Point Home Equity 2024: Navigating the Housing Market delves into the world of home equity, a vital component of personal finance. This guide explores the evolving landscape of home equity in 2024, considering factors like interest rates, market trends, and the potential impact of economic shifts.

Understanding the mortgage approval process is crucial. Explore the key factors that influence Mortgage Approval in 2024 to increase your chances of success.

Whether you’re looking to tap into your home equity for financial goals or simply want to understand its role in your financial well-being, this comprehensive overview provides valuable insights.

The FHA program offers various benefits for homebuyers. Research FHA Lenders in 2024 to find the best options for your needs.

We’ll examine how home equity is defined, its significance in personal finance, and the various ways it can be used. Furthermore, we’ll analyze the projected changes in home values and interest rates for 2024, exploring the potential impact of economic factors on home equity growth.

Stay informed about the current market by checking out Current Home Loan Rates in 2024 to get a real-time picture of the lending landscape.

This exploration includes insights from real estate experts and market analysts on the outlook for home equity in the year ahead.

Looking to invest in commercial real estate? Learn more about the current landscape of Commercial Property Mortgages in 2024 to make informed decisions.

Last Word

Understanding home equity in the context of the ever-changing housing market is crucial for informed financial decisions. By exploring the various methods of accessing home equity, the responsible strategies for utilizing it, and the potential risks and opportunities associated with leveraging it, you can navigate the market with confidence.

Adjustable Rate Mortgages (ARMs) can offer flexibility, but it’s important to understand the potential risks. Get informed about ARM Rates in 2024 and how they might affect your monthly payments.

Whether you’re considering using home equity for home improvements, debt consolidation, or other financial goals, this guide provides the knowledge and insights you need to make informed choices and maximize your financial potential in 2024.

USAA is a trusted financial institution for military members. Discover the specific home loan offerings available through USAA Home Loans in 2024.

FAQ Compilation: Point Home Equity 2024

What are the current interest rates for home equity loans and lines of credit?

The convenience of online mortgage applications is growing in popularity. Learn more about Online Mortgages in 2024 and how they might simplify the process for you.

Interest rates for home equity loans and lines of credit vary depending on factors like your credit score, loan amount, and lender. It’s best to compare offers from multiple lenders to secure the most favorable terms.

Navigating the homebuying process for the first time can be daunting. Find resources and guidance specifically for First Time Buyers in 2024 to make the journey smoother.

How does inflation affect home equity?

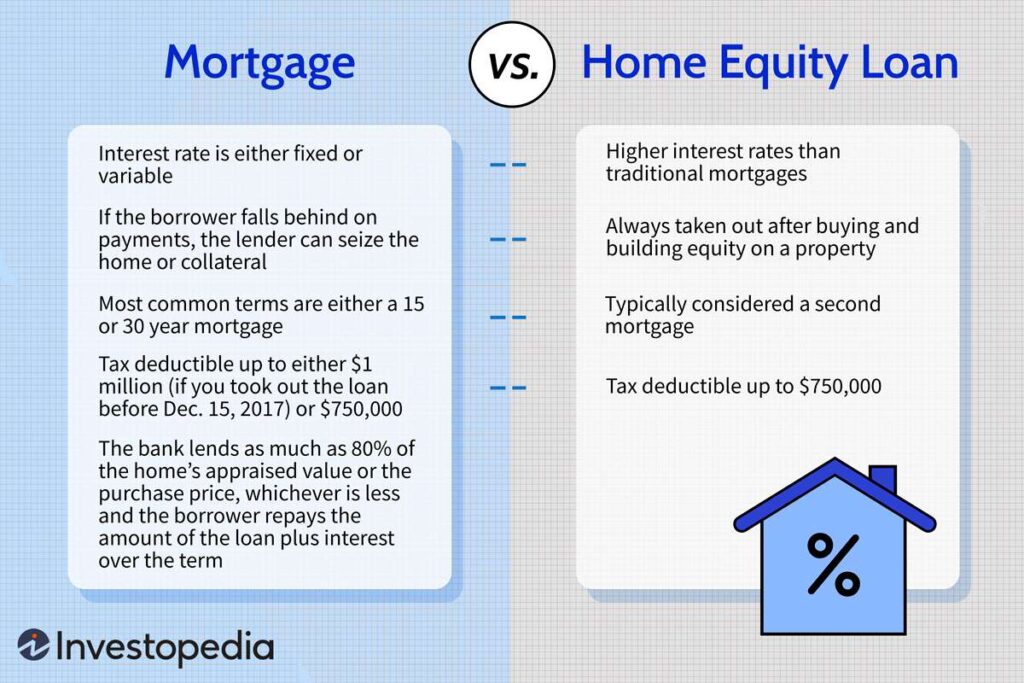

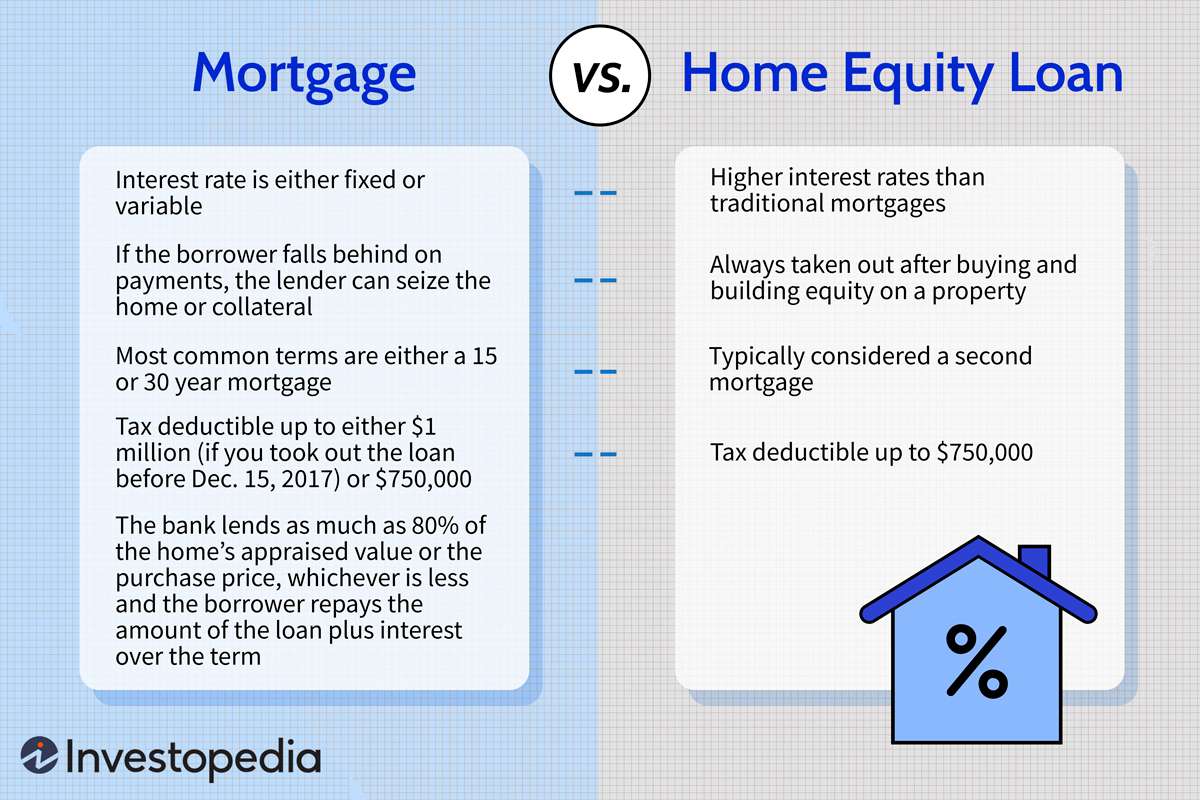

Considering a second mortgage? Explore the options and implications of a 2nd Mortgage in 2024 to see if it’s right for your financial situation.

Inflation can impact home equity in several ways. Rising prices can increase the value of your home, but also increase the cost of borrowing, potentially making it more expensive to access your home equity.

Are you a member of the Navy? Discover the potential benefits of a Navy Federal VA Loan Rate in 2024 and how it could help you achieve your homeownership goals.

What are some of the risks associated with accessing home equity?

Stay up-to-date on the latest trends in the housing market. Check out Home Interest Rates Today in 2024 to get a sense of what to expect.

Risks associated with accessing home equity include overextending yourself financially, potentially putting your home at risk if you can’t keep up with repayments. It’s crucial to carefully assess your financial situation and only borrow what you can comfortably repay.

Thinking about tapping into your home equity? Learn about the process and potential implications of Taking Equity Out Of Your Home in 2024.

Chase is a major financial institution offering refinancing options. Explore Chase Refinance Rates in 2024 to see if they could benefit your current mortgage.

Finding the best interest rate can save you money over the life of your mortgage. Compare different lenders and explore Best Home Loan Interest Rates in 2024 to secure a favorable deal.

For a more personalized mortgage experience, consider working with Private Mortgage Lenders in 2024. They often offer more flexibility and tailored solutions.