PNC Bank layoffs rumors in October 2024 have sent ripples through the financial world, prompting concerns about the bank’s future and the potential impact on employees, customers, and stakeholders. These rumors, fueled by a combination of economic uncertainty, industry trends, and recent financial performance, have sparked intense speculation and analysis.

The EV tax credit has been a popular incentive for those looking to purchase electric vehicles. Find out if there are any limits on the EV tax credit in 2024 and how it might impact your decision to buy an electric car.

The rumors stem from a confluence of factors, including PNC Bank’s recent financial performance, the broader economic climate, and historical trends within the banking industry. While PNC Bank has not issued any official statements confirming or denying these rumors, their silence has only fueled speculation and anxiety among employees.

Contents List

PNC Bank Layoff Rumors in October 2024: An Analysis

The banking industry, always sensitive to economic fluctuations, is currently facing a wave of uncertainty. Rumors of potential layoffs at PNC Bank in October 2024 have sparked anxieties among employees, customers, and stakeholders. This article delves into the background of these rumors, examining their origins, potential impact, and possible reasons behind them.

PNC Bank’s restructuring in 2024 has led to significant changes, including layoffs and adjustments to operations. Learn more about the reasons behind this restructuring and how it will affect the bank’s future.

We will also explore the perspectives of industry experts and analyze the broader trends influencing the banking sector.

While the government hasn’t officially announced a fourth stimulus check, many are curious about the possibility. Read this article for insights into the likelihood of receiving a fourth stimulus check in 2024.

Background of PNC Bank Layoffs

Understanding the context of these rumors requires examining PNC Bank’s recent financial performance, its history of layoffs, and the current economic climate.

Virginia has implemented a tax rebate program for businesses in October 2024, aiming to provide financial relief and stimulate economic growth. Learn more about this tax rebate program and how businesses can benefit from it.

- PNC Bank has consistently reported strong financial performance in recent years. The bank’s earnings have been robust, driven by factors such as growth in lending and fee income. However, the recent economic slowdown and rising interest rates have begun to impact the banking industry, potentially affecting PNC Bank’s future earnings.

- PNC Bank has a history of implementing layoffs, albeit not frequently. Previous instances of layoffs have typically been linked to restructuring initiatives or cost-cutting measures. These past layoffs have generally been met with mixed reactions, with some employees expressing concerns about job security and others acknowledging the need for organizational adjustments.

Suzanne Somers has had a long and successful career in entertainment, spanning several decades. Learn more about her impressive career earnings and the impact she’s made on the industry.

- The current economic climate is characterized by high inflation, rising interest rates, and concerns about a potential recession. These factors have created a challenging environment for banks, potentially leading to a slowdown in loan growth and increased credit losses. This economic uncertainty could influence PNC Bank’s decisions regarding workforce optimization.

Rumors and Speculation

The rumors of layoffs at PNC Bank in October 2024 have spread rapidly, fueled by a combination of factors.

- The origin of these rumors is unclear, but they have likely emerged from discussions among employees, social media chatter, and industry speculation. The recent trend of layoffs in the banking sector has likely contributed to the spread of these rumors.

- PNC Bank has not publicly confirmed or denied these rumors. The bank’s silence has fueled speculation and anxiety among employees. The lack of official communication has created an environment of uncertainty, making it difficult for employees to gauge the likelihood of layoffs.

- The current rumors resemble previous instances of speculation about PNC Bank layoffs. In the past, similar rumors have emerged, often based on anecdotal evidence or industry trends. However, these past rumors have not always materialized into actual layoffs, highlighting the importance of separating speculation from concrete information.

Potential Impact of Layoffs, PNC Bank layoffs rumors in October 2024

The potential impact of layoffs at PNC Bank would be significant, affecting employees, customers, and stakeholders.

- Layoffs would undoubtedly have a profound impact on PNC Bank’s employees. Losing their jobs would create financial hardship and emotional distress. The uncertainty surrounding the rumors has already led to anxiety and reduced morale among employees. Layoffs could further erode employee trust and commitment.

Google’s Q3 2024 earnings report is highly anticipated, especially with the increasing competition from companies like Microsoft. Read about how Google’s earnings compare to its rivals and what it means for the future of the tech industry.

- The impact on PNC Bank’s customers would depend on the extent of the layoffs and the specific departments affected. If layoffs occur in customer-facing roles, it could lead to longer wait times, reduced service quality, and a decline in customer satisfaction.

This could potentially damage PNC Bank’s reputation and brand image.

- Layoffs would also have implications for PNC Bank’s stakeholders, including investors and shareholders. Reduced workforce could impact PNC Bank’s financial performance, potentially leading to lower profits and reduced shareholder value. This could also affect the bank’s ability to compete effectively in the market.

PNC Bank’s recent job cuts in October 2024 have raised concerns about the financial industry’s future. Learn more about the reasons behind these cuts and what they mean for employees and the broader economy.

Possible Reasons for Layoffs

Several potential reasons could explain why PNC Bank might consider layoffs.

- Cost-cutting measures are a common reason for layoffs in companies facing economic pressures. PNC Bank, like other banks, may be looking to reduce expenses to maintain profitability during a period of economic uncertainty. Layoffs could be a way to streamline operations and reduce labor costs.

- Restructuring is another potential reason for layoffs. PNC Bank may be considering reorganizing its operations, potentially leading to the elimination of certain roles or departments. This restructuring could be driven by factors such as changing customer needs, technological advancements, or a desire to improve efficiency.

While the government hasn’t officially announced any stimulus checks for October 2024, there’s still speculation about the possibility. Stay up-to-date on the latest news regarding stimulus checks and see what experts are predicting.

- Technological advancements have significantly impacted the banking industry, leading to automation and digitalization of many tasks. PNC Bank may be considering layoffs as part of its strategy to adapt to these technological changes. This could involve replacing certain roles with technology or streamlining processes to reduce the need for human labor.

Employee Concerns and Reactions

The rumors of layoffs have understandably caused significant concern among PNC Bank employees. Employees are worried about their job security, potential financial hardship, and the impact on their families.

Rich Paul, a prominent sports agent, has made a name for himself in the world of basketball. Read more about his net worth and his future prospects in the ever-evolving sports industry.

- Employees are expressing concerns about the potential impact of layoffs on their careers, financial stability, and personal well-being. Many employees are seeking information and reassurance from PNC Bank management about the rumors.

- The uncertainty surrounding the rumors has led to a decline in employee morale and productivity. Employees are struggling to focus on their work when their job security is uncertain. This could have a negative impact on PNC Bank’s overall performance.

With economic uncertainty looming, many are wondering which companies are most likely to make layoffs in October 2024. This article explores some of the companies that are facing potential job cuts.

- Employees are considering various strategies to address the uncertainty surrounding layoffs. Some employees are seeking new employment opportunities, while others are focusing on improving their skills and qualifications to enhance their marketability. The rumors have also prompted employees to engage in discussions and support groups to share their anxieties and seek support.

Industry Perspectives

Industry experts have mixed perspectives on the potential for layoffs at PNC Bank. Some experts believe that layoffs are likely given the current economic climate and the trend of workforce reductions in the banking sector. Others believe that PNC Bank may be able to avoid significant layoffs by implementing other cost-cutting measures or focusing on growth opportunities.

Tesla’s Q3 2024 earnings report is sure to be a hot topic, and investors will be closely watching the stock price reaction. Find out how the market responded to Tesla’s performance and what it means for the company’s future.

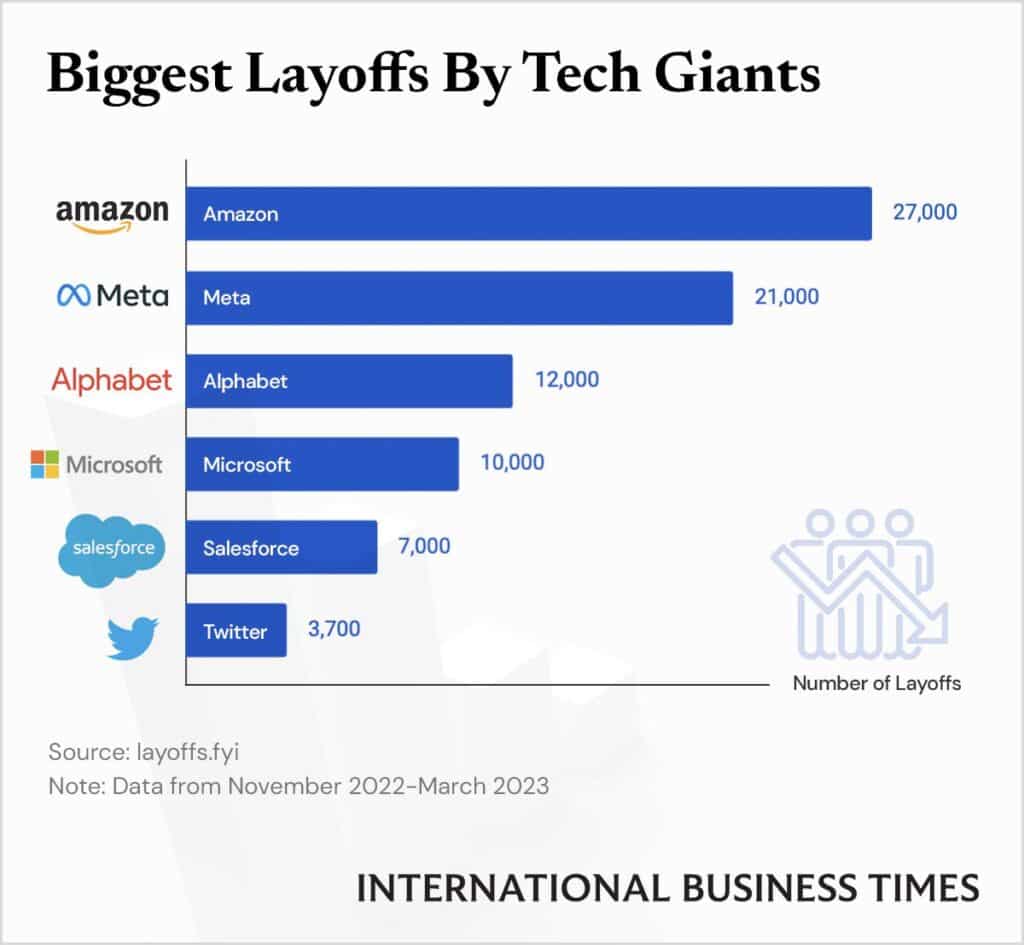

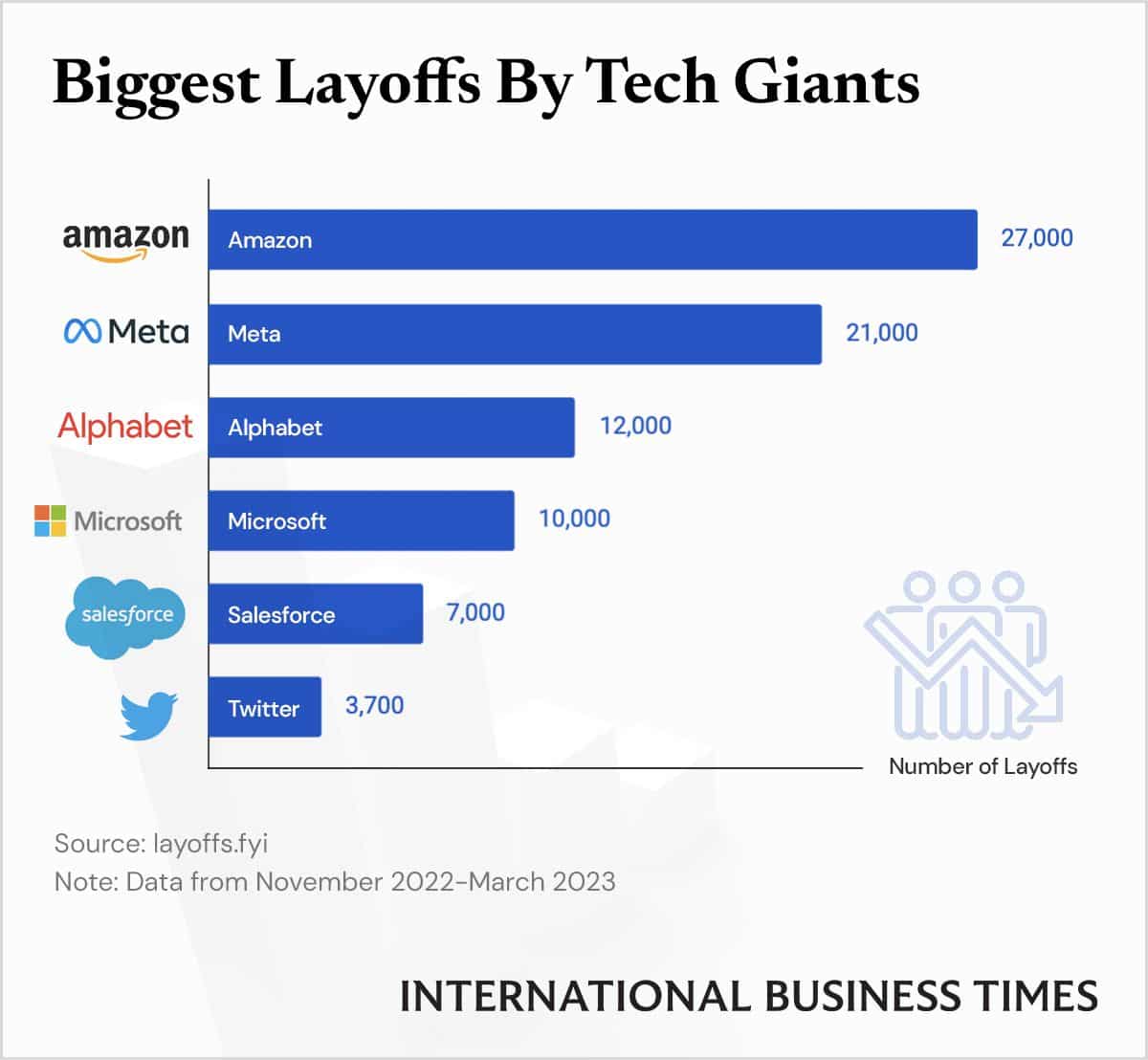

- Industry experts point to the recent trend of layoffs in the banking sector as evidence that PNC Bank may be considering similar measures. Banks across the country have been reducing their workforces in response to economic pressures, increased competition, and technological advancements.

The World Series 2024 is already generating a lot of buzz on social media, with fans eagerly discussing the contenders and making predictions. Check out this article to see what the latest trends are and which teams are dominating the conversation.

- Experts also note that PNC Bank has a history of implementing layoffs when necessary, suggesting that it may be willing to make similar decisions in the future. However, they also emphasize that PNC Bank’s strong financial performance and growth in recent years could give it some flexibility in managing its workforce.

To qualify for the Virginia tax rebate in October 2024, businesses must meet certain criteria. Find out if your business is eligible for this financial assistance.

- The situation at PNC Bank is not unique to the bank. Many other banks are facing similar challenges, including economic uncertainty, increased competition, and technological disruption. The industry is grappling with these challenges, and layoffs are becoming increasingly common as banks seek to adapt to the changing landscape.

Taylor Swift’s music has been a major source of income for her, and it’s no surprise that she’s one of the wealthiest entertainers in the world. Read more about her impressive net worth and how her music empire has contributed to her success.

Future Outlook

The future of PNC Bank in light of the layoff rumors is uncertain. However, based on the current trends and industry perspectives, it is possible to Artikel a potential timeline and scenarios.

- Timeline:

- October 2024:The rumored layoff date. PNC Bank may announce its decision regarding layoffs or provide updates on its workforce optimization plans.

- November-December 2024:If layoffs occur, PNC Bank will likely begin implementing them during this period. This could involve informing affected employees, providing severance packages, and transitioning responsibilities.

- January-March 2025:PNC Bank may continue to adjust its workforce and implement cost-cutting measures during this period. The bank may also focus on initiatives to improve efficiency and adapt to the changing economic environment.

- Scenarios:

Scenario Impact on PNC Bank Significant Layoffs Reduced workforce, potential impact on customer service and financial performance, decline in employee morale. Limited Layoffs Minor workforce adjustments, potential impact on specific departments, minimal impact on overall operations. No Layoffs Continued focus on growth and innovation, potential for increased investments in technology and customer service. - Visual Representation:

The potential future of PNC Bank in light of the rumors can be visualized as a branching path. One path leads to significant layoffs, resulting in a smaller workforce and potential challenges. Another path leads to limited layoffs, with minimal impact on operations.

The third path represents no layoffs, with PNC Bank continuing to invest in growth and innovation. The actual outcome will depend on PNC Bank’s strategic decisions and the evolving economic environment.

Concluding Remarks: PNC Bank Layoffs Rumors In October 2024

The future of PNC Bank remains uncertain, but the rumors surrounding potential layoffs in October 2024 have highlighted the complexities and challenges facing the banking industry. As we navigate this period of uncertainty, it’s crucial to consider the potential impact on employees, customers, and the broader financial landscape.

Only time will tell the true extent of these rumors and their impact on PNC Bank’s future.

FAQ Guide

What is the current financial performance of PNC Bank?

PNC Bank’s recent financial performance has been mixed, with some quarters showing strong results while others have been more challenging. It’s important to analyze the bank’s financial reports and statements to gain a comprehensive understanding of their current situation.

Are there any official statements from PNC Bank regarding layoffs?

With the economy still facing challenges, many are wondering if another stimulus check is on the horizon. Get the latest updates on the potential for a stimulus in October 2024 and see what experts are saying.

As of now, PNC Bank has not issued any official statements confirming or denying the rumors of layoffs in October 2024. However, the bank’s silence has only fueled speculation and uncertainty.

What are the potential alternatives to layoffs that PNC Bank could consider?

PNC Bank could explore alternative strategies to address potential challenges, such as cost-cutting measures, voluntary buyouts, or strategic partnerships. It’s important to consider a range of options before resorting to layoffs.