The Kotak Immediate Annuity Plan Brochure Artikels a comprehensive financial solution designed to provide you with a steady stream of income for the future. This plan, tailored to meet the diverse needs of individuals seeking financial security, offers a range of customizable options, including flexible payment schedules, diverse investment choices, and attractive tax benefits.

Variable annuities are offered by a variety of life insurance companies. If you’re looking for information on life insurance companies that offer variable annuities , you can find a list of companies online.

Whether you’re aiming to supplement your retirement income, create a legacy for your loved ones, or simply ensure financial stability, Kotak Immediate Annuity Plan provides a robust framework to achieve your goals. With a focus on transparency and customer support, this plan empowers you to make informed decisions about your financial future.

Transamerica offers a variety of variable annuity products, including the Series X-Share. If you’re interested in learning more about the Transamerica Variable Annuity Series X-Share , you can find more information online.

Contents List

Kotak Immediate Annuity Plan: A Secure and Flexible Income Stream for Your Future

The Kotak Immediate Annuity Plan is a comprehensive retirement solution designed to provide you with a steady and predictable income stream throughout your golden years. This plan offers a unique blend of security, flexibility, and tax benefits, making it an ideal choice for individuals seeking financial peace of mind in their retirement.

An annuity due is a type of annuity where payments are made at the beginning of each period. If you’re looking to calculate the present value of an annuity due, you can find resources and information on how to calculate an annuity due.

Product Overview

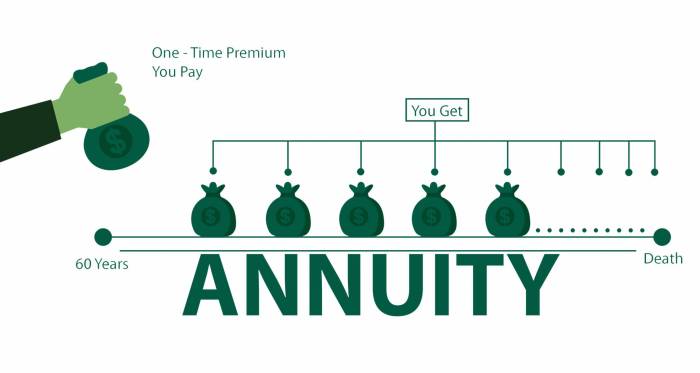

The Kotak Immediate Annuity Plan is a product designed for individuals who are looking for a guaranteed income stream during their retirement years. This plan allows you to convert a lump sum of money into a regular income stream, providing financial security and peace of mind.

B shares are a type of variable annuity that typically have higher expenses than other share classes. If you’re considering a variable annuity, you can find information on B share variable annuities to help you make an informed decision.

The target audience for this plan includes individuals who have accumulated a significant amount of savings and are looking for a reliable source of income during retirement.

If you’re looking for contact information for a variable annuity life insurance company, you can find a list of companies and their phone numbers on this website.

- Guaranteed Income Stream:The Kotak Immediate Annuity Plan provides a guaranteed income stream for life, ensuring you have a reliable source of income throughout your retirement.

- Flexibility:You have the flexibility to choose the annuity payment options that best suit your needs, including lump sum, monthly, or quarterly payments. You can also choose a fixed term or lifetime annuity.

- Tax Benefits:The Kotak Immediate Annuity Plan offers tax benefits on both the premium paid and the annuity payments received.

- Investment Options:You have the option to choose from a range of investment options, allowing you to tailor your plan to your risk tolerance and financial goals.

Annuity Options

The Kotak Immediate Annuity Plan offers a variety of annuity payment options to cater to your individual needs and preferences. These options provide flexibility in terms of payment frequency, duration, and income stream.

The BA II Plus financial calculator is a popular tool for calculating annuity values. If you’re looking for guidance on how to calculate a growing annuity using the BA II Plus calculator , you can find helpful resources online.

- Lump Sum Payment:You can choose to receive the entire annuity amount as a single lump sum payment. This option is suitable for individuals who have specific short-term financial goals or prefer to manage their funds independently.

- Monthly Payment:This option provides a regular and predictable income stream every month, ensuring you have a consistent source of funds for your daily expenses.

- Quarterly Payment:You can opt for quarterly payments, which provide a balance between regular income and lump sum flexibility.

- Fixed Term Annuity:This option provides a guaranteed income stream for a specific period, such as 5, 10, or 15 years. This is ideal for individuals who have a specific time frame in mind for their income needs.

- Lifetime Annuity:This option provides a guaranteed income stream for the rest of your life, ensuring you have financial security for as long as you live. This is a popular choice for individuals who want to eliminate the risk of outliving their savings.

Variable annuities often come with administrative fees, which can impact your overall returns. If you’re considering a variable annuity, it’s important to understand the administrative fees associated with your annuity.

Investment Options

The Kotak Immediate Annuity Plan allows you to choose from a variety of investment options, each with its own risk and return profile. You can select the investment option that best aligns with your risk tolerance and financial goals.

- Fixed Income:This option provides a stable and predictable return, making it suitable for individuals who prioritize capital preservation and income security. Examples of fixed income investments include bonds, government securities, and fixed deposits.

- Equity:This option offers the potential for higher returns but also carries a higher level of risk. Equity investments include stocks and mutual funds, which are subject to market fluctuations. This option is suitable for individuals who have a higher risk tolerance and are willing to accept potential volatility for the opportunity to earn higher returns.

An annuity is a financial product that provides a stream of payments over a set period of time. You can find more information about what an annuity is and how it works to help you make informed financial decisions.

Eligibility Criteria

To be eligible for the Kotak Immediate Annuity Plan, you must meet the following criteria:

- Age:You must be at least 60 years old to apply for the plan. However, specific age requirements may vary depending on the chosen annuity option.

- Income:There are no specific income restrictions for the Kotak Immediate Annuity Plan. However, your income level may influence the annuity amount you can receive.

- Documentation:You will need to provide certain documents to apply for the plan, such as proof of identity, proof of address, and medical reports. The specific documents required may vary depending on the chosen annuity option and the amount of the annuity.

Variable annuities can be a great investment option, but they also come with some risks. Understanding the potential risks involved is crucial before investing. You can learn more about the investment risks associated with variable annuities to make informed decisions.

Tax Benefits

The Kotak Immediate Annuity Plan offers several tax benefits that can help you maximize your retirement savings. These benefits include:

- Tax Deduction on Premium:You can claim a tax deduction on the premium paid for the Kotak Immediate Annuity Plan, subject to certain limits and conditions. This can help you reduce your taxable income and save on taxes.

- Tax-Free Annuity Payments:The annuity payments you receive from the Kotak Immediate Annuity Plan are generally tax-free. This means you can enjoy your retirement income without having to pay taxes on it.

Fees and Charges

The Kotak Immediate Annuity Plan comes with certain fees and charges, which are clearly Artikeld in the plan document. These fees may include:

- Premium Fee:A fee charged on the premium amount you pay for the annuity plan. This fee may vary depending on the chosen annuity option and the amount of the premium.

- Annuity Payment Fee:A fee charged on each annuity payment you receive. This fee may vary depending on the annuity option and the payment frequency.

- Surrender Fee:A fee charged if you surrender the annuity plan before maturity. This fee may vary depending on the time elapsed since the plan’s commencement.

Customer Support, Kotak Immediate Annuity Plan Brochure

Kotak Life Insurance offers comprehensive customer support to ensure you have a smooth and positive experience with the Kotak Immediate Annuity Plan. You can reach out to our customer support team through the following channels:

- Phone:You can call our customer support hotline at [phone number] to address your queries or concerns.

- Email:You can send an email to [email address] for assistance.

- Website:You can visit our website at [website address] for information and resources related to the Kotak Immediate Annuity Plan.

Case Studies and Examples

The Kotak Immediate Annuity Plan can be customized to meet your specific financial goals and needs. Here are some examples of how the plan can be used for different purposes:

- Retirement Planning:Mr. Sharma, a 62-year-old retired teacher, purchased a Kotak Immediate Annuity Plan to ensure a regular income stream during his retirement years. The plan provided him with a monthly income of ₹25,000, allowing him to cover his expenses and enjoy his retirement comfortably.

Calculating monthly annuity payments can be a complex process, but there are resources available to help you. If you’re looking to calculate your monthly annuity payments, you can find helpful information on how to calculate monthly annuity payments.

- Income Generation:Ms. Patel, a 65-year-old businesswoman, wanted to generate a regular income stream from her savings. She purchased a Kotak Immediate Annuity Plan with a lump sum payment of ₹10 lakhs, which provided her with a quarterly income of ₹50,000. This income stream allowed her to supplement her existing income and maintain her desired lifestyle.

The Knights of Columbus offers a variety of financial products, including annuities. If you’re considering a K Of C Annuity, you can learn more about it here. These annuities are designed to provide a stream of income for retirement and can be a valuable part of your overall financial plan.

- Estate Planning:Mr. Singh, a 70-year-old businessman, wanted to ensure his wife’s financial security after his passing. He purchased a Kotak Immediate Annuity Plan with a lifetime annuity option, which provided his wife with a guaranteed income stream for the rest of her life.

The exclusion ratio is used to determine the taxable portion of annuity payments. If you’re looking to calculate the exclusion ratio for your annuity, you can find resources and information on how to calculate the annuity exclusion ratio.

Comparison with Other Products

The Kotak Immediate Annuity Plan compares favorably with similar products offered by other providers. Here is a table that highlights the key differences and advantages of the Kotak plan:

| Feature | Kotak Immediate Annuity Plan | Competitor A | Competitor B |

|---|---|---|---|

| Annuity Payment Options | Lump sum, monthly, quarterly, fixed term, lifetime | Monthly, fixed term | Lump sum, monthly |

| Investment Options | Fixed income, equity | Fixed income only | Equity only |

| Tax Benefits | Tax deduction on premium, tax-free annuity payments | Tax deduction on premium only | Tax-free annuity payments only |

| Customer Support | Phone, email, website | Phone only | Email only |

Last Recap

The Kotak Immediate Annuity Plan Brochure offers a comprehensive guide to understanding the benefits, features, and intricacies of this innovative financial solution. By providing a detailed breakdown of annuity options, investment strategies, eligibility criteria, tax advantages, and customer support resources, this brochure empowers individuals to make informed decisions that align with their financial aspirations.

Microsoft Excel can be a helpful tool for calculating annuity values. If you’re looking for guidance on how to calculate annuities using Excel , there are many resources available online.

Whether you’re seeking a secure retirement income stream, a reliable source of financial stability, or a means to protect your loved ones, the Kotak Immediate Annuity Plan provides a comprehensive solution tailored to meet your unique needs.

If you’re wondering what an annuity is and how it can benefit you, you can find answers to your questions by learning more about annuities in Hindi.

Common Queries: Kotak Immediate Annuity Plan Brochure

What are the minimum and maximum investment amounts for the Kotak Immediate Annuity Plan?

The minimum and maximum investment amounts vary depending on the specific annuity option you choose. It’s best to contact Kotak directly for the most up-to-date information.

Can I withdraw my investment before the maturity period?

Early withdrawal penalties can apply to variable annuities, which can impact your financial strategy. If you’re thinking about withdrawing from your variable annuity before the designated time, it’s important to be aware of the potential early withdrawal penalties you may face.

Early withdrawal options may be available, but they could incur penalties. It’s crucial to review the terms and conditions of your specific plan for details on early withdrawals.

How do I access customer support for the Kotak Immediate Annuity Plan?

You can reach customer support through their website, phone number, or email address provided in the brochure or on their official website.