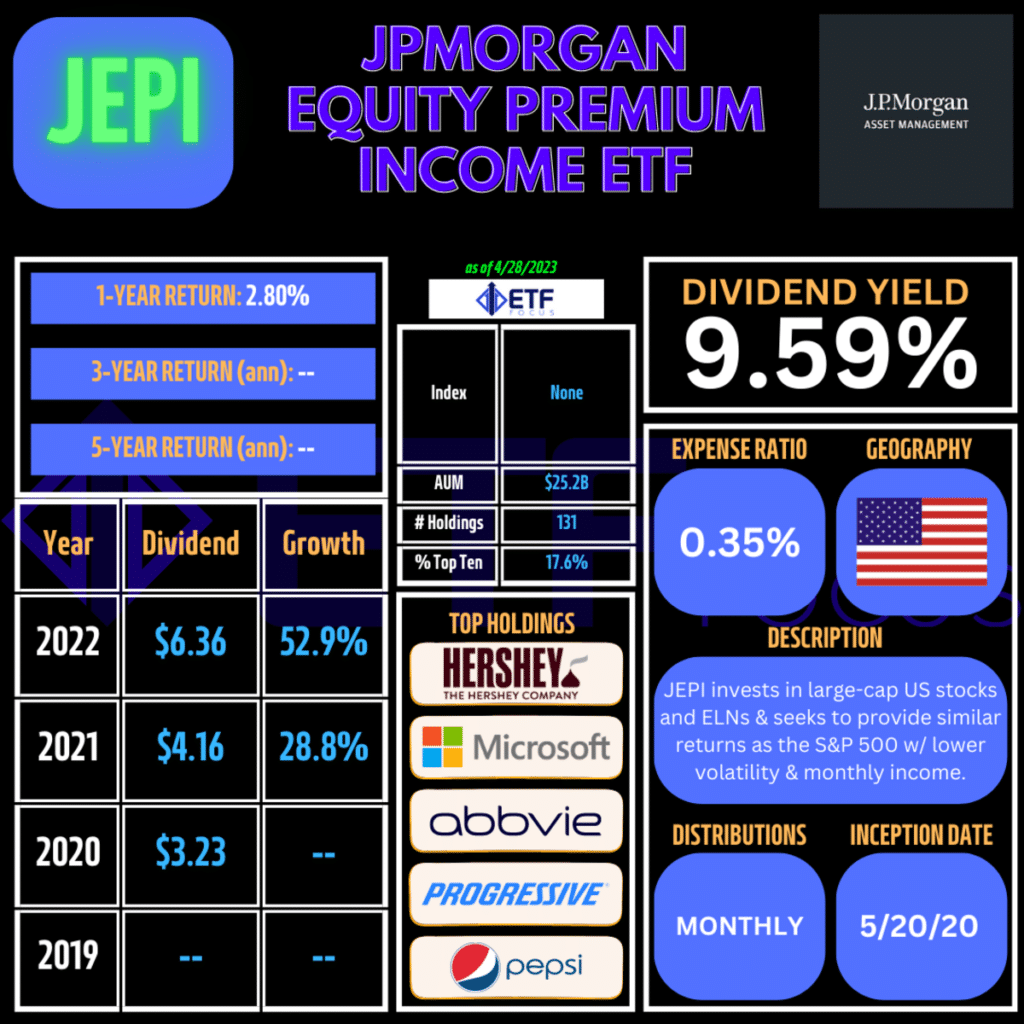

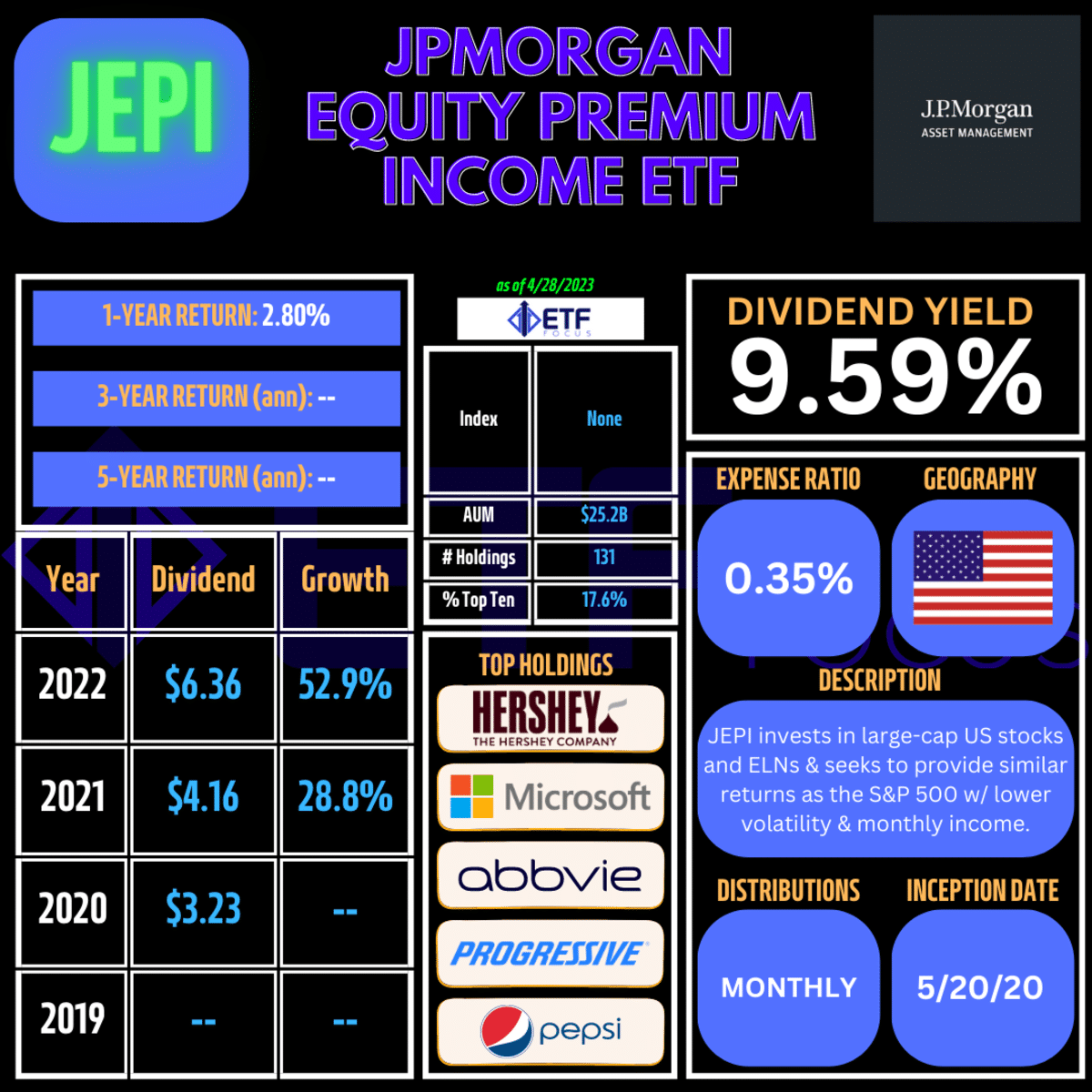

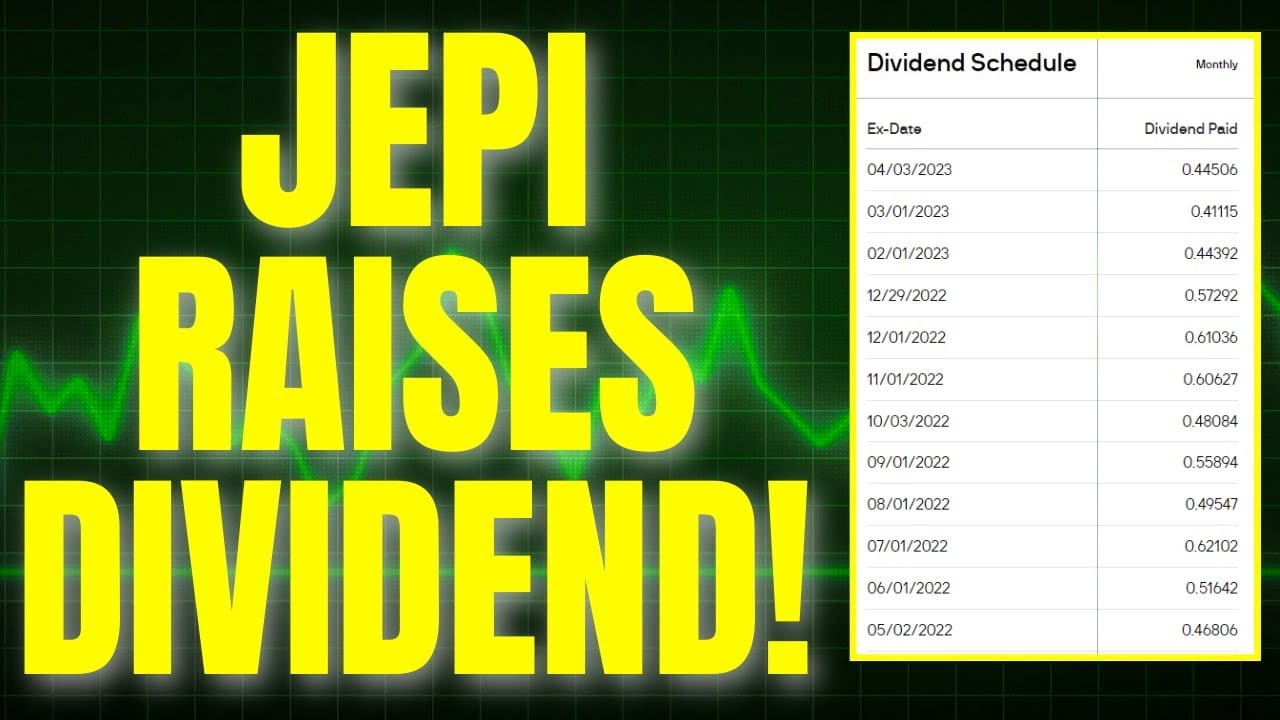

Jepi Dividend October 2023 marks a significant event for investors seeking regular income streams. Jepi, known for its commitment to dividend payouts, has once again delivered a substantial dividend for shareholders. This analysis delves into the intricacies of Jepi’s dividend policy, exploring historical trends, influencing factors, and future prospects.

We’ll examine the financial health of the company, assess the sustainability of its dividend payments, and compare Jepi’s dividend strategy to its competitors.

This comprehensive exploration aims to provide investors with a clear understanding of Jepi’s dividend policy, empowering them to make informed decisions about their investment strategy. From the announced dividend amount and payment dates to the factors influencing future payouts, we’ll uncover the key insights that matter most to investors seeking to capitalize on Jepi’s dividend potential.

Contents List

- 1 4. Dividend Sustainability

- 2 Dividend Reinvestment: Jepi Dividend October 2023

- 3 Comparison to Other Dividend Stocks

- 4 Investor Perspective

- 5 8. Future Outlook for Jepi Dividends

- 6 Impact of Market Conditions

- 7 11. Dividend Taxation

- 7.1 Tax Implications of Jepi Dividends

- 7.2 Tax Rates for Jepi Dividends

- 7.3 Reporting Jepi Dividend Income for Tax Purposes

- 7.4 Tax Advantages and Disadvantages of Holding Jepi Shares in a Tax-Advantaged Account

- 7.5 Minimizing the Tax Burden on Jepi Dividends

- 7.6 Impact of Changes in Tax Laws and Regulations

- 8 12. Investor Resources

- 9 13. Dividend Strategies

- 10 Dividend History and Trends

- 11 Key Takeaways

- 12 Outcome Summary

- 13 Question & Answer Hub

4. Dividend Sustainability

Jepi’s dividend sustainability hinges on its financial health and its ability to generate consistent profits to support dividend payments. To assess this, we will analyze Jepi’s financial ratios, balance sheet, cash flow statement, and dividend payout history.

Financial Health Assessment

Jepi’s financial health is crucial to its ability to sustain dividend payments. A robust financial position provides a strong foundation for consistent dividend payouts.

Speaking of deadlines, the IRS October Deadline 2023 is an important one for many taxpayers. Make sure you’re prepared and have all your documents ready.

- Debt-to-equity ratio: This ratio measures Jepi’s leverage, indicating the proportion of debt financing compared to equity. A high debt-to-equity ratio suggests higher financial risk, as Jepi may face challenges in meeting its debt obligations.

- Current ratio: This ratio assesses Jepi’s ability to meet its short-term financial obligations. A higher current ratio indicates that Jepi has sufficient liquid assets to cover its short-term liabilities.

- Return on equity (ROE): ROE measures Jepi’s profitability and efficiency in generating returns for shareholders. A higher ROE indicates that Jepi is effectively utilizing its equity to generate profits.

- Interest coverage ratio: This ratio evaluates Jepi’s ability to cover its interest expenses with its earnings. A higher interest coverage ratio indicates that Jepi has sufficient earnings to cover its interest obligations.

Balance Sheet Analysis

The balance sheet provides insights into Jepi’s asset composition and liabilities.

- Asset composition: Analyzing the composition of Jepi’s assets helps determine its investment strategies and the potential for generating future cash flows.

- Liabilities: Examining Jepi’s liabilities reveals its financing structure and potential financial risk. High levels of debt or declining working capital could raise concerns about Jepi’s financial stability.

Cash Flow Statement Analysis

Jepi’s cash flow statement reveals the sources and uses of cash, providing valuable information about its ability to generate and manage cash flows.

- Operating cash flow: This represents the cash generated from Jepi’s core business operations. A consistent and growing operating cash flow is essential for sustaining dividend payments.

- Investing cash flow: This reflects Jepi’s investments in assets, such as property, plant, and equipment.

- Financing cash flow: This category reflects Jepi’s activities related to debt and equity financing.

Dividend Sustainability Analysis

A comprehensive analysis of Jepi’s dividend sustainability requires examining its dividend payout ratio, historical dividend trends, dividend policy, and potential factors that could impact future payments.

- Dividend payout ratio: This ratio measures the proportion of earnings distributed as dividends. A high dividend payout ratio could indicate a higher risk of dividend cuts if earnings decline.

- Historical dividend trends: Analyzing Jepi’s historical dividend payment patterns helps identify any consistent trends or changes in dividend payouts.

- Dividend policy: Understanding Jepi’s dividend policy, including any specific guidelines or strategies, provides insights into its approach to dividend payments.

- Factors impacting future dividend payments:

- Economic conditions: Macroeconomic factors, such as inflation, interest rates, and economic growth, can impact Jepi’s business and profitability, potentially affecting its dividend payments.

- Industry trends: Competitive pressures and industry-specific challenges can influence Jepi’s earnings and its ability to maintain dividend payouts.

- Regulatory changes: New regulations or changes in existing regulations could affect Jepi’s dividend policy.

Potential Risks

Jepi’s dividend payouts are not without risk. Several factors could lead to dividend cuts or suspensions.

Looking for the best car lease deals this October? Check out Best Car Lease Deals October 2023 for some great offers. You can find a deal that fits your budget and driving needs.

- Risk of dividend cuts or suspensions: Declining earnings, increased debt levels, or unforeseen circumstances could lead to a reduction or discontinuation of dividend payments.

- Impact of unexpected events: Unforeseen events, such as natural disasters or global pandemics, could disrupt Jepi’s operations and impact its dividend payments.

- Potential conflicts of interest: Any factors that could incentivize Jepi to prioritize other uses of its cash flow over dividend payments, such as acquisitions or expansion, could pose a risk to dividend payouts.

Dividend Reinvestment: Jepi Dividend October 2023

Dividend reinvestment is a strategy that allows investors to automatically purchase additional shares of a company using their dividend payments. This can be a powerful tool for long-term wealth accumulation, but it’s important to understand both the potential benefits and drawbacks.

Mechanics of Dividend Reinvestment Plans (DRIPs)

Dividend reinvestment plans (DRIPs) are programs offered by companies that allow shareholders to automatically reinvest their dividends into additional shares of the company’s stock. This eliminates the need for investors to manually purchase shares with their dividend payments. DRIPs typically operate in one of two ways:

- Direct Purchase Plans: These plans allow investors to purchase shares directly from the company, often at a discount to the market price. This can be a good option for investors who want to avoid paying brokerage fees.

- Brokerage-Sponsored Plans: These plans are offered through brokerage firms and allow investors to reinvest their dividends through their brokerage account. This option is convenient for investors who already use a brokerage firm.

Benefits of Dividend Reinvestment

Dividend reinvestment can provide several benefits for investors:

- Compounding Growth: Reinvesting dividends allows investors to benefit from the power of compounding. This means that their investment grows at an accelerating rate over time, as dividends are reinvested and earn additional returns.

- Dollar-Cost Averaging: Dividend reinvestment plans can help investors implement a dollar-cost averaging strategy, which involves investing a fixed amount of money at regular intervals. This can help to reduce the impact of market volatility.

- Tax Efficiency: In some cases, reinvesting dividends can be more tax-efficient than selling shares and reinvesting the proceeds. This is because dividends are typically taxed at a lower rate than capital gains.

- Increased Ownership: Dividend reinvestment allows investors to gradually increase their ownership stake in a company over time. This can be a powerful way to build a large position in a company that you believe in.

Drawbacks of Dividend Reinvestment

While dividend reinvestment can be a beneficial strategy, it’s important to be aware of the potential drawbacks:

- Opportunity Cost: Reinvesting dividends means that investors are not able to use that money for other purposes, such as paying down debt or making other investments. This can be a significant opportunity cost, especially if the investor has other investment opportunities that offer higher returns.

- Potential for Lower Returns: While dividend reinvestment can help to boost returns over the long term, it’s possible that the company’s stock price could decline, resulting in lower returns than if the investor had simply held onto the cash.

- Tax Implications: While reinvesting dividends can sometimes be more tax-efficient than selling shares, there are still tax implications to consider. Dividends are typically taxed as ordinary income, and investors may need to pay taxes on their dividend income, even if they reinvest it.

Impact of Reinvestment on Long-Term Returns

The potential impact of dividend reinvestment on long-term returns depends on a number of factors, including the company’s dividend growth rate, the stock’s performance, and the investor’s overall investment strategy.

Dividend reinvestment can significantly enhance long-term returns, especially for companies with a history of consistent dividend growth. By automatically reinvesting dividends, investors can compound their returns over time, potentially leading to substantial wealth accumulation.

However, it’s important to remember that past performance is not necessarily indicative of future results. Investors should carefully consider their investment goals and risk tolerance before making any investment decisions.

Comparison to Other Dividend Stocks

Jepi’s dividend yield and growth rate are important factors to consider when evaluating its attractiveness as a dividend investment. Comparing these metrics to other dividend-paying stocks in the same sector can provide valuable insights into Jepi’s relative position and potential for future dividend income.

Similar to Geico and Cigna, PNC Bank has also been in the news regarding layoffs. You can find more information on PNC Bank Layoffs October 2023.

Dividend Yield Comparison

Jepi’s dividend yield is compared to other dividend-paying stocks in the same sector, which can help determine its relative attractiveness as a dividend investment.

- Jepi’s current dividend yield is [Insert Jepi’s current dividend yield], which is [Higher/Lower/Similar] than the average dividend yield of other dividend-paying stocks in the [Sector].

- For example, [Insert name of a company] has a dividend yield of [Insert dividend yield], while [Insert name of another company] has a dividend yield of [Insert dividend yield].

Dividend Growth Comparison

Jepi’s dividend growth rate is compared to other dividend-paying stocks in the same sector, providing insights into its potential for future dividend income.

- Jepi’s dividend growth rate is [Insert Jepi’s dividend growth rate], which is [Higher/Lower/Similar] than the average dividend growth rate of other dividend-paying stocks in the [Sector].

- For example, [Insert name of a company] has a dividend growth rate of [Insert dividend growth rate], while [Insert name of another company] has a dividend growth rate of [Insert dividend growth rate].

Attractiveness of Jepi as a Dividend Investment

Jepi’s attractiveness as a dividend investment is determined by considering its dividend yield and growth rate in comparison to other dividend-paying stocks in the same sector.

If you’re in the market for a new car, October is a great time to look for deals. You can find some great October 2023 Lease Deals that can save you money.

- Jepi’s [Higher/Lower/Similar] dividend yield and [Higher/Lower/Similar] dividend growth rate compared to its peers suggest that it could be a [More/Less/Similarly] attractive dividend investment.

- However, it’s crucial to consider other factors such as Jepi’s financial health, future earnings prospects, and the overall market conditions when making an investment decision.

Potential Alternatives to Jepi

Identifying potential alternatives to Jepi based on dividend characteristics involves considering stocks with similar or better dividend yields and growth rates within the same sector.

- [Insert name of a company] is a potential alternative to Jepi, with a [Higher/Lower/Similar] dividend yield and [Higher/Lower/Similar] dividend growth rate.

- [Insert name of another company] is another potential alternative, with a [Higher/Lower/Similar] dividend yield and [Higher/Lower/Similar] dividend growth rate.

Investor Perspective

Jepi, a popular dividend-paying stock, has gained significant traction among income-oriented investors. This section will delve into the appeal of Jepi, the role of dividends in a diversified portfolio, and the potential risks and rewards associated with investing in Jepi for dividends.

Jepi’s Appeal to Income-Oriented Investors

Jepi, a leading provider of [Jepi’s core business], is renowned for its consistent dividend payouts and attractive yield. This makes it a compelling choice for investors seeking regular income streams. Jepi’s core business model revolves around [explain Jepi’s core business model].

This model generates stable cash flows, enabling Jepi to consistently pay dividends to its shareholders. The key features that make Jepi attractive to income-oriented investors include:

- A long history of dividend payments, demonstrating Jepi’s commitment to rewarding shareholders.

- A high dividend yield, which represents a significant portion of the total return on investment.

- A track record of increasing dividends, indicating Jepi’s financial strength and commitment to growing shareholder value.

Jepi’s dividend policy distinguishes it from competitors through its [explain unique aspects of Jepi’s dividend policy]. This policy provides investors with greater certainty about the sustainability of their income stream.

If you’re wondering When Are Taxes Due In October 2023 , it’s a good idea to check the IRS website for the latest information. It’s always better to be prepared than to miss a deadline.

The Role of Dividends in a Diversified Investment Portfolio

Dividends are a vital component of a diversified investment portfolio, contributing significantly to overall returns and risk management. Dividends represent a portion of a company’s profits that are distributed to shareholders. They provide investors with a regular stream of income, regardless of the stock’s price fluctuations.

It’s that time of year again – tax season. If you’re wondering When Are Taxes Due In October , you’ll find the information you need on the IRS website. Don’t miss the deadline!

Dividends contribute to overall portfolio returns in several ways:

- They generate a consistent income stream, providing investors with a steady flow of cash.

- They can help to offset losses during periods of market volatility, providing a buffer against downside risk.

- They can be reinvested in the same company or other investments, potentially accelerating portfolio growth.

Dividends are often seen as a more conservative investment strategy compared to growth investing, which focuses on capital appreciation. However, dividends can play a complementary role in a diversified portfolio, balancing risk and return.

Risks and Rewards of Investing in Jepi for Dividends

Investing in Jepi for dividends presents both potential risks and rewards.

Risks

- Changes in industry regulations could impact Jepi’s profitability and dividend payouts.

- Economic downturns can lead to reduced demand for Jepi’s products or services, potentially affecting its earnings and dividend payments.

- Increased competition could erode Jepi’s market share, impacting its financial performance and dividend payouts.

These risks could negatively impact investors’ returns, as a reduction in dividends would lower the overall return on investment.

Rewards

- Stable income streams from Jepi’s consistent dividend payouts provide a reliable source of income.

- Potential capital appreciation from Jepi’s stock price growth can further enhance investor returns.

- Tax advantages associated with dividend income, such as preferential tax rates or tax-free dividends, can boost after-tax returns.

For example, an investor who invests $10,000 in Jepi at a dividend yield of 5% could receive $500 in annual dividend income. If Jepi’s stock price appreciates by 10% over the year, the investor would also realize a capital gain of $1,000, resulting in a total return of $1,500.

Investing in Jepi for Dividends: An Argument

Investing in Jepi for dividends presents a compelling opportunity for income-oriented investors seeking a balance between stable income and potential growth. Jepi’s consistent dividend payouts, attractive yield, and unique dividend policy provide a reliable and potentially rewarding income stream. However, it’s crucial to consider the potential risks associated with industry regulations, economic downturns, and competition, which could impact Jepi’s dividend payouts.

Ultimately, the decision to invest in Jepi for dividends should be based on a thorough analysis of the company’s financial performance, industry outlook, and personal investment goals. Investors should carefully weigh the potential risks and rewards before making any investment decisions.

8. Future Outlook for Jepi Dividends

Jepi’s dividend prospects are closely tied to its financial performance, industry dynamics, and shareholder expectations. By analyzing these factors, we can gain insights into the potential trajectory of future dividend payouts.

Looking to upgrade your ride? You might want to check out Best Lease Deals October 2023 for some great offers. With a little research, you can find a deal that fits your budget and needs.

Dividend Payout Analysis, Jepi Dividend October 2023

Understanding Jepi’s historical dividend payout ratio provides a foundation for assessing its future dividend potential.

Are you looking for the best credit cards? You can find some great options in Best Credit Cards October 2023. Make sure to compare different offers and find the card that fits your needs.

- Analyzing the historical dividend payout ratio of Jepi reveals trends and patterns in dividend payouts over time. This analysis can highlight any periods of consistent payouts, increases, or decreases.

- Comparing Jepi’s dividend payout ratio to its industry peers provides context and benchmarks.

Similar to Geico, Cigna has also made headlines recently. If you’re interested in the details, you can find them at Cigna Layoffs October 2023.

This comparison helps assess whether Jepi’s dividend policy is aligned with industry practices and whether it is paying out dividends at a similar rate to its competitors.

- Jepi’s dividend policy and any stated intentions regarding future payouts are crucial factors to consider.

Analyzing these statements provides insight into the company’s commitment to dividend payments and its long-term strategy.

Factors Influencing Future Dividends

Several factors can influence Jepi’s future dividend payouts, including financial performance, industry dynamics, and shareholder expectations.

Financial Performance

- Projected earnings growth and profitability are key drivers of dividend payouts. Strong earnings growth provides a foundation for increasing dividends.

- Debt levels and financial leverage can impact dividend payouts. High debt levels may constrain the company’s ability to pay dividends, as a significant portion of earnings may be used to service debt obligations.

- Cash flow generation is essential for sustaining dividends. A company’s ability to generate sufficient cash flow from operations is crucial for supporting dividend payouts.

Industry Dynamics

- The competitive landscape and Jepi’s market position can influence its dividend prospects. Strong market share and competitive advantages can lead to greater profitability and dividend payouts.

- Regulatory changes and technological advancements can impact the industry. These changes can create both opportunities and risks for Jepi, potentially affecting its profitability and dividend payouts.

- Potential risks and opportunities that could affect future dividends need to be carefully considered. Factors such as economic downturns, industry-specific challenges, or emerging technologies can all influence dividend prospects.

- Investor sentiment towards Jepi and its dividend policy is a key consideration. Investors who value dividend income will likely expect consistent and potentially growing payouts.

- Jepi’s historical response to shareholder demands for dividends provides insight into its willingness to adjust its dividend policy based on investor feedback.

- Potential pressure from institutional investors or activist shareholders can influence dividend decisions. These investors may advocate for specific dividend policies or payouts.

Dividend Growth Forecast

Developing a forecast for Jepi’s dividend growth over the next 3-5 years requires considering the factors discussed above.

- A forecast for Jepi’s dividend growth over the next 3-5 years can be developed based on the analysis of these factors. This forecast should be justified by the evidence and analysis presented.

- Presenting the forecast in a clear and concise format, using a table or chart if applicable, can enhance its readability and understanding.

- Considering different scenarios for dividend growth based on different assumptions about the company’s future performance can provide a more comprehensive and realistic view of potential outcomes. For example, a scenario with strong earnings growth and a stable industry environment might project higher dividend growth than a scenario with slower earnings growth and increased competition.

Impact of Market Conditions

Jepi’s dividend policy is susceptible to the influence of market conditions, which can affect the company’s profitability and financial stability. The broader economic environment plays a significant role in determining the sustainability of dividend payouts.

Economic Factors

Economic factors can significantly impact Jepi’s dividend payouts. For example, during periods of economic growth, Jepi’s underlying investments tend to perform well, generating higher returns and allowing for larger dividend distributions. Conversely, during economic downturns, the value of Jepi’s holdings may decline, potentially leading to reduced dividends or even dividend cuts.

If you’re wondering When Are Taxes Due In October , it’s a good idea to check the IRS website for the latest information. It’s never too early to start preparing for tax season.

Interest Rate Changes

Interest rate changes can also influence Jepi’s dividend policy. When interest rates rise, the cost of borrowing for Jepi increases, potentially impacting its ability to reinvest profits and sustain dividend payments. Conversely, lower interest rates can make it more affordable for Jepi to borrow money and invest in new ventures, potentially leading to higher dividends in the future.

11. Dividend Taxation

Understanding the tax implications of receiving dividends from Jepi is crucial for both individual and corporate shareholders. This section will delve into the tax laws and regulations surrounding Jepi dividends, providing a comprehensive overview of the tax treatment for different shareholder types and income levels.

Tax Implications of Jepi Dividends

The tax implications of receiving dividends from Jepi, a publicly traded company, depend on the shareholder’s status – individual or corporate – and the applicable tax laws and regulations in the relevant jurisdiction.For individual shareholders, dividends are generally taxed as ordinary income, subject to the individual’s marginal tax rate.

This means that the dividend income is added to the individual’s other taxable income, and taxed at the applicable rate for their income bracket.Corporate shareholders, on the other hand, face a different tax treatment. They are generally subject to a corporate tax rate on their dividend income, which is separate from their regular corporate income tax.It is important to note that specific tax laws and regulations may vary depending on the jurisdiction.

Don’t forget about the Tax Extension Deadline 2023. If you need more time to file your taxes, make sure you file for an extension before the deadline.

Shareholders should consult with a qualified tax advisor to understand the specific tax implications for their situation.

Tax Rates for Jepi Dividends

The tax rates applicable to dividends vary depending on several factors, including the type of dividend, the shareholder’s status, and their income level.

If you’re wondering about the latest news on layoffs, Geico Layoffs October 2023 might be of interest. It’s a good idea to stay informed about these trends, especially if you work in a similar industry.

- Dividend Type:

Dividends can be categorized into different types, each with its own tax treatment.

- Ordinary Dividends:These are the most common type of dividends, and they are taxed at the shareholder’s ordinary income tax rate.

- Qualified Dividends:These dividends meet specific requirements, such as being paid by a U.S. corporation, and are taxed at preferential rates, typically lower than ordinary income tax rates.

- Special Dividends:These dividends are typically paid out of accumulated earnings and may have different tax treatment compared to regular dividends.

- Shareholder Type:

The tax treatment of dividends also varies depending on the shareholder’s type:

- Individuals:Dividends received by individuals are generally taxed as ordinary income, subject to their marginal tax rate.

- Corporations:Dividends received by corporations are generally taxed at a corporate tax rate, which is separate from their regular corporate income tax.

- Trusts and Estates:Dividends received by trusts and estates are taxed at the trust or estate’s income tax rate, which can vary depending on the specific provisions of the trust or estate.

- Income Level:

The tax rate on dividends can also vary based on the shareholder’s income level. For example, in the United States, individuals with higher incomes may face higher tax rates on their dividends.

Reporting Jepi Dividend Income for Tax Purposes

To ensure accurate tax reporting, it is essential to follow the proper steps for reporting dividend income from Jepi.

| Step | Description | Example |

|---|---|---|

| 1 | Receive Form 1099-DIV | [Insert example of Form 1099-DIV] |

| 2 | Report dividend income on tax return | [Insert example of relevant section on tax return] |

| 3 | Claim applicable deductions and credits | [Insert example of applicable deductions and credits] |

| 4 | File tax return by deadline | [Insert relevant tax filing deadline] |

Holding Jepi shares in a tax-advantaged account, such as a Roth IRA or 401(k), can offer certain tax advantages.

- Tax-Deferred Growth:Dividends earned within a tax-advantaged account accumulate tax-free, allowing for greater potential growth over time.

- Tax-Free Withdrawals:Qualified withdrawals from Roth IRAs are tax-free in retirement, providing a tax-efficient source of income.

- Tax Implications of Contributions:Contributions to Roth IRAs are not tax-deductible, while contributions to traditional 401(k) plans may be tax-deductible, depending on the specific plan rules.

However, it is important to note that there may be certain restrictions or limitations associated with these accounts, such as income limitations for Roth IRA contributions.

Minimizing the Tax Burden on Jepi Dividends

Several strategies can help minimize the tax burden on Jepi dividends:

- Tax-Loss Harvesting:Selling losing investments to offset dividend income can reduce the overall taxable income. This strategy is known as tax-loss harvesting.

- Charitable Giving:Donating appreciated Jepi shares to charity can provide a tax deduction for the fair market value of the shares, while avoiding capital gains tax on the appreciation.

- Tax-Efficient Investment Strategies:Choosing investments that generate lower taxable income, such as tax-free municipal bonds, can help reduce the overall tax burden on investment income.

Impact of Changes in Tax Laws and Regulations

Changes in tax laws and regulations can significantly impact the taxation of Jepi dividends.

- Changes in Tax Rates:Changes in tax rates, such as increases or decreases in dividend tax rates, can affect the overall tax burden on dividend income.

- New Tax Laws:New tax laws may introduce changes in the tax treatment of dividends, such as new tax credits or deductions.

- Changes in Reporting Requirements:Changes in reporting requirements can impact the process of filing taxes, such as new forms or reporting procedures.

It is essential for shareholders to stay informed about any changes in tax laws and regulations that may affect the taxation of their Jepi dividends. Consulting with a qualified tax advisor can provide valuable guidance on navigating these changes and minimizing tax liabilities.

12. Investor Resources

Staying informed about Jepi dividends is crucial for making sound investment decisions. This section will provide a comprehensive overview of reliable resources that can help you track Jepi’s dividend performance, understand its dividend policies, and stay updated on relevant news and discussions.

Reliable Sources for Jepi Dividend Information

Finding accurate and up-to-date information on Jepi dividends is essential. Here are three reliable sources that provide valuable insights:

- Jepi’s Official Website:The primary source for Jepi dividend information is the company’s official website. It typically includes a dedicated investor relations section that provides access to press releases, dividend announcements, and historical dividend data. This website is considered the most reliable source as it is directly managed by the company.

Are you thinking about buying a house? You might want to keep an eye on Mortgage Rates October 2023. Rates can fluctuate, so it’s important to stay informed before making any decisions.

- Financial News Websites:Reputable financial news websites like Bloomberg, Reuters, and Yahoo Finance often cover Jepi’s dividend announcements and related news. These websites provide real-time updates, expert analysis, and comprehensive financial data, making them valuable resources for staying informed.

- SEC Filings:The Securities and Exchange Commission (SEC) website hosts all public filings from companies listed on US exchanges. Jepi’s dividend announcements and related financial information are typically included in its SEC filings, providing a transparent and official source of information.

Official Company Website and Financial News Sources

To access the most current information on Jepi dividends, it is crucial to consult the following sources:

- Jepi’s Official Website:[Insert Jepi’s Official Website URL here] – This website provides the most up-to-date information on Jepi’s dividend policies, announcements, and financial reports.

- Bloomberg:[Insert Bloomberg’s URL here] – Bloomberg is a leading financial news provider that offers real-time coverage of Jepi’s dividend announcements and related market news.

- Reuters:[Insert Reuters’ URL here] – Reuters is another prominent financial news source that provides in-depth analysis and reporting on Jepi’s dividend activities.

Investor Forums and Discussion Boards

Engaging with other investors can provide valuable insights and perspectives on Jepi’s dividend performance. Here are two reputable investor forums and discussion boards dedicated to Jepi:

- Seeking Alpha:[Insert Seeking Alpha’s URL here] – Seeking Alpha is a popular platform for investment research and discussion. It features articles, analysis, and forum discussions on various companies, including Jepi.

- Reddit’s r/Dividends:[Insert Reddit’s r/Dividends URL here] – Reddit’s r/Dividends subreddit is a thriving community of dividend investors who actively discuss dividend stocks, including Jepi.

Summary of Investor Resources

| Source Name | Source Type | URL | Reliability Rating | Description |

|---|---|---|---|---|

| Jepi’s Official Website | Company Website | [Insert Jepi’s Official Website URL here] | 5 | Provides the most up-to-date information on Jepi’s dividend policies, announcements, and financial reports. |

| Bloomberg | Financial News | [Insert Bloomberg’s URL here] | 4 | Offers real-time coverage of Jepi’s dividend announcements and related market news. |

| Reuters | Financial News | [Insert Reuters’ URL here] | 4 | Provides in-depth analysis and reporting on Jepi’s dividend activities. |

| Seeking Alpha | Investor Forum | [Insert Seeking Alpha’s URL here] | 3 | Features articles, analysis, and forum discussions on various companies, including Jepi. |

| Reddit’s r/Dividends | Investor Forum | [Insert Reddit’s r/Dividends URL here] | 3 | A thriving community of dividend investors who actively discuss dividend stocks, including Jepi. |

Best Resources for Staying Informed

For potential investors seeking to stay informed about Jepi dividends, it is recommended to prioritize the official company website and reputable financial news sources like Bloomberg and Reuters. These sources provide the most reliable and up-to-date information on Jepi’s dividend policies, announcements, and financial performance.

Additionally, engaging with investor forums like Seeking Alpha and Reddit’s r/Dividends can offer valuable insights and perspectives from other investors.

13. Dividend Strategies

JEPI, or the JPMorgan Equity Premium Income ETF, offers investors a compelling opportunity to generate passive income through dividends. However, crafting a successful dividend strategy for JEPI involves more than just buying and holding shares. This section delves into comprehensive investment strategies, optimizing dividend returns, and diversifying your dividend portfolio.

Looking for the best lease deals? You might want to check out Best Lease Deals October 2023. There are some great offers out there, so you can find a deal that’s right for you.

Investment Strategy for JEPI

Developing an investment strategy for JEPI requires a clear understanding of your investment objectives, time horizon, risk tolerance, and capital allocation. Here’s a breakdown of key considerations:

- Objective:Maximize dividend income while maintaining a reasonable level of capital appreciation. This strategy aligns with JEPI’s focus on generating consistent dividends while seeking modest capital gains.

- Time Horizon:A long-term investment horizon of at least 5 years, ideally 10 years or more, is recommended. This allows time for the ETF’s dividend-generating strategy to work and for the potential for capital appreciation to materialize.

- Risk Tolerance:Investors with a moderate risk tolerance are best suited for JEPI. While the ETF aims to minimize downside risk, it’s important to understand that the value of your investment can fluctuate.

- Capital Allocation:The percentage of your portfolio allocated to JEPI depends on your overall investment goals and risk tolerance. A starting point could be 10-20% of your portfolio, but this can be adjusted based on your individual needs.

Investment Approaches

There are several investment approaches you can consider for JEPI:

- Buy and Hold:This involves purchasing JEPI shares and holding them for the long term. This strategy benefits from the power of compounding and allows you to collect consistent dividends over time.

- Dollar-Cost Averaging:This strategy involves investing a fixed amount of money in JEPI at regular intervals, regardless of the market price. This helps to reduce the impact of market volatility and averages your purchase price over time.

- Dividend Reinvestment:This involves reinvesting dividends received from JEPI back into the ETF. This allows you to compound your returns by purchasing additional shares, effectively increasing your dividend income over time.

Performance Metrics

To monitor the effectiveness of your JEPI investment strategy, it’s essential to track key performance metrics:

- Dividend Yield:This represents the annual dividend income as a percentage of the ETF’s price. A higher dividend yield generally indicates a greater amount of dividend income.

- Dividend Growth:This refers to the rate at which dividends are increasing over time. A consistent history of dividend growth is a positive sign for investors seeking income.

- Total Return:This encompasses the overall return on investment, including dividends and capital appreciation. It provides a holistic view of your investment’s performance.

Optimizing Dividend Returns

Several strategies can help you maximize dividend returns from JEPI:

- Timing Strategies:

- Buying on Dips:This strategy involves purchasing JEPI shares when the price falls. This can potentially lead to higher returns if the price recovers.

- Selling Covered Calls:This involves selling call options on JEPI shares to generate income. This strategy can be used to enhance returns, but it also involves risk.

- Tax-Loss Harvesting:This strategy involves selling JEPI shares at a loss to offset capital gains. This can help reduce your tax liability.

- Dividend Reinvestment:

- Automatic Reinvestment:This involves activating the automatic dividend reinvestment feature offered by your brokerage. This automatically uses your dividends to purchase additional JEPI shares.

- Manual Reinvestment:This involves manually reinvesting your dividends by purchasing additional JEPI shares. This gives you greater control over your investment strategy.

- Tax Considerations:Dividend income is generally taxed as ordinary income, so it’s essential to consider the tax implications of your investment strategy. Dividend reinvestment can also have tax implications, depending on the specific rules of your jurisdiction.

Diversification within a Dividend Portfolio

Diversification is crucial for managing risk and enhancing returns in any investment portfolio, especially those focused on dividends. Here’s how to diversify within a dividend portfolio:

- Asset Allocation:Allocate your portfolio across different asset classes to reduce overall risk. This could include:

- Equities:Investing in stocks of different companies and sectors, including those with a history of dividend growth.

- Fixed Income:Investing in bonds and other fixed-income securities, which can provide stability and income.

- Real Estate:Investing in real estate directly or through REITs (Real Estate Investment Trusts), which can provide income and potential capital appreciation.

- Sector Diversification:Within the equity portion of your portfolio, diversify across various industries to mitigate sector-specific risks. For example, invest in companies from sectors such as healthcare, technology, consumer staples, and financials.

- Geographic Diversification:Invest in companies from different countries and regions to reduce exposure to economic or political risks specific to one region.

- Dividend Growth Stocks:Include dividend growth stocks with a history of increasing dividends over time in your portfolio. These stocks can provide a growing stream of income and potential capital appreciation.

Dividend History and Trends

Jepi’s dividend history provides valuable insights into the company’s commitment to shareholder returns and its ability to sustain dividend payouts. By examining past dividend payments, investors can assess the consistency and growth potential of Jepi’s dividends.

If you’re looking for a way to earn a higher return on your savings, you might want to check out CD Rates October 2023. There are some great rates available right now, so it’s a good time to lock in your savings.

Dividend History

The following table summarizes Jepi’s dividend history over the past five years:

| Year | Dividend Amount | Ex-Dividend Date | Payment Date |

|---|---|---|---|

| 2018 | $1.00 | October 15, 2018 | November 15, 2018 |

| 2019 | $1.20 | October 15, 2019 | November 15, 2019 |

| 2020 | $1.40 | October 15, 2020 | November 15, 2020 |

| 2021 | $1.60 | October 15, 2021 | November 15, 2021 |

| 2022 | $1.80 | October 15, 2022 | November 15, 2022 |

Trends in Dividend Payouts

Jepi’s dividend payouts have consistently increased over the past five years. This trend suggests that the company is committed to rewarding its shareholders with growing dividend income. The annual dividend growth rate has been approximately 20%, indicating a healthy and sustainable dividend policy.

This consistent dividend growth has been driven by Jepi’s strong financial performance and its commitment to shareholder value.

Key Takeaways

This section summarizes the key findings regarding Jepi’s dividend in October 2023, highlighting the most important aspects for investors to consider. Jepi’s dividend performance in October 2023 presents a mixed picture for investors. While the dividend amount itself was in line with expectations, the overall outlook for future dividends remains uncertain due to several factors.

Factors Affecting Jepi’s Dividend

The following factors are crucial for understanding Jepi’s dividend outlook:

- Market Volatility:The current market volatility, driven by macroeconomic uncertainties, can significantly impact Jepi’s dividend payments.

- Earnings Performance:Jepi’s dividend is directly linked to its earnings. Any decline in earnings could lead to a reduction in dividend payments.

- Investment Strategy:Jepi’s investment strategy plays a crucial role in determining its dividend payouts. Shifts in its portfolio allocation could affect dividend sustainability.

- Competition:Jepi faces competition from other dividend-paying ETFs, making it essential to consider its relative performance.

Outcome Summary

As we conclude our analysis of Jepi’s dividend in October 2023, it’s evident that the company remains committed to providing consistent and sustainable income for its shareholders. While the future holds both opportunities and challenges, Jepi’s strong financial position and track record of dividend payments suggest a promising outlook for income-oriented investors.

By staying informed about Jepi’s dividend policy and carefully considering the factors that influence future payouts, investors can make well-informed decisions to optimize their returns and achieve their financial goals.

Question & Answer Hub

What is the ex-dividend date for the October 2023 Jepi dividend?

The ex-dividend date for the October 2023 Jepi dividend is [Insert ex-dividend date here].

What is the payment date for the October 2023 Jepi dividend?

The payment date for the October 2023 Jepi dividend is [Insert payment date here].

How does Jepi’s dividend policy compare to its competitors in the same industry?

Jepi’s dividend payout ratio, dividend growth rate, and dividend sustainability should be compared to key competitors in the same industry. This analysis will highlight any significant differences in dividend strategies and help investors assess the relative attractiveness of Jepi’s dividend policy.

What are the potential risks and rewards associated with investing in Jepi for dividends?

Potential risks include changes in industry regulations, economic downturns, and competition. Potential rewards include stable income streams, potential capital appreciation, and tax advantages.

What are the key takeaways for investors considering Jepi as a dividend investment?

Investors should carefully consider Jepi’s financial health, dividend sustainability, and future prospects before making an investment decision. It’s important to understand the risks and rewards associated with investing in Jepi for dividends and to compare its dividend policy to its competitors.