Mobiloans are revolutionizing the way people access financial assistance, offering a convenient and readily available solution for various needs. These loans, often accessed through mobile applications, provide a streamlined borrowing experience, attracting a wide range of individuals seeking quick and easy access to funds.

Sometimes, you need money quickly and don’t want a credit check holding you back. If that’s the case, you might be interested in loans without a credit check. Just remember to research thoroughly and compare options before making a decision.

The rise of mobile lending has been fueled by the increasing adoption of smartphones and the growing demand for financial services that are accessible anytime, anywhere. Mobile loans cater to individuals with diverse financial profiles, from those seeking emergency funds to those looking for short-term financing for personal expenses or business ventures.

Planning a road trip in an RV? RV loans can help you finance your dream adventure. Be sure to compare lenders and consider your budget before making a decision.

Closing Notes: Mobiloans

The future of mobile lending looks bright, with innovations in technology continually improving the borrowing experience. As mobile loan providers continue to refine their services and adapt to evolving market demands, we can expect even more convenient and accessible options for individuals seeking financial assistance.

Are you feeling overwhelmed by multiple debts? A debt consolidation loan can help you simplify your finances by combining your debts into a single loan with a potentially lower interest rate.

With responsible borrowing practices and a thorough understanding of the terms and conditions, mobile loans can be a valuable tool for managing finances and achieving financial goals.

Looking for a great deal on your next car? Cheap car finance options are available, but it’s crucial to compare lenders and shop around to find the best rates.

Clarifying Questions

What are the typical interest rates for mobile loans?

Need cash in a hurry? Quick cash loans can provide immediate access to funds, but it’s essential to be aware of the associated fees and interest rates.

Interest rates for mobile loans can vary significantly depending on the lender, loan amount, and borrower’s creditworthiness. It’s crucial to compare rates from different providers before making a decision.

Are mobile loans safe?

Curious about the rates offered by Wells Fargo for personal loans? Wells Fargo personal loan rates can vary depending on your credit score and loan amount. It’s always good to compare rates from different lenders before deciding.

Choosing a reputable and licensed mobile loan provider is essential to ensure safety. Look for providers with strong security measures and a positive track record.

Need a loan fast? Online loans with no credit check can be a convenient way to access funds quickly. However, be aware that these loans may come with higher interest rates.

What happens if I can’t repay my mobile loan on time?

Want to spread out your loan payments? Installment loans online allow you to pay back your loan in fixed monthly installments, making budgeting easier. Make sure to understand the terms and conditions before applying.

Late payments can result in penalties and affect your credit score. Contact your lender immediately if you face difficulties making repayments to discuss potential solutions.

Looking to buy a home? An FHA loan could be a great option for you. They’re known for their flexible requirements and lower down payments, making them accessible to a wider range of buyers.

Even if you have less-than-perfect credit, you may still be able to qualify for a loan. No credit check loans with guaranteed approval from direct lenders can be a good option, but it’s important to understand the risks involved.

Need money now? I need money now is a common sentiment, and there are various options available, but it’s important to choose a responsible and reliable lender.

Starting or growing a business? Understanding business loan rates is essential for making informed financial decisions. Compare lenders and explore different loan options to find the best fit for your business needs.

Looking for a loan provider near you? Loans near me searches can help you find local lenders who can provide personalized service and guidance.

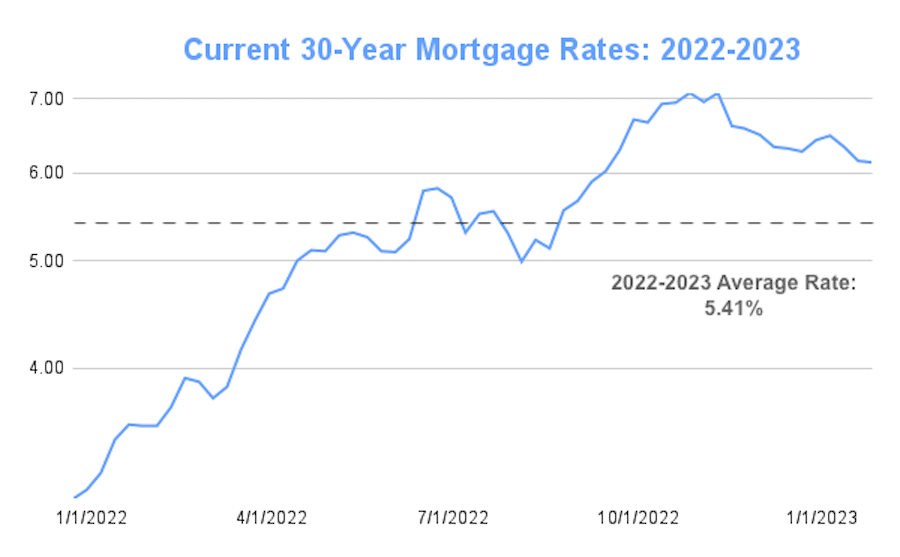

Keeping up with current home interest rates is important for anyone considering buying or refinancing a home. Understanding the market can help you make informed decisions about your mortgage.

Knowing the current business loan interest rates can be crucial for making smart financial decisions for your business. Researching different lenders and comparing rates is a good practice.