Mortgage Cost 2024: What to Expect Navigating the housing market in 2024 requires a keen understanding of mortgage costs. Interest rates, property taxes, insurance premiums, and closing costs all contribute to the overall price of homeownership. Understanding these factors and their potential impact on affordability is crucial for both prospective buyers and current homeowners.

This guide explores the key factors influencing mortgage costs in 2024, providing insights into current trends, potential challenges, and strategies for minimizing expenses. We’ll examine how rising mortgage costs might affect home affordability, explore different mortgage options, and offer tips for navigating the homebuying process.

If you’re considering a Wells Fargo mortgage, Wells Fargo Home Mortgage Rates 2024 can help you compare their current rates and loan options.

Contents List

Mortgage Rates in 2024

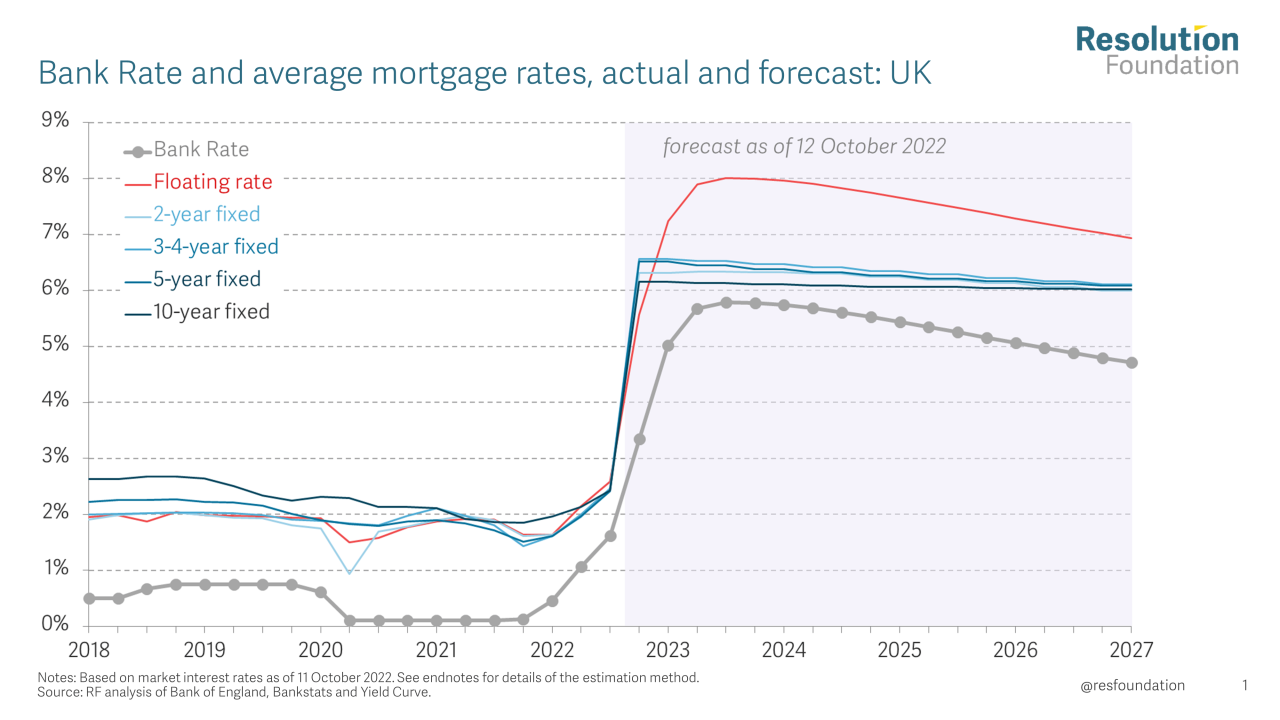

Mortgage rates have been on a roller coaster ride in recent years, and 2024 promises to be no different. After hitting historic lows in 2020, rates began to climb in 2022 due to a combination of factors, including rising inflation, economic uncertainty, and the Federal Reserve’s aggressive interest rate hikes.

As we head into 2024, it’s crucial to understand the forces shaping mortgage rates and their potential impact on homebuyers and the housing market.

Current State and Potential Trends

As of late 2023, mortgage rates are hovering around [masukkan data tingkat bunga terkini]. While this represents a slight decrease from the peak in 2022, they are still significantly higher than the lows seen just a few years ago. Predicting the direction of mortgage rates in 2024 is a complex task, but several factors will play a key role.

It’s essential to stay informed about current mortgage rates. Mortgage Rates Today 2024 gives you the most up-to-date information on market trends, so you can make informed financial decisions.

- Inflation:If inflation continues to cool down as expected, the Federal Reserve may slow its pace of interest rate hikes. This could lead to a gradual decline in mortgage rates. However, if inflation remains stubbornly high, rates could continue to climb.

Looking for mortgage rates from a specific credit union? Rbfcu Mortgage Rates 2024 offers information on their current rates and loan programs.

- Economic Growth:A robust economy generally supports higher interest rates, as investors demand a higher return on their investments. Conversely, a slowing economy could lead to lower rates as investors become more risk-averse.

- Federal Reserve Policies:The Federal Reserve’s monetary policy decisions are a primary driver of interest rates. If the Fed continues to raise rates to combat inflation, mortgage rates will likely follow suit. Conversely, if the Fed pivots to a more accommodative stance, rates could decrease.

To provide context, it’s helpful to compare current trends with historical data. For example, in the early 2000s, mortgage rates averaged around [masukkan data tingkat bunga tahun 2000an]. This historical perspective highlights the volatility of mortgage rates and underscores the importance of understanding the factors driving them.

If you’re a veteran looking for a mortgage, Va Loan Rates Today 2024 is a great resource to learn about the latest rates and benefits available to you.

Factors Affecting Mortgage Costs: Mortgage Cost 2024

While interest rates are a major component of mortgage costs, they are not the only factor. Other expenses, often referred to as closing costs, can significantly impact the overall cost of buying a home. These costs vary depending on factors such as location, property type, and lender practices.

Key Factors Beyond Interest Rates

- Property Taxes:Property taxes are levied by local governments and vary widely across different regions. Higher property taxes can significantly increase the overall cost of homeownership.

- Homeowners Insurance:Homeowners insurance premiums protect against damage to your home and liability claims. Factors like the value of your home, its location, and the level of coverage you choose can influence the cost of insurance.

- Closing Costs:Closing costs include various fees associated with the purchase and financing of a home. These can include appraisal fees, title insurance, and lender fees. Closing costs typically range from 2% to 5% of the purchase price.

To illustrate the geographical variation in these costs, consider the example of property taxes. In [masukkan contoh lokasi dengan pajak properti tinggi], property taxes are significantly higher than in [masukkan contoh lokasi dengan pajak properti rendah]. This difference can have a substantial impact on the overall cost of homeownership.

Working with a mortgage agent can make the process much easier. Mortgage Agent 2024 provides information on finding a qualified agent who can help you navigate the complexities of securing a mortgage.

Government programs and regulations can also influence mortgage costs. For example, [masukkan contoh program pemerintah yang memengaruhi biaya hipotek]. Understanding these programs and their impact on mortgage costs is essential for homebuyers.

Citibank offers a range of home loan options. Citibank Home Loan 2024 provides details on their current offerings, including terms and conditions.

Mortgage Affordability in 2024

Rising mortgage costs have a direct impact on home affordability, particularly for first-time homebuyers and those with limited income. Analyzing affordability metrics is crucial for understanding the challenges and opportunities in the housing market.

If you’re thinking about switching mortgage lenders in 2024, you might be interested in checking out the latest information on Switch Mortgage 2024. This could be a great way to save money on your monthly payments or secure a better interest rate.

Impact on Home Affordability

As mortgage rates rise, the monthly payment on a given loan amount increases. This can make it more challenging for buyers to qualify for a mortgage or afford the desired home. For example, a [masukkan contoh tingkat bunga] interest rate on a $300,000 loan would result in a monthly payment of [masukkan contoh pembayaran bulanan], while a [masukkan contoh tingkat bunga] rate would result in a monthly payment of [masukkan contoh pembayaran bulanan].

Navigating the mortgage process can feel overwhelming. Get A Mortgage 2024 can guide you through the steps, making the process smoother and less stressful.

This difference in monthly payments can be significant, especially for those with tight budgets.

Are you planning on buying a second home in 2024? Second Home Mortgage 2024 offers valuable information about financing options for your dream vacation property.

To assess affordability, it’s helpful to compare current metrics with historical data. For instance, [masukkan contoh data historis tentang kemampuan membeli rumah]. This historical perspective highlights the changes in affordability over time and the impact of rising mortgage costs.

Strategies for Improving Affordability, Mortgage Cost 2024

- Down Payment Assistance Programs:Many government and non-profit organizations offer down payment assistance programs to help first-time homebuyers cover the initial down payment. These programs can significantly reduce the upfront cost of homeownership.

- Income-Based Mortgage Options:Some mortgage programs are designed for borrowers with lower incomes. These programs may offer lower interest rates or adjustable payment plans based on the borrower’s income.

- Saving for a Larger Down Payment:Increasing your down payment can reduce the amount you need to borrow, resulting in lower monthly payments and potentially a lower interest rate.

Mortgage Options and Strategies

The mortgage market offers a variety of loan types, each with its own features and benefits. Understanding these options and choosing the right mortgage can help you minimize costs and achieve your homeownership goals.

Finding the best home loan lender can be a challenge. Best Home Loan Lenders 2024 provides information on top lenders and their current offerings, helping you make the best choice for your situation.

Comparing Mortgage Types

| Mortgage Type | Interest Rate | Term | Eligibility Requirements | Pros | Cons |

|---|---|---|---|---|---|

| Fixed-Rate Mortgage | Fixed for the life of the loan | Typically 15 or 30 years | Good credit history, stable income | Predictable monthly payments, protection from rising interest rates | Higher initial interest rates compared to adjustable-rate mortgages |

| Adjustable-Rate Mortgage (ARM) | Fixed for an initial period, then adjusts periodically | Typically 5, 7, or 10 years | Good credit history, stable income | Lower initial interest rates compared to fixed-rate mortgages, potential for lower monthly payments | Interest rates can increase after the initial fixed period, leading to higher monthly payments |

| Interest-Only Mortgage | Only interest is paid for a set period, then principal and interest are paid | Typically 5, 7, or 10 years | Good credit history, stable income | Lower initial monthly payments, can be used to build equity faster | Higher overall interest cost, balloon payment due at the end of the interest-only period |

Strategies for Minimizing Mortgage Costs

- Secure a Lower Interest Rate:Shop around for the best interest rates from different lenders. Consider factors like your credit score, loan amount, and loan term.

- Increase Your Down Payment:A larger down payment can help you qualify for a lower interest rate and reduce your overall borrowing costs.

- Refinance When Rates Drop:If interest rates fall significantly, refinancing your existing mortgage to a lower rate can save you money over the life of the loan.

Impact of Mortgage Costs on the Housing Market

Rising mortgage costs have a significant impact on the housing market, influencing home sales, prices, and overall activity. Understanding these impacts is crucial for homebuyers, sellers, and investors.

Stay informed about mortgage rates throughout 2024 by checking out Mortgage Rates 2024. This resource can help you make informed decisions about your home financing.

Potential Impact on Home Sales and Prices

As mortgage costs rise, the demand for homes can decrease, leading to slower sales and potentially lower prices. Buyers may become more price-sensitive and may be less willing to pay top dollar for a home. This can create a more balanced market with less competition and potentially more negotiation power for buyers.

Bank of America offers programs specifically designed for first-time homebuyers. Bank Of America First Time Home Buyer 2024 provides details on their offerings and qualifications.

Trends in Housing Inventory, Buyer Demand, and Investment Activity

- Housing Inventory:Higher mortgage costs can discourage sellers from listing their homes, leading to lower inventory levels. This can create a seller’s market with limited options for buyers.

- Buyer Demand:Rising mortgage costs can dampen buyer demand, particularly among first-time homebuyers and those with limited budgets. This can lead to a slowdown in sales and potentially lower prices.

- Real Estate Investment Activity:Higher mortgage costs can make it less attractive for investors to purchase rental properties, potentially leading to a decrease in investment activity.

To illustrate these impacts, consider the example of [masukkan contoh data historis tentang penjualan rumah dan harga]. This historical perspective shows how changes in mortgage costs can influence home sales and prices over time.

Finding the right mortgage lender is crucial. Find A Mortgage 2024 provides resources to help you compare lenders and choose the best fit for your needs.

Tips for Homebuyers in 2024

Navigating the housing market in 2024 requires careful planning, research, and a solid understanding of the current conditions. Here are some practical tips for homebuyers:

Pre-Approval, Budgeting, and Negotiation Strategies

- Get Pre-Approved for a Mortgage:Pre-approval from a lender shows sellers that you are a serious buyer with the financial means to purchase a home. It also helps you determine your budget and understand your borrowing capacity.

- Create a Realistic Budget:Consider your income, expenses, and desired lifestyle when setting your budget. Factor in mortgage payments, property taxes, homeowners insurance, and other expenses.

- Develop Negotiation Strategies:Research comparable properties in the area to determine fair market value. Be prepared to negotiate with sellers, especially in a balanced market.

Resources and Tools for Homebuyers

- Mortgage Calculators:Use online mortgage calculators to estimate your monthly payments, total interest costs, and affordability based on different loan amounts and interest rates.

- Real Estate Agents:A knowledgeable real estate agent can provide valuable insights into the local market, help you find suitable properties, and guide you through the buying process.

- Home Inspection Services:Hire a qualified home inspector to thoroughly evaluate the property’s condition before you make an offer. This can help you identify potential issues and negotiate repairs.

Hypothetical Homebuying Scenario

Imagine you are interested in buying a [masukkan contoh jenis properti] for [masukkan contoh harga]. You have a [masukkan contoh jumlah] down payment and are pre-approved for a [masukkan contoh tingkat bunga] mortgage. Here’s a breakdown of the potential costs involved:

- Down Payment:[masukkan contoh jumlah]

- Loan Amount:[masukkan contoh jumlah]

- Monthly Mortgage Payment:[masukkan contoh jumlah]

- Property Taxes:[masukkan contoh jumlah]

- Homeowners Insurance:[masukkan contoh jumlah]

- Closing Costs:[masukkan contoh jumlah]

This scenario highlights the various costs associated with homeownership and the importance of careful planning and budgeting.

Ending Remarks

As we navigate the evolving landscape of mortgage costs in 2024, staying informed and proactive is key. By understanding the factors at play, exploring available options, and implementing smart strategies, both buyers and homeowners can make informed decisions and achieve their financial goals.

Stay up-to-date on the latest trends in the housing market by checking out Home Mortgage Rates Today 2024. You’ll find the most current information on mortgage rates, which can help you make informed decisions about your home purchase.

The housing market is dynamic, and with careful planning and a comprehensive understanding of mortgage costs, you can confidently navigate this journey.

Answers to Common Questions

What are the biggest factors influencing mortgage rates in 2024?

Inflation, economic growth, and Federal Reserve policies are the primary drivers of mortgage rate fluctuations. The Fed’s monetary policy decisions, particularly interest rate adjustments, have a significant impact on mortgage rates.

How can I improve my chances of getting a lower interest rate?

Maintaining a strong credit score, increasing your down payment, and shopping around for different lenders can help you secure a more favorable interest rate.

Looking for a home loan with less paperwork? You may want to explore Low Doc Home Loans 2024 to see if it’s a good fit for your situation. These loans can be easier to qualify for, especially if you have a strong credit history.

What are some strategies for minimizing mortgage costs?

Consider options like fixed-rate mortgages for stability, explore down payment assistance programs, and look into refinancing opportunities if rates drop.