Money Platforms have become an integral part of the modern financial landscape, transforming how we manage, invest, and spend our money. From simple payment processors to sophisticated investment platforms, these digital tools offer convenience, security, and a range of financial management features that were previously unavailable.

Need to tap into your home’s equity? An equity loan could be the right option for you. You might also want to consider Lightstream loans , which offer competitive rates and flexible terms.

This comprehensive guide explores the world of money platforms, delving into their diverse types, key features, and impact on the financial industry. We’ll examine the benefits and challenges associated with these platforms, analyze popular examples, and provide insights into future trends and innovations shaping this dynamic sector.

Contents List

- 1 Money Platforms: A Comprehensive Guide

- 1.1 Definition and Types of Money Platforms

- 1.2 Key Features and Benefits of Money Platforms

- 1.3 Impact of Money Platforms on Financial Landscape

- 1.4 Comparison of Popular Money Platforms

- 1.5 Risks and Challenges Associated with Money Platforms

- 1.6 Future Trends and Innovations in Money Platforms

- 1.7 Examples of Money Platforms in Action

- 1.8 Best Practices for Choosing and Using Money Platforms

- 2 Final Review: Money Platform

- 3 Top FAQs

Money Platforms: A Comprehensive Guide

In today’s digital age, money platforms have revolutionized the way we manage our finances. From making payments to investing, these platforms offer a wide range of services that have transformed the financial landscape. This comprehensive guide will delve into the definition, types, features, benefits, impact, and future of money platforms, providing you with a thorough understanding of this evolving industry.

If you’re looking to release equity from your home, equity release interest rates can help you understand the costs involved.

Definition and Types of Money Platforms

A money platform is a digital service that enables individuals and businesses to perform financial transactions and manage their money electronically. These platforms provide a centralized hub for accessing a variety of financial services, simplifying and streamlining the financial process.

If you’re a veteran, you might qualify for a VA loan. To learn more about interest rates for VA loans, check out VA loan rates.

Money platforms can be broadly categorized into several types, each with its own specific functionalities and target audience:

- Payment Processors:These platforms facilitate online and mobile payments between individuals and businesses. Examples include PayPal, Stripe, and Square.

- Digital Wallets:Digital wallets allow users to store, send, and receive money digitally. Popular examples include Venmo, Cash App, and Apple Pay.

- Investment Platforms:These platforms provide tools for investing in stocks, bonds, mutual funds, and other financial instruments. Examples include Robinhood, Betterment, and Acorns.

- Cryptocurrency Exchanges:These platforms enable users to buy, sell, and trade cryptocurrencies. Examples include Coinbase, Binance, and Kraken.

- Banking Platforms:Online banks and mobile banking apps provide traditional banking services, such as account management, transfers, and loans, through digital interfaces. Examples include Chase Mobile, Bank of America, and Ally Bank.

Key Features and Benefits of Money Platforms

Money platforms offer a wide range of features and benefits that have made them increasingly popular among consumers and businesses alike.

Need to finance a home renovation? Renovation loans can help you get the money you need. If you need cash quickly, consider getting cash now with a personal loan.

- Convenience and Accessibility:Money platforms provide 24/7 access to financial services, allowing users to manage their money from anywhere with an internet connection.

- Security and Fraud Protection:Many money platforms employ advanced security measures, such as encryption and two-factor authentication, to protect user data and prevent fraud.

- Cost-Effectiveness:Money platforms often offer lower fees compared to traditional financial institutions, making them an attractive option for budget-conscious individuals and businesses.

- Enhanced Financial Management Tools:Many platforms provide tools for budgeting, saving, investing, and tracking spending, empowering users to take control of their finances.

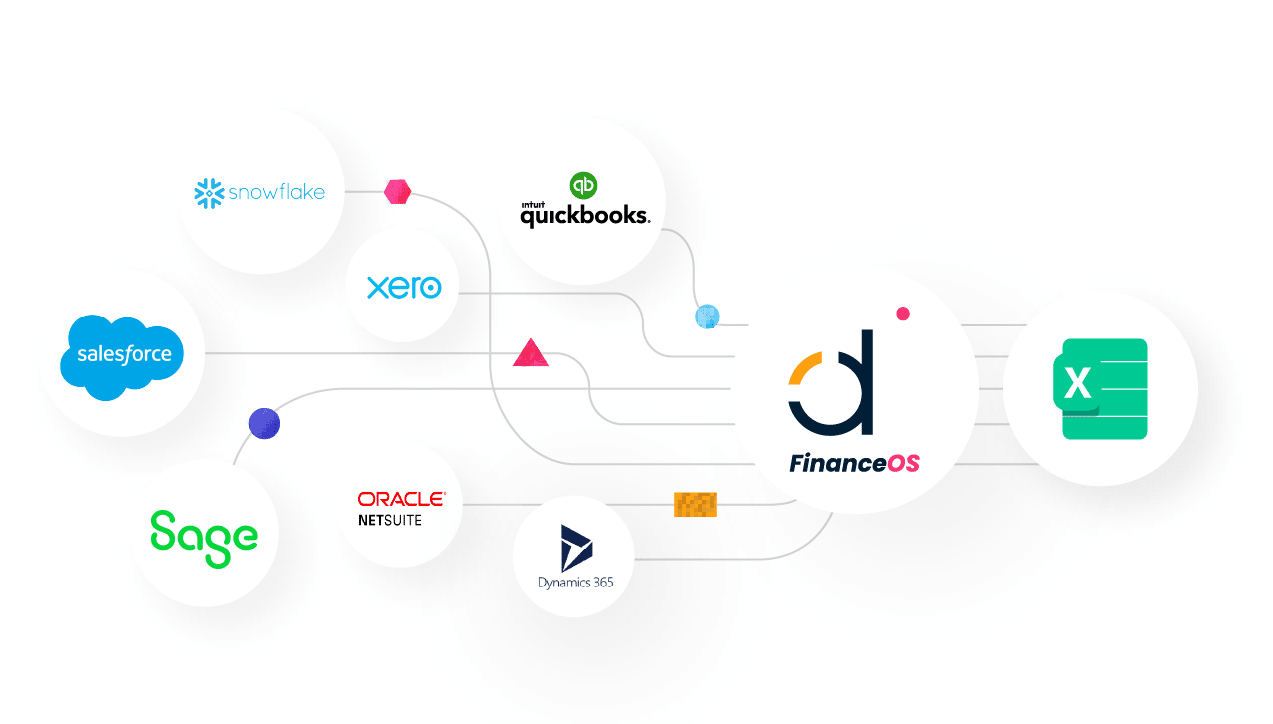

- Integration with Other Services:Money platforms can be integrated with other services, such as e-commerce platforms and social media, creating a seamless financial experience.

Impact of Money Platforms on Financial Landscape

Money platforms have had a profound impact on the financial industry, transforming the way we interact with money and financial institutions.

First National Bank offers competitive mortgage rates for home buyers. First National mortgage rates are a great place to start your search. As a home buyer, you might also want to explore resources for home buyers.

- Disruption of Traditional Financial Institutions:Money platforms have challenged the dominance of traditional banks and financial institutions by offering alternative, more convenient, and often more cost-effective services.

- Rise of FinTech:The emergence of money platforms has fueled the growth of financial technology (FinTech), a sector that is rapidly innovating and disrupting the financial industry.

- Increased Financial Inclusion:Money platforms have made financial services more accessible to individuals and businesses who were previously excluded from the traditional banking system.

- Potential Future of Money Platforms:Money platforms are expected to continue evolving, with advancements in artificial intelligence, blockchain technology, and open banking shaping the future of financial services.

Comparison of Popular Money Platforms

| Platform Name | Key Features | Pros | Cons |

|---|---|---|---|

| PayPal | Online payments, money transfers, virtual credit card, merchant services | Widely accepted, secure, user-friendly | Fees can be high, customer support can be slow |

| Venmo | Peer-to-peer payments, social integration, mobile payments | Easy to use, social features, low fees | Limited functionality for businesses, security concerns |

| Robinhood | Stock trading, options trading, cryptocurrency trading, fractional shares | Commission-free trading, user-friendly interface, educational resources | Limited investment options, gamification can be addictive |

| Coinbase | Cryptocurrency buying, selling, and trading, wallet management, staking | Easy to use, secure, wide range of cryptocurrencies | Fees can be high, limited customer support |

Risks and Challenges Associated with Money Platforms

While money platforms offer numerous benefits, they also come with certain risks and challenges that users should be aware of.

Looking for the best mortgage rates? Check out US Bank mortgage rates to see what options are available to you. You might also be interested in Jumbo mortgage rates if you’re looking for a larger loan.

- Security Breaches and Data Privacy:Money platforms store sensitive financial data, making them potential targets for cyberattacks and data breaches. Users must be vigilant about protecting their accounts and personal information.

- Regulatory Compliance and Oversight:The rapid growth of money platforms has led to challenges in regulating and overseeing these services, raising concerns about consumer protection and financial stability.

- User Trust and Adoption:Building trust and encouraging widespread adoption of money platforms requires addressing security concerns, ensuring transparency, and providing excellent customer support.

- Competition and Market Dynamics:The money platform industry is highly competitive, with new players constantly entering the market, leading to a dynamic and ever-evolving landscape.

Future Trends and Innovations in Money Platforms

The money platform industry is constantly evolving, with new trends and innovations emerging regularly. These advancements are shaping the future of financial services and providing users with more sophisticated and personalized experiences.

Finding the right mortgage broker can make a big difference. Find a mortgage broker near you to get started. You might also want to compare average mortgage rates before you make a decision.

- Artificial Intelligence (AI) and Machine Learning:AI and machine learning are being used to enhance money platform functionalities, such as fraud detection, personalized recommendations, and automated financial management.

- Blockchain Technology and Cryptocurrencies:Blockchain technology is revolutionizing financial transactions, offering increased security, transparency, and efficiency. Cryptocurrencies are becoming increasingly integrated into money platforms, providing new investment opportunities and payment options.

- Open Banking and Data Sharing:Open banking initiatives allow users to share their financial data with third-party apps and services, enabling more personalized and integrated financial experiences.

- Personalized Financial Services:Money platforms are increasingly offering personalized financial services, tailored to individual needs and preferences, using data analytics and AI to provide customized recommendations and insights.

Examples of Money Platforms in Action

Money platforms are being used in a variety of real-world scenarios, transforming the way we manage our finances and interact with businesses.

Need a personal loan? Apply for a personal loan today and get the money you need.

- Online Shopping:Payment processors like PayPal and Stripe make online shopping more convenient and secure, allowing users to make purchases without sharing their credit card details directly with merchants.

- Peer-to-Peer Payments:Digital wallets like Venmo and Cash App simplify peer-to-peer payments, making it easy to split bills, send money to friends, and pay for goods and services.

- Investment Management:Investment platforms like Robinhood and Betterment provide accessible and user-friendly tools for investing in stocks, bonds, and other financial instruments, empowering individuals to build their wealth.

- Cryptocurrency Trading:Cryptocurrency exchanges like Coinbase and Binance enable users to buy, sell, and trade cryptocurrencies, offering opportunities for investment and diversification.

- Mobile Banking:Mobile banking apps like Chase Mobile and Bank of America provide convenient access to traditional banking services, allowing users to manage their accounts, transfer funds, and pay bills from their smartphones.

Best Practices for Choosing and Using Money Platforms

Choosing the right money platform for your needs requires careful consideration and research. Here are some best practices to follow:

- Thorough Research and Comparison:Compare different money platforms based on their features, fees, security measures, and user experience to find the best fit for your requirements.

- Security Awareness and Measures:Be vigilant about protecting your accounts and personal information by using strong passwords, enabling two-factor authentication, and avoiding suspicious links or emails.

- Responsible Financial Management:Use money platforms responsibly by setting budgets, tracking your spending, and avoiding excessive debt. Utilize the tools and resources provided by these platforms to manage your finances effectively.

Final Review: Money Platform

As the financial landscape continues to evolve, money platforms will undoubtedly play an increasingly significant role. By understanding the intricacies of these platforms, individuals can make informed decisions, leverage their potential, and navigate the complexities of the modern financial world with greater confidence and efficiency.

Looking for a car loan? Car finance options are available to help you get the car you need. If you’re looking for a loan in your area, find loan places near you.

Top FAQs

What are the risks associated with using money platforms?

While money platforms offer numerous benefits, they also present certain risks, including security breaches, data privacy concerns, and potential fraud. It’s crucial to choose reputable platforms with strong security measures and to be aware of potential scams.

How do I choose the right money platform for my needs?

Selecting the right money platform depends on your individual needs and financial goals. Consider factors like the platform’s features, fees, security measures, user experience, and compatibility with your existing financial tools.

Are money platforms safe to use?

Reputable money platforms prioritize security and employ robust measures to protect user data and funds. However, it’s always advisable to practice good online security habits and be cautious of suspicious activities.

What are some examples of money platforms in action?

Popular examples include PayPal for online payments, Venmo for peer-to-peer transactions, Robinhood for stock trading, and Coinbase for cryptocurrency exchanges.