Is Annuity From Lic Taxable 2024 – Is Annuity From LIC Taxable in 2024? This question is on the minds of many individuals seeking financial security through LIC annuities. Understanding the tax implications of LIC annuities is crucial for making informed financial decisions. This guide will delve into the complexities of annuity taxation, particularly focusing on LIC annuities and the potential changes in 2024.

Annuity contingent is a specific type of annuity with unique characteristics. This article explores the concept of annuity contingent in 2024: Annuity Contingent Is 2024.

Annuities are financial products that provide a stream of income payments, often for a set period or throughout your lifetime. LIC annuities, specifically, are offered by the Life Insurance Corporation of India, a prominent financial institution. These annuities can be a valuable tool for retirement planning and income generation, but it’s essential to consider the tax implications associated with them.

Security updates are essential for keeping your Android devices safe. This article provides information about the latest security updates for Android WebView 202: Android WebView 202 security updates.

Contents List

Annuity Basics: Is Annuity From Lic Taxable 2024

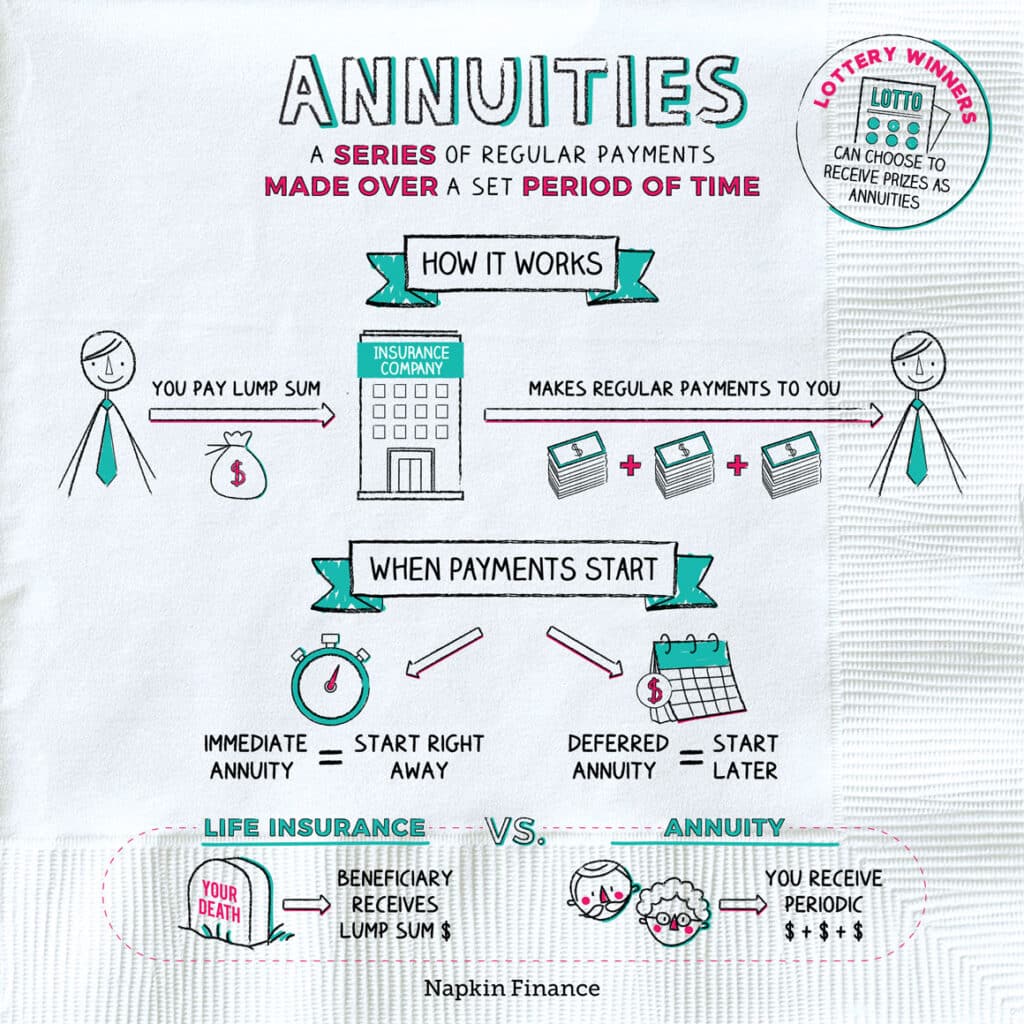

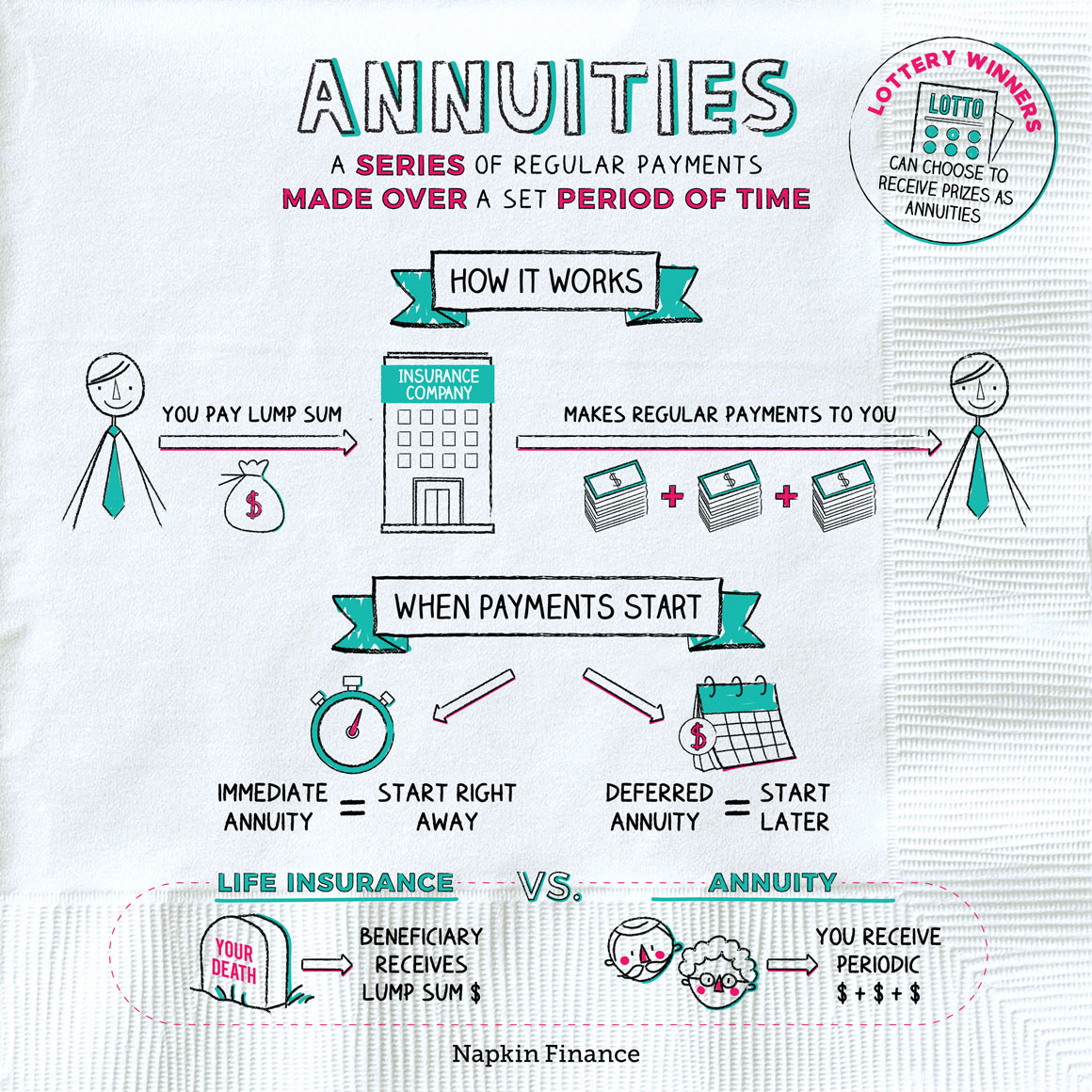

An annuity is a financial product that provides a stream of regular payments for a set period of time. It’s essentially a contract between you and an insurance company where you make a lump sum payment or a series of payments, and in return, the insurer guarantees a stream of income for a specific duration.

Understanding the definition of an annuity is crucial for anyone dealing with financial planning or investments. This article clarifies the definition of an annuity in 2024: Annuity Is Defined As 2024.

Annuities are often used for retirement planning, as they can provide a steady source of income during your golden years.

Battery life is a key consideration for any smartphone user. This article discusses the battery life and efficiency of the Snapdragon 2024 processor: Snapdragon 2024 battery life and efficiency.

Types of Annuities

There are various types of annuities, each with its own set of features and benefits. Understanding the different types is crucial for choosing the annuity that best suits your needs and financial goals.

Annuities are a complex financial instrument, and understanding them is crucial for making sound financial decisions. This article provides a comprehensive overview of annuities in the context of Excel 2024: Annuity Is Excel 2024.

- Fixed Annuities:These offer a guaranteed rate of return, providing predictable income payments. The interest rate is fixed for a certain period, making them suitable for individuals seeking stability and protection from market fluctuations. However, fixed annuities typically offer lower returns compared to variable annuities.

Debugging tools are essential for Android app developers. This article explores the debugging tools available for Android WebView 202: Android WebView 202 debugging tools.

- Variable Annuities:These link your returns to the performance of underlying investments, such as stocks or bonds. This means your income payments can fluctuate depending on the market’s performance. While they offer the potential for higher returns, they also carry more risk.

Glovo is making big moves, with plans to expand its services and reach even more customers. Their strategy involves focusing on key markets and diversifying their offerings. You can learn more about their exciting plans in this article: Glovo app future plans and expansion strategy.

- Indexed Annuities:These offer a guaranteed minimum return linked to the performance of a specific market index, such as the S&P 500. They provide a balance between potential growth and downside protection. Indexed annuities typically offer a minimum return and a potential for higher returns based on the index’s performance.

- Immediate Annuities:These start paying out immediately after you purchase them. You make a lump sum payment, and the insurance company begins providing regular payments right away. Immediate annuities are often used for individuals who need a steady stream of income immediately, such as retirees.

Dollify is a fun and easy-to-use app for creating adorable cartoon avatars. If you’re new to Dollify, this article provides helpful tips and tricks to get you started: Dollify 2024: Tips and Tricks for Beginners.

- Deferred Annuities:These start paying out at a later date, allowing you to accumulate tax-deferred growth on your investment. Deferred annuities are often used for retirement planning, as they provide a way to grow your savings tax-deferred and then receive regular payments later in life.

Dollify continues to evolve, with new features and updates being added regularly. This article highlights some of the latest additions to the app: Dollify 2024: New Features and Updates.

Features of an Annuity Contract

An annuity contract Artikels the terms and conditions of the annuity, including the following key features:

- Premium:The amount of money you pay to purchase the annuity.

- Payment Period:The duration for which you will receive payments.

- Payment Amount:The amount of money you will receive in each payment.

- Interest Rate:The rate at which your annuity grows, which can be fixed, variable, or indexed.

- Death Benefit:The amount of money your beneficiaries will receive if you die before the annuity payments are exhausted.

- Surrender Charges:Fees charged if you withdraw money from your annuity before a certain period.

Factors to Consider When Choosing an Annuity

Choosing the right annuity requires careful consideration of your individual circumstances, financial goals, and risk tolerance. Here are some key factors to keep in mind:

- Risk Tolerance:How much risk are you willing to take with your investment? If you prefer a guaranteed return, a fixed annuity might be suitable. If you are willing to take on more risk for the potential of higher returns, a variable annuity could be an option.

- Time Horizon:How long do you need the annuity payments to last? If you need income for a short period, an immediate annuity might be suitable. If you need income for a longer period, a deferred annuity could be an option.

- Financial Goals:What are you trying to achieve with the annuity? Are you looking for income, growth, or protection from market fluctuations? Your goals will influence the type of annuity you choose.

- Fees and Expenses:Annuities often come with fees and expenses, so it’s important to compare different options and choose an annuity with reasonable fees.

LIC Annuities

LIC, or Life Insurance Corporation of India, is a state-owned insurance company that offers a range of financial products, including annuities. LIC annuities are known for their reliability, guaranteed income, and tax benefits.

Developing Android apps requires a range of tools. This article highlights the top Android app development tools available in 2024: Top Android app development tools in 2024.

Overview of LIC Annuities

LIC annuities are insurance-based products that provide a regular stream of income for a specified period. These annuities are designed to provide financial security and income stability during retirement or other life stages. LIC offers various types of annuities, including:

- Immediate Annuities:These annuities start paying out immediately after you purchase them, providing a steady source of income right away.

- Deferred Annuities:These annuities start paying out at a later date, allowing you to accumulate tax-deferred growth on your investment.

- Joint Life Annuities:These annuities provide income to two individuals, typically a couple, and continue until the death of the last surviving member.

- Guaranteed Period Annuities:These annuities guarantee income payments for a specific period, even if you die before the end of the period. This provides financial security for your beneficiaries.

Unique Characteristics of LIC Annuities

LIC annuities have several unique characteristics that set them apart from other annuity options. These include:

- Guaranteed Returns:LIC annuities typically offer guaranteed returns, providing stability and predictability of income payments. This makes them suitable for individuals seeking security and protection from market fluctuations.

- Tax Benefits:LIC annuities offer tax benefits, as the income payments are generally taxed at a lower rate than other sources of income.

- Flexibility:LIC annuities offer flexibility in terms of payment options, allowing you to choose the frequency and duration of payments that best suit your needs.

- Death Benefits:LIC annuities typically include a death benefit, which provides financial protection for your beneficiaries if you die before the annuity payments are exhausted.

Comparison with Other Annuity Options

LIC annuities can be compared to other annuity options available in the market. Here’s a brief comparison:

| Feature | LIC Annuities | Other Annuity Options |

|---|---|---|

| Guaranteed Returns | Typically offer guaranteed returns. | May offer guaranteed returns, but not always. |

| Tax Benefits | Offer tax benefits on income payments. | Tax benefits may vary depending on the type of annuity. |

| Flexibility | Offer flexibility in payment options. | Flexibility may vary depending on the provider and annuity type. |

| Death Benefits | Typically include a death benefit. | Death benefits may or may not be available. |

Taxation of Annuities

The taxation of annuity payments depends on the type of annuity and the tax laws of the country. In general, annuity payments are taxed as ordinary income, meaning they are subject to your regular income tax rate. However, there are some exceptions and specific tax implications that apply to LIC annuities.

Choosing the right task management tool is crucial for productivity. This article helps you determine if Google Tasks is the right fit for your needs: Google Tasks 2024: Is it Right for You?.

General Tax Rules Governing Annuity Payments

Here are some general tax rules governing annuity payments:

- Taxable Portion:A portion of each annuity payment is considered taxable income. This portion is calculated based on the annuity contract’s terms and the amount of premium you paid.

- Exclusion Ratio:The exclusion ratio determines the portion of each payment that is tax-free. It is calculated by dividing the total premium paid by the expected total annuity payments.

- Taxable Portion:The remaining portion of each payment after the exclusion ratio is considered taxable income.

Tax Implications of LIC Annuities

LIC annuities have specific tax implications that are important to understand. Here are some key points:

- Taxable Income:Income payments from LIC annuities are generally taxed as ordinary income. However, there may be some exceptions depending on the specific type of annuity.

- Tax Deductions:In some cases, you may be able to deduct certain expenses related to LIC annuities, such as premiums paid or investment management fees.

- Tax-Deferred Growth:Deferred LIC annuities allow your investment to grow tax-deferred, meaning you won’t pay taxes on the earnings until you start receiving payments.

Tax Benefits and Drawbacks of LIC Annuities, Is Annuity From Lic Taxable 2024

LIC annuities offer potential tax benefits, but it’s important to consider the potential drawbacks as well:

- Tax-Deferred Growth:Deferred LIC annuities offer tax-deferred growth, which can be beneficial for long-term savings. However, you will eventually have to pay taxes on the accumulated earnings when you start receiving payments.

- Taxable Income:While LIC annuities may offer tax benefits, the income payments are still generally taxed as ordinary income. This can impact your overall tax liability.

- Surrender Charges:If you withdraw money from your LIC annuity before a certain period, you may have to pay surrender charges. These charges can reduce the tax benefits you receive.

Taxation in 2024

Tax laws related to annuities can change from year to year. It’s essential to stay informed about any updates or changes that may affect LIC annuities in 2024.

Annuity is a term with various meanings in different contexts. This article explains the different ways in which the term “annuity” is used: Annuity Is Also Known As 2024.

Changes to Tax Laws Related to Annuities in 2024

While there are no specific changes to tax laws related to annuities announced for 2024, it’s crucial to stay updated on any potential changes. Tax laws are subject to revision, and new legislation can impact the taxation of annuities. It’s advisable to consult with a tax professional to get the most up-to-date information and guidance on the tax implications of LIC annuities in 2024.

Key Considerations for Tax Planning with LIC Annuities in 2024

Here are some key considerations for tax planning with LIC annuities in 2024:

- Tax Bracket:Your tax bracket can impact the tax implications of your annuity payments. If you expect to be in a higher tax bracket in retirement, you may want to consider strategies to minimize your tax liability.

- Withdrawal Strategies:The way you withdraw money from your LIC annuity can affect your tax liability. Consider strategies to minimize taxes, such as withdrawing only the amount you need and leaving the rest to grow tax-deferred.

- Tax-Loss Harvesting:If you have other investments that have lost value, you may be able to use tax-loss harvesting to offset the taxable portion of your annuity payments.

- Consult a Tax Professional:It’s always advisable to consult with a qualified tax professional to get personalized guidance on tax planning with LIC annuities in 2024.

Case Studies

Let’s look at a hypothetical scenario to illustrate the tax implications of LIC annuities and how tax planning strategies can optimize the tax benefits.

Hypothetical Scenario

Suppose Mr. Sharma, a 60-year-old retiree, purchases a LIC immediate annuity with a lump sum payment of ₹10,000,000. The annuity contract guarantees him an annual payment of ₹800,000 for 15 years.

Choosing the right processor for your device can be a tough decision. This article compares the Snapdragon 2024 and Snapdragon 8 Gen 3, highlighting their key features and performance differences: Snapdragon 2024 vs Snapdragon 8 Gen 3.

Analysis of Tax Implications

In this scenario, Mr. Sharma’s annual annuity payments will be partially taxable. The exclusion ratio, which determines the tax-free portion of each payment, is calculated as follows:

Exclusion Ratio = Total Premium Paid / Expected Total Annuity Payments = ₹10,000,000 / (₹800,000 x 15) = 0.83

Annuity equations are used to calculate the present or future value of annuity payments. This article provides an overview of annuity equations in 2024: Annuity Equation 2024.

This means that 83% of each payment is tax-free, and the remaining 17% is considered taxable income. Therefore, Mr. Sharma’s annual taxable income from the annuity will be ₹136,000 (₹800,000 x 0.17).

Tax Planning Strategies

Mr. Sharma can implement several tax planning strategies to optimize the tax benefits of his LIC annuity. These include:

- Withdrawals:Mr. Sharma can withdraw only the amount he needs each year to minimize his taxable income.

- Tax-Loss Harvesting:If Mr. Sharma has other investments that have lost value, he can use tax-loss harvesting to offset the taxable portion of his annuity payments.

- Tax-Efficient Investments:Mr. Sharma can invest the tax-free portion of his annuity payments in tax-efficient investments, such as municipal bonds, to further reduce his tax liability.

- Consult a Tax Professional:It’s crucial for Mr. Sharma to consult with a tax professional to understand the specific tax implications of his LIC annuity and develop a comprehensive tax plan.

Final Review

Navigating the tax landscape surrounding LIC annuities in 2024 requires careful planning. By understanding the nuances of taxation, you can make informed decisions about your financial future. Remember, seeking professional financial advice tailored to your individual circumstances is always recommended.

With proper planning, LIC annuities can contribute significantly to your financial security, offering a steady stream of income for years to come.

FAQ

What are the different types of LIC annuities?

Google Tasks is a simple yet powerful task management tool that’s constantly evolving. This article explores the future of Google Tasks and its potential to become a leading task management platform: Google Tasks 2024: The Future of Task Management.

LIC offers various annuity options, including immediate annuities, deferred annuities, and variable annuities. Each type has unique features and tax implications.

How are annuity payments taxed in general?

Generally, annuity payments are taxed as ordinary income. However, the tax treatment can vary depending on the type of annuity and the specific provisions of the contract.

Are there any specific tax benefits associated with LIC annuities?

While LIC annuities are generally taxed as ordinary income, certain deductions or exemptions may be available under specific circumstances. It’s crucial to consult with a tax advisor to determine your eligibility for any potential tax benefits.

How can I minimize the tax burden on my LIC annuity payments?

Tax planning strategies, such as utilizing tax-advantaged accounts or choosing specific annuity options with favorable tax features, can help minimize your tax liability. A financial advisor can provide guidance on effective tax planning strategies for your LIC annuity.