October 2024 Income Tax Brackets for Head of Household: Navigating the tax landscape as a Head of Household filer can be complex, especially with ever-changing tax laws and economic conditions. Understanding the income tax brackets specific to this filing status is crucial for accurate tax preparation and maximizing potential deductions and credits.

This guide delves into the intricacies of these brackets, providing valuable insights into how your income affects your tax liability.

The Head of Household filing status is designed for unmarried individuals who pay more than half the costs of keeping a home for a qualifying child or dependent. This status offers tax benefits compared to being single, often resulting in lower tax liability.

As you navigate the tax system, understanding the benefits and requirements of the Head of Household status is essential. This guide provides a comprehensive overview of the income tax brackets, deductions, and credits relevant to this filing status, empowering you to make informed decisions about your tax obligations.

Contents List

- 1 Head of Household Filing Status

- 2 Understanding Tax Brackets

- 3 Income Tax Brackets for Head of Household in October 2024

- 3.1 Income Tax Brackets for Head of Household in October 2024

- 3.2 Standard Deduction for Head of Household in October 2024, October 2024 income tax brackets for head of household

- 3.3 Personal Exemption for Head of Household in October 2024

- 3.4 Child Tax Credit for Head of Household in October 2024

- 3.5 Comparison of Income Tax Brackets for Different Filing Statuses

- 3.6 Impact of Potential Changes to Tax Laws or Economic Conditions

- 4 Tax Planning Considerations for Head of Household Filers

- 5 Resources for Head of Household Filers: October 2024 Income Tax Brackets For Head Of Household

- 6 Last Word

- 7 Clarifying Questions

Head of Household Filing Status

The Head of Household filing status is a tax filing option available to unmarried individuals who pay more than half the costs of keeping a home for a qualifying child or dependent. This status often provides significant tax benefits compared to filing as single.This filing status is designed to recognize the financial responsibility of individuals who maintain a household for dependents, offering them lower tax rates and a higher standard deduction than single filers.

Who Qualifies for Head of Household Status?

To qualify for Head of Household filing status, you must meet the following criteria:

- Be unmarried at the end of the tax year.

- Pay more than half the costs of keeping up a home for a qualifying child or dependent.

- Have a qualifying child or dependent living with you for more than half the year.

- The qualifying child or dependent cannot be claimed as a dependent by another taxpayer.

Examples of Individuals Who Qualify for Head of Household Status

- A single parent with a child living with them.

- A divorced individual who pays more than half the costs of keeping up a home for their child.

- An individual who provides a home for a qualifying relative, such as a parent, grandparent, or sibling.

Understanding Tax Brackets

Income tax brackets are a system used by the government to determine how much tax you owe based on your income level. They divide income into different ranges, each with its own tax rate. The higher your income, the higher the tax rate you’ll pay on a portion of your income.

Don’t miss out on the opportunity to maximize your retirement savings. Check out the 2024 401k contribution limits for employees over 50 to see how much you can contribute.

Marginal Tax Rates

Marginal tax rates are the rates applied to each additional dollar of income. They are the most important aspect of income tax brackets because they determine how much extra tax you’ll pay for every dollar you earn above a certain threshold.

For example, if you fall into the 22% tax bracket, you’ll pay 22% tax on every dollar earned between the lower and upper limits of that bracket.

Investing can be complex, and understanding the tax implications is essential. A tax calculator for investments in October 2024 can help you make informed decisions.

Federal and State Income Tax Brackets

Federal and state income tax brackets operate independently. This means that you might be in a different tax bracket at the federal level than you are at the state level.

The Seahawks had a tough loss this week. Read the Rapid Reactions: Seahawks Comeback Falls Short In Week 5 Loss for a recap of the game.

For instance, you could be in the 22% federal tax bracket but in the 5% state tax bracket.

Tax season is around the corner, and understanding the tax brackets for head of household in 2024 is crucial for accurate filing.

Income Tax Brackets for Head of Household in October 2024

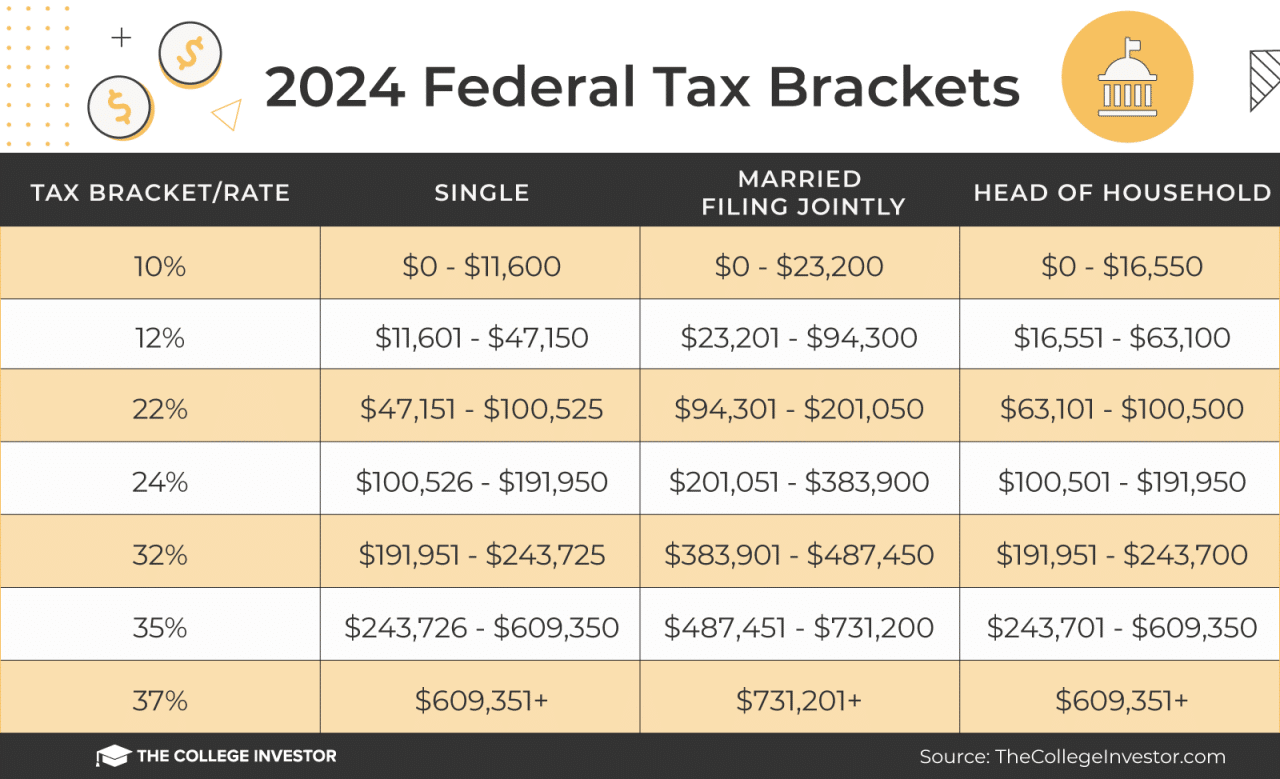

The income tax brackets for Head of Household filing status in October 2024 are based on the federal tax code and determine the percentage of your taxable income that you owe in taxes. The tax brackets are progressive, meaning that as your income increases, the percentage of your income taxed also increases.

Small businesses have specific contribution limits to consider. Check out the 401k contribution limits for 2024 for small businesses to ensure you’re maximizing your retirement savings.

Income Tax Brackets for Head of Household in October 2024

The income tax brackets for Head of Household in October 2024 are as follows:

| Income Range | Tax Rate |

|---|---|

$0

|

10% |

$10,276

|

12% |

| $41,776

The 401k contribution limits for 2024 by age vary, so it’s important to know what applies to you.

|

22% |

$89,076

|

24% |

| $170,051

It’s crucial to understand the penalties for exceeding IRA contribution limits to avoid any unexpected financial consequences.

|

32% |

$215,951

|

35% |

| $539,901+ | 37% |

Standard Deduction for Head of Household in October 2024, October 2024 income tax brackets for head of household

The standard deduction for Head of Household in October 2024 is $20,800. This means that you can deduct $20,800 from your taxable income before calculating your tax liability.

| Income Range | Standard Deduction |

|---|---|

| All Head of Household filers | $20,800 |

Personal Exemption for Head of Household in October 2024

The personal exemption for Head of Household in October 2024 is $0. This means that you cannot deduct any amount from your taxable income for yourself.

For those who rely on mileage deductions, it’s important to stay informed about any changes. The mileage rate for October 2024 may have been updated.

| Income Range | Personal Exemption |

|---|---|

| All Head of Household filers | $0 |

Child Tax Credit for Head of Household in October 2024

The Child Tax Credit for Head of Household in October 2024 is $2,000 per qualifying child. This means that you can deduct up to $2,000 from your tax liability for each qualifying child.

| Income Range | Child Tax Credit |

|---|---|

| All Head of Household filers | $2,000 per qualifying child |

Comparison of Income Tax Brackets for Different Filing Statuses

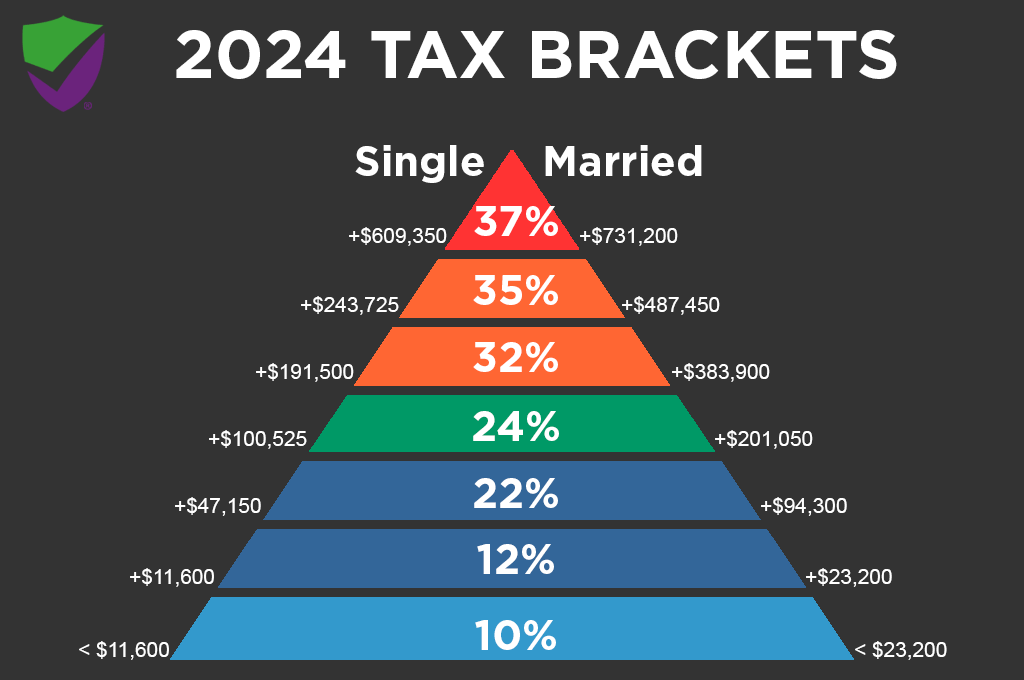

The income tax brackets for Head of Household are generally more favorable than the brackets for Single filers and less favorable than the brackets for Married Filing Jointly filers. The brackets for Married Filing Separately are generally the least favorable.

Impact of Potential Changes to Tax Laws or Economic Conditions

Changes to tax laws or economic conditions could potentially impact the income tax brackets for Head of Household in October 2024. For example, if Congress were to increase the standard deduction for Head of Household filers, this would result in a lower tax liability for many taxpayers.

Conversely, if Congress were to reduce the Child Tax Credit, this would increase the tax liability for many taxpayers with children. Additionally, changes in economic conditions, such as inflation, could also impact the income tax brackets. For example, if inflation were to rise significantly, this could lead to an increase in the income tax brackets to account for the decreased purchasing power of the dollar.

Tax Planning Considerations for Head of Household Filers

Tax planning can significantly impact your tax liability, especially for Head of Household filers who often have unique circumstances and deductions. By strategically planning your financial decisions, you can minimize your tax burden and maximize your financial well-being.

The 2024 tax bracket changes compared to 2023 could impact your tax liability, so it’s worth reviewing these updates.

Tax Planning Strategies

Here are some effective tax planning strategies for Head of Household filers:

- Maximize deductions: Identifying and utilizing all eligible deductions can significantly reduce your taxable income. Some common deductions for Head of Household filers include the standard deduction, mortgage interest, property taxes, charitable contributions, and medical expenses.

- Consider tax-advantaged savings accounts: Explore options like 401(k)s, traditional and Roth IRAs, and Health Savings Accounts (HSAs) to reduce your current tax liability and save for future expenses. Contributions to these accounts are often tax-deductible, and withdrawals in retirement are often tax-free.

- Review charitable contributions: Optimizing your charitable giving strategies can maximize your tax benefits. Consider donating appreciated assets like stocks or real estate to reduce your capital gains tax liability.

- Plan for estimated taxes: If you anticipate a significant income change or expect to owe more than $1,000 in taxes, make quarterly estimated tax payments to avoid penalties for underpayment.

Tax Credits and Their Impact

Tax credits directly reduce your tax liability, dollar-for-dollar. Several tax credits are available to Head of Household filers, including the Child Tax Credit, the Earned Income Tax Credit, and the American Opportunity Tax Credit. These credits can significantly reduce your tax burden, especially if you have children or a low to moderate income.

Planning for retirement? The 401k contribution limits for 2024 for self-employed have been announced, so it’s a good time to review your savings strategy.

Calculating Estimated Tax Payments

Follow these steps to calculate your estimated tax payments:

- Determine your expected income: Consider your salary, investments, and other income sources.

- Estimate your deductions and credits: Use the previous year’s tax return as a guide and adjust for any changes in your circumstances.

- Calculate your tax liability: Use the tax brackets for Head of Household filers to determine your tax liability based on your expected income, deductions, and credits.

- Divide your tax liability by four: This will give you your estimated quarterly tax payment.

- Make your payments: You can make your payments online, by mail, or through your tax preparer.

Remember to file Form 1040-ES, Estimated Tax for Individuals, to make your quarterly payments.

Resources for Head of Household Filers: October 2024 Income Tax Brackets For Head Of Household

Navigating the tax system as a head of household can be overwhelming, but there are numerous resources available to help you understand your obligations and ensure you file accurately. This section provides a comprehensive overview of valuable resources for head of household filers, encompassing both online platforms and professional services.

Wondering how much you can contribute to your 401k this year? The 401k contribution limit for 2024 is a significant factor in your retirement planning.

Online Resources

The internet offers a wealth of information and tools to assist you in your tax preparation journey. Here are some reliable online resources that can help you access tax information and filing requirements:

- IRS website:The official source for tax information, forms, and publications. The IRS website is a treasure trove of information, providing comprehensive guidance on various tax-related matters, including filing requirements, deductions, credits, and payment options. You can access a wide range of forms, publications, and other resources to help you understand your tax obligations and navigate the filing process effectively.

For those who need to track their mileage for business purposes, you’ll want to know when the mileage rate will be updated for October 2024.

- Tax preparation software:Options for filing taxes online or through desktop software. Tax preparation software has revolutionized the tax filing process, offering user-friendly interfaces and comprehensive features to guide you through the process. These software programs provide step-by-step instructions, automated calculations, and even tax optimization tools to help you maximize your refund or minimize your tax liability.

Popular options include TurboTax, H&R Block, and TaxAct.

- Tax professional websites:Websites of Certified Public Accountants (CPAs) and Enrolled Agents (EAs) offer valuable insights into tax planning and preparation. Tax professionals, such as CPAs and EAs, possess specialized knowledge and expertise in tax matters. Their websites often provide informative articles, blog posts, and other resources to help you understand complex tax concepts and make informed decisions.

For those over 50, you can contribute more to your 401k. The 401k contribution limits for 2024 for catch-up contributions are higher for older workers.

Tax Preparation Software and Services

Tax preparation software and services have become increasingly popular, offering convenience, accuracy, and cost-effectiveness.

- Online Tax Preparation Software:Online tax preparation software, such as TurboTax, H&R Block, and TaxAct, allows you to file your taxes electronically from the comfort of your home. These software programs provide step-by-step guidance, automated calculations, and even tax optimization tools to help you maximize your refund or minimize your tax liability.

- Desktop Tax Preparation Software:For those who prefer a more traditional approach, desktop tax preparation software is also available. These programs, such as TaxCut and TurboTax Deluxe, can be installed on your computer and allow you to file your taxes offline. They often offer similar features to online software, including comprehensive tax forms, calculations, and guidance.

For those looking to maximize their retirement savings, you might be curious about the catch-up contribution limit for Roth IRAs in 2024.

- Tax Preparation Services:If you prefer professional assistance, you can choose from a range of tax preparation services. These services, offered by CPAs, EAs, and other tax professionals, provide comprehensive tax preparation and advice. They can help you understand your tax obligations, identify deductions and credits, and file your taxes accurately and efficiently.

If you’re working with government agencies, you’ll need to be familiar with the W9 Form for October 2024. This form is essential for reporting your tax information.

Tax Professionals

Seeking professional guidance from a tax professional can be highly beneficial, especially if you have complex tax situations or require specialized advice.

| Resource | Description |

|---|---|

| IRS website | Official source for tax information, forms, and publications. |

| Tax preparation software | Options for filing taxes online or through desktop software. |

| Tax professionals | Certified Public Accountants (CPAs) and Enrolled Agents (EAs) provide tax advice and preparation services. |

Last Word

Filing as Head of Household comes with unique tax advantages, but navigating the complex world of tax brackets and deductions can be daunting. By understanding the intricacies of income tax brackets and exploring the available tax planning strategies, you can optimize your tax liability and maximize your financial well-being.

Remember, seeking professional guidance from a tax advisor can provide personalized insights and ensure you’re taking advantage of all applicable deductions and credits. Stay informed, plan wisely, and confidently navigate the tax landscape as a Head of Household filer.

Clarifying Questions

What are the key differences between Head of Household and Single filing status?

The Head of Household filing status generally offers lower tax rates and a higher standard deduction compared to Single filing status. This benefit is intended to support individuals who provide a home for qualifying children or dependents.

How do I qualify for Head of Household filing status?

To qualify, you must be unmarried and pay more than half the costs of keeping a home for a qualifying child or dependent. The child or dependent must live with you for more than half the year, and you must claim them as a dependent on your tax return.

Can I still claim the Child Tax Credit if I file as Head of Household?

Yes, you can claim the Child Tax Credit if you file as Head of Household and meet the eligibility requirements for the credit. The credit is worth up to $2,000 per qualifying child.