Is A Variable Annuity A Good Investment 2024? This question is on the minds of many investors, particularly in today’s volatile market. Variable annuities offer a unique blend of growth potential and income security, but they also come with complexities and risks.

If you’re considering a retirement plan with guaranteed income, a 457 B Variable Annuity 2024 might be something to look into. These plans can offer a steady stream of income, but they’re not for everyone. Before you decide, it’s essential to understand how they work and if they’re the right fit for your financial goals.

Understanding the ins and outs of these financial products is crucial for making informed decisions.

Variable annuities are insurance-based investments that allow you to participate in the growth of the stock market while providing potential tax advantages and income guarantees. They function similarly to mutual funds, with your contributions being invested in a variety of sub-accounts that track different market indexes or investment strategies.

If you’re a federal employee, you might be considering the Thrift Savings Plan (TSP). To calculate potential annuity payments from your TSP, you can find helpful resources at Calculating Tsp Annuity 2024. This information can guide your planning for a comfortable retirement.

However, unlike traditional annuities, variable annuities offer the potential for higher returns, but they also carry the risk of market fluctuations.

Contents List

- 1 What Are Variable Annuities?

- 2 Potential Benefits of Variable Annuities

- 3 Risks and Considerations of Variable Annuities

- 4 Comparing Variable Annuities to Other Investment Options

- 5 Factors to Consider Before Investing in a Variable Annuity

- 6 Current Market Conditions and Their Impact on Variable Annuities: Is A Variable Annuity A Good Investment 2024

- 7 Last Word

- 8 FAQ Overview

What Are Variable Annuities?

Variable annuities are a type of insurance product that combines investment features with income guarantees. They offer the potential for growth based on the performance of underlying investments, while also providing protection against market downturns.

An annuity is a financial product that provides a stream of regular payments over a specific period. To understand the definition of an annuity, visit Annuity Is Defined As Mcq 2024 for a comprehensive explanation.

Core Features of Variable Annuities

Variable annuities are characterized by their flexibility and potential for growth. Here are some key features:

- Investment Options:Variable annuities allow you to invest in a range of sub-accounts, which typically mirror mutual funds or exchange-traded funds (ETFs). These sub-accounts offer exposure to different asset classes, such as stocks, bonds, and real estate.

- Growth Potential:The value of your variable annuity can increase or decrease based on the performance of the underlying investments. If your chosen sub-accounts perform well, your annuity value will grow.

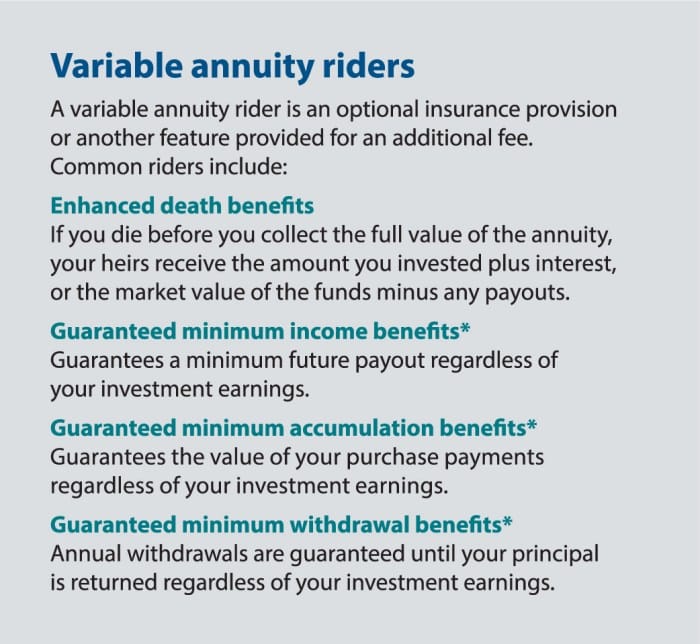

- Income Guarantees:Some variable annuities offer guaranteed minimum income benefits (GMIBs) or guaranteed lifetime withdrawal benefits (GLWBs). These features provide a safety net by guaranteeing a minimum income stream during retirement, even if your investments decline in value.

- Tax Deferral:Earnings from variable annuities are tax-deferred, meaning you won’t owe taxes on them until you withdraw the money. This can be advantageous, as it allows your investments to grow tax-free for a longer period.

Differences Between Variable Annuities and Traditional Annuities

Variable annuities differ from traditional annuities in a few key ways:

- Investment Risk:Traditional annuities provide fixed payments, while variable annuities offer the potential for higher returns but also carry the risk of investment losses.

- Growth Potential:Variable annuities have the potential for higher growth, but they are also subject to market fluctuations.

- Taxation:Traditional annuities are taxed on the income received, while variable annuities are taxed on withdrawals.

How Variable Annuities Work

Variable annuities work by allocating your investment to sub-accounts, which are managed by professional fund managers. The value of your annuity will fluctuate based on the performance of these sub-accounts.

- Sub-accounts:Variable annuities offer a range of sub-accounts, allowing you to diversify your investment portfolio. Each sub-account is designed to track the performance of a specific asset class or investment strategy.

- Investment Options:You can choose to allocate your investment among different sub-accounts, based on your risk tolerance and investment goals. For example, you might choose to invest in a mix of stock, bond, and real estate sub-accounts.

- Earnings:The earnings from your sub-accounts are credited to your annuity account, and they grow tax-deferred until you withdraw them.

- Withdrawals:When you withdraw money from your variable annuity, you will pay taxes on the earnings portion of the withdrawal.

Potential Benefits of Variable Annuities

Variable annuities can offer several potential benefits, making them an attractive investment option for some individuals.

Growth Potential

Variable annuities offer the potential for higher returns than traditional annuities, as they are linked to the performance of underlying investments. This growth potential can be particularly attractive for individuals with a longer investment horizon and a higher risk tolerance.

In the world of annuities, there are different types, and an ordinary annuity is one of the most common. To understand the characteristics of an ordinary annuity, visit Annuity Is Ordinary 2024 for a detailed explanation.

Tax Advantages

The tax-deferred nature of variable annuities is a significant benefit. This means that you won’t owe taxes on the earnings from your investments until you withdraw them. This can allow your investment to grow tax-free for a longer period, potentially leading to greater returns.

Death Benefit

Variable annuities typically include a death benefit feature. This feature ensures that your beneficiaries will receive a minimum payout, even if the value of your annuity has declined. The death benefit can be a valuable asset for individuals who want to provide financial security for their loved ones.

The “J” factor calculation is an important consideration in HVAC system design. To learn more about this calculation and its impact on HVAC efficiency, explore J Calculation Hvac 2024. This information can help you make informed decisions about your HVAC system.

Income Generation

Variable annuities can provide a source of income during retirement. You can withdraw money from your annuity on a regular basis, either through a fixed payment schedule or through a flexible withdrawal plan. Some variable annuities offer guaranteed minimum income benefits (GMIBs) or guaranteed lifetime withdrawal benefits (GLWBs), which can provide a safety net during retirement.

Sometimes you need a little help remembering what something is, especially if you’re trying to understand complex financial terms. If you’re looking for a fun way to learn about annuities, try Annuity Unscramble 2024. It’s a quick and easy way to test your knowledge.

Risks and Considerations of Variable Annuities

While variable annuities offer potential benefits, they also come with certain risks and considerations that investors should carefully weigh.

Annuity payments often start at a specific date. To find out when your annuity payments might begin, you can check the terms of your contract or consult the resources at Annuity Date Is 2024. This information can help you plan your finances effectively.

Market Volatility and Investment Losses

Variable annuities are subject to market volatility, meaning the value of your investment can fluctuate significantly. If the market declines, your annuity value may also decline, potentially resulting in investment losses.

Fees and Expenses

Variable annuities typically carry a range of fees and expenses, which can impact your returns. These fees can include:

- Mortality and expense risk charges:These charges are designed to cover the insurance company’s costs of providing the death benefit and other guarantees.

- Administrative fees:These fees cover the costs of managing the annuity account.

- Investment management fees:These fees are charged by the fund managers who manage the sub-accounts.

Surrender Charges

Variable annuities often include surrender charges, which are fees you pay if you withdraw money from your annuity before a certain period. These charges are designed to discourage early withdrawals and can significantly reduce your returns.

When considering a variable annuity, it’s important to understand the associated charges. These charges can impact your overall returns, so it’s crucial to carefully review them before making a decision. A Variable Annuity Charges 2024 provides valuable insights into these fees and how they might affect your investment.

Tax Implications

The tax implications of variable annuities can be complex, especially during withdrawals. You will need to carefully consider the tax implications of your withdrawals, as they can impact your overall returns.

The exclusion ratio for variable annuities is a crucial factor in determining how much of your annuity payments is considered taxable income. To learn more about this ratio and how it affects your tax obligations, visit Variable Annuity Exclusion Ratio 2024 for a detailed explanation.

Complexities

Variable annuities can be complex products, with a wide range of features and options. It is important to fully understand the terms and conditions of your annuity before investing.

Comparing Variable Annuities to Other Investment Options

Variable annuities are just one of many investment options available. It’s important to compare them to other options to determine if they are the right fit for your investment goals.

Variable Annuities vs. Mutual Funds, ETFs, and Individual Stocks, Is A Variable Annuity A Good Investment 2024

Here is a table comparing variable annuities to other common investment options:

| Investment Option | Growth Potential | Risk | Fees and Expenses | Tax Advantages | Other Features |

|---|---|---|---|---|---|

| Variable Annuity | High | High | High | Tax-deferred growth | Death benefit, income guarantees |

| Mutual Funds | Moderate to High | Moderate to High | Moderate | Taxable income | Diversification, professional management |

| ETFs | Moderate to High | Moderate to High | Low | Taxable income | Diversification, low trading costs |

| Individual Stocks | High | High | Low | Taxable income | Potential for high returns, high risk |

Suitability for Different Investment Goals and Risk Tolerances

The suitability of variable annuities depends on your investment goals and risk tolerance.

- Long-term investors with a high risk tolerance:Variable annuities can be a good option for long-term investors who are comfortable with the potential for market volatility and investment losses. The tax-deferred growth and death benefit features can be attractive for these investors.

- Individuals seeking income guarantees:Variable annuities with guaranteed minimum income benefits (GMIBs) or guaranteed lifetime withdrawal benefits (GLWBs) can provide a safety net during retirement. These features can be attractive for individuals who want to ensure a minimum income stream, even if their investments decline in value.

- Individuals with complex tax situations:Variable annuities can be a good option for individuals with complex tax situations, as the tax-deferred growth can help to reduce their overall tax burden.

Factors to Consider Before Investing in a Variable Annuity

Before investing in a variable annuity, it is essential to carefully consider your investment goals and risk tolerance.

Understanding Your Investment Goals and Risk Tolerance

It’s important to have a clear understanding of your investment goals and risk tolerance before investing in any product.

- Investment goals:What are you hoping to achieve with your investment? Are you saving for retirement, a down payment on a house, or your children’s education?

- Risk tolerance:How comfortable are you with the potential for market volatility and investment losses? Are you willing to accept a higher risk for the potential for higher returns, or do you prefer a more conservative approach?

Questions to Ask a Financial Advisor

If you are considering investing in a variable annuity, it’s essential to consult with a qualified financial advisor. Here are some questions to ask them:

- What are the fees and expenses associated with this annuity?

- What are the surrender charges?

- What are the death benefit features?

- What are the tax implications of this annuity?

- How does this annuity compare to other investment options?

Key Factors to Consider When Choosing a Variable Annuity Product

When choosing a variable annuity product, consider the following factors:

- Investment options:Does the annuity offer a wide range of sub-accounts that align with your investment goals?

- Fees and expenses:Are the fees and expenses competitive? Compare the fees of different annuity products before making a decision.

- Surrender charges:What are the surrender charges, and how long do they last?

- Death benefit features:What is the death benefit, and how does it work?

- Income guarantees:Does the annuity offer any income guarantees, such as GMIBs or GLWBs?

- Financial strength of the insurance company:Make sure the insurance company is financially sound and has a strong track record of providing annuity products.

Current Market Conditions and Their Impact on Variable Annuities: Is A Variable Annuity A Good Investment 2024

Current market conditions can significantly impact the performance of variable annuities.

Charles Schwab offers a helpful Annuity Calculator Charles Schwab 2024 that can provide you with personalized estimates for your annuity payments. It’s a great tool to explore different scenarios and see how your choices might affect your retirement income.

Current State of the Stock Market

The stock market can be volatile, and its performance can significantly impact the value of variable annuities. If the stock market declines, the value of your annuity may also decline.

Bankrate offers a user-friendly Annuity Calculator Bankrate 2024 that can help you estimate potential annuity payments. It’s a helpful tool to explore different scenarios and see how your choices might impact your retirement income.

Rising Interest Rates and Inflation

Rising interest rates and inflation can also impact variable annuity returns. Rising interest rates can make it more expensive for insurance companies to provide guarantees, which can lead to higher fees and expenses. Inflation can also erode the purchasing power of your investment returns.

Annuity calculations can seem daunting, but you don’t have to be a financial expert to get started. With a tool like Microsoft Excel, you can easily calculate your potential annuity payments. Check out this guide on Calculating Annuity In Excel 2024 to learn how to use Excel’s powerful functions to analyze your options.

Suitability of Variable Annuities in Different Market Conditions

The suitability of variable annuities depends on the current market conditions and your investment goals.

When planning for retirement, you might be wondering if an annuity or an IRA is the right choice for you. Annuity Vs Ira 2024 explores the key differences between these two popular retirement savings options, helping you make an informed decision.

- Bull market:In a bull market, variable annuities can offer the potential for higher returns, as the value of your investments is likely to increase. However, it’s important to remember that bull markets don’t last forever.

- Bear market:In a bear market, variable annuities can be riskier, as the value of your investments is likely to decline. If you are concerned about market downturns, you may want to consider a more conservative investment option.

- Rising interest rates:Rising interest rates can make it more expensive for insurance companies to provide guarantees, which can lead to higher fees and expenses. This can impact the returns on variable annuities.

- Inflation:Inflation can erode the purchasing power of your investment returns. If inflation is high, it’s important to choose investments that have the potential to outpace inflation.

Last Word

Ultimately, deciding whether a variable annuity is a good investment for you depends on your individual financial goals, risk tolerance, and time horizon. It’s essential to thoroughly research and understand the intricacies of these products before making any decisions. Consulting with a qualified financial advisor can help you navigate the complexities of variable annuities and determine if they align with your investment strategy.

FAQ Overview

How much money do I need to invest in a variable annuity?

The minimum investment amount for variable annuities varies depending on the insurance company and specific product. It’s important to check the requirements before making a decision.

Are there any fees associated with variable annuities?

Annuity contracts can come with various features and complexities. To get a comprehensive overview of the basics and understand the different types of annuities available, explore Annuity General 2024. It’s a great starting point for anyone considering an annuity as part of their retirement planning.

Yes, variable annuities typically involve a range of fees, including administrative fees, mortality and expense charges, and surrender charges. These fees can significantly impact your returns, so it’s crucial to carefully consider them before investing.

When it comes to annuities, understanding the different types is key. An ordinary annuity is a common type where payments are made at the end of each period. To learn more about the intricacies of this type of annuity, visit Calculating Ordinary Annuity 2024 and gain insights into its workings.

What happens to my money if the market declines?

As variable annuities are linked to the stock market, their value can fluctuate. If the market declines, the value of your investment may also decrease. However, some variable annuities offer downside protection features that can mitigate losses to a certain extent.

Can I withdraw my money from a variable annuity before retirement?

You can typically withdraw money from a variable annuity before retirement, but you may be subject to surrender charges and tax penalties. The terms and conditions for withdrawals vary depending on the specific product.