Psecu Mortgage Rates 2024 offer a glimpse into the current landscape of home financing, with rates fluctuating based on factors like the Federal Reserve’s monetary policy and overall market conditions. Understanding these rates is crucial for prospective homeowners seeking to secure a mortgage, as they directly impact the affordability and overall cost of their dream home.

Buying your first home can be an exciting time. There are often special programs available to help first-time home buyers. You can find out more about first-time home buyer interest rates in 2024 to see what’s available.

This guide delves into the intricacies of Psecu mortgage rates, providing valuable insights into the current market trends, various mortgage products, and the application process, empowering you to make informed decisions about your home financing journey.

From fixed-rate mortgages that provide stability to adjustable-rate mortgages that offer potential for lower initial payments, Psecu offers a range of options to suit different financial situations and risk tolerances. Navigating the complexities of mortgage rates can be daunting, but this guide aims to simplify the process by providing clear explanations, helpful tips, and valuable resources.

Maybe you’re happy with your current mortgage but want to explore other options. Switching lenders can sometimes be a good move, especially if you’re looking for a lower interest rate. If you’re thinking about a switch, check out the current information on switching mortgages in 2024.

Contents List

Understanding Psecu Mortgage Rates

Psecu, a credit union known for its competitive financial products, offers a range of mortgage options to its members. Understanding Psecu mortgage rates is crucial for making informed decisions about homeownership. This article delves into the current rates, historical trends, and factors that influence them, providing a comprehensive overview of Psecu’s mortgage landscape.

A second charge mortgage is a type of loan that is secured against your home. If you’re considering a second charge mortgage, it’s important to understand the terms and conditions. You can find out more about second charge mortgages in 2024 to see if it’s right for you.

Current Psecu Mortgage Rates

Psecu mortgage rates for 2024 are influenced by several factors, including the Federal Reserve’s monetary policy and prevailing market conditions. As of today, Psecu offers a variety of fixed and adjustable-rate mortgages (ARMs). Fixed-rate mortgages provide stability with consistent monthly payments, while ARMs offer potentially lower initial rates but come with the risk of fluctuating payments over time.

Thinking about tapping into your home’s equity? An equity line of credit can be a helpful tool for home improvements or other financial needs. Get a sense of the current rates with information on equity line of credit rates in 2024.

For example, a 30-year fixed-rate mortgage from Psecu might currently have an interest rate of around 6.5%, while a 5/1 ARM might have an initial rate of 5.5%. These rates are subject to change based on market fluctuations and Psecu’s internal policies.

Reverse mortgages can be a good option for homeowners who are looking to tap into their home equity. If you’re considering a reverse mortgage, check out AAG reverse mortgages for 2024 to learn more.

It’s essential to contact Psecu directly for the most up-to-date rates.

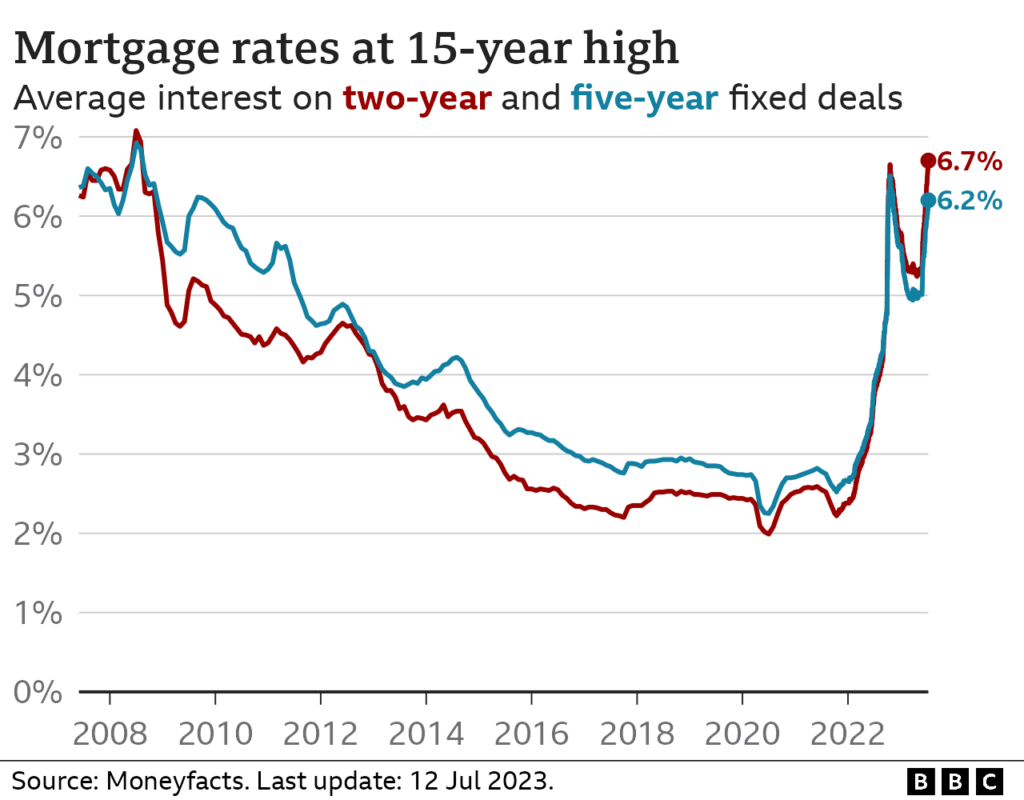

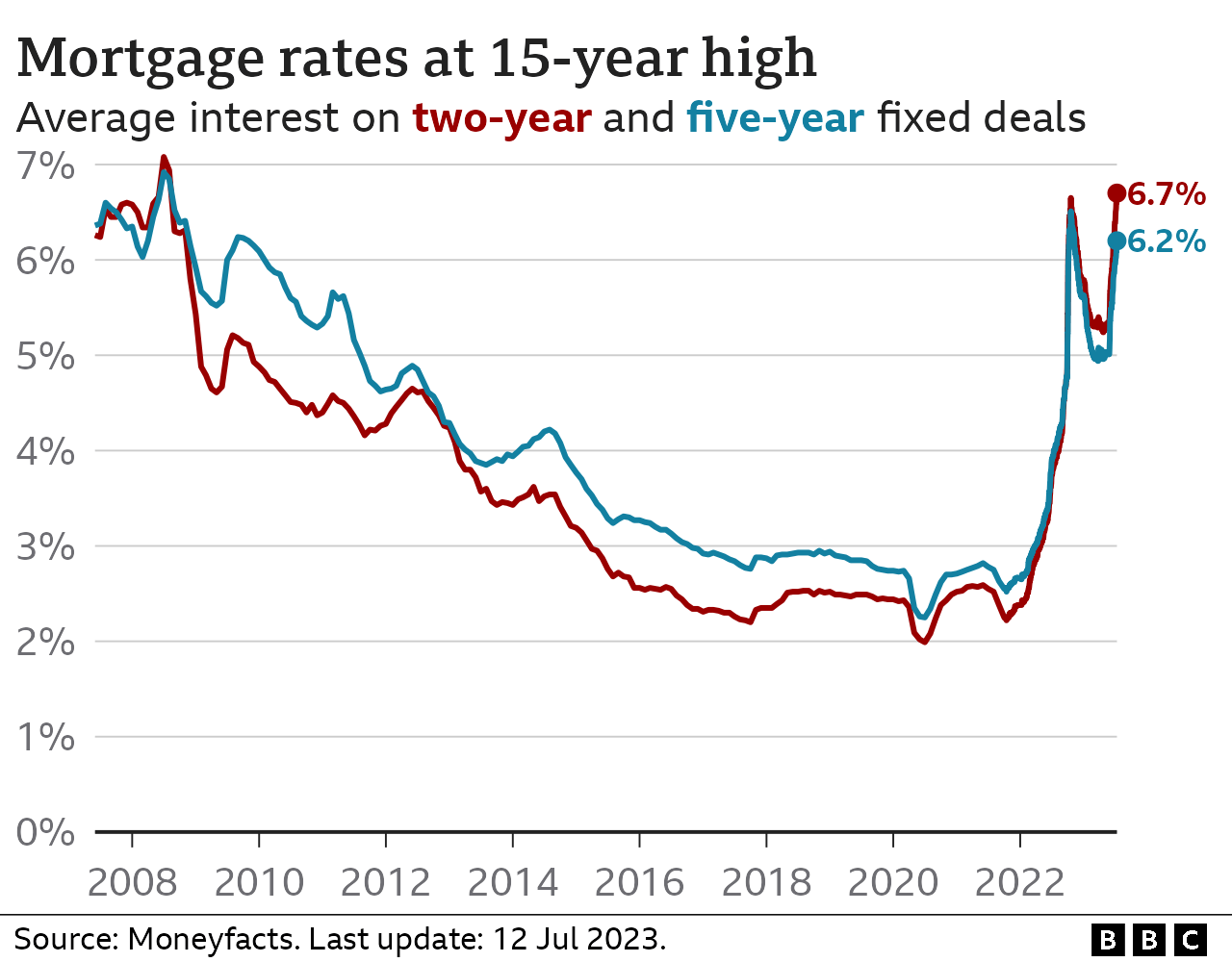

Historical Psecu Mortgage Rates

Psecu mortgage rates have fluctuated over the past year, mirroring broader trends in the mortgage market. Rates generally declined in the first half of 2023, driven by the Federal Reserve’s efforts to ease inflation. However, they have trended upwards in recent months due to a combination of factors, including rising inflation and the Fed’s continued rate hikes.

It’s important to note that historical rates are not necessarily indicative of future rates. The mortgage market is constantly evolving, and factors like economic conditions and investor sentiment can significantly impact rate changes.

Choosing the right lender is a big part of the home buying process. You can find a list of home lenders for 2024 to compare their offerings and find the best fit for your needs.

Factors Influencing Psecu Mortgage Rates

Psecu mortgage rates are influenced by several factors, including:

- Federal Reserve’s Monetary Policy:The Federal Reserve’s actions, such as setting interest rates, directly impact mortgage rates. When the Fed raises interest rates, it generally leads to higher mortgage rates, and vice versa.

- Market Conditions:Factors like inflation, economic growth, and investor confidence play a role in influencing mortgage rates. When inflation is high, rates tend to rise to reflect the increased cost of borrowing.

- Psecu’s Internal Policies:Psecu sets its own mortgage rates based on its financial performance, risk appetite, and competitive landscape. These factors can also contribute to variations in rates compared to other lenders.

Psecu Mortgage Products

Psecu offers a diverse range of mortgage products designed to meet the unique needs of its members. These products cater to different financial situations, credit profiles, and homeownership goals. Understanding the features and eligibility requirements of each product is crucial for selecting the right mortgage option.

Credit unions can often offer competitive mortgage rates. If you’re a member of a credit union, you might want to check out the rates they’re offering. Check out ICCU mortgage rates for 2024 to see what’s available.

Types of Psecu Mortgages

Psecu offers a variety of mortgage products, including:

- Conventional Loans:Conventional loans are the most common type of mortgage. They are typically offered by private lenders, but Psecu also provides conventional loan options. These loans generally require a higher credit score and down payment than other types of mortgages.

VA loans can offer competitive rates for veterans. If you’re considering a VA loan, take a look at the current VA mortgage rates for 2024 to get a better idea of what you might qualify for.

- FHA Loans:FHA loans are government-insured mortgages that are designed to make homeownership more accessible to borrowers with lower credit scores and down payments. These loans typically have lower down payment requirements and more flexible credit guidelines compared to conventional loans.

- VA Loans:VA loans are available to eligible veterans, active-duty military personnel, and surviving spouses. These loans offer benefits like no down payment requirement and lower interest rates. They are guaranteed by the Department of Veterans Affairs.

- Jumbo Loans:Jumbo loans are mortgages that exceed the conforming loan limits set by Fannie Mae and Freddie Mac. These loans are typically used for higher-priced homes and often require a larger down payment and a strong credit history.

Psecu Mortgage Product Comparison

| Mortgage Product | Interest Rates | Loan Terms | Down Payment Requirements | Credit Score Requirements |

|---|---|---|---|---|

| Conventional | Variable | 15-30 years | 5-20% | 620+ |

| FHA | Variable | 15-30 years | 3.5% | 580+ |

| VA | Variable | 15-30 years | 0% | 620+ |

| Jumbo | Variable | 15-30 years | 10-20% | 700+ |

It’s important to note that the specific interest rates, loan terms, and down payment requirements for each Psecu mortgage product can vary based on factors like your credit score, debt-to-income ratio, and the property you’re purchasing.

If you need a little extra help qualifying for a mortgage, a guarantor loan can be a good option. You can learn more about guarantor home loans in 2024 to see if it’s a good fit for your situation.

Applying for a Psecu Mortgage

Applying for a Psecu mortgage involves a straightforward process that begins with gathering the necessary documentation and meeting the credit requirements. Psecu offers resources and guidance to make the application process smooth and efficient.

Chase is a well-known name in the banking world. If you’re considering a mortgage with Chase, it’s always a good idea to check the current rates. You can find information on Chase mortgage rates for today in 2024.

Application Process

The application process for a Psecu mortgage typically involves the following steps:

- Pre-qualification:Psecu offers a pre-qualification tool that provides an estimate of how much you can borrow without affecting your credit score. This gives you a general idea of your affordability and helps you narrow down your mortgage options.

- Application:Once you’ve chosen a mortgage product, you’ll need to complete a formal application. This involves providing personal and financial information, including your income, assets, debts, and employment history.

- Documentation:Psecu will require you to provide supporting documentation to verify the information you provided in your application. This typically includes pay stubs, tax returns, bank statements, and credit reports.

- Credit Check:Psecu will review your credit history to assess your creditworthiness. A higher credit score generally improves your chances of getting approved for a mortgage at a favorable interest rate.

- Property Appraisal:Once your application is approved, Psecu will order an appraisal to determine the fair market value of the property you’re purchasing. This appraisal is used to ensure that the loan amount is appropriate for the property’s value.

- Loan Closing:Once the appraisal is complete and all other requirements are met, you’ll attend a loan closing where you’ll sign the mortgage documents and finalize the loan process.

Pre-approval for a Psecu Mortgage

Obtaining pre-approval for a Psecu mortgage can be beneficial in several ways. It provides you with a clear picture of your borrowing capacity, allowing you to shop for homes within your budget. Pre-approval also strengthens your offer when you make an offer on a property, demonstrating to sellers that you’re a serious and qualified buyer.

Saving up for a down payment can be a challenge. Thankfully, there are programs out there that can help. You can find out more about home down payment assistance in 2024 to see if you qualify.

Tips for Improving Your Chances of Approval, Psecu Mortgage Rates 2024

Here are some tips to improve your chances of getting approved for a Psecu mortgage:

- Maintain a Good Credit Score:Aim for a credit score of at least 620 or higher to improve your chances of getting approved for a mortgage at a competitive interest rate.

- Manage Your Debt:Keep your debt-to-income ratio (DTI) low. A lower DTI shows lenders that you can comfortably handle your existing debt obligations and make your mortgage payments.

- Save for a Down Payment:A larger down payment can reduce your loan amount and improve your chances of getting approved. It can also lead to lower interest rates.

- Review Your Credit Report:Check your credit report for any errors and dispute them with the credit bureaus. This ensures that your credit history is accurate and reflects your true creditworthiness.

Last Recap: Psecu Mortgage Rates 2024

In conclusion, Psecu Mortgage Rates 2024 provide a dynamic and evolving landscape for homebuyers. By understanding the factors influencing these rates, exploring the various mortgage products available, and carefully navigating the application process, borrowers can secure a mortgage that aligns with their individual financial goals.

BECU is another well-known credit union that offers mortgage services. If you’re considering a mortgage with BECU, you can check out the current rates by looking at BECU mortgage rates for 2024.

This guide has aimed to equip you with the knowledge and resources necessary to make informed decisions about your home financing journey. Remember, researching, comparing options, and consulting with a Psecu mortgage loan officer are crucial steps in finding the right mortgage for your needs.

Refinancing your mortgage can be a good way to save money on your monthly payments. If you’re thinking about refinancing, it’s important to know the current rates. Take a look at refi rates for 2024 to see if it’s a good option for you.

Answers to Common Questions

What are the current Psecu mortgage rates for 2024?

Figuring out your monthly payments can be a big step in the home buying process. If you’re considering a large mortgage, check out the current rates for a 400k mortgage payment in 2024 to get a better idea of what you might be looking at.

Psecu mortgage rates for 2024 are subject to change daily. For the most up-to-date information, it’s recommended to visit Psecu’s website or contact a loan officer directly.

What is the minimum credit score required for a Psecu mortgage?

The minimum credit score requirement for a Psecu mortgage varies depending on the specific mortgage product and your individual circumstances. Generally, a higher credit score improves your chances of approval and may lead to more favorable interest rates. It’s best to contact Psecu for personalized guidance.

What are the closing costs associated with a Psecu mortgage?

If you’re a veteran looking to buy a home, VA loans can be a great option. To get a sense of the current market, you can check out the VA interest rates for today in 2024.

Closing costs for a Psecu mortgage can include origination fees, appraisal fees, title insurance, and other expenses. The exact costs will vary based on the loan amount, property location, and other factors. Psecu provides detailed breakdowns of closing costs during the application process.

How can I improve my chances of getting approved for a Psecu mortgage?

To improve your chances of getting approved for a Psecu mortgage, consider improving your credit score, saving for a larger down payment, and providing complete and accurate documentation during the application process. Psecu loan officers can offer personalized tips to strengthen your application.