Is Annuity Gator Legit 2024? This question is on the minds of many seeking reliable retirement income solutions. Annuity Gator, a leading provider of annuity products, aims to simplify the complex world of annuities, offering a range of options to meet individual needs and financial goals.

Annuity is a term with various synonyms. Learn about alternative names for annuities in this article: Annuity Is Also Known As 2024. It provides a comprehensive list of synonyms and explains their relevance.

But with the vast landscape of financial products, it’s crucial to carefully evaluate any company before entrusting your savings to them. This comprehensive review will delve into Annuity Gator’s services, reputation, and potential benefits and risks, providing you with the information you need to make an informed decision.

We’ll explore the company’s history, its diverse product offerings, and its standing within the industry. By examining customer reviews, financial stability, and potential risks, we aim to provide a balanced perspective on whether Annuity Gator aligns with your retirement planning objectives.

Contents List

- 1 Annuity Gator Overview

- 2 Annuity Gator’s Products and Services

- 3 Annuity Gator’s Reputation and Trustworthiness

- 4 Comparing Annuity Gator to Competitors

- 5 Factors to Consider When Choosing Annuity Gator

- 6 Potential Benefits of Using Annuity Gator

- 7 Potential Risks of Using Annuity Gator

- 8 Tips for Working with Annuity Gator

- 9 Final Review: Is Annuity Gator Legit 2024

- 10 FAQ Overview

Annuity Gator Overview

Annuity Gator is a company that specializes in helping individuals find and purchase annuities. Annuities are financial products that provide a guaranteed stream of income, often for life. They can be a valuable tool for retirement planning, as they can provide a steady source of income during your golden years.

Annuity Gator aims to simplify the process of finding the right annuity for your needs, offering a variety of services and resources to help you make informed decisions.

Target Audience

Annuity Gator’s services are primarily targeted towards individuals who are approaching retirement or are already retired. This includes people who are looking for ways to supplement their retirement income, protect their savings from market volatility, or simply have a guaranteed income stream.

Want to know how Dollify 2024 compares to previous versions? This article: Dollify 2024: Comparison to Previous Versions provides a detailed analysis of the differences and improvements, helping you decide if the upgrade is right for you.

The company also works with individuals who are looking to leave a legacy for their loved ones through an annuity that can provide income for beneficiaries after their passing.

Learn the formula for calculating annuities in this comprehensive guide: Annuity Formula Is 2024. It breaks down the formula step-by-step and provides examples for a deeper understanding.

Company History

Annuity Gator was founded in [year] with a mission to empower individuals to make informed decisions about their financial future. Since its inception, the company has grown steadily, expanding its product offerings and service capabilities to meet the evolving needs of its clients.

Key milestones include [mention key milestones, like expanding to new markets, launching new products, or achieving industry recognition].

Annuity Gator’s Products and Services

Annuity Gator offers a wide range of annuity products to cater to different financial goals and risk tolerances. Here are some of the most common types of annuities offered by the company:

Types of Annuities

- Fixed Annuities:These annuities provide a guaranteed rate of return, which means your principal is protected from market fluctuations. They are ideal for individuals who prioritize safety and stability over potential growth.

- Variable Annuities:These annuities allow your money to grow based on the performance of underlying investments, such as mutual funds. While they offer the potential for higher returns, they also come with a higher level of risk.

- Indexed Annuities:These annuities offer a combination of guaranteed principal protection and the potential for growth tied to a specific market index, such as the S&P 500. They provide a balance between safety and potential returns.

- Immediate Annuities:These annuities provide a stream of income payments that begin immediately after you purchase the annuity. They are suitable for individuals who need a guaranteed income stream right away.

- Deferred Annuities:These annuities provide a stream of income payments that begin at a later date, such as during retirement. They allow you to accumulate wealth over time before receiving income payments.

Key Features and Benefits

Each type of annuity offered by Annuity Gator comes with its own set of features and benefits. For example, fixed annuities typically offer a guaranteed rate of return and principal protection, while variable annuities provide the potential for higher returns but also come with a higher level of risk.

Indexed annuities offer a balance between safety and potential growth. Immediate annuities provide a guaranteed income stream immediately, while deferred annuities allow you to accumulate wealth over time before receiving income payments.

Google Tasks is evolving rapidly, and its future looks promising. This article: Google Tasks 2024: The Future of Task Management explores the potential advancements and how Google Tasks might shape the future of task management.

Tailored Services

Annuity Gator understands that each individual’s financial situation is unique. Therefore, they offer personalized services to help you find the right annuity product that meets your specific needs and goals. This includes a comprehensive needs assessment, product recommendations, and ongoing support throughout the process.

The company’s team of experienced financial advisors is dedicated to providing personalized guidance and ensuring that you understand the intricacies of each annuity product.

Annuity Gator’s Reputation and Trustworthiness

Annuity Gator has established a strong reputation in the industry, known for its commitment to transparency, integrity, and customer satisfaction. Here’s a closer look at the company’s reputation and trustworthiness:

Customer Reviews and Testimonials

Annuity Gator has received positive reviews and testimonials from its clients. Many customers appreciate the company’s knowledgeable and friendly staff, its commitment to providing personalized service, and its transparent pricing. You can find numerous online reviews and testimonials from satisfied customers on websites like [mention websites where reviews are available].

Looking for the Bengali meaning of “annuity”? You’ve come to the right place! Learn about the concept of annuities and their translation in Bengali with this helpful article: Annuity Is Bengali Meaning 2024. It provides a clear explanation and relevant examples for a better understanding.

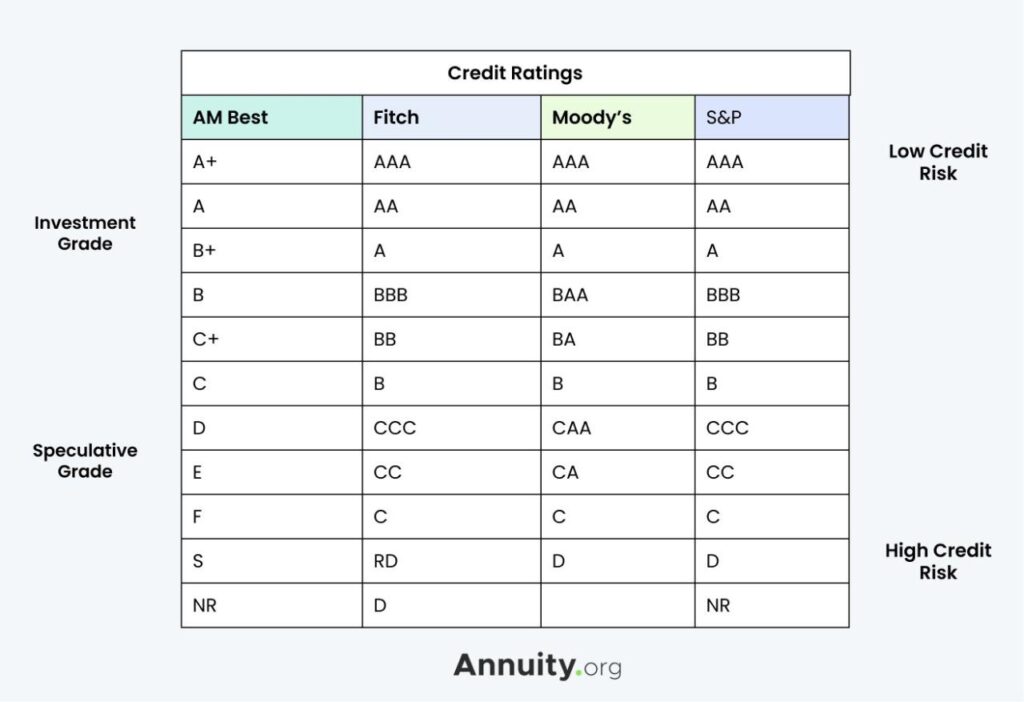

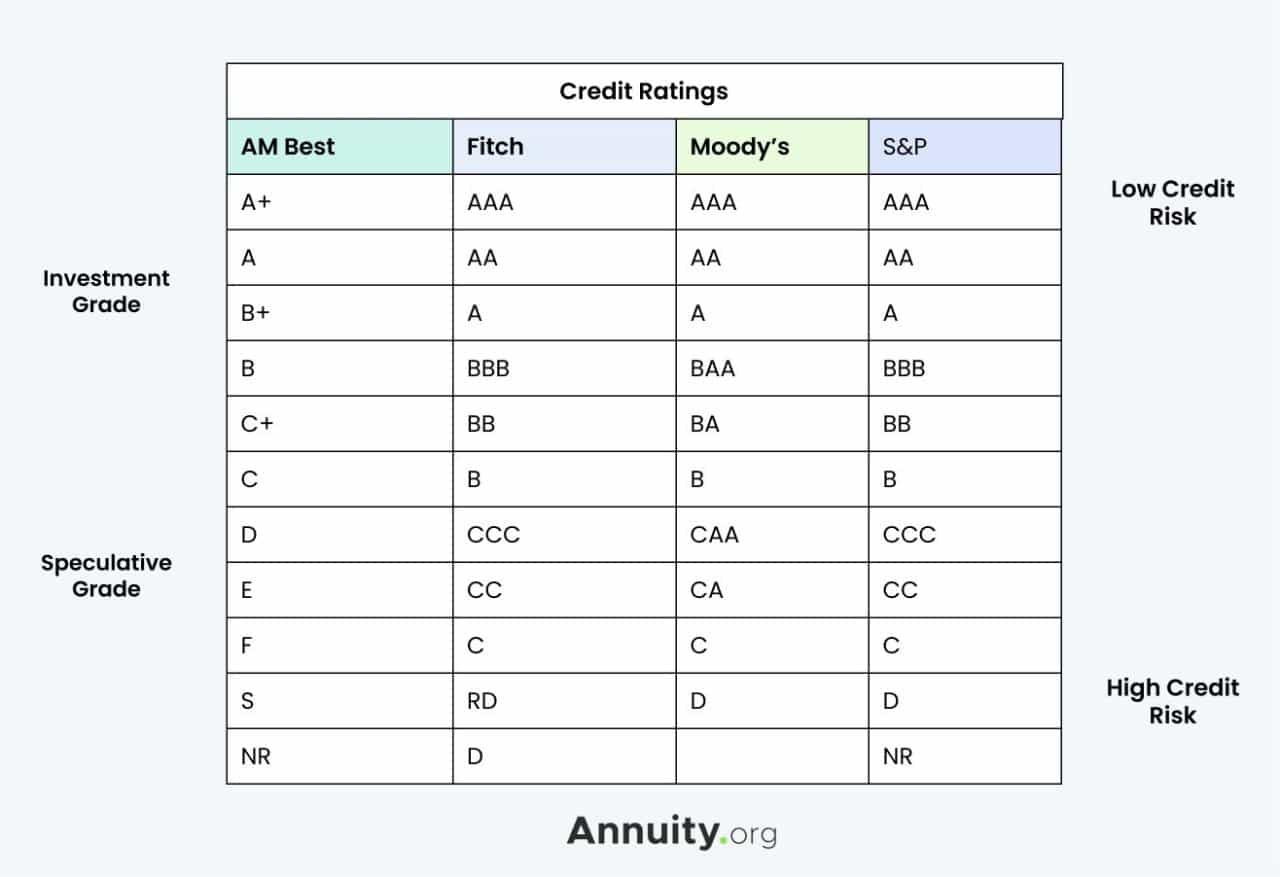

Financial Stability and Accreditations

Annuity Gator is a financially stable company with a strong track record. The company is [mention any relevant accreditations or ratings, such as being licensed or registered with the appropriate regulatory bodies]. This demonstrates the company’s commitment to operating ethically and complying with industry standards.

For optimal performance and security, it’s essential to follow best practices when using Android WebView 202. This article: Android WebView 202 best practices provides a comprehensive guide to best practices, ensuring a smooth and efficient user experience.

It also gives potential clients confidence in the company’s ability to meet its financial obligations.

Potential Risks and Concerns

While Annuity Gator is a reputable company, it’s important to be aware of the potential risks and concerns associated with using their services. These include:

- High Fees and Commissions:Annuities often come with high fees and commissions, which can eat into your returns. It’s essential to carefully review the fees associated with any annuity product before making a decision.

- Limited Access to Funds:Annuities can have restrictions on withdrawing your funds, especially during the early years of the contract. This can make it difficult to access your money if you need it for an emergency.

- Potential for Market Downturns:Variable annuities and indexed annuities are subject to market fluctuations, which means you could lose money if the market declines. It’s essential to consider your risk tolerance and investment horizon before investing in these types of annuities.

- Complexity of Annuity Contracts:Annuity contracts can be complex and difficult to understand. It’s important to carefully review the contract and seek professional financial advice before making a decision.

Comparing Annuity Gator to Competitors

Annuity Gator is not the only company offering annuity products. It’s essential to compare different providers to find the best option for your needs. Here’s a comparison of Annuity Gator with some of its key competitors in the annuity market:

Competitor Comparison Table

| Competitor | Features | Benefits | Pricing | Customer Reviews |

|---|---|---|---|---|

| Annuity Gator | [List key features] | [List key benefits] | [Provide pricing information] | [Summarize customer reviews] |

| Competitor 1 | [List key features] | [List key benefits] | [Provide pricing information] | [Summarize customer reviews] |

| Competitor 2 | [List key features] | [List key benefits] | [Provide pricing information] | [Summarize customer reviews] |

Strengths and Weaknesses

Annuity Gator has several strengths compared to its competitors, including [mention key strengths, such as a wider range of products, lower fees, or better customer service]. However, the company also has some weaknesses, such as [mention key weaknesses, such as a limited product selection, higher fees, or less experienced advisors].

It’s essential to weigh the strengths and weaknesses of each provider before making a decision.

Android WebView 202 is a powerful tool for enterprise applications. Discover how it can enhance your business solutions by reading this article: Android WebView 202 for enterprise use. It covers the key benefits and implementation strategies.

Factors to Consider When Choosing Annuity Gator

Deciding whether Annuity Gator is the right choice for you requires careful consideration of your individual circumstances and financial goals. Here are some key factors to consider:

Personal Financial Goals

What are your financial goals? Are you looking for a guaranteed income stream during retirement, protection from market volatility, or a way to leave a legacy for your loved ones? Understanding your financial goals will help you determine the type of annuity that best suits your needs.

Risk Tolerance

How much risk are you willing to take? Fixed annuities offer guaranteed returns and principal protection, while variable annuities and indexed annuities offer the potential for higher returns but also come with a higher level of risk. Your risk tolerance will help you choose an annuity that aligns with your comfort level.

Dollify 2024 can be a powerful tool for businesses looking to enhance their branding and engagement. Explore how to use Dollify for business purposes in this article: Dollify 2024: How to Use Dollify 2024 for Business. It offers practical examples and strategies for incorporating Dollify into your business marketing.

Time Horizon

How long do you plan to hold the annuity? If you need income payments immediately, an immediate annuity might be the right choice. If you have a longer time horizon, a deferred annuity could allow you to accumulate wealth over time before receiving income payments.

Research and Comparison

Before making a decision, it’s essential to research and compare different annuity providers. This includes reviewing their product offerings, fees, customer reviews, and financial stability. You can use online resources, consult with a financial advisor, or contact the providers directly to gather information.

Potential Benefits of Using Annuity Gator

Annuity Gator can offer several potential benefits to individuals who are looking for financial security and a guaranteed income stream. These benefits can be realized in different life scenarios, providing peace of mind and financial stability.

Guaranteed Income Stream

Annuities provide a guaranteed income stream, which can be especially valuable during retirement. This means you can count on receiving regular payments, regardless of market fluctuations, providing financial stability and peace of mind.

Are annuities taxable? This is a common question. Find out the answer and understand the tax implications of annuities in this informative article: Annuity Is Taxable 2024. It provides a clear explanation and helpful tips for managing your taxes.

Tax Advantages

Annuities can offer tax advantages, depending on the type of annuity you choose. For example, some annuities allow you to defer taxes on the earnings until you begin receiving income payments. This can help you save on taxes in the long run.

Protection from Market Volatility, Is Annuity Gator Legit 2024

Fixed annuities and indexed annuities provide protection from market volatility. This means your principal is protected from losses, even if the market declines. This can be a valuable benefit for individuals who are risk-averse or are approaching retirement.

Dollify 2024 is a great tool for creating fun and engaging content for social media. Learn how to use it effectively for your online presence in this article: Dollify 2024: How to Use Dollify 2024 for Social Media. It provides tips and tricks for creating eye-catching visuals.

Long-Term Financial Security

Annuities can provide long-term financial security by providing a steady stream of income for life. This can help you cover your living expenses, pay for healthcare, or leave a legacy for your loved ones.

Potential Risks of Using Annuity Gator

While annuities can offer several benefits, it’s important to be aware of the potential risks associated with using Annuity Gator’s services. Understanding these risks will help you make informed decisions and mitigate potential downsides.

High Fees and Commissions

Annuities often come with high fees and commissions, which can eat into your returns. It’s essential to carefully review the fees associated with any annuity product before making a decision. Compare fees across different providers and consider the long-term impact of these fees on your overall returns.

Google Tasks is a simple yet effective task management app. Explore its features and learn why it’s considered the best free option in this article: Google Tasks 2024: The Best Free Task Management App. It highlights the key benefits and user-friendly interface.

Limited Access to Funds

Annuities can have restrictions on withdrawing your funds, especially during the early years of the contract. This can make it difficult to access your money if you need it for an emergency. Before purchasing an annuity, understand the surrender charges and withdrawal penalties that may apply.

Potential for Market Downturns

Variable annuities and indexed annuities are subject to market fluctuations, which means you could lose money if the market declines. It’s essential to consider your risk tolerance and investment horizon before investing in these types of annuities. If you’re risk-averse, a fixed annuity might be a better option.

Curious about the relationship between annuities and compound interest? Find out if annuities involve compound interest and explore the intricacies of this financial concept in this article: Is Annuity Compound Interest 2024.

Complexity of Annuity Contracts

Annuity contracts can be complex and difficult to understand. It’s important to carefully review the contract and seek professional financial advice before making a decision. Make sure you understand the terms and conditions of the contract, including the fees, surrender charges, and withdrawal penalties.

Tips for Working with Annuity Gator

If you’re considering working with Annuity Gator, it’s essential to approach the process with careful planning and due diligence. Here are some tips to help you navigate the process and make informed decisions:

Careful Research

Before working with Annuity Gator or any other annuity provider, conduct thorough research. This includes reviewing the company’s website, reading customer reviews, and comparing its products and services to those of competitors. Understand the company’s reputation, financial stability, and any relevant accreditations.

Understanding Annuity Contracts

Take the time to carefully review the annuity contract before signing it. Make sure you understand the terms and conditions, including the fees, surrender charges, withdrawal penalties, and the guarantees provided. If you’re unsure about any aspect of the contract, seek professional financial advice.

Seeking Professional Financial Advice

Working with a qualified financial advisor can be invaluable when making decisions about annuities. A financial advisor can help you assess your financial goals, risk tolerance, and time horizon, and recommend the most suitable annuity product for your needs. They can also help you understand the complexities of annuity contracts and ensure that you make informed decisions.

Debugging Android WebView 202 can be challenging, but these tools can make the process smoother: Android WebView 202 debugging tools. This article provides a comprehensive list of essential debugging tools and techniques.

Checklist of Questions

Before making a decision, ask Annuity Gator these questions:

- What types of annuities do you offer?

- What are the fees and commissions associated with each annuity product?

- What are the surrender charges and withdrawal penalties?

- What are the guarantees provided by each annuity product?

- What is your track record and financial stability?

- Do you have any accreditations or ratings?

- Can you provide me with references from satisfied customers?

Final Review: Is Annuity Gator Legit 2024

In conclusion, while Annuity Gator presents a compelling option for those seeking guaranteed income and tax advantages, it’s essential to conduct thorough research and seek professional financial advice before making any decisions. Understanding your personal financial goals, risk tolerance, and time horizon is crucial in determining whether Annuity Gator’s services are the right fit for your individual circumstances.

Understanding annuities can be easier when you see real-life examples. This article: Annuity Examples In Real Life 2024 provides practical scenarios to help you grasp how annuities work in everyday situations.

Remember, making informed choices about your retirement planning is essential to achieving financial security and peace of mind.

FAQ Overview

What types of annuities does Annuity Gator offer?

Annuity Gator provides a range of annuity products, including fixed annuities, variable annuities, and indexed annuities. Each type offers different features, benefits, and risk levels.

How can I contact Annuity Gator for more information?

You can visit Annuity Gator’s website or call their customer service line to learn more about their products and services.

Is Annuity Gator regulated by any financial authorities?

Yes, Annuity Gator is regulated by state insurance departments and adheres to industry standards. It’s crucial to ensure any financial provider you work with is properly regulated.

Dollify has been making waves in the world of digital avatars. If you’re curious about what’s new in the latest version, you can check out this article: Dollify 2024: What’s New and Different. It explores the exciting features and updates that set Dollify 2024 apart.