The IRS Tax Deadline October 2024 takes center stage, marking a significant shift in the tax landscape for individuals and businesses alike. This extension, a result of various factors including the ongoing impact of the COVID-19 pandemic and IRS resource constraints, offers a much-needed reprieve for many taxpayers.

This shift in the deadline presents both opportunities and challenges, requiring careful consideration and strategic planning to navigate the new tax environment effectively.

The extended deadline provides taxpayers with additional time to gather necessary documents, seek professional assistance if needed, and ensure accurate and timely filing. It also allows the IRS to adjust its procedures and resources to accommodate the anticipated increase in filings, ultimately aiming for a smoother and more efficient tax season.

While the extension brings a sense of relief, it’s crucial to understand the implications of this change and how it might affect future tax seasons and policies.

Contents List

- 1 IRS Tax Deadline Overview

- 2 Who Benefits from the Extended Deadline?

- 3 3. Filing Requirements and Procedures

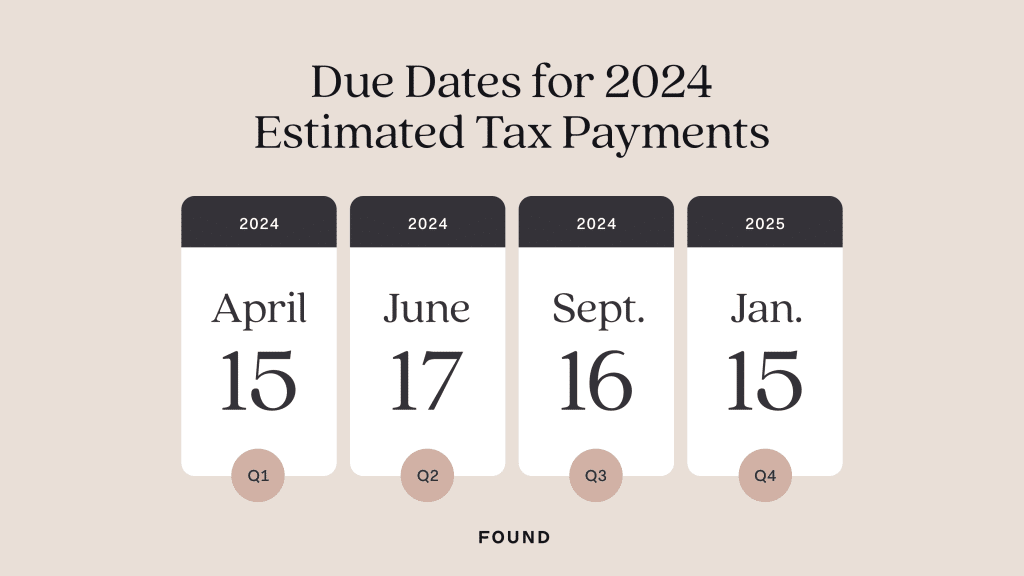

- 4 Tax Payment Options and Deadlines

- 5 Common Tax Filing Mistakes to Avoid

- 6 Tax Planning Strategies for the October Deadline

- 7 Impact on Businesses and Small Businesses

- 8 IRS Resources and Support

- 9 9. Implications for Future Tax Seasons: Irs Tax Deadline October 2024

- 10 Tax-Related News and Updates

- 11 Common Tax Questions and Answers

- 12 Tax Filing Tips and Best Practices

- 13 Future Considerations and Preparation

- 14 Final Review

- 15 Detailed FAQs

IRS Tax Deadline Overview

The October 2024 tax deadline represents a significant shift in the traditional tax filing schedule for individuals and businesses in the United States. This extension, while offering temporary relief to taxpayers, also presents challenges for the IRS in terms of managing an increased workload and ensuring timely processing of returns.

Understanding the reasons behind this extended deadline and its potential impact is crucial for navigating the tax season effectively.

October 2024 has been a tumultuous month for the financial sector, with PNC Bank announcing layoffs. If you’re concerned about the impact of these layoffs, you can find more information on our website: PNC Bank Layoffs October 2024.

Significance of the October 2024 Tax Deadline

The October 2024 tax deadline is significant for both individuals and businesses due to its potential impact on tax filing and payment obligations. This extension provides additional time for taxpayers to gather necessary documentation, prepare their returns, and make payments.

For individuals, this could mean more time to organize financial records, claim deductions and credits, and plan for potential tax liabilities. For businesses, the extension allows for more time to reconcile financial statements, finalize tax calculations, and manage potential tax obligations.The extended deadline also has implications for the IRS’s workload and resource allocation.

The agency anticipates a surge in filings during the extended period, which could strain its processing capacity and potentially lead to delays in refunds and tax notices. The IRS will need to allocate resources effectively to handle the increased volume of filings and ensure timely processing while maintaining compliance standards.

Events and Changes Leading to the Extended Deadline

The extension of the IRS tax deadline to October 2024 is a result of a confluence of events and changes that have impacted the agency’s operations in recent years.

- COVID-19 Pandemic:The COVID-19 pandemic significantly disrupted the IRS’s operations, leading to staff shortages, processing delays, and increased taxpayer inquiries. The agency faced challenges in adapting to remote work arrangements and maintaining service levels while addressing the unique needs of taxpayers during the pandemic.

- Budget Constraints:The IRS has faced significant budget constraints in recent years, limiting its ability to hire and retain staff, invest in technology upgrades, and expand its service offerings. These limitations have contributed to backlogs in processing returns and delays in responding to taxpayer inquiries.

Looking to lease a new car? October 2024 is a great time to do it, as many dealerships offer great deals to entice buyers. You can find a list of the best lease deals for October 2024 on our website.

- Legislative Changes:Recent legislation, such as the Tax Cuts and Jobs Act of 2017, has introduced significant changes to the tax code, requiring the IRS to implement new regulations, update its systems, and provide guidance to taxpayers. These changes have added complexity to tax preparation and increased the workload for the agency.

If you’re looking for a great deal on a new car, you might want to check out the best lease deals in October 2023. There are some fantastic offers out there right now, so you can find the perfect car for your needs without breaking the bank.

History of IRS Tax Deadlines and Extensions

The IRS has a history of granting tax deadline extensions in response to various challenges, including natural disasters, economic downturns, and legislative changes. The following table provides a summary of IRS tax deadlines and extensions over the past decade:

| Year | Original Deadline | Extension Granted | Reason |

|---|---|---|---|

| 2014 | April 15 | None | – |

| 2015 | April 15 | None | – |

| 2016 | April 15 | None | – |

| 2017 | April 15 | None | – |

| 2018 | April 15 | April 17 | Emancipation Day holiday in Washington D.C. |

| 2019 | April 15 | None | – |

| 2020 | April 15 | July 15 | COVID-19 pandemic |

| 2021 | April 15 | May 17 | COVID-19 pandemic |

| 2022 | April 18 | None | – |

| 2023 | April 18 | None | – |

The October 2024 tax deadline is the most significant extension in recent history, reflecting the ongoing challenges faced by the IRS. While previous extensions were primarily driven by specific events, such as holidays or natural disasters, the October 2024 deadline is a result of a broader set of challenges that have accumulated over several years.

This extension highlights the need for long-term solutions to address the IRS’s resource constraints and ensure timely processing of returns.

The extended deadline provides an opportunity for taxpayers to plan ahead and avoid potential last-minute stress. Here are some tips for navigating the October 2024 tax deadline effectively:* Gather your tax documents early:Start gathering your tax documents, such as W-2s, 1099s, and other relevant forms, as soon as possible.

This will give you ample time to organize your financial records and prepare for tax season.

Utilize online tools and resources

There are numerous online tools and resources available to assist with tax preparation, including free filing software and tax calculators. These tools can simplify the process and help you identify potential deductions and credits.

Consider professional assistance

If you find tax preparation overwhelming or have complex tax situations, consider seeking professional assistance from a tax advisor or accountant. They can provide expert guidance and ensure your tax return is filed accurately and on time.

Stay informed about updates and changes

The IRS may issue updates and guidance related to the October 2024 tax deadline. Stay informed by visiting the IRS website or subscribing to their email alerts.

File your return electronically

E-filing your tax return is generally faster and more secure than filing by mail. It also reduces the risk of errors and ensures your return is processed promptly.

Pay your taxes on time

Even with the extended deadline, it is crucial to pay your taxes on time to avoid penalties. If you cannot afford to pay your taxes in full, consider setting up a payment plan with the IRS.The October 2024 tax deadline presents both opportunities and challenges for taxpayers.

By planning ahead, utilizing available resources, and staying informed, you can navigate this extended tax season effectively and ensure your tax obligations are met on time.

Who Benefits from the Extended Deadline?

The extended tax deadline offers a welcome reprieve for many taxpayers, providing them with additional time to file their returns and potentially avoid penalties. This extended period benefits various groups, each facing unique challenges and circumstances that necessitate more time to fulfill their tax obligations.

Categories of Taxpayers Benefitting from the Extended Deadline

The extended deadline is a boon to several categories of taxpayers, each facing unique challenges and circumstances. These include:

- Individuals with Complex Tax Situations:Taxpayers with complex financial situations, such as those with multiple sources of income, investments, or business ventures, often require more time to gather necessary documentation and accurately calculate their tax liability. For example, self-employed individuals or those with rental properties may need extra time to compile their income and expense records.

- Individuals Facing Financial Hardship:Taxpayers experiencing financial difficulties may struggle to meet their tax obligations on time. The extended deadline offers them a crucial opportunity to get their finances in order, seek professional advice, or explore potential tax relief options. This could include individuals who have recently lost their jobs, experienced a medical emergency, or faced unexpected financial setbacks.

- Individuals with Busy Schedules:The extended deadline provides a much-needed buffer for individuals with demanding work schedules, family commitments, or other time-sensitive obligations. For example, working parents, students, or individuals involved in community activities may find it challenging to prioritize tax filing amidst their busy lives.

October 2024 is almost here, and you can already get a sneak peek at the calendar. Planning your month ahead? You can find the October 2024 Calendar on our website.

- Individuals with Medical or Personal Challenges:Individuals dealing with medical emergencies, family crises, or other personal challenges may require additional time to focus on their well-being and manage their affairs. The extended deadline offers them a crucial period to address these pressing issues without the added stress of a looming tax deadline.

- Individuals Seeking Professional Assistance:Some taxpayers may prefer to seek professional guidance from tax preparers or financial advisors to ensure accurate and compliant filings. The extended deadline allows them sufficient time to consult with these professionals, review their tax situation, and make informed decisions about their filings.

Reasons Behind the Extended Deadline for Specific Groups

The extended deadline is designed to address the unique needs of different taxpayer categories. For example:

- Individuals with Complex Tax Situations:The extended deadline provides them with ample time to gather all necessary documentation, including income statements, investment records, and business expenses. This ensures they can accurately calculate their tax liability and avoid errors that could lead to penalties.

- Individuals Facing Financial Hardship:The extended deadline offers them a crucial period to explore options for financial relief, such as payment plans or tax credits. This can alleviate their financial burden and prevent them from incurring penalties for late filing.

- Individuals with Busy Schedules:The extended deadline gives them more time to prioritize tax filing without compromising their other responsibilities. This reduces stress and ensures they can dedicate adequate time to complete their returns accurately.

- Individuals with Medical or Personal Challenges:The extended deadline provides them with a much-needed reprieve from the added pressure of tax filing, allowing them to focus on their well-being and address their personal needs.

- Individuals Seeking Professional Assistance:The extended deadline gives them ample time to consult with tax professionals, review their tax situation, and make informed decisions about their filings. This ensures they receive expert guidance and avoid potential tax-related issues.

Comparison of Benefits for Different Taxpayer Categories

| Taxpayer Category | Benefits ||—|—|| Individuals with Complex Tax Situations | More time to gather documentation, accurately calculate tax liability, and avoid errors || Individuals Facing Financial Hardship | Time to explore financial relief options, alleviate financial burden, and avoid penalties || Individuals with Busy Schedules | Reduced stress, ability to prioritize tax filing without compromising other responsibilities || Individuals with Medical or Personal Challenges | Reprieve from tax-related stress, time to focus on well-being and personal needs || Individuals Seeking Professional Assistance | Time to consult with tax professionals, review tax situation, and make informed decisions |

Thinking about getting a new car? October 2024 is a great time to check out the best car lease deals available. You might be surprised at the great deals you can find!

3. Filing Requirements and Procedures

The October 2024 tax deadline provides taxpayers with ample time to gather the necessary information and file their returns accurately. This section Artikels the key steps involved in filing your taxes by the extended deadline.

Filing Deadline

The tax filing deadline for October 2024 is October 15, 2024. This extended deadline applies to both individual and business tax returns. However, it is important to note that penalties may apply for late payments, even if the return is filed on time.

Required Documents and Information

To file your taxes accurately, you need to gather essential documents and information related to your income, deductions, credits, and personal details. The following table Artikels the required documents organized by category:

| Category | Required Documents |

|---|---|

| Income | W-2 forms, 1099 forms, pay stubs, interest statements, dividend statements, unemployment benefits statements, etc. |

| Deductions | Medical expense receipts, charitable donation records, home mortgage interest statements, property tax statements, student loan interest statements, etc. |

| Credits | Child tax credit documentation, education credit documentation, earned income tax credit documentation, etc. |

| Other | Social Security number, bank account information, spouse’s Social Security number (if applicable), dependents’ Social Security numbers (if applicable), etc. |

The IRS website offers a user-friendly platform for filing taxes online. Here is a step-by-step guide for navigating the IRS website and filing your taxes:

- Access the IRS website: Go to the official IRS website at www.irs.gov.

- Choose the appropriate filing method: The IRS offers several filing methods, including Free File, e-file, and mail-in filing. Free File is a program that allows taxpayers to file their taxes for free using tax preparation software provided by participating companies. E-file allows taxpayers to file their taxes electronically through a tax preparation software or through a tax professional. Mail-in filing involves filling out paper tax forms and mailing them to the IRS.

- Create an account or log in: If you are filing taxes online, you will need to create an account or log in to the IRS website. You will need your Social Security number and other personal information to create an account.

- Enter personal information and tax details: Once you have logged in, you will need to enter your personal information, such as your name, address, and Social Security number, and your tax details, such as your income, deductions, and credits.

- Review and submit the tax return: After entering all of your information, you will need to review your tax return carefully before submitting it. The IRS website provides a tool that allows you to review your tax return and make any necessary changes before submitting it.

- Track the status of the filing: Once you have submitted your tax return, you can track its status on the IRS website. The IRS website provides a tool that allows you to track the status of your refund or any outstanding tax liability.

Tax Filing Options

Taxpayers have several options for filing their taxes, each with its own advantages and disadvantages. Here is a comparison of the different filing options:

- Online Filing: Online filing is a convenient and cost-effective option for many taxpayers. It is typically faster than mail-in filing, as the IRS processes electronic returns more quickly. Many online tax preparation software programs offer free versions for taxpayers with simple tax situations.

However, some online filing services charge a fee, especially for more complex tax situations.

- Mail-in Filing: Mail-in filing is suitable for individuals who prefer paper forms or who have complex tax situations that may not be easily handled by online tax preparation software. However, mail-in filing can take longer to process than electronic filing. Taxpayers should also ensure they complete the forms correctly and mail them to the correct address to avoid delays or errors.

PNC Bank announced layoffs in October 2023, affecting many employees. You can find more information about the layoffs on our website: PNC Bank Layoffs October 2023.

- Tax Professional: Tax professionals provide expert guidance and assistance with tax preparation. They can help taxpayers understand complex tax laws and find deductions and credits they may not be aware of. However, hiring a tax professional can be expensive, especially for more complex tax situations.

Additional Resources

The IRS provides a variety of resources to help taxpayers file their taxes accurately and on time. These resources include:

- IRS Publications: The IRS publishes a variety of publications that provide information about taxes. These publications cover a wide range of topics, including income, deductions, credits, and filing requirements. You can find IRS publications on the IRS website.

- Tax Preparation Software: Many tax preparation software programs are available to help taxpayers file their taxes. These programs can help taxpayers gather the necessary information, calculate their taxes, and e-file their returns. Some tax preparation software programs offer free versions for taxpayers with simple tax situations.

However, some programs charge a fee, especially for more complex tax situations.

- Free Tax Assistance Programs: Several free tax assistance programs are available to help low- and moderate-income taxpayers file their taxes. These programs are typically offered by community organizations, volunteer groups, and government agencies. You can find information about free tax assistance programs on the IRS website.

Tax Payment Options and Deadlines

Paying your taxes on time is crucial to avoid penalties. The IRS offers various payment methods to accommodate different taxpayer needs and preferences. This section Artikels the available options and the associated deadlines, emphasizing the importance of understanding these details to avoid potential penalties.

Payment Methods and Deadlines

The IRS provides various payment options for taxpayers, including:

- Direct Pay: This online payment method allows taxpayers to pay directly from their bank account. It is free and offers real-time confirmation. The deadline for online payments is the same as the tax filing deadline.

- Electronic Funds Withdrawal (EFW): When filing electronically, taxpayers can choose to pay their taxes directly from their bank account. This option is generally available through tax preparation software or through a tax professional.

- Credit Card: Taxpayers can use a credit card to pay their taxes through third-party payment processors, such as Pay1040 or PayUSAtax. These services typically charge a fee for processing payments. The deadline for credit card payments varies depending on the payment processor.

- Debit Card: Similar to credit card payments, taxpayers can use a debit card through third-party payment processors. These services also charge a fee for processing payments.

- Check or Money Order: Taxpayers can mail a check or money order payable to the U.S. Treasury. The check should be mailed to the address provided on the tax form instructions. The deadline for check or money order payments is the same as the tax filing deadline.

- Cash: Taxpayers can pay their taxes in cash at a retail partner, such as Dollar General, CVS, Walgreens, Walmart, or Kroger. This option is available for payments up to $500. The deadline for cash payments is the same as the tax filing deadline.

Consequences of Late Payments, Irs Tax Deadline October 2024

Late payments can result in penalties, including:

- Failure to Pay Penalty: The IRS imposes a penalty of 0.5% of the unpaid tax for each month or part of a month that the tax remains unpaid. This penalty is capped at 25% of the unpaid tax. For example, if you owe $10,000 in taxes and fail to pay by the deadline, you may be subject to a penalty of $50 for each month or part of a month that the tax remains unpaid, up to a maximum penalty of $2,500.

It’s almost October, and that means it’s time to start thinking about your taxes. If you’re wondering if any taxes are due in October, we’ve got you covered. Check out our article on Taxes Due October for more information.

- Interest: The IRS charges interest on underpayments and late payments. The interest rate is determined by the federal short-term rate and is subject to change quarterly. The interest rate for underpayments is generally higher than the interest rate for late payments.

Payment Options and Deadlines Comparison

| Payment Method | Deadline | Fee ||—|—|—|| Direct Pay | Same as tax filing deadline | None || Electronic Funds Withdrawal (EFW) | Same as tax filing deadline | None || Credit Card | Varies depending on the payment processor | Yes || Debit Card | Varies depending on the payment processor | Yes || Check or Money Order | Same as tax filing deadline | None || Cash | Same as tax filing deadline | None |

Note:The IRS may grant taxpayers an extension to file their tax return. However, an extension to file does not extend the time to pay taxes. If you owe taxes and need more time to pay, you can request a payment plan from the IRS.

Common Tax Filing Mistakes to Avoid

Navigating the complexities of tax filing can be challenging, and even seasoned taxpayers can fall prey to common mistakes. These errors can lead to delays, penalties, and even audits. By understanding these pitfalls and implementing preventive measures, you can ensure a smooth and accurate tax filing experience.

Mistakes Related to Personal Information

Providing accurate and complete personal information is crucial for accurate tax filing. Errors in this area can cause delays and complications.

- Incorrect Social Security Number (SSN):Double-check your SSN on all tax forms and documents. An incorrect SSN can lead to delays in processing your return and may trigger an audit.

- Typos in Name or Address:Ensure your name and address on all tax forms match your official records. Inconsistent information can lead to confusion and delays in processing.

- Missing or Incorrect Filing Status:Choosing the correct filing status is essential. Carefully consider your marital status, dependents, and other relevant factors to select the appropriate status.

Tax Planning Strategies for the October Deadline

With the extended tax deadline looming, it’s crucial to strategize effectively to maximize deductions and minimize your tax liability. This section delves into practical tax planning strategies, highlighting ways to utilize available tax credits and benefits, and emphasizing the importance of seeking professional tax advice.

Maximizing Deductions and Minimizing Tax Liability

This section discusses ways to maximize deductions and minimize tax liability, focusing on strategies like claiming itemized deductions, understanding the standard deduction, and utilizing various tax credits and benefits.

- Itemized Deductions:Instead of claiming the standard deduction, consider itemizing deductions if your total deductions exceed the standard deduction amount. This can include deductions for medical expenses, charitable contributions, state and local taxes (SALT), home mortgage interest, and more. Remember, the SALT deduction is capped at $10,000 per household.

- Standard Deduction:If your itemized deductions are less than the standard deduction amount, claiming the standard deduction is a simpler option. The standard deduction amount varies based on your filing status and age.

- Tax Credits:Tax credits directly reduce your tax liability, dollar-for-dollar. Some common tax credits include the Earned Income Tax Credit (EITC), the Child Tax Credit, and the American Opportunity Tax Credit for education expenses.

- Tax Benefits:Various tax benefits can help lower your tax burden, such as deductions for retirement contributions, health savings accounts (HSAs), and child care expenses.

Utilizing Available Tax Credits and Benefits

This section elaborates on the importance of understanding and utilizing available tax credits and benefits, emphasizing their potential to significantly reduce your tax liability.

- Earned Income Tax Credit (EITC):This credit is available to low- and moderate-income working individuals and families. The credit amount depends on your income, filing status, and number of qualifying children.

- Child Tax Credit:This credit is available for each qualifying child under 17 years old. The credit amount is $2,000 per child, with a portion refundable.

- American Opportunity Tax Credit:This credit is available for the first four years of post-secondary education expenses. The credit amount is up to $2,500 per student, with a portion refundable.

Seeking Professional Tax Advice

This section highlights the importance of seeking professional tax advice, emphasizing the benefits of having a tax expert guide you through the complex tax system.

Did you know that the IRS has an October deadline for certain tax payments? If you need to file an extension, you might be wondering when the deadline is. You can find all the information you need on our website: Irs October Deadline 2023.

- Tax Planning:A tax advisor can help you develop a comprehensive tax plan tailored to your individual circumstances, maximizing deductions and minimizing your tax liability.

- Tax Compliance:A tax advisor can ensure you comply with all tax laws and regulations, reducing the risk of penalties or audits.

- Tax Strategies:A tax advisor can recommend tax strategies that may not be readily apparent, such as tax-efficient investment strategies or estate planning techniques.

Impact on Businesses and Small Businesses

The extended tax deadline provides a much-needed reprieve for businesses and small businesses, particularly those grappling with the ongoing economic challenges. This extended period allows businesses to focus on stabilizing their operations, managing cash flow, and navigating the complex landscape of government support programs.

Filing Requirements and Procedures for Businesses

The extended deadline offers a window of opportunity for businesses to organize their financial records, prepare their tax returns, and strategize for the future. Understanding the specific filing requirements and procedures for different business structures is crucial.

| Type of Business | Filing Deadline | Required Documents | Online Filing Platforms |

|---|---|---|---|

| Sole Proprietorship | October 15, 2024 | Schedule C, Form 1040 | TaxAct, TurboTax, H&R Block |

| Partnership | October 15, 2024 | Form 1065, Schedule K-1 | TaxAct, TurboTax, H&R Block |

| Corporation | October 15, 2024 | Form 1120, Schedule K-1 | TaxAct, TurboTax, H&R Block |

Challenges and Opportunities for Businesses

The extended deadline presents both challenges and opportunities for businesses.

Financial Strain

The extended deadline provides breathing room for businesses facing financial strain. This period allows them to focus on managing cash flow, negotiating with creditors, and exploring options for government assistance.

Supply Chain Disruptions

The extended deadline allows businesses to navigate the ongoing supply chain disruptions more effectively. This time can be used to explore alternative suppliers, adjust inventory levels, and implement strategies to mitigate supply chain risks.

Employee Retention

The extended deadline offers businesses more time to develop and implement strategies to retain employees. This period allows them to explore options such as flexible work arrangements, training programs, and employee assistance programs to support employee well-being and reduce turnover.

Government Support Programs

The extended deadline provides businesses with more time to access and utilize government support programs designed to aid businesses during challenging economic times. This includes programs like the Paycheck Protection Program (PPP), Economic Injury Disaster Loan (EIDL), and Employee Retention Tax Credit (ERTC).

If you’re planning on leasing a new car, October 2024 might be a good time to do it. There are often some great deals available, and you can find some amazing offers on a variety of vehicles. Check out the best lease deals for October 2024 to find the perfect car for your needs.

The extended tax deadline offers businesses a valuable opportunity to stabilize their operations, navigate economic challenges, and prepare for a stronger future.

IRS Resources and Support

The IRS offers a wide range of resources and support services to help taxpayers navigate the tax system effectively. From online tools and publications to contact information and support services, the IRS provides comprehensive assistance for various tax-related needs.

Comprehensive Resource List

The IRS provides a variety of resources to assist taxpayers, including:

| Resource Name | Description | Purpose | Access Method |

|---|---|---|---|

| IRS Website | The official website of the Internal Revenue Service. | Provides information on taxes, tax forms, publications, and other resources. | https://www.irs.gov |

| IRS2Go Mobile App | A free mobile app that allows taxpayers to access various IRS services. | Provides access to tax information, tax forms, payment options, and other resources. | Available on iOS and Android devices. |

| Taxpayer Advocate Service (TAS) | An independent organization within the IRS that helps taxpayers resolve tax problems with the IRS. | Provides assistance with tax disputes, audits, and other tax-related issues. | https://www.taxpayeradvocate.irs.gov |

| Tax Forms and Publications | A collection of tax forms, instructions, and guides for various tax-related situations. | Provides guidance on filing tax returns, understanding tax laws, and other tax-related matters. | https://www.irs.gov/forms-pubs |

| Contact Information | Phone numbers, email addresses, and physical addresses for various IRS departments and offices. | Provides a means to contact the IRS for tax-related inquiries and assistance. | https://www.irs.gov/contact-us |

| Taxpayer Assistance Centers (TACs) | Physical locations where taxpayers can receive in-person assistance with tax-related matters. | Provides assistance with tax forms, filing requirements, and other tax-related issues. | https://www.irs.gov/help-resources/find-a-taxpayer-assistance-center |

| IRS Volunteer Income Tax Assistance (VITA) Program | A free tax preparation service for low- to moderate-income taxpayers. | Provides free tax preparation assistance to eligible taxpayers. | https://www.irs.gov/individuals/free-tax-preparation |

| Tax Counseling for the Elderly (TCE) Program | A free tax preparation service for taxpayers aged 60 and older. | Provides free tax preparation assistance to seniors. | https://www.irs.gov/individuals/free-tax-preparation |

Access and Utilization

To access and utilize these resources, taxpayers can follow these steps:

- Visit the IRS website:The IRS website is the primary source of information for all tax-related matters. Taxpayers can access tax forms, publications, instructions, and other resources online.

- Download the IRS2Go mobile app:The IRS2Go mobile app provides access to various IRS services, including tax information, tax forms, payment options, and other resources.

Cigna has also announced layoffs in October 2024, impacting employees across the country. You can find more information about the layoffs on our website: Cigna Layoffs October 2024.

- Contact the Taxpayer Advocate Service (TAS):Taxpayers can contact the TAS to resolve tax problems with the IRS.

- Locate a Taxpayer Assistance Center (TAC):Taxpayers can visit a TAC to receive in-person assistance with tax-related matters.

- Utilize the VITA or TCE programs:Eligible taxpayers can utilize the VITA or TCE programs for free tax preparation assistance.

Example Scenarios

Here are some examples of how taxpayers can use these resources to address common tax-related issues:

- Filing a tax return online:Taxpayers can access and download tax forms from the IRS website, and use tax preparation software or file their return online through the IRS’s Free File program.

- Getting help with a tax audit:Taxpayers can contact the Taxpayer Advocate Service (TAS) for assistance with tax audits.

- Resolving a tax debt:Taxpayers can contact the IRS to explore payment options, such as setting up a payment plan or offering an Offer in Compromise (OIC).

- Requesting a tax transcript:Taxpayers can request a tax transcript online through the IRS website or by mail.

- Accessing tax forms and publications:Taxpayers can download tax forms and publications from the IRS website or order them by mail.

9. Implications for Future Tax Seasons: Irs Tax Deadline October 2024

The October 2024 tax deadline has the potential to significantly impact future tax seasons, influencing both taxpayers and the IRS. This extended deadline creates a ripple effect, affecting financial planning strategies, tax compliance, and even future tax policies.

Long-Term Implications

The October 2024 deadline could have long-term consequences for taxpayers, particularly regarding financial planning, tax compliance, and tax policy.

- Impact on Financial Planning: The extended deadline might lead to changes in individuals’ and businesses’ financial planning strategies. Taxpayers may adjust their investment plans, savings goals, and spending habits based on the new deadline. Businesses might revise their financial projections and budgeting cycles to align with the October deadline.

For instance, businesses may adjust their quarterly tax payments to accommodate the later filing date.

- Tax Compliance: Failure to meet the October 2024 deadline could result in penalties for taxpayers. The IRS might adopt stricter enforcement measures, including increased audits and penalties, to ensure compliance. This could lead to higher tax burdens for individuals and businesses who miss the deadline.

- Tax Policy: The October 2024 deadline could influence future tax policy discussions and changes. The extended deadline may prompt lawmakers to re-evaluate the current tax system and consider adjustments to filing deadlines, penalties, or other aspects of tax compliance. For example, there might be discussions about extending the regular tax filing deadline to October for all taxpayers in future years.

Impact on Future Deadlines and Policies

The October 2024 deadline could influence future tax filing deadlines and policies, potentially leading to adjustments in how taxes are filed and paid.

- Filing Deadlines: Future deadlines may be adjusted to accommodate the October 2024 deadline. This could involve extending the regular tax filing deadline for all taxpayers to October or establishing a permanent October deadline for specific groups, such as those affected by natural disasters.

October 2024 has been a challenging month for Geico, with the company announcing layoffs. If you’re looking for more information on the Geico layoffs, you can find it on our website: Geico Layoffs October 2024.

This could lead to greater consistency in tax filing deadlines, making it easier for taxpayers to plan and manage their tax obligations.

- Tax Policies: The October 2024 deadline could lead to changes in tax policies regarding extensions, penalties, or other aspects of tax compliance. For example, the IRS might adjust the penalty structure for late filing or late payment, or introduce new measures to encourage early filing.

This could create a more equitable tax system by reducing the burden on taxpayers who face unforeseen circumstances.

IRS Procedures

The IRS might adjust its procedures to handle the potential increase in filings and communication needs associated with the October 2024 deadline.

- Processing and Enforcement: The IRS might adjust its processing procedures and enforcement practices to handle the potential increase in filings. This could involve streamlining processes, increasing staff, or implementing new technologies to expedite processing and ensure timely refunds. The IRS might also need to adjust its audit procedures and enforcement policies to accommodate the later deadline and ensure compliance.

October 2024 is almost here, and with it comes the annual tax deadline for those who filed for an extension. If you’re wondering when you need to file your taxes, you can find the answer on our website: When Are Taxes Due In October 2024.

- Communication and Outreach: The IRS might implement new communication and outreach strategies to inform taxpayers about the new deadline and any related changes. This could involve using various channels, such as social media, email, and traditional mail, to reach a wider audience.

The IRS might also provide additional support and resources to help taxpayers understand the new deadline and navigate the tax filing process.

- Technology and Automation: The IRS might explore new technologies or automation to improve efficiency and manage the increased workload. This could involve using artificial intelligence (AI) to automate certain tasks, such as processing tax returns or answering taxpayer inquiries. The IRS might also invest in upgrading its online systems to handle the increased traffic and provide better customer service.

Tax-Related News and Updates

The October 2024 tax deadline is approaching, and the IRS has released several updates and announcements that could significantly impact your tax filing. Staying informed about these changes is crucial to ensure you comply with the latest regulations and maximize your tax benefits.

October is a great time to start saving for the future. With the holidays coming up, it’s important to make sure you have enough money set aside. If you’re looking for the best CD rates in October 2024 , we’ve got you covered.

We’ve compiled a list of the top rates from some of the best banks in the country, so you can find the perfect option for your needs.

Key Tax Updates and Their Implications

Recent tax updates have focused on various aspects of the tax code, including changes to deductions, credits, and income thresholds. Here are some notable updates and their potential impact on your tax filing:

- Inflation Reduction Act:This landmark legislation has introduced significant changes to the tax code, including expanded tax credits for clean energy investments, increased funding for the IRS, and enhanced tax enforcement.

- Child Tax Credit:The American Rescue Plan Act temporarily expanded the Child Tax Credit, but these changes have expired.

October is a busy month for tax payments. If you’re wondering if any taxes are due in October, you can find the answer on our website: Taxes Due October.

While the credit is still available, the amount and eligibility requirements have reverted to pre-pandemic levels.

- Standard Deduction:The standard deduction amount is adjusted annually for inflation. The IRS has announced an increase in the standard deduction for 2024, which could benefit taxpayers who choose not to itemize their deductions.

If you filed for a tax extension, you might be wondering when the IRS deadline is. You can find all the information you need on our website: Irs Tax Deadline October 2023.

Common Tax Questions and Answers

With the October 2024 tax deadline approaching, many taxpayers have questions about their filing obligations and how to navigate the process. Here are some common questions and their answers to help you understand the extended deadline and your tax responsibilities.

Frequently Asked Questions About the October 2024 Deadline

The extended deadline offers taxpayers more time to file their returns and make payments, but it’s crucial to understand the specifics and how it impacts your situation.

- Who benefits from the extended deadline?The October 2024 deadline primarily benefits taxpayers who typically file their returns by April 15th. This includes individuals, businesses, and non-profit organizations.

- Does the extended deadline apply to all taxes?While the October deadline primarily applies to income tax returns, some other taxes, like estimated taxes, may still have earlier deadlines. Consult the IRS website for specific deadlines for various taxes.

- What happens if I don’t file by the October deadline?Failure to file by the extended deadline can result in penalties and interest charges. The IRS may also take enforcement actions, such as liens or levies, to collect unpaid taxes.

- Can I still file for an extension beyond the October deadline?In certain circumstances, you may be able to request an extension to file your return beyond October. However, this only extends the filing deadline, not the payment deadline. You must still pay any taxes owed by the original deadline.

- What are the common reasons for the October 2024 extension?The October deadline is often extended due to natural disasters, economic downturns, or other significant events that may affect taxpayers’ ability to file their returns on time.

- How can I avoid late filing penalties?The best way to avoid late filing penalties is to file your return on time, even if you can’t pay the full amount owed. You can request a payment plan or file for an extension if necessary.

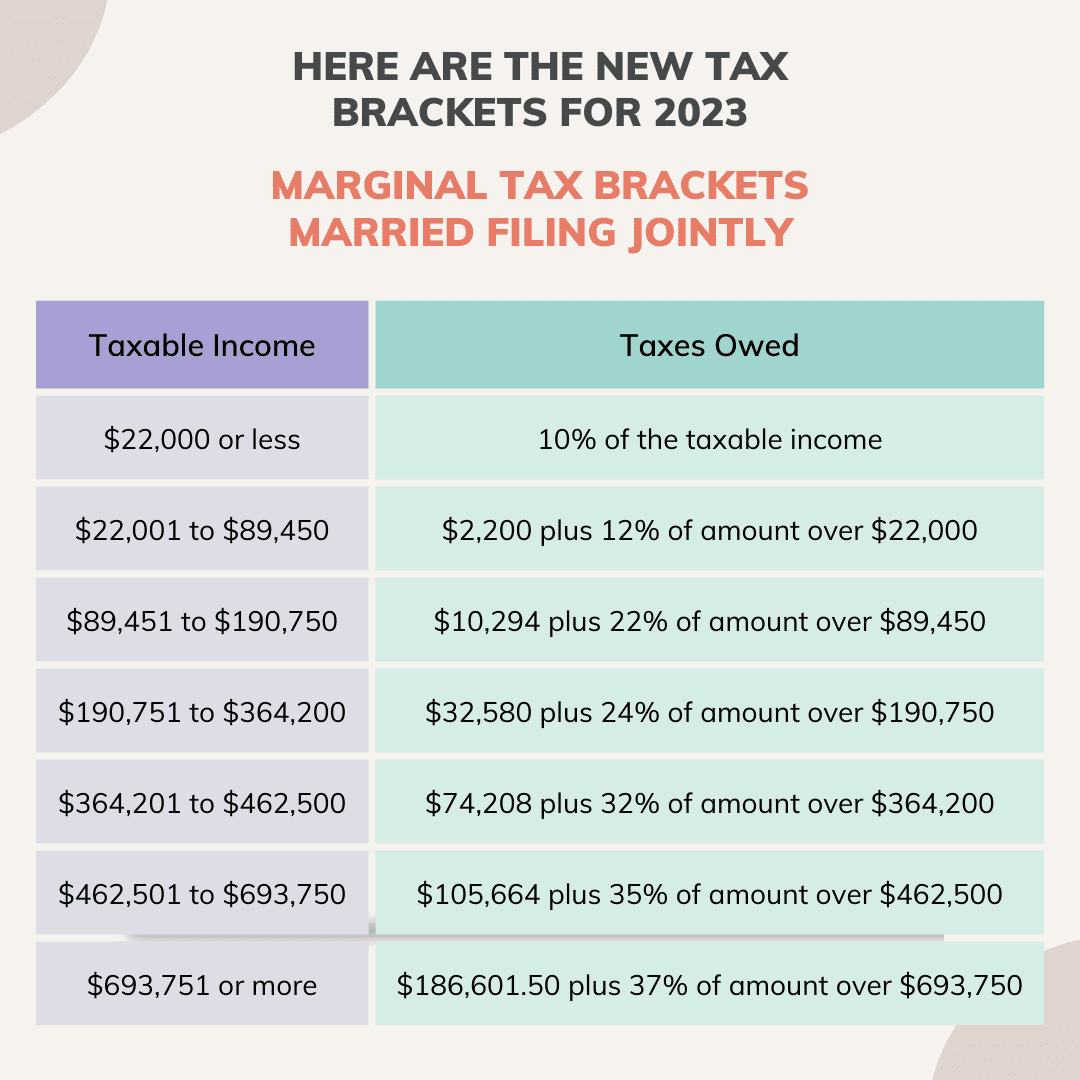

- Are there any changes to tax rates or deductions for the October 2024 deadline?The IRS usually announces any changes to tax rates or deductions well in advance. It’s important to stay updated on any changes that may impact your tax obligations.

- What resources are available to help me file my taxes?The IRS provides various resources, including publications, online tools, and phone support, to help taxpayers understand their tax obligations and file their returns accurately.

- What are the implications of the October 2024 deadline for future tax seasons?While the October deadline is a one-time extension, it may set a precedent for future tax seasons. Taxpayers should stay informed about any changes to filing deadlines and tax laws.

Tax Filing Tips and Best Practices

Navigating the tax filing process can be daunting, but with the right strategies and preparation, you can ensure a smooth and accurate filing experience. This section provides practical tips and best practices to help you file your taxes confidently and efficiently.

Importance of Accurate Record-Keeping and Organization

Maintaining meticulous records is crucial for accurate tax filing. Accurate records ensure you can claim all eligible deductions and credits, while also helping you avoid potential audits.

- Gather all relevant documents, including W-2s, 1099s, receipts, and other income and expense statements.

- Organize your documents systematically, using folders or a digital filing system. Consider using a spreadsheet or dedicated software to track income and expenses throughout the year.

- Keep records for at least three years, as this is the IRS’s standard audit period.

Benefits of Utilizing Tax Software or Professional Assistance

Tax software and professional assistance can significantly simplify the filing process and help you maximize your tax benefits.

- Tax software programs are user-friendly and guide you through the filing process step-by-step, providing helpful prompts and calculations. They often offer access to tax professionals for support and guidance.

- Hiring a tax professional can be beneficial, especially if you have a complex tax situation, such as owning a business, investments, or international income. They can provide expert advice and ensure you claim all eligible deductions and credits.

- Before choosing a tax professional, research their qualifications and experience. Look for individuals who are licensed and certified by reputable organizations.

Future Considerations and Preparation

The October 2024 tax deadline offers a valuable opportunity to reflect on your tax obligations and prepare for future tax seasons. By taking proactive steps now, you can streamline your tax filing process, minimize your tax liability, and achieve your financial goals.

Key Points for Future Tax Seasons

It’s essential to be prepared for upcoming tax seasons to ensure accurate and timely filing. Here are some key takeaways to keep in mind:

- Maintain Accurate Records:Keep detailed records of all income and expenses throughout the year. This includes receipts, invoices, bank statements, and other relevant documentation. Accurate recordkeeping will simplify tax preparation and help you avoid errors.

- Understand Deadlines and Requirements:Stay informed about tax deadlines and filing requirements. The IRS website and tax professionals can provide up-to-date information. Knowing these details will help you avoid penalties and ensure compliance.

- Seek Professional Advice:If you have complex financial situations or are unsure about tax laws, consider seeking advice from a qualified tax professional. They can provide personalized guidance and help you make informed decisions.

Encouraging Proactive Tax Planning

Proactive tax planning is crucial for maximizing your financial well-being. By taking a strategic approach to your taxes throughout the year, you can minimize your tax liability, maximize deductions and credits, and achieve your financial goals. This involves understanding your income and expenses, identifying potential deductions and credits, and making informed financial decisions that align with your tax situation.

Staying Informed about Tax Changes

Tax laws are constantly evolving, making it essential to stay informed about changes that could impact your tax obligations. Here are some resources and strategies to keep you up-to-date:

| Resource | Description | Benefits |

|---|---|---|

| IRS Website | The official source for tax information and updates. | Provides accurate and reliable information directly from the IRS. |

| Tax Professionals | Certified public accountants (CPAs) and other qualified professionals offer personalized advice and guidance. | Offers tailored strategies and insights based on your specific financial situation. |

| Tax Newsletters | Industry publications and email subscriptions share insights and analysis of tax law changes. | Provides in-depth analysis and interpretations of tax updates. |

| Social Media | Follow reputable tax organizations and experts for timely updates and insights. | Offers a convenient platform to access concise and up-to-date information. |

Final Review

As the October 2024 tax deadline approaches, it’s clear that this extension is a significant event with far-reaching implications. By understanding the reasons behind the extension, the benefits it offers, and the potential challenges it presents, taxpayers can prepare effectively and navigate this new tax landscape with confidence.

Proactive planning, accurate record-keeping, and seeking professional guidance when needed are key strategies for success in this extended tax season. Staying informed about tax updates and changes is essential to ensure compliance and maximize tax benefits. With careful preparation and a clear understanding of the new deadline, taxpayers can confidently meet their tax obligations and navigate the evolving tax environment.

Detailed FAQs

What are the penalties for filing my taxes late?

The penalties for late filing can vary depending on the amount of tax owed and the length of the delay. The IRS may charge a penalty of 0.5% of the unpaid taxes for each month or part of a month that taxes are late, up to a maximum of 25%.

There is also a penalty for failing to pay on time, which is typically 0.5% of the unpaid taxes for each month or part of a month that payment is late, up to a maximum of 25%. It’s important to note that the IRS may waive penalties in certain circumstances, such as if you can demonstrate that you had reasonable cause for the delay.

Can I still file my taxes electronically if the deadline is extended?

Yes, you can still file your taxes electronically, even with the extended deadline. Many online tax preparation services and software programs are available to help you file your taxes electronically. However, it’s important to note that the deadline for filing electronically is the same as the deadline for filing by mail, which is October 15, 2024.

This means that you must submit your electronic tax return by October 15, 2024, to avoid penalties.

What are the different ways I can pay my taxes?

You have several options for paying your taxes, including:

- Direct Pay:You can make tax payments directly from your bank account using the IRS’s online payment system, Direct Pay.

- Debit Card, Credit Card, or Digital Wallet:You can pay your taxes using a debit card, credit card, or digital wallet through a third-party payment processor, such as Pay1040 or PayUSAtax. Note that there may be fees associated with using these payment methods.

- Check or Money Order:You can pay your taxes by mail using a check or money order. Make your check or money order payable to the U.S. Treasury, and include your name, address, Social Security number, the tax year, and the relevant tax form or notice number.

- Cash:You can pay your taxes in cash at a retail partner, such as Walmart, CVS, or Walgreens. However, there is a limit to the amount of cash you can pay in person.