Mortgage Rates Plunge 2024 takes center stage, offering a glimmer of hope for potential homebuyers. The recent decline in mortgage rates, a stark contrast to the historically high levels of the past year, has sparked renewed interest in the housing market.

This shift is fueled by a combination of factors, including the Federal Reserve’s efforts to curb inflation and the ongoing economic uncertainty.

Navigating the mortgage market can be daunting, but finding the Best Fixed Rate Mortgage 2024 can make the process smoother. Compare rates, fees, and terms to find the best fit for your individual needs and financial situation.

The impact of these plummeting rates is far-reaching, influencing not only the affordability of homeownership but also the dynamics of the housing market itself. With lower monthly payments becoming a reality, buyers find themselves with increased purchasing power, leading to a surge in demand.

However, this surge in demand also presents challenges for sellers, who must navigate a more competitive landscape and adjust their pricing strategies accordingly. The economic implications of this rate plunge are equally significant, potentially boosting consumer spending and stimulating economic growth.

But as with any economic shift, there are risks and challenges to consider, prompting a careful analysis of the potential long-term effects of these low rates.

Curious about the monthly payments for a $300,000 mortgage over 30 years in 2024? You can explore this scenario and get a clearer picture of your potential financial commitments by visiting $300 000 Mortgage Payment 30 Years 2024.

Contents List

Mortgage Rates Plunge in 2024

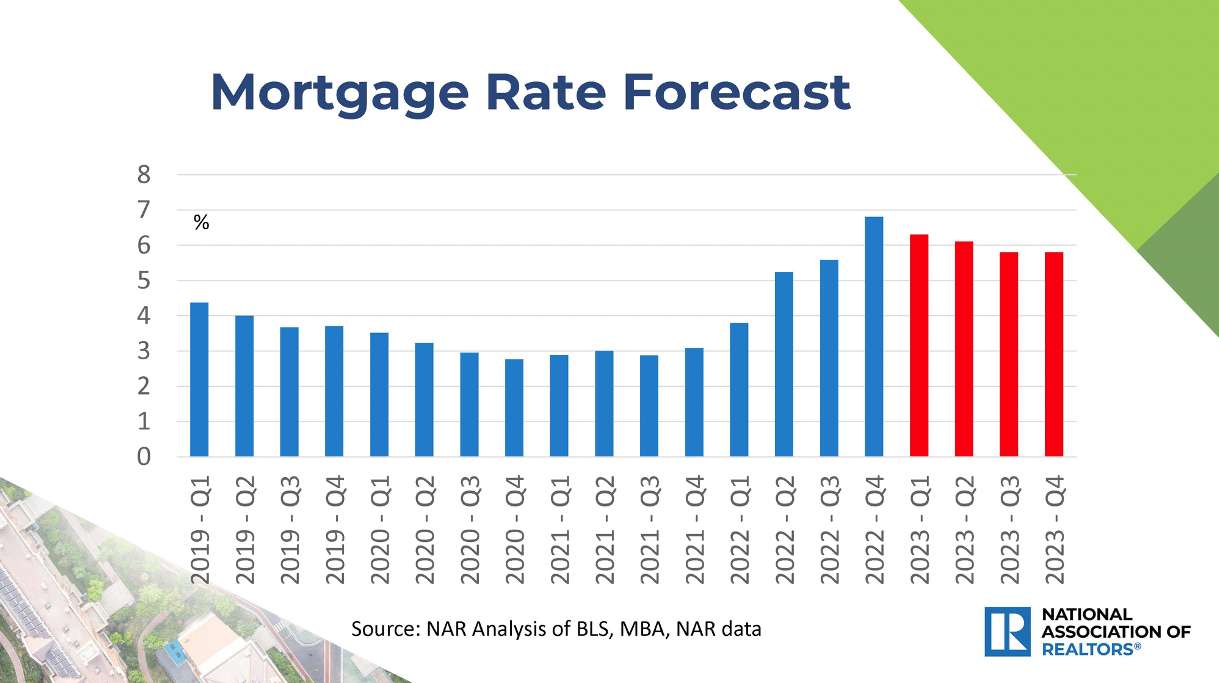

The year 2024 has witnessed a significant drop in mortgage rates, a trend that has generated excitement among potential homebuyers and raised concerns for sellers. This decline, a stark contrast to the high rates of 2022 and early 2023, is a result of several factors, including the Federal Reserve’s shift in monetary policy and the overall economic climate.

Looking to secure a 30-year fixed mortgage in 2024? You can check out the latest rates and information on 30 Year Fixed 2024. Understanding the current market conditions is crucial for making informed decisions about your home financing.

This article will delve into the intricacies of this rate plunge, examining its impact on various stakeholders and the broader economic landscape.

Mortgage Rate Plunge Context

Mortgage rates have experienced a substantial decline in 2024, a welcome change for many potential homebuyers. After reaching a peak of over 7% in late 2022, rates have steadily retreated, hovering around the 5% mark in recent months. This drop represents a significant shift from historical trends, where rates have generally been higher over the past decade.

Rocket Mortgage is a popular lender in the mortgage market. To find out more about their current interest rates in 2024, you can visit Rocket Mortgage Interest Rates 2024 to compare their offerings.

The primary driver of this decline is the Federal Reserve’s decision to slow down its rate hikes. The Fed, in its effort to combat inflation, had aggressively raised interest rates throughout 2022. However, with signs of inflation cooling, the Fed has pivoted to a more cautious approach, resulting in a decline in borrowing costs across the board, including mortgages.

Understanding 30-year fixed rates is crucial for making informed mortgage decisions. You can explore current rates and trends by visiting 30 Year Fixed Rate 2024 to gather valuable insights.

The impact of this rate plunge on the housing market is multifaceted. On one hand, it has stimulated demand, leading to increased home sales and a more competitive market. On the other hand, it has also led to a surge in refinancing activity, as homeowners seek to capitalize on lower rates and reduce their monthly payments.

Mr. Cooper is a well-known name in the mortgage industry. If you’re considering them for your home loan needs in 2024, you can find more details about Mr Cooper Home Loans 2024 to see if they align with your goals.

Impact on Homebuyers

Lower mortgage rates offer significant benefits to potential homebuyers. The most immediate advantage is a reduction in monthly mortgage payments. This allows buyers to stretch their budgets, affording them access to a wider range of properties and potentially increasing their purchasing power.

Additionally, lower rates can also reduce the overall cost of borrowing, resulting in lower interest payments over the life of the mortgage.

Round Point Mortgage is another company that offers mortgage solutions. To learn more about their services and offerings in 2024, you can visit Round Point Mortgage 2024 to explore their options.

The current mortgage market bears a striking resemblance to periods of low rates in the past, such as the early 2000s. However, it’s crucial to remember that past trends do not necessarily guarantee future outcomes. The current economic landscape and the future course of interest rates remain uncertain, making it essential for buyers to carefully consider their financial situation and long-term goals before making a purchase.

Want to know what a mortgage on $300,000 would look like in 2024? You can get a better understanding of the potential monthly payments and overall financial implications by visiting Mortgage On 300k 2024.

| Interest Rate | Monthly Payment (on a $300,000 Loan) |

|---|---|

| 5.00% | $1,610 |

| 5.50% | $1,700 |

| 6.00% | $1,790 |

| 6.50% | $1,880 |

The table above illustrates the impact of different interest rates on monthly mortgage payments for a $300,000 loan. As the interest rate increases, so does the monthly payment, highlighting the significant financial implications of even small rate changes.

Staying up-to-date on mortgage rates is essential. You can find the current rates for 30-year fixed mortgages in 2024 by checking out Current 30 Year Fixed Mortgage Rates 2024. This information can help you make informed decisions about your home financing options.

Impact on Home Sellers

While lower mortgage rates present a boon for buyers, they can pose challenges for home sellers. The increased purchasing power of buyers with lower rates can create a more competitive market, leading to multiple offers and potentially driving up prices.

Purchasing your first home can be an exciting and significant step. To find home loans specifically tailored for first-time buyers in 2024, you can visit Home Loans For First Time Buyers 2024 to explore your options.

Sellers may find themselves needing to adjust their pricing strategies to remain competitive and attract buyers.

M&T Bank is another financial institution offering mortgage services. To explore their mortgage offerings in 2024, you can visit M&T Bank Mortgage 2024 to learn more about their rates, programs, and services.

The current market dynamics are reminiscent of previous periods of low rates, where bidding wars and fast-paced sales were commonplace. However, it’s crucial for sellers to remain informed about market trends and consult with real estate professionals to develop a sound strategy that aligns with their individual circumstances and goals.

Point is a company that specializes in home equity solutions. If you’re looking for information about their offerings in 2024, you can visit Point Home Equity 2024 to learn more about their programs.

Impact on the Economy

The decline in mortgage rates has broader economic implications, potentially stimulating consumer spending and contributing to economic growth. Lower borrowing costs can encourage homeowners to undertake home improvement projects or make larger purchases, boosting economic activity. Additionally, the increased demand for housing can create jobs in the construction and real estate sectors, further supporting economic growth.

New Rez is a company that provides mortgage solutions. To learn more about their offerings in 2024, including their services and programs, you can visit New Rez 2024 for additional information.

However, it’s essential to acknowledge potential risks associated with low rates. One concern is the potential for a housing bubble, where rapid price increases driven by low rates could lead to an unsustainable market. Additionally, prolonged periods of low rates can also encourage excessive borrowing, potentially leading to future financial instability.

First Direct is another provider of mortgage services. To learn more about their offerings in 2024, including rates and terms, you can visit First Direct Mortgage Rates 2024 for a comprehensive overview.

Financial Considerations, Mortgage Rates Plunge 2024

When considering a mortgage, it’s crucial to understand the various types available and their associated benefits and drawbacks. Fixed-rate mortgages offer the stability of a consistent interest rate throughout the loan term, providing predictable monthly payments. Adjustable-rate mortgages (ARMs) offer potentially lower initial rates, but their rates can fluctuate over time, making them less predictable.

Choosing the right mortgage depends on individual circumstances and financial goals. Those seeking stability and predictability may opt for a fixed-rate mortgage, while those willing to take on some risk for potential lower initial rates may consider an ARM.

It’s essential to carefully assess your financial situation, long-term goals, and risk tolerance before making a decision.

Regardless of the type of mortgage chosen, financial planning and budgeting are crucial. Understanding your income, expenses, and debt obligations will help you determine how much you can afford to borrow and ensure that your mortgage payments fit comfortably within your budget.

It’s also advisable to consult with a financial advisor to develop a comprehensive financial plan that includes your mortgage and other financial goals.

Looking for home loans in your area? You can find lenders and loan options near you by visiting Home Loans Near Me 2024 for a localized search of available options.

Final Review: Mortgage Rates Plunge 2024

The Mortgage Rates Plunge 2024 is a complex phenomenon with far-reaching implications for both individuals and the broader economy. Understanding the nuances of this shift, including its impact on homebuyers, sellers, and the overall market, is crucial for making informed decisions.

As we navigate this evolving landscape, it’s essential to remain informed about the latest trends and consider the long-term implications of these changes. Whether you’re a prospective buyer, a seasoned seller, or simply an observer of the market, staying abreast of these developments is key to making the most of this dynamic period.

Question & Answer Hub

What factors are driving the decline in mortgage rates?

The decline in mortgage rates is primarily attributed to the Federal Reserve’s efforts to combat inflation by raising interest rates. These rate hikes, while intended to cool the economy, have also led to a decrease in borrowing costs, including mortgage rates.

How do lower mortgage rates affect affordability?

Lower mortgage rates translate to lower monthly payments, making homeownership more affordable for potential buyers. This increased affordability can lead to a surge in demand, potentially driving up home prices.

What are the potential risks associated with low mortgage rates?

While lower rates can stimulate economic growth, they also carry potential risks. One concern is the possibility of asset bubbles, where rapid price increases in certain sectors, like housing, become unsustainable. Additionally, low rates can incentivize excessive borrowing, potentially leading to increased household debt.