Is Annuity The Same As Life Insurance 2024? This question often arises when individuals are planning for their financial future, seeking ways to secure income and protect loved ones. While both annuities and life insurance play significant roles in financial planning, they are fundamentally distinct products with unique purposes and features.

This article explores the key differences between these financial instruments, highlighting their individual strengths and helping you make informed decisions for your specific needs.

Understanding the Annuity Exclusion Ratio 2024 is crucial for calculating the tax-free portion of annuity payments. In the realm of technology, Top Android app development tools in 2024 are shaping the mobile app landscape.

Annuities are financial products designed to provide a steady stream of income during retirement, often acting as a supplement to Social Security or other retirement savings. Life insurance, on the other hand, is primarily focused on protecting beneficiaries by providing a death benefit upon the insured’s passing.

Understanding the nuances of each product is crucial for making strategic financial decisions.

Contents List

Understanding Annuities

Annuities are financial products that provide a stream of regular payments, typically for a set period or for the lifetime of the annuitant. They are often used for retirement planning, but they can also be used for other purposes, such as supplementing income or protecting against longevity risk.

Types of Annuities, Is Annuity The Same As Life Insurance 2024

There are several types of annuities, each with its own unique features and benefits. Here are some of the most common types:

- Fixed Annuities:These annuities provide a guaranteed rate of return, meaning that the payments you receive will not fluctuate based on market performance. This type of annuity is best suited for those who prioritize stability and predictability.

- Variable Annuities:Unlike fixed annuities, variable annuities offer the potential for higher returns, but they also come with greater risk. The payments you receive will depend on the performance of the underlying investments, which are typically mutual funds or other securities.

- Indexed Annuities:These annuities offer a combination of guaranteed returns and potential for growth. They are linked to a specific market index, such as the S&P 500, and your payments will be affected by the performance of that index.

Key Features of an Annuity Contract

An annuity contract Artikels the terms and conditions of the annuity, including the payout options and guarantees. Here are some of the key features to consider:

- Payout Options:Annuity contracts offer various payout options, such as a lump sum payment, a fixed monthly income, or a combination of both. The payout option you choose will depend on your individual needs and financial goals.

- Guarantees:Annuities may offer certain guarantees, such as a minimum interest rate or a death benefit. These guarantees can provide peace of mind and protect your investment from market fluctuations.

- Fees:Annuity contracts typically include fees, such as administrative fees, surrender charges, and mortality and expense charges. It’s important to understand the fees associated with an annuity before making a decision.

Tax Implications of Annuity Payments

The tax implications of annuity payments depend on the type of annuity and the payout options chosen. In general, the payments you receive from an annuity are taxed as ordinary income. However, the portion of the payment that represents your original investment is not taxed.

For example, if you invested $100,000 in an annuity and receive $1,000 per month, the first $100,000 in payments will be tax-free, while the remaining payments will be taxed as ordinary income.

Life Insurance Explained

Life insurance is a contract that provides a financial benefit to your beneficiaries upon your death. It is a crucial tool for protecting your loved ones and ensuring their financial security in the event of your passing.

Types of Life Insurance

Life insurance policies come in various forms, each with its own features and benefits. Here are some of the most common types:

- Term Life Insurance:This type of life insurance provides coverage for a specific period, typically 10, 20, or 30 years. It is typically more affordable than permanent life insurance, but it does not build cash value.

- Whole Life Insurance:Whole life insurance provides permanent coverage, meaning it remains in effect for your entire lifetime. It also builds cash value that you can borrow against or withdraw.

- Universal Life Insurance:Universal life insurance is a flexible type of permanent life insurance that allows you to adjust your premium payments and death benefit. It also builds cash value, but the interest rate earned on the cash value is not guaranteed.

Factors Influencing the Cost of Life Insurance

The cost of life insurance is determined by several factors, including:

- Age:Younger individuals generally pay lower premiums than older individuals, as they have a longer life expectancy.

- Health:Your health status plays a significant role in determining your premium. Individuals with pre-existing medical conditions typically pay higher premiums.

- Coverage Amount:The amount of coverage you choose will also affect your premium. The higher the coverage amount, the higher the premium.

- Lifestyle:Your lifestyle habits, such as smoking or engaging in dangerous activities, can also influence your premium.

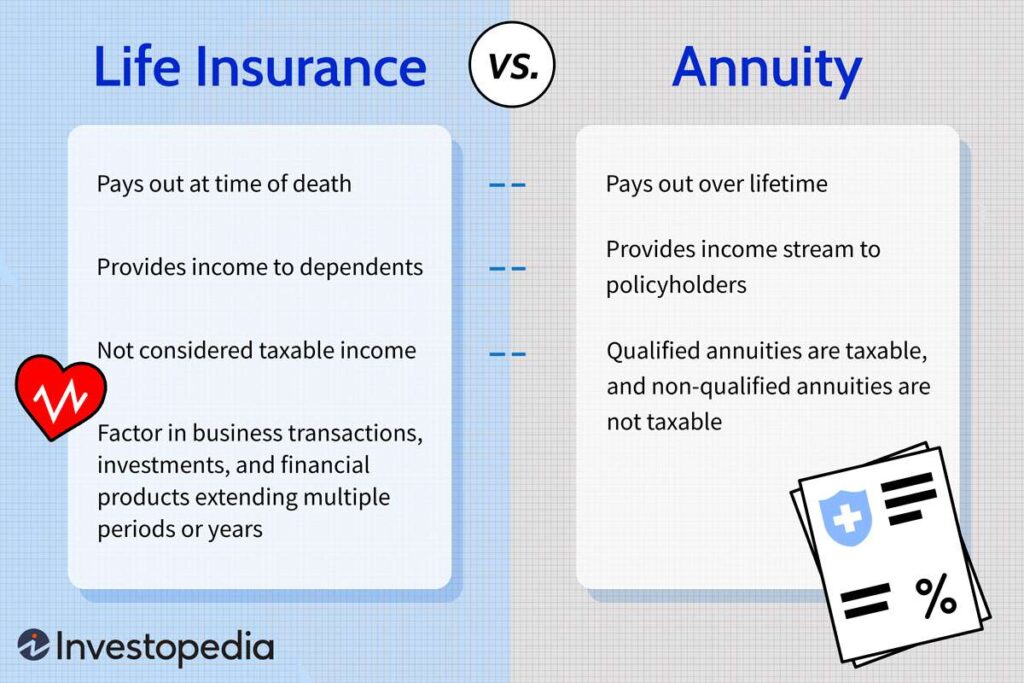

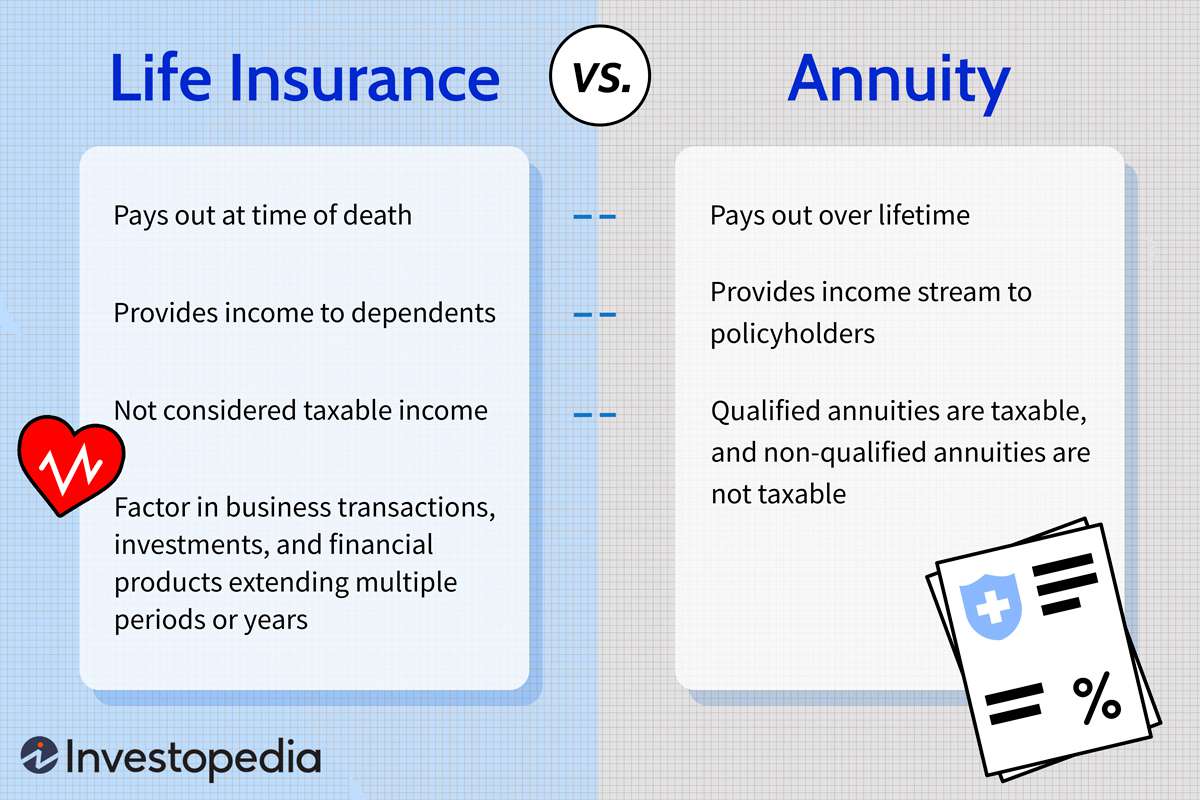

Key Differences: Annuities vs. Life Insurance

Annuities and life insurance are distinct financial products with different objectives and features. Understanding the key differences between them is crucial for making informed decisions about your financial planning.

Objective and Function

Annuities are designed to provide a stream of income during retirement or other periods of life. They are primarily focused on income generation and longevity protection. Life insurance, on the other hand, is designed to protect your beneficiaries from financial hardship in the event of your death.

It provides a lump sum death benefit to your designated beneficiaries.

Kathy’s annuity experience, detailed in Kathy’s Annuity Is Currently Experiencing 2024 , highlights the importance of careful planning. For those in the UK, Annuity Calculator Uk 2024 can provide valuable insights.

Benefits and Features

Annuities offer various payout options, including fixed payments, variable payments, and lump sums. They may also offer guarantees, such as minimum interest rates or death benefits. Life insurance, on the other hand, provides a death benefit that can be used to cover funeral expenses, debts, or provide financial support to beneficiaries.

Annuity certain, as explained in Annuity Certain Is An Example Of 2024 , is a common type of annuity. To fully understand annuities, it’s essential to grasp their definition, as detailed in An Annuity Is Defined As 2024.

Ultimately, Annuity Is Given By 2024 a specific formula that ensures regular payments over a predetermined period.

Key Characteristics

| Characteristic | Annuities | Life Insurance |

|---|---|---|

| Objective | Income generation, longevity protection | Death benefit protection |

| Benefit | Regular income payments | Lump sum death benefit |

| Investment | May involve investments, but not always | Not typically an investment |

| Taxation | Payments are taxed as ordinary income | Death benefit is generally tax-free |

| Flexibility | Limited flexibility in terms of payments | Flexible in terms of coverage amount and premium payments |

Annuity as a Life Insurance Alternative

In certain circumstances, an annuity might serve as a viable alternative to life insurance. Here’s how:

Income Security and Potential Death Benefits

Annuities can provide a steady stream of income during retirement, which can help ensure financial security. Some annuities also offer a death benefit, which can be used to cover funeral expenses or provide a lump sum payment to beneficiaries.

Inheriting an annuity can raise questions about its taxability, addressed in I Inherited An Annuity Is It Taxable 2024. The healthcare sector also offers diverse career paths, including those in annuity health, as explored in Annuity Health Careers 2024.

Situations Where an Annuity Might Be Suitable

Here are some situations where an annuity might be a suitable option:

- Individuals with limited financial resources:Annuities can be a more affordable option than life insurance, especially for individuals with limited financial resources.

- Individuals seeking guaranteed income:Fixed annuities provide guaranteed income, which can be beneficial for those who prioritize stability and predictability.

- Individuals concerned about longevity risk:Annuities can help protect against longevity risk, ensuring a stream of income throughout retirement, even if you live longer than expected.

Considerations for Choosing Between Annuities and Life Insurance: Is Annuity The Same As Life Insurance 2024

Choosing between an annuity and life insurance requires careful consideration of your individual needs, financial goals, and circumstances. Here are some factors to consider:

Financial Goals and Needs

Determine your primary financial goals and needs. Are you seeking income security in retirement or protection for your beneficiaries in the event of your death? Your answer will help guide your decision between an annuity and life insurance.

Risk Tolerance

Consider your risk tolerance. Annuities, particularly variable annuities, can involve investment risk, while life insurance typically offers guaranteed death benefits. Choose the product that aligns with your comfort level with risk.

Financial Situation

Evaluate your current financial situation. Can you afford both an annuity and life insurance? Consider the costs and premiums associated with each product and choose the option that fits your budget.

Annuity health plans, like the ones discussed in Annuity Health 2024 , are becoming increasingly popular as individuals seek to secure their future healthcare costs. Understanding the nuances of annuities, including the Annuity Formula Is 2024 , is crucial to making informed decisions.

Professional Advice

Consulting with a financial advisor is highly recommended to determine the best option for your specific needs. A financial advisor can provide personalized guidance and help you understand the complexities of annuities and life insurance.

Checklist of Questions

Here are some questions to guide your decision-making process:

- What are my primary financial goals?

- What is my risk tolerance?

- What is my current financial situation?

- What are the costs and premiums associated with each product?

- What are the tax implications of each product?

- What are the guarantees and payout options offered by each product?

Concluding Remarks

Choosing between an annuity and life insurance requires careful consideration of your individual financial goals and risk tolerance. It is essential to weigh the benefits and drawbacks of each product, considering your current financial situation, age, and long-term objectives. Consulting with a qualified financial advisor can provide valuable insights and personalized guidance to help you determine the most suitable option for your unique circumstances.

Detailed FAQs

How do I choose between an annuity and life insurance?

When exploring annuities, it’s important to grasp their fundamental definition, as outlined in An Annuity Is Best Defined As 2024. One of the most well-known providers, John Hancock, offers a range of annuity options, which are detailed in Annuity John Hancock 2024.

The choice between an annuity and life insurance depends on your individual needs and priorities. If your primary goal is to provide income security during retirement, an annuity may be a better option. If your focus is on protecting your loved ones financially in the event of your death, life insurance is more appropriate.

What are the tax implications of annuities and life insurance?

While annuities can be a valuable financial tool, there are potential downsides, as explored in Annuity Is Bad 2024. For instance, the tax implications of annuity income can be complex, particularly when considering if it qualifies as capital gains, as discussed in Is Annuity Income Capital Gains 2024.

Annuities can be subject to income taxes on the payouts, while life insurance death benefits are generally tax-free to beneficiaries. It’s important to consult with a tax advisor to understand the specific tax implications for your situation.

Can I have both an annuity and life insurance?

Yes, you can have both an annuity and life insurance. Many individuals choose to have both products to address different financial needs and provide comprehensive protection for their future.

What are some examples of situations where an annuity might be a suitable option?

An annuity might be a suitable option for individuals who want to:

– Generate a guaranteed stream of income during retirement.

– Protect against outliving their savings.

– Ensure a steady source of income for a surviving spouse.