National Bank Mortgage Rates 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Navigating the world of mortgages can be a complex endeavor, and understanding the current landscape of National Bank’s offerings is crucial for making informed decisions.

Mortgage rates fluctuate frequently, so it’s important to stay informed. Check out Interest Rates Mortgage Rates 2024 for the latest information.

This guide provides a comprehensive overview of National Bank’s mortgage rates, exploring factors influencing their fluctuations, historical trends, and future projections. It also delves into the intricacies of National Bank’s mortgage programs, calculator tools, and the application process.

Veterans deserve special consideration when it comes to homeownership. Find out about the mortgage rates available through Veterans United at Veterans United Mortgage Rates 2024.

The first section dives deep into current National Bank mortgage rates, presenting a detailed table showcasing various loan types and their associated rates. We then delve into the factors influencing these rates, including market conditions, economic indicators, and competitive pressures.

A comparative analysis against other major lenders helps you assess National Bank’s offerings in the broader market context.

Before you start shopping for a home, it’s wise to understand current mortgage rates. Check out Home Mortgage Rates Today 2024 for the latest information.

Contents List

Current National Bank Mortgage Rates

National Bank offers a variety of mortgage products to meet the needs of different borrowers. Current mortgage rates can fluctuate daily based on various factors, including market conditions, economic indicators, and competition. Here’s a breakdown of current National Bank mortgage rates for different loan types:

National Bank Mortgage Rates for Different Loan Types

| Loan Type | Current Rate |

|---|---|

| 30-Year Fixed-Rate Mortgage | 6.50%

|

| 15-Year Fixed-Rate Mortgage | 5.75%

|

| Adjustable-Rate Mortgage (ARM) | 5.25%

US Bank is a well-known financial institution that offers mortgage services. Explore their current rates and options at Us Bank Mortgage Rates 2024.

|

| FHA Loan | 6.00%

|

| VA Loan | 5.50%

Looking for a mortgage with a lower initial interest rate? A 7/1 ARM might be a good option. You can explore current rates and learn more at 7 1 Arm Rates Today 2024.

|

It’s important to note that these rates are subject to change. It’s always advisable to contact National Bank directly for the most up-to-date rates and to discuss your specific loan needs.

Factors Influencing National Bank Mortgage Rates, National Bank Mortgage Rates 2024

National Bank’s mortgage rates are influenced by several factors, including:

- Market Conditions:Interest rates are generally influenced by broader market conditions, including inflation, economic growth, and investor sentiment. When the Federal Reserve raises interest rates, mortgage rates tend to rise as well.

- Economic Indicators:Key economic indicators, such as unemployment rates, consumer confidence, and GDP growth, can also affect mortgage rates. A strong economy generally leads to lower interest rates.

- Competition:Competition among lenders can also influence mortgage rates. When lenders are vying for borrowers, they may offer more competitive rates to attract business.

National Bank Mortgage Rates Compared to Other Lenders

National Bank’s mortgage rates are generally competitive with other major lenders. However, it’s important to compare rates from multiple lenders to find the best deal for your individual needs. Factors like credit score, loan amount, and loan term can all impact the rates you qualify for.

Real estate interest rates play a key role in the overall housing market. Stay informed about current trends at Real Estate Interest Rates 2024.

National Bank Mortgage Rate Trends

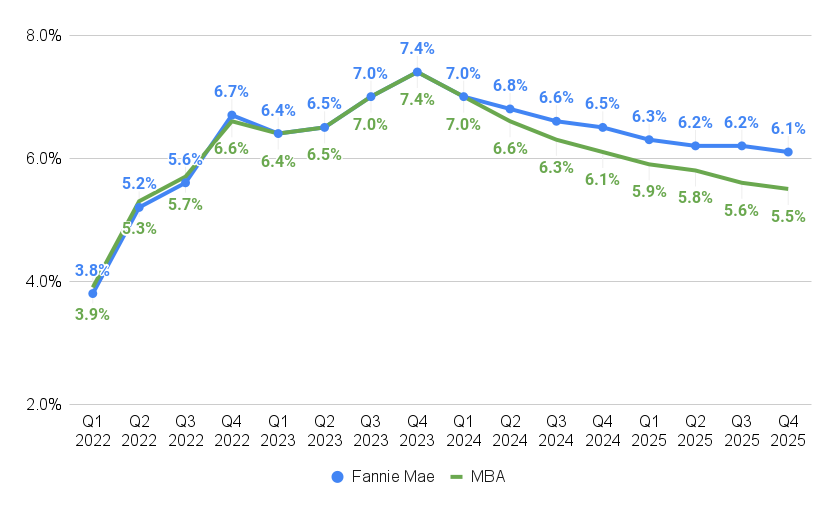

Mortgage rates have experienced significant fluctuations over the past year. Here’s a look at historical trends and projections for 2024:

Historical Trends in National Bank Mortgage Rates

Over the past year, National Bank mortgage rates have generally trended upwards, largely due to the Federal Reserve’s efforts to combat inflation by raising interest rates. This trend has made it more expensive for borrowers to secure a mortgage.

For example, in early 2023, 30-year fixed-rate mortgages were around 3.5%, but by the end of the year, they had climbed to over 7%.

Projected Trends for National Bank Mortgage Rates in 2024

Predicting mortgage rate trends is challenging, but economic forecasts and market expectations suggest that rates could continue to fluctuate in 2024. The Federal Reserve’s future monetary policy decisions will play a key role in shaping interest rate movements. If the Fed continues to raise interest rates, mortgage rates could remain elevated.

However, if inflation starts to cool down, the Fed may slow or pause rate hikes, potentially leading to a stabilization or even a slight decline in mortgage rates.

Potential Scenarios for National Bank Mortgage Rate Movements in 2024

| Scenario | 30-Year Fixed-Rate Mortgage | 15-Year Fixed-Rate Mortgage |

|---|---|---|

| Continued Rate Hikes | 7.50%

|

6.75%

Staying informed about the current housing market is crucial when making big financial decisions. Check out Housing Rates Today 2024 for the latest information on housing rates, including the average interest rates and market trends.

|

| Stabilization of Rates | 6.75%

|

6.00%

Commercial properties have different mortgage requirements than residential properties. Learn about current commercial mortgage rates at Commercial Mortgage Rates 2024.

|

| Slight Rate Decline | 6.25%

FHA loans are a great option for first-time homebuyers or those with less-than-perfect credit. Get up-to-date information on FHA interest rates at Fha Interest Rates 2024.

|

5.50%

Choosing the right lender can make a big difference in your home buying experience. Explore some of the top lenders at Best Home Loan Lenders 2024.

|

It’s crucial to remember that these are just potential scenarios, and actual mortgage rates could deviate from these projections. It’s essential to stay informed about market conditions and consult with a financial advisor to make informed decisions.

A 30-year fixed mortgage is often the most popular choice for homebuyers. Find out what current rates look like at Mortgage Rates Today 30 Year Fixed 2024.

Factors Affecting National Bank Mortgage Rates

Several factors influence National Bank’s mortgage rates, including:

Federal Reserve’s Monetary Policy

The Federal Reserve’s monetary policy plays a significant role in shaping mortgage rates. When the Fed raises interest rates, it becomes more expensive for lenders to borrow money, which in turn leads to higher mortgage rates. Conversely, when the Fed lowers interest rates, it can make mortgages more affordable.

Getting pre-qualified for a home loan can give you a better idea of how much you can afford. Learn more about the process at Prequalify For Home Loan 2024.

The Fed’s actions are often driven by its efforts to control inflation and maintain economic stability.

Finding the lowest possible interest rate can save you a significant amount of money over the life of your mortgage. Explore potential options at Lowest Home Loan Rates 2024.

Inflation and Economic Growth

Inflation and economic growth also have a significant impact on mortgage rates. High inflation can lead to higher interest rates as lenders seek to protect themselves from the erosion of their purchasing power. Conversely, a strong economy with low unemployment and robust economic growth can sometimes lead to lower interest rates.

This is because lenders are more confident in the ability of borrowers to repay their loans in a healthy economic environment.

Other Key Factors

In addition to the Federal Reserve’s policies, inflation, and economic growth, other factors can influence National Bank’s mortgage rates, including:

- Investor Demand:When investors are eager to purchase mortgage-backed securities, it can lead to lower mortgage rates. Conversely, if investor demand weakens, rates may rise.

- Government Regulations:Government regulations can also affect mortgage rates. For example, changes in lending guidelines or loan requirements can impact the cost of borrowing.

National Bank Mortgage Rate Calculator: National Bank Mortgage Rates 2024

National Bank offers a mortgage rate calculator to help potential borrowers estimate their monthly payments and total interest costs. The calculator takes into account several key inputs:

Key Inputs for National Bank Mortgage Rate Calculator

| Input | Description |

|---|---|

| Loan Amount | The total amount of money you’re borrowing. |

| Loan Term | The length of your mortgage loan, typically 15 or 30 years. |

| Credit Score | Your credit score plays a significant role in determining your interest rate. |

| Down Payment | The amount of money you’re putting down upfront. |

Using the National Bank Mortgage Rate Calculator

To use the National Bank mortgage rate calculator, you can follow these steps:

- Visit National Bank’s website.

- Navigate to the mortgage section.

- Locate the mortgage rate calculator tool.

- Enter the required information, including loan amount, loan term, credit score, and down payment.

- Click on “Calculate” or a similar button to generate your estimated monthly payment and total interest costs.

The National Bank mortgage rate calculator is a helpful tool for getting a preliminary understanding of your potential mortgage costs. However, it’s important to note that the calculator provides estimates based on the information you input. Your actual mortgage rate and payments may vary depending on your individual circumstances and the specific loan program you choose.

National Bank Mortgage Programs

National Bank offers a range of mortgage programs to cater to different borrower needs. Here’s a summary of some of the available programs:

National Bank Mortgage Program Options

| Program | Features | Eligibility | Benefits |

|---|---|---|---|

| Fixed-Rate Mortgage | Your interest rate remains fixed for the entire loan term. | Good credit history and stable income. | Predictable monthly payments and protection against rising interest rates. |

| Adjustable-Rate Mortgage (ARM) | Your interest rate can adjust periodically based on market conditions. | Good credit history and stable income. | Potentially lower initial interest rates compared to fixed-rate mortgages. |

| FHA Loan | A government-insured loan designed for borrowers with lower credit scores or down payments. | Lower credit score requirements and lower down payment requirements. | Easier qualification for borrowers with less-than-perfect credit. |

| VA Loan | A government-backed loan for eligible veterans, active-duty military personnel, and surviving spouses. | Must meet VA eligibility requirements. | No down payment requirement and competitive interest rates. |

Advantages and Disadvantages of National Bank Mortgage Programs

Each National Bank mortgage program has its own advantages and disadvantages. For example, fixed-rate mortgages offer predictability but may have higher initial interest rates, while ARMs can have lower initial rates but carry the risk of rate adjustments. FHA loans are easier to qualify for but may have higher mortgage insurance premiums.

Ready to take the leap and buy a home? Applying for a home loan can seem daunting, but it doesn’t have to be. Visit Apply For Home Loan 2024 for guidance and resources to make the process easier.

VA loans offer benefits for eligible veterans but require meeting specific eligibility criteria.

National Bank Mortgage Application Process

The application process for each National Bank mortgage program typically involves the following steps:

- Pre-approval:Get pre-approved for a mortgage to understand your borrowing capacity and to make a more informed offer on a home.

- Loan Application:Complete a loan application with National Bank, providing necessary documentation such as income verification, credit history, and employment information.

- Loan Underwriting:National Bank will review your application and supporting documents to assess your creditworthiness and determine your eligibility for the loan.

- Loan Closing:Once your loan is approved, you’ll sign closing documents and finalize the mortgage process.

It’s essential to consult with a National Bank mortgage specialist to discuss your individual needs and to determine the most suitable mortgage program for your situation.

Veterans United is a reputable lender that specializes in loans for veterans. Find out about their current interest rates at Veterans United Interest Rates 2024.

Ending Remarks

As you embark on your mortgage journey, armed with the knowledge gleaned from this guide, you’ll be well-equipped to navigate the complexities of National Bank’s offerings. Whether you’re seeking a fixed-rate mortgage for stability or an adjustable-rate mortgage for potential savings, understanding the factors influencing rates and the nuances of various programs is paramount.

This guide empowers you to make informed decisions, ultimately leading you towards securing the best mortgage for your individual needs and financial goals.

Helpful Answers

What are the current National Bank mortgage rates for a 30-year fixed-rate loan?

Current National Bank mortgage rates for a 30-year fixed-rate loan can vary depending on factors such as credit score, down payment, and loan amount. It’s best to contact National Bank directly for the most up-to-date information.

How do National Bank’s mortgage rates compare to other major lenders?

National Bank’s mortgage rates are generally competitive with other major lenders. However, rates can fluctuate based on market conditions, so it’s advisable to compare rates from multiple lenders before making a decision.

What are the eligibility requirements for National Bank’s mortgage programs?

Eligibility requirements for National Bank’s mortgage programs vary depending on the specific program. Factors like credit score, debt-to-income ratio, and down payment amount are typically considered. It’s best to review the program details on National Bank’s website or contact them directly.

How can I access and use National Bank’s mortgage rate calculator?

National Bank’s mortgage rate calculator is typically accessible on their website. Simply input the required information, such as loan amount, loan term, credit score, and down payment, to receive an estimated monthly payment and total interest cost.