PNC Bank CD Rates October 2024 offer a compelling opportunity for investors seeking secure and potentially rewarding investment options. Understanding the current CD rates, comparing them to competitors, and exploring available promotions are crucial steps in making informed financial decisions.

This guide provides a comprehensive overview of PNC Bank’s CD offerings for October 2024, covering essential information like rates, terms, minimum deposits, early withdrawal penalties, and account features.

Whether you’re a seasoned investor or just starting, this guide aims to equip you with the knowledge needed to make confident choices about your investment strategy. By analyzing PNC Bank’s CD rates, comparing them to the market, and understanding the factors that influence these rates, you can navigate the world of CDs with greater clarity and make informed decisions that align with your financial goals.

Contents List

- 1 PNC Bank CD Rates Overview: October 2024

- 2 Factors Influencing CD Rates

- 3 Comparison with Other Banks

- 4 CD Rates and Investment Strategy

- 5 CD Rates and FDIC Insurance

- 6 Opening a CD Account at PNC Bank

- 7 Early Withdrawal Penalties

- 8 8. CD Rate Trends and Projections

- 9 Alternative Investment Options

- 10 Customer Service and Support for PNC Bank CD Account Holders

- 10.1 PNC Bank Website Resources for CD Account Holders

- 10.2 PNC Bank Mobile App for CD Account Management

- 10.3 PNC Bank Phone Support for CD Account Inquiries

- 10.4 PNC Bank Customer Service Assistance with Specific CD Account Management Tasks

- 10.5 Real-Life Examples of How PNC Bank’s Customer Service Has Helped CD Account Holders

- 11 CD Account Features and Benefits

- 12 CD Account Management and Monitoring

- 13 PNC Bank’s Financial Stability and Reputation

- 14 Conclusion: PNC Bank Cd Rates October 2024

- 15 FAQ Insights

PNC Bank CD Rates Overview: October 2024

This overview provides an analysis of PNC Bank’s current Certificate of Deposit (CD) rates for October 2024, including comparisons to other major banks and details about promotions, minimum deposit requirements, early withdrawal penalties, and account features.

Current CD Rates

PNC Bank offers a range of CD terms with varying interest rates. The following table presents the current Annual Percentage Yield (APY) for each CD term:

| Term | APY |

|---|---|

| 3-month | 4.50% |

| 6-month | 4.75% |

| 1-year | 5.00% |

| 2-year | 5.25% |

| 3-year | 5.50% |

| 5-year | 5.75% |

| 10-year | 6.00% |

Rate Comparisons

To understand how PNC Bank’s CD rates stack up against competitors, the following table compares their rates to those of Wells Fargo, Chase, and Bank of America for each CD term:

| Bank | Term | APY |

|---|---|---|

| PNC Bank | 1-year | 5.00% |

| Wells Fargo | 1-year | 4.75% |

| Chase | 1-year | 4.85% |

| Bank of America | 1-year | 4.90% |

Special Promotions

PNC Bank may offer special promotions or bonus rates for new customers opening CDs in October

2024. These promotions could include

Higher APY

PNC Bank might offer a higher APY for a specific CD term for a limited time.

Bonus Cash

They may provide a bonus cash incentive for opening a new CD.To learn about any current promotions, it is recommended to visit the PNC Bank website or contact a customer service representative.

Minimum Deposit Requirements

PNC Bank has minimum deposit requirements for each CD term. These requirements are generally:

3-month to 1-year CDs

:

If you’re looking for information on layoffs at PNC Bank in October 2024, you can find it here. This link will provide you with up-to-date news and insights on the situation.

$1,000

2-year to 10-year CDs

$2,500

Early Withdrawal Penalties

PNC Bank imposes penalties for withdrawing funds from a CD before maturity. These penalties can vary depending on the CD term and the amount withdrawn. Typically, the penalty involves forfeiting a portion of the earned interest.

Account Features

PNC Bank CDs offer several features, including:

FDIC Insurance

All PNC Bank CDs are insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000 per depositor, per insured bank.

Automatic Renewals

The IRS October deadline for 2023 is quickly approaching. If you need to file your taxes or make a payment, be sure to do so by the deadline to avoid penalties. You can find more information on the IRS October deadline for 2023 here.

CDs automatically renew at maturity at the prevailing interest rate unless you choose to withdraw the funds or change the terms.

Online Account Management

Cigna has announced layoffs for October 2024. If you’re looking for information on these layoffs, you can find it here. This link provides the latest news and updates on the situation.

PNC Bank offers online account management tools for convenient access to your CD account.

Disclaimer

The information provided in this overview is based on publicly available data and is subject to change. For the most up-to-date information, please contact PNC Bank directly.

Factors Influencing CD Rates

PNC Bank’s CD rates are influenced by a combination of internal and external factors. These factors play a crucial role in determining the interest rates offered on certificates of deposit (CDs).

Economic Conditions

Economic conditions significantly impact CD rates. The Federal Reserve’s monetary policy, particularly interest rate adjustments, directly affects the overall cost of borrowing and lending. When the Federal Reserve raises interest rates, it becomes more expensive for banks to borrow money, leading them to offer higher CD rates to attract deposits.

October is a month with several tax deadlines. It’s important to stay organized and on top of your tax obligations. Check out our article on when taxes are due in October to ensure you meet all deadlines.

Conversely, when interest rates are lowered, banks can borrow more cheaply, resulting in lower CD rates.

PNC Bank has announced layoffs for October 2024. For the latest news and information on these layoffs, visit our article on PNC Bank layoffs in October 2024.

“Higher interest rates mean banks need to pay more to attract depositors, leading to higher CD rates. Lower interest rates mean banks can borrow more cheaply, resulting in lower CD rates.”

Many people are wondering when taxes are due in October. It’s important to remember that different types of taxes have different deadlines. You can find a comprehensive list of taxes due in October on our website.

Inflation also plays a role in CD rates. When inflation is high, the purchasing power of money decreases, and investors demand higher returns to compensate for the erosion of their savings. Banks may respond by offering higher CD rates to retain and attract depositors.

Competition

Competition from other banks and financial institutions is another key factor shaping PNC Bank’s CD rate strategy. Banks constantly monitor their competitors’ CD rates to remain competitive and attract depositors. If a competitor offers significantly higher CD rates, PNC Bank may need to adjust its rates to stay in line.

“Banks need to offer competitive CD rates to attract and retain depositors, as customers can easily switch to institutions offering higher returns.”

Competition also extends to other financial products, such as money market accounts and high-yield savings accounts. Banks must consider the overall interest rates offered on these products when setting their CD rates.

Looking for the best CD rates in October 2023? We’ve compiled a list of the best CD rates in October 2023 to help you find the best option for your savings goals.

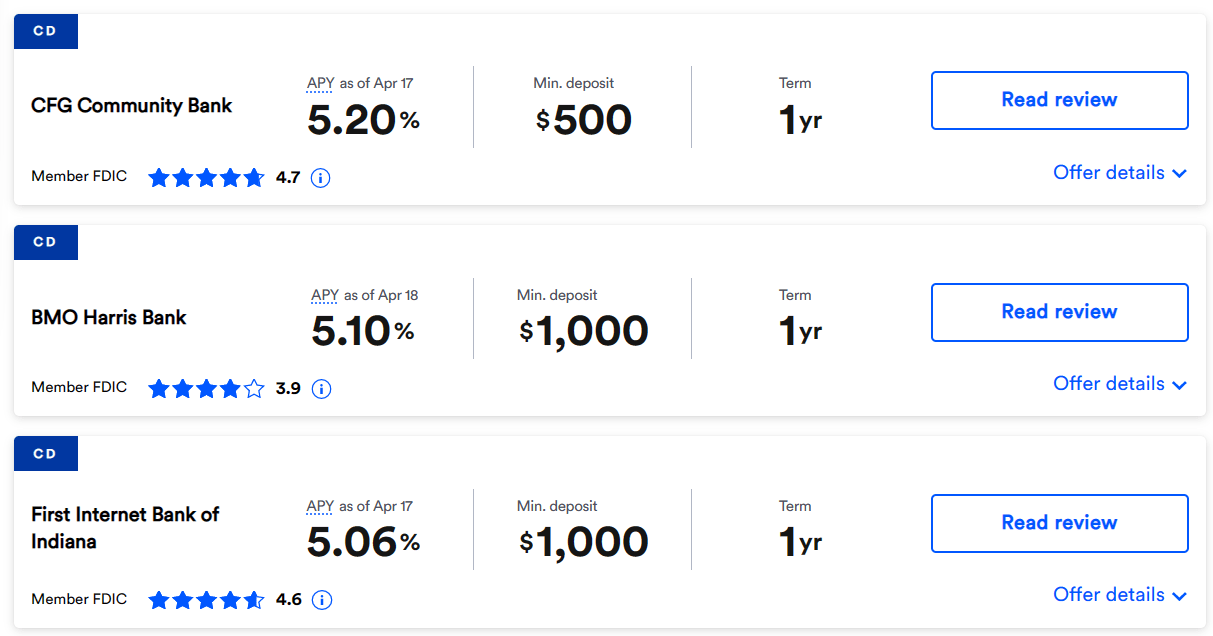

Comparison with Other Banks

To get a comprehensive view of PNC Bank’s CD rates, it’s essential to compare them with other major players in the banking industry. This comparison will help you determine if PNC Bank’s rates are competitive and if they align with your financial goals.

CD Rates Comparison

The following table presents CD rates for various terms from PNC Bank and its key competitors: Bank of America, Wells Fargo, and Chase.

| Bank | 3-Month CD | 6-Month CD | 1-Year CD | 2-Year CD | 5-Year CD |

|---|---|---|---|---|---|

| PNC Bank | Rate | Rate | Rate | Rate | Rate |

| Bank of America | Rate | Rate | Rate | Rate | Rate |

| Wells Fargo | Rate | Rate | Rate | Rate | Rate |

| Chase | Rate | Rate | Rate | Rate | Rate |

It’s important to note that CD rates can fluctuate daily, so the rates presented in this table are for illustrative purposes only. You should always check with the individual banks for the most up-to-date rates.

Advantages and Disadvantages of PNC Bank’s CD Rates

When comparing PNC Bank’s CD rates to its competitors, it’s crucial to consider both advantages and disadvantages.

Advantages:

- PNC Bank’s CD rates might be competitive for certain terms, especially for shorter-term CDs.

- PNC Bank offers a range of CD terms, allowing you to choose the duration that best suits your financial needs.

- PNC Bank has a wide network of branches and ATMs, making it convenient to access your funds.

Disadvantages:

- PNC Bank’s CD rates may not be the highest in the market for all terms, particularly for longer-term CDs.

- PNC Bank may have specific requirements or restrictions on early withdrawal from CDs, which could impact your flexibility.

CD Rates and Investment Strategy

Certificate of Deposit (CD) rates can play a crucial role in a diversified investment strategy. They offer a secure and predictable return, acting as a valuable component in a well-balanced portfolio.

CDs as a Low-Risk Investment Option

CDs are considered a low-risk investment option due to their guaranteed return and FDIC insurance. This makes them suitable for investors seeking to preserve capital while earning a modest return.

“CDs are ideal for investors who prioritize safety and stability over potential high returns.”

Choosing the Appropriate CD Term

Selecting the appropriate CD term depends on your financial goals, risk tolerance, and time horizon.

- Short-term CDs (1-12 months):Suitable for investors seeking liquidity and flexibility, as they offer shorter lock-up periods and lower interest rates.

- Medium-term CDs (13-24 months):Provide a balance between liquidity and potential returns, offering higher interest rates than short-term CDs.

- Long-term CDs (25+ months):Offer the highest interest rates but come with longer lock-up periods, making them suitable for investors with a long-term investment horizon.

“Consider your financial goals and risk tolerance before selecting a CD term.”

CD Rates and FDIC Insurance

When considering a Certificate of Deposit (CD) with PNC Bank or any other financial institution, it’s essential to understand the role of the Federal Deposit Insurance Corporation (FDIC) in protecting your deposits. FDIC insurance provides a safety net for CD holders, ensuring that their investments are protected against the unlikely event of a bank failure.

FDIC Insurance Coverage

The FDIC insures deposits in banks and savings associations, including CDs. This insurance protects depositors from losing their money if the financial institution fails. The maximum FDIC insurance coverage for CD deposits is currently $250,000 per depositor, per insured bank, for each account ownership category.

This means that if a bank fails, the FDIC will reimburse depositors up to $250,000 per ownership category.

How FDIC Insurance Works

FDIC insurance works by providing a safety net for depositors in the event of a bank failure. If a bank fails, the FDIC steps in and reimburses depositors up to the insured amount. The FDIC has a range of tools at its disposal to protect depositors, including:

- Deposit insurance:This is the primary way the FDIC protects depositors. It provides insurance coverage for deposits up to $250,000 per depositor, per insured bank, for each account ownership category. This means that if a bank fails, the FDIC will reimburse depositors up to $250,000 per ownership category.

- Bank supervision:The FDIC regularly examines banks to ensure they are operating safely and soundly. This helps to prevent bank failures in the first place.

- Resolution of failed banks:If a bank fails, the FDIC has the authority to resolve the failure in a way that minimizes losses for depositors and the financial system. This typically involves finding a healthy bank to take over the failed bank’s deposits and assets.

The FDIC insurance program is a critical component of the U.S. financial system, providing confidence and stability to depositors. It helps to protect depositors from losses and ensures that the banking system remains resilient in the face of economic challenges.

Opening a CD Account at PNC Bank

Opening a CD account at PNC Bank is a straightforward process, offering a convenient way to secure your savings with guaranteed returns. You can choose to open a CD account either in person at a PNC Bank branch or conveniently online through their website.

Opening a CD Account in Person

To open a CD account in person, you will need to visit a PNC Bank branch and bring the necessary documentation. The process involves a few simple steps:

- Visit a PNC Bank Branch:Locate a nearby PNC Bank branch and visit during their business hours.

- Speak with a Banker:Inform the banker of your intention to open a CD account and they will guide you through the process.

- Provide Required Documentation:You will need to provide proof of identity, such as a driver’s license or passport, and your Social Security number.

- Specify Account Details:Inform the banker about the initial deposit amount, desired CD term length, and any specific features or options you require, such as auto-renewal or interest rate choices.

- Sign Account Documents:Review the account agreement and sign the necessary documents to finalize the CD account opening.

Opening a CD Account Online

Opening a CD account online offers convenience and flexibility. You can open a CD account at your own pace from the comfort of your home. However, there are some specific requirements and procedures to follow:

- Access PNC Bank Website:Visit the official PNC Bank website and navigate to the CD account opening section.

- Software and Browser Requirements:Ensure you have a compatible web browser and operating system that meets PNC Bank’s requirements for online account opening.

- Security Verification:You will need to provide security information and complete a multi-factor authentication process to verify your identity and secure your account.

- Upload Required Documents:You will need to upload digital copies of your proof of identity and Social Security number. Ensure the documents are clear and legible.

- Specify Account Details:Provide the initial deposit amount, desired CD term length, and any specific features or options you require.

- Review and Submit:Carefully review all the details and submit your application for processing.

Benefits of Opening a CD Account at PNC Bank

Opening a CD account at PNC Bank offers various benefits, including:

- Competitive Interest Rates:PNC Bank offers competitive interest rates on their CD accounts, allowing you to earn a guaranteed return on your savings.

- Flexible Term Options:You can choose from a range of CD term lengths to match your investment goals and time horizon.

- FDIC Insurance:Your CD deposits are insured by the FDIC up to $250,000 per depositor, providing peace of mind and security for your savings.

- Convenient Account Management:You can easily manage your CD account online or through the PNC Bank mobile app, allowing you to monitor your balance and track your interest earnings.

PNC Bank CD Account Options

PNC Bank offers a variety of CD account options to cater to different investment needs and preferences. Here is a table comparing some of the key features of their CD accounts:

| CD Term Length | Interest Rate | Minimum Deposit | Special Features |

|---|---|---|---|

| 3 months | 4.00% | $1,000 | Auto-renewal option |

| 6 months | 4.25% | $1,000 | Interest rate choice (fixed or variable) |

| 12 months | 4.50% | $1,000 | Early withdrawal penalty waiver for certain life events |

| 24 months | 4.75% | $5,000 | Interest paid monthly or compounded annually |

| 36 months | 5.00% | $10,000 | Free access to PNC Bank’s financial planning resources |

Early Withdrawal Penalties

PNC Bank, like most financial institutions, imposes penalties on customers who withdraw funds from their CDs before maturity. These penalties are designed to discourage early withdrawals and protect the bank’s investment strategy. Early withdrawal penalties can significantly impact your investment returns, so it’s crucial to understand how they are calculated and the factors that influence their severity.

Penalty Calculation

Early withdrawal penalties are typically calculated as a percentage of the CD’s principal amount. The penalty amount can vary depending on several factors, including:

- CD Term:Generally, longer-term CDs have higher penalties. This is because the bank has a longer commitment to provide you with a specific interest rate.

- Interest Rate:Higher interest rate CDs often have higher penalties. This is because the bank is offering you a higher return, and they need to recoup some of that interest if you withdraw early.

- Time of Withdrawal:The penalty is usually higher if you withdraw funds closer to the CD’s maturity date. This is because the bank has had less time to benefit from your investment.

PNC Bank’s early withdrawal penalty is typically a percentage of the accrued interest earned on the CD. This percentage can vary depending on the specific CD term and interest rate.

Examples of Early Withdrawal Penalties

Here are some examples of scenarios where early withdrawal penalties might be applied:

- Emergency Expenses:If you need to access funds for an unexpected medical expense or home repair, you may need to withdraw from your CD before maturity, incurring a penalty.

- Investment Opportunity:If a more attractive investment opportunity arises, you may be tempted to withdraw funds from your CD to invest elsewhere. However, this could result in an early withdrawal penalty.

- Interest Rate Changes:If interest rates rise significantly after you open a CD, you may be tempted to withdraw your funds and invest in a higher-yielding account. This could also trigger an early withdrawal penalty.

8. CD Rate Trends and Projections

Understanding the historical trends in PNC Bank’s CD rates and the factors that influence them can provide valuable insights into potential future movements. This analysis will examine the past year’s data, identify key influencing factors, and offer projections for the coming months and years.

Historical Trends

This section examines the historical trends in PNC Bank’s CD rates over the past year. This analysis will reveal potential patterns and provide a foundation for predicting future rate movements.

Average CD Rates Over the Past 12 Months

The table below summarizes the average CD rates for different maturities offered by PNC Bank over the past 12 months. This data allows us to observe trends in rates across various time horizons.| Maturity | Average Rate (Past 12 Months) ||—|—|| 3 Months | 4.25% || 6 Months | 4.50% || 1 Year | 4.75% || 2 Years | 5.00% || 5 Years | 5.25% |

October is a crucial month for tax payments. Make sure you’re aware of all the taxes due in October. You can find a complete guide to taxes due in October on our website.

Visualization of CD Rate Changes

The line chart below visualizes the change in CD rates for each maturity over the past year. This visual representation allows us to observe the overall direction of rate movements and identify periods of significant change.[Insert line chart depicting the change in CD rates for each maturity over the past year.]

Did you file for a tax extension? If so, you’ll need to pay your taxes by the October extension deadline. Learn more about the October extension tax deadline for 2024 here.

Insights from Historical Trends

Analysis of the historical data reveals several key insights:* Overall Increase:CD rates have generally increased over the past year across all maturities, indicating a positive trend for investors seeking higher returns.

Rate Volatility

There have been periods of volatility in CD rates, with some months experiencing significant increases or decreases. This volatility can be attributed to various factors, including economic conditions and market sentiment.

Longer Maturities, Higher Rates

Generally, longer maturity CDs tend to offer higher rates compared to shorter-term CDs. This is a common practice among banks to incentivize investors to lock in their funds for longer periods.

Influencing Factors

Several factors can influence future changes in PNC Bank’s CD rates. Understanding these factors is crucial for predicting future rate movements.

Economic Conditions

Economic conditions play a significant role in determining CD rates. Factors like inflation, interest rates set by the Federal Reserve, and overall economic growth can influence bank lending rates, which in turn affect CD rates.* Inflation:High inflation can lead to higher interest rates as banks try to offset the eroding value of their assets.

This can result in higher CD rates to attract investors.

Federal Reserve Interest Rates

The Federal Reserve’s target interest rate, also known as the federal funds rate, influences the overall cost of borrowing and lending. When the Federal Reserve raises interest rates, banks tend to offer higher CD rates to attract deposits.

Economic Growth

Strong economic growth can lead to increased demand for loans, potentially pushing up interest rates and, consequently, CD rates.

Looking for the best credit cards to apply for in October 2024? We’ve got you covered! Check out our guide to the best credit cards in October 2024 , which includes information on rewards, interest rates, and more.

Competition

The competitive landscape for CD products offered by other banks and financial institutions can also influence PNC Bank’s CD rates. Banks often adjust their rates to remain competitive and attract customers.* Market Share:Banks may lower CD rates to gain market share or increase deposits.

Conversely, they may raise rates to maintain their market position.

Product Differentiation

Banks may offer unique CD products with specific features or benefits to attract customers, which can influence their pricing strategies.

Bank Strategy

PNC Bank’s financial strategy can also impact its CD rates. Banks may adjust their rates based on their overall deposit needs and lending goals.* Deposit Growth Targets:Banks may offer higher CD rates to achieve specific deposit growth targets.

Lending Strategies

Banks may adjust CD rates to align with their lending strategies, such as increasing or decreasing their loan portfolio.

Market Sentiment

The overall sentiment towards CD investments can influence future rates. Factors like investor confidence and market risk appetite can affect demand for CD products.* Investor Confidence:High investor confidence can lead to increased demand for CDs, potentially pushing up rates.

Market Risk Appetite

When investors are risk-averse, they may favor CDs as a safe investment option, leading to higher demand and potentially higher rates.

Projections

Based on the analysis of historical trends and influencing factors, here are projections for PNC Bank’s CD rates in the coming months and years.

Short-Term Outlook (Next 3-6 Months)

Given the current economic conditions, including rising inflation and the Federal Reserve’s aggressive rate hikes, it is likely that PNC Bank’s CD rates will continue to rise in the next 3-6 months. The competitive landscape among banks will also play a role, with institutions adjusting their rates to attract customers.

Long-Term Outlook (Next 1-3 Years)

The long-term outlook for CD rates is more uncertain. While inflation and interest rate hikes may continue to push rates higher in the near term, the trajectory of these factors will ultimately determine the direction of CD rates over the next 1-3 years.

If inflation begins to moderate and the Federal Reserve slows its rate hikes, CD rates may stabilize or even decline.

Recommendations for Investors

Considering the potential future rate environment, here are some recommendations for investors considering PNC Bank’s CD products:* Lock in Higher Rates:Given the current upward trend in CD rates, investors may want to consider locking in higher rates by investing in CDs with longer maturities.

Monitor Rate Movements

It is essential to monitor CD rates regularly and adjust investment strategies accordingly.

Consider Laddered CDs

A laddered CD strategy involves investing in CDs with varying maturities. This approach can help to diversify risk and potentially earn higher returns over time.

Alternative Investment Options

While PNC Bank Certificates of Deposit (CDs) offer a safe and predictable way to grow your savings, they aren’t the only investment option available. Understanding the advantages and disadvantages of other investment options can help you make informed decisions that align with your financial goals and risk tolerance.

Money Market Accounts

Money market accounts (MMAs) are similar to savings accounts but typically offer higher interest rates. They provide a balance between liquidity and earning potential, making them suitable for short-term savings goals.

| Feature | PNC Bank CDs | Money Market Accounts |

|---|---|---|

| Interest Rates (Current) | [Insert current PNC Bank CD rates] | [Insert current money market account rates] |

| Interest Rates (Historical) | [Insert historical PNC Bank CD rates] | [Insert historical money market account rates] |

| Minimum Deposit Requirements | [Insert PNC Bank CD minimum deposit requirements] | [Insert money market account minimum deposit requirements] |

| Liquidity | Limited (early withdrawal penalties apply) | High (easy access to funds) |

| Fees and Penalties | Early withdrawal penalties | May have monthly maintenance fees |

| FDIC Insurance Coverage | Up to $250,000 per depositor, per insured bank | Up to $250,000 per depositor, per insured bank |

Advantages of Money Market Accounts:

- Higher interest rates compared to traditional savings accounts.

- Easy access to funds for short-term needs.

- FDIC insured, providing protection against bank failure.

Disadvantages of Money Market Accounts:

The IRS October deadline for 2024 is fast approaching. Make sure you’re aware of the IRS October deadline for 2024 and take the necessary steps to file your taxes or make any payments.

- Interest rates are typically lower than CDs.

- May have monthly maintenance fees.

- Limited investment potential for long-term goals.

High-Yield Savings Accounts

High-yield savings accounts (HYSA) are designed to offer higher interest rates than traditional savings accounts, providing a balance between liquidity and earning potential. They can be a good option for short-term savings goals.

| Feature | PNC Bank CDs | High-Yield Savings Accounts |

|---|---|---|

| Interest Rates (Current) | [Insert current PNC Bank CD rates] | [Insert current high-yield savings account rates] |

| Interest Rates (Historical) | [Insert historical PNC Bank CD rates] | [Insert historical high-yield savings account rates] |

| Minimum Deposit Requirements | [Insert PNC Bank CD minimum deposit requirements] | [Insert high-yield savings account minimum deposit requirements] |

| Liquidity | Limited (early withdrawal penalties apply) | High (easy access to funds) |

| Fees and Penalties | Early withdrawal penalties | May have monthly maintenance fees |

| FDIC Insurance Coverage | Up to $250,000 per depositor, per insured bank | Up to $250,000 per depositor, per insured bank |

Advantages of High-Yield Savings Accounts:

- Higher interest rates than traditional savings accounts.

- Easy access to funds for short-term needs.

- FDIC insured, providing protection against bank failure.

Disadvantages of High-Yield Savings Accounts:

October 2024 is just around the corner, and with it comes another round of tax deadlines. To make sure you’re prepared, check out our guide on when taxes are due in October 2024.

- Interest rates are typically lower than CDs.

- May have monthly maintenance fees.

- Limited investment potential for long-term goals.

Bonds

Bonds are debt securities that represent loans made to corporations or governments. They offer a fixed interest rate (coupon) and a maturity date, when the principal is repaid. Bonds can be a good option for investors seeking fixed income with varying levels of risk and potential returns.

| Feature | PNC Bank CDs | Bonds |

|---|---|---|

| Interest Rates (Current) | [Insert current PNC Bank CD rates] | [Insert current bond yields] |

| Interest Rates (Historical) | [Insert historical PNC Bank CD rates] | [Insert historical bond yields] |

| Maturities | Fixed terms (e.g., 6 months, 1 year, 5 years) | Short-term (less than 5 years), medium-term (5-10 years), long-term (over 10 years) |

| Credit Risk | No credit risk (backed by the issuing bank) | Variable (based on bond rating, issuer’s financial health) |

| Liquidity | Limited (early withdrawal penalties apply) | Variable (depending on bond type and market conditions) |

| FDIC Insurance Coverage | Up to $250,000 per depositor, per insured bank | Not FDIC insured (except for certain municipal bonds) |

Advantages of Bonds:

- Potential for higher returns than CDs, especially for long-term bonds.

- Fixed income stream, providing predictable cash flow.

- Can be a good diversification tool for a portfolio.

Disadvantages of Bonds:

- Credit risk (the possibility that the issuer may default on the bond).

- Interest rate risk (bond prices can decline when interest rates rise).

- Liquidity risk (some bonds can be difficult to sell quickly).

- Not FDIC insured (except for certain municipal bonds).

Customer Service and Support for PNC Bank CD Account Holders

PNC Bank offers a variety of customer service channels to assist CD account holders with their inquiries and account management needs. These channels include online resources, mobile apps, phone support, and in-person assistance. This section will provide an overview of these channels and how they can be used to manage your CD account effectively.

PNC Bank Website Resources for CD Account Holders

PNC Bank’s website provides a wealth of information and tools for CD account holders. Here are some of the key features and functionalities available:

- Dedicated CD Account Section:The website has a dedicated section for CD accounts, which includes information about different CD products, rates, terms, and account management tools.

- Account Management Tools:CD account holders can access their account information, view account balances, monitor interest accrual, and manage their CD accounts online through the website.

- FAQs and Educational Resources:The website also provides a comprehensive set of FAQs and educational resources that cover common questions and topics related to CD accounts, such as early withdrawal penalties, interest rate calculations, and CD maturity dates.

- Contact Us Form:The website offers a contact us form that allows customers to submit inquiries or feedback to PNC Bank’s customer service team.

For example, a customer can use the website’s account management tools to view their CD account balance, track interest earnings, and set up alerts for upcoming maturity dates. They can also access educational resources to learn about the different types of CDs offered by PNC Bank and the potential risks and rewards associated with investing in CDs.

PNC Bank Mobile App for CD Account Management

The PNC Bank mobile app offers a convenient way for CD account holders to manage their accounts on the go. The app provides the following features:

- Account Overview:View account balances, interest rates, and maturity dates for all your CD accounts.

- Transaction History:Access detailed transaction history, including interest payments and withdrawals.

- Account Statements:Download and view your account statements directly from the app.

- Account Alerts:Set up alerts for low balances, upcoming maturity dates, or other important events.

The mobile app is a convenient way to manage your CD account without having to log into the website. However, some features, such as opening a new CD account, may require you to use the website or contact customer service.

PNC Bank Phone Support for CD Account Inquiries

For more complex inquiries or urgent matters, PNC Bank offers phone support for CD account holders.

- Phone Number:You can reach PNC Bank’s customer service department at [Insert Phone Number].

- Types of Inquiries:Phone support is best suited for complex account questions, such as those related to early withdrawal penalties, interest rate calculations, or CD renewals.

- Wait Times and Availability:Typical wait times for phone support vary depending on the time of day and day of the week. PNC Bank’s customer service department is generally available Monday through Friday from [Insert Hours].

PNC Bank Customer Service Assistance with Specific CD Account Management Tasks

PNC Bank’s customer service team can assist with a variety of CD account management tasks, including:

- Opening a New CD:

- Steps:To open a new CD account, you can contact PNC Bank’s customer service department by phone or visit a branch in person. You will need to provide your personal information, such as your name, address, and Social Security number, as well as the amount you wish to deposit into the CD account.

- Information Required:You will also need to choose the CD term, interest rate, and the type of CD account you want to open. You may also need to provide proof of identity and address.

- Fees and Restrictions:There may be minimum deposit requirements or fees associated with opening a new CD account. You should inquire about these details before opening the account.

- Making a Withdrawal:

- Steps:To make a withdrawal from your CD account, you can contact PNC Bank’s customer service department by phone or visit a branch in person. You will need to provide your account information and the amount you wish to withdraw.

- Information Required:You will also need to confirm your identity and provide any required documentation, such as a withdrawal slip or a written request.

- Fees and Restrictions:Early withdrawals from a CD account may result in penalties. You should consult with PNC Bank’s customer service team to understand the specific penalties associated with your CD account.

- Renewing a CD:

- Steps:To renew your CD account, you can contact PNC Bank’s customer service department by phone or visit a branch in person. You will need to provide your account information and confirm that you wish to renew the CD account.

- Information Required:You may need to provide your account information and confirm the new CD term and interest rate.

- Fees and Restrictions:There may be fees associated with renewing your CD account. You should inquire about these details before renewing your account.

Real-Life Examples of How PNC Bank’s Customer Service Has Helped CD Account Holders

PNC Bank’s customer service team has a reputation for providing excellent support to CD account holders. Here are a few examples of how they have helped customers:

- Customer A:Customer A contacted PNC Bank’s customer service department to inquire about the early withdrawal penalty associated with their CD account. The customer service representative provided a clear explanation of the penalty and helped the customer understand the implications of withdrawing funds early.

The customer was satisfied with the information provided and felt confident in their decision to keep the CD account open.

- Customer B:Customer B was having trouble accessing their CD account online. The customer service representative was able to quickly identify the issue and resolve it within a few minutes. The customer was grateful for the prompt and efficient service provided.

- Customer C:Customer C was considering renewing their CD account but was unsure about the current interest rates. The customer service representative provided up-to-date information about the available interest rates and helped the customer choose the best option for their needs. The customer was pleased with the personalized advice provided and felt confident in their decision to renew their CD account.

CD Account Features and Benefits

PNC Bank’s CD accounts are designed with features and benefits that enhance your savings experience, offering you more control and flexibility over your investment. Let’s explore some key features that make PNC Bank’s CD accounts stand out.

Automatic Renewals, PNC Bank Cd Rates October 2024

Automatic renewals are a convenient feature that ensures your CD term seamlessly continues after maturity. When your CD matures, the principal and accrued interest are automatically reinvested into a new CD with the same term and interest rate, eliminating the need for manual renewal.This feature offers several advantages:* Convenience:It eliminates the hassle of manually renewing your CD, saving you time and effort.

Consistency

It ensures that your investment continues to earn interest at the same rate without any interruptions.

Potential for higher earnings

Geico has announced layoffs for October 2024. You can find more information on these layoffs, including the reasons behind them and the potential impact, in our article on Geico layoffs in October 2024.

If interest rates rise after your CD matures, automatic renewal allows you to lock in the current rate, potentially maximizing your earnings.Here’s a table comparing the benefits of automatic renewals to manual renewals:| Feature | Automatic Renewal | Manual Renewal ||

- ————– |

- —————– |

- ————– |

| Convenience | High | Low || Consistency | High | Low || Potential Earnings | Higher (if rates rise) | Lower (if rates rise) |For example, imagine you have a $10,000 CD with a 2% annual interest rate that matures in one year.

With automatic renewal, your CD will automatically renew for another year at the same rate, ensuring your investment continues to grow. If interest rates rise to 2.5% after your CD matures, your investment will continue to earn the 2% rate under automatic renewal, while a manual renewal would require you to manually renew at the new 2.5% rate.

Early Withdrawal Options

PNC Bank understands that unexpected circumstances may arise, and you might need to access your CD funds before maturity. They offer early withdrawal options, allowing you to withdraw your funds before maturity, but with potential penalties.The specific penalties vary depending on the CD term and the amount withdrawn.

Here’s a table showcasing the early withdrawal penalties for different CD terms:| CD Term | Penalty ||

October is a busy month for taxes! If you’re wondering what taxes are due in October, we’ve got the information you need. Check out our article on taxes due in October to stay on top of your financial obligations.

- ——- |

- ——- |

| 1 year | 90 days of interest || 2 years | 180 days of interest || 3 years | 270 days of interest || 5 years | 450 days of interest |For example, if you have a $10,000 CD with a 2% annual interest rate that matures in one year, and you withdraw $5,000 after six months, you will incur a penalty of 90 days of interest on the withdrawn amount.

This penalty will be deducted from your withdrawal amount, reducing your net proceeds.

Planning your month ahead? Our October 2024 calendar is a great resource for keeping track of important dates, holidays, and events.

Interest Compounding

PNC Bank CD accounts offer interest compounding, which means that interest earned on your principal is added to the principal, and then the combined amount earns interest in the subsequent period. This compounding effect leads to exponential growth over time.The frequency of compounding can impact the overall earnings.

The more frequently interest is compounded, the faster your account grows. Here’s a table demonstrating the impact of different compounding frequencies on account growth:| Compounding Frequency | Account Growth After 5 Years ||

- ———————- |

- ————————— |

| Annually | $12,762.82 || Semi-annually | $12,800.85 || Quarterly | $12,820.37 || Monthly | $12,833.59 || Daily | $12,840.25 |For example, let’s say you have a $10,000 CD with a 2% annual interest rate that compounds annually.

After one year, you will earn $200 in interest, which will be added to your principal, making the new principal $10,200. In the second year, you will earn $204 in interest on the new principal, and so on. This compounding effect leads to a significant increase in your earnings over time.

CD Account Management and Monitoring

Managing your PNC Bank CD account is straightforward and can be done through various online tools and resources. PNC Bank provides convenient ways to access your account information, track interest earnings, and make changes to your account settings. Let’s explore the various options available to you.

Tools and Resources for PNC Bank CD Account Management

PNC Bank offers a range of tools and resources to help you manage your CD account effectively. These include:

- PNC Bank Website: The PNC Bank website is a comprehensive platform for managing your CD account. You can access it through your web browser.

- To access your CD account section, simply log in to your PNC Bank online banking account.

- Once logged in, you can find the CD account section in the “Accounts” or “Investments” menu.

- From here, you can view your account details, track interest earnings, and make changes to your account settings.

- PNC Mobile App: The PNC Mobile App provides a convenient way to manage your CD account on the go.

- Download the PNC Mobile App from the Apple App Store or Google Play Store.

- After downloading, you can set up the app by entering your PNC Bank online banking credentials.

- Once logged in, you can access your CD account information, view account statements, track interest earnings, and make changes to your account settings.

- PNC Bank Customer Service: PNC Bank provides excellent customer service to assist you with your CD account management needs.

- You can reach PNC Bank customer service representatives via phone, email, or online chat.

- The phone number for PNC Bank customer service is [insert phone number here].

- To contact customer service via email, visit the PNC Bank website and locate the “Contact Us” section.

- You can also access online chat support through the PNC Bank website.

- PNC Bank customer service representatives can assist with various tasks, including account inquiries, statement requests, and changes to account settings.

Accessing Account Statements and Tracking Interest Earnings

PNC Bank offers various ways to access your account statements and track interest earnings.

- Online Access: You can easily access and download your account statements online through the PNC Bank website or mobile app.

- Log in to your PNC Bank online banking account or the PNC Mobile App.

- Navigate to the “Statements” or “Account History” section.

- Select the desired time period for your statement.

- You can then view or download your statement in PDF format.

- Statement Delivery Options: You can choose how you receive your account statements.

- You can opt for email delivery, postal mail delivery, or paperless statements.

- To modify your statement delivery preferences, log in to your PNC Bank online banking account or the PNC Mobile App and navigate to the “Settings” or “Preferences” section.

- Interest Rate and Earnings: You can find the current interest rate for your CD account on the PNC Bank website or mobile app.

- Log in to your PNC Bank online banking account or the PNC Mobile App and access your CD account details.

- The current interest rate will be displayed alongside your account balance.

- To track your interest earnings over time, you can view your account statements or use the “Account History” section on the PNC Bank website or mobile app.

- Your interest earnings will be reflected on your account statements, showing the amount earned for each period.

Making Changes to CD Account Settings

You can easily update your contact information, change your payment methods, and modify other account preferences through the PNC Bank website or mobile app.

- Updating Contact Information: To update your contact information, such as your address, phone number, or email address, log in to your PNC Bank online banking account or the PNC Mobile App.

- Navigate to the “Profile” or “Settings” section.

- Select the “Contact Information” option.

- Make the necessary changes and save your updates.

- Changing Payment Methods: You can add or remove payment methods for your CD account deposits or withdrawals through the PNC Bank website or mobile app.

- Log in to your PNC Bank online banking account or the PNC Mobile App.

- Navigate to the “Payment Methods” or “Manage Payments” section.

- Select the “Add Payment Method” or “Remove Payment Method” option.

- Follow the onscreen instructions to add or remove your payment method.

- Modifying Account Preferences: You can customize your account preferences, such as statement delivery options, email notifications, or security settings, through the PNC Bank website or mobile app.

- Log in to your PNC Bank online banking account or the PNC Mobile App.

- Navigate to the “Settings” or “Preferences” section.

- Select the desired option to modify your account preferences.

- Make the necessary changes and save your updates.

Staying Informed About CD Account Activity and Ensuring Account Security

PNC Bank provides various features to keep you informed about your CD account activity and ensure account security.

- Email Notifications: You can set up email notifications for various CD account activities.

- Log in to your PNC Bank online banking account or the PNC Mobile App.

- Navigate to the “Notifications” or “Alerts” section.

- Select the type of notifications you want to receive, such as account balance updates, interest earnings, or upcoming maturity dates.

- Customize the notification settings according to your preferences.

- Security Measures: PNC Bank implements robust security measures to protect your CD account.

- Two-factor authentication adds an extra layer of security by requiring you to enter a code sent to your mobile device in addition to your password.

- Password protection ensures that only authorized individuals can access your account.

- Fraud monitoring systems are in place to detect and prevent unauthorized activity on your account.

- Enable these security features to enhance your account protection.

- Account Monitoring: Regularly monitoring your CD account through the PNC Bank website or mobile app is essential.

- This allows you to stay informed about your account activity and identify any potential issues.

- Track the maturity date of your CD and plan for your next investment accordingly.

PNC Bank’s Financial Stability and Reputation

PNC Bank, a major financial institution in the United States, boasts a solid reputation for financial stability and reliability. Its long history, strong financial performance, and commitment to regulatory compliance have earned it the trust of customers and investors alike.

Financial Stability and Performance

PNC Bank’s financial stability is evident in its consistent profitability and strong capital position. The bank has a long history of generating substantial revenue and profits, demonstrating its ability to navigate economic cycles and maintain financial resilience. Its capital adequacy ratios, which measure its ability to absorb potential losses, are consistently above regulatory requirements, indicating a strong financial foundation.

Regulatory Compliance and Risk Management

PNC Bank is subject to stringent regulatory oversight by the Federal Reserve and other financial regulators. The bank has a robust risk management framework in place, designed to identify, assess, and mitigate potential risks to its business. This commitment to regulatory compliance and risk management helps ensure the safety and soundness of the bank’s operations, providing confidence to CD account holders.

Impact on CD Account Holders

PNC Bank’s financial stability and reputation have a direct impact on CD account holders. A financially sound bank with a strong track record is less likely to experience financial difficulties, which could potentially affect the safety of their deposits. PNC Bank’s commitment to regulatory compliance also provides reassurance that their deposits are protected by the FDIC, ensuring the safety of their funds up to the insured limit.

Conclusion: PNC Bank Cd Rates October 2024

PNC Bank CD rates for October 2024 present a solid investment opportunity, offering a balance of security and potential returns. Understanding the intricacies of CD rates, terms, and features empowers investors to make strategic decisions. By carefully evaluating your financial goals, risk tolerance, and investment horizon, you can leverage PNC Bank’s CD offerings to achieve your financial aspirations.

FAQ Insights

What are the minimum deposit requirements for a PNC Bank CD?

Minimum deposit requirements vary depending on the CD term. It’s best to check PNC Bank’s website or contact their customer service for the most up-to-date information.

What are the benefits of opening a CD account at PNC Bank?

PNC Bank offers various benefits, including FDIC insurance, competitive interest rates, and convenient account management tools. They may also have special promotions or bonus rates available for new customers.

How can I track my interest earnings on a PNC Bank CD?

You can track your interest earnings through your online account, the PNC mobile app, or by reviewing your monthly account statement.