Is Annuity Counted As Income 2024? This question is crucial for anyone considering annuities as part of their retirement planning. Annuities, often described as a financial tool for guaranteed income, can offer a sense of security in later years. However, understanding the tax implications of annuity payments is essential to maximizing their benefits and avoiding potential surprises.

Calculating the future value of an annuity can be easily done in Excel. There are built-in formulas that simplify this process, making it a great tool for financial planning. The Fv Annuity Excel 2024 article provides more details.

This guide explores the intricacies of annuity taxation in 2024, dissecting the various types of annuities, how they are taxed, and the factors that can influence your income from them. We’ll also delve into how annuity income can be integrated into your retirement planning, ensuring you make informed decisions about this financial instrument.

Qualified annuities offer tax advantages that can make them attractive retirement options. Understanding the requirements and benefits of qualified annuities can help you make informed decisions. Visit Annuity Is Qualified 2024 for more details.

Contents List

Understanding Annuities

Annuities are financial instruments that provide a stream of regular payments over a specified period of time. They are commonly used for retirement planning, income generation, and estate planning. Annuities can be categorized into various types, each with its unique features and benefits.

Nerdwallet provides a helpful annuity calculator that allows you to compare different annuity options and estimate potential returns. This tool can help you make informed decisions about your retirement planning. Check out the Annuity Calculator Nerdwallet 2024 for more details.

Types of Annuities

There are numerous types of annuities, each designed to meet specific financial needs. Some common types include:

- Fixed Annuities:These annuities provide a guaranteed rate of return, offering predictable income payments. They are suitable for individuals seeking stability and security.

- Variable Annuities:These annuities invest in a portfolio of mutual funds, providing the potential for higher returns but also carrying greater risk. They are suitable for individuals seeking growth potential.

- Indexed Annuities:These annuities link their returns to a specific market index, such as the S&P 500. They offer potential growth with some downside protection.

- Immediate Annuities:These annuities begin making payments immediately after purchase. They are ideal for individuals seeking immediate income.

- Deferred Annuities:These annuities start making payments at a future date, allowing for growth and tax deferral during the accumulation phase.

How Annuities Work, Is Annuity Counted As Income 2024

Annuities operate in two phases: the accumulation phase and the payout phase.

Understanding the annuity formula is essential for making informed decisions about your retirement savings. This formula helps calculate the present or future value of an annuity based on various factors. The Annuity Formula Is 2024 article provides more details.

- Accumulation Phase:During this phase, you make contributions to the annuity contract, which grows tax-deferred. The growth is based on the chosen investment options, such as fixed interest rates or variable investments.

- Payout Phase:Once the accumulation phase ends, the annuity enters the payout phase. The annuity provider begins making regular payments to you, either for a fixed period or for the rest of your life.

Examples of Annuity Contracts

Annuity contracts vary significantly in terms of their features and benefits. Here are a few examples:

- Single Premium Immediate Annuity (SPIA):This annuity requires a single lump-sum payment and begins making payments immediately. It is often used for income generation in retirement.

- Fixed Indexed Annuity:This annuity links its returns to a specific market index, such as the S&P 500, but also provides a minimum guaranteed return. It is suitable for individuals seeking potential growth with downside protection.

- Variable Annuity with Living Benefits:This annuity allows for investment in a portfolio of mutual funds, providing the potential for higher returns. It also includes features such as guaranteed minimum income benefits and death benefits.

Taxation of Annuities

The tax implications of annuity payments depend on the type of annuity and the specific terms of the contract.

The taxability of annuity payments can vary depending on the type of annuity and the rules in your jurisdiction. To learn more about the tax implications of annuities received from LIC, you can visit Is Annuity Received From Lic Taxable 2024.

Tax-Deferred Annuities

Tax-deferred annuities allow for tax deferral on the earnings during the accumulation phase. This means that you do not pay taxes on the growth of your investment until you start receiving payments in the payout phase.

The HMrc annuity calculator can help you estimate your potential annuity income. This tool is especially helpful for understanding the tax implications of your choices. Check out the Annuity Calculator Hmrc 2024 for more information.

Tax-Free Annuities

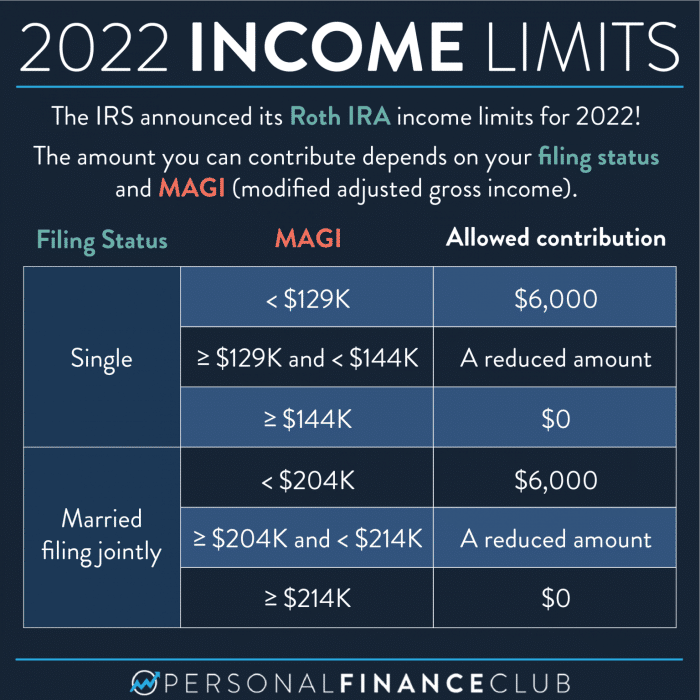

Some annuities, such as Roth IRAs, offer tax-free withdrawals in retirement. Contributions to Roth IRAs are made with after-tax dollars, so you do not pay taxes on the withdrawals.

IRS Classification of Annuity Payments

The IRS classifies annuity payments into two categories for tax purposes:

- Return of Principal:This portion of the annuity payment represents your original contributions, which are not taxed.

- Earnings:This portion of the annuity payment represents the growth on your contributions, which is taxed as ordinary income.

Annuities and Income in 2024

The tax rules for annuities are subject to change, and it is important to stay updated on the latest regulations.

Calculator.net offers a wide range of financial calculators, including an annuity calculator. This tool can help you understand the basics of annuities and estimate potential payouts. Visit Calculator.Net Annuity 2024 to explore the calculator.

Tax Treatment of Annuity Distributions in 2024

In 2024, the tax treatment of annuity distributions will likely follow the existing rules. The portion of the payment representing the return of principal will be tax-free, while the portion representing earnings will be taxed as ordinary income.

An annuity certain is a type of annuity that guarantees payments for a fixed period of time. This type of annuity is often used for estate planning purposes. To learn more about annuity certain, visit Annuity Certain Is An Example Of 2024.

Changes or Updates to Annuity Tax Regulations in 2024

As of now, there are no significant changes or updates to annuity tax regulations anticipated for 2024. However, it is advisable to consult with a tax professional for personalized guidance.

Factors Affecting Annuity Income

Several factors can influence the amount of income you receive from an annuity.

Annuities are primarily used to provide a guaranteed stream of income during retirement. This can help ensure financial security and peace of mind during your golden years. To learn more about the purpose of annuities, visit An Annuity Is Primarily Used To Provide 2024.

Age, Health, and Investment Strategy

Your age and health status can affect the length of the payout period and the amount of income you receive. A younger individual with a longer life expectancy will typically receive lower monthly payments than an older individual with a shorter life expectancy.

Similarly, the investment strategy chosen for your annuity can impact its growth potential and ultimately, the income you receive.

Canada offers a range of annuity options for retirees. If you’re looking for an annuity calculator specifically for the Canadian market, you can find one at Annuity Calculator Canada 2024.

Inflation and Interest Rates

Inflation can erode the purchasing power of your annuity payments over time. If interest rates rise, the value of your annuity may decrease, potentially reducing your income. However, some annuities, such as indexed annuities, offer protection against inflation.

Potential Income from Different Annuity Options

The potential income from different annuity options varies significantly. Fixed annuities provide a guaranteed rate of return, while variable annuities offer the potential for higher returns but also carry greater risk. Indexed annuities offer a balance between potential growth and downside protection.

Annuity options are available for a range of investment amounts, including $30,000. If you’re considering an annuity with this amount, you can find information about the available options and their features at Annuity 30k 2024.

Annuity Income and Financial Planning

Annuity income can play a crucial role in retirement planning, providing a steady stream of income to meet your financial needs.

Annuities can be a valuable tool for retirement planning, providing a reliable source of income. To learn more about how annuities can be used in retirement, you can visit Is Annuity Retirement 2024.

Tax Implications of Different Annuity Payout Options

| Payout Option | Tax Treatment |

|---|---|

| Fixed Annuity | Tax-deferred during accumulation phase, taxed as ordinary income during payout phase. |

| Variable Annuity | Tax-deferred during accumulation phase, taxed as ordinary income during payout phase. |

| Indexed Annuity | Tax-deferred during accumulation phase, taxed as ordinary income during payout phase. |

Integrating Annuity Income into Retirement Planning

Annuity income can be integrated into retirement planning in various ways, such as:

- Income Replacement:Annuities can provide a steady stream of income to replace lost wages during retirement.

- Supplementing Social Security:Annuities can supplement Social Security benefits to meet your living expenses.

- Estate Planning:Annuities can provide a guaranteed stream of income to beneficiaries after your death.

Strategies for Managing Annuity Income Effectively

Here are some strategies for managing annuity income effectively:

- Diversify Income Sources:Don’t rely solely on annuity income. Consider other sources of income, such as Social Security, pensions, or investments.

- Budgeting and Financial Planning:Create a budget that accounts for your annuity income and other sources of income. This will help you manage your expenses and ensure financial stability.

- Consider Tax Implications:Understand the tax implications of your annuity payments and factor them into your financial planning.

Final Review: Is Annuity Counted As Income 2024

Navigating the complex world of annuities and their tax implications can feel daunting. However, by understanding the fundamental principles and specific regulations for 2024, you can make informed choices that align with your financial goals. Remember, seeking professional advice from a financial advisor can provide personalized guidance and ensure you maximize the benefits of your annuity investments.

FAQ Summary

What are the different types of annuities?

Choosing between an annuity and drawdown can be a difficult decision. Both options have their pros and cons, and the best choice depends on your individual circumstances. To help you decide, check out the Is Annuity Better Than Drawdown 2024 article.

Annuities come in various forms, including fixed, variable, and indexed annuities, each with its own features and risks. Fixed annuities offer guaranteed interest rates, while variable annuities invest in the market, potentially offering higher returns but also greater risk. Indexed annuities link their growth to a specific market index, offering potential gains with some downside protection.

The BA II Plus calculator is a popular choice for financial professionals. It can be used to calculate annuity due, which is a type of annuity where payments are made at the beginning of each period. Learn more about Calculating Annuity Due On Ba Ii Plus 2024.

How do I choose the right annuity for me?

Annuity joint and survivor options are a popular choice for couples, ensuring a continuous income stream for the surviving partner. To explore the details and benefits of this type of annuity, you can visit Annuity Joint And Survivor 2024.

The best annuity for you depends on your individual circumstances, risk tolerance, and financial goals. Consider your age, health, investment horizon, and desired level of income security when making your decision. It’s crucial to consult with a financial advisor to get personalized guidance.

Can I withdraw money from my annuity before retirement?

Depending on the type of annuity and its terms, you may be able to withdraw money before retirement, but penalties and taxes may apply. Early withdrawals can also impact your future income stream. It’s essential to review your annuity contract carefully and seek professional advice before making any withdrawals.