The Kotak Immediate Annuity Plan Calculator is a powerful tool that helps individuals plan for a secure and comfortable retirement. This calculator allows you to estimate the amount of annuity payments you can receive based on your investment amount, age, and other factors.

Kathy’s annuity, like many others, is subject to market fluctuations and potential changes in interest rates. To understand how market conditions can impact an annuity, you can read about Kathy’s Annuity Is Currently Experiencing 2024.

By using this calculator, you can gain valuable insights into the potential income stream you can generate through an annuity plan.

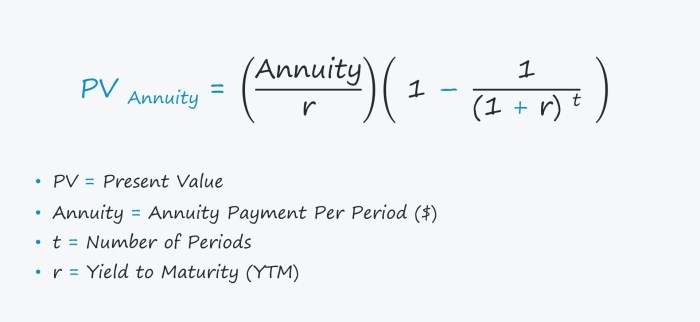

Calculating the annual payment of an annuity involves using formulas that take into account the principal amount, interest rate, and the number of payment periods. If you need help understanding how to calculate annual payments, you can find information on Calculating Annuity Annual Payment 2024.

The Kotak Immediate Annuity Plan offers a variety of features, including flexible payment options, tax benefits, and guaranteed income for life. It’s a popular choice for individuals seeking to ensure a steady stream of income during their retirement years.

An annuity is a financial product that provides a series of payments over a set period. If you’re interested in learning more about the definition of an annuity, you can find information on Annuity Is Defined As Mcq 2024.

Contents List

Kotak Immediate Annuity Plan: An Overview: Kotak Immediate Annuity Plan Calculator

The Kotak Immediate Annuity Plan is a retirement savings plan offered by Kotak Mahindra Life Insurance Company. This plan provides a guaranteed income stream for life, making it an ideal choice for individuals seeking financial security during their retirement years.

An immediate annuity provides income starting immediately after the initial investment is made. If you’re looking for a real-world example of how an immediate annuity works, you can find one on Immediate Annuity Example.

The plan allows you to convert a lump sum amount into regular annuity payments, ensuring a steady source of income for the rest of your life. This comprehensive guide delves into the intricacies of the Kotak Immediate Annuity Plan, exploring its features, benefits, eligibility criteria, and more.

Annuity due calculations differ from ordinary annuities because payments are made at the beginning of each period. If you’re looking for guidance on calculating the future value of an annuity due, you can find information on Calculate Annuity Due Future Value 2024.

Purpose and Features of Kotak Immediate Annuity Plan

The Kotak Immediate Annuity Plan serves the purpose of providing a steady income stream for individuals during their retirement years. The plan offers various features designed to cater to diverse financial needs and preferences. Key features include:

- Guaranteed Income for Life:The plan guarantees regular income payments for the rest of your life, ensuring financial stability during retirement.

- Lump Sum Investment:You can convert a lump sum amount into a regular annuity, providing a secure income stream.

- Flexible Payment Options:The plan offers various payment options, including monthly, quarterly, half-yearly, or yearly payments, allowing you to choose the frequency that suits your needs.

- Tax Benefits:Investing in Kotak Immediate Annuity Plan can provide tax benefits, making it an attractive option for tax-conscious individuals.

- Life Cover:Some annuity plans may offer life cover, providing financial protection for your loved ones in case of your demise.

Key Benefits of Choosing Kotak Immediate Annuity Plan

Choosing the Kotak Immediate Annuity Plan offers several advantages, making it a compelling retirement savings option. Here are some key benefits:

- Financial Security:The plan guarantees a regular income stream for life, providing financial security during retirement.

- Predictable Income:Annuity payments are predictable, allowing you to budget effectively and plan for your future expenses.

- Inflation Protection:Some plans offer inflation protection, ensuring that your annuity payments keep pace with rising living costs.

- Tax Advantages:Investing in the Kotak Immediate Annuity Plan can provide tax benefits, reducing your overall tax burden.

- Peace of Mind:The plan provides peace of mind knowing that you have a guaranteed income stream to support your lifestyle during retirement.

Eligibility Criteria for Kotak Immediate Annuity Plan

To be eligible for the Kotak Immediate Annuity Plan, individuals must meet certain criteria. These criteria may vary depending on the specific plan chosen. However, common eligibility requirements include:

- Age:Individuals must be above a certain minimum age, typically around 45 years old, to be eligible for the plan.

- Health:Some plans may require individuals to undergo a medical examination to assess their health status.

- Minimum Investment Amount:There may be a minimum investment amount required to participate in the plan.

- Resident Indian:Individuals must be resident Indians to be eligible for the plan.

Understanding Annuity Payments

Annuity payments are regular income payments made to an individual for a specific period or for life. These payments are derived from a lump sum investment made in an annuity plan. The Kotak Immediate Annuity Plan offers various payment options, each with its own set of benefits and drawbacks.

Variable annuities do not provide guaranteed returns, unlike traditional fixed annuities. To learn more about the risks and benefits of variable annuities, you can read about A Variable Annuity Does Not Provide 2024.

Understanding these options is crucial to choosing the payment option that best suits your individual needs.

Withdrawing from a variable annuity before age 59 1/2 generally comes with a 10% penalty. To learn more about the rules and potential consequences of early withdrawals from variable annuities, you can read about Variable Annuity Withdrawal Before 59 1/2 2024.

Types of Annuity Payment Options

The Kotak Immediate Annuity Plan provides several payment options, each designed to cater to different financial needs and preferences. These options include:

- Fixed Annuity:This option provides a fixed amount of payment for the duration of the annuity period. The payment amount remains constant throughout the annuity term, providing predictable income.

- Variable Annuity:This option provides payments that fluctuate based on the performance of underlying investments. The payment amount can vary depending on market conditions, potentially offering higher returns but also carrying greater risk.

- Guaranteed Annuity:This option guarantees a minimum payment amount, providing a safety net for your income stream. However, the actual payment amount may be higher depending on the performance of the underlying investments.

- Joint Annuity:This option provides payments to two individuals, typically a couple. The payments continue until the death of the last surviving annuitant.

Benefits and Drawbacks of Each Payment Option

Each annuity payment option has its own set of benefits and drawbacks. It is essential to carefully consider these factors before choosing the option that best aligns with your financial goals and risk tolerance.

Calculating an annuity payout involves considering several factors, including the initial investment amount, the chosen payout period, and the interest rate. If you’re interested in learning how to calculate annuity payouts, you can find helpful information on Calculating An Annuity Payout 2024.

| Payment Option | Benefits | Drawbacks |

|---|---|---|

| Fixed Annuity | Predictable income, low risk | Limited potential for growth, may not keep pace with inflation |

| Variable Annuity | Potential for higher returns, may keep pace with inflation | Greater risk, unpredictable income |

| Guaranteed Annuity | Guaranteed minimum payment, provides a safety net | May not offer the highest potential returns |

| Joint Annuity | Provides income for two individuals, ensures financial security for both | May have a lower payment amount compared to individual annuities |

Calculating Annuity Amount

The annuity amount you receive depends on several factors, including the lump sum investment, your age, gender, payment frequency, and the chosen annuity option. Understanding these factors and how they influence the annuity amount is crucial for making informed investment decisions.

Variable annuities, while not paying dividends in the traditional sense, offer potential growth based on the performance of the underlying investment accounts. You can learn more about how they work and if they are right for you by reading about Do Variable Annuities Pay Dividends 2024.

Factors Influencing Annuity Amount

| Factor | Impact on Annuity Amount |

|---|---|

| Lump Sum Investment | Higher investment amount leads to higher annuity payments |

| Age | Younger individuals receive lower annuity payments as they are expected to receive payments for a longer period |

| Gender | Women generally receive lower annuity payments than men due to their longer life expectancy |

| Payment Frequency | More frequent payments (e.g., monthly) lead to lower individual payments |

| Annuity Option | Different annuity options offer varying payment amounts and features |

Using the Kotak Immediate Annuity Plan Calculator

The Kotak Immediate Annuity Plan Calculator is a user-friendly tool that helps you estimate your potential annuity amount. The calculator requires you to input certain information, such as your age, gender, lump sum investment, and desired payment frequency. Once you enter this information, the calculator will provide an estimated annuity amount based on the chosen plan and payment option.

Current immediate annuity rates are influenced by factors like interest rates and the age of the annuitant. To get an idea of what current rates look like, you can check out Current Immediate Annuity Rates.

- Visit the Kotak Mahindra Life Insurance website:Access the website of Kotak Mahindra Life Insurance Company.

- Locate the Kotak Immediate Annuity Plan Calculator:Navigate to the section for the Kotak Immediate Annuity Plan and locate the calculator tool.

- Enter your details:Input your age, gender, lump sum investment amount, and desired payment frequency.

- Choose a plan and payment option:Select the specific Kotak Immediate Annuity Plan and payment option that aligns with your needs.

- Calculate your estimated annuity amount:Click on the “Calculate” button to receive an estimated annuity amount based on your inputs.

Scenarios and Examples of Annuity Amount Calculations

To illustrate how the annuity amount is calculated, let’s consider some hypothetical scenarios:

- Scenario 1:A 60-year-old male invests a lump sum of ₹10 lakh in a fixed annuity plan with monthly payments. The estimated annuity amount could be around ₹8,000 per month.

- Scenario 2:A 55-year-old female invests a lump sum of ₹15 lakh in a variable annuity plan with quarterly payments. The estimated annuity amount could fluctuate based on market performance, potentially ranging from ₹40,000 to ₹50,000 per quarter.

Tax Implications

Investing in the Kotak Immediate Annuity Plan has tax implications that individuals should be aware of. Understanding these implications can help you make informed financial decisions and maximize your tax benefits.

An annuity is essentially a series of payments, typically received at regular intervals. If you’re interested in learning more about the basics of annuities and how they work, you can find information on Annuity Is A Series Of 2024.

Tax Benefits Associated with Kotak Immediate Annuity Plan

The Kotak Immediate Annuity Plan offers certain tax benefits that can reduce your overall tax liability. These benefits may include:

- Tax Deduction on Premiums:Some annuity plans allow for tax deductions on premiums paid. This can help reduce your taxable income and save on taxes.

- Tax-Free Annuity Payments:Annuity payments received under the plan may be tax-free, depending on the specific plan and payment option chosen.

Tax Deductions and Exemptions

| Tax Benefit | Description |

|---|---|

| Tax Deduction on Premiums | You may be able to deduct a portion of the premiums paid towards the annuity plan from your taxable income. This can reduce your tax liability. |

| Tax-Free Annuity Payments | Annuity payments received under the plan may be tax-free, depending on the specific plan and payment option chosen. This can provide a significant tax advantage during retirement. |

Comparing Kotak Immediate Annuity Plan with Other Options

The Kotak Immediate Annuity Plan is just one of many retirement investment options available. Comparing this plan with other options can help you make an informed decision that aligns with your financial goals and risk tolerance.

Immediate annuities provide a guaranteed stream of income starting right away. The amount you receive depends on several factors, including the size of your initial investment and your age. If you’re curious about how immediate annuities work and how much you might earn, check out this article on Immediate Annuity Earnings.

Key Differences and Similarities

When comparing the Kotak Immediate Annuity Plan with other retirement investment options, such as mutual funds, fixed deposits, and equity investments, it is essential to consider the key differences and similarities.

The “annuity number” often refers to the unique identification number assigned to a specific annuity contract. If you’re looking for more information on how annuity numbers are used, you can find it on Annuity Number 2024.

- Guaranteed Income:The Kotak Immediate Annuity Plan guarantees a regular income stream for life, while other options like mutual funds and equity investments offer potential for growth but do not guarantee returns.

- Risk Profile:The Kotak Immediate Annuity Plan is generally considered a lower-risk option compared to other investments like equity investments, which carry higher potential for both gains and losses.

- Liquidity:Annuity plans typically have limited liquidity, meaning that you may not be able to easily access your invested funds. Other options like mutual funds and fixed deposits offer greater flexibility in terms of liquidity.

- Tax Implications:Tax implications vary across different investment options. Annuity plans may offer specific tax benefits, while other options may have different tax structures.

Pros and Cons of Each Option

To assist you in making an informed decision, here is a summary of the pros and cons of different retirement investment options:

| Investment Option | Pros | Cons |

|---|---|---|

| Kotak Immediate Annuity Plan | Guaranteed income for life, low risk, tax benefits | Limited liquidity, may not offer the highest potential returns |

| Mutual Funds | Potential for higher returns, diversification, professional management | Market risk, potential for losses, no guaranteed returns |

| Fixed Deposits | Guaranteed returns, low risk, high liquidity | Returns may not keep pace with inflation, limited potential for growth |

| Equity Investments | Potential for high returns, growth potential, ownership in companies | High risk, potential for losses, requires active management |

Factors to Consider Before Investing

Before investing in the Kotak Immediate Annuity Plan, it is crucial to carefully consider several factors to ensure that this plan aligns with your individual financial needs and goals.

Assessing Individual Financial Needs and Goals, Kotak Immediate Annuity Plan Calculator

Your financial needs and goals are unique and will significantly influence your investment decisions. Consider factors such as your current income, expenses, retirement savings, and desired lifestyle during retirement. These factors will help you determine how much income you need from an annuity plan and what payment frequency is suitable for you.

Choosing the Right Annuity Plan

The Kotak Immediate Annuity Plan offers various options, each with its own features and benefits. It is essential to choose the plan that best aligns with your risk tolerance, investment horizon, and financial goals. Consider factors such as the payment frequency, annuity type (fixed, variable, or guaranteed), and any additional features offered by the plan.

Wrap-Up

Planning for retirement is essential, and the Kotak Immediate Annuity Plan Calculator can be a valuable resource in your journey. By understanding the factors that influence your annuity payments and the tax implications, you can make informed decisions about your retirement savings strategy.

Consider exploring the Kotak Immediate Annuity Plan Calculator today and take control of your future financial security.

Key Questions Answered

What are the different payment options available with the Kotak Immediate Annuity Plan?

The Kotak Immediate Annuity Plan offers various payment options, including monthly, quarterly, semi-annually, and annually. You can choose the option that best suits your financial needs and preferences.

Variable annuity rates can fluctuate depending on market performance. If you’re looking for information on variable annuity rates over the past few years, you can find data on Variable Annuity Rates 2021 2024.

Can I withdraw my investment before maturity?

Generally, you cannot withdraw your investment before maturity in an immediate annuity plan. However, there may be exceptions based on the specific plan terms and conditions. It’s important to review the policy details carefully before making any investment decisions.

How do I access the Kotak Immediate Annuity Plan Calculator?

You can access the Kotak Immediate Annuity Plan Calculator on the official Kotak Mahindra Life Insurance website or through their mobile app. You can also contact a Kotak Mahindra Life Insurance representative for assistance.

The Annuity 2000 Basic Mortality Table is a standard table used to calculate life expectancies for annuity purposes. If you’re interested in learning more about this table and how it is used, you can find information on Annuity 2000 Basic Mortality Table 2024.