Mercedes Me Finance stands as a comprehensive financial solution designed to simplify and enhance the Mercedes-Benz ownership experience. It offers a suite of services that cater to the unique needs of both prospective and current Mercedes-Benz owners, providing a convenient and personalized approach to financing, leasing, and other related financial services.

Santander offers a range of financial products, including Santander Loans , that cater to different needs. From personal loans to mortgages, they can provide financial assistance for various life events.

Merc

If you’re a member of the military, Navy Federal Loans can be a valuable resource for financial services. They offer competitive rates and personalized support for military personnel and their families.

edes Me Finance goes beyond traditional financing options, offering online account management, flexible payment plans, and tailored solutions that are accessible through a user-friendly digital platform. This approach prioritizes transparency, convenience, and customer satisfaction, making it an attractive option for those seeking a streamlined and personalized automotive financial experience.

Contents List

- 1 Mercedes-Benz Financial Services Overview

- 2 Mercedes Me Finance Features and Benefits

- 3 Mercedes Me Finance Applications and Use Cases

- 4 Mercedes Me Finance Integration with Mercedes-Benz Ecosystem

- 5 Customer Testimonials and Case Studies

- 6 Mercedes Me Finance in the Automotive Industry Landscape

- 7 Ultimate Conclusion

- 8 Quick FAQs

Mercedes-Benz Financial Services Overview

Mercedes-Benz Financial Services (MBFS) is a global financial services provider that plays a crucial role in the Mercedes-Benz ecosystem. It offers a wide range of financial products and services designed to make owning or leasing a Mercedes-Benz more accessible and convenient for customers.

Key Products and Services, Mercedes Me Finance

MBFS provides a comprehensive suite of financial solutions tailored to the needs of Mercedes-Benz customers, including:

- Financing Options:MBFS offers various financing options, including loans, leases, and other tailored programs to suit different budgets and financial situations.

- Leasing Programs:MBFS provides flexible leasing programs that allow customers to drive a new Mercedes-Benz without the commitment of ownership. These programs often include maintenance and other benefits.

- Insurance Solutions:MBFS offers insurance products designed specifically for Mercedes-Benz vehicles, providing comprehensive coverage and peace of mind.

- Other Related Services:MBFS also provides a range of other services, such as extended warranties, roadside assistance, and vehicle protection plans.

Target Audience

MBFS services are designed for a diverse audience, including:

- Potential Car Buyers:MBFS helps potential car buyers secure financing for their dream Mercedes-Benz, making it easier to purchase their desired vehicle.

- Existing Mercedes-Benz Owners:MBFS offers financial solutions and services to existing Mercedes-Benz owners, helping them manage their vehicle ownership and access additional benefits.

- Other Stakeholders:MBFS also caters to other stakeholders in the automotive industry, such as dealerships and fleet managers, providing financial solutions and support.

Mercedes Me Finance Features and Benefits

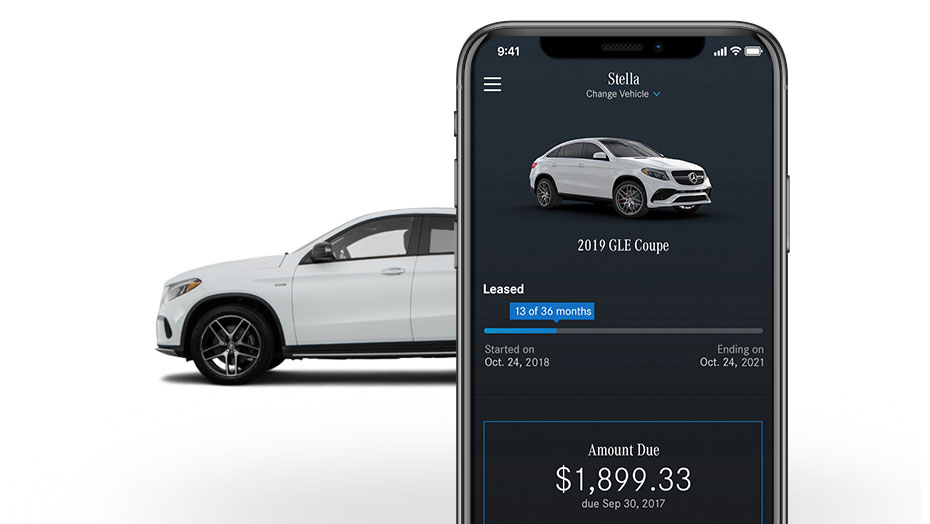

Mercedes Me Finance is a digital platform that offers a seamless and convenient way for customers to manage their MBFS services. It provides a range of features and benefits that enhance the overall customer experience.

Online Account Management

Mercedes Me Finance allows customers to manage their accounts online, providing them with 24/7 access to their financing details, payment history, and other relevant information. Customers can easily make payments, view their account statements, and manage their financing options all from the convenience of their computer or mobile device.

Personalized Financing Options

Mercedes Me Finance offers personalized financing options based on individual customer needs and financial profiles. Customers can choose from a variety of loan terms, interest rates, and payment plans to find the best solution for their specific situation.

When shopping for a new car, it’s essential to research and compare auto rates from different lenders. This will help you secure the best financing terms for your vehicle purchase.

Flexible Payment Plans

Mercedes Me Finance offers flexible payment plans that allow customers to tailor their payments to their budget. Customers can choose to make monthly, bi-weekly, or even weekly payments, providing them with greater control over their finances.

If you’re looking for a reliable option for financing your next vehicle, Chase Auto Loan might be worth considering. They offer competitive rates and flexible terms, making it easier to drive off in your dream car.

Convenient Digital Tools

Mercedes Me Finance provides a range of convenient digital tools that simplify the financing process. Customers can use the platform to get pre-approved for financing, apply for loans, and track their applications online.

Guaranteed Rate is a well-established mortgage lender offering a range of services, including Guaranteed Rate mortgages. They provide competitive rates and personalized guidance throughout the home buying process.

Advantages over Traditional Financing

Mercedes Me Finance offers several advantages over traditional financing options, including:

- Convenience:Mercedes Me Finance provides a digital and convenient way to manage financing, eliminating the need for physical paperwork and in-person visits.

- Transparency:Mercedes Me Finance offers transparency throughout the financing process, with clear and accessible information on loan terms, interest rates, and payment schedules.

- Tailored Solutions:Mercedes Me Finance provides personalized financing options that are tailored to individual customer needs and financial profiles.

Oportun offers financial services, including Oportun loans , that aim to provide access to credit for underserved communities. They strive to make financial products accessible and affordable.

Customer Success Stories

Mercedes Me Finance has helped countless customers achieve their automotive goals. Here are some real-world examples of how Mercedes Me Finance has made a difference:

“I was hesitant about financing a new Mercedes-Benz, but Mercedes Me Finance made the process so easy. The online application was simple, and I was pre-approved within minutes. The personalized financing options were great, and I was able to find a loan that fit my budget perfectly.”

John S., Mercedes-Benz Owner

Home Credit provides financial solutions, including Home Credit cash loans , to help individuals meet their financial needs. These loans can be a helpful option for short-term financial assistance.

“I’ve been a Mercedes-Benz owner for years, and Mercedes Me Finance has been a game-changer for me. I can manage my account online, make payments easily, and even access my vehicle’s maintenance history. It’s so convenient and user-friendly.”

Keeping an eye on BMO mortgage rates is crucial when planning your home purchase. Understanding current market trends can help you make informed decisions about your financing options.

Sarah M., Mercedes-Benz Owner

Finding the best mortgage deals can be a daunting task, but it’s essential to secure the most favorable terms for your home purchase. It’s worth comparing rates and terms from various lenders to find the best fit for your financial situation.

Mercedes Me Finance Applications and Use Cases

Mercedes Me Finance can be used in a variety of scenarios, providing financial solutions for different customer needs.

| Use Case | Features and Benefits |

|---|---|

| Purchasing a New Mercedes-Benz | – Personalized financing options tailored to your budget and needs

|

| Financing a Pre-Owned Vehicle | – Financing options for certified pre-owned Mercedes-Benz vehicles

|

| Leasing a Car | – Flexible lease terms and options to suit your driving needs

A credit builder loan can be a useful tool for individuals looking to improve their credit score. By making regular payments, you can build a positive credit history and unlock better financial opportunities.

|

| Accessing Other Financial Services | – Insurance solutions specifically designed for Mercedes-Benz vehicles

Upgrade provides financial products, including Upgrade personal loans , designed to help individuals manage their finances. They offer competitive rates and flexible terms for various financial needs.

|

Mercedes Me Finance Integration with Mercedes-Benz Ecosystem

Mercedes Me Finance seamlessly integrates with other Mercedes-Benz services and platforms, creating a unified and convenient experience for customers.

Brightlending is a financial technology company that focuses on providing innovative lending solutions. They offer a variety of loan products, including Brightlending loans , designed to cater to different financial needs.

Integration with Mercedes Me App

Mercedes Me Finance is integrated with the Mercedes Me app, providing customers with a single platform to manage their vehicle, financing, and other services. Customers can access their financing details, make payments, and view their account information directly within the app.

Choosing the right mortgage company is crucial for a smooth and successful home purchase. Research different lenders, compare rates and terms, and select the company that best meets your needs.

Integration with Mercedes-Benz Dealerships

Mercedes Me Finance is integrated with Mercedes-Benz dealerships, allowing customers to access financing options and complete their transactions directly at the dealership. Dealerships can also provide personalized financing advice and support to customers.

Staying informed about current home loan rates is essential for making sound financial decisions. Understanding market trends can help you secure the most favorable terms for your mortgage.

Integration with Online Portals

Mercedes Me Finance is integrated with online portals, allowing customers to apply for financing, manage their accounts, and access other services online. This integration provides customers with 24/7 access to their financing information and tools.

Benefits of Integration

The integration of Mercedes Me Finance with other Mercedes-Benz services and platforms offers numerous benefits for customers, including:

- Streamlined Processes:The integration streamlines the financing process, making it easier and more convenient for customers to access and manage their financing options.

- Personalized Experiences:The integration allows for personalized experiences, providing customers with tailored financing solutions and services based on their individual needs.

- Enhanced Convenience:The integration provides customers with 24/7 access to their financing information and tools, enhancing convenience and accessibility.

Customer Testimonials and Case Studies

Mercedes Me Finance has received positive feedback from customers who have benefited from its convenient features and personalized services.

“I was impressed with the ease of use of Mercedes Me Finance. The online application was quick and straightforward, and I was approved for financing within a few days. The platform is very user-friendly, and I can easily manage my account and payments online.”

David L., Mercedes-Benz Owner

“Mercedes Me Finance provided me with personalized financing options that were tailored to my budget and needs. I was able to secure a loan with competitive interest rates and flexible payment terms. I highly recommend this service to anyone looking to finance a Mercedes-Benz.”

Emily R., Mercedes-Benz Owner

Mercedes Me Finance in the Automotive Industry Landscape

Mercedes Me Finance is a leading example of how digital platforms are transforming the automotive financing landscape. It offers a convenient, transparent, and personalized approach to financing that is becoming increasingly popular among consumers.

Bank of America is a well-known financial institution offering a variety of financial products, including Bank of America auto loan rates. It’s worth exploring their options to find the best deal for your car purchase.

Comparison with Competitors

Mercedes Me Finance compares favorably with similar offerings from other automotive brands, such as BMW Financial Services and Audi Financial Services. MBFS stands out for its comprehensive suite of financial products and services, its seamless integration with other Mercedes-Benz platforms, and its commitment to customer satisfaction.

Evolving Landscape of Automotive Financing

The automotive financing landscape is evolving rapidly, driven by technological advancements and changing consumer preferences. Digital platforms are playing a key role in shaping the customer experience, offering greater convenience, transparency, and personalization.

Future Trends and Innovations

Future trends in automotive financing include:

- Increased use of artificial intelligence (AI):AI can be used to personalize financing offers, streamline the application process, and improve fraud detection.

- Growth of subscription-based models:Subscription-based models offer flexible access to vehicles without the commitment of ownership, appealing to consumers who prefer short-term commitments.

- Integration with connected car technologies:Connected car technologies can be used to collect data on driving behavior, which can be used to personalize insurance rates and financing offers.

Ultimate Conclusion

Mercedes Me Finance is more than just a financing platform; it’s a gateway to a seamless and enriching Mercedes-Benz ownership journey. With its focus on customer-centric solutions, digital convenience, and integration with the wider Mercedes-Benz ecosystem, Mercedes Me Finance empowers individuals to achieve their automotive aspirations with ease and confidence.

Quick FAQs

What are the eligibility requirements for Mercedes Me Finance?

Eligibility requirements typically include factors such as credit history, income, and residency. It’s best to contact Mercedes-Benz Financial Services directly for specific eligibility criteria.

How do I make payments with Mercedes Me Finance?

Mercedes Me Finance offers various payment methods, including online payments, automatic deductions, and traditional payment options. You can manage your payments through your online account or by contacting customer support.

What are the interest rates for Mercedes Me Finance?

Interest rates for Mercedes Me Finance can vary depending on factors such as creditworthiness, loan amount, and chosen financing plan. You can obtain a personalized quote and learn about interest rates by contacting Mercedes-Benz Financial Services.