Medigap Plans 2024 offer a vital safety net for individuals seeking additional coverage beyond Original Medicare. These plans, also known as Medicare Supplement Insurance, help bridge the gap in out-of-pocket costs, providing peace of mind and financial protection against unexpected medical expenses.

When it comes to auto insurance, it’s important to compare quotes from different companies. Auto Insurance Companies 2024 provides a comprehensive list of top-rated insurers, allowing you to find the best coverage at the right price.

Understanding the various Medigap plan options, their coverage variations, and eligibility requirements is crucial for making informed decisions about your healthcare needs.

Errors and omissions insurance is crucial for professionals who face potential liability risks. Errors And Omissions Insurance 2024 provides information on coverage options and helps you find the right protection for your business.

This comprehensive guide explores the ins and outs of Medigap Plans 2024, delving into key aspects such as eligibility, enrollment, costs, benefits, and plan comparisons. We’ll break down the intricacies of each plan, provide insights into premium factors, and highlight the benefits of choosing the right Medigap plan for your unique circumstances.

Whether you’re newly eligible for Medicare or seeking to optimize your existing coverage, this resource will empower you to make informed choices about your healthcare future.

Contents List

- 1 Medigap Plans 2024: A Comprehensive Guide

- 1.1 Medigap Plan Basics

- 1.2 Medigap Plan Options

- 1.3 Key Features and Limitations, Medigap Plans 2024

- 1.4 Comparing Coverage for Essential Healthcare Services

- 1.5 Medigap Eligibility and Enrollment

- 1.6 Enrollment Period

- 1.7 Applying for a Medigap Plan

- 1.8 Resources for Finding Medigap Plans

- 1.9 Medigap Costs and Premiums

- 1.10 Factors Influencing Premiums

- 1.11 Average Premium Costs

- 1.12 Impact of Age and Health Conditions

- 1.13 Premium Costs for Different Medigap Plans in [State Name]

- 1.14 Medigap Benefits and Coverage

- 1.15 Types of Healthcare Expenses Covered

- 1.16 How Medigap Plans Work with Original Medicare

- 1.17 Examples of Common Healthcare Scenarios

- 1.18 Specific Benefits and Coverage Details for Each Medigap Plan

- 2 End of Discussion

- 3 Essential FAQs

Medigap Plans 2024: A Comprehensive Guide

Navigating the complex world of Medicare can be daunting, especially when it comes to supplemental insurance. Medigap plans, also known as Medicare Supplement Insurance, are designed to bridge the gaps in Original Medicare coverage, offering peace of mind and financial protection against high healthcare costs.

AARP offers car insurance for members, providing discounts and special benefits. Aarp Car Insurance 2024 helps you find affordable coverage that meets your needs.

This comprehensive guide will delve into the intricacies of Medigap plans, providing you with all the information you need to make informed decisions about your Medicare coverage.

Medigap Plan Basics

Medigap plans are private insurance policies that help cover out-of-pocket expenses associated with Original Medicare, including deductibles, coinsurance, and copayments. They offer a standardized way to supplement your Medicare benefits, ensuring you have predictable healthcare costs and less financial risk.

Getting a homeowners insurance quote is essential for protecting your home and belongings. Homeowners Insurance Quote 2024 helps you compare quotes from leading insurers and find the best coverage at the right price.

Medigap Plan Options

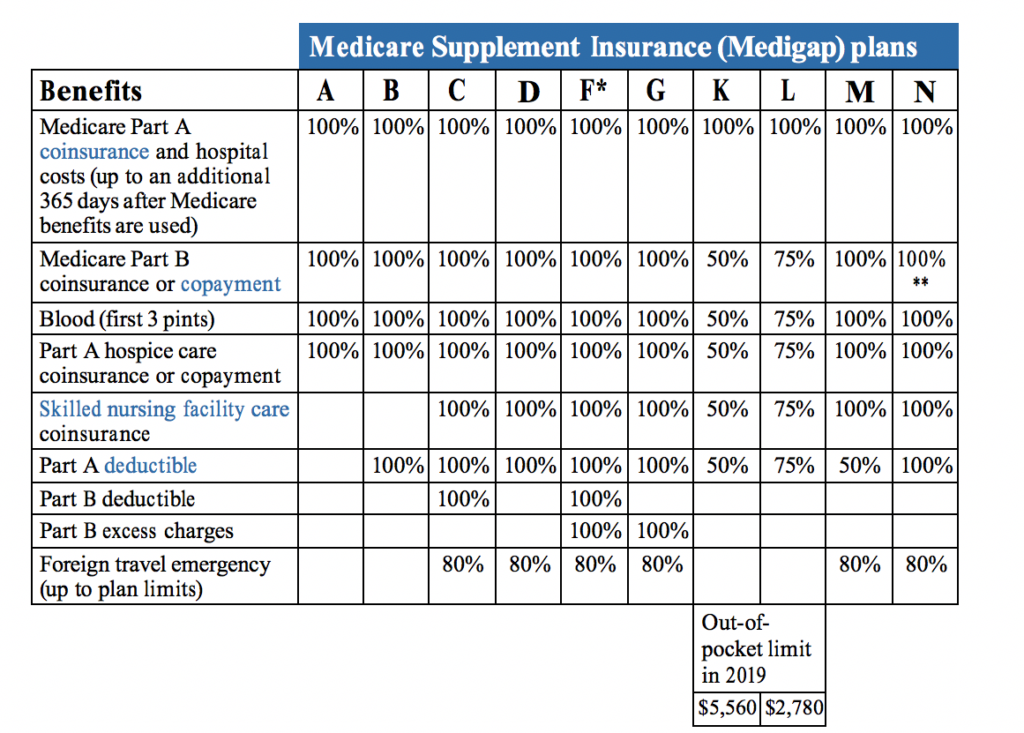

There are 10 standardized Medigap plans, labeled A through N, each offering varying levels of coverage. Understanding the differences between these plans is crucial for choosing the right one for your individual needs.

- Plan A:The most basic Medigap plan, covering 80% of the Medicare Part B coinsurance and 100% of the Part A hospital deductible.

- Plan B:Similar to Plan A, but includes coverage for foreign travel emergency benefits.

- Plan C:Offers broader coverage than Plans A and B, including coverage for Medicare Part B deductibles and coinsurance, as well as Part A hospital deductibles and coinsurance.

- Plan D:Provides coverage for Part B deductibles and coinsurance, but not for Part A hospital deductibles and coinsurance.

- Plan F:The most comprehensive Medigap plan, covering all Medicare deductibles, coinsurance, and copayments, including Part A and Part B.

- Plan G:Similar to Plan F, but does not cover the Medicare Part B deductible.

- Plan K:Includes a $1,900 out-of-pocket maximum for each benefit period.

- Plan L:Includes a $2,400 out-of-pocket maximum for each benefit period.

- Plan M:Includes a $2,800 out-of-pocket maximum for each benefit period.

- Plan N:Includes a $3,100 out-of-pocket maximum for each benefit period.

Key Features and Limitations, Medigap Plans 2024

Each Medigap plan has its own unique set of features and limitations. It’s important to carefully consider these factors before making a decision.

| Medigap Plan | Key Features | Limitations |

|---|---|---|

| Plan A | Covers 80% of Part B coinsurance, 100% of Part A deductible | Does not cover Part B deductible, limited coverage for foreign travel emergencies |

| Plan B | Covers 80% of Part B coinsurance, 100% of Part A deductible, foreign travel emergency benefits | Does not cover Part B deductible |

| Plan C | Covers Part B deductibles and coinsurance, Part A deductibles and coinsurance | Not available for enrollment after 2003 |

| Plan D | Covers Part B deductibles and coinsurance | Does not cover Part A deductibles and coinsurance |

| Plan F | Covers all Medicare deductibles, coinsurance, and copayments | Not available for enrollment after 2003 |

| Plan G | Covers all Medicare deductibles, coinsurance, and copayments except Part B deductible | Does not cover Part B deductible |

| Plan K | Includes $1,900 out-of-pocket maximum | Limited coverage compared to other plans |

| Plan L | Includes $2,400 out-of-pocket maximum | Limited coverage compared to other plans |

| Plan M | Includes $2,800 out-of-pocket maximum | Limited coverage compared to other plans |

| Plan N | Includes $3,100 out-of-pocket maximum | Limited coverage compared to other plans |

Comparing Coverage for Essential Healthcare Services

Here’s a table illustrating the coverage for essential healthcare services across different Medigap plans:

| Healthcare Service | Plan A | Plan B | Plan C | Plan D | Plan F | Plan G | Plan K | Plan L | Plan M | Plan N |

|---|---|---|---|---|---|---|---|---|---|---|

| Hospital Stay (Part A) | 100% | 100% | 100% | 0% | 100% | 100% | 100% | 100% | 100% | 100% |

| Doctor’s Visits (Part B) | 80% | 80% | 100% | 100% | 100% | 100% | 100% | 100% | 100% | 100% |

| Outpatient Services | 80% | 80% | 100% | 100% | 100% | 100% | 100% | 100% | 100% | 100% |

| Preventive Care | Covered | Covered | Covered | Covered | Covered | Covered | Covered | Covered | Covered | Covered |

| Prescription Drugs | Not Covered | Not Covered | Not Covered | Not Covered | Not Covered | Not Covered | Not Covered | Not Covered | Not Covered | Not Covered |

Medigap Eligibility and Enrollment

Eligibility for Medigap plans is tied to your Medicare status. You must be enrolled in both Medicare Part A and Part B to qualify for a Medigap plan.

Enrollment Period

The enrollment period for Medigap plans is a crucial factor to consider. You have a six-month window to enroll in a Medigap plan without being subjected to medical underwriting. This window starts the month you turn 65 and are enrolled in Medicare Part B.

Looking for Medicare coverage in 2024? Unitedhealthcare Medicare 2024 offers a variety of plans to fit your needs, including Original Medicare, Medicare Advantage, and Medicare Part D prescription drug coverage.

After this initial enrollment period, you may be required to undergo medical underwriting, which can lead to higher premiums or even denial of coverage.

With so many insurance companies out there, it can be tough to choose the right one. Insurance Companies 2024 offers a comprehensive list of top-rated providers, helping you make an informed decision.

Applying for a Medigap Plan

Applying for a Medigap plan is relatively straightforward. You can contact insurance companies directly, work with a licensed insurance agent, or use online resources to compare plans and apply. The application process typically involves providing personal information, health history, and Medicare enrollment details.

Life insurance provides financial protection for your loved ones in the event of your death. Life Insurance Policy 2024 helps you understand the different types of life insurance policies and find the right coverage for your family.

Resources for Finding Medigap Plans

Here are some valuable resources for finding Medigap plans:

- Medicare.gov:The official website of Medicare provides comprehensive information about Medigap plans, including plan comparisons, eligibility requirements, and enrollment details.

- State Health Insurance Assistance Programs (SHIP):SHIPs are free, unbiased resources available in every state that offer counseling and guidance on Medicare and Medigap plans.

- Insurance Company Websites:Most major insurance companies offer Medigap plans. You can visit their websites to compare plans, get quotes, and apply online.

Medigap Costs and Premiums

Medigap plan premiums are influenced by several factors, including your age, health status, location, and the specific plan you choose.

Humana offers a wide range of Medicare Advantage plans to meet your health needs. Humana Medicare Advantage Plans 2024 provides detailed information on plan options, coverage, and costs.

Factors Influencing Premiums

- Age:Premiums generally increase with age, as older individuals tend to have higher healthcare costs.

- Health Status:Individuals with pre-existing health conditions may face higher premiums, as insurance companies assess their risk profile.

- Location:Premiums can vary by state and even by county, reflecting regional differences in healthcare costs.

- Plan Type:More comprehensive Medigap plans, such as Plan F and Plan G, typically have higher premiums than less comprehensive plans.

Average Premium Costs

Average Medigap plan premiums vary depending on the plan, location, and individual circumstances. For example, the average monthly premium for a Plan F in California might be around $200, while in Florida, it could be closer to $150. These are just estimates, and your actual premium will depend on your specific situation.

Biberk is a leading provider of insurance solutions for businesses and individuals. Biberk 2024 offers a wide range of insurance products, including auto, home, and life insurance.

Impact of Age and Health Conditions

Age and health conditions significantly impact Medigap plan premiums. As you age, your premiums are likely to increase, reflecting the higher likelihood of healthcare needs. Similarly, individuals with pre-existing health conditions may face higher premiums due to the potential for increased healthcare utilization.

UnitedHealthcare offers a variety of Medicare Advantage plans designed to meet your health needs. Unitedhealthcare Medicare Advantage 2024 provides detailed information on plan options, coverage, and costs.

Premium Costs for Different Medigap Plans in [State Name]

Here’s a table illustrating the estimated monthly premiums for different Medigap plans in [State Name] for a 65-year-old individual in good health:

| Medigap Plan | Estimated Monthly Premium |

|---|---|

| Plan A | $50

Getting health insurance quotes can be a daunting task, but it’s essential for finding the best coverage for your needs. Health Insurance Quotes 2024 makes it easy to compare plans and prices from top insurance providers.

|

| Plan B | $60

|

| Plan C | Not Available |

| Plan D | $70

Need auto insurance near you? Auto Insurance Near Me 2024 helps you find local insurance agents who can provide personalized quotes and expert advice.

|

| Plan F | $150

Looking for the best car insurance deal? Compare The Market Car Insurance 2024 helps you compare quotes from multiple insurers and find the most competitive rates.

|

| Plan G | $120

|

| Plan K | $40

|

| Plan L | $50

|

| Plan M | $60

|

| Plan N | $70

|

Medigap Benefits and Coverage

Medigap plans provide coverage for a wide range of healthcare expenses, helping you manage your out-of-pocket costs.

Travel insurance can provide peace of mind while you’re exploring the world. Allianz Travel Insurance 2024 offers a range of plans to protect you from unexpected events and medical emergencies.

Types of Healthcare Expenses Covered

- Hospital Deductibles:Medigap plans cover the deductible for inpatient hospital stays under Medicare Part A.

- Hospital Coinsurance:Medigap plans cover a portion of the coinsurance for hospital stays, typically 80% or 100% depending on the plan.

- Doctor’s Visit Coinsurance:Medigap plans cover a portion of the coinsurance for doctor’s visits and other outpatient services under Medicare Part B.

- Part B Deductible:Some Medigap plans cover the annual deductible for Medicare Part B.

- Blood Transfusions:Medigap plans cover the first three pints of blood per year.

- Foreign Travel Emergency Benefits:Certain Medigap plans offer limited coverage for emergency medical expenses while traveling outside the United States.

How Medigap Plans Work with Original Medicare

Medigap plans work in conjunction with Original Medicare. They act as a secondary insurer, paying for expenses that Original Medicare does not fully cover. For example, if you have a hospital stay and Medicare Part A covers $10,000, but the total bill is $15,000, your Medigap plan would cover the remaining $5,000.

Examples of Common Healthcare Scenarios

- Hospital Stay:You have a three-day hospital stay costing $10,000. Medicare Part A covers $8,000, leaving a $2,000 balance. Your Medigap plan covers the remaining $2,000.

- Doctor’s Visit:You have a doctor’s visit costing $200. Medicare Part B covers $160, leaving a $40 balance. Your Medigap plan covers the remaining $40.

- Prescription Drugs:You have a prescription for a medication costing $100. Medigap plans do not cover prescription drugs. You would need to have a separate Medicare Part D prescription drug plan to cover this cost.

Specific Benefits and Coverage Details for Each Medigap Plan

Here’s a table outlining the specific benefits and coverage details for each Medigap plan:

| Medigap Plan | Hospital Deductible | Hospital Coinsurance | Part B Deductible | Part B Coinsurance | Blood Transfusions | Foreign Travel Emergency Benefits |

|---|---|---|---|---|---|---|

| Plan A | 100% | 80% | 0% | 80% | Covered | Limited |

| Plan B | 100% | 80% | 0% | 80% | Covered | Covered |

| Plan C | 100% | 100% | 100% | 100% | Covered | Covered |

| Plan D | 0% | 0% | 100% | 100% | Covered | Covered |

| Plan F | 100% | 100% | 100% | 100% | Covered | Covered |

| Plan G | 100% | 100% | 0% | 100% | Covered | Covered |

| Plan K | 100% | 100% | 100% | 100% | Covered | Covered |

| Plan L | 100% | 100% | 100% | 100% | Covered | Covered |

| Plan M | 100% | 100% | 100% | 100% | Covered | Covered |

| Plan N | 100% | 100% | 100% | 100% | Covered | Covered |

End of Discussion

Navigating the world of Medicare supplemental insurance can be complex, but with a thorough understanding of Medigap Plans 2024, you can gain control over your healthcare costs and ensure comprehensive coverage. By carefully considering your individual needs, exploring available plan options, and utilizing the resources provided in this guide, you can make confident decisions that safeguard your financial well-being and provide peace of mind for years to come.

Remember, choosing the right Medigap plan is a significant step in securing your healthcare future, so take the time to research, compare, and select the plan that best aligns with your unique needs and circumstances.

Essential FAQs

What is the difference between Medigap and Medicare Advantage?

Medigap plans supplement Original Medicare, covering out-of-pocket costs. Medicare Advantage plans are managed care plans that replace Original Medicare.

Can I change my Medigap plan after enrollment?

You can change your Medigap plan during the annual open enrollment period or during a guaranteed issue period if you experience certain life events.

Gap insurance can be a valuable addition to your auto insurance policy, protecting you from financial loss if your car is totaled. Gap Insurance 2024 helps you understand the benefits and find the right coverage for your situation.

How often do Medigap plan premiums increase?

Medigap plan premiums can increase annually, but the amount of the increase is regulated by state laws.

What happens if I cancel my Medigap plan?

If you cancel your Medigap plan, you will no longer have supplemental coverage and will be responsible for all out-of-pocket costs associated with Original Medicare.