October Extension Tax Deadline 2024: A Guide to Filing for More Time – The annual tax filing season in the United States can be a stressful time for many individuals and businesses. The Internal Revenue Service (IRS) offers a valuable option for those who need extra time to prepare their returns: the October extension.

This extension allows taxpayers to delay filing their taxes until October 15th, providing a much-needed reprieve from the usual April deadline.

This guide explores the ins and outs of the October extension, delving into its eligibility criteria, benefits, drawbacks, and the process of filing for an extension. We’ll also discuss common mistakes to avoid, strategic tax planning tips, and the impact of recent tax legislation on the extension deadline.

Whether you’re an individual, a small business owner, or a financial professional, understanding the October extension can be crucial for navigating the complexities of the tax system and ensuring a smooth filing experience.

Contents List

- 1 Overview of the October Extension Tax Deadline

- 2 Eligibility for the Extension

- 3 Benefits and Drawbacks of Filing for an Extension

- 4 Filing for an Extension

- 5 Tax Obligations After Filing for an Extension

- 6 Common Mistakes to Avoid When Filing for an Extension

- 7 7. Impact of the October Extension on Tax Planning

- 8 Resources for Taxpayers

- 9 Tax Filing Tips and Strategies

- 10 Tax Penalties and Interest

- 11 Tax Filing Options and Methods

- 12 Impact of Recent Tax Legislation

- 13 Future Outlook for the October Extension Deadline

- 14 Conclusive Thoughts: October Extension Tax Deadline 2024

- 15 Questions Often Asked

Overview of the October Extension Tax Deadline

The October extension deadline for federal income taxes is a crucial aspect of the US tax system, providing taxpayers with additional time to file their returns. This deadline allows individuals and businesses to avoid penalties for late filing, while still meeting their tax obligations.The October extension deadline has been a feature of the US tax system for many years.

It was initially established to provide flexibility for taxpayers who needed more time to gather their financial information and complete their tax returns. Over time, the extension deadline has evolved to reflect changes in tax laws and regulations, as well as economic conditions.

Key Dates and Deadlines

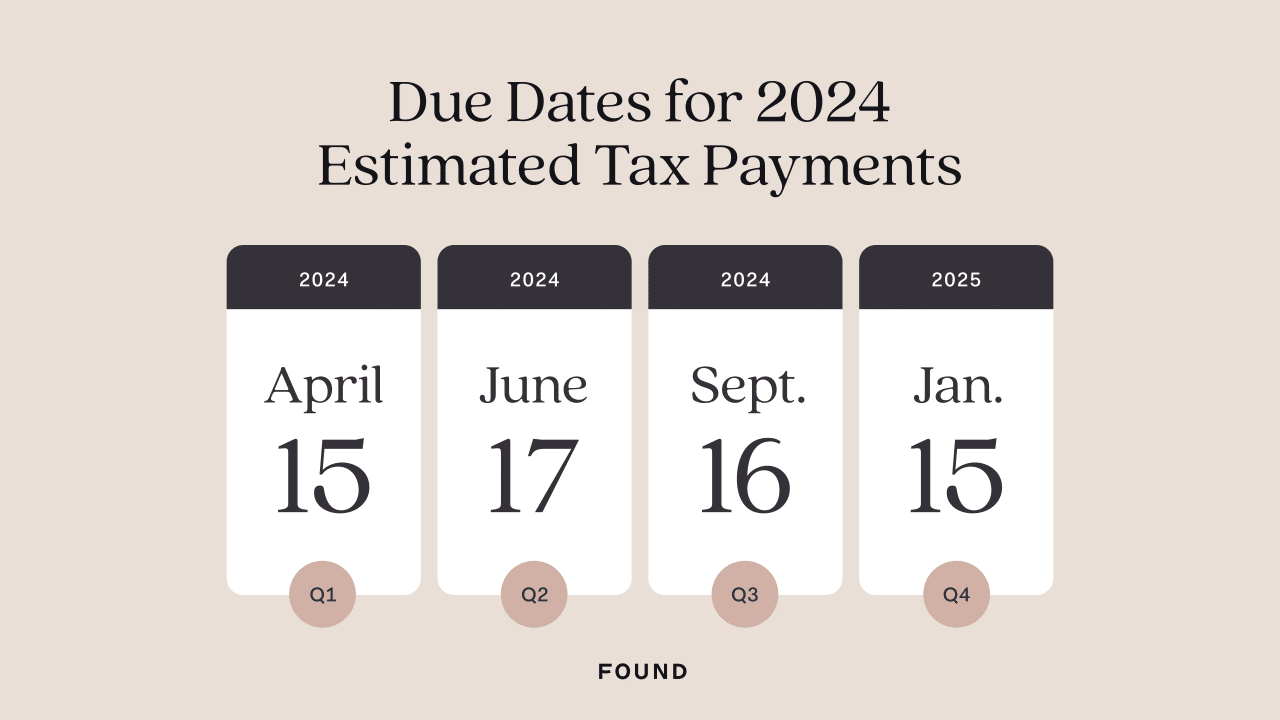

The October extension deadline is typically set for October 15th, although this date can vary depending on the year. The Internal Revenue Service (IRS) publishes a calendar of key tax dates and deadlines each year. Here are some of the key dates related to the October extension deadline:

- April 15th: The standard deadline for filing federal income tax returns.

- October 15th: The deadline for filing for an extension to file your federal income tax return.

- April 15th of the following year: The deadline for paying any taxes owed, even if you filed for an extension.

It’s important to note that filing for an extension only extends the deadline for filing your tax return, not the deadline for paying any taxes owed. If you owe taxes, you must still pay them by April 15th of the following year, even if you filed for an extension.

Eligibility for the Extension

To understand who can benefit from the October extension, it’s essential to examine the specific criteria individuals and businesses must meet. This section Artikels the eligibility requirements for both groups.

Eligibility for Individuals

Individuals seeking an extension must meet certain criteria to be eligible. These criteria ensure that the extension is granted only to those who genuinely need additional time to file their taxes.

- The individual must be a U.S. citizen or resident alien.

- The individual must have a valid Social Security number or Individual Taxpayer Identification Number (ITIN).

- The individual must have filed their previous year’s tax return on time.

- The individual must owe taxes, not a refund.

Common situations where an individual taxpayer might be granted an extension are summarized below:

| Situation | Explanation of Eligibility |

|---|---|

| Missing tax documents | If a taxpayer is missing essential documents, such as W-2 forms or 1099 forms, they may need an extension to gather the necessary information. |

| Complex tax situation | Individuals with complex tax situations, such as those with foreign income or significant investments, may require additional time to prepare their returns. |

| Recent life changes | Major life changes, such as marriage, divorce, or the birth of a child, can complicate tax filings and necessitate an extension. |

The most common reasons individuals request an extension are due to delays in receiving tax documents, the complexity of their tax situation, or significant life changes that require additional time to gather information and prepare their returns.

Eligibility for Businesses

Businesses seeking an extension must also meet specific eligibility criteria. These criteria ensure that the extension is granted only to businesses that genuinely need additional time to file their taxes.

- The business must be registered with the IRS.

- The business must have a valid Employer Identification Number (EIN).

- The business must have filed its previous year’s tax return on time.

- The business must owe taxes, not a refund.

The eligibility requirements for different business structures are summarized below:

| Business Type | Eligibility Criteria |

|---|---|

| Sole Proprietorship | The individual owner must meet the eligibility criteria for individuals, as the business is not a separate legal entity. |

| Partnership | Each partner must meet the eligibility criteria for individuals, as the partnership is not a separate legal entity. |

| Corporation | The corporation must meet the eligibility criteria for businesses, as it is a separate legal entity. |

A business may be denied an extension if it fails to meet the eligibility criteria, or if the IRS determines that the business is not genuinely seeking additional time to file its taxes. For example, a business that has consistently filed its taxes late or that has a history of tax fraud may be denied an extension.

Key Differences in Eligibility

While both individuals and businesses must meet certain general criteria to be eligible for the October extension, there are some key differences. Individuals must meet the eligibility criteria as individuals, while businesses must meet the criteria as a separate legal entity.

Additionally, businesses may face additional scrutiny from the IRS regarding their eligibility, especially if they have a history of tax noncompliance.

Common Questions about Eligibility

Individuals and businesses often have questions about their eligibility for the October extension. Here are some common questions and their answers:

- Question:Can I file for an extension if I owe taxes but haven’t filed my previous year’s return on time? Answer:No, you must have filed your previous year’s return on time to be eligible for an extension.

- Question:Can I file for an extension if I am expecting a refund? Answer:No, you can only file for an extension if you owe taxes.

- Question:Can I file for an extension if I am a non-resident alien? Answer:It depends on your specific circumstances. Consult with a tax professional to determine your eligibility.

Benefits and Drawbacks of Filing for an Extension

Requesting an extension to file your taxes can be a helpful tool, but it’s crucial to understand both the advantages and potential drawbacks. While an extension grants you extra time to gather necessary documents and complete your return, it doesn’t extend the deadline for paying your taxes.

Advantages of Filing for an Extension

Filing for an extension provides additional time for preparing your taxes, allowing you to gather all necessary documents, review your financial records, and ensure accuracy. This can be especially beneficial for individuals with complex tax situations, such as self-employed individuals or those with multiple income sources.

Disadvantages of Filing for an Extension

While an extension gives you more time to prepare your return, it doesn’t extend the deadline for paying your taxes. If you owe taxes, you’re still required to pay them by the original due date, even if you’ve filed for an extension.

Failure to do so can result in penalties for late payment.

Comparison of Filing for an Extension and Paying Estimated Taxes

Filing for an extension provides additional time to prepare your return, but it doesn’t eliminate the need to pay taxes on time. Paying estimated taxes, on the other hand, involves making quarterly payments throughout the year, ensuring you’re staying current with your tax obligations.

Estimated taxes are often a better option than filing for an extension if you anticipate owing a significant amount of taxes.

While filing for an extension allows you to avoid penalties for late filing, it doesn’t exempt you from penalties for late payment. Paying estimated taxes ensures you’re meeting your tax obligations throughout the year, minimizing the risk of penalties.

Filing for an Extension

Requesting an extension for your tax return provides you with additional time to gather necessary documents, complete your tax calculations, and ensure accuracy. This is especially beneficial for individuals facing complex tax situations, self-employed individuals, or those with significant income or deductions.

Steps to File for an Extension

The process of filing for an extension is relatively straightforward. Here’s a breakdown of the essential steps involved:

- Complete Form 4868:The primary form for requesting an extension is Form 4868, “Application for Automatic Extension of Time to File U.S. Individual Income Tax Return.” This form allows you to extend the filing deadline for your tax return but not the payment deadline.

- Gather Necessary Information:Before filling out Form 4868, gather the following information:

- Your Social Security number or ITIN

- Your filing status (single, married filing jointly, etc.)

- Your estimated tax liability

- Your address and contact information

- File Form 4868 by the Original Deadline:The extension request must be filed by the original tax deadline, which is typically April 15th for most individuals. You can file Form 4868 electronically through tax preparation software, online tax services, or by mail.

- Pay Estimated Taxes:While an extension grants you additional time to file your return, it does not extend the payment deadline. You are still required to pay your estimated tax liability by the original tax deadline. Failure to do so could result in penalties.

- File Your Completed Return by the Extended Deadline:You will have until October 15th to file your completed tax return, including all supporting documentation. However, the tax payment is still due by the original deadline.

Tips for Completing the Extension Form

- Review the Instructions:Carefully read the instructions provided with Form 4868. This will ensure you understand the requirements and complete the form correctly.

- Double-Check for Accuracy:Before submitting your extension request, review the information you have provided to ensure accuracy. Errors on the form could delay processing or result in additional correspondence from the IRS.

- Keep a Copy for Your Records:Retain a copy of your completed Form 4868 for your records. This will help you track the status of your extension request and ensure you file your completed tax return by the extended deadline.

Resources and Websites

Taxpayers can access Form 4868 and instructions from various sources:

- IRS Website:The official website of the Internal Revenue Service (IRS) provides downloadable versions of Form 4868 and accompanying instructions.

- Tax Preparation Software:Many tax preparation software programs allow you to electronically file Form 4868 directly from their platform.

- Online Tax Services:Online tax services also offer the option to file for an extension electronically.

Tax Obligations After Filing for an Extension

Filing for an extension gives you more time to gather your financial records and prepare your tax return, but it doesn’t relieve you of your tax obligations. You still need to pay your taxes by the original deadline, even if you file an extension.You remain responsible for paying your taxes on time, even if you’ve filed for an extension.

Paying Estimated Taxes

If you’re self-employed or have income from sources other than wages, you’re likely required to pay estimated taxes throughout the year. This is done through quarterly payments. Even if you’ve filed for an extension, you’re still responsible for making these estimated tax payments.

Failure to do so can result in penalties.

Potential Penalties

The IRS can impose penalties for late payment of taxes, even if you’ve filed for an extension. The penalty for late payment is typically 0.5% of the unpaid taxes for each month or part of a month that the taxes are late, up to a maximum of 25%.

The penalty can be reduced or waived if you can demonstrate reasonable cause for the late payment.

October is here, and with it comes a new month to plan for. Check out the October 2023 calendar to see what days are important, and don’t forget to look into October’s best lease deals if you’re considering a new car.

Consequences of Failing to File by the Extended Deadline

Even though you’ve filed for an extension, you must still file your actual tax return by the extended deadline. If you fail to do so, you’ll be subject to penalties. These penalties can be significant and may include:

- A penalty for failure to file, which is typically 5% of the unpaid taxes for each month or part of a month that the return is late, up to a maximum of 25%.

- A penalty for failure to pay, which is typically 0.5% of the unpaid taxes for each month or part of a month that the taxes are late, up to a maximum of 25%.

It’s important to note that the penalties for failure to file and failure to pay can be combined, meaning you could be assessed a total penalty of up to 30% of the unpaid taxes.

Common Mistakes to Avoid When Filing for an Extension

Filing for an extension can be a lifesaver when you need more time to prepare your tax return. However, even a simple process like this can be fraught with potential pitfalls. Many taxpayers make common mistakes that can lead to penalties, interest charges, or delays in processing their extension request.

To ensure a smooth and hassle-free experience, it’s crucial to be aware of these common errors and take steps to avoid them.

Common Mistakes When Filing for an Extension

Many taxpayers make common mistakes when filing for an extension. These mistakes can lead to penalties, interest charges, or delays in processing the extension request. Here are some of the most common mistakes to avoid:

| Mistake | Description | Example |

|---|---|---|

| Not Filing Form 4868 | Failing to file the official extension form, Form 4868, is a critical error. This form is the only way to officially request an extension from the IRS. | A taxpayer simply assuming that paying estimated taxes on time is enough for an extension, without filing Form 4868. |

| Missing the Deadline | While the extension deadline is October 15th, failing to file Form 4868 by this deadline will negate the extension. | A taxpayer mistakenly believing that the extension deadline is November 15th and missing the October 15th deadline. |

| Incomplete Information | Form 4868 requires essential information like your name, Social Security number, and the amount of tax you estimate you owe. Missing or incorrect information can lead to delays. | A taxpayer forgetting to include their Social Security number on Form 4868. |

| Not Paying Estimated Taxes | An extension grants you more time to file your return, but it doesn’t excuse you from paying your taxes. Failing to pay estimated taxes by the original deadline can lead to penalties. | A taxpayer assuming that the extension automatically covers all tax payments, neglecting to pay estimated taxes. |

| Ignoring the Extension Period | While the extension allows you more time to file, it’s crucial to remember that you still have to file your return by the extended deadline, which is typically April 15th of the following year. | A taxpayer forgetting about the extended deadline and missing it, thinking they have until the following October. |

Avoiding Common Mistakes

Here’s how to avoid these common mistakes:

- File Form 4868 on time:Make sure you file Form 4868 by the October 15th deadline to avoid losing the extension. Mark your calendar and set reminders to ensure you don’t miss the deadline.

- Double-check the deadline:Don’t assume the extension deadline is the same as the original filing deadline. Ensure you understand the correct deadline for filing Form 4868.

- Complete Form 4868 accurately:Carefully fill out all required information on Form 4868, including your name, Social Security number, and estimated tax liability. Double-check the form before submitting it.

- Pay estimated taxes:Remember that an extension only extends the filing deadline, not the payment deadline. Make sure you pay your estimated taxes by the original deadline to avoid penalties.

- Keep track of the extended deadline:Don’t forget about the extended deadline. Mark your calendar and set reminders to ensure you file your return by the extended deadline, which is typically April 15th of the following year.

Consequences of Common Mistakes

Making mistakes when filing for an extension can have serious consequences. Here are some of the potential consequences:

- Penalties:The IRS can impose penalties for failing to file on time, even if you have filed for an extension. Penalties can be substantial, especially if you have underpaid your taxes.

- Interest charges:Interest may be charged on any unpaid taxes from the original due date until the date you pay. Interest rates can vary depending on the type of tax and the time period involved.

- Delays in processing:Incomplete or inaccurate information on Form 4868 can lead to delays in processing your extension request. This can cause further complications if you need to file your return before the extended deadline.

7. Impact of the October Extension on Tax Planning

The October extension offers a valuable opportunity to refine your tax planning strategy and potentially save money. This extra time allows you to gather all necessary documents, review your financial situation, and make informed decisions about your tax obligations.

Strategic Tax Planning with the October Extension

The extension grants you additional time to thoroughly analyze your financial records and explore potential tax savings strategies. You can utilize this time to:

- Maximize Deductions: Review your expenses and identify potential deductions you may have missed. This includes deductions for medical expenses, charitable donations, homeownership, and business expenses.

- Minimize Tax Liability: Explore various tax planning strategies to reduce your overall tax liability. This might involve adjusting your income, claiming available tax credits, or optimizing your investment portfolio.

- Optimize Investment Strategies: The extension provides time to evaluate your investment portfolio and make necessary adjustments to optimize tax efficiency. This could involve shifting assets, considering tax-advantaged accounts, or implementing tax-loss harvesting strategies.

Leveraging the Extension for Business Tax Optimization

The October extension presents an opportunity for businesses to refine their tax strategies and maximize their financial benefits.

- Accelerated Depreciation: Businesses can use the extension to explore strategies for accelerating depreciation on assets, leading to higher deductions in the early years of an asset’s life and potentially reducing taxable income.

- Tax Credits: The extension provides time to research and claim available tax credits for businesses. This could include credits for research and development, energy efficiency, or investments in renewable energy.

- Business Expense Planning: The extension allows businesses to carefully plan and optimize their business expenses. This could involve adjusting spending patterns, exploring cost-saving measures, and maximizing deductible expenses.

Tax Planning Tips for Individuals with the October Extension

Individuals can utilize the extension to refine their tax strategies and maximize their tax refunds or minimize their tax liability.

- Income Planning: The extension allows you to adjust your income, potentially reducing your tax burden. This could involve adjusting your withholdings, deferring income, or taking advantage of tax-advantaged savings options.

- Deductions: Review your expenses and identify potential deductions for charitable donations, medical expenses, homeownership, and other eligible items. This can significantly reduce your taxable income.

- Tax Credits: Explore available tax credits that could reduce your tax liability. This includes credits for education expenses, child tax credits, and other relevant credits based on your individual circumstances.

Resources for Taxpayers

Navigating the tax landscape can be complex, especially when dealing with extensions. Fortunately, numerous resources are available to guide taxpayers through the process. These resources offer valuable information, tools, and support to ensure accurate and timely filing.

Government Websites

Government websites provide official information and guidance on tax matters.

- The Internal Revenue Service (IRS) website (IRS.gov) is the primary source for tax information. It offers comprehensive details on tax rules, forms, publications, and deadlines.

- The IRS Taxpayer Advocate Service (TAS) provides assistance to taxpayers experiencing difficulties with the IRS. They can help resolve issues and advocate for taxpayers’ rights.

- State tax websites provide information specific to each state’s tax laws and regulations.

Tax Preparation Software

Tax preparation software simplifies the tax filing process and can provide guidance on extensions.

- Intuit TurboTax, H&R Block, and TaxAct are popular software options that offer features to help taxpayers file for extensions.

- These programs provide step-by-step guidance, calculate taxes, and generate necessary forms.

- Some software options offer dedicated support for taxpayers seeking extensions.

Financial Advisors

Financial advisors can offer personalized advice on tax matters, including extensions.

- Certified Public Accountants (CPAs) and Enrolled Agents (EAs) are qualified professionals who specialize in tax preparation and planning.

- They can provide guidance on whether an extension is necessary, assist with filing, and develop strategies to minimize tax liability.

- Financial advisors can also help taxpayers understand their tax obligations and plan for future tax years.

Tax Organizations

Tax organizations provide information, resources, and advocacy for taxpayers.

- The National Taxpayer Advocate (NTA) is an independent organization within the IRS that advocates for taxpayers’ rights and interests.

- The Tax Foundation is a non-profit organization that conducts research and analysis on tax policy.

- The American Institute of Certified Public Accountants (AICPA) provides resources and guidance for CPAs and the public.

Contact Information

| Organization | Website | Phone Number |

|---|---|---|

| Internal Revenue Service (IRS) | IRS.gov | 1-800-829-1040 |

| IRS Taxpayer Advocate Service (TAS) | TaxpayerAdvocate.IRS.gov | 1-877-777-4778 |

| National Taxpayer Advocate (NTA) | TaxpayerAdvocate.IRS.gov | 1-877-777-4778 |

| Tax Foundation | TaxFoundation.org | 202-734-0001 |

| American Institute of Certified Public Accountants (AICPA) | AICPA.org | 888-777-7077 |

Tax Filing Tips and Strategies

Tax season can be a stressful time, but with the right strategies and preparation, you can navigate the process smoothly and maximize your tax savings. This section provides comprehensive tax filing tips and strategies to help you prepare for filing your taxes, including those seeking an extension.

Record-keeping

Keeping accurate and organized financial records is essential for successful tax filing. This section provides tips on how to organize and maintain your financial records for tax purposes.

- Tip: Gather all relevant documents.

- Description:Before you start filing your taxes, gather all necessary documents, including W-2s, 1099s, receipts, and other relevant financial statements. This will ensure you have all the information needed to complete your return accurately.

- Benefits:This helps you avoid missing any deductions or credits and ensures you have all the necessary information to respond to any inquiries from the IRS.

- Considerations:Organize your documents in a logical manner and keep them in a safe place. Consider using a digital filing system for easy access and storage.

- Tip: Track all income sources.

- Description:Record all income sources, including wages, salaries, interest, dividends, and any other income received. This will ensure you report all income accurately and avoid potential penalties.

- Benefits:This ensures you report all income accurately and avoid potential penalties.

- Considerations:Keep track of all income sources throughout the year, not just at the end of the tax year. This makes it easier to compile the information when filing your taxes.

- Tip: Keep detailed records of expenses.

- Description:Maintain detailed records of all deductible expenses, including medical expenses, charitable contributions, business expenses, and home office expenses. This will ensure you can claim all eligible deductions.

- Benefits:This can help you reduce your taxable income and potentially lower your tax liability.

- Considerations:Ensure you have receipts and documentation for all expenses. Keep records organized and readily accessible.

Deductions

Identifying and claiming eligible deductions is crucial for maximizing your tax savings. This section provides strategies for finding and claiming available deductions.

- Tip: Understand common deductions.

- Description:Familiarize yourself with common deductions, such as the standard deduction, itemized deductions, and deductions for charitable contributions, medical expenses, and homeownership. This will help you identify potential deductions you may be eligible for.

- Benefits:This can help you reduce your taxable income and potentially lower your tax liability.

- Considerations:Keep in mind that deductions have specific requirements and limitations. Consult with a tax professional if you are unsure about the eligibility of a particular deduction.

- Tip: Claim the standard deduction or itemize.

- Description:Choose the standard deduction or itemize your deductions based on which option will result in a lower tax liability. The standard deduction is a fixed amount, while itemizing allows you to deduct specific expenses.

- Benefits:This can help you reduce your taxable income and potentially lower your tax liability.

- Considerations:Compare the standard deduction to your itemized deductions to determine which option is more beneficial.

- Tip: Explore specialized deductions.

- Description:Explore specialized deductions that may be available to you based on your occupation, family situation, or other circumstances. For example, educators may be eligible for a deduction for expenses related to their profession, while parents may be able to claim a deduction for child tax credits.

- Benefits:This can help you reduce your taxable income and potentially lower your tax liability.

- Considerations:Ensure you meet the eligibility requirements for any specialized deductions you claim. Consult with a tax professional for guidance.

Credits

Tax credits can directly reduce your tax liability, offering significant savings. This section provides guidance on claiming available tax credits.

Looking to find the best CD rates in October 2023? PNC Bank is a good place to start, but don’t forget to check out other banks to see who offers the highest interest rates.

- Tip: Research available tax credits.

- Description:Research available tax credits that you may be eligible for, such as the Earned Income Tax Credit, Child Tax Credit, and American Opportunity Tax Credit. These credits can provide substantial tax savings.

- Benefits:This can directly reduce your tax liability and potentially result in a tax refund.

- Considerations:Ensure you meet the eligibility requirements for any tax credits you claim. Consult with a tax professional for guidance.

- Tip: Claim the Earned Income Tax Credit (EITC).

- Description:The EITC is a refundable tax credit for low- to moderate-income working individuals and families. If you are eligible, claiming the EITC can significantly reduce your tax liability or even result in a tax refund.

- Benefits:The EITC can provide a substantial tax refund, helping to boost your financial well-being.

- Considerations:The EITC has income and filing status requirements. Use the IRS’s EITC Assistant tool to determine if you are eligible.

Other Relevant Topics

This section covers additional tax filing tips and strategies that can help you avoid common mistakes, understand tax terminology, and utilize available resources.

- Tip: Understand tax terminology.

- Description:Familiarize yourself with common tax terminology, such as Adjusted Gross Income (AGI), deductions, credits, and tax brackets. This will help you understand your tax return and make informed decisions.

- Benefits:This helps you navigate the tax filing process with confidence and avoid potential mistakes.

- Considerations:Consult with a tax professional if you have any questions or need clarification on tax terminology.

- Tip: Use tax preparation software or hire a tax professional.

- Description:Consider using tax preparation software or hiring a tax professional to assist you with filing your taxes. These options can help ensure accuracy and maximize your tax savings.

- Benefits:This can help you avoid costly mistakes and ensure you claim all eligible deductions and credits.

- Considerations:Research different software options and compare their features and pricing. When choosing a tax professional, ensure they are licensed and experienced.

- Tip: File your taxes on time.

- Description:File your taxes on time to avoid penalties. The deadline for filing your taxes is typically April 15th, but this can vary depending on the year. If you need more time, you can file for an extension.

- Benefits:This helps you avoid penalties for late filing.

- Considerations:Remember that an extension only extends the filing deadline, not the payment deadline. You still need to pay your taxes by the original deadline.

- Tip: Avoid common mistakes.

- Description:Be aware of common tax filing mistakes, such as errors in reporting income, deductions, or credits. Double-check your return for accuracy before filing.

- Benefits:This helps you avoid costly mistakes and potential audits.

- Considerations:Consult with a tax professional if you are unsure about any aspect of your tax return.

- Tip: Utilize available resources.

- Description:Take advantage of available resources, such as the IRS website, tax preparation software, and tax professionals. These resources can provide valuable information and guidance on tax filing.

- Benefits:This can help you navigate the tax filing process with ease and confidence.

- Considerations:Ensure you are using reliable and trustworthy resources.

Tax Penalties and Interest

The October tax extension deadline allows taxpayers to delay filing their tax return, but it doesn’t excuse them from paying their tax liability. If you don’t pay your taxes on time, you may face penalties and interest.

Late Payment Penalties

Late payment penalties are assessed when you don’t pay your taxes by the original due date, even if you’ve filed for an extension. There are three main types of late payment penalties:

- Flat Penalty:This penalty is a fixed amount, typically $210, that applies to the first $10,000 of unpaid taxes. This penalty is applied if you don’t pay your taxes on time, regardless of the reason.

- Penalty for Underpayment:This penalty applies if you don’t pay enough taxes throughout the year, either through withholding or estimated tax payments. The penalty is calculated based on the difference between your actual tax liability and your payments, and it’s applied for each month or part of a month that the underpayment remains unpaid.

- Penalty for Failure to Pay Estimated Taxes:This penalty applies if you don’t pay enough estimated taxes throughout the year, and you owe a significant amount at the end of the tax year. The penalty is calculated based on the amount of underpayment and the length of time the underpayment remains unpaid.

Calculation

Here’s how to calculate each type of late payment penalty:

- Flat Penalty:The flat penalty is a fixed amount, typically $210, for the first $10,000 of unpaid taxes.

- Penalty for Underpayment:This penalty is calculated based on the difference between your actual tax liability and your payments, and it’s applied for each month or part of a month that the underpayment remains unpaid. The penalty rate is usually an annual rate, but it’s applied on a monthly basis.

To calculate the penalty, you’ll need to determine the underpayment for each month and multiply it by the applicable penalty rate for that month. For example, if your underpayment for a month is $1,000 and the penalty rate for that month is 0.5%, the penalty for that month would be $ 5.

The penalty for underpayment is generally calculated as follows:

Underpayment x Penalty Rate x Number of Months of Underpayment

- Penalty for Failure to Pay Estimated Taxes:This penalty is calculated based on the amount of underpayment and the length of time the underpayment remains unpaid. The penalty rate is usually an annual rate, but it’s applied on a monthly basis. To calculate the penalty, you’ll need to determine the underpayment for each month and multiply it by the applicable penalty rate for that month.

For example, if your underpayment for a month is $1,000 and the penalty rate for that month is 0.5%, the penalty for that month would be $ 5. The penalty for failure to pay estimated taxes is generally calculated as follows:

Underpayment x Penalty Rate x Number of Months of Underpayment

Example

Let’s say you owe $15,000 in taxes but only paid $10,000 by the original due date. You would be assessed a flat penalty of $210 for the first $10,000 of unpaid taxes. The remaining $5,000 would be subject to the penalty for underpayment, which would be calculated based on the penalty rate and the number of months the underpayment remained unpaid.

Late Filing Penalties

Late filing penalties are assessed when you don’t file your tax return by the original due date, even if you’ve paid your taxes. There are two main types of late filing penalties:

- Penalty for Failure to File on Time:This penalty applies if you don’t file your tax return by the original due date, even if you’ve paid your taxes. The penalty is usually a percentage of your unpaid tax liability, but it’s capped at a certain amount.

For example, the penalty for failure to file on time is generally calculated as follows:

Penalty Rate x Unpaid Tax Liability

- Penalty for Failure to Pay on Time:This penalty applies if you don’t pay your taxes by the original due date, even if you’ve filed your tax return. The penalty is usually a percentage of your unpaid tax liability, but it’s capped at a certain amount. For example, the penalty for failure to pay on time is generally calculated as follows:

Penalty Rate x Unpaid Tax Liability

Calculation

Here’s how to calculate each type of late filing penalty:

- Penalty for Failure to File on Time:This penalty is usually a percentage of your unpaid tax liability, but it’s capped at a certain amount. The penalty rate is usually an annual rate, but it’s applied on a monthly basis. To calculate the penalty, you’ll need to determine the unpaid tax liability for each month and multiply it by the applicable penalty rate for that month.

For example, if your unpaid tax liability for a month is $1,000 and the penalty rate for that month is 0.5%, the penalty for that month would be $ 5. The penalty for failure to file on time is generally calculated as follows:

Unpaid Tax Liability x Penalty Rate x Number of Months of Underpayment

- Penalty for Failure to Pay on Time:This penalty is usually a percentage of your unpaid tax liability, but it’s capped at a certain amount. The penalty rate is usually an annual rate, but it’s applied on a monthly basis. To calculate the penalty, you’ll need to determine the unpaid tax liability for each month and multiply it by the applicable penalty rate for that month.

For example, if your unpaid tax liability for a month is $1,000 and the penalty rate for that month is 0.5%, the penalty for that month would be $ 5. The penalty for failure to pay on time is generally calculated as follows:

Unpaid Tax Liability x Penalty Rate x Number of Months of Underpayment

Example

Let’s say you owed $10,000 in taxes but didn’t file your tax return by the original due date. You would be assessed a penalty for failure to file on time, which would be calculated based on the penalty rate and the number of months you were late filing.

For example, if the penalty rate is 0.5% per month and you were late filing for two months, the penalty would be $100 (0.5% x $10,000 x 2 months).

Interest

Interest may be assessed on unpaid taxes, even if you’ve filed for an extension. There are two main types of interest:

- Interest on Underpayment:This interest is charged on any underpayment of taxes, including underpayment of estimated taxes. The interest rate is usually an annual rate, but it’s applied on a daily basis. To calculate the interest, you’ll need to determine the amount of underpayment and multiply it by the applicable interest rate for each day the underpayment remains unpaid.

Keep your finances in check with a great credit card. October is a great time to look for the best credit cards available, so you can get the most out of your spending.

For example, if your underpayment is $1,000 and the interest rate is 7%, the interest for one day would be $1.92 ($1,000 x 0.07 / 365). The interest on underpayment is generally calculated as follows:

Underpayment x Interest Rate x Number of Days of Underpayment

Need to know when taxes are due in October? The IRS October deadline is October 16th, so make sure you’re prepared to file or pay any remaining taxes.

- Interest on Late Payment:This interest is charged on any late payment of taxes, including late payment of estimated taxes. The interest rate is usually an annual rate, but it’s applied on a daily basis. To calculate the interest, you’ll need to determine the amount of late payment and multiply it by the applicable interest rate for each day the payment remains unpaid.

For example, if your late payment is $1,000 and the interest rate is 7%, the interest for one day would be $1.92 ($1,000 x 0.07 / 365). The interest on late payment is generally calculated as follows:

Late Payment x Interest Rate x Number of Days of Late Payment

Calculation

Here’s how to calculate each type of interest:

- Interest on Underpayment:This interest is charged on any underpayment of taxes, including underpayment of estimated taxes. The interest rate is usually an annual rate, but it’s applied on a daily basis. To calculate the interest, you’ll need to determine the amount of underpayment and multiply it by the applicable interest rate for each day the underpayment remains unpaid.

For example, if your underpayment is $1,000 and the interest rate is 7%, the interest for one day would be $1.92 ($1,000 x 0.07 / 365). The interest on underpayment is generally calculated as follows:

Underpayment x Interest Rate x Number of Days of Underpayment

- Interest on Late Payment:This interest is charged on any late payment of taxes, including late payment of estimated taxes. The interest rate is usually an annual rate, but it’s applied on a daily basis. To calculate the interest, you’ll need to determine the amount of late payment and multiply it by the applicable interest rate for each day the payment remains unpaid.

For example, if your late payment is $1,000 and the interest rate is 7%, the interest for one day would be $1.92 ($1,000 x 0.07 / 365). The interest on late payment is generally calculated as follows:

Late Payment x Interest Rate x Number of Days of Late Payment

Example

Let’s say you owed $10,000 in taxes but only paid $5,000 by the original due date. You would be assessed interest on the underpayment of $5,000. The interest rate is usually an annual rate, but it’s applied on a daily basis.

For example, if the interest rate is 7%, the interest for one day would be $9.59 ($5,000 x 0.07 / 365). The total interest charged would depend on the number of days the underpayment remained unpaid.

Common Scenarios

Here are some common scenarios where taxpayers may be assessed penalties and interest:

- Scenario 1:A taxpayer fails to file their tax return on time, but files within 60 days of the due date. This taxpayer may be assessed a penalty for failure to file on time, but they will not be assessed a penalty for failure to pay on time if they paid their taxes by the original due date.

However, they may be assessed interest on the unpaid tax liability.

- Scenario 2:A taxpayer underpays their taxes, but files their return on time. This taxpayer may be assessed a penalty for underpayment and interest on the underpayment. The penalty for underpayment is calculated based on the difference between the actual tax liability and the amount paid, and it’s applied for each month or part of a month that the underpayment remains unpaid.

The interest on underpayment is calculated based on the amount of underpayment and the number of days the underpayment remains unpaid.

- Scenario 3:A taxpayer fails to pay estimated taxes throughout the year and owes a significant amount at the end of the tax year. This taxpayer may be assessed a penalty for failure to pay estimated taxes and interest on the underpayment.

The penalty for failure to pay estimated taxes is calculated based on the amount of underpayment and the length of time the underpayment remains unpaid. The interest on underpayment is calculated based on the amount of underpayment and the number of days the underpayment remains unpaid.

Writing

Dear [Client Name],I am writing to you today to discuss the penalties and interest that have been assessed on your recent tax return. I understand that this news can be frustrating, and I want to assure you that I am here to help.The penalties and interest were assessed because [explain the reason for the penalties and interest, e.g., you filed your return late, you underpaid your taxes, you failed to pay estimated taxes].

I know that this may have been due to [explain the reason for the late filing, underpayment, or failure to pay estimated taxes, e.g., a change in your financial situation, a misunderstanding of the tax laws, an oversight].However, it is important to understand that these penalties and interest are assessed by the IRS to ensure that everyone pays their fair share of taxes.

The penalties and interest are designed to discourage taxpayers from delaying their tax obligations and to encourage them to comply with the tax laws.I want to help you avoid these penalties and interest in the future. Here are some tips:

- File your tax return on time:Even if you can’t pay your taxes on time, you should still file your tax return by the original due date. This will help you avoid the penalty for failure to file on time. You can file for an extension to delay filing your tax return, but you still need to pay your taxes by the original due date to avoid penalties.

- Pay your taxes on time:If you can’t pay your taxes on time, you should contact the IRS to discuss your options. You may be able to set up a payment plan or apply for a penalty abatement. You may also be able to avoid penalties by paying your taxes in installments.

- Pay estimated taxes throughout the year:If you have a significant income that is not subject to withholding, you may need to pay estimated taxes throughout the year to avoid penalties. The IRS has several methods for paying estimated taxes, including online, by mail, and by phone.

- Keep accurate records:This will help you to file your tax return accurately and on time. It will also help you to track your income and expenses, which can help you to avoid penalties for underpayment or failure to pay estimated taxes.

- Seek professional advice:A tax advisor can help you to understand your tax obligations and to avoid penalties and interest. They can also help you to develop a tax plan that meets your individual needs.

I am here to help you understand your tax obligations and to avoid penalties and interest in the future. Please do not hesitate to contact me if you have any questions or concerns.Sincerely,[Your Name]

Tax Filing Options and Methods

Choosing the right tax filing method is crucial for a smooth and accurate tax filing experience. This section explores the different options available, their advantages and disadvantages, and how to choose the best fit for your individual needs.

Online Filing

Online filing has become increasingly popular due to its convenience and speed. Many tax preparation software programs offer user-friendly interfaces, built-in tax calculators, and error checks, making the process relatively straightforward.

- Advantages:

- Convenience:Online filing eliminates the need for paper forms, envelopes, and trips to the post office. You can file your taxes from the comfort of your home or on the go.

- Speed:Electronic filing allows the IRS to process your return quickly, often within a few weeks.

- Accuracy:Tax software programs can help you avoid common errors by providing guidance and calculations. They also often include features like error checks and review tools.

- User-Friendly Features:Many online tax preparation programs offer features like built-in tax calculators, interview-style guides, and step-by-step instructions to simplify the filing process.

- Disadvantages:

- Security Concerns:Sharing sensitive financial information online raises concerns about data security. Ensure you choose a reputable software provider with robust security measures.

- Reliance on Internet Access:Online filing requires a stable internet connection, which might not be readily available in all locations.

- Limited Support for Complex Situations:Online tax software programs may not be suitable for complex tax situations involving deductions, credits, or special circumstances. You might need to seek professional assistance for such cases.

- Popular Online Filing Software:

- TurboTax:Offers various plans catering to different tax situations, from simple returns to complex ones.

- H&R Block:Provides a wide range of online tax preparation options, including free filing for simple returns.

- TaxAct:Offers a user-friendly interface and affordable pricing, making it a popular choice for many taxpayers.

Mail-in Filing

Mail-in filing involves using paper forms and sending them to the IRS by mail. This method offers a degree of control over the filing process but can be time-consuming and prone to errors.

- Advantages:

- Control Over Filing Process:You have complete control over the information you submit and can carefully review your forms before mailing them.

- Use of Paper Forms:If you prefer working with paper forms, mail-in filing is the only option available.

- Potential Cost Savings:You can avoid the cost of paid tax software or professional assistance if you are comfortable preparing your own return.

- Disadvantages:

- Time-Consuming Process:Gathering information, filling out forms, and mailing them can be a lengthy process.

- Potential for Errors:Paper forms can be prone to errors, especially if you are unfamiliar with tax laws and regulations.

- Risk of Lost or Delayed Mail:Mailing your tax return poses the risk of it getting lost or delayed in transit.

- Where to Obtain Forms:

- IRS Website:You can download most tax forms directly from the IRS website.

- IRS by Phone:You can contact the IRS by phone to request forms to be mailed to you.

Professional Assistance

Seeking assistance from a tax professional can be beneficial, especially for complex tax situations or if you prefer personalized advice and guidance.

- Advantages:

- Expertise in Tax Laws:Tax professionals are knowledgeable about tax laws, regulations, and deductions, which can help you maximize your tax savings.

- Personalized Advice:They can provide personalized advice based on your specific financial situation and tax goals.

- Potential Tax Savings:Tax professionals can help you identify deductions and credits you may be eligible for, potentially reducing your tax liability.

- Disadvantages:

- Cost:Hiring a tax professional can be expensive, especially if your tax situation is complex.

- Sharing Personal Financial Information:You need to provide your tax professional with sensitive financial information, which raises privacy concerns.

- Potential Conflicts of Interest:It is essential to choose a reputable tax professional with no conflicts of interest.

- Types of Professionals:

- Certified Public Accountants (CPAs):Licensed professionals with expertise in accounting and tax law.

- Enrolled Agents (EAs):Tax professionals licensed by the IRS to represent taxpayers before the agency.

- Tax Attorneys:Lawyers specializing in tax law who can provide legal advice and representation in tax-related matters.

Comparison of Filing Methods

| Criteria | Online Filing | Mail-in Filing | Professional Assistance |

|---|---|---|---|

| Cost | Free or paid (depending on software and plan) | Free (except for postage) | Variable (based on professional fees) |

| Time | Relatively fast (especially with electronic filing) | Time-consuming (gathering information, filling out forms, mailing) | Variable (depending on complexity and professional workload) |

| Convenience | Highly convenient (file from anywhere with internet access) | Less convenient (requires paper forms, mailing) | Very convenient (handles all aspects of tax filing) |

| Accuracy | High accuracy (with built-in calculators and error checks) | Prone to errors (especially if unfamiliar with tax laws) | High accuracy (due to professional expertise) |

| Support | Limited support (often through online FAQs or chat) | No direct support (except through IRS resources) | Extensive support (personalized advice and guidance) |

| Security | Potential security risks (depending on software provider) | No security risks (except for lost or delayed mail) | Potential security risks (sharing financial information with professional) |

Choosing the Right Filing Method

The best tax filing method for you depends on your individual circumstances. Consider the following factors:

- Income Level:Higher income levels often mean more complex tax situations, potentially requiring professional assistance or specialized software.

- Tax Situation:If you have deductions, credits, or special circumstances, professional assistance might be beneficial to ensure accurate and optimized tax filing.

- Level of Comfort with Technology:If you are comfortable with technology, online filing might be a suitable option. If you prefer working with paper forms, mail-in filing might be better.

- Time Constraints:If you have limited time, online filing or professional assistance can save you time and effort.

- Financial Resources:Consider your budget when choosing between paid tax software and professional assistance. Free online filing options are available for simple returns.

Impact of Recent Tax Legislation

The October extension deadline for filing taxes is a crucial aspect of tax planning, and recent tax legislation has introduced changes that may impact your obligations and strategies. Understanding these changes is vital for maximizing your tax benefits and avoiding penalties.

Impact on the Extension Deadline

Recent tax legislation, such as the Tax Cuts and Jobs Act of 2017 and the Inflation Reduction Act of 2022, has not directly changed the October extension deadline for individual income taxes. However, these acts have introduced significant changes to the tax code that may indirectly affect the deadline.

For example, the Tax Cuts and Jobs Act of 2017 lowered the corporate tax rate and introduced changes to individual tax brackets, which may impact the complexity of tax calculations and require more time for filing.

Changes to Eligibility Criteria

The Inflation Reduction Act of 2022 expanded the eligibility criteria for certain tax credits, such as the Clean Vehicle Tax Credit and the Energy Efficient Home Improvement Credit. These changes may require taxpayers to adjust their tax planning strategies to maximize these credits.

Changes to Filing Procedures

The Internal Revenue Service (IRS) frequently updates its online filing systems and forms. While the October extension deadline remains unchanged, recent tax legislation may have introduced changes to the forms and procedures required for filing. It’s crucial to stay updated on the latest IRS guidelines and forms to ensure accurate and timely filing.

Changes to Tax Rates

Recent tax legislation has impacted tax rates in various ways. The Tax Cuts and Jobs Act of 2017 reduced the standard deduction for individual taxpayers, while the Inflation Reduction Act of 2022 introduced a new minimum tax on corporations with large book income.

These changes may affect your overall tax liability and necessitate adjustments to your tax planning strategies.

Adapting Tax Planning Strategies, October Extension Tax Deadline 2024

Recent tax legislation has created opportunities for taxpayers to adapt their strategies for maximizing tax benefits. For example, the Inflation Reduction Act of 2022 introduced new tax credits for clean energy investments, which may encourage taxpayers to consider investments in renewable energy sources.

Additionally, the Tax Cuts and Jobs Act of 2017 lowered the corporate tax rate, potentially leading to increased investment and economic growth. Taxpayers should consider these changes when developing their tax planning strategies.

Future Outlook for the October Extension Deadline

While the October 15th tax extension deadline has been a staple of the U.S. tax system for many years, its future remains uncertain. Several factors could influence potential changes to this deadline, prompting taxpayers to stay informed and adapt their tax planning strategies accordingly.

Potential Changes to the October Extension Deadline

Changes to the October extension deadline are not out of the realm of possibility. Tax policy is dynamic and subject to adjustments based on various factors.

- Simplification of the Tax Code:One potential driver of change is the ongoing effort to simplify the U.S. tax code. A streamlined tax system might necessitate adjustments to deadlines, including the October extension. This could involve moving towards a simpler filing process with fewer extensions, potentially leading to a consolidated deadline for all taxpayers.

Looking for a new car? October is a great time to find lease deals , so check out the best offers and get ready to drive off in your dream car.

- Technological Advancements:The increasing reliance on technology in tax preparation and filing could also influence the October extension deadline. Advancements in artificial intelligence (AI) and automation may enable taxpayers to complete their returns more efficiently, potentially reducing the need for extensions. A more efficient system might result in a shift toward earlier deadlines.

Taxes are due in October, so make sure you’re prepared. The October tax deadline is fast approaching, so get your finances in order. And if you need to file an extension, the deadline for that is October 16th.

- Economic Considerations:Economic conditions can also impact tax deadlines. During periods of economic uncertainty or instability, policymakers may consider extending deadlines to provide taxpayers with additional time to navigate financial challenges. However, in periods of economic growth, there may be pressure to streamline the tax system and maintain a consistent filing schedule.

Conclusive Thoughts: October Extension Tax Deadline 2024

The October extension can be a valuable tool for taxpayers who need more time to prepare their returns. By understanding the eligibility criteria, benefits, drawbacks, and filing procedures, individuals and businesses can make informed decisions about whether to file for an extension.

Remember, while the extension grants additional time for filing, it doesn’t extend the payment deadline for taxes owed. Careful planning, accurate record-keeping, and timely payments are essential for avoiding penalties and interest. If you have any questions or concerns about the October extension or your tax obligations, don’t hesitate to consult a qualified tax professional for personalized advice.

Questions Often Asked

Can I file for an extension if I owe taxes?

Yes, you can file for an extension even if you owe taxes. However, filing an extension only extends the deadline for filing your return, not the deadline for paying your taxes. You’ll still need to make estimated tax payments or pay the full amount owed by the original April deadline to avoid penalties.

How do I know if I qualify for an extension?

The IRS offers an extension to most taxpayers. However, there are certain situations where an extension might be denied, such as if you’re under audit or have a history of failing to file on time. It’s best to consult with a tax professional to determine your eligibility.

What are the consequences of not filing my tax return by the extended deadline?

If you fail to file your tax return by the extended deadline, you’ll be subject to penalties. The penalty for late filing is typically a percentage of the unpaid taxes, and it can accrue interest. You may also face penalties for late payment if you haven’t paid the full amount owed by the original deadline.