Joint Immediate Annuity is a financial product designed to provide a steady stream of income for couples during retirement. Unlike other types of annuities, Joint Immediate Annuities offer a unique feature: they guarantee payments for the lifetime of both spouses, even after one passes away.

When considering an immediate annuity, it’s essential to understand the potential expenses and fees involved. These costs can vary depending on the provider and the specific type of annuity you choose. For detailed information about these expenses, check out our article on Immediate Annuity Expense Fees Or Charges.

This makes them an attractive option for couples who want to ensure their financial security throughout their golden years.

The Knights of Columbus (K of C) offers annuity products designed to provide income for retirement. These annuities can be a valuable option for those seeking financial security in their later years. To learn more about the K of C’s annuity offerings, check out our page on K Of C Annuity 2024.

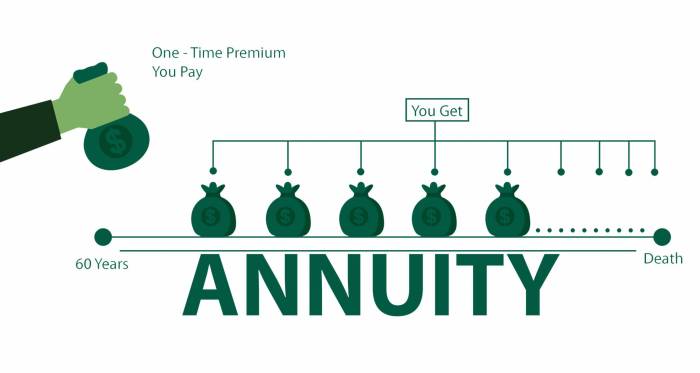

This type of annuity works by converting a lump sum of money into a series of regular payments. These payments can be customized to meet the couple’s specific needs and financial goals. For example, they can choose to receive a fixed monthly income or a variable payment that adjusts with inflation.

Calculating the annuity payment amount involves several factors, including the principal amount, interest rate, and time period. Our guide on Formula For Calculating The Annuity Payment 2024 provides a comprehensive explanation of the calculation process.

The benefits of a Joint Immediate Annuity extend beyond simply providing a steady income stream. They also offer tax advantages, protection against outliving savings, and the peace of mind that comes with knowing that your loved one will be financially secure even after you are gone.

An annuity of $300,000 can provide a significant stream of income for retirement. The specific payment amount will depend on factors like your age, gender, and chosen payout option. To learn more about how this amount could translate into monthly payments, visit our page on Annuity 300 000 2024.

Contents List

Introduction to Joint Immediate Annuities

A Joint Immediate Annuity is a type of insurance contract that provides a guaranteed stream of income to two individuals, typically a married couple, for the rest of their lives. This annuity begins paying out immediately after purchase, making it an attractive option for those looking for a reliable source of retirement income.

Immediate annuities are designed to start providing payments immediately after the purchase. Unlike other annuities, they do not have an accumulation period. For a deeper understanding of how immediate annuities work, read our article on An Immediate Annuity Accumulation Period.

Unlike other types of annuities, a Joint Immediate Annuity is designed to provide income for two individuals simultaneously. It offers flexibility in payment options, allowing for a single stream of income or separate payments for each individual.

While variable annuities are not typically known for paying dividends in the traditional sense, some may offer features that resemble dividends. Our article on Do Variable Annuities Pay Dividends 2024 explores this topic further.

A Joint Immediate Annuity can be particularly beneficial in situations where both spouses rely on each other for financial support during retirement. It can also provide peace of mind by guaranteeing a steady income stream regardless of life expectancy.

Growing annuities are designed to provide increasing payments over time, helping to offset the effects of inflation. Calculating the potential growth of an annuity can be complex, but our guide on Calculating Growing Annuity 2024 provides helpful tools and resources.

Key Features of Joint Immediate Annuities

Joint Immediate Annuities offer various features that cater to different retirement needs. Here are some key aspects to consider:

- Joint and Survivor Annuities:These annuities provide income to both individuals until the death of the first person, and then continue to pay the surviving spouse until their death.

- Period Certain Annuities:These annuities guarantee income payments for a specified period, regardless of the life expectancy of the individuals. If both individuals die before the period ends, the payments continue to be made to their beneficiaries.

- Joint Life:This refers to the combined life expectancy of both individuals. The annuity payments are based on this joint life expectancy.

- Last Survivor:This refers to the individual who lives the longest. The annuity payments continue until the death of the last survivor.

- Guaranteed Payment Period:This feature ensures that the annuity payments continue for a minimum period, even if both individuals die before the end of the period. The guaranteed payment period can range from five to twenty years, depending on the contract.

Benefits of Joint Immediate Annuities

Joint Immediate Annuities offer several advantages for couples seeking reliable retirement income.

Many variable annuities offer a fixed account option, providing a guaranteed return. This can be a valuable feature for those seeking some stability within their portfolio. Our article on Variable Annuity Fixed Account 2024 explains these accounts in more detail.

- Steady Income Stream:Joint Immediate Annuities provide a guaranteed stream of income for the duration of the contract, ensuring financial stability during retirement.

- Tax Benefits:Annuity payments are generally taxed as ordinary income, but the interest earned on the annuity is tax-deferred. This can result in significant tax savings over time.

- Protection Against Outliving Savings:Joint Immediate Annuities help protect against the risk of outliving retirement savings. By providing a guaranteed income stream, they ensure that couples have a steady source of income even if their savings run out.

Considerations for Purchasing a Joint Immediate Annuity

Before purchasing a Joint Immediate Annuity, it’s essential to carefully consider various factors to ensure it aligns with your retirement goals.

O Shares are a type of variable annuity share that often come with specific features and fees. Understanding these differences is important when comparing various annuity options. For detailed information about O Share Variable Annuities, visit our dedicated article on O Share Variable Annuity 2024.

- Annuity Amount and Payment Schedule:The annuity amount and payment schedule should be determined based on your retirement income needs and life expectancy.

- Interest Rates and Inflation:Interest rates and inflation can significantly impact the value of a Joint Immediate Annuity. Consider the potential impact of these factors on your long-term income stream.

- Potential Risks:Joint Immediate Annuities come with some risks, such as the possibility of lower returns than other investments and the potential for market volatility to affect the value of the annuity.

Comparison with Other Retirement Income Options, Joint Immediate Annuity

Joint Immediate Annuities are just one of many retirement income options available. It’s important to compare them with other alternatives to make an informed decision.

Required Minimum Distributions (RMDs) apply to most retirement accounts, including variable annuities. Understanding these rules is crucial for maximizing your retirement income and avoiding potential penalties. Our article on Rmd Variable Annuity 2024 explains RMDs in detail.

- Traditional IRAs and 401(k)s:These accounts offer tax-deferred growth and tax-deductible contributions, but withdrawals are taxed in retirement. They provide flexibility in investment choices but require careful management.

- Roth IRAs:These accounts offer tax-free withdrawals in retirement, but contributions are not tax-deductible. They provide tax advantages but may not be suitable for everyone.

| Retirement Income Option | Key Features | Considerations |

|---|---|---|

| Joint Immediate Annuity | Guaranteed income stream, tax-deferred growth, protection against outliving savings | Lower returns than other investments, potential market volatility |

| Traditional IRA and 401(k) | Tax-deferred growth, tax-deductible contributions, flexibility in investment choices | Taxable withdrawals in retirement, requires careful management |

| Roth IRA | Tax-free withdrawals in retirement, tax-free growth | Contributions are not tax-deductible, may not be suitable for everyone |

Example Scenarios for Joint Immediate Annuities

Here are two scenarios demonstrating how a Joint Immediate Annuity can be used in different retirement situations:

- Scenario 1: Early Retirement:A couple decides to retire early at age 60. They have a significant amount of savings but are concerned about the longevity risk of outliving their savings. A Joint Immediate Annuity can provide them with a guaranteed income stream to supplement their savings and ensure they have enough income for the rest of their lives.

The variable annuity market in the United States is diverse, with various providers offering different types of products. Understanding the current landscape and available options is crucial when making informed decisions. Our article on Variable Annuity Usa 2024 provides valuable insights into this market.

- Scenario 2: High Medical Expenses:A couple in their 70s is expecting significant medical expenses in the future. A Joint Immediate Annuity can provide them with a steady income stream to cover these expenses and protect their savings.

| Scenario | Key Features | Benefits | Challenges |

|---|---|---|---|

| Early Retirement | Guaranteed income stream, protection against outliving savings | Provides financial security during retirement, reduces longevity risk | May require a larger initial investment |

| High Medical Expenses | Guaranteed income stream, protection against outliving savings | Provides a steady income stream to cover medical expenses, protects savings | May require a larger initial investment, may not be suitable for all medical expenses |

Ending Remarks

Joint Immediate Annuities offer a compelling solution for couples seeking to secure their retirement income and ensure their financial well-being throughout their later years. By providing a guaranteed stream of payments for both spouses, these annuities offer a level of security that other retirement income options cannot match.

While there are considerations to weigh before purchasing a Joint Immediate Annuity, such as interest rates and potential risks, the benefits of financial stability and peace of mind for both partners make it a valuable option for many couples.

Transamerica offers a variety of variable annuity products, including the B Share option. These shares are often subject to different fees and features compared to other types of shares. For a detailed analysis of Transamerica’s B Share Variable Annuity, visit our dedicated article on Transamerica B Share Variable Annuity 2024.

FAQ Guide: Joint Immediate Annuity

What are the different types of Joint Immediate Annuities?

There are two main types: joint and survivor annuities, where payments continue to the surviving spouse after the first spouse passes away, and period certain annuities, which guarantee payments for a specific period of time, regardless of the spouses’ lifespan.

When a variable annuity holder passes away, their beneficiaries may be entitled to a death benefit. The specifics of this benefit can vary depending on the policy terms. For more information about variable annuity death claims, read our article on Variable Annuity Death Claim 2024.

How do interest rates affect the value of a Joint Immediate Annuity?

Higher interest rates generally lead to larger annuity payments, as the insurer can earn more on the invested funds. Conversely, lower interest rates result in smaller payments.

The Annuity 2000 Mortality Table is a widely used standard for calculating annuity payments. It provides a projection of life expectancy based on historical data, helping insurers determine the appropriate payout amounts. To learn more about this important table and its implications, visit our page on Annuity 2000 Mortality Table 2024.

What are the potential risks associated with purchasing a Joint Immediate Annuity?

Variable annuities can be a great way to grow your retirement savings, but it’s important to understand the different features and fees associated with them. You can learn more about the different types of variable annuities, such as Variable Annuity Insurance 2024 , and how they work by reading our comprehensive guide.

One risk is that inflation could erode the purchasing power of the annuity payments over time. Another risk is that the insurer could become insolvent, potentially jeopardizing the payments.

How do I choose the right Joint Immediate Annuity for my needs?

It’s crucial to consult with a financial advisor who specializes in annuities to determine the best type and amount for your specific circumstances and financial goals.