Is the mileage rate changing in October 2024? This question has become a pressing concern for businesses and individuals alike, as the potential impact of a change could significantly affect travel expenses and financial planning. The mileage rate, a standardized reimbursement for using a personal vehicle for business purposes, is subject to periodic adjustments based on factors like inflation, fuel prices, and economic conditions.

As we approach the end of 2023, speculation about a potential mileage rate change in October 2024 is gaining momentum, prompting many to seek clarity on the matter.

The mileage rate is a crucial element for businesses that rely on employee travel and for individuals who use their vehicles for work-related errands. It ensures fair compensation for the costs associated with vehicle operation, including fuel, maintenance, and depreciation.

Understanding the current mileage rate, its historical trends, and the potential factors that could influence future adjustments is essential for informed decision-making and effective financial management.

Contents List

Official Announcements and Resources

The mileage rate is an important consideration for individuals and businesses that incur travel expenses. To stay informed about any changes to the mileage rate, it’s essential to rely on official announcements and resources.

Missing the October 2024 tax deadline can come with penalties, so it’s important to be aware of the consequences. This article provides information on potential penalties for late filing.

Official Channels for Mileage Rate Announcements, Is the mileage rate changing in October 2024?

The official channels for mileage rate announcements are typically government agencies responsible for setting and publishing these rates. In the United States, the Internal Revenue Service (IRS) is responsible for setting the standard mileage rates for business, medical, and moving expenses.

If you’re a freelancer, you have a bit more time to file your taxes than most. This article provides the specific tax deadline for freelancers in October 2024.

Relevant Government Websites and Publications

- Internal Revenue Service (IRS):The IRS website is the primary source for information about mileage rates. It provides the current standard mileage rates, historical rates, and relevant publications.

- Federal Register:The Federal Register is a daily publication of the U.S. government that contains official documents, including notices of proposed rule changes, final regulations, and other announcements.

Are you planning on using your vehicle for business purposes? If so, it’s important to know the current mileage rate. This article provides the latest mileage rate for business use.

The mileage rate changes are often announced in the Federal Register.

Mileage Rate Information

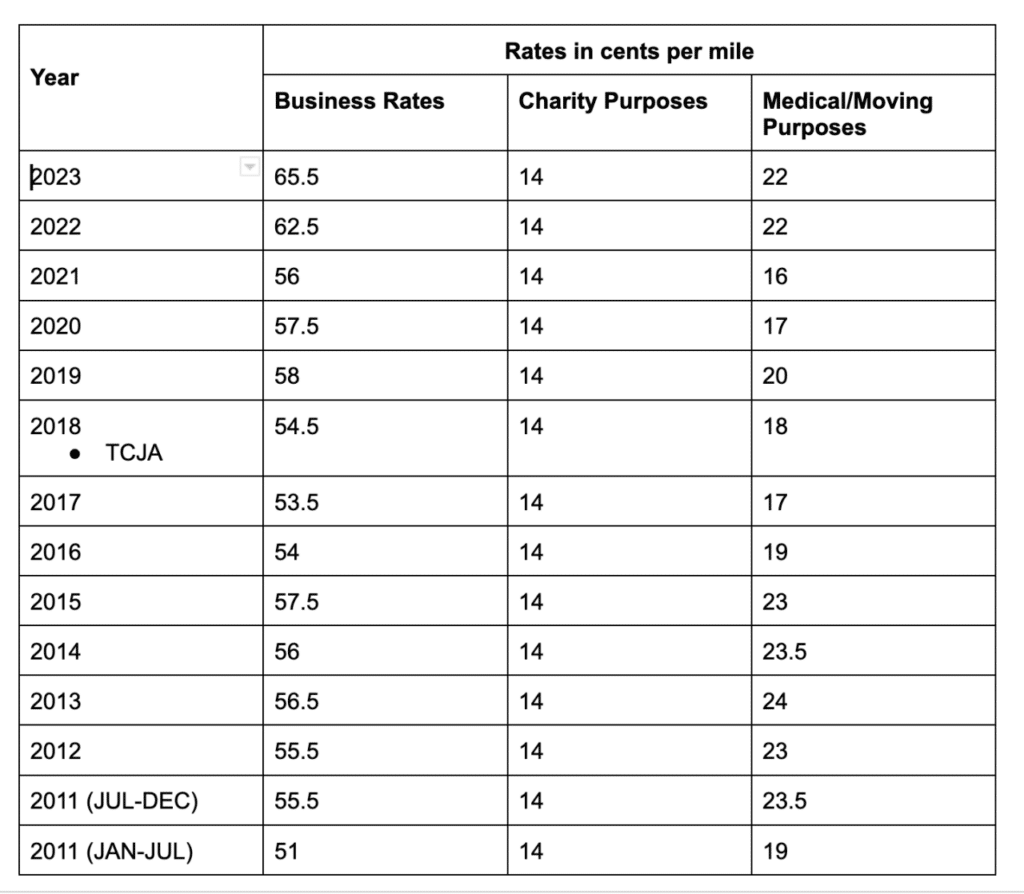

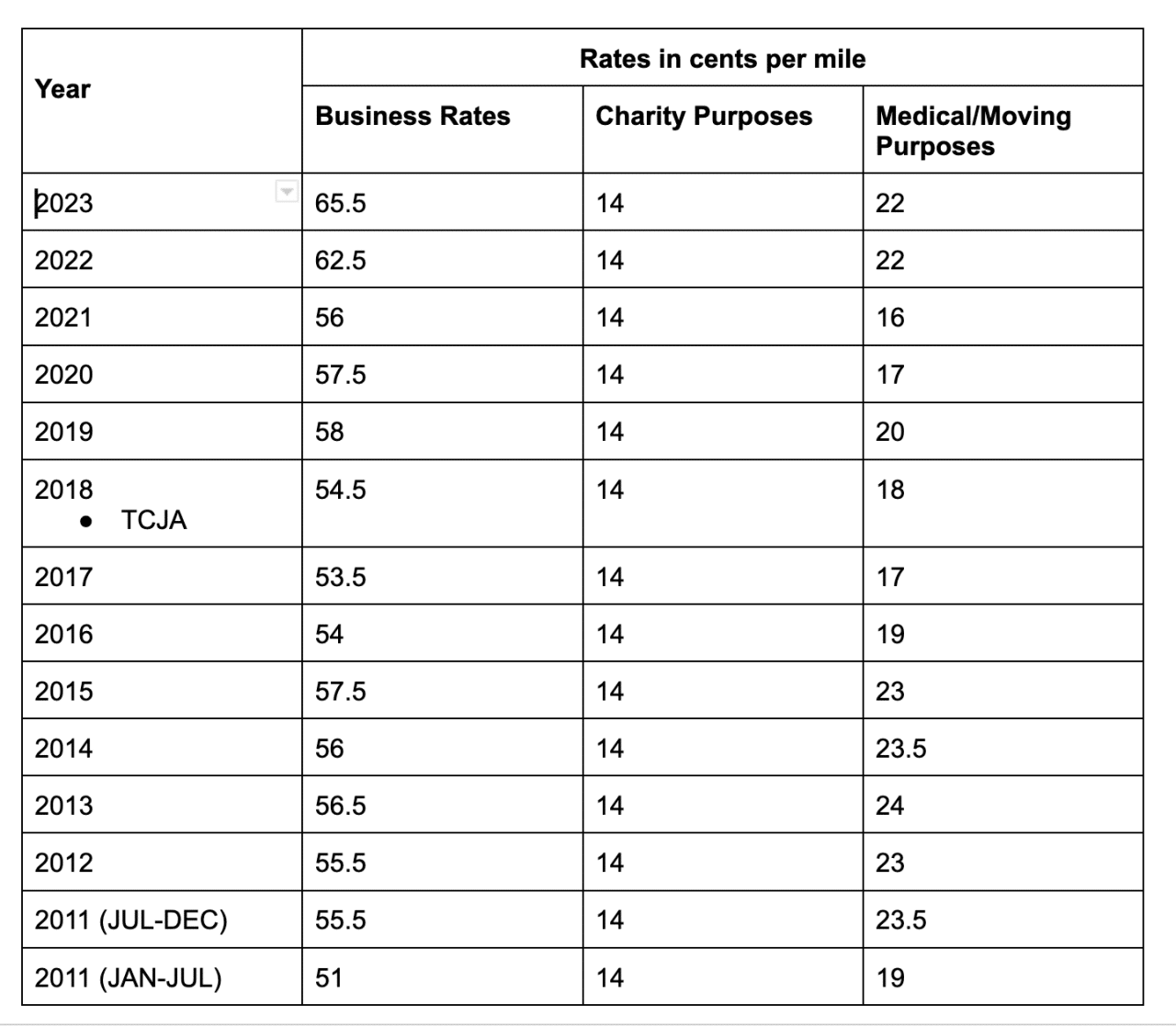

The table below provides key information about the mileage rate for the past few years:

| Year | Mileage Rate | Effective Date | Source |

|---|---|---|---|

| 2023 | 65.5 cents per mile (business) | January 1, 2023 | IRS Publication 529, Miscellaneous Deductions |

| 2022 | 62.5 cents per mile (business) | January 1, 2022 | IRS Publication 529, Miscellaneous Deductions |

| 2021 | 58.5 cents per mile (business) | January 1, 2021 | IRS Publication 529, Miscellaneous Deductions |

Impact of a Mileage Rate Change

A change in the mileage rate can have a significant impact on both businesses and individuals who rely on vehicle use for work or personal reasons. Understanding the implications of such a change is crucial for financial planning and decision-making.

The October 2024 tax deadline is a key date for many taxpayers. This article clarifies the specific deadline for filing your taxes.

Financial Effects of a Mileage Rate Change

A mileage rate change can have a direct impact on the financial bottom line for businesses and individuals.

If you’re wondering about the highest tax bracket for 2024, you’re not alone. This article breaks down the different tax brackets and what they mean for your income.

Businesses

- Increased Expenses:If the mileage rate increases, businesses will experience higher costs associated with employee travel, delivery services, and other vehicle-related activities. This can lead to reduced profits or necessitate adjustments to pricing strategies.

- Reduced Profits:A decrease in the mileage rate could result in lower reimbursements for employees, impacting their take-home pay and potentially affecting employee morale. Businesses might need to adjust compensation packages or find alternative ways to incentivize employees.

Individuals

- Increased or Decreased Reimbursements:Individuals who use their vehicles for work purposes, such as self-employed professionals or those who receive mileage reimbursements from their employers, will be directly affected by a change in the mileage rate. An increase in the rate will result in higher reimbursements, while a decrease will lead to lower reimbursements.

It’s always good to compare tax brackets from year to year. This article highlights the differences between the 2023 and 2024 tax brackets.

- Tax Implications:The mileage rate is used for tax purposes to deduct vehicle expenses. A change in the rate could affect the amount of tax deductions available, potentially increasing or decreasing tax liability.

Strategies for Adapting to a New Mileage Rate

Businesses and individuals can take proactive steps to adapt to a new mileage rate and mitigate potential financial impacts.

The tax brackets for 2024 may be different from those in 2023. This article explains the changes and how they could affect your tax liability.

Businesses

- Review Expense Tracking:Businesses should carefully review their expense tracking systems to ensure accurate reporting of vehicle-related expenses. This will help identify areas where cost savings can be implemented.

- Negotiate Contracts:Businesses with long-term contracts that include mileage reimbursement clauses should consider renegotiating these contracts to reflect the new mileage rate. This can help protect profit margins and ensure fair compensation.

- Explore Alternative Transportation Options:Businesses should explore alternative transportation options, such as public transportation, carpooling, or ride-sharing services, to reduce reliance on personal vehicles and minimize mileage-related expenses.

Individuals

- Track Mileage Accurately:Individuals should maintain accurate records of their mileage for work-related travel. This will ensure they receive the correct reimbursement amount or can claim the appropriate tax deductions.

- Negotiate Reimbursement Rates:Individuals who receive mileage reimbursements from their employers should consider negotiating a higher rate to offset the impact of a decrease in the standard mileage rate.

- Consider Tax Deductions:Individuals who use their vehicles for work purposes should be aware of the tax deductions available for vehicle expenses. Consult with a tax professional to determine the best strategy for minimizing tax liability.

Closure

The possibility of a mileage rate change in October 2024 highlights the dynamic nature of this reimbursement system. While the exact outcome remains uncertain, staying informed about official announcements and relevant resources is paramount. By understanding the factors influencing the mileage rate and its potential impact, businesses and individuals can proactively adapt to any changes and ensure their financial stability in the long run.

The mileage rate, a vital component of travel expense management, will continue to evolve, reflecting the ever-changing economic landscape and the need for fair compensation for vehicle use.

Common Queries: Is The Mileage Rate Changing In October 2024?

What is the current mileage rate for 2023?

The current mileage rate for 2023 is [insert current mileage rate].

Who sets the mileage rate?

The Internal Revenue Service (IRS) sets the mileage rate for business use of a personal vehicle.

How often does the mileage rate change?

The mileage rate is typically adjusted annually, often at the beginning of the calendar year.

What is the impact of inflation on the mileage rate?

Inflation can lead to an increase in the mileage rate as the costs associated with vehicle operation, such as fuel and maintenance, rise.

Wondering about the mileage rate for October 2024? This article provides the latest mileage rate for October 2024.

The IRS offers various resources to help taxpayers navigate the tax process. This article highlights some of the key resources available for the October 2024 tax deadline.

Retirees have their own specific tax deadlines. This article clarifies the October 2024 tax deadline for retirees.

The Seahawks put up a valiant effort, but ultimately fell short in Week 5. This article provides a detailed recap of the game and analyzes the Seahawks’ performance.

The standard mileage rate for October 2024 is important for those who use their vehicles for business purposes. This article outlines the current standard mileage rate.

The mileage rate for October 2024 can impact your tax deductions. This article provides the specific mileage rate for October 2024.

The tax brackets for 2024 in the United States are important to understand for tax planning purposes. This article outlines the tax brackets for 2024 in the United States.

There are a number of tax deductions available for the October 2024 deadline. This article provides information on potential tax deductions.