Pv Annuity Of 1 Table 2024 provides a powerful tool for financial professionals and individuals alike to calculate the present value of future annuity payments. This table, a cornerstone of financial analysis, helps to understand the time value of money, a crucial concept in making sound financial decisions.

The table essentially translates future cash flows into their present-day equivalent, taking into account the effects of interest rates and the passage of time. By understanding how interest rates and time periods influence the present value of an annuity, you can make informed decisions about investments, loans, and retirement planning.

Contents List

- 1 Understanding PV Annuity of 1 Table 2024

- 2 Outcome Summary

- 3 Helpful Answers

Understanding PV Annuity of 1 Table 2024

The PV Annuity of 1 table, also known as the present value of an annuity of 1 table, is a fundamental tool in financial analysis. It provides a comprehensive framework for calculating the present value of a series of equal payments, known as an annuity, that occur over a specific period.

There are a variety of online calculators available to help you determine the value of your annuity. If you’re looking for a user-friendly tool, check out this annuity calculator that can help you understand the math behind your annuity.

Understanding this table is crucial for making informed financial decisions, whether you’re evaluating investments, analyzing loan terms, or planning for retirement.

Calculating the present value of an annuity due on a financial calculator like the BA II Plus can be a bit tricky. If you’re looking for guidance on calculating annuity due on a BA II Plus , this article can provide you with the steps you need.

Concept and Relevance

The PV Annuity of 1 table is based on the concept of time value of money, which states that money received today is worth more than the same amount received in the future. This is due to the potential for earning interest or returns on the money over time.

Figuring out how much your annuity will pay out can be tricky. Luckily, there are online calculators that can help you determine your annuity amount for 2024. Just input your information and the calculator will do the rest.

The table essentially discounts future annuity payments back to their present value, taking into account the time value of money and the applicable interest rate.

Annuity funds are designed to provide you with a consistent stream of income throughout your retirement. A key thing to remember is that these funds are unrestricted , meaning you can use them for whatever you want, not just essential expenses.

Purpose and Use, Pv Annuity Of 1 Table 2024

The primary purpose of the PV Annuity of 1 table is to determine the present value of an annuity, which is the equivalent amount of money that would need to be invested today to generate the same future stream of payments.

An annuity of $60,000 can provide a significant source of income during retirement. If you’re looking for information about annuities of $60,000 , this article can provide you with helpful insights.

This information is essential for various financial calculations, such as:

- Loan Calculations:Determining the present value of loan payments helps calculate the loan amount or the monthly payment required.

- Investment Analysis:Evaluating the present value of future cash flows from investments allows investors to compare different investment options.

- Retirement Planning:Calculating the present value of future retirement income helps individuals determine how much they need to save to achieve their financial goals.

Structure and Interpretation

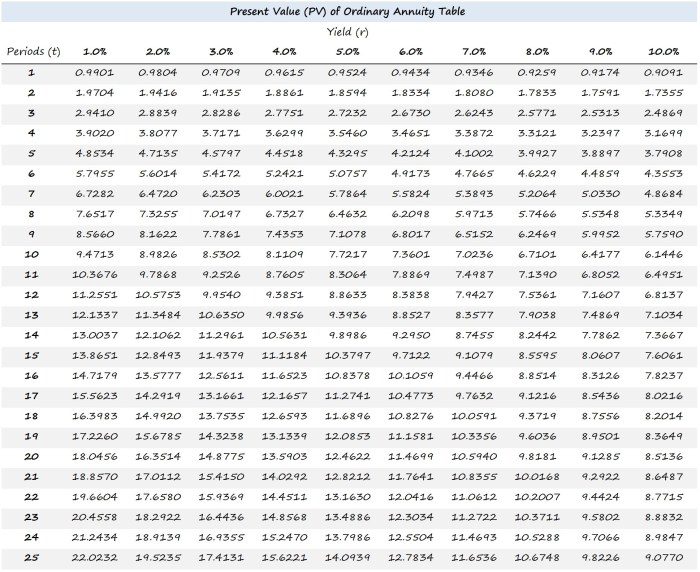

The PV Annuity of 1 table is typically structured with rows representing different time periods (years) and columns representing various interest rates. Each cell in the table contains a factor that represents the present value of an annuity of $1 for the corresponding time period and interest rate.

An annuity and a pension are both forms of retirement income, but they have some key differences. If you’re wondering if annuities and pensions are the same, this article can help you understand the distinction.

To interpret the table, locate the intersection of the row representing the desired time period and the column representing the applicable interest rate. The value in that cell represents the present value factor. Multiply this factor by the amount of each annuity payment to determine the present value of the entire annuity stream.

When choosing an annuity provider, it’s important to make sure they are legitimate and trustworthy. If you’re wondering if Annuity Gator is a reputable company, you can research their background and reviews to make an informed decision.

Factors Affecting PV Annuity of 1

Two primary factors influence the present value of an annuity: interest rates and time periods.

The word “annuity” has seven letters, and it’s a term often used in the context of financial planning. If you’re curious about annuities , this article can provide you with a basic understanding of the concept.

Interest Rates

The higher the interest rate, the lower the present value of the annuity. This is because a higher interest rate means that future payments are discounted more heavily to reflect the potential for earning higher returns on invested capital. As interest rates increase, the values in the PV Annuity of 1 table decrease.

The interest rates on annuities can vary depending on the term of the annuity. If you’re interested in learning more about 3-year annuity rates , this article can provide you with some insights.

Time Periods

The longer the time period, the lower the present value of the annuity. This is because the further into the future the payments are received, the more they are discounted to reflect the time value of money. As the time period increases, the values in the PV Annuity of 1 table generally decrease.

A PV annuity chart can be a valuable tool for visualizing how the present value of an annuity changes over time. If you’re looking for a visual representation of this concept, be sure to check out this resource: Pv Annuity Chart 2024.

Applications of PV Annuity of 1 Table

The PV Annuity of 1 table has widespread applications in various financial scenarios:

Loan Calculations

Banks and other lenders use the PV Annuity of 1 table to calculate the present value of loan payments. This allows them to determine the maximum loan amount they can offer based on the borrower’s ability to repay the loan over time.

An annuity can be a great way to ensure you have a reliable income stream for as long as you need it. However, it’s important to remember that annuities are indefinite in duration, meaning they can last for your entire lifetime.

Investment Analysis

Investors use the PV Annuity of 1 table to evaluate the present value of future cash flows from investments. This helps them compare different investment opportunities and make informed decisions based on their risk tolerance and financial goals.

In simple terms, an annuity is a financial product that provides regular payments over a set period of time. To get a deeper understanding of what an annuity is and how it works, check out this resource: Annuity What Is The Meaning 2024.

Retirement Planning

Individuals use the PV Annuity of 1 table to estimate the present value of their future retirement income. This allows them to determine how much they need to save to achieve a comfortable retirement lifestyle.

Calculating the amount of your annuity can be a bit complex, but there are formulas available to help you. If you’re looking for guidance on how to calculate annuity formulas , this article will provide you with the steps you need.

Comparison with Other Financial Tables

The PV Annuity of 1 table is closely related to other financial tables, such as the present value of 1 table and the future value of 1 table. However, each table serves a specific purpose and provides different information.

If you’re considering investing in an annuity, you may want to calculate its internal rate of return (IRR). This calculation can be done using an IRR calculator , which can help you determine the profitability of your investment.

Present Value of 1 Table

The present value of 1 table calculates the present value of a single lump sum payment received at a future date. In contrast, the PV Annuity of 1 table focuses on the present value of a series of equal payments.

Future Value of 1 Table

The future value of 1 table calculates the future value of a single lump sum investment made today. This table is used to determine how much an investment will grow over time, while the PV Annuity of 1 table focuses on discounting future payments back to their present value.

Limitations and Considerations

While the PV Annuity of 1 table is a valuable tool for financial analysis, it has limitations that should be considered:

Assumptions

The table assumes a constant interest rate and equal payments over the entire time period. In reality, interest rates can fluctuate, and payments may vary. This can lead to inaccuracies in the present value calculations.

Inflation

The table does not account for inflation, which can erode the purchasing power of future payments. When making financial decisions, it’s essential to consider the impact of inflation on the real value of money.

Risk

The table does not factor in risk, which can affect the likelihood of receiving future payments. For example, investments carry inherent risks that could impact the actual returns realized.

Taxes

The table does not consider taxes, which can reduce the net present value of an annuity. It’s crucial to factor in taxes when calculating the present value of future payments.

It’s important to use the PV Annuity of 1 table effectively and avoid potential pitfalls. Consult with a financial advisor to ensure you are making informed decisions based on your specific circumstances and goals.

Outcome Summary

The PV Annuity of 1 Table 2024 offers a valuable resource for understanding the present value of future annuity payments. Its applications span various financial scenarios, from loan calculations to investment analysis. By carefully considering the factors that influence present value, you can utilize this table effectively to make informed financial decisions and maximize the value of your investments.

Helpful Answers

How often is the PV Annuity of 1 Table updated?

The table is typically updated annually to reflect changes in interest rates and economic conditions.

What are some common applications of the PV Annuity of 1 Table in real-world scenarios?

While both annuities and life insurance are financial products, they have different purposes. An annuity provides a steady stream of income, while life insurance pays out a lump sum to your beneficiaries. To learn more about the differences, check out this article: Is Annuity The Same As Life Insurance 2024.

It is used in loan calculations to determine the present value of future loan payments, in investment analysis to evaluate the present value of future cash flows from investments, and in retirement planning to estimate the present value of future retirement income.

What are the limitations of using the PV Annuity of 1 Table?

The table relies on certain assumptions, such as constant interest rates and predictable cash flows, which may not always hold true in real-world situations. It is important to consider factors such as inflation, risk, and taxes when making financial decisions.

Is there a specific website where I can find the PV Annuity of 1 Table 2024?

You can typically find the PV Annuity of 1 Table 2024 on websites of financial institutions, accounting software providers, and financial education resources.