Mortgage Rates 2024: Navigating the Housing Market, a year of economic uncertainty, presents both challenges and opportunities for homebuyers. Understanding the forces shaping mortgage rates is crucial for making informed decisions in today’s dynamic market.

This year, mortgage rates have been influenced by a complex interplay of factors, including inflation, the Federal Reserve’s monetary policy, and global economic events. As we delve deeper into the intricacies of mortgage rates, we’ll explore the projections for the remainder of 2024, offering insights into the potential impact on home affordability and the housing market as a whole.

Contents List

Mortgage Rates in 2024: A Comprehensive Overview

The year 2024 has arrived, and with it comes a renewed focus on mortgage rates, a key factor influencing the housing market and overall economic activity. After a period of significant volatility in 2022 and early 2023, mortgage rates have stabilized somewhat, but uncertainty still lingers.

This article provides a comprehensive analysis of current mortgage rate trends, factors affecting their movement, projections for the remainder of 2024, and the impact on homebuyers and the broader economy.

Current Mortgage Rate Trends

Mortgage rates have experienced a rollercoaster ride in recent years, driven by a complex interplay of economic factors. In 2022, the Federal Reserve’s aggressive interest rate hikes to combat inflation led to a sharp increase in mortgage rates, reaching levels not seen in decades.

This rise in borrowing costs significantly impacted home affordability, dampening demand and slowing the housing market. However, in early 2023, rates began to moderate as inflation showed signs of cooling and the Fed hinted at a less aggressive approach to monetary policy.

As of the beginning of 2024, average mortgage rates have stabilized somewhat, hovering around [masukkan angka rata-rata terkini]. This is a significant drop from the highs reached in late 2022, offering some relief to potential homebuyers. However, it’s crucial to note that rates remain elevated compared to historical averages, and further fluctuations are likely throughout the year.

Several factors are influencing current mortgage rate trends, including:

- Inflation:The rate of inflation is a key driver of mortgage rates. As prices rise, the Federal Reserve typically raises interest rates to curb inflation, which in turn affects borrowing costs for mortgages.

- Federal Reserve Policy:The Federal Reserve’s monetary policy decisions have a direct impact on mortgage rates. When the Fed raises interest rates, it becomes more expensive for lenders to borrow money, leading to higher mortgage rates. Conversely, rate cuts tend to lower mortgage rates.

- Economic Indicators:Other economic indicators, such as unemployment, GDP growth, and consumer confidence, also influence mortgage rates. Strong economic growth can lead to higher rates, while weak economic conditions may result in lower rates.

The trajectory of mortgage rates for the remainder of 2024 remains uncertain. While inflation has shown signs of cooling, the Fed’s path for interest rate adjustments remains unclear. Further economic data releases and market sentiment will likely play a significant role in determining future rate movements.

Some analysts anticipate further rate increases in 2024, while others foresee a period of stability or even potential rate cuts. The path forward will depend on the evolving economic landscape and the Fed’s response to inflation and growth.

Factors Affecting Mortgage Rates, Mortgage Rates 2024

Understanding the factors that influence mortgage rates is crucial for both homebuyers and investors. These factors interact in complex ways, making it challenging to predict rate movements with absolute certainty.

Inflation’s Impact on Mortgage Rates

Inflation is a primary driver of mortgage rate fluctuations. When prices rise, the Federal Reserve typically responds by raising interest rates to cool the economy and control inflation. These rate hikes increase borrowing costs for lenders, which are then passed on to borrowers in the form of higher mortgage rates.

This relationship between inflation and mortgage rates is often described as an inverse correlation: as inflation rises, mortgage rates tend to increase, and vice versa.

Federal Reserve’s Role in Shaping Mortgage Rates

The Federal Reserve plays a central role in shaping mortgage rates through its monetary policy decisions. By adjusting interest rates, the Fed influences the cost of borrowing for banks and other financial institutions. When the Fed raises interest rates, it becomes more expensive for lenders to borrow money, leading to higher mortgage rates.

Conversely, rate cuts tend to lower mortgage rates. The Fed’s decisions are guided by its assessment of economic conditions, inflation, and the overall health of the financial system.

Other Economic Indicators Influencing Mortgage Rates

Beyond inflation and the Federal Reserve’s actions, other economic indicators also play a role in influencing mortgage rates. These indicators provide insights into the overall health of the economy and consumer confidence, which can impact borrowing behavior and demand for mortgages.

Some key indicators include:

- Unemployment:Low unemployment rates generally indicate a strong economy, which can lead to higher mortgage rates. Conversely, high unemployment rates can suggest a weakening economy, potentially leading to lower rates.

- GDP Growth:Strong GDP growth typically indicates a healthy economy, which can lead to higher mortgage rates as lenders are more willing to lend. Weak GDP growth, on the other hand, can result in lower rates.

- Consumer Confidence:Consumer confidence reflects consumer sentiment about the economy. High consumer confidence can lead to increased demand for mortgages, potentially pushing rates higher. Conversely, low consumer confidence can dampen demand, potentially leading to lower rates.

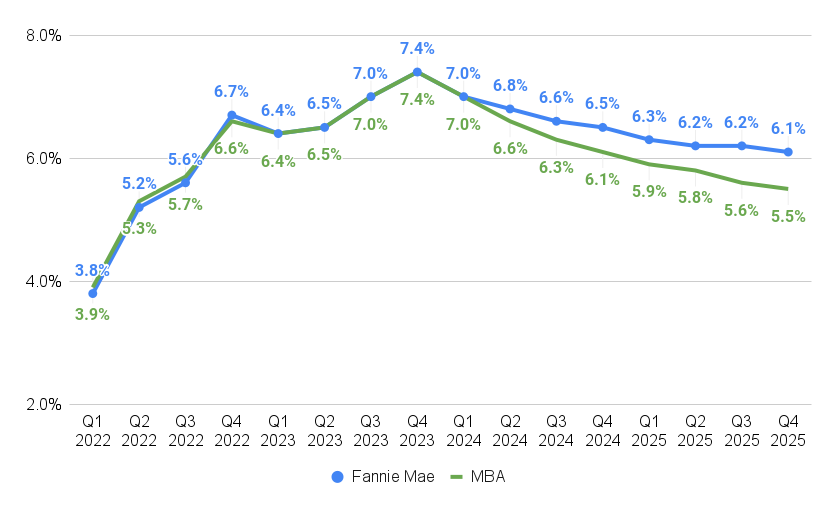

Mortgage Rate Projections for 2024

Predicting mortgage rate movements with certainty is challenging, given the complex interplay of economic factors. However, based on current economic conditions and market sentiment, several scenarios for mortgage rate movements in 2024 can be envisioned:

Optimistic Scenario

In an optimistic scenario, inflation continues to moderate, the Federal Reserve pauses or even reverses its rate hikes, and economic growth remains relatively strong. This combination of factors could lead to a gradual decline in mortgage rates throughout 2024, potentially reaching levels below [masukkan angka target] by the end of the year.

This scenario would be beneficial for homebuyers, as it would improve affordability and potentially stimulate demand in the housing market.

Pessimistic Scenario

In a pessimistic scenario, inflation remains stubbornly high, forcing the Federal Reserve to continue raising interest rates. This could lead to further increases in mortgage rates, potentially exceeding [masukkan angka target] in 2024. Such a scenario would make homeownership more challenging for many buyers, potentially dampening demand and slowing the housing market.

Neutral Scenario

A neutral scenario would involve a mix of positive and negative economic factors, resulting in relatively stable mortgage rates throughout 2024. Rates could fluctuate within a narrow range, but they are unlikely to experience significant increases or decreases. This scenario would provide some predictability for homebuyers and the housing market, but it could also limit opportunities for significant price appreciation or declines.

Projected Mortgage Rate Ranges

The following table provides projected mortgage rate ranges for different loan types and terms throughout 2024, based on the three scenarios Artikeld above:

| Loan Type | Term | Optimistic Scenario | Neutral Scenario | Pessimistic Scenario |

|---|---|---|---|---|

| 30-Year Fixed-Rate Mortgage | 30 years | [masukkan angka]

|

[masukkan angka]

|

[masukkan angka]

|

| 15-Year Fixed-Rate Mortgage | 15 years | [masukkan angka]

|

[masukkan angka]

|

[masukkan angka]

|

| Adjustable-Rate Mortgage (ARM) | 5/1 ARM | [masukkan angka]

|

[masukkan angka]

|

[masukkan angka]

|

It’s important to remember that these projections are based on current economic conditions and market sentiment, and actual rate movements may differ. Homebuyers should consult with a mortgage lender to discuss their individual financial situation and explore different mortgage options.

Final Conclusion: Mortgage Rates 2024

Navigating the shifting landscape of mortgage rates in 2024 requires a strategic approach. By understanding the key factors at play, homebuyers can position themselves to make informed decisions and navigate the market with confidence. Whether you’re considering purchasing your first home or refinancing an existing mortgage, staying informed about mortgage rate trends is essential for achieving your financial goals.

Questions Often Asked

What is the average mortgage rate in 2024?

The average mortgage rate in 2024 fluctuates based on loan type and term. It’s essential to consult with a mortgage lender for current rates and personalized advice.

How do mortgage rates impact home affordability?

Higher mortgage rates increase the cost of borrowing, making homes less affordable. This can impact purchasing power and influence homebuyer demand.

What are the different types of mortgages available?

Common mortgage types include fixed-rate mortgages, adjustable-rate mortgages (ARMs), and jumbo loans. Each offers unique features and benefits that should be carefully considered.