October 2024 Tax Rebate for Families with Children is a significant initiative aimed at providing financial relief and boosting economic well-being for families across the nation. This program offers a direct payment to eligible families, with the amount calculated based on the number of dependent children.

The objective is to alleviate financial strain, empower families to make essential purchases, and ultimately improve the lives of children.

A stimulus check in October 2024 could be a welcome boost for seniors. This article discusses the potential for a stimulus check for seniors in October 2024.

The rebate program is expected to have a wide-ranging impact on families, from providing much-needed financial support to influencing spending patterns and potentially even improving child development outcomes. It’s crucial to understand the eligibility criteria, application process, and potential benefits to fully grasp the significance of this program.

The possibility of a stimulus check in October 2024 is generating a lot of discussion. This article examines the current status of a potential stimulus check in October 2024.

Contents List

Overview of the October 2024 Tax Rebate

The October 2024 Tax Rebate is a government initiative designed to provide financial relief to families with children. The rebate aims to stimulate the economy, ease the financial burden on families, and enhance the well-being of children. This program is targeted towards families who meet specific eligibility criteria, providing them with a direct payment to help offset expenses related to raising children.

Navigating job hunting after a layoff can be stressful, but there are resources to help. This article provides a list of the best resources to find new jobs after layoffs in October 2024. It includes sites for job searching, career advice, and networking.

Eligibility Criteria

To qualify for the October 2024 Tax Rebate, families must meet the following criteria:

- Have at least one child under the age of 18 living in their household.

- Meet the income eligibility threshold, which is expected to be based on a specific income level or a combination of factors, including family size and income.

- Be a legal resident of the country where the program is implemented.

Amount of the Rebate

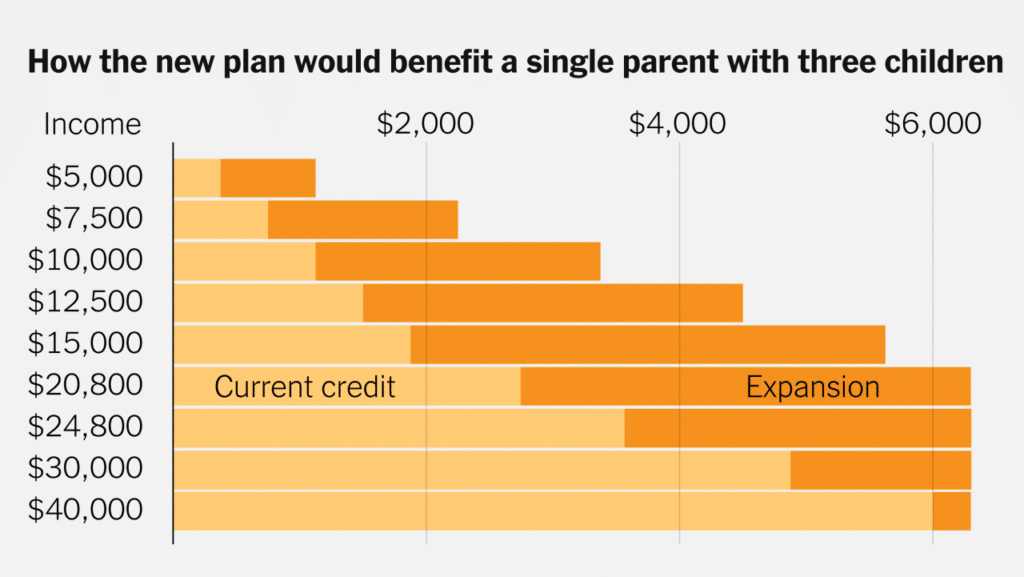

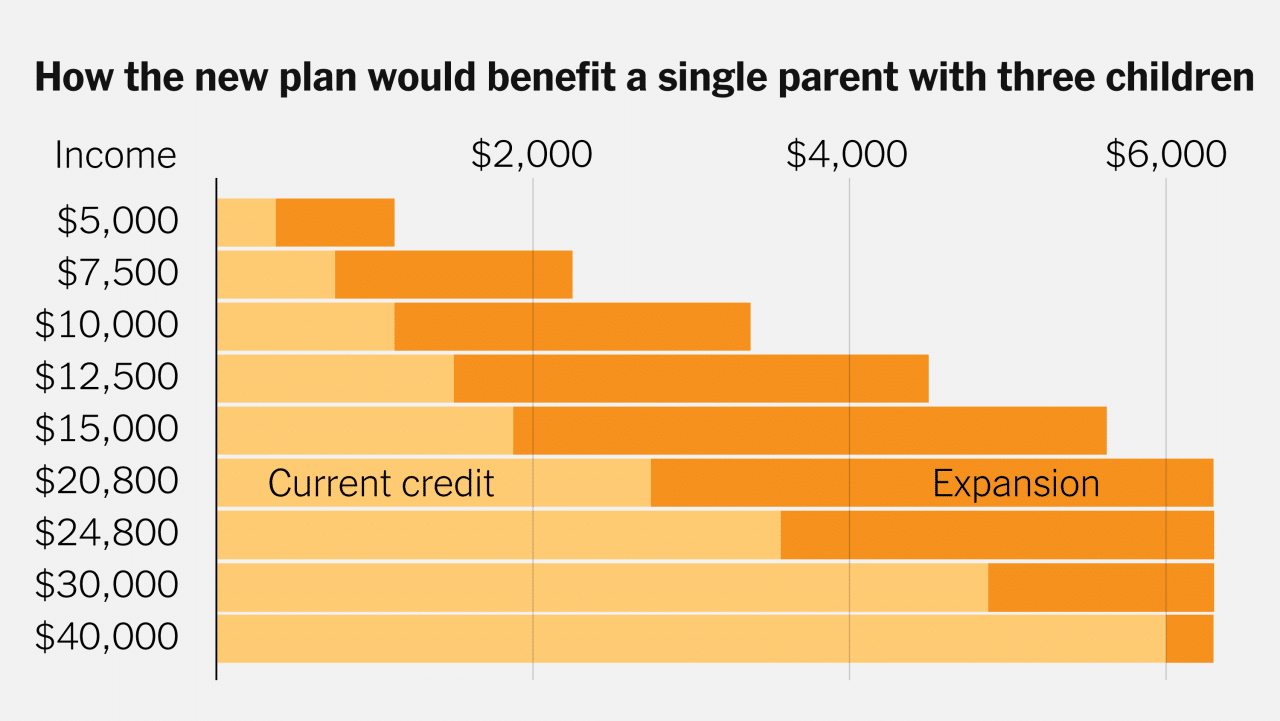

The amount of the tax rebate is expected to vary depending on the number of children in the household and the family’s income. It is likely to be calculated using a formula that takes into account these factors. For instance, a family with two children might receive a larger rebate than a family with one child, and families with lower incomes might receive a higher percentage of their income as a rebate.

Impact on Families with Children

The October 2024 Tax Rebate is intended to have a positive impact on families with children by providing them with additional financial resources. This could translate into several benefits:

Potential Economic Benefits

The rebate could provide families with extra money to cover essential expenses such as groceries, housing, and healthcare. This could alleviate financial stress and improve overall financial stability. For example, a family struggling to make ends meet might be able to use the rebate to pay off debt, save for future expenses, or invest in their children’s education.

Influence on Family Spending and Saving Habits

The rebate could influence family spending and saving habits. Families might choose to spend the rebate on goods and services, contributing to economic growth. Alternatively, they might decide to save the money for future expenses or invest it for their children’s education or future financial security.

Government policies surrounding layoffs can vary depending on the circumstances. This article covers the government policies related to layoffs in October 2024, including unemployment benefits and potential support programs.

Effects on Child Well-being and Development

The rebate could indirectly benefit children by improving their overall well-being and development. Increased family income could lead to better nutrition, healthcare, and access to educational opportunities. For example, a family might be able to afford to enroll their child in a music program or provide them with extracurricular activities that enhance their development.

Economic policy discussions are always evolving. This article covers the alternative economic policies being considered for October 2024, which may include a stimulus check.

Program Implementation and Administration

The successful implementation of the October 2024 Tax Rebate program requires careful planning and execution. Several key aspects need to be considered:

Application Process

The application process for the rebate should be straightforward and accessible to all eligible families. This could involve an online application portal, a paper-based application, or a combination of both. The process should be designed to minimize paperwork and ensure that families can easily apply and receive their rebate.

The potential for a stimulus check in October 2024 is a hot topic, but the current economic climate is uncertain. This article explains the possible impact of a stimulus check on inflation.

Potential Challenges

Implementing the program efficiently can pose challenges. Ensuring accurate eligibility verification, preventing fraud, and managing the distribution of rebates to millions of families can be complex tasks. The program administrators need to develop robust systems and procedures to address these challenges.

Knowing who is eligible for stimulus payments is important. This article outlines the potential eligibility requirements for stimulus payments in October 2024.

Potential for Fraud or Abuse

Any program involving financial assistance is susceptible to fraud or abuse. To mitigate these risks, the program should incorporate strong anti-fraud measures, such as identity verification, income verification, and monitoring for suspicious applications. Regular audits and investigations can also help detect and deter fraud.

The Federal Reserve’s role in economic policy is crucial. This article discusses whether the Federal Reserve will play a role in any potential stimulus measures in October 2024.

Economic and Social Implications: October 2024 Tax Rebate For Families With Children

The October 2024 Tax Rebate is expected to have broader economic and social implications. These implications are important to consider to assess the program’s overall impact.

The possibility of a stimulus check in October 2024 is sparking conversations about how it could benefit families. This article explores the potential impact of a stimulus check on families.

Impact on the Overall Economy, October 2024 Tax Rebate for Families with Children

The rebate could stimulate the economy by increasing consumer spending. Families receiving the rebate might spend a portion of the money on goods and services, boosting demand and supporting businesses. However, the extent of this economic impact will depend on how families choose to use the rebate and the overall state of the economy.

Tax rebates often focus on helping low-income families. This article examines the potential for a tax rebate targeted specifically towards low-income families in October 2024.

Social Implications

The rebate could have social implications, such as its impact on income inequality. By providing financial assistance to families with children, the program could help reduce poverty and inequality. However, the design of the program and its eligibility criteria will influence its effectiveness in addressing these issues.

Layoffs can impact the stock market in various ways. This article explores the potential impact of layoffs in October 2024 on the stock market.

Comparison to Similar Programs

The October 2024 Tax Rebate can be compared to similar programs implemented in the past to assess its potential effectiveness and learn from previous experiences. For example, examining the impact of previous tax rebates or child tax credits can provide insights into the potential benefits and challenges of the current program.

If a tax rebate is being considered, understanding the eligibility requirements is essential. This article outlines the potential eligibility requirements for a tax rebate in October 2024.

Alternative Policy Options

In addition to the October 2024 Tax Rebate, there are alternative policy options for supporting families with children. These options offer different approaches and could be considered alongside or instead of the tax rebate program.

A stimulus check can have significant political implications. This article analyzes the potential political implications of a stimulus in October 2024.

Alternative Policy Options

- Expanded Child Tax Credit:A more generous and permanent child tax credit could provide families with ongoing financial support, rather than a one-time rebate.

- Universal Basic Income:A universal basic income program could provide a regular cash payment to all families, regardless of income, potentially reducing poverty and supporting child development.

- Affordable Housing Programs:Increasing access to affordable housing could help families save money on housing costs and free up resources for other essential needs.

- Early Childhood Education Programs:Investing in high-quality early childhood education programs could benefit children’s development and improve their future economic prospects.

Benefits and Drawbacks of Alternative Policies

Each alternative policy option has its own benefits and drawbacks. For example, an expanded child tax credit could provide more targeted support to families with children, but it might not address the needs of families struggling with housing costs or lack of access to quality childcare.

A universal basic income program could provide a safety net for all families, but it might be expensive to implement and could disincentivize work.

Potential Improvements to the October 2024 Tax Rebate

The October 2024 Tax Rebate program could be improved by considering the following:

- Simplifying the application process:Streamlining the application process and making it more accessible to all eligible families could increase participation and ensure that families receive the benefits they deserve.

- Increasing the amount of the rebate:A larger rebate could provide families with more significant financial relief and have a greater impact on their well-being.

- Making the program more permanent:A permanent tax rebate program could provide families with ongoing financial support and reduce uncertainty about future income.

- Addressing income inequality:The program could be designed to provide greater support to families with lower incomes, helping to reduce income inequality and ensure that the benefits are targeted towards those who need them most.

Final Review

The October 2024 Tax Rebate for Families with Children represents a significant step towards supporting families and fostering a brighter future for children. While the program offers numerous benefits, it’s essential to address potential challenges and ensure its effective implementation.

By carefully evaluating the program’s impact and considering alternative policy options, we can refine and strengthen our efforts to support families and promote economic prosperity for all.

Losing a job due to layoffs can be a challenging experience, but there are ways to cope. This article offers tips and resources for coping with job loss due to layoffs in October 2024.

Essential FAQs

What are the eligibility requirements for the October 2024 Tax Rebate?

Eligibility criteria typically include factors like income level, residency status, and the number of dependent children. Specific details can be found on the official government website or through relevant resources.

October 2024 is shaping up to be a pivotal month in the economy, and layoffs are a key indicator. The trends in layoffs will give us insight into the overall health of the economy.

How can I apply for the October 2024 Tax Rebate?

The application process usually involves filing a tax return or accessing a dedicated online portal. The exact process will be communicated through official channels.

When will the October 2024 Tax Rebate payments be distributed?

The payment schedule will be announced by the government and may vary depending on the chosen distribution method.

What are the potential drawbacks of the October 2024 Tax Rebate?

Potential drawbacks could include potential for fraud or abuse, administrative challenges, and unintended consequences on the economy.