Is Annuity For Life Insurance Taxable 2024 – Is Annuity For Life Insurance Taxable in 2024? This question is top of mind for many individuals considering annuities as part of their financial planning. Annuities, often viewed as a reliable stream of income during retirement, can come in various forms, each with its unique tax implications.

Flagship phones in 2024 are likely to be powered by the Snapdragon 2024 chipset. It’s expected to offer significant performance improvements, advanced AI capabilities, and improved battery life.

Understanding how annuities are taxed, particularly when combined with life insurance, is crucial for making informed financial decisions.

This article delves into the complex world of annuity taxation, exploring the different types of annuities, their tax treatment, and the interplay between annuities and life insurance. We’ll examine recent changes in tax laws related to annuities in 2024 and discuss potential future adjustments.

Choosing the right annuity issuer is crucial for ensuring your financial security. Annuity issuers in 2024 offer various products with different features and terms. It’s important to compare options and choose an issuer with a strong financial track record.

By understanding the tax implications of annuities, individuals can optimize their financial strategies and make informed choices that align with their long-term goals.

The timing of your annuity payments is a key factor. Annuity date is the date you receive your payments, and it’s important to understand how it affects your financial planning. You can choose a payment schedule that aligns with your needs and goals.

Contents List

Understanding Annuities

Annuities are financial products that provide a stream of regular payments, typically for a set period of time or for life. They are often used in retirement planning to provide a steady income stream, but they can also be used for other purposes, such as supplementing income during a period of disability or leaving a legacy to heirs.

Types of Annuities

Annuities can be broadly classified into two main types: fixed annuities and variable annuities. Each type has its own unique features and risks.

Thinking about making money from your Android app? Monetizing an Android app in 2024 involves different strategies. You can consider in-app purchases, subscriptions, or even advertising. Research what works best for your app’s audience.

- Fixed Annuities:Fixed annuities offer a guaranteed rate of return, which means that the payments you receive will not fluctuate based on market performance. This type of annuity is generally considered to be less risky than a variable annuity, but it also offers a lower potential return.

Google Tasks is evolving, and the future of task management might include more integrations and features. It’s becoming a more robust tool for managing daily tasks and projects.

- Variable Annuities:Variable annuities offer a return that is tied to the performance of a specific investment portfolio. This means that the payments you receive can fluctuate based on market conditions. Variable annuities have the potential for higher returns, but they also carry a higher risk of loss.

Hybrid apps, which combine native and web elements, can benefit from the improvements in Android WebView 202. The updated webview provides a better user experience and smoother performance for web-based content within the app.

Purpose of Annuities

Annuities can serve various purposes in financial planning, including:

- Retirement Income:Annuities can provide a steady stream of income during retirement, which can help you cover your living expenses and maintain your lifestyle.

- Income Supplement:Annuities can be used to supplement your income during a period of disability or unemployment.

- Legacy Planning:Annuities can be used to leave a legacy to your heirs, as they can provide a stream of income for them after your death.

Key Components of an Annuity Contract

An annuity contract is a legally binding agreement between you and the insurance company that issues the annuity. It Artikels the terms of the annuity, including the following:

- Premium Amount:This is the amount of money you will pay to purchase the annuity.

- Payment Period:This is the length of time that you will receive payments from the annuity.

- Payment Amount:This is the amount of money you will receive in each payment.

- Death Benefit:This is the amount of money that will be paid to your beneficiary upon your death.

- Surrender Charges:These are fees that you may have to pay if you withdraw your money from the annuity before a certain period of time.

Taxation of Annuities

The tax treatment of annuity payments depends on the type of annuity and how the payments are structured. It’s essential to understand the tax implications before investing in an annuity.

Taxation of Annuity Payments

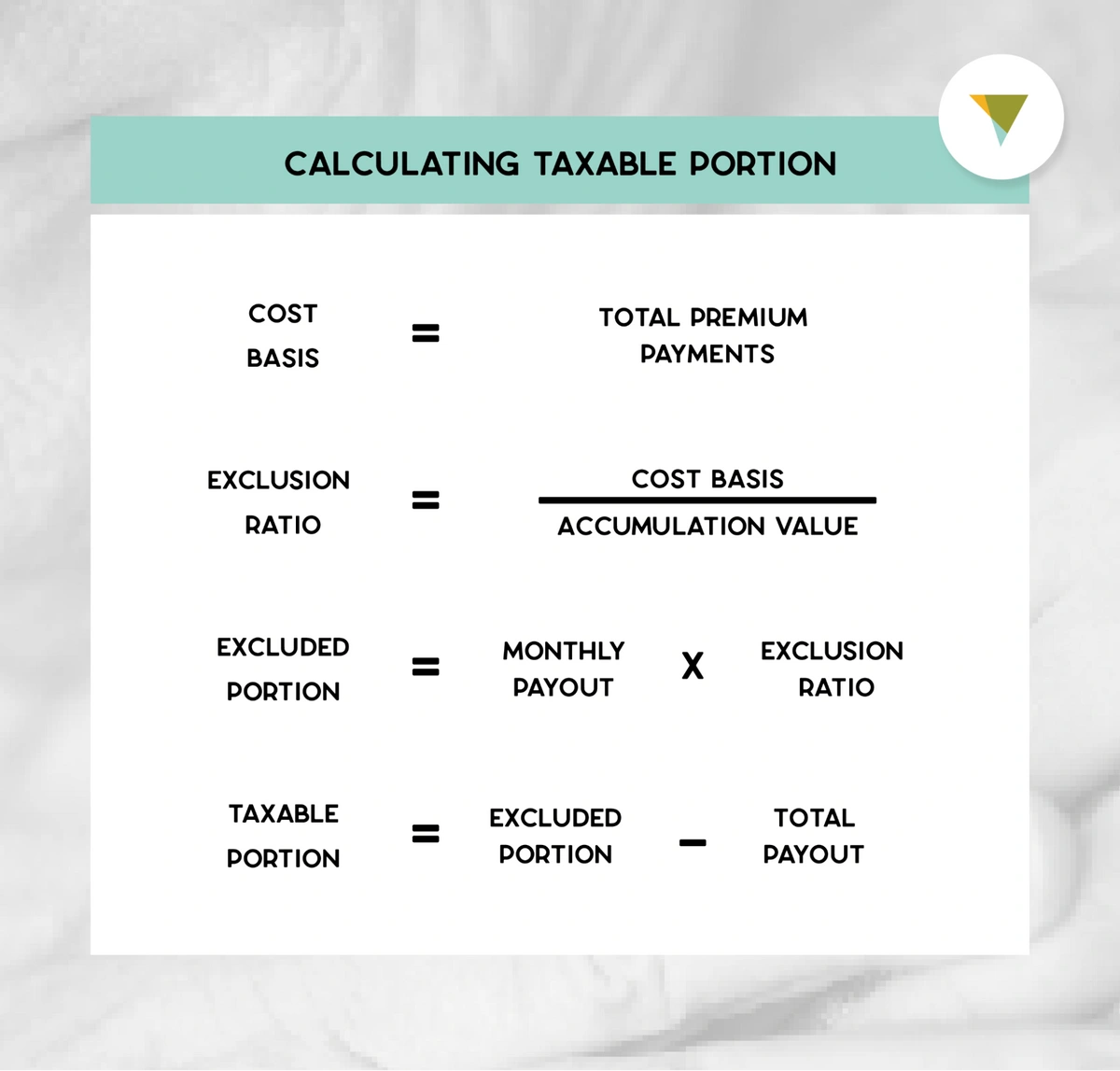

Annuity payments are generally taxed as ordinary income, meaning they are subject to your regular income tax rate. However, there are some exceptions to this rule. For example, if you purchased the annuity with after-tax dollars, a portion of each payment may be considered a return of your principal, which is not taxable.

If you’re facing compatibility issues with your Android app, it could be related to Android WebView 202. It’s a core component that handles web content, and updates can sometimes lead to glitches. Make sure to check for the latest updates and compatibility information.

Tax Treatment of Different Annuity Types

The tax treatment of annuities can vary depending on the type of annuity you purchase. Here’s a brief overview of the tax implications for different annuity types:

- Fixed Annuities:Fixed annuity payments are generally taxed as ordinary income.

- Variable Annuities:Variable annuity payments are generally taxed as ordinary income, but the growth of the underlying investments may be taxed as capital gains.

Tax Implications of Withdrawals from an Annuity

The tax implications of withdrawing money from an annuity depend on the type of annuity and the age of the annuitant. Generally, withdrawals from an annuity before age 59 1/2 are subject to a 10% early withdrawal penalty, in addition to ordinary income tax.

Withdrawals after age 59 1/2 are generally taxed as ordinary income, but there may be some exceptions depending on the specific annuity contract.

Life Insurance and Annuities: Is Annuity For Life Insurance Taxable 2024

Life insurance and annuities are often considered separate financial products, but they can be intertwined in certain situations. Understanding their relationship and tax implications is crucial for informed financial planning.

Relationship Between Life Insurance and Annuities

Life insurance provides a death benefit to beneficiaries upon the insured’s death. Annuities, on the other hand, provide a stream of income payments to the annuitant during their lifetime. While distinct, these products can be combined to achieve specific financial goals.

The popular app Dollify 2024 has some exciting updates. It’s now easier to create unique and stylish avatars. You can explore new features, customization options, and even create custom backgrounds.

Tax Implications of Combining Life Insurance and Annuities

Combining life insurance and annuities can have various tax implications depending on the specific products and how they are structured. For instance, a life insurance policy with an annuity rider might offer tax-deferred growth on the annuity portion, while the death benefit remains tax-free.

However, it’s essential to consult with a financial advisor to understand the tax implications of such combinations.

Annuity products can be complex, and it’s essential to be aware of potential issues. Annuity issues in 2024 may include factors like interest rate changes, market volatility, and changes in tax laws.

Situations Where an Annuity Might Be Considered a Life Insurance Product

In some cases, an annuity might be considered a life insurance product for tax purposes. This typically occurs when the annuity has a death benefit feature that pays out a lump sum to a beneficiary upon the annuitant’s death. These types of annuities are often referred to as “annuities with a death benefit” or “life insurance annuities.”

Android WebView 202 brings new features for developers, including improved performance and security. New features like improved JavaScript engine performance and enhanced security measures are beneficial for hybrid apps.

Taxation of Annuities in 2024

As of 2024, the tax treatment of annuities remains largely unchanged. However, it’s crucial to stay updated on any recent changes or updates to annuity tax laws, as they can impact your financial planning decisions.

Recent Changes or Updates to Annuity Tax Laws in 2024, Is Annuity For Life Insurance Taxable 2024

No significant changes or updates to annuity tax laws have been implemented in 2024. However, it’s essential to monitor any potential legislation or regulatory changes that might impact the tax treatment of annuities in the future.

Tax Implications of Annuities Under the Current Tax Code

Under the current tax code, annuity payments are generally taxed as ordinary income. However, as previously mentioned, there are some exceptions to this rule, such as the tax-free return of principal for annuities purchased with after-tax dollars.

Potential Future Changes to Annuity Taxation

The tax treatment of annuities is a complex issue, and there is always the possibility of future changes to the tax code. It’s essential to stay informed about any proposed changes or updates to annuity tax laws and how they might affect your financial planning.

Examples and Case Studies

To illustrate the tax implications of annuities, let’s consider a few examples and case studies.

Dollify 2024 is a great tool for creating fun and engaging content for social media. How to use Dollify 2024 for social media involves creating personalized avatars, using them in posts, and sharing them with friends and followers.

Examples of How Annuities Are Taxed in Different Scenarios

Here are a few examples of how annuities are taxed in different scenarios:

- Example 1:A 65-year-old individual purchases a fixed annuity with $100,000 of after-tax dollars. The annuity pays a guaranteed annual return of 4%. The individual receives $4,000 in annual payments. The first $4,000 of each payment is considered a return of principal and is not taxable.

The remaining $4,000 is considered ordinary income and is taxed at the individual’s regular income tax rate.

- Example 2:A 55-year-old individual purchases a variable annuity with $50,000 of after-tax dollars. The annuity’s underlying investments grow by 6% over the next five years. The individual withdraws $10,000 from the annuity. The withdrawal is taxed as ordinary income, but the individual may also be subject to a 10% early withdrawal penalty.

Case Studies that Illustrate the Tax Implications of Annuities

Here are a few case studies that illustrate the tax implications of annuities:

- Case Study 1:A retiree with a significant amount of savings decides to purchase a fixed annuity to provide a steady stream of income. The annuity provides a guaranteed annual return of 3%, and the retiree receives $5,000 in annual payments. The payments are taxed as ordinary income, but the retiree can deduct the annuity payments from their taxable income, reducing their overall tax liability.

Developing Android apps for specific industries requires understanding their unique needs and challenges. Android app development for specific industries in 2024 includes areas like healthcare, finance, education, and retail, each with its own set of requirements.

- Case Study 2:A young professional decides to purchase a variable annuity to supplement their retirement savings. The annuity’s underlying investments grow significantly over the next 10 years. The individual decides to withdraw a portion of the annuity’s value to pay for a down payment on a new home.

The withdrawal is taxed as ordinary income, but the individual may also be subject to a 10% early withdrawal penalty.

Table Showcasing Different Annuity Types and Their Tax Treatment

| Annuity Type | Tax Treatment of Payments | Tax Treatment of Withdrawals |

|---|---|---|

| Fixed Annuity | Ordinary Income | Ordinary Income, subject to early withdrawal penalty if withdrawn before age 59 1/2 |

| Variable Annuity | Ordinary Income, capital gains on underlying investments | Ordinary Income, subject to early withdrawal penalty if withdrawn before age 59 1/2 |

Financial Planning Considerations

Annuities can play a significant role in retirement planning and income supplementation. However, it’s crucial to carefully consider the potential benefits and drawbacks of using annuities for tax purposes.

Role of Annuities in Retirement Planning

Annuities can be a valuable tool for retirement planning, as they can provide a steady stream of income during retirement. They can help you cover your living expenses, maintain your lifestyle, and reduce the risk of outliving your savings.

Annuity products can provide a steady stream of income in retirement. An annuity is a financial contract where an insurance company guarantees regular payments for a set period. It’s important to understand the different types and risks involved before making a decision.

How Annuities Can Be Used to Supplement Income

Annuities can be used to supplement your income during retirement or other periods of financial need. They can provide a regular source of income that can help you bridge the gap between your savings and your expenses.

Looking for a simple and reliable task manager? Google Tasks 2024 might be a good option. It’s integrated with Google services and is accessible from various devices. However, it might not be the best fit for complex project management.

Potential Benefits and Drawbacks of Using Annuities for Tax Purposes

Here are some potential benefits and drawbacks of using annuities for tax purposes:

- Benefits:

- Tax-deferred growth: Annuities can offer tax-deferred growth, which means that you don’t have to pay taxes on the earnings until you withdraw them. This can help your savings grow faster over time.

- Guaranteed income: Some annuities offer guaranteed income payments, which can provide peace of mind during retirement.

- Protection from market volatility: Fixed annuities can provide protection from market volatility, which can be beneficial during periods of economic uncertainty.

- Drawbacks:

- High fees: Annuities can have high fees, which can eat into your returns.

- Limited flexibility: Once you purchase an annuity, you may have limited flexibility to withdraw your money or change the payment terms.

- Tax implications: Annuities can have complex tax implications, and it’s essential to understand the tax treatment of annuity payments before you invest.

Final Thoughts

Navigating the intricacies of annuity taxation can be challenging, but understanding the basics is essential for making informed financial decisions. By carefully considering the tax implications of different annuity types and their interplay with life insurance, individuals can optimize their retirement planning and ensure that their investments are structured for maximum tax efficiency.

As tax laws are constantly evolving, staying informed about the latest changes is crucial for maximizing the benefits of annuities and achieving long-term financial success.

Query Resolution

What are the different types of annuities?

Annuities come in various forms, including fixed annuities, variable annuities, and indexed annuities, each offering different features and risk profiles. Fixed annuities provide a guaranteed rate of return, while variable annuities offer the potential for growth but also carry investment risk.

Indexed annuities link their returns to a specific market index, such as the S&P 500.

How do I know if an annuity is right for me?

The suitability of an annuity depends on your individual financial situation, risk tolerance, and financial goals. Consulting with a financial advisor can help you determine if an annuity aligns with your specific needs and objectives.

What are the tax implications of withdrawing from an annuity?

Curious about the performance of the latest Snapdragon processors? Snapdragon 2024 performance benchmarks are being released, offering insights into the power and efficiency of these chips. They’re designed to deliver smooth and fast experiences for flagship phones.

The tax treatment of annuity withdrawals depends on the type of annuity and the timing of the withdrawal. Generally, a portion of each withdrawal is considered taxable income, while the remainder represents a return of your principal investment, which is tax-free.

However, specific tax rules apply to different annuity types and withdrawal scenarios.

What are some common misconceptions about annuity taxation?

One common misconception is that all annuity withdrawals are fully taxable. While some withdrawals may be fully taxable, others may be partially taxable or tax-free, depending on the specific annuity type and withdrawal circumstances. It’s essential to understand the tax implications of each annuity before making investment decisions.