October 2024 Tax Rebate for Homeowners: This program aims to provide financial relief to homeowners, potentially boosting the housing market and promoting affordability. The rebate is intended to help homeowners manage rising housing costs and contribute to economic stability.

The application process for the October 2024 stimulus check is likely to be streamlined and accessible to eligible individuals. October 2024 stimulus check application process The government may utilize existing systems or create new platforms to ensure a smooth and efficient application process.

The program offers a significant opportunity for homeowners to receive financial assistance, potentially offsetting expenses related to property taxes, mortgage payments, or home improvements. The rebate is designed to be accessible to a wide range of homeowners, with eligibility criteria focusing on income levels and property value.

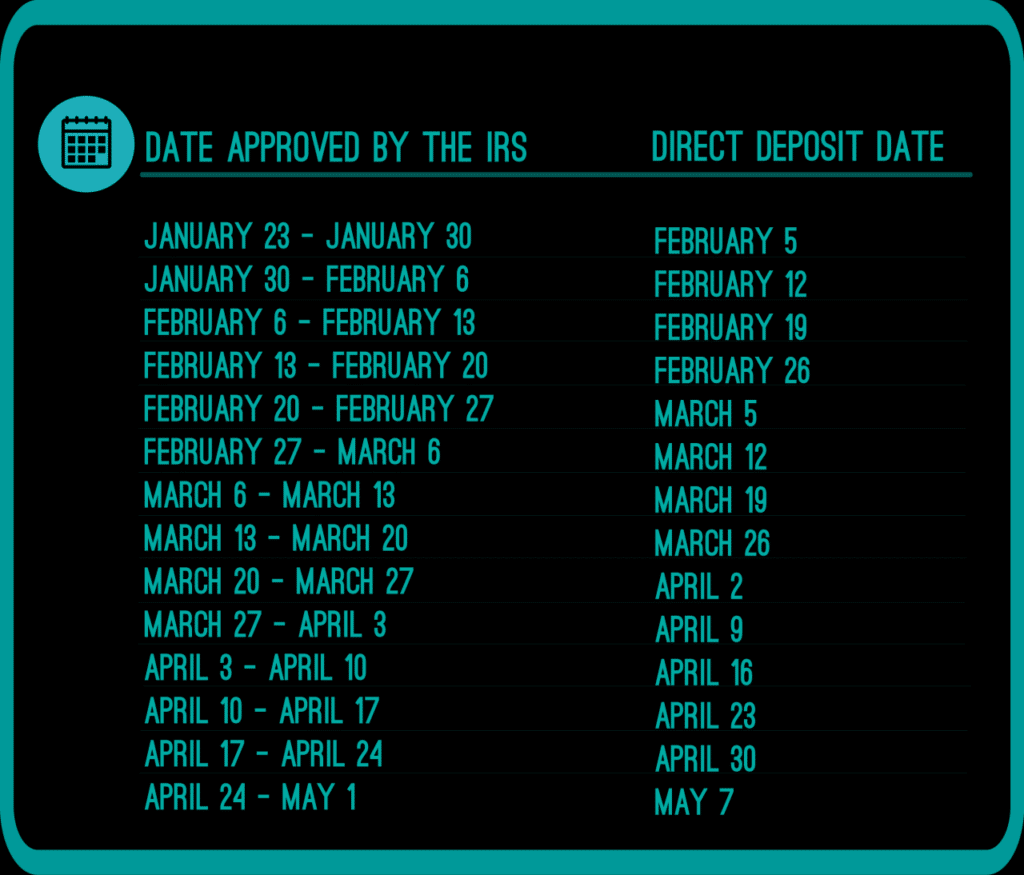

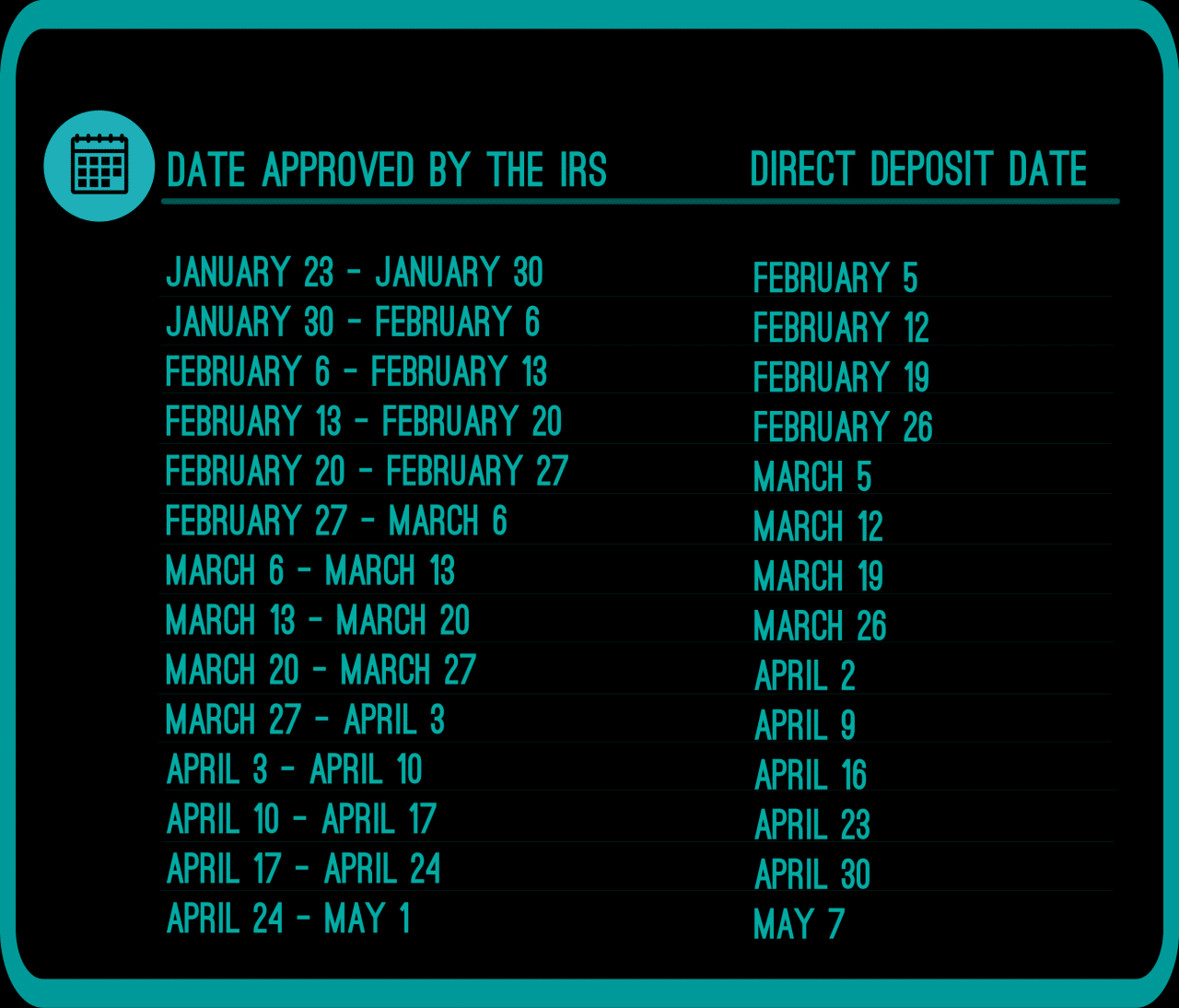

The methods for distributing the October 2024 stimulus check are likely to be similar to previous rounds of payments. October 2024 stimulus check payment methods This could include direct deposit, paper checks, or prepaid debit cards.

Contents List

- 1 October 2024 Tax Rebate for Homeowners

- 1.1 Overview of the October 2024 Tax Rebate

- 1.2 Eligibility Criteria for the Tax Rebate

- 1.3 Amount and Structure of the Rebate

- 1.4 Application and Claim Process

- 1.5 Impact and Potential Benefits of the Rebate

- 1.6 Potential Challenges and Considerations, October 2024 Tax Rebate for Homeowners

- 1.7 Comparisons with Similar Programs

- 1.8 Future Outlook and Sustainability

- 2 Final Review

- 3 Essential FAQs: October 2024 Tax Rebate For Homeowners

October 2024 Tax Rebate for Homeowners

The October 2024 Tax Rebate for Homeowners is a government initiative designed to provide financial assistance to homeowners, aiming to ease the burden of homeownership costs and stimulate the housing market.

Layoffs can have a significant impact on the stock market, particularly if they are widespread or occur in major industries. How do layoffs in October 2024 affect the stock market? Investors may react negatively to news of layoffs, as it can signal a decline in economic activity and corporate earnings.

Overview of the October 2024 Tax Rebate

The October 2024 Tax Rebate for Homeowners is a government program that offers a direct financial reimbursement to eligible homeowners. The rebate aims to alleviate financial pressures associated with homeownership, including property taxes, mortgage payments, and maintenance costs. The primary beneficiaries of this rebate program are homeowners residing within the designated geographical area.

There is speculation about a potential tax rebate for students in October 2024. October 2024 Tax Rebate for Students However, the details and eligibility criteria for such a rebate are still unknown.

The program targets individuals and families who have experienced significant financial hardship due to rising housing costs, economic downturns, or other unforeseen circumstances. The program’s objective is to provide much-needed financial relief to homeowners, enhancing their ability to maintain their homes, improve living standards, and contribute to the overall stability of the housing market.

Layoffs in October 2024 could be driven by a variety of factors, including economic downturns, technological advancements, and company restructuring. What are the reasons for layoffs in October 2024? Understanding these reasons can help us better understand the potential impact on the economy and individual workers.

Eligibility Criteria for the Tax Rebate

To qualify for the October 2024 Tax Rebate, homeowners must meet specific eligibility criteria. These criteria are designed to ensure that the program effectively targets individuals and families who require financial assistance.

Layoffs can have a significant impact on the economy, particularly in key industries. What are the economic implications of layoffs in October 2024? They can lead to decreased consumer spending, reduced productivity, and increased unemployment, which can create a ripple effect throughout the economy.

- Residency:Homeowners must be permanent residents of the designated geographical area where the program is implemented. This may include specific counties, states, or regions.

- Property Ownership:Applicants must be the legal owners of the property for which they are seeking the rebate. This includes sole ownership, joint ownership, or ownership through a trust or estate.

- Income Restrictions:There may be income restrictions imposed on eligible homeowners. This could involve setting a maximum annual income threshold or defining specific income brackets that qualify for the rebate.

- Property Value Limitations:The program may also have limitations on the assessed value of the property. This ensures that the rebate targets homeowners with modest or middle-income properties, preventing individuals with high-value properties from benefiting disproportionately.

Homeowners can verify their eligibility by visiting the designated website or contacting the relevant government agency. The application process typically involves submitting a completed application form, along with supporting documentation, such as proof of residency, property ownership, and income.

The Federal Reserve’s role in any stimulus measures in October 2024 is uncertain. Will the Federal Reserve play a role in any stimulus measures in October 2024? The Fed may choose to support the economy through monetary policy tools, such as interest rate adjustments or asset purchases, in conjunction with any fiscal stimulus measures.

Amount and Structure of the Rebate

The maximum rebate amount available to eligible homeowners is determined by factors such as the property’s assessed value, the homeowner’s income, and the program’s specific guidelines. The rebate amount may be calculated using a formula that considers these factors, ensuring a fair and equitable distribution of funds.

Stay up-to-date on the latest news and developments regarding the October 2024 stimulus check. October 2024 stimulus check news updates Official announcements and updates will be released by government agencies and news outlets.

- Maximum Rebate Amount:The maximum rebate amount may vary depending on the program’s specific parameters. It could range from a fixed amount to a percentage of the property’s assessed value or a certain portion of the homeowner’s annual income.

- Rebate Calculation Formula:The rebate amount may be calculated based on a formula that considers the homeowner’s income, property value, and other relevant factors. The formula aims to ensure a fair distribution of funds, providing greater assistance to those with lower incomes and lower property values.

The potential impact of a stimulus on the economy in October 2024 is a complex issue with many factors at play. How will the stimulus affect the economy in October 2024? While it could provide a much-needed boost to consumer spending, concerns remain about its long-term effects on inflation and the overall health of the economy.

- Limitations or Caps:There may be limitations or caps on the total rebate amount per household. This ensures that the program’s resources are distributed effectively and prevents individuals from receiving an excessive amount of financial assistance.

Application and Claim Process

Homeowners interested in applying for the October 2024 Tax Rebate can access the application process through the designated website or by contacting the relevant government agency.

Inflation is a key factor that will influence the possibility of a stimulus package in October 2024. How will inflation impact the potential for a stimulus in October 2024? If inflation remains high, policymakers may be hesitant to implement a stimulus, as it could further exacerbate price increases.

- Application Form:Homeowners must complete an application form, providing accurate information about their residency, property ownership, income, and other relevant details.

- Supporting Documentation:To support their application, homeowners must submit necessary documentation, such as proof of residency, property ownership, income verification, and other relevant documents.

- Submission Channels:Applications can be submitted through designated channels, such as online portals, mail, or in-person at designated locations.

- Updates and Communication:Homeowners can receive updates on the status of their applications through the designated website, email, or phone. The program’s administrators will communicate with applicants throughout the process.

Impact and Potential Benefits of the Rebate

The October 2024 Tax Rebate is expected to have a positive impact on homeowners and the housing market.

Rumors are circulating about a potential stimulus check for seniors in October 2024. October 2024 stimulus check for seniors While there’s no official confirmation yet, it’s a topic that many seniors are eager to learn more about.

- Economic Impact:The rebate is anticipated to provide a much-needed financial boost to homeowners, enabling them to meet their homeownership expenses and stimulate spending in the local economy.

- Increased Homeownership Rates:The rebate program could potentially increase homeownership rates by making homeownership more affordable for individuals and families who may have previously been unable to afford it.

- Housing Affordability:By providing financial assistance to homeowners, the rebate program could help to stabilize housing prices and increase affordability for both current and prospective homeowners.

- Local Community Benefits:The rebate program could benefit local communities by fostering economic growth, reducing housing instability, and improving the overall quality of life for residents.

Potential Challenges and Considerations, October 2024 Tax Rebate for Homeowners

While the October 2024 Tax Rebate aims to address challenges related to homeownership affordability, it is important to consider potential challenges and limitations.

The exact timing of the October 2024 stimulus check remains uncertain. When will the October 2024 stimulus check be sent However, if it’s approved, the government will likely aim for a quick distribution to provide immediate relief to those who need it.

- Program Implementation:Implementing a large-scale rebate program can be complex and require careful planning and coordination to ensure efficient distribution of funds and minimize administrative burdens.

- Fairness and Equity:It is essential to ensure that the program’s eligibility criteria are fair and equitable, preventing unintended consequences or disproportionate benefits to certain groups.

- Potential for Abuse:The program’s administrators must establish robust safeguards to prevent potential abuse or fraud, ensuring that the rebate is used for its intended purpose.

- Unforeseen Impacts:It is important to consider potential unintended consequences of the program, such as potential increases in housing prices or changes in housing market dynamics.

Comparisons with Similar Programs

The October 2024 Tax Rebate shares similarities with existing or past homeowner assistance programs, such as property tax relief programs, mortgage assistance programs, and home improvement grants.

Identifying which companies are most likely to lay off employees in October 2024 is a challenging task. Which companies are most likely to lay off employees in October 2024? However, factors like industry performance, economic conditions, and company-specific challenges can provide some insights into potential layoff trends.

- Eligibility Criteria:Similar programs may have different eligibility criteria, including income restrictions, property value limitations, and residency requirements.

- Rebate Amounts:The amount of financial assistance provided by similar programs may vary depending on the program’s objectives, funding levels, and specific guidelines.

- Program Structures:The structure of similar programs may differ, including the methods for application, disbursement of funds, and program administration.

By comparing the October 2024 Tax Rebate to existing or past programs, policymakers can identify best practices, address potential shortcomings, and refine the program’s design to maximize its effectiveness and achieve its intended outcomes.

Future Outlook and Sustainability

The long-term sustainability of the October 2024 Tax Rebate program will depend on factors such as its effectiveness, funding levels, and political support.

The potential impact of a stimulus check on inflation in October 2024 is a subject of ongoing debate. October 2024 stimulus check and inflation Some argue that it could fuel further inflation, while others believe it would provide much-needed relief to consumers struggling with rising prices.

- Program Effectiveness:The program’s effectiveness in achieving its objectives, such as increasing homeownership rates, reducing housing costs, and stimulating economic growth, will be a key factor in determining its future.

- Funding Levels:The program’s sustainability will also depend on ongoing funding levels. The government must allocate sufficient resources to ensure that the program can continue to provide financial assistance to eligible homeowners.

- Future Housing Policy:The October 2024 Tax Rebate program may influence future housing policy initiatives, leading to the development of new programs or modifications to existing programs aimed at improving housing affordability and stability.

The program’s effectiveness and public support will ultimately determine its future. Based on its impact, policymakers may consider modifications or adjustments to the program, ensuring that it remains relevant and responsive to evolving housing market conditions and the needs of homeowners.

Final Review

The October 2024 Tax Rebate for Homeowners represents a crucial step towards supporting homeowners and fostering a healthy housing market. The program’s impact will be closely watched, with potential benefits extending beyond individual homeowners to the broader economy. As the program unfolds, its effectiveness and long-term sustainability will be assessed, informing future housing policy and affordability initiatives.

Essential FAQs: October 2024 Tax Rebate For Homeowners

What is the deadline to apply for the October 2024 Tax Rebate?

The application deadline is typically stated on the official program website or application materials. It’s essential to check for the deadline to ensure timely submission.

Can I receive the rebate if I’m renting my home?

No, the rebate is specifically designed for homeowners. It is not applicable to renters.

What happens if I don’t meet the eligibility requirements?

If you don’t meet the eligibility criteria, you will not be eligible for the rebate. It’s crucial to carefully review the eligibility requirements before applying.

How can I get updates on the October 2024 Tax Rebate program?

You can stay updated by visiting the official program website or subscribing to relevant newsletters or announcements.

While a stimulus package can provide short-term economic relief, it’s important to consider the potential drawbacks. What are the potential drawbacks of a stimulus in October 2024? These can include increased inflation, dependence on government handouts, and potential long-term economic consequences.