Is Annuity Received From Lic Taxable 2024 – Is Annuity Received From LIC Taxable in 2024? This question is crucial for anyone considering annuities as part of their retirement planning. Annuities, a financial product offering a stream of payments over time, can be a valuable tool for ensuring financial security during retirement.

If you have questions about annuities, you can find some answers here. Some annuities provide immediate payments, and you can find more about those here. If you’re considering using Annuity Gator, you might want to know if it’s legitimate, and you can find information about that here.

However, understanding the tax implications of annuity payments is essential for maximizing their benefits. This guide will delve into the intricacies of annuity taxation in 2024, focusing on the role of the Life Insurance Company (LIC) in India.

We will explore the different types of annuities, the tax treatment of payments, and how annuity payments can affect your overall retirement income. By examining the tax rules and relevant factors, we aim to provide clarity and practical insights to help you make informed decisions regarding your retirement savings.

Contents List

Understanding Annuities: Is Annuity Received From Lic Taxable 2024

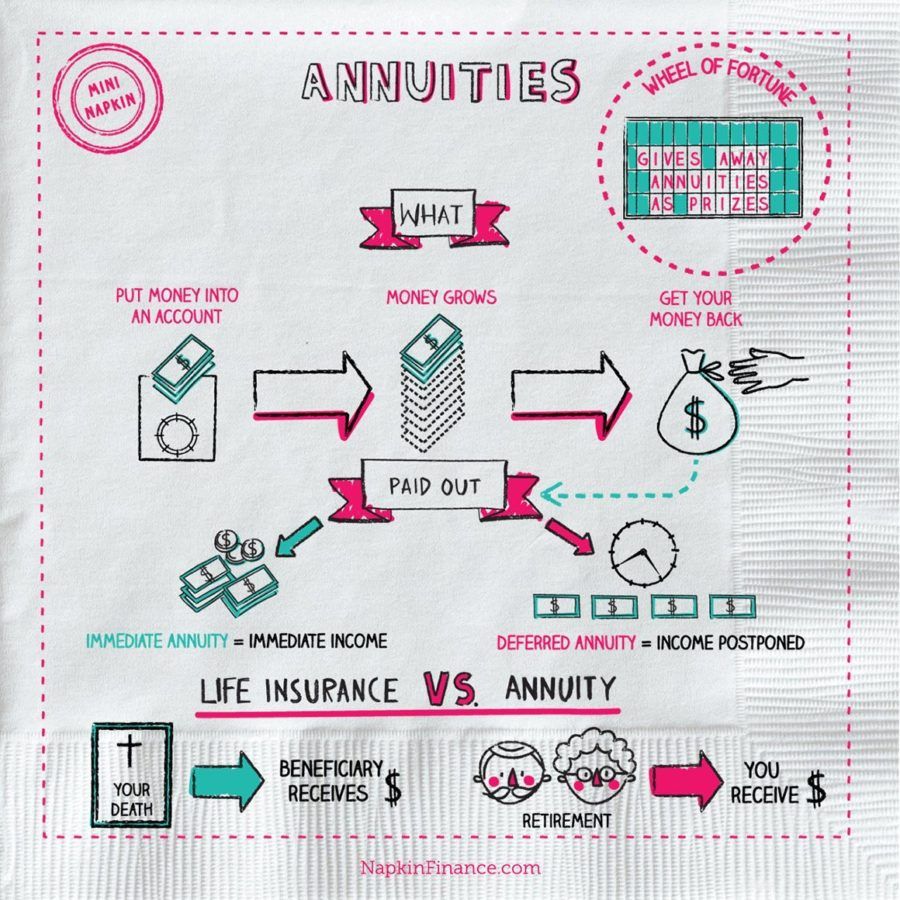

An annuity is a financial product that provides a stream of regular payments, either for a fixed period or for the lifetime of the annuitant. They are often used as a retirement planning tool, as they can provide a steady source of income during retirement.

Annuities can be purchased from insurance companies, including the Life Insurance Corporation (LIC) of India.

Types of Annuities

Annuities come in various forms, each with its own set of features and benefits. Some common types of annuities include:

- Fixed Annuities:These annuities offer a guaranteed rate of return, providing predictable payments. The principal is protected from market fluctuations.

- Variable Annuities:These annuities offer the potential for higher returns, but also carry more risk. The principal is invested in mutual funds or other securities, and the payments can fluctuate based on market performance.

- Indexed Annuities:These annuities link the growth of the principal to a specific index, such as the S&P 500. They offer potential for growth with some downside protection.

- Immediate Annuities:These annuities start paying out immediately after purchase. They are often used by individuals who need an immediate source of income.

- Deferred Annuities:These annuities start paying out at a later date, allowing the principal to grow over time. They are often used for long-term retirement planning.

Tax Implications of Annuities

The tax treatment of annuity payments depends on the type of annuity and the age of the recipient. In general, a portion of each annuity payment is considered a return of principal, which is not taxable. The remaining portion is considered interest or investment income, which is taxable.

For example, if an individual purchases a fixed annuity for $100,000 and receives annual payments of $10,000, the first $10,000 received would be considered a return of principal and would not be taxed. The remaining portion of the payment would be considered taxable interest income.

Examples of Annuity Use in Retirement Planning

- Guaranteed Income Stream:Annuities can provide a guaranteed income stream during retirement, regardless of market fluctuations. This can help individuals plan for their financial needs and reduce the risk of outliving their savings.

- Income Supplement:Annuities can be used to supplement other sources of retirement income, such as Social Security or pensions.

- Long-Term Care Protection:Some annuities offer long-term care benefits, which can help cover the costs of nursing home care or assisted living.

The Role of the Life Insurance Company (LIC)

The LIC plays a significant role in the Indian insurance market, offering a wide range of financial products, including annuities. The LIC’s annuities are designed to provide a steady stream of income for individuals during their retirement years.

LIC’s Role in Issuing and Managing Annuities

The LIC issues and manages annuities, ensuring that policyholders receive their payments as scheduled. The LIC’s expertise in insurance and financial management makes it a reliable provider of annuity products.

LIC’s Policies and Procedures Regarding Annuity Payouts

The LIC has established policies and procedures for annuity payouts, ensuring that payments are made promptly and accurately. Policyholders can contact the LIC for information about their annuity payments and any applicable fees or charges.

LIC’s Tax Reporting Requirements for Annuity Recipients

The LIC is required to report annuity payments to the tax authorities. Annuity recipients will receive a Form 16 or a similar document from the LIC, which details the amount of annuity payments received during the year. This information can be used by individuals to file their income tax returns.

Taxability of Annuity Payments in 2024

The tax rules for annuity payments received in 2024 are subject to change based on the latest tax laws and regulations. It is essential to consult with a tax advisor for specific guidance on the tax treatment of annuity payments in your situation.

Factors Determining Taxability of Annuity Payments

- Type of Annuity:The tax treatment of annuity payments can vary depending on the type of annuity purchased.

- Age of the Recipient:The age of the recipient can also affect the taxability of annuity payments. For example, payments received before the age of 59 1/2 may be subject to an early withdrawal penalty.

Comparison of Tax Treatment with Other Retirement Income, Is Annuity Received From Lic Taxable 2024

Annuity payments are generally taxed as ordinary income. This is similar to the tax treatment of other forms of retirement income, such as pensions and Social Security benefits. However, the tax treatment of annuity payments can differ from other retirement income sources in certain circumstances.

Tax Implications of Annuities in Retirement Planning

Annuity payments can have a significant impact on overall retirement income and tax planning. It is important to consider the tax implications of annuity payments when making retirement planning decisions.

The word “annuity” can be translated into Tamil, and you can find the meaning here. Understanding the tax implications of immediate annuities is crucial, and you can find more information about that here. An annuity is essentially a series of payments, and you can get a definition of it here.

Impact of Annuity Payments on Overall Retirement Income

Annuity payments can contribute to overall retirement income, providing a consistent source of funds during retirement. However, it is important to note that annuity payments are subject to taxation, which can reduce the overall amount of income available for spending.

It’s helpful to understand the concept of an annuity with an example, which you can find here. You might have heard of annuity lotteries, and you can find information about them here. An annuity certain is a specific type of annuity, and you can find an example of it here.

Annuity Payments and Tax Brackets

Annuity payments can affect an individual’s tax bracket. As annuity payments are taxed as ordinary income, they can increase an individual’s taxable income, potentially pushing them into a higher tax bracket.

Strategies for Minimizing Tax Burden on Annuity Payments

- Tax-Advantaged Annuities:Consider purchasing tax-advantaged annuities, such as qualified annuities, which may offer tax benefits.

- Timing of Payments:Strategically timing annuity payments to coincide with periods of lower income can help minimize the tax burden.

- Tax-Loss Harvesting:If possible, use tax-loss harvesting strategies to offset taxable income from annuity payments.

Practical Examples of Annuity Taxation

Hypothetical Scenario

Assume an individual, aged 65, purchased a fixed annuity for $100,000 and receives annual payments of $10,000. The annuity was purchased with after-tax dollars.

Tax Implications

The individual will receive $10,000 per year in annuity payments. Of this amount, a portion will be considered a return of principal and will not be taxed. The remaining portion will be considered taxable interest income. The exact amount of taxable income will depend on the annuity contract and the age of the recipient.

There’s a lot of general information about annuities available online, and you can find some here. If you’re in Sarasota, you might be interested in Annuity King, and you can find information about them here. Annuities are often discussed in multiple-choice questions, and you can find some examples here.

Table Illustrating Tax Treatment

| Year | Payment Amount | Return of Principal | Taxable Interest Income |

|---|---|---|---|

| 1 | $10,000 | $5,000 | $5,000 |

| 2 | $10,000 | $5,000 | $5,000 |

| 3 | $10,000 | $5,000 | $5,000 |

Conclusive Thoughts

In conclusion, the taxability of annuity payments received from the LIC in 2024 is a complex matter influenced by various factors, including the type of annuity, the age of the recipient, and the specific provisions of Indian tax law. By understanding the intricacies of annuity taxation, individuals can effectively plan their retirement finances, minimize their tax burden, and maximize the benefits of their annuity investments.

It is always advisable to consult with a qualified financial advisor or tax professional for personalized guidance tailored to your specific circumstances.

Clarifying Questions

How do I know if my annuity payments are taxable?

The taxability of your annuity payments depends on several factors, including the type of annuity, the age at which you started receiving payments, and the specific provisions of Indian tax law. It’s best to consult with a tax professional to determine the taxability of your specific annuity.

If you’re looking for information about annuity health in Westmont, Illinois for 2024, you can find it here. It’s important to understand how annuity payments are taxed, and you can find out more about that here. When planning your annuity, you might need to calculate the number of periods, and there are calculators available for that here.

What are the tax implications of withdrawing from an annuity?

If you withdraw from an annuity before the age of 60, the withdrawals may be subject to a 10% penalty, in addition to regular income tax. However, there are exceptions to this rule, so it’s important to consult with a tax professional for personalized advice.

Can I deduct annuity payments on my tax return?

Generally, you cannot deduct annuity payments on your tax return. However, there may be certain circumstances where you can claim a deduction for medical expenses paid through an annuity contract.

What are the tax benefits of an annuity?

While annuity payments themselves are generally taxable, certain types of annuities, such as deferred annuities, offer tax-deferred growth, meaning that you won’t be taxed on the earnings until you withdraw them. Additionally, if you choose to receive your annuity payments as a lump sum, you may be able to qualify for favorable tax treatment.