, if the annual limit is $6,500, you can contribute $3,250 to each type of IRA.

Are there any exceptions to the IRA contribution limits?

There are some exceptions to the IRA contribution limits, such as for individuals with disabilities or those who are blind. It’s best to consult with a tax advisor to determine if you qualify for any exceptions.

Tax brackets are subject to change each year, so it’s crucial to understand the potential impact on your finances. Tax bracket changes for 2024 could affect how much you owe in taxes, so staying informed is key.

Each tax bracket has a corresponding tax rate, which is the percentage of your income that will be taxed. Tax rates for each tax bracket in 2024 can range from 10% to 37%, so understanding your bracket is crucial for accurate tax planning.

Tax credits can be a valuable way to reduce your tax liability. Tax credits for the October 2024 deadline are available for various situations, such as education, childcare, and energy efficiency.

The mileage rate is used to calculate deductions for business use of a personal vehicle. How much is the mileage rate for October 2024? is a question many business owners and employees ask, as it can impact their tax liability.

Retirees have specific tax deadlines and considerations. The October 2024 tax deadline for retirees may be different from other taxpayers, so it’s important to consult with a tax professional for guidance.

The Seahawks had a tough loss this past weekend, but it’s important to analyze what went wrong. Rapid Reactions: Seahawks Comeback Falls Short In Week 5 Loss provides insights into the team’s performance and potential areas for improvement.

Understanding tax brackets is essential for accurate tax planning. Understanding tax brackets for 2024 involves knowing your income level, the applicable tax rates, and how these factors affect your tax liability.

Proper tax preparation is crucial for avoiding penalties and ensuring you’re paying the correct amount of taxes. Tax preparation tips for the October 2024 deadline can help you navigate the process smoothly and efficiently.