Pv Calculator Annuity 2024: Navigating the world of annuities can feel overwhelming, but understanding the present value (PV) of your future income stream is crucial for making informed financial decisions. This guide will empower you to confidently calculate the true worth of your annuity, taking into account factors like interest rates, payment amounts, and the duration of your investment.

The exclusion ratio is a key factor in determining the taxable portion of your annuity payments. Calculate Annuity Exclusion Ratio 2024 provides a step-by-step guide on how to calculate your exclusion ratio, ensuring you understand the tax implications of your annuity payments.

We’ll delve into the mechanics of PV calculators, explore different types of annuities and their impact on PV calculations, and analyze how current economic conditions might affect your returns. By understanding these concepts, you can make informed choices about your annuity options and ensure you’re maximizing your financial well-being.

Understanding the definition of an annuity is essential for informed financial decisions. An Annuity Is Best Defined As 2024 provides a comprehensive definition of an annuity, highlighting its key characteristics and purpose.

Contents List

- 1 Understanding PV Calculators for Annuities

- 2 Annuity Types and their Impact on PV Calculations

- 3 Factors Affecting Annuity PV in 2024: Pv Calculator Annuity 2024

- 4 Practical Applications of PV Calculators for Annuities

- 5 Resources and Tools for Annuity PV Calculations

- 6 Final Summary

- 7 Question & Answer Hub

Understanding PV Calculators for Annuities

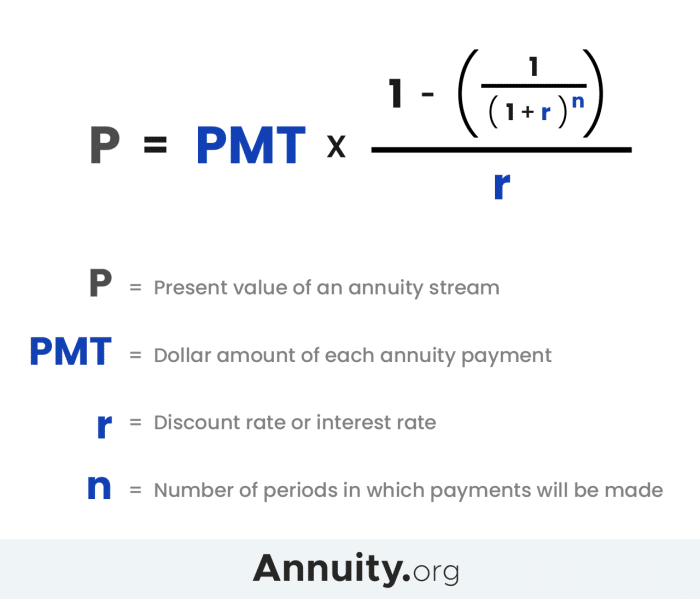

A PV calculator is a financial tool that helps determine the present value (PV) of an annuity, which is a series of regular payments made over a specific period. This tool is essential for anyone considering an annuity, as it provides a clear understanding of the value of the future payments in today’s dollars.

The PV calculator considers various factors, including the interest rate, payment amount, and the duration of the annuity, to calculate the present value.

Annuity certain is a common type of annuity with guaranteed payments for a specific period. Annuity Certain Is An Example Of 2024 provides an overview of annuity certain, highlighting its key features and benefits.

How PV Calculators Work

A PV calculator utilizes a mathematical formula to calculate the present value of an annuity. This formula takes into account the time value of money, meaning that money today is worth more than the same amount of money in the future due to its potential to earn interest.

Inherited annuities can present unique tax implications. How Is Inherited Annuity Taxed 2024 clarifies the tax rules surrounding inherited annuities, providing valuable insights for beneficiaries and their financial advisors.

The formula used for calculating the present value of an ordinary annuity is:

PV = PMT

An annuity with a principal of $60,000 can provide a steady stream of income throughout retirement. Annuity 60000 2024 explores the potential benefits and considerations associated with a $60,000 annuity, helping you make informed decisions about your retirement planning.

Inheriting an annuity can raise questions about taxability. I Inherited An Annuity Is It Taxable 2024 clarifies the tax implications of inherited annuities, helping you understand whether your inherited annuity is subject to taxation.

- [1

- (1 + r)^-n] / r

Where:

- PV is the present value of the annuity

- PMT is the payment amount

- r is the interest rate per period

- n is the number of periods

Key Variables Affecting PV

- Interest Rate:A higher interest rate generally results in a lower present value, as the future payments are discounted at a higher rate.

- Payment Amount:A higher payment amount leads to a higher present value, as the total value of the future payments increases.

- Duration of the Annuity:A longer annuity duration generally results in a higher present value, as the future payments are spread over a longer period, allowing for more time to accumulate interest.

Annuity Types and their Impact on PV Calculations

Different types of annuities have distinct characteristics that affect their present value calculations. Understanding these differences is crucial for making informed financial decisions.

Ordinary Annuities

An ordinary annuity involves payments made at the end of each period. The PV calculator uses the standard formula mentioned earlier to determine the present value. The present value of an ordinary annuity is typically lower than that of an annuity due, as the payments are received later in the period.

Annuities Due

An annuity due involves payments made at the beginning of each period. The PV calculation for an annuity due is slightly different from that of an ordinary annuity. The formula for calculating the present value of an annuity due is:

PV = PMT

- [1

- (1 + r)^-n] / r

- (1 + r)

The additional factor (1 + r) accounts for the fact that the first payment is received at the beginning of the period, earning an extra period of interest.

Deferred Annuities

A deferred annuity involves a period of time where no payments are made, followed by a series of regular payments. The PV calculation for a deferred annuity involves two steps: first, calculating the PV of the annuity at the time the payments begin, and then discounting that value back to the present time.

Calculating annuity payouts can be a bit complex, but with the help of Microsoft Excel, it becomes more manageable. Calculating Annuity In Excel 2024 provides practical guidance on using Excel formulas to calculate annuity values and make informed financial decisions.

Factors Affecting Annuity PV in 2024: Pv Calculator Annuity 2024

The economic climate plays a significant role in determining annuity interest rates and, consequently, the present value of annuities. In 2024, several factors are likely to influence PV calculations.

An annuity is often viewed as a single sum payment, but it can be structured in various ways. Annuity Is A Single Sum 2024 clarifies the concept of annuities as single sums, explaining the different payment structures and how they can impact your retirement income.

Interest Rate Environment

Interest rates are expected to remain elevated in 2024, driven by inflation and central bank policies. Higher interest rates will generally result in lower present values for annuities, as the future payments are discounted at a higher rate.

Annuity and IRA are both popular retirement savings options, but they have distinct characteristics. Annuity Vs Ira 2024 explores the key differences between the two, highlighting the potential benefits and drawbacks of each for your specific situation.

Inflation

Persistent inflation can erode the purchasing power of future payments, reducing their present value. Annuities that offer inflation protection, such as those with a cost-of-living adjustment (COLA), may be more attractive in an inflationary environment.

For residents of Westmont, Illinois, finding the right annuity provider can be crucial. Annuity Health Westmont Il 2024 offers insights into annuity options and providers available in Westmont, helping you make informed decisions about your retirement planning.

Market Volatility

Volatility in the financial markets can also affect annuity interest rates. In periods of heightened volatility, investors may demand higher returns, leading to higher interest rates and lower present values for annuities.

Regulatory Changes, Pv Calculator Annuity 2024

Changes in regulations or industry practices could impact annuity offerings and their present value calculations. For instance, new regulations may require insurers to increase reserves or adjust their pricing models, potentially affecting annuity rates and present values.

Annuity options can be diverse, and 3 Annuity 2024 delves into three prominent types of annuities. Understanding these variations can help you determine which annuity best aligns with your financial goals and risk tolerance.

Practical Applications of PV Calculators for Annuities

PV calculators are invaluable tools for understanding the value of annuity options and making informed financial decisions. Here’s a step-by-step guide on using a PV calculator:

Using a PV Calculator

- Input the payment amount (PMT):This is the amount of each regular payment you will receive from the annuity.

- Input the interest rate (r):This is the annual interest rate offered by the annuity, expressed as a decimal.

- Input the number of periods (n):This is the total number of payments you will receive over the lifetime of the annuity.

- Select the annuity type:Choose whether the annuity is an ordinary annuity, an annuity due, or a deferred annuity.

- Calculate the present value (PV):The calculator will then compute the present value of the annuity based on the inputted variables.

Hypothetical Scenario

Imagine you are considering two annuity options: Option A offers a $10,000 annual payment for 10 years at an interest rate of 4%, while Option B offers a $12,000 annual payment for 5 years at an interest rate of 5%.

Annuity is a common topic in multiple-choice questions (MCQs). Annuity Is A Mcq 2024 explores the various ways annuities are presented in MCQs, providing insights into common concepts and potential test questions.

Using a PV calculator, you can determine that the present value of Option A is approximately $77,026, while the present value of Option B is approximately $50,763. Based on this analysis, Option A may be more valuable to you if you prioritize a longer stream of income, even with a lower annual payment.

Annuity 5 refers to a type of annuity with a specific payout structure. Annuity 5 2024 delves into the specifics of annuity 5, explaining its characteristics and how it can be beneficial for your retirement planning.

Annuity Scenarios and PV Calculations

| Annuity Type | Payment Amount | Interest Rate | Duration | Present Value |

|---|---|---|---|---|

| Ordinary Annuity | $5,000 | 3% | 20 years | $79,079 |

| Annuity Due | $6,000 | 4% | 15 years | $74,384 |

| Deferred Annuity (5-year deferral) | $7,000 | 5% | 10 years | $44,057 |

Resources and Tools for Annuity PV Calculations

Numerous online calculators, financial planning tools, and software applications are available to assist with annuity PV calculations. Here are some reputable resources:

Online PV Calculators

- Bankrate.com:Offers a comprehensive annuity calculator that allows you to compare different annuity options and calculate their present value.

- Investopedia:Provides a user-friendly PV calculator that can be used to determine the present value of various financial instruments, including annuities.

- Calculator.net:Offers a free online PV calculator with various features, including the ability to adjust for inflation and taxes.

Financial Planning Software

- Personal Capital:A popular financial planning platform that includes tools for annuity analysis and PV calculations.

- Mint:A free budgeting and financial management app that offers basic annuity calculations.

- Quicken:A comprehensive personal finance software that provides advanced features for annuity planning and PV calculations.

Financial Resources

- The Financial Planning Association (FPA):Offers resources and articles on annuity planning and PV calculations.

- The American College of Financial Services:Provides educational materials and courses on annuities and retirement planning.

- The Securities and Exchange Commission (SEC):Offers investor education resources on annuities and other financial products.

Final Summary

Equipped with a solid grasp of PV calculations and the knowledge of how various factors influence annuity values, you can confidently approach your financial planning. Whether you’re considering a traditional annuity, a variable annuity, or a deferred annuity, understanding the present value will empower you to make choices that align with your long-term goals and financial security.

When it comes to annuities, understanding the quarterly formula is crucial for accurate calculations. Annuity Formula Quarterly 2024 explains the quarterly annuity formula, helping you understand how interest accrues and payments are calculated over time.

Remember, informed decision-making is the key to unlocking the true potential of your annuity investments.

Choosing between an annuity and drawdown in 2024 is a big decision, so it’s helpful to understand the differences. Annuity Or Drawdown 2024 provides a comprehensive overview of both options, helping you weigh the pros and cons to make an informed choice.

Question & Answer Hub

How often should I recalculate the PV of my annuity?

It’s recommended to recalculate the PV of your annuity at least annually, or more frequently if there are significant changes in interest rates, market conditions, or your personal financial circumstances.

What are the risks associated with annuities?

Annuities can carry risks, such as the potential for lower returns than expected, the possibility of losing principal, and the risk of outliving your annuity payments. It’s important to carefully consider these risks before investing in an annuity.

Are there any tax implications associated with annuities?

Yes, there are tax implications associated with annuities. The tax treatment of annuity payments depends on the type of annuity and the terms of the contract. It’s essential to consult with a tax professional to understand the tax implications of your specific annuity.