Omni Calculator Annuity 2024 is a powerful tool that can help you understand and plan for your financial future. Annuities are financial products that provide a stream of regular payments, often for life, and can be a valuable component of a well-rounded retirement plan.

There’s a specific formula used for calculating loans with an annuity. You can find the annuity loan formula online and learn more about how it works.

Whether you are looking to secure a steady income stream, protect your savings from market volatility, or simply understand the intricacies of annuities, this calculator offers a comprehensive and user-friendly approach.

This guide will delve into the fundamentals of annuities, explore the features and functionality of the Omni Calculator Annuity tool, and discuss its applications in the current market landscape. We will also examine the advantages and disadvantages of annuities, providing you with the information you need to make informed decisions about your financial future.

If you’re using Excel to calculate annuities, you can find information about FV annuity in Excel. This can help you model your annuity payments and future value.

Contents List

Annuity Basics

An annuity is a financial product that provides a stream of regular payments for a specific period of time. Annuities can be used for a variety of purposes, including retirement planning, saving for a goal, or providing income for a loved one.

Annuity calculations can be tricky, but there are tools available to help. You can use an annuity number of periods calculator to determine how many periods your annuity will last.

Types of Annuities

There are many different types of annuities, each with its own unique features and benefits. Here are some of the most common types:

- Fixed annuities:These annuities provide a guaranteed rate of return, which means that the payments you receive will not fluctuate. This can be a good option for people who are looking for stability and predictability.

- Variable annuities:These annuities invest in the stock market, so the payments you receive can fluctuate depending on the performance of the market. This can be a good option for people who are willing to take on more risk in exchange for the potential for higher returns.

When figuring out your retirement plan, you might need to know what annuity is required over 12 years. This can help you determine how much income you can expect to receive from your annuity in the future.

- Immediate annuities:These annuities start making payments immediately after you purchase them. This can be a good option for people who need income right away.

- Deferred annuities:These annuities start making payments at a later date, such as when you retire. This can be a good option for people who are saving for retirement.

Present Value and Future Value

The concept of present value and future value is crucial in annuity calculations. Present value refers to the current value of a future stream of payments, while future value represents the value of an investment at a future date.

Factors Affecting Annuity Payments

Several factors influence the amount of annuity payments you receive, including:

- Interest rates:Higher interest rates generally result in higher annuity payments.

- Investment period:The longer the investment period, the higher the potential for growth and larger annuity payments.

- Annuity type:Different types of annuities have varying payment structures and features.

- Age and health:These factors can influence the length of the annuity payout period.

Omni Calculator Annuity Features

The Omni Calculator Annuity tool is a powerful and user-friendly tool that can help you understand the different aspects of annuities and make informed decisions about your financial future.

If you need help understanding how annuities work, there are plenty of resources available online. You can find information about how to calculate an annuity and learn more about this type of investment.

Features of the Omni Calculator Annuity Tool

The Omni Calculator Annuity tool offers a wide range of features, including:

- Calculation of annuity payments:The calculator allows you to calculate the amount of your annuity payments based on your specific needs and goals.

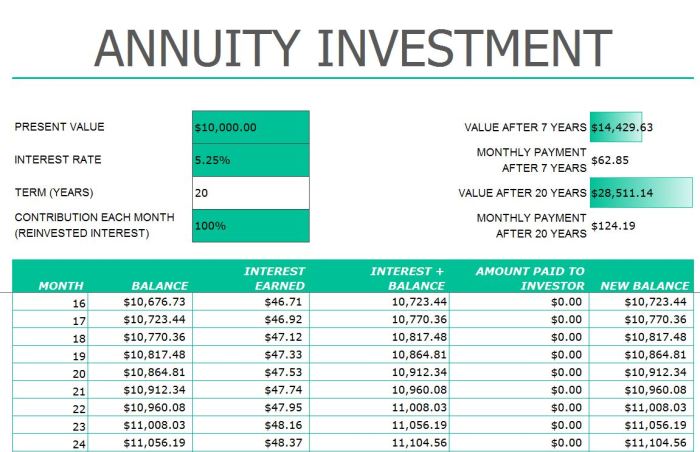

- Present value and future value calculations:The tool can calculate the present value of a future stream of payments and the future value of an investment.

- Visualization of results:The calculator provides graphical representations of your annuity payments and growth over time.

- Customization options:You can adjust various parameters, such as interest rates, investment period, and annuity type, to see how they affect your results.

Using the Calculator for Different Scenarios, Omni Calculator Annuity 2024

The Omni Calculator Annuity tool can be used for a variety of scenarios, including:

- Retirement planning:You can use the calculator to estimate your retirement income and determine how much you need to save to achieve your financial goals.

- Saving for a goal:The calculator can help you determine how much you need to save each month to reach a specific financial goal, such as buying a house or paying for your child’s education.

- Income planning:The calculator can help you understand how much income you can expect from an annuity and how it can supplement your other sources of income.

Annuity Applications in 2024

The annuity market is constantly evolving, with new trends and challenges emerging every year. In 2024, annuities continue to be a popular option for individuals seeking guaranteed income and wealth management solutions.

Hargreaves Lansdown offers an online annuity calculator that can help you estimate your potential annuity income. This can be a valuable tool when planning your retirement.

Trends and Challenges in the Annuity Market

Here are some key trends and challenges shaping the annuity market in 2024:

- Rising interest rates:The Federal Reserve’s interest rate hikes have led to higher annuity rates, making them more attractive to investors seeking fixed income.

- Increased demand for guaranteed income:With market volatility and concerns about longevity, individuals are seeking products that provide guaranteed income streams.

- Technological advancements:Online platforms and digital tools are simplifying annuity purchases and providing greater transparency and access to information.

Impact of Rising Interest Rates on Annuity Returns

Rising interest rates generally have a positive impact on annuity returns. As interest rates increase, insurance companies can offer higher annuity rates to attract investors. This can lead to higher annuity payments for individuals.

CNN has a helpful annuity calculator that can help you understand the potential benefits of an annuity. This tool can be useful when making decisions about your retirement savings.

Annuity Use for Wealth Management and Income Planning

Annuities can be a valuable tool for wealth management and income planning in 2024. They offer a way to protect assets from market volatility and provide a steady stream of income during retirement.

Advantages and Disadvantages of Annuities

Annuities can be a valuable part of a diversified investment portfolio, but it’s essential to understand their advantages and disadvantages before making a decision.

Annuity is often compared to life insurance, but they are different financial products. You can learn more about the differences between annuities and life insurance to make an informed decision.

Benefits of Purchasing an Annuity

Here are some key benefits of annuities:

- Guaranteed income:Annuities provide a stream of guaranteed payments for a specified period, offering peace of mind and financial security.

- Tax advantages:Depending on the type of annuity, certain payments may be tax-deferred or tax-free, potentially reducing your tax liability.

- Protection from market volatility:Annuities can protect your principal from market downturns, providing a safe haven for your savings.

- Longevity protection:Annuities can provide income for the rest of your life, ensuring that you have a reliable source of income even if you live longer than expected.

Potential Risks and Drawbacks of Annuities

While annuities offer benefits, they also come with potential risks and drawbacks:

- Lack of liquidity:Annuities typically have surrender charges or penalties for early withdrawals, limiting your access to funds.

- Potential for lower returns:Annuities may offer lower returns compared to other investment options, such as stocks or bonds.

- Complexity:Annuities can be complex financial products with various terms and conditions that can be difficult to understand.

- Fees and expenses:Annuities often involve fees and expenses that can reduce your overall returns.

Comparison with Other Investment Options

Annuities are just one investment option among many. It’s essential to compare them with other investment options, such as stocks, bonds, and real estate, to determine the best fit for your financial goals and risk tolerance.

An annuity with a payout of $600,000 is a significant sum. You can explore the specifics of this type of annuity here and see if it’s a good fit for your retirement goals.

Annuity Calculator Use Cases

The Omni Calculator Annuity tool can be used for a wide range of scenarios, providing valuable insights into annuity payments and financial planning.

If you’re wondering what an annuity is, you can find out here. Annuities are a type of investment that can provide you with a steady stream of income in retirement.

Annuity Scenarios and Results

| Scenario | Annuity Type | Investment Period | Interest Rate | Monthly Payment |

|---|---|---|---|---|

| Retirement planning | Fixed annuity | 20 years | 4% | $2,500 |

| Saving for a house | Deferred annuity | 10 years | 5% | $500 |

| Income planning | Immediate annuity | 15 years | 3% | $1,000 |

Specific Use Cases for the Calculator

- Retirement planning:Calculate your retirement income based on your savings, investment period, and interest rate.

- Saving for a house:Determine how much you need to save each month to reach your down payment goal.

- Income planning:Estimate your monthly income from an annuity and plan for future expenses.

- Financial goal setting:Calculate the amount of annuity payments needed to achieve a specific financial goal.

- Comparing annuity options:Analyze different annuity types and their potential returns based on your specific circumstances.

Steps Involved in Using the Omni Calculator Annuity Tool

Using the Omni Calculator Annuity tool is straightforward. Follow these steps:

- Access the Omni Calculator website:Visit the Omni Calculator website and search for the Annuity Calculator.

- Enter your information:Provide the required information, such as your investment amount, investment period, interest rate, and annuity type.

- Run the calculation:Click the “Calculate” button to generate your results.

- Analyze the results:Review the calculated annuity payments, present value, and future value.

- Adjust parameters:Experiment with different scenarios by adjusting the parameters and observing the impact on your results.

Illustrative Examples of Annuity Calculations

Let’s explore some hypothetical examples of how the Omni Calculator Annuity tool can be used for financial planning.

Annuity 712 is a specific type of annuity product, and you can find more information about it here. It’s important to understand the details of any annuity before investing, as they can be complex financial products.

Retirement Planning Example

Imagine a 55-year-old individual with $500,000 in savings who wants to retire at 65. Using the Omni Calculator, they can estimate their retirement income by entering their savings, investment period (10 years), and an assumed interest rate of 4%. The calculator might indicate that they can expect a monthly retirement income of $4,000 from their annuity.

Calculating an annuity due involves a slightly different formula than a regular annuity. You can learn more about calculating annuity due and understand how it works.

Saving for a House Example

Consider someone who wants to save for a down payment on a house in 5 years. They aim to save $50,000 and can afford to contribute $500 per month. Using the calculator, they can determine the required interest rate to achieve their goal.

Annuity 72t is a specific type of annuity with unique features. You can learn more about this type of annuity here.

The calculator might suggest an interest rate of 6% is needed to reach their target within the desired timeframe.

When considering an annuity, you might want to look into the 30-day free look period. This gives you time to review the annuity contract and decide if it’s right for you.

Impact of Interest Rates on Annuity Payments

To illustrate the impact of different interest rates, imagine two individuals each investing $100,000 in a fixed annuity for 20 years. The first individual receives a 3% interest rate, while the second receives a 5% interest rate. Over time, the individual with the higher interest rate will receive significantly larger annuity payments.

This highlights the importance of considering interest rates when choosing an annuity.

Figuring out how much to deposit into an annuity can be a challenge. Thankfully, you can use an online tool to calculate your annuity deposit and make sure you’re on track for your financial goals.

Concluding Remarks

As we conclude our exploration of Omni Calculator Annuity 2024, it’s clear that this tool offers a valuable resource for individuals seeking to understand and plan for their financial future. By leveraging its intuitive features and comprehensive calculations, you can gain valuable insights into the potential benefits and drawbacks of annuities, allowing you to make informed decisions about your retirement planning and wealth management strategies.

Whether you’re looking to secure a steady income stream, protect your savings from market volatility, or simply gain a deeper understanding of this financial product, Omni Calculator Annuity 2024 provides a powerful tool for navigating the complexities of annuities.

Detailed FAQs: Omni Calculator Annuity 2024

What types of annuities can I calculate with Omni Calculator Annuity 2024?

Omni Calculator Annuity 2024 can handle various annuity types, including fixed, variable, immediate, and deferred annuities. You can adjust the parameters to reflect your specific needs and goals.

Is Omni Calculator Annuity 2024 free to use?

Yes, Omni Calculator Annuity 2024 is a free online tool available to everyone. You can use it without any subscription or registration requirements.

How accurate are the calculations provided by Omni Calculator Annuity 2024?

Omni Calculator Annuity 2024 uses robust algorithms and industry-standard formulas to provide accurate calculations. However, it’s important to note that these calculations are based on the information you input, and results may vary depending on your individual circumstances.

Can I use Omni Calculator Annuity 2024 to compare different annuity providers?

While Omni Calculator Annuity 2024 can help you understand the mechanics of annuities, it does not provide comparisons between different providers. To compare annuity offerings, you should consult with a financial advisor or research various providers directly.