IRS October Deadline 2024: Key Dates and Tax Implications – October is a crucial month for taxpayers, with numerous deadlines looming for various tax-related activities. From filing extensions and paying estimated taxes to making charitable contributions, understanding the intricacies of the October deadline is essential for avoiding penalties and ensuring tax compliance.

This guide provides a comprehensive overview of the IRS October deadline, covering key dates, affected taxpayers, potential consequences of missing deadlines, and practical tips for avoiding late penalties. We’ll delve into common mistakes to avoid, explore relevant resources, and discuss tax planning strategies for navigating this critical period.

Contents List

- 1 IRS October Deadline Overview

- 2 Key Tax Filing Dates in October

- 3 Who is Affected by the October Deadline?

- 4 Consequences of Missing the October Deadline

- 5 5. Tips for Avoiding Late Penalties: IRS October Deadline 2024

- 6 6. Common Mistakes to Avoid

- 7 7. Resources for Taxpayers

- 8 Tax Planning Strategies for October

- 9 Impact of October Deadline on Businesses

- 10 10. The October Deadline and Retirement Planning

- 11 11. Future of the October Deadline

- 12 Examples of Tax-Related Activities Due in October

- 13 Illustrations of Penalties for Missing the October Deadline

- 14 Epilogue

- 15 Essential FAQs

IRS October Deadline Overview

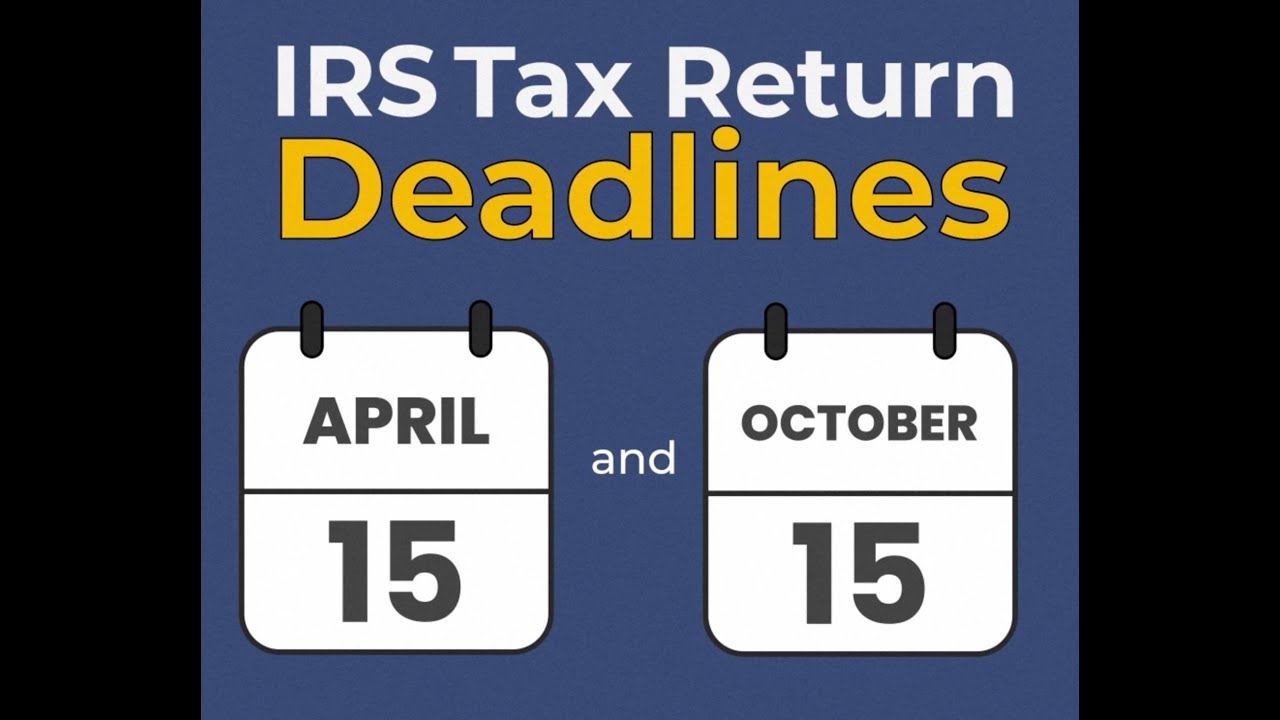

The October deadline for tax-related activities is a crucial date for many taxpayers, marking the end of the extended filing period for certain tax obligations. This deadline applies to various tax-related activities, including payments, extensions, and certain forms. Understanding the October deadline is essential for individuals and businesses to ensure compliance with IRS regulations and avoid potential penalties.

The Significance of the October Deadline

The October deadline is significant because it provides taxpayers with an extended period to fulfill their tax obligations beyond the traditional April 15th deadline. This extension is primarily intended for individuals and businesses who require more time to gather necessary documentation, complete their tax returns, or make payments.

The October deadline offers a grace period for those who cannot meet the initial April deadline, allowing them to avoid late filing penalties.

Types of Tax-Related Activities Due in October

- Tax Payments:The October deadline applies to individuals and businesses who have been granted an extension to file their tax returns. This extension allows them to file their returns by October 15th but requires them to pay any outstanding taxes by the same date.

Failing to make the payment by October 15th will result in penalties.

- Extension Requests:Taxpayers who need more time to file their tax returns can request an extension from the IRS. This extension allows them to file their return by October 15th, but they still need to pay any taxes owed by the original April 15th deadline.

- Certain Forms:Some tax forms, such as Form 1040-X (Amended U.S. Individual Income Tax Return), have an October deadline. This form is used to correct errors on previously filed tax returns and may require additional time for processing.

History of the October Deadline

The October deadline has been a part of the IRS tax calendar for several decades. It was initially introduced as a way to provide taxpayers with more time to file their returns in situations where they faced unforeseen circumstances. Over the years, the October deadline has been modified and adjusted to accommodate changing tax laws and economic conditions.

For example, in 2020, the IRS extended the October deadline to July 15th due to the COVID-19 pandemic.

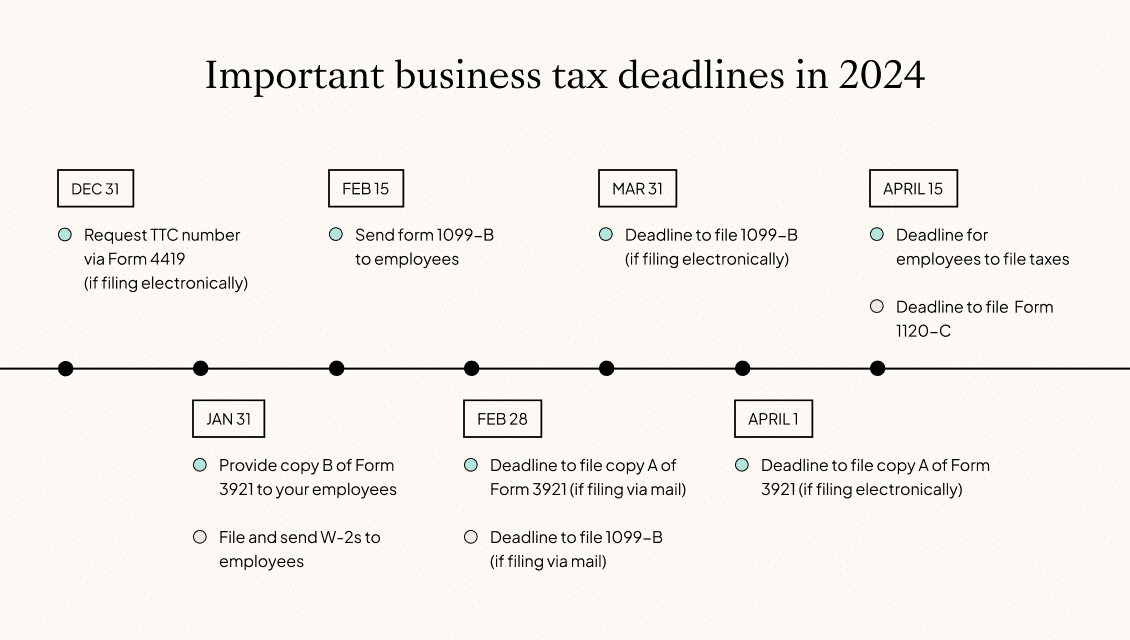

Key Tax Filing Dates in October

October is a crucial month for tax-related activities, with several important deadlines to keep in mind. These deadlines apply to individuals, businesses, and other entities required to file tax returns with the IRS.

Key Tax Filing Dates in October

Understanding these deadlines is essential to avoid penalties and ensure timely compliance with tax obligations.

If you’re still working on your taxes, don’t forget that some taxes are due in October. Check out the Taxes Due October list to make sure you’re up-to-date.

| Date | Activity | Description | Penalty for Late Filing |

|---|---|---|---|

| October 15, 2024 | Estimated Tax Payment | Fourth and final estimated tax payment for the 2024 tax year. This applies to individuals and businesses who are required to make estimated tax payments. | Interest and penalties may apply if estimated taxes are not paid on time. |

| October 15, 2024 | Extension Filing Deadline | Deadline to file an extension for filing your 2023 tax return. This extension grants an additional six months to file your return, but it does not extend the time to pay taxes owed. | Interest and penalties may apply on any unpaid taxes owed, even with an extension. |

Who is Affected by the October Deadline?

The October 15th deadline applies to various taxpayers, including individuals, businesses, and non-profits. Understanding the specific requirements for each category is crucial for meeting the deadline and avoiding potential penalties.

Individuals

Individuals who are granted an extension for filing their tax return by the IRS have until October 15th to file their return. This extension is typically granted for those who need more time to gather all the necessary documentation.

“For individuals, the October 15th deadline applies only to those who have been granted an extension for filing their tax return. This extension allows individuals to file their tax return at a later date, but it does not extend the deadline for paying taxes.”

Businesses

Several business entities are affected by the October 15th deadline, including partnerships, S corporations, and C corporations. These businesses may have extensions for filing their tax returns.

October is a great month to find some good CD rates. Check out the CD Rates October 2023 and see what’s available.

- Partnerships: Partnerships typically have until March 15th of the following year to file their tax returns. However, they can request an extension until September 15th. If the partnership has a fiscal year that ends in September, the extension deadline for filing is October 15th.

- S Corporations: Similar to partnerships, S corporations have until March 15th to file their tax returns. An extension can be requested to September 15th. If the S corporation’s fiscal year ends in September, the extension deadline for filing is October 15th.

- C Corporations: C corporations have until April 15th to file their tax returns. They can request an extension until October 15th.

Non-Profits

Non-profit organizations, similar to businesses, may have extensions for filing their tax returns. The specific deadline depends on the type of non-profit and its fiscal year.

“Non-profit organizations that are subject to the October 15th deadline include those with a fiscal year ending in September and those who have been granted an extension for filing their tax returns.”

Consequences of Missing the October Deadline

Missing the October deadline for filing your taxes can result in significant financial penalties and other consequences. It is essential to understand the potential ramifications of non-compliance and take steps to ensure timely filing.

Penalties for Late Filing

The IRS imposes penalties for late filing and late payment. These penalties are calculated based on the amount of unpaid taxes and the length of the delay.

- Late Filing Penalty:The penalty for late filing is typically 0.5% of the unpaid tax for each month or part of a month that the return is late, up to a maximum of 25% of the unpaid tax.

- Late Payment Penalty:The penalty for late payment is 0.5% of the unpaid tax for each month or part of a month that the payment is late, up to a maximum of 25% of the unpaid tax.

5. Tips for Avoiding Late Penalties: IRS October Deadline 2024

Filing your taxes on time is crucial. Late penalties can significantly impact your finances, so taking proactive steps to avoid them is essential. This guide provides practical tips to help you stay on top of your tax obligations and avoid any potential penalties.

Planning

Planning ahead is the key to avoiding late penalties. By taking steps to prepare early, you can minimize the chances of missing the deadline.

- Set reminders for tax deadlines. The IRS offers various tools and services to help you stay informed, such as email reminders or text messages. You can also use a calendar or a task management app to set reminders for important tax dates.

- Gather all necessary documents well in advance. This includes your W-2 forms, 1099 forms, and any other relevant documentation. The earlier you gather these documents, the more time you have to review them and ensure everything is accurate.

- Consider using tax preparation software or hiring a tax professional. Tax preparation software can guide you through the process and help you avoid common errors. A tax professional can provide expert advice and ensure your taxes are filed correctly and on time.

Communication

Open communication with the tax authorities is crucial, especially if you anticipate a delay in filing your taxes.

- Contact the tax authorities if you anticipate a delay. If you know you won’t be able to file your taxes by the deadline, contact the IRS as soon as possible to explain your situation. They may grant you an extension to file, but you still need to pay any taxes owed by the original deadline.

- Keep records of all communication with the IRS. Document any phone calls, emails, or letters you send or receive from the IRS. This documentation can be helpful if you need to resolve any issues related to your tax filing.

Record-Keeping

Accurate and organized record-keeping is essential for tax compliance.

- Maintain accurate records of all income and expenses. Keep track of all your income sources and expenses throughout the year. This information is crucial for preparing your tax return and ensuring you claim all eligible deductions.

- Organize receipts and other supporting documentation. Keep all receipts, invoices, and other documentation related to your income and expenses. This documentation can be helpful in case of an IRS audit.

6. Common Mistakes to Avoid

Filing taxes by the October deadline can be tricky, even for seasoned taxpayers. There are a few common mistakes that people make, which can lead to penalties or delays in receiving your refund. Let’s take a look at some of the most common mistakes and how to avoid them.

The Tax Deadline 2023 is a crucial date for anyone who owes taxes. Make sure you know the deadline and file your taxes on time.

Common Mistakes

Here are some common mistakes taxpayers make when filing for an extension:

-

Mistake:Not filing for an extension on time.

Example:You know you need more time to file your taxes, but you forget to file for an extension by the April deadline.

Consequences:You’ll be subject to penalties for late filing, even if you eventually file your taxes by the October deadline.

Looking for a quick reference for October? The October 2023 Calendar can help you stay organized.

-

Mistake:Not paying estimated taxes.

Example:You received a large sum of money from a side hustle or investment, but you didn’t pay estimated taxes on it.

Consequences:You could face penalties for underpayment of taxes, even if you file by the October deadline.

-

Mistake:Not keeping accurate records.

Example:You misplaced receipts or didn’t keep track of your income and expenses.

Consequences:You may have trouble accurately calculating your taxes, which could lead to errors and penalties.

-

Mistake:Not understanding your tax obligations.

Example:You’re unsure about which deductions or credits you’re eligible for, or you’re not aware of recent tax law changes.

Consequences:You could miss out on deductions or credits, or you could make mistakes on your tax return that result in penalties.

-

Mistake:Not double-checking your return before filing.

Example:You rush through filing your taxes and don’t take the time to review your return for errors.

Consequences:You could make mistakes that lead to penalties, delays in receiving your refund, or even an audit.

Common Mistakes Table

| Mistake | Example | Consequences |

|---|---|---|

| Not filing for an extension on time | You know you need more time to file your taxes, but you forget to file for an extension by the April deadline. | You’ll be subject to penalties for late filing, even if you eventually file your taxes by the October deadline. |

| Not paying estimated taxes | You received a large sum of money from a side hustle or investment, but you didn’t pay estimated taxes on it. | You could face penalties for underpayment of taxes, even if you file by the October deadline. |

| Not keeping accurate records | You misplaced receipts or didn’t keep track of your income and expenses. | You may have trouble accurately calculating your taxes, which could lead to errors and penalties. |

| Not understanding your tax obligations | You’re unsure about which deductions or credits you’re eligible for, or you’re not aware of recent tax law changes. | You could miss out on deductions or credits, or you could make mistakes on your tax return that result in penalties. |

| Not double-checking your return before filing | You rush through filing your taxes and don’t take the time to review your return for errors. | You could make mistakes that lead to penalties, delays in receiving your refund, or even an audit. |

Video Script

Hi everyone, today we’re talking about common mistakes to avoid when filing your taxes by the October deadline. Avoiding these mistakes can save you time, money, and a lot of stress. Let’s dive in.

Mistake number one: Not filing for an extension on time. This is a common mistake, especially if you’re busy or forgetful. If you don’t file for an extension by the April deadline, you’ll be subject to penalties, even if you file your taxes by the October deadline.

Mistake number two: Not paying estimated taxes. If you receive a large sum of money from a side hustle or investment, you need to pay estimated taxes on it. Not doing so can result in penalties, even if you file by the October deadline.

October is a great month to find some good deals on a new car. Check out the October 2023 Lease Deals and see what’s available.

Mistake number three: Not keeping accurate records. This is crucial for calculating your taxes correctly. Make sure you keep track of your income and expenses and save all your receipts.

Remember, filing your taxes by the October deadline is important, but avoiding these common mistakes will make the process smoother and less stressful.

The IRS October Deadline 2023 is a crucial date for anyone who owes taxes. Make sure you know the deadline and file your taxes on time.

7. Resources for Taxpayers

Staying informed about the October deadline is crucial to ensure you meet your tax obligations and avoid potential penalties. Understanding the resources available to you can help navigate the complexities of tax filing and make the process smoother.

IRS Website

The IRS website is your primary source for comprehensive information about the October deadline and other tax-related matters. The website offers detailed guidance, forms, publications, and tools to assist taxpayers.

| Resource | Description | Contact Information | Link |

|---|---|---|---|

| IRS Website | The IRS website provides a wealth of information on the October deadline, including:

|

IRS Customer Service: 1-800-829-1040 | https://www.irs.gov/ |

Tax Preparation Software

Tax preparation software offers a convenient and user-friendly way to file your taxes, especially when dealing with the October deadline. These software programs provide guidance, calculations, and e-filing capabilities.

| Resource | Description | Contact Information | Link |

|---|---|---|---|

| TurboTax | TurboTax offers a comprehensive range of tax preparation tools, including features specifically designed for those filing extensions and making payments by the October deadline. | TurboTax Customer Service: 1-800-446-8878 | https://turbotax.intuit.com/ |

| H&R Block | H&R Block provides user-friendly tax preparation software with features to help you navigate the October deadline, including guidance on filing extensions and payments. | H&R Block Customer Service: 1-800-472-5625 | https://www.hrblock.com/ |

| TaxSlayer | TaxSlayer offers a range of tax preparation options, including software tailored for those needing to file extensions and make payments by the October deadline. | TaxSlayer Customer Service: 1-800-829-1040 | https://www.taxslayer.com/ |

Professional Tax Advisors

Consulting a professional tax advisor can be highly beneficial, especially if you have complex tax situations or require specialized guidance regarding the October deadline. Tax advisors can provide personalized advice, help you understand your tax obligations, and ensure you take advantage of all available deductions and credits.

| Resource | Description | Contact Information | Link |

|---|---|---|---|

| National Association of Tax Professionals (NATP) | The NATP is a professional organization that provides resources for finding qualified tax advisors. You can use their website to search for members in your area. | NATP Customer Service: 1-800-628-7788 | https://www.natptax.com/ |

| American Institute of Certified Public Accountants (AICPA) | The AICPA offers a directory of certified public accountants (CPAs) who specialize in tax preparation and can provide guidance on the October deadline. | AICPA Customer Service: 1-888-777-7077 | https://www.aicpa.org/ |

Specific Tax-Related Activities Impacted by the October Deadline

The October deadline primarily affects taxpayers who have been granted an extension to file their tax return. This includes:

- Filing the actual tax return

- Paying any remaining tax liability

Potential Consequences of Missing the October Deadline

Failing to meet the October deadline can result in penalties, including:

- Late filing penalty: A percentage of your unpaid tax liability

- Late payment penalty: A percentage of your unpaid tax liability

- Interest on unpaid taxes: Accumulated interest on any outstanding balance

Tax Planning Strategies for October

October is a crucial month for tax planning, as it offers a final opportunity to adjust your tax situation before the year ends. By implementing effective strategies in October, you can potentially minimize your tax liability and maximize your financial well-being.

Making Charitable Contributions

Charitable contributions are a great way to reduce your taxable income. If you haven’t already made your annual charitable contributions, October is a good time to do so. You can deduct cash contributions up to 60% of your Adjusted Gross Income (AGI).

For non-cash contributions, you can deduct the fair market value of the donated item.

Adjusting Withholdings

Review your tax withholdings to ensure they are accurate. If you have experienced a significant change in your income or deductions, you may need to adjust your W-4 form to reflect these changes. This can help prevent underpayment penalties at the end of the tax year.

Exploring Tax Credits

Tax credits can directly reduce your tax liability, offering a more significant benefit than deductions. Some tax credits have deadlines in October, such as the Earned Income Tax Credit (EITC) and the Child Tax Credit. Research these credits to see if you qualify and can take advantage of them before the deadline.

Prepaying Property Taxes

If you live in a state that allows you to prepay property taxes, you may want to consider doing so in October. This can help reduce your taxable income for the current year, lowering your tax liability.

October is a great time to find the best CD rates. Check out the Best CD Rates October 2023 to maximize your savings.

Maximizing Retirement Contributions

October is a good time to review your retirement contributions and ensure you are maximizing your contributions. If you are self-employed, you may want to consider making additional contributions to a Solo 401(k) or SEP IRA.

Tax Deductible Expenses

Review your expenses to identify any deductible items you may have overlooked. These could include medical expenses, home office expenses, or educational expenses. By claiming these deductions, you can lower your taxable income.

Investing in Tax-Advantaged Accounts

Consider investing in tax-advantaged accounts such as a traditional IRA, Roth IRA, or 401(k). These accounts can help you save for retirement while reducing your tax liability.

Impact of October Deadline on Businesses

The October tax deadline presents a crucial period for businesses, requiring them to finalize and submit various tax-related documents and fulfill their financial obligations. Businesses must navigate a complex web of tax regulations and deadlines, and failing to meet these requirements can lead to significant financial penalties.

Corporate Tax Returns

Businesses, depending on their legal structure, must file corporate tax returns by the October deadline. This includes corporations, partnerships, S corporations, and limited liability companies (LLCs). The deadline ensures that the IRS has the necessary information to assess the tax liability of these entities and collect the appropriate taxes.

Estimated Taxes

Businesses are required to make quarterly estimated tax payments throughout the year. These payments are based on the projected income and tax liability of the business. The October deadline serves as a final opportunity for businesses to ensure they have made sufficient estimated tax payments.

If a business’s estimated tax payments fall short of their actual tax liability, they may face penalties.

October is a busy month for taxes. The October Extension Tax Deadline 2023 is fast approaching, so make sure you have your paperwork in order.

Businesses are required to pay quarterly estimated taxes if their annual tax liability exceeds $1,000.

Payroll

Businesses with employees are responsible for withholding taxes from their employees’ wages and paying these taxes to the IRS. The October deadline includes the obligation to file payroll tax returns and make any necessary payments. Businesses must carefully track employee earnings, withhold the correct amount of taxes, and submit these payments promptly to avoid penalties.

Preparing for the October Deadline

Businesses can take proactive steps to prepare for the October deadline and minimize the risk of penalties. These steps include:

- Maintain accurate financial records:Keeping detailed records of income, expenses, and payroll is crucial for accurate tax calculations.

- Track estimated tax payments:Businesses should carefully track their estimated tax payments throughout the year to ensure they are meeting their obligations.

- Seek professional advice:Consulting with a tax professional can help businesses navigate complex tax regulations and ensure they are meeting all requirements.

- File on time:Businesses should file their tax returns and make all necessary payments by the October deadline to avoid penalties.

10. The October Deadline and Retirement Planning

As you approach retirement, understanding the October deadline for Required Minimum Distributions (RMDs) from retirement accounts is crucial. This deadline can significantly impact your retirement planning, influencing your investment decisions and overall tax strategy.

Impact of the October Deadline on Retirement Planning

The October deadline for RMDs can influence your retirement planning in several ways.

Get the best deals on a new car with the Best Lease Deals October 2023. You might find some amazing deals this month.

- Contribution Decisions: If you’re nearing retirement, you might consider making contributions to your retirement accounts in the current year to maximize your tax benefits. However, the RMD requirement could affect this decision. Since you’ll be required to withdraw a certain amount from your retirement accounts, your contributions might be offset by these withdrawals, impacting your overall tax savings.

- Investment Strategy: The RMD requirement can also influence your investment strategy. With potential market fluctuations, you might be concerned about taking distributions in a down market. Therefore, you might adjust your investment strategy to include more conservative investments that provide stability and reduce the risk of losses during the RMD withdrawal period.

- Minimizing Tax Impact: You can use several strategies to minimize the tax impact of RMDs. One approach is to consider converting a portion of your traditional IRA to a Roth IRA before you reach age 72. This conversion will allow you to pay taxes on the conversion amount now, while your tax bracket is potentially lower, and avoid paying taxes on the withdrawals in retirement.

Another strategy is to carefully consider your investment choices within your retirement accounts to minimize taxable distributions.

Tax Considerations in Retirement Planning, IRS October Deadline 2024

Here’s a table outlining key considerations for taxpayers when incorporating tax considerations into their retirement planning:

| Consideration | Impact on Retirement Planning | Example |

|---|---|---|

| RMDs | Required minimum distributions (RMDs) must be taken annually from traditional IRAs and 401(k)s after age 72. These distributions are taxed as ordinary income. | A 75-year-old individual with a $500,000 traditional IRA is required to take an RMD of approximately $20,000, which will be taxed as ordinary income. |

| Tax-advantaged accounts (e.g., 401(k), Roth IRA) | Contributions to tax-advantaged accounts grow tax-deferred (401(k), traditional IRA) or tax-free (Roth IRA). Distributions from these accounts may be subject to taxes in retirement. | A 50-year-old individual contributes $10,000 to a 401(k) plan. The contributions grow tax-deferred, and the individual will pay taxes on the distributions in retirement. |

| Traditional IRA vs. Roth IRA | Traditional IRA contributions are tax-deductible, but distributions are taxed in retirement. Roth IRA contributions are not tax-deductible, but distributions are tax-free in retirement. | A 35-year-old individual contributes $6,000 to a traditional IRA. The contributions are tax-deductible, but the individual will pay taxes on the distributions in retirement. The same individual could contribute $6,000 to a Roth IRA, which would not be tax-deductible, but distributions in retirement would be tax-free. |

| Tax bracket in retirement | Your tax bracket in retirement will affect the taxability of your retirement income. It’s essential to consider your expected tax bracket when making decisions about retirement planning. | An individual who expects to be in a lower tax bracket in retirement might choose to contribute to a traditional IRA, while an individual who expects to be in a higher tax bracket might choose to contribute to a Roth IRA. |

| Tax-efficient investment strategies | Investing in assets that generate tax-efficient income, such as dividends and capital gains, can help minimize your tax liability in retirement. | A retiree might invest in a dividend-paying stock, which generates income that is taxed at a lower rate than ordinary income. |

The October deadline for RMDs serves as a reminder of the importance of tax-smart retirement planning. By adjusting your strategies, you can maximize your retirement savings and minimize your tax burden.

- Review your investment portfolio: Ensure your investments are aligned with your tax goals. Consider tax-efficient strategies, such as investing in tax-advantaged accounts or choosing investments that generate tax-efficient income.

- Explore Roth IRA conversions: If you expect to be in a higher tax bracket in retirement, consider converting a portion of your traditional IRA to a Roth IRA. This can help reduce your tax liability in retirement.

- Seek professional advice: Consulting with a financial advisor can help you develop a comprehensive retirement plan that addresses your unique circumstances and tax situation.

11. Future of the October Deadline

The October deadline for tax filing has been a fixture in the American tax system for decades. However, the future of this deadline is uncertain, as various factors could influence its existence and form. This section explores the potential changes or trends that may affect the October deadline in the future.

The news of Geico Layoffs October 2023 has been a concern for many employees. This is a reminder that the job market can be unpredictable.

Technological Advancements

Technological advancements have significantly impacted the tax filing process, and this trend is likely to continue. Automation, artificial intelligence, and online platforms have already simplified tax preparation and filing. This trend will likely continue, potentially leading to a more streamlined and efficient tax system.

The implications of these advancements are far-reaching. The increased use of technology could potentially make the October deadline less relevant.

- Taxpayers might be able to file their taxes more efficiently and quickly, leading to a potential shift towards a more year-round filing system.

- Real-time tax calculations and automatic filing could eliminate the need for a specific deadline.

However, these advancements also present challenges.

- Increased reliance on technology could exacerbate digital divides and create challenges for taxpayers without access to computers or reliable internet connections.

- The complexity of tax laws and regulations might require sophisticated AI systems, which could be expensive to develop and maintain.

Despite these challenges, the increasing role of technology in tax filing is likely to continue, potentially impacting the October deadline and requiring adaptation from both taxpayers and the IRS.

Economic Shifts

Economic shifts, such as inflation or recessions, can significantly impact the tax system. During periods of economic uncertainty, the government might adjust tax deadlines to provide taxpayers with more time to manage their finances. In times of recession, the government may extend the October deadline to alleviate financial pressure on taxpayers and allow them more time to meet their tax obligations.

Don’t forget that some taxes are due in October. Check out the When Are Taxes Due In October 2023 list to make sure you’re up-to-date.

Conversely, during periods of high inflation, the government might need to adjust tax deadlines to ensure timely revenue collection. The potential impact of economic shifts on the October deadline is significant.

- Extensions to the October deadline could provide taxpayers with much-needed flexibility during economic downturns, but they could also delay the government’s revenue collection.

- Changes in the October deadline might create uncertainty and confusion for taxpayers, potentially impacting their tax planning and compliance.

The government will need to carefully consider the economic implications of any changes to the October deadline, balancing the needs of taxpayers with the requirements of revenue collection.

Legislative Updates

Changes to tax laws and regulations are a constant feature of the American tax system. These updates can significantly impact the October deadline, either by extending or shortening the filing period or by introducing new tax rules that affect filing requirements.

For example, legislative updates could introduce new tax credits or deductions, requiring taxpayers to adjust their filing strategies and potentially affecting the October deadline. Similarly, changes in tax rates or income thresholds could necessitate adjustments to the filing process, potentially impacting the October deadline.

The implications of legislative updates for the October deadline are significant.

- Changes to tax laws could require adjustments to the October deadline to accommodate new filing requirements or tax rules.

- The introduction of new tax credits or deductions could necessitate extensions to the October deadline to allow taxpayers more time to understand and claim these benefits.

The IRS and lawmakers will need to work together to ensure that any legislative updates are effectively communicated to taxpayers and that the October deadline remains relevant and manageable.

If you’re in the market for a new car, October is a great time to look for deals. Check out the October 2023 Lease Deals and see what’s available.

Social Trends

Social trends, such as changing work patterns and evolving societal expectations, can also influence the October deadline. The rise of remote work, gig economy, and flexible work arrangements has challenged the traditional tax filing schedule. These changing work patterns could necessitate adjustments to the October deadline to accommodate the needs of self-employed individuals and gig workers, who may have different income streams and filing requirements.

Additionally, evolving societal expectations around work-life balance could influence the timing of tax deadlines. The implications of social trends for the October deadline are significant.

- Changes to the October deadline might be necessary to accommodate the needs of individuals with non-traditional work arrangements.

- Adjustments to the October deadline could reflect evolving societal expectations around work-life balance and provide taxpayers with more flexibility.

The IRS will need to consider the impact of social trends on the tax filing process and adjust the October deadline accordingly to ensure that it remains fair and equitable for all taxpayers.

Examples of Tax-Related Activities Due in October

October is a crucial month for taxpayers, as several tax-related activities have deadlines in this month. It’s essential to stay organized and meet these deadlines to avoid penalties and ensure you maximize your tax benefits.

Tax-Related Activities Due in October

| Activity | Description | Due Date | Penalty for Late Filing |

|---|---|---|---|

| Filing Extensions | Individuals and businesses can file extensions to postpone the deadline for filing their tax returns. | October 15th | No penalty for late filing, but you may be subject to penalties for underpayment if you owe taxes. |

| Paying Estimated Taxes | Self-employed individuals, small business owners, and others with significant income from sources other than employment are required to pay estimated taxes throughout the year. | October 15th | Penalties for underpayment can be assessed if you fail to pay enough estimated taxes. |

| Making Charitable Contributions | Charitable donations can be deducted on your tax return, providing tax benefits. | Year-end | No penalty for late filing, but you may miss out on tax benefits. |

| Reporting Certain Types of Income | Specific types of income, such as royalties, interest, or dividends, may require separate reporting forms. | Various deadlines | Penalties may apply for late or incorrect reporting. |

Tax Calendar for October

Here are some important dates and deadlines to keep in mind during October:* October 15th:Deadline for filing extensions for individual and business tax returns.

October 15th

Deadline for paying estimated taxes for the third quarter.

October 31st

Deadline for filing Form 1099-MISC for certain types of income.

Common Tax Mistakes to Avoid in October

* Failing to file for an extension:If you need more time to file your return, make sure to file for an extension by October 15th.

Underpaying estimated taxes

If you’re looking for the best interest rates on your savings, check out the PNC Bank CD Rates October 2023. These rates can be a great way to earn a higher return on your money.

Calculate your estimated tax payments accurately to avoid penalties for underpayment.

Missing the deadline for charitable contributions

Make sure to make your charitable contributions before year-end to claim the tax deductions.

Call to Action

If you have any questions or need assistance with your tax obligations, it’s always best to consult with a qualified tax professional. They can help you navigate the complexities of the tax system and ensure you comply with all applicable rules and regulations.

Illustrations of Penalties for Missing the October Deadline

Missing the October tax deadline can have serious consequences, resulting in penalties and potential financial burdens. These penalties are designed to encourage timely tax compliance and ensure the government receives its due revenue. Understanding the potential consequences can help taxpayers avoid these penalties and maintain their financial well-being.

Illustrations of Penalties

Here are some illustrations of the potential penalties for missing the October tax deadline:

- Illustration 1: Late Filing Penalty for Extension

Imagine a taxpayer who requested an extension to file their income taxes but failed to submit their return by the October deadline. The IRS will assess a late filing penalty, which is calculated as a percentage of the unpaid taxes.

This late filing penalty can be substantial, especially if the taxpayer owes a significant amount.

Consequences:

The taxpayer will not only face the late filing penalty but also potentially incur interest charges on the unpaid taxes. The interest charges accumulate over time, further increasing the taxpayer’s financial burden.

The PNC Bank Layoffs October 2023 have impacted many employees and families. It’s important to stay informed about the latest job market trends.

Visual Representation:

A visual representation could depict a person overwhelmed by a pile of paperwork, a clock ticking down, and a large “Late” stamp on their tax forms, symbolizing the stress and consequences of missing the deadline.

Looking for a new credit card? Check out the Best Credit Cards October 2023 to find the best deals and rewards.

- Illustration 2: Underpayment Penalty for Estimated Taxes

Consider a taxpayer who underestimated their tax liability and failed to pay sufficient estimated taxes throughout the year. If the taxpayer’s tax liability exceeds the amount of estimated taxes paid by the October deadline, they will be subject to an underpayment penalty.

Consequences:

The underpayment penalty is calculated as a percentage of the underpayment amount. In addition to the penalty, the taxpayer may also face interest charges on the underpayment, potentially leading to a significant financial burden. Failure to pay estimated taxes can also increase the likelihood of audits and additional penalties.

Visual Representation:

A visual representation could depict a person with a shrinking bank account, a tax bill looming, and a pile of bills labeled “Penalty” and “Interest,” highlighting the financial stress and potential consequences of underpayment.

- Illustration 3: Late Filing Penalty for Business Tax Return

A business owner who fails to file their business tax return by the October deadline will be subject to a late filing penalty. The penalty is typically calculated as a percentage of the unpaid taxes.

Consequences:

Missing the deadline can have severe consequences for businesses. The IRS may suspend the business’s license, take legal action, and even deny tax benefits. This can significantly impact the business’s operations and financial stability.

Visual Representation:

A visual representation could depict a business owner with a closed storefront, a “Closed for Non-Payment” sign, and a pile of legal documents, highlighting the potential business disruptions and legal ramifications of missing the deadline.

Epilogue

Staying informed about the IRS October deadline is paramount for taxpayers. By understanding the key dates, potential penalties, and available resources, individuals and businesses can effectively manage their tax obligations and avoid unnecessary complications. Remember, proactive planning, accurate record-keeping, and timely communication with the IRS are crucial for ensuring tax compliance and minimizing potential financial burdens.

Essential FAQs

What are the specific tax-related activities impacted by the October deadline?

The October deadline affects a variety of tax-related activities, including filing extensions for income taxes, paying estimated taxes, making charitable contributions, and reporting certain types of income.

What are the potential consequences of missing the October deadline?

Missing the October deadline can result in penalties, including late filing penalties, underpayment penalties, interest charges, and potential audits. The specific consequences vary depending on the activity and the amount of underpayment or delay.