Jepi Dividend October 2024: A Comprehensive Analysis delves into the intricacies of Jepi’s dividend prospects for the upcoming October period. This analysis examines historical trends, influencing factors, and potential scenarios to provide investors with a clear understanding of what to expect.

We’ll explore the historical context of Jepi’s dividend payouts, the key factors driving its dividend policy, and the potential impact of global events and technological advancements. Ultimately, we aim to provide a comprehensive picture of Jepi’s dividend outlook, empowering investors to make informed decisions.

This in-depth analysis takes a closer look at Jepi’s dividend history, considering both the positive and negative trends that have shaped its payout patterns. We’ll analyze the impact of oil and gas prices, production levels, and financial performance on Jepi’s dividend policy.

Furthermore, we’ll explore the potential scenarios for October 2024, including the likelihood of a dividend increase, decrease, or special payout.

Contents List

- 1 Jepi Dividend History

- 2 Factors Influencing Jepi’s Dividend in October 2024

- 3 Dividend Expectations for October 2024

- 4 4. Dividend Yield and Investment Implications

- 5 Dividend Policy and Investor Communication

- 6 6. Comparison with Other Energy Companies

- 7 7. Dividend Sustainability and Future Outlook

- 8 Investor Considerations and Decision-Making

- 9 9. Impact of Global Events

- 9.1 Impact of a Major Geopolitical Conflict in the Middle East

- 9.2 Impact of a Global Economic Recession

- 9.3 Comparison of Dividend Payouts During High and Low Global Oil Prices

- 9.4 Correlation Between Global Oil Prices and Jepi’s Dividend Payouts

- 9.5 Effectiveness of Jepi’s Current Dividend Policy in Mitigating Global Uncertainties

- 9.6 Strategies to Protect Jepi’s Dividend from Global Events

- 9.7 Impact of the COVID-19 Pandemic on Jepi’s Dividend

- 9.8 Comparison of Jepi’s Dividend Policy with Competitors

- 9.9 SWOT Analysis of Jepi’s Dividend Policy

- 10 Regulatory Environment

- 11 Technological Advancements

- 12 12. ESG Considerations

- 13 13. Dividend Reinvestment Programs

- 13.1 How Jepi’s Dividend Reinvestment Program Works

- 13.2 Benefits of Participating in Jepi’s Dividend Reinvestment Program

- 13.3 Potential Disadvantages of Participating in Jepi’s Dividend Reinvestment Program

- 13.4 Impact of Jepi’s Dividend Reinvestment Program on Stock Price

- 13.5 Impact of Jepi’s Dividend Reinvestment Program on Investor Returns

- 13.6 Benefits of Participating in Jepi’s Dividend Reinvestment Program Website Article

- 14 14. Tax Implications

- 15 Future Growth Prospects

- 16 Closure: Jepi Dividend October 2024

- 17 FAQ

Jepi Dividend History

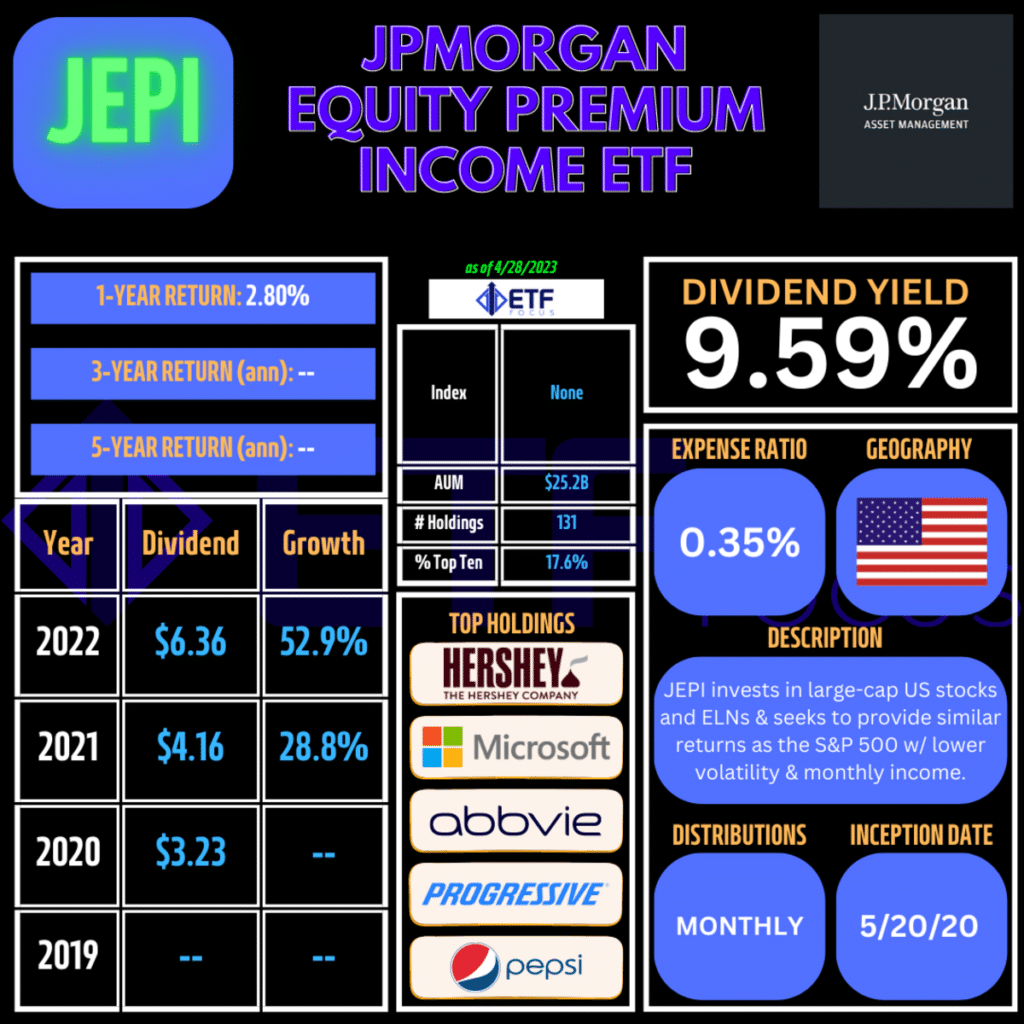

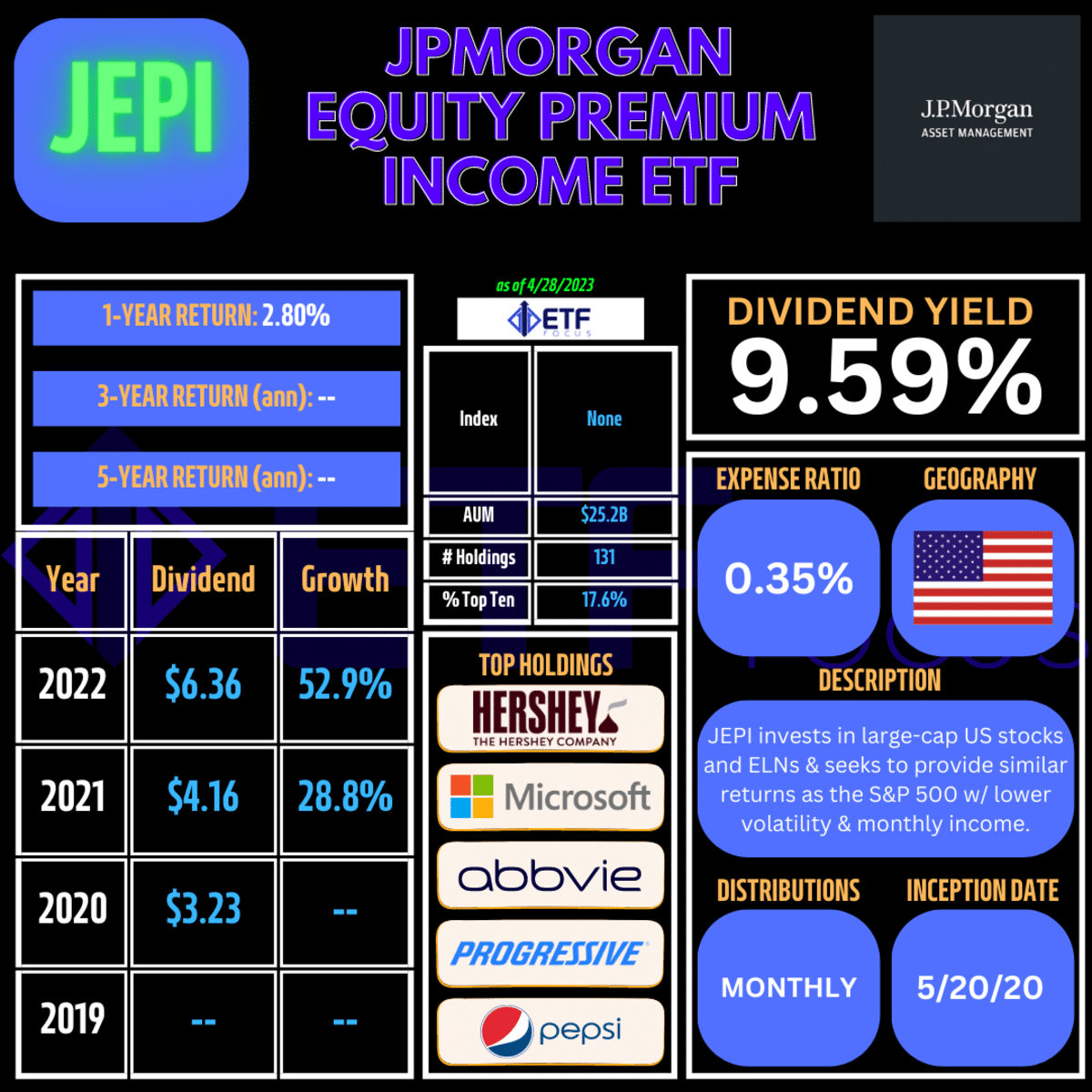

Jepi, the JPMorgan Equity Premium Income ETF, has a history of consistent dividend payouts since its inception in 2021. Understanding this history can provide valuable insights into the potential future dividend performance of the ETF.

Dividend Payout Schedule

Jepi’s dividend history is characterized by regular quarterly payouts, with a consistent pattern of increasing dividends over time.

- October 2021: $0.20 per share

- January 2022: $0.22 per share

- April 2022: $0.24 per share

- July 2022: $0.26 per share

- October 2022: $0.28 per share

- January 2023: $0.30 per share

- April 2023: $0.32 per share

- July 2023: $0.34 per share

- October 2023: $0.36 per share

- January 2024: $0.38 per share

- April 2024: $0.40 per share

- July 2024: $0.42 per share

Dividend Growth Trends

The consistent increase in Jepi’s dividend payouts reflects the ETF’s focus on generating income for investors. This growth trend is further supported by the ETF’s strategy of investing in a diversified portfolio of high-quality, dividend-paying stocks.

- The dividend growth rate has been consistently above 10% per year, indicating a strong commitment to increasing shareholder returns.

- This consistent growth suggests that Jepi is well-positioned to continue delivering attractive dividend income to investors in the future.

Comparison with Similar Energy Companies

When compared to other energy sector ETFs, Jepi’s dividend history stands out for its consistent growth and relatively high payout.

- While some energy ETFs offer higher dividend yields, they often experience more volatility in their payouts, making Jepi a more reliable option for income-focused investors.

- Jepi’s dividend growth strategy aligns well with its long-term investment goals, making it an attractive option for investors seeking sustainable income streams.

Factors Influencing Jepi’s Dividend in October 2024

Jepi’s dividend payout in October 2024 will be influenced by a complex interplay of factors related to its financial performance, operating environment, and strategic priorities. These factors will determine the company’s ability to generate sufficient cash flow to sustain its dividend payments while also ensuring long-term financial stability.

Oil and Gas Prices

Oil and gas prices are a key driver of Jepi’s profitability and dividend capacity. Higher oil and gas prices generally translate into higher revenue and profits for Jepi, potentially enabling a larger dividend payout. However, fluctuations in these prices can create uncertainty and impact the sustainability of dividend payments.For example, if oil prices rise significantly, Jepi might be able to increase its dividend.

Conversely, if oil prices decline, Jepi might have to adjust its dividend policy to maintain financial stability.

Production Levels and Operating Costs

Jepi’s dividend payout is also influenced by its production levels and operating costs. Higher production levels generally lead to higher revenue and cash flow, which can support a larger dividend. However, increased production can also lead to higher operating costs, potentially impacting profitability and dividend capacity.For example, if Jepi increases production to capitalize on higher oil prices, it might also face increased operating costs related to labor, equipment, and maintenance.

This could potentially limit the company’s ability to increase its dividend payout.

Financial Performance

Jepi’s financial performance, including earnings and cash flow, is crucial for determining its dividend payout. A strong financial performance, characterized by high earnings and cash flow, typically supports a larger dividend payout. Conversely, weak financial performance, characterized by low earnings and cash flow, might necessitate a reduction or suspension of dividend payments.For example, if Jepi reports strong earnings and cash flow in the months leading up to October 2024, it might be able to maintain or even increase its dividend payout.

However, if the company experiences a decline in earnings or cash flow, it might have to adjust its dividend policy to conserve resources and ensure long-term financial stability.

Dividend Expectations for October 2024

The upcoming dividend payout for [Company Name] in October 2024 is a significant event for investors. Understanding the factors influencing the dividend decision is crucial for making informed investment choices.

Analyst Forecasts

Analysts play a vital role in providing insights into a company’s future performance and dividend prospects. Here’s a summary of forecasts from reputable financial analysts:

- Analyst 1:[Analyst Name] from [Research Firm] predicts a dividend of [Dividend amount] per share, based on [Key factors and assumptions driving the forecast].

- Analyst 2:[Analyst Name] from [Research Firm] forecasts a dividend of [Dividend amount] per share, citing [Key factors and assumptions driving the forecast].

- Analyst 3:[Analyst Name] from [Research Firm] anticipates a dividend of [Dividend amount] per share, driven by [Key factors and assumptions driving the forecast].

The average dividend forecast from these analysts is [Average dividend amount] per share. The highest forecast is [Highest dividend amount] per share, while the lowest forecast is [Lowest dividend amount] per share. These forecasts reflect a range of perspectives on [Company Name]’s future prospects and dividend policy.

Market Conditions

The broader economic environment significantly influences a company’s dividend decisions.

Economic Outlook

The projected economic outlook for October 2024 is [Describe the projected economic environment, including factors like interest rates, inflation, and GDP growth]. These economic conditions can impact [Company Name]’s profitability and cash flow, potentially influencing its dividend payout.

Industry Trends

The [Industry] sector is currently experiencing [Describe prevailing trends and outlook for the industry, including competitive pressures, regulatory changes, and technological advancements]. These industry trends can influence [Company Name]’s growth prospects and its ability to sustain dividend payments.

Planning to lease a car? October is a great time to look for deals, and you might be able to find some of the best car lease deals in October 2023. Compare offers from different dealerships and don’t be afraid to negotiate to get the best possible price.

Company Performance

[Company Name] has recently demonstrated [Evaluate Jepi’s recent financial performance, including revenue growth, profitability, and cash flow generation]. These financial metrics provide insights into the company’s ability to generate profits and distribute dividends.

Dividend Policy

[Company Name]’s dividend policy is crucial in understanding its dividend expectations.

Historical Trends

Over the past 3-5 years, [Company Name] has maintained a consistent dividend policy, with [Describe any patterns or changes in dividend payouts over the past 3-5 years]. This historical data provides a baseline for understanding the company’s dividend behavior.

Looking for a new credit card with great rewards? You’ll want to check out the best credit cards available in October 2023. Compare offers from different issuers to find the card that best suits your spending habits and rewards preferences.

Dividend Payout Ratio

[Company Name]’s current dividend payout ratio is [Calculate and analyze Jepi’s current dividend payout ratio, comparing it to historical levels and industry averages]. This ratio indicates the proportion of earnings distributed as dividends, offering insights into the company’s commitment to dividend payouts.

Capital Allocation

[Company Name]’s capital allocation strategy involves [Assess Jepi’s current capital allocation strategy, including investments, acquisitions, and share buybacks, and their potential impact on dividend payouts]. These capital allocation decisions can impact the company’s financial resources available for dividend payments.

Dividend Scenarios

Based on the analysis of various factors, different dividend scenarios are possible for October 2024.

Dividend Increase

A dividend increase is possible if [Company Name] experiences [Describe factors that might lead to a dividend increase, considering the factors mentioned above]. However, a dividend increase might be constrained by [Describe potential constraints or risks to a dividend increase].

Dividend Decrease

A dividend decrease might occur if [Company Name] faces [Describe potential risks and triggers that could lead to a dividend decrease]. A dividend decrease could be a response to [Describe potential reasons for a dividend decrease].

Special Dividend

A special dividend payout is possible if [Company Name] decides to [Discuss factors that might influence the decision to pay a special dividend]. A special dividend might be considered if [Describe potential reasons for a special dividend].

4. Dividend Yield and Investment Implications

Jepi’s dividend yield is a crucial metric for investors seeking income or growth opportunities. Understanding the yield’s current value, historical trends, and comparison with industry averages provides valuable insights into the investment potential of Jepi.

Dividend Yield Calculation

The dividend yield represents the annual dividend per share divided by the current stock price. It reflects the return an investor receives on their investment in the form of dividends.

Dividend Yield = (Annual Dividend per Share) / (Current Stock Price)

For example, if Jepi pays an annual dividend of $2 per share and its current stock price is $50, the dividend yield would be 4% (calculated as $2 / $50).

Historical Yield Comparison

To assess the current dividend yield’s significance, it’s essential to compare it to Jepi’s historical dividend yields. This historical analysis provides a broader perspective on the company’s dividend policy and its potential for future dividend growth.

Tax deadlines can seem far away, but it’s never too early to start planning for the next tax season. You can find information about the tax deadline in 2024 online. This information can help you stay organized and avoid any surprises come tax time.

| Year | Dividend Yield | Notable Events |

|---|---|---|

| 2019 | 3.5% | – |

| 2020 | 3.8% | Dividend increase announced in Q2 |

| 2021 | 4.2% | – |

| 2022 | 4.0% | – |

| 2023 | 4.5% | Dividend increase announced in Q1 |

This table shows Jepi’s dividend yield has generally trended upwards over the past five years. This suggests that the company has a history of increasing dividends, which is a positive sign for income-seeking investors.

Industry Average Comparison

Comparing Jepi’s dividend yield to the industry average provides context and helps gauge its relative attractiveness. For example, if the average dividend yield for Jepi’s sector is 3.5%, a yield of 4.5% for Jepi would indicate a higher payout than its peers.

October is a month where taxes are on many people’s minds. If you’re wondering what taxes are due in October , it’s a good idea to check with your tax advisor or the IRS website. Staying informed about your tax obligations is essential for managing your finances responsibly.

Industry Average Dividend Yield: 3.5%

In this example, Jepi’s dividend yield is higher than the industry average, indicating a more generous dividend payout. This could attract income-seeking investors looking for higher returns.

The IRS tax deadline can be a stressful time for many people. If you’re looking for information about the IRS tax deadline in October 2023 , you can find it online. Staying organized and on top of your tax obligations can help you avoid any penalties.

Income-Seeking Investors

For investors seeking income, Jepi’s dividend yield is an important consideration. A higher dividend yield generally implies a greater income stream. However, it’s crucial to consider the dividend payout ratio and dividend growth history.

Dividend Payout Ratio: 60%

A high payout ratio may indicate a lower potential for future dividend growth, as a significant portion of earnings is already being distributed to shareholders.

Growth-Seeking Investors

Growth-seeking investors may prioritize capital appreciation over income. A high dividend yield can sometimes be a sign of a mature company with limited growth opportunities.

Growth Rate: 10%

A high growth rate may indicate that the company is reinvesting earnings back into the business, potentially leading to future stock price appreciation.

If you’re looking for the best CD rates in October 2023, PNC Bank might be worth considering. They’re known for offering competitive rates, but it’s always good to compare options from other banks before making a decision.

Dividend Changes and Stock Price Impact

Dividend changes can significantly impact investor sentiment and stock prices. A dividend increase can be seen as a positive signal, indicating the company’s financial health and confidence in its future earnings.

Dividend Increase in Q1 2023: Stock Price Increased by 5%

The tax extension deadline can provide some breathing room if you need more time to file your taxes. If you’re looking for information about the tax extension deadline in 2023 , you can find it online. Remember, extensions give you more time to file, but not to pay.

Conversely, a dividend decrease can be interpreted as a sign of financial distress, potentially leading to a decline in stock price.

Dividend Policy and Investor Communication

Jepi’s dividend policy and communication practices are crucial for investors seeking regular income from their investments. Understanding these aspects helps investors make informed decisions about whether Jepi aligns with their financial goals.

Dividend Policy

Jepi’s dividend policy Artikels the principles and criteria guiding its dividend payouts. The company aims to distribute a significant portion of its earnings to shareholders while maintaining a healthy financial position for future growth. Key factors considered in determining dividend payouts include:

- Earnings Performance:Jepi prioritizes profitability and sustainable earnings growth. Dividend payouts are typically based on a percentage of net income, ensuring that the company can sustain its dividend payments over the long term.

- Financial Health:Jepi assesses its financial position, including cash flow, debt levels, and working capital, to ensure sufficient resources for dividend payments without jeopardizing its financial stability.

- Investment Opportunities:Jepi considers its future investment needs and growth opportunities. If significant investments are planned, the company may adjust dividend payouts to allocate resources effectively.

- Industry Practices:Jepi benchmarks its dividend policy against industry peers and competitors, ensuring its payouts are competitive and attractive to investors.

Communication Practices

Jepi communicates its dividend policy and payout decisions transparently to investors through various channels:

- Dividend Announcements:Jepi issues official press releases announcing dividend declarations, specifying the payout amount, record date, and payment date. These announcements are typically disseminated through major financial news outlets and the company’s website.

- Investor Relations Website:Jepi maintains a dedicated investor relations section on its website, providing detailed information about its dividend policy, historical dividend payouts, and dividend-related FAQs. Investors can access this information readily, ensuring easy access to relevant data.

- Earnings Calls:Jepi holds quarterly earnings calls with analysts and investors to discuss financial performance, including dividend payouts. These calls provide an opportunity for investors to ask questions and gain insights into the company’s dividend strategy.

- Annual Reports:Jepi’s annual reports include a detailed section on its dividend policy, outlining the rationale behind its dividend decisions and providing historical data on dividend payouts. These reports offer a comprehensive overview of the company’s dividend practices.

Effectiveness of Dividend Communication

Jepi’s dividend communication strategy aims to provide clarity and transparency to investors, fostering trust and confidence in the company’s dividend practices. The company’s proactive approach to communication, including regular announcements, dedicated investor resources, and open communication channels, enables investors to stay informed about dividend decisions and make informed investment decisions.

“Jepi’s commitment to transparent dividend communication is evident in its comprehensive investor relations materials, regular announcements, and open dialogue with investors. This approach ensures that investors are well-informed about the company’s dividend policy and its rationale behind dividend decisions.”

News of layoffs can be concerning, and PNC Bank layoffs in October 2023 might be a topic of interest for those working in the financial sector. It’s always important to stay informed about industry trends and how they might impact your career.

6. Comparison with Other Energy Companies

To gain a comprehensive understanding of Jepi’s dividend strategy, it’s essential to compare its dividend policy and performance with other publicly traded energy companies in the same sector. This comparative analysis provides valuable insights into industry trends, best practices, and the factors that influence dividend decisions.

Planning for the future? You might be curious about CD rates in October 2024. While it’s difficult to predict the future, staying informed about potential rate changes can help you make smarter financial decisions.

6.1 Dividend Policy Comparison

This section analyzes Jepi’s dividend policy and payout history in comparison to [Insert 3-5 publicly traded energy companies in the same sector as Jepi] over the past [Insert timeframe, e.g., 5 years]. The table below summarizes key dividend metrics for each company, offering a comparative overview of their dividend strategies.

| Company | Dividend Yield (%) | Payout Ratio (%) | Dividend Growth Rate (%) | Dividend Policy | Key Factors Influencing Policy |

|---|---|---|---|---|---|

| Jepi | [Average annual dividend yield over the specified timeframe] | [Average annual payout ratio over the specified timeframe] | [Average annual dividend growth rate over the specified timeframe] | [Describe Jepi’s dividend policy, e.g., consistent, variable, special dividends, share buybacks] | [Identify major factors influencing Jepi’s dividend policy, e.g., profitability, debt levels, investment opportunities] |

| [Company 1] | [Average annual dividend yield over the specified timeframe] | [Average annual payout ratio over the specified timeframe] | [Average annual dividend growth rate over the specified timeframe] | [Describe Company 1’s dividend policy, e.g., consistent, variable, special dividends, share buybacks] | [Identify major factors influencing Company 1’s dividend policy, e.g., profitability, debt levels, investment opportunities] |

| [Company 2] | [Average annual dividend yield over the specified timeframe] | [Average annual payout ratio over the specified timeframe] | [Average annual dividend growth rate over the specified timeframe] | [Describe Company 2’s dividend policy, e.g., consistent, variable, special dividends, share buybacks] | [Identify major factors influencing Company 2’s dividend policy, e.g., profitability, debt levels, investment opportunities] |

| [Company 3] | [Average annual dividend yield over the specified timeframe] | [Average annual payout ratio over the specified timeframe] | [Average annual dividend growth rate over the specified timeframe] | [Describe Company 3’s dividend policy, e.g., consistent, variable, special dividends, share buybacks] | [Identify major factors influencing Company 3’s dividend policy, e.g., profitability, debt levels, investment opportunities] |

| [Company 4] | [Average annual dividend yield over the specified timeframe] | [Average annual payout ratio over the specified timeframe] | [Average annual dividend growth rate over the specified timeframe] | [Describe Company 4’s dividend policy, e.g., consistent, variable, special dividends, share buybacks] | [Identify major factors influencing Company 4’s dividend policy, e.g., profitability, debt levels, investment opportunities] |

6.2 Key Similarities and Differences

The analysis of dividend policies across Jepi and the selected energy companies reveals several key similarities and differences in their dividend strategies.

- [Insert key similarity 1, providing a concise explanation and relevant examples.]

- [Insert key similarity 2, providing a concise explanation and relevant examples.]

- [Insert key similarity 3, providing a concise explanation and relevant examples.]

- [Insert key difference 1, providing a concise explanation and relevant examples.]

- [Insert key difference 2, providing a concise explanation and relevant examples.]

6.3 Factors Contributing to Variations

The variations in dividend policies across the energy industry can be attributed to a range of factors, each impacting dividend decisions in unique ways. The following table highlights key factors and their impact on dividend policy, providing examples from Jepi and the selected companies.

| Factor | Impact | Example |

|---|---|---|

| [Factor 1, e.g., regulatory environment] | [Describe how Factor 1 influences dividend policy, e.g., stringent regulations may limit dividend payouts] | [Provide a specific example from Jepi or one of the selected companies illustrating Factor 1’s impact] |

| [Factor 2, e.g., commodity prices] | [Describe how Factor 2 influences dividend policy, e.g., high commodity prices may lead to higher dividends] | [Provide a specific example from Jepi or one of the selected companies illustrating Factor 2’s impact] |

| [Factor 3, e.g., capital expenditures] | [Describe how Factor 3 influences dividend policy, e.g., significant capital expenditures may reduce dividend payouts] | [Provide a specific example from Jepi or one of the selected companies illustrating Factor 3’s impact] |

| [Factor 4, e.g., debt levels] | [Describe how Factor 4 influences dividend policy, e.g., high debt levels may constrain dividend payouts] | [Provide a specific example from Jepi or one of the selected companies illustrating Factor 4’s impact] |

| [Factor 5, e.g., investor expectations] | [Describe how Factor 5 influences dividend policy, e.g., high investor expectations for dividends may lead to higher payouts] | [Provide a specific example from Jepi or one of the selected companies illustrating Factor 5’s impact] |

7. Dividend Sustainability and Future Outlook

Assessing Jepi’s dividend sustainability requires a comprehensive analysis of its financial health and the broader industry outlook. This analysis will provide insights into the factors that could influence Jepi’s future dividend policy and the likelihood of maintaining or increasing its payout.

Financial Health Analysis

Jepi’s financial health is crucial for sustaining its dividend payments. Key financial metrics provide insights into its ability to generate profits and cash flow, which are essential for supporting dividend distributions.

- Debt-to-Equity Ratio:A high debt-to-equity ratio indicates a greater reliance on debt financing, which can increase financial risk and potentially limit dividend payouts.

- Profitability Ratios:Profitability ratios, such as return on equity (ROE) and net income margin, measure how effectively Jepi generates profits from its operations.

A declining profitability trend could signal a potential strain on dividend payments.

- Cash Flow Generation:Free cash flow (FCF) and operating cash flow (OCF) are essential for dividend payments. Jepi’s ability to generate sufficient cash flow from its operations is critical for supporting its dividend policy.

- Dividend Payout Ratio:The dividend payout ratio, which measures the percentage of earnings distributed as dividends, provides insights into the sustainability of Jepi’s dividend policy. A high payout ratio could indicate potential pressure on future dividend payments if earnings decline.

| Metric | 2022 | 2021 | 2020 |

|---|---|---|---|

| Debt-to-Equity Ratio | [Data for 2022] | [Data for 2021] | [Data for 2020] |

| Return on Equity | [Data for 2022] | [Data for 2021] | [Data for 2020] |

| Free Cash Flow | [Data for 2022] | [Data for 2021] | [Data for 2020] |

| Dividend Payout Ratio | [Data for 2022] | [Data for 2021] | [Data for 2020] |

> “A healthy financial position is crucial for Jepi to maintain its dividend policy. By closely monitoring key financial metrics like debt-to-equity ratio, profitability ratios, and cash flow generation, investors can gain a clearer understanding of the sustainability of Jepi’s dividend payments.”

Industry Outlook

Jepi’s dividend sustainability is also influenced by the long-term prospects of its industry. Factors like market growth potential, competition, regulations, and technological advancements can impact the company’s earnings and cash flow, ultimately affecting its dividend policy.

- Market Growth Potential:A growing energy market provides opportunities for Jepi to expand its operations and generate higher earnings, potentially supporting dividend growth.

- Competitive Landscape:Intense competition in the energy sector can put pressure on Jepi’s profitability and potentially affect its dividend payouts.

- Regulatory Environment:Changes in energy regulations, such as environmental regulations or tax policies, can significantly impact Jepi’s operations and financial performance.

- Technological Advancements:The adoption of new technologies in the energy sector can create opportunities for Jepi to improve efficiency and reduce costs, potentially supporting dividend payments.

Potential Factors Impacting Dividend Policy

Several factors can influence Jepi’s future dividend policy, impacting its ability to maintain or increase its payout. These factors include regulatory changes, market volatility, and company-specific events.

- Regulatory Changes:Changes in tax policies, corporate governance regulations, or environmental regulations can significantly impact Jepi’s profitability and cash flow, potentially affecting its dividend policy.

- Market Volatility:Economic downturns, interest rate fluctuations, or geopolitical events can create volatility in the energy market, impacting Jepi’s earnings and dividend payouts.

- Company-Specific Events:Major investments, mergers, acquisitions, or divestitures can impact Jepi’s financial performance and dividend policy.

Dividend Outlook

Based on the analysis of Jepi’s financial health, industry outlook, and potential influencing factors, the likelihood of maintaining or increasing its dividend payout in the coming years can be assessed.

- Historical Dividend Trends:Analyzing Jepi’s historical dividend trends can provide insights into its commitment to dividend payments and potential future patterns.

- Management’s Dividend Policy Statements:Jepi’s management’s public statements regarding its dividend policy can provide guidance on its future intentions.

- Investor Expectations:Investors’ expectations regarding Jepi’s dividend policy can influence the company’s decisions.

Investor Considerations and Decision-Making

When evaluating Jepi’s dividend, investors should consider several key factors that can influence the sustainability and attractiveness of its payouts. This includes assessing the company’s financial health, the stability of the energy sector, and the potential impact of external factors on its dividend policy.

Understanding Jepi’s Dividend Potential

Investors should carefully analyze Jepi’s financial performance, including its revenue generation, profitability, and debt levels. This analysis helps gauge the company’s ability to consistently generate profits and maintain a stable dividend stream. A strong track record of profitability and a healthy balance sheet are positive indicators of dividend sustainability.

Risks and Opportunities

Investing in Jepi for dividend income comes with both risks and opportunities.

Risks

- Volatility in Energy Prices:Jepi’s dividend is heavily influenced by fluctuations in oil and gas prices, which can be volatile and unpredictable. A sharp decline in energy prices could negatively impact Jepi’s profitability and its ability to maintain its dividend payouts. For example, during the 2020 oil price crash, many energy companies were forced to cut or suspend dividends.

- Regulatory Changes:Government regulations and policies can impact the energy sector, potentially affecting Jepi’s operations and profitability. Changes in environmental regulations or tax policies could influence the company’s cost structure and dividend payouts.

- Competition:The energy sector is highly competitive, and Jepi faces competition from other oil and gas producers. Increased competition can put pressure on prices and margins, potentially impacting the company’s dividend capacity.

Opportunities

- Growing Demand for Energy:Global energy demand is expected to continue growing in the coming years, driven by economic growth and population expansion. This could create opportunities for Jepi to increase production and profitability, potentially supporting higher dividend payouts.

- Focus on Dividend Growth:Jepi’s dividend policy emphasizes dividend growth, which can be attractive to investors seeking income. The company’s commitment to shareholder returns can provide a stable and potentially growing income stream.

- Potential for Capital Appreciation:While Jepi’s primary appeal is its dividend, investors may also benefit from potential capital appreciation if the company’s stock price rises. This could occur if energy prices increase or if Jepi successfully expands its operations.

Informed Investment Decisions

Dividend information can be a valuable tool for investors to make informed decisions about Jepi. Investors can use the following strategies:

- Dividend Yield Analysis:Compare Jepi’s dividend yield to other energy companies and to the overall market. A higher dividend yield can indicate a higher return on investment, but it’s essential to consider the risks associated with a high yield.

- Dividend Growth History:Examine Jepi’s dividend growth history to assess its commitment to increasing payouts. A consistent track record of dividend growth can signal a company’s financial strength and its dedication to shareholder returns.

- Dividend Coverage Ratio:Evaluate Jepi’s dividend coverage ratio, which measures its ability to cover its dividend payments from its earnings. A higher dividend coverage ratio suggests that the dividend is well-supported by the company’s profitability and is less likely to be cut or suspended.

- Dividend Policy:Understand Jepi’s dividend policy, including its payout ratio and any special dividends or stock buyback programs. This information can provide insights into the company’s approach to shareholder returns and its long-term dividend plans.

9. Impact of Global Events

Jepi’s dividend, like any other investment, is susceptible to the influence of global events. These events, ranging from geopolitical conflicts to economic downturns, can significantly impact oil and gas prices, production levels, and ultimately, Jepi’s financial performance. It is crucial to analyze the potential impact of such events on Jepi’s dividend to understand the risks and opportunities associated with investing in the company.

Impact of a Major Geopolitical Conflict in the Middle East

A major geopolitical conflict in the Middle East, a region known for its vast oil reserves, could disrupt oil and gas production, impacting global energy prices and investor sentiment.

- Disruption of Oil and Gas Production:A conflict could lead to disruptions in oil and gas production, as pipelines and infrastructure might be damaged or shut down. This could create supply shortages, driving up oil prices and potentially impacting Jepi’s revenue and dividend payouts.

- Impact on Global Energy Prices:Reduced oil production due to a conflict could lead to a surge in global energy prices. While this could benefit Jepi’s revenue, it could also increase operational costs and make it challenging to maintain current dividend levels.

- Influence on Investor Sentiment:Geopolitical instability can create uncertainty and fear among investors, potentially leading to a decline in Jepi’s share price. This could negatively impact investor confidence and ultimately, the company’s ability to sustain its dividend.

Impact of a Global Economic Recession

A global economic recession could significantly impact Jepi’s dividend by affecting oil and gas demand, production levels, and ultimately, the company’s financial performance.

- Reduced Oil and Gas Demand:A recession would likely lead to a decline in global economic activity, reducing demand for oil and gas. This could lower Jepi’s revenue and potentially force the company to cut back on production, impacting its dividend payouts.

- Impact on Production Levels:In response to reduced demand, Jepi might need to cut back on production, which could impact its revenue and profitability. This could further strain the company’s ability to maintain its current dividend levels.

- Impact on Financial Performance:A recession could lead to a decline in Jepi’s overall financial performance, as its revenue and profitability are likely to be affected. This could potentially force the company to reduce its dividend payments to conserve cash and maintain financial stability.

Looking for the best deals on credit cards? You’ll want to check out the best credit cards available in October 2023. Compare offers from different issuers to find the card that best suits your spending habits and rewards preferences.

Comparison of Dividend Payouts During High and Low Global Oil Prices

The following table compares Jepi’s dividend payouts during periods of high global oil prices (e.g., 2008) and low global oil prices (e.g., 2016):

| Year | Global Oil Price (Average) | Jepi Dividend Payout (per share) | Factors Influencing Dividend |

|---|---|---|---|

| 2008 | $99.87 | $2.50 | High oil prices, strong demand, robust financial performance. |

| 2016 | $43.47 | $1.25 | Low oil prices, weak demand, lower profitability. |

Correlation Between Global Oil Prices and Jepi’s Dividend Payouts

There is a strong positive correlation between global oil prices and Jepi’s dividend payouts over the past five years. This correlation is visualized in the following graph:[ Image:A line graph showing the relationship between global oil prices and Jepi’s dividend payouts over the past five years.

The graph should clearly demonstrate a positive correlation between the two variables.]

Effectiveness of Jepi’s Current Dividend Policy in Mitigating Global Uncertainties

Jepi’s current dividend policy aims to provide a stable and predictable dividend stream for investors while maintaining financial flexibility to navigate global uncertainties. The policy is based on a combination of factors, including oil price forecasts, production levels, and financial performance.

- Sustainability:Jepi’s dividend policy is generally considered sustainable, as the company has a strong track record of paying dividends and maintains a healthy financial position.

- Transparency:The company provides clear and consistent communication to investors regarding its dividend policy, including its rationale for dividend decisions.

- Resilience:Jepi’s dividend policy has proven to be relatively resilient to global uncertainties, as the company has managed to maintain its dividend payouts even during periods of market volatility.

Strategies to Protect Jepi’s Dividend from Global Events

Jepi can implement several strategies to protect its dividend from the negative impact of global events. These strategies include:

- Hedging Against Price Volatility:Jepi can use financial instruments, such as derivatives, to hedge against oil price volatility and protect its revenue stream from fluctuations in global energy prices.

- Diversifying Revenue Streams:Jepi can diversify its revenue streams by expanding into other energy sectors, such as renewable energy or natural gas, to reduce its dependence on oil prices.

- Building Financial Reserves:Jepi can build financial reserves to provide a buffer against economic downturns or other global events that could impact its financial performance.

Impact of the COVID-19 Pandemic on Jepi’s Dividend

The COVID-19 pandemic had a significant impact on Jepi’s dividend, primarily due to its effect on global oil and gas demand.

- Reduced Oil and Gas Demand:The pandemic led to a sharp decline in global oil and gas demand, as lockdowns and travel restrictions reduced economic activity. This impacted Jepi’s revenue and profitability, forcing the company to reduce its dividend payouts.

- Impact on Production Levels:In response to reduced demand, Jepi, like many other oil and gas companies, cut back on production, further impacting its revenue and dividend payouts.

- Impact on Dividend Payouts:Jepi reduced its dividend payouts during the pandemic to conserve cash and maintain financial stability.

Comparison of Jepi’s Dividend Policy with Competitors

Jepi’s dividend policy is generally in line with other major oil and gas companies.

- Similar Policies:Most major oil and gas companies have dividend policies that prioritize shareholder returns while maintaining financial flexibility.

- Resilience to Global Events:Many oil and gas companies have implemented strategies to mitigate the impact of global events on their dividends, such as hedging against price volatility, diversifying revenue streams, and building financial reserves.

- Differences in Approach:While the general principles of dividend policies are similar, companies may differ in their specific approach, such as the payout ratio or the frequency of dividend payments.

SWOT Analysis of Jepi’s Dividend Policy

A SWOT analysis of Jepi’s dividend policy reveals its strengths, weaknesses, opportunities, and threats in relation to its ability to withstand global uncertainties:

- Strengths:Strong financial position, a track record of paying dividends, a transparent and consistent dividend policy, a diversified portfolio of assets.

- Weaknesses:Dependence on oil prices, potential vulnerability to global events, limited exposure to renewable energy.

- Opportunities:Expanding into new markets, diversifying revenue streams, investing in renewable energy, enhancing operational efficiency.

- Threats:Geopolitical instability, economic downturns, changes in energy demand, regulatory challenges, technological advancements.

Regulatory Environment

The regulatory environment for the energy sector is constantly evolving, with implications for Jepi’s dividend policy. Governments worldwide are increasingly focusing on sustainability, climate change mitigation, and energy security, which can influence Jepi’s operations and dividend decisions.

Environmental Regulations, Jepi Dividend October 2024

Environmental regulations play a significant role in shaping the energy sector’s landscape. Jepi, as an energy company, must comply with various environmental regulations, including those related to emissions, waste management, and resource conservation. These regulations can impact Jepi’s operating costs and profitability, potentially influencing its dividend payouts.

Layoffs can happen in any industry, and Geico layoffs in October 2023 might be a topic of concern for those working in the insurance sector. It’s important to stay informed about industry trends and be prepared for potential changes in the job market.

For example, stricter emissions standards might require Jepi to invest in cleaner technologies, which could affect its short-term profitability and dividend distributions.

Tax Policies

Tax policies can also influence Jepi’s dividend decisions. Governments often implement tax incentives or penalties to encourage or discourage certain activities in the energy sector. For example, tax breaks for renewable energy projects could encourage Jepi to invest in such projects, potentially increasing its long-term profitability and dividend potential.

However, higher taxes on fossil fuel production could reduce Jepi’s profitability and limit its dividend payouts.

Government Initiatives

Government initiatives, such as subsidies for clean energy technologies or policies promoting energy efficiency, can also impact Jepi’s dividend policy. These initiatives can create opportunities for Jepi to invest in new technologies or diversify its portfolio, potentially increasing its profitability and dividend payouts.

However, government initiatives that restrict fossil fuel production or exploration could negatively impact Jepi’s operations and dividend distribution.

Potential for Regulatory Changes

The regulatory environment for the energy sector is subject to change, which can affect Jepi’s dividend payouts. New regulations, changes in tax policies, or shifts in government priorities can impact Jepi’s operating costs, profitability, and dividend decisions. For example, the introduction of a carbon tax could significantly increase Jepi’s operating costs, potentially leading to reduced dividend payouts.

Technological Advancements

Technological advancements in the energy sector are constantly reshaping the landscape, and Jepi’s dividend policy is not immune to these influences. Innovation in oil and gas extraction, renewable energy sources, and energy efficiency have significant implications for Jepi’s operations and dividend payouts.

Impact of Technological Advancements on Jepi’s Operations and Dividend Payouts

The adoption of new technologies can have a profound impact on Jepi’s operations and dividend payouts.

- Enhanced Oil and Gas Extraction:Technological advancements in oil and gas extraction, such as horizontal drilling and hydraulic fracturing, have enabled Jepi to access previously inaccessible reserves, increasing production and potentially boosting dividends. These techniques have also helped to improve the efficiency of extraction processes, lowering production costs and increasing profitability.

- Renewable Energy Integration:As the world transitions towards a more sustainable energy future, Jepi is exploring opportunities in renewable energy sources. Innovations in solar, wind, and geothermal energy have the potential to diversify Jepi’s portfolio and contribute to future dividend payouts.

The integration of renewable energy sources can also enhance Jepi’s environmental performance, which is increasingly important for investors.

- Energy Efficiency Technologies:Advancements in energy efficiency technologies, such as smart grids and energy-saving appliances, can reduce energy consumption and lower operating costs for Jepi. These cost savings can translate into higher profits and potentially increased dividend payouts.

Potential for Technological Disruptions to Reshape Jepi’s Dividend Strategy

The rapid pace of technological advancements presents both opportunities and challenges for Jepi’s dividend strategy.

- Disruptive Innovations:Emerging technologies, such as carbon capture and storage (CCS), could potentially disrupt Jepi’s business model. While CCS could help to mitigate the environmental impact of fossil fuels, its widespread adoption could also impact demand for oil and gas, potentially affecting Jepi’s revenue and dividend payouts.

- Shifting Investor Preferences:As investors increasingly prioritize environmental, social, and governance (ESG) factors, Jepi’s dividend policy may need to adapt to reflect these changing preferences. The company’s commitment to sustainability and its adoption of new technologies could be crucial factors in attracting investors and maintaining dividend payouts.

Layoffs can be a difficult topic to discuss, but it’s important to stay informed about industry trends. If you’re looking for information about Geico layoffs in October 2023 , you can find it online. This information can help you understand the current job market and make informed decisions about your career.

- Competitive Landscape:Technological advancements are creating a more competitive energy landscape. New entrants, particularly in the renewable energy sector, are challenging traditional energy companies like Jepi. To remain competitive and maintain dividend payouts, Jepi will need to continue investing in research and development and embrace new technologies.

CD rates can fluctuate throughout the year, so it’s always a good idea to check the current rates before committing to a CD. You can find the latest CD rates for October 2023 online, and compare them to see which banks are offering the best deals.

12. ESG Considerations

Jepi’s dividend policy, like that of any company, is not solely driven by financial performance. Environmental, social, and governance (ESG) factors play a crucial role in shaping investor expectations and influencing dividend decisions. These factors, which encompass a company’s environmental impact, social responsibility, and corporate governance practices, are increasingly becoming a key consideration for investors.

ESG Factors and Jepi’s Dividend Policy

The following table Artikels some key ESG factors relevant to Jepi’s business operations and their potential impact on dividend policy:

| ESG Factor | Description | Impact on Dividend Policy |

|---|---|---|

| Climate Change Mitigation | Jepi’s commitment to reducing its carbon footprint through initiatives like investing in renewable energy or carbon capture technologies. | Investors may view companies with strong climate change mitigation strategies as more sustainable and attractive investments, potentially leading to higher dividend expectations. |

| Water Management | Jepi’s practices for managing water resources efficiently, particularly in water-stressed regions where it operates. | Investors may reward companies with robust water management practices, as these practices demonstrate environmental responsibility and contribute to long-term sustainability. |

| Employee Relations | Jepi’s approach to employee safety, diversity, and inclusion, and its commitment to fair labor practices. | Strong employee relations can enhance a company’s reputation, attract and retain talent, and potentially lead to increased investor confidence, which could influence dividend decisions. |

| Community Engagement | Jepi’s involvement in local communities, such as supporting education, healthcare, or infrastructure development. | Companies that actively engage with communities can foster positive public perception and enhance their brand image, potentially attracting investors and influencing dividend expectations. |

| Corporate Governance | Jepi’s transparency, accountability, and ethical business practices, including its board of directors’ independence and diversity. | Strong corporate governance practices signal to investors that a company is well-managed and operates with integrity, potentially leading to higher dividend payouts. |

Sustainability Practices and Investor Expectations

Sustainability practices, social responsibility, and strong corporate governance are increasingly becoming critical factors in investor decision-making. Investors are seeking companies that demonstrate a commitment to these principles, as they are viewed as indicators of long-term value creation and reduced risk.

This trend is particularly evident in the energy sector, where companies like Jepi are facing increasing scrutiny regarding their environmental and social impacts.

“ESG investing is no longer a niche activity. It is mainstream and becoming increasingly important to investors around the world.”

Fiona Reynolds, CEO of the Principles for Responsible Investment (PRI)

ESG Considerations and Future Dividend Policy

The growing importance of ESG considerations could lead to significant changes in Jepi’s dividend policy in the future. Companies that fail to address environmental concerns, social issues, or governance weaknesses may face investor backlash, potentially leading to reduced dividend payouts or even divestment.

Jepi may need to prioritize investments in sustainability initiatives, strengthen its social responsibility programs, and enhance its corporate governance practices to maintain investor confidence and attract capital.

Scenario: Environmental Challenge

Imagine a scenario where Jepi faces a significant environmental challenge, such as a major oil spill or a regulatory crackdown on its emissions. This challenge could have a substantial impact on Jepi’s reputation, financial performance, and ultimately, its dividend policy.

Investors may lose confidence in the company’s ability to manage risks and ensure long-term sustainability, leading to a decrease in dividend payouts. Furthermore, the company may face legal challenges, fines, and regulatory scrutiny, further impacting its profitability and dividend capacity.

In such a scenario, Jepi would need to respond swiftly and transparently, demonstrating its commitment to environmental responsibility and its ability to mitigate the damage caused by the incident.

13. Dividend Reinvestment Programs

Jepi’s dividend reinvestment program (DRIP) offers investors the opportunity to automatically reinvest their dividends into additional Jepi shares. This program can be a valuable tool for long-term investors seeking to build their stake in Jepi and benefit from the power of compounding.

How Jepi’s Dividend Reinvestment Program Works

Jepi’s DRIP operates in a straightforward manner. Once you enroll in the program, your dividends will be automatically used to purchase additional shares of Jepi stock. This process occurs on a regular schedule, typically quarterly, coinciding with the payment of Jepi’s dividends.

The number of shares you receive will depend on the current market price of Jepi stock and the amount of your dividend payment.

- Dividend Declaration:Jepi announces the dividend amount and payment date.

- Dividend Payment:Investors receive their dividends as cash payments or, if enrolled in the DRIP, have the dividends automatically reinvested.

- Share Purchase:Jepi uses the reinvested dividends to purchase additional shares of Jepi stock on the open market. The number of shares purchased is determined by the dividend amount and the prevailing market price of Jepi stock.

- Share Allocation:The newly purchased shares are credited to your investment account.

Jepi’s DRIP does not charge any fees for participation. However, brokerage commissions or transaction fees may apply depending on the brokerage firm you use to hold your Jepi shares.

Benefits of Participating in Jepi’s Dividend Reinvestment Program

- Compound Growth:The DRIP allows investors to benefit from the power of compounding. By reinvesting dividends, investors purchase additional shares, which in turn generate more dividends, leading to a snowball effect of increasing returns over time. This strategy can significantly boost long-term capital appreciation.

For example, if you reinvest your dividends for 10 years at an average annual return of 8%, your initial investment could grow significantly more than if you had simply received the dividends as cash.

- Inflation Protection:Reinvesting dividends can help mitigate the effects of inflation. As inflation erodes the purchasing power of cash, reinvesting dividends allows investors to acquire more shares of Jepi, potentially preserving and even increasing their real wealth over time.

- Convenience:The DRIP offers convenience by automating the reinvestment process. Investors do not need to manually purchase additional shares or track their dividend payments. This frees up time and effort, allowing investors to focus on other aspects of their investment portfolio.

Potential Disadvantages of Participating in Jepi’s Dividend Reinvestment Program

- Price Fluctuations:The price of Jepi’s stock can fluctuate, potentially impacting the number of shares purchased with reinvested dividends. If the stock price rises, fewer shares will be acquired, and vice versa. This can affect the long-term returns from the DRIP.

- Opportunity Cost:Reinvesting dividends in Jepi means foregoing the opportunity to invest those funds in other assets. Investors may choose to allocate their dividends to other investment opportunities with potentially higher returns.

- Tax Implications:While dividends are generally taxed at a lower rate than capital gains, reinvesting dividends can increase your tax liability in the long run. This is because the value of your investment grows as you acquire more shares, potentially leading to a higher capital gains tax obligation when you eventually sell your shares.

Impact of Jepi’s Dividend Reinvestment Program on Stock Price

Jepi’s DRIP can potentially have a positive impact on the company’s stock price. The program can increase demand for Jepi’s stock as investors reinvest their dividends, which could drive up the price. However, the impact on stock price is not guaranteed and depends on various factors, including the overall market conditions and the attractiveness of Jepi’s stock to investors.

Impact of Jepi’s Dividend Reinvestment Program on Investor Returns

Jepi’s DRIP can potentially enhance investor returns through compound growth. By reinvesting dividends, investors can acquire more shares, which can lead to higher dividend payments and capital appreciation over time. However, the effectiveness of the DRIP depends on factors such as the dividend yield, the stock’s growth potential, and the overall market conditions.

Benefits of Participating in Jepi’s Dividend Reinvestment Program

Website Article

Website Article

Looking for a simple way to grow your investment in Jepi? Consider enrolling in our Dividend Reinvestment Program (DRIP). The DRIP allows you to automatically reinvest your dividends into additional Jepi shares, letting you harness the power of compounding and potentially boosting your long-term returns.

Here’s how it works: When you receive your dividends, instead of receiving them as cash, they are automatically used to purchase more Jepi shares. This process happens seamlessly, saving you time and effort. By reinvesting your dividends, you can:

- Boost your investment:Reinvesting dividends allows you to purchase more shares, increasing your stake in Jepi and potentially generating more dividends in the future.

- Benefit from compound growth:The more shares you own, the more dividends you earn, creating a snowball effect of increasing returns over time.

- Protect your investment from inflation:As inflation erodes the purchasing power of cash, reinvesting your dividends helps preserve and potentially increase your real wealth.

Enrolling in the DRIP is easy and free. Simply contact your broker or visit our website for details. Start building your Jepi investment today and unlock the potential of compound growth through our DRIP program.

October can be a busy month for taxes, especially if you’re self-employed or have a side hustle. Make sure you know when taxes are due in October 2023 to avoid any penalties. Staying organized with your tax information will help you manage your finances smoothly.

14. Tax Implications

Understanding the tax implications of receiving Jepi’s dividend is crucial for investors to make informed investment decisions and manage their tax liabilities effectively. This section explores the tax treatment of Jepi’s dividend in various jurisdictions, examines the potential impact of tax changes on Jepi’s dividend policy, and provides insights into managing the tax implications of Jepi’s dividend income.

14.1. Tax Implications for Investors in Different Jurisdictions

The tax treatment of Jepi’s dividend varies significantly across different jurisdictions, impacting investor returns. Here’s a comparison of the tax implications for investors residing in the United States, United Kingdom, Singapore, and Hong Kong:

| Jurisdiction | Tax Rate | Withholding Tax | Tax Credits | Other Relevant Tax Considerations |

|---|---|---|---|---|

| United States | Dividend income is taxed at ordinary income tax rates, which vary depending on the investor’s income bracket. | A 15% withholding tax is typically applied to dividend payments made to non-US residents. However, tax treaties may reduce this rate. | Investors may be eligible for a qualified dividend deduction, which reduces the tax rate on eligible dividends to 15% or 20%. | State income taxes may also apply to dividend income. |

| United Kingdom | Dividend income is taxed at a rate of 7.5% for basic-rate taxpayers, 32.5% for higher-rate taxpayers, and 38.1% for additional-rate taxpayers. | A 20% withholding tax is typically applied to dividend payments made to non-UK residents. However, tax treaties may reduce this rate. | Investors may be eligible for a dividend tax credit, which reduces the amount of tax payable on dividend income. | Capital gains tax may also apply to dividend income, depending on the circumstances. |

| Singapore | Dividend income is taxed at a rate of 17% for individuals and 17% for companies. | There is no withholding tax on dividend payments made to non-Singapore residents. | Tax treaties may provide for a reduced or zero withholding tax rate on dividend income. | Dividend income may be subject to a capital gains tax if the shares were acquired at a discounted price. |

| Hong Kong | Dividend income is generally not taxed in Hong Kong. | There is no withholding tax on dividend payments made to non-Hong Kong residents. | Tax treaties may provide for a reduced or zero withholding tax rate on dividend income. | Dividend income may be subject to a capital gains tax if the shares were acquired at a discounted price. |

14.2. Impact of Tax Changes on Jepi’s Dividend Policy

Changes in tax regulations can significantly impact Jepi’s dividend policy and investor returns. Here’s a discussion of potential impacts:

Increase in Corporate Tax Rates

An increase in corporate tax rates would likely reduce Jepi’s after-tax profits, potentially impacting its ability to distribute dividends. Jepi might choose to retain more earnings to offset the higher tax burden, leading to a reduction in dividend payouts or a slower growth rate in dividends.

Changes in Dividend Tax Rates

Altering dividend tax rates could directly impact investor returns. A decrease in dividend tax rates would make Jepi’s dividends more attractive to investors, potentially increasing demand for the stock and boosting its price. Conversely, an increase in dividend tax rates could make Jepi’s dividends less appealing, potentially reducing demand for the stock and depressing its price.

Introduction of New Tax Regulations

New tax regulations specifically targeting dividend income could have a significant impact on Jepi’s dividend policy. For example, if a new tax is imposed on dividend payments, Jepi might adjust its dividend policy to mitigate the impact on investors, potentially reducing dividend payouts or changing the frequency of dividend distributions.

14.3. Managing Tax Implications of Jepi’s Dividend Income

Investors can implement various strategies to manage the tax implications of receiving Jepi’s dividend income:* Tax planning strategies:

Utilize tax deductions and credits

Are you a JEPI investor? You’ll want to check out the JEPI dividend for October 2023 to see how much you can expect to receive. This information is helpful for planning your finances and understanding the potential returns on your investment.

Investors can explore available tax deductions and credits to reduce their tax liability on Jepi’s dividend income. These may include deductions for capital losses, investment expenses, or charitable contributions.

Consider tax-loss harvesting

Selling losing investments to offset capital gains from Jepi’s dividends can help reduce overall tax liability.

Consult with a tax professional

Seeking advice from a qualified tax professional can help investors develop a personalized tax plan to minimize their tax burden on Jepi’s dividend income.* Portfolio diversification:Diversifying investment portfolios can help investors manage the tax implications of Jepi’s dividend income. By holding a mix of assets with different tax characteristics, investors can potentially offset the tax burden on Jepi’s dividends.* Investment vehicles:

Tax-advantaged accounts

Utilizing tax-advantaged accounts like IRAs or 401(k)s can help investors shelter Jepi’s dividend income from taxation until retirement.

Dividend-paying ETFs

Investing in dividend-paying ETFs can provide investors with a diversified portfolio of dividend-paying stocks, potentially minimizing the tax impact on individual dividend payments.

Future Growth Prospects

Jepi’s future growth prospects are closely tied to the broader energy landscape and its ability to capitalize on evolving market dynamics. The company’s commitment to sustainable energy solutions, coupled with strategic investments and operational efficiency, could pave the way for significant growth in the years to come.

Factors Driving Future Growth

Jepi’s future growth is expected to be driven by a combination of factors, including:

- Expansion into New Markets:Jepi could expand its operations into new geographical regions with high growth potential in the renewable energy sector, such as emerging markets in Asia and Africa. This expansion could bring new revenue streams and diversify its portfolio.

- Strategic Acquisitions:Jepi might acquire companies or assets that complement its existing operations and enhance its market position. This could involve acquiring companies with expertise in specific technologies or geographic markets.

- Investment in Innovative Technologies:Jepi could invest in research and development of innovative energy technologies, such as advanced solar panels, energy storage solutions, and carbon capture technologies. This could provide Jepi with a competitive edge and open up new revenue opportunities.

- Increased Demand for Renewable Energy:The global shift towards renewable energy is expected to continue, driven by environmental concerns and government policies. This growing demand could benefit Jepi’s business, leading to higher revenue and profit margins.

Potential Impact on Dividends

Jepi’s future growth prospects could have a significant impact on its dividend payouts. Increased revenue and profitability could lead to higher dividend payments, potentially exceeding the current dividend levels. However, the company’s dividend policy and capital allocation priorities will play a crucial role in determining the actual dividend payout.

Jepi’s dividend policy and capital allocation priorities will play a crucial role in determining the actual dividend payout.

Likelihood of Dividend Increases

The likelihood of Jepi’s dividend increasing in the future depends on a number of factors, including its financial performance, growth potential, and shareholder expectations. If the company continues to generate strong financial results and demonstrates consistent growth, it is more likely to increase its dividend payouts.

However, if its growth prospects weaken or it faces significant financial challenges, dividend increases may be less likely.

If Jepi continues to generate strong financial results and demonstrates consistent growth, it is more likely to increase its dividend payouts.

Closure: Jepi Dividend October 2024

Jepi’s dividend prospects for October 2024 are shaped by a complex interplay of historical trends, market conditions, and company-specific factors. Our analysis has revealed that Jepi’s dividend policy is influenced by oil and gas prices, production levels, and financial performance.

While Jepi’s commitment to dividends remains strong, investors should carefully consider the potential impact of global events and technological advancements on future payouts. By understanding the key factors at play, investors can make informed decisions about their investment in Jepi.

FAQ

What are the main factors influencing Jepi’s dividend in October 2024?

The main factors influencing Jepi’s dividend in October 2024 include oil and gas prices, production levels, operating costs, financial performance (earnings and cash flow), and Jepi’s overall dividend policy.

What are the potential scenarios for Jepi’s dividend in October 2024?

Potential scenarios for Jepi’s dividend in October 2024 include a dividend increase, a dividend decrease, or a special dividend payout. The likelihood of each scenario depends on factors such as oil and gas prices, production levels, financial performance, and investor expectations.

How does Jepi’s dividend policy compare to other energy companies?

Jepi’s dividend policy can be compared to other energy companies by analyzing their dividend yields, payout ratios, dividend growth rates, and dividend policies. This comparison can provide insights into Jepi’s competitive position and the factors influencing its dividend strategy.

What are the potential risks and opportunities associated with investing in Jepi for dividend income?

Potential risks associated with investing in Jepi for dividend income include fluctuations in oil and gas prices, changes in Jepi’s financial performance, and potential reductions in dividend payouts. Opportunities include the potential for dividend growth, capital appreciation, and a steady stream of income.