Rava 5 Variable Annuity 2024 offers a unique approach to retirement planning, combining the security of an annuity with the potential for growth in the market. This product allows investors to allocate their funds across a variety of investment options, tailoring their portfolio to their individual risk tolerance and financial goals.

When it comes to annuities, calculating future values is a common task. If you’re dealing with a problem involving this calculation, you might find the information in this article helpful: Problem 6-24 Calculating Annuity Future Values 2024. It provides insights into how to approach such calculations.

This comprehensive guide delves into the intricacies of the Rava 5 Variable Annuity, exploring its features, benefits, risks, and how it compares to other annuity products available in the market. We’ll also discuss the factors to consider when deciding if this annuity is the right fit for your specific circumstances.

Annuity is a financial product that provides a stream of payments over a period of time, and understanding its meaning is crucial in making informed financial decisions. If you’re curious about the details of annuities, you can check out this article on Annuity Is Meaning 2024 to gain a better grasp of the concept.

Contents List

Rava 5 Variable Annuity Overview

The Rava 5 Variable Annuity is a type of retirement savings product that offers the potential for growth through investments in a variety of sub-accounts. This annuity allows individuals to choose from a range of investment options, including stocks, bonds, and mutual funds, providing flexibility to align their investment strategy with their risk tolerance and financial goals.

Variable annuity income riders are designed to provide a guaranteed stream of income during retirement. If you’re interested in learning more about these riders and how they work, you can check out Variable Annuity Income Rider 2024.

Key Features and Benefits

The Rava 5 Variable Annuity offers a number of key features and benefits, including:

- Potential for Growth:The variable nature of the annuity allows for the potential to earn higher returns than traditional fixed annuities, but also carries greater risk.

- Investment Flexibility:Investors have the freedom to choose from a variety of investment options to tailor their portfolio based on their individual preferences and risk tolerance.

- Tax-Deferred Growth:Earnings within the annuity grow tax-deferred, meaning that taxes are not paid until the funds are withdrawn in retirement.

- Death Benefit:The annuity may offer a death benefit to beneficiaries, ensuring that a portion of the investment is passed on to loved ones.

- Guaranteed Minimum Income:Some variable annuities may include a guaranteed minimum income rider, providing a guaranteed stream of income in retirement, even if the investment performance is poor.

Investment Options

The Rava 5 Variable Annuity offers a diverse range of investment options, allowing investors to create a portfolio that aligns with their risk tolerance and financial goals. These options may include:

- Mutual Funds:A broad range of mutual funds, offering exposure to different asset classes, such as stocks, bonds, and real estate.

- Exchange-Traded Funds (ETFs):ETFs provide diversified exposure to specific sectors or markets, offering a more cost-effective alternative to traditional mutual funds.

- Individual Stocks:The ability to invest in individual stocks provides investors with the potential for higher returns but also carries a greater risk.

- Bonds:Bonds offer a more conservative investment option, providing income and potential for capital appreciation.

Potential Risks, Rava 5 Variable Annuity 2024

While the Rava 5 Variable Annuity offers potential for growth, it also carries certain risks that investors should carefully consider:

- Market Risk:The value of the annuity’s investment options can fluctuate with market conditions, potentially resulting in losses.

- Investment Risk:The choice of investment options within the annuity carries inherent risk, and the potential for losses depends on the specific investment choices made.

- Fees and Expenses:Variable annuities often come with fees and expenses, which can impact the overall returns on the investment.

- Liquidity Risk:Withdrawals from a variable annuity may be subject to surrender charges, which can impact the liquidity of the investment.

Rava 5 Variable Annuity in 2024

The Rava 5 Variable Annuity continues to be a relevant option for retirement savings in 2024. The current market conditions, however, present both opportunities and challenges for investors.

Annuities are complex financial products, and understanding their nuances is essential for making informed decisions. If you’re looking for a comprehensive overview of annuities, you might find the article on Annuity 3 2024 helpful.

Current Market Conditions and Impact

In 2024, the market is characterized by elevated inflation and rising interest rates. These factors can impact the performance of the Rava 5 Variable Annuity, particularly for investments in stocks and bonds. The potential for higher returns is balanced against the risk of market volatility and potential for losses.

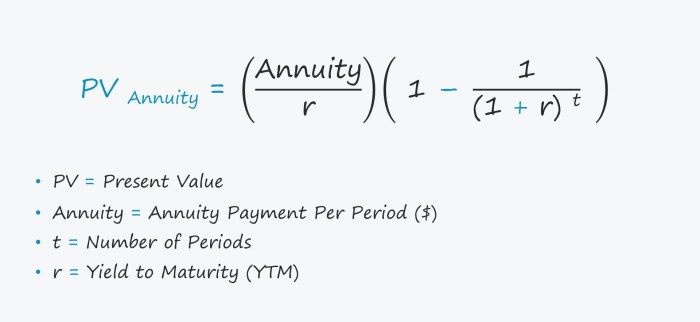

Calculating annuity payments often involves using a specific formula. If you’re looking for a detailed explanation of the annuity formula, you can visit Annuity Formula Is 2024. This article provides a comprehensive breakdown of the formula and its components.

Recent Performance Data

To gain a comprehensive understanding of the Rava 5 Variable Annuity’s performance in 2024, it’s crucial to analyze recent performance data. This data should include the returns generated by the annuity’s various investment options, taking into account factors such as market conditions and fees.

Calculating annuity payments involves a specific formula. If you’re looking for a breakdown of this formula, you can check out Formula For Calculating The Annuity Payment 2024. It provides a clear explanation of the components and how they work together.

It’s essential to consider the performance of the annuity’s sub-accounts, as well as the overall performance of the product itself.

Choosing between a variable annuity and a fixed annuity can be a significant decision. To understand the key differences between these two types of annuities, you can visit Variable Annuity Vs Fixed Annuity 2024. This article provides a clear comparison of their features and risks.

Updates and Changes in 2024

It’s essential to stay informed about any updates or changes made to the Rava 5 Variable Annuity in 2024. These changes could include modifications to investment options, fees, or other product features. Understanding these updates is crucial for making informed investment decisions.

Annuities and pensions are often compared, but they have key differences. To understand whether an annuity is the same as a pension, you can read Is Annuity Same As Pension 2024. This article provides insights into their similarities and distinctions.

Potential Opportunities and Challenges

The Rava 5 Variable Annuity presents both opportunities and challenges in 2024. Investors can capitalize on potential growth opportunities through strategic investment choices, while navigating the challenges posed by market volatility and rising interest rates. Understanding the potential for both growth and risk is crucial for making informed investment decisions.

Calculating the annuity exclusion ratio is a crucial step for tax purposes. If you’re seeking information on how to calculate this ratio, you can find guidance on Calculate Annuity Exclusion Ratio 2024. This article provides a detailed explanation of the process.

Rava 5 Variable Annuity vs. Other Annuities

The Rava 5 Variable Annuity is not the only annuity product available in the market. Comparing it to other similar products can help investors make an informed decision about which option best aligns with their needs and goals.

Understanding how to calculate ordinary annuities is crucial for financial planning. If you’re interested in learning more about this calculation, you can find helpful information on Calculating Ordinary Annuity 2024. This article provides guidance on the steps involved.

Key Differences in Features, Benefits, and Risks

When comparing the Rava 5 Variable Annuity to its competitors, it’s essential to consider key differences in features, benefits, and risks. These differences can include:

- Investment Options:The range and types of investment options available may vary between different annuity products.

- Fees and Expenses:Fees and expenses can vary significantly, impacting the overall returns on the investment.

- Guaranteed Minimum Income:The availability and features of guaranteed minimum income riders can vary between products.

- Death Benefit:The death benefit features and payout options may differ between annuities.

Advantages and Disadvantages

Comparing the advantages and disadvantages of the Rava 5 Variable Annuity to its competitors can help investors identify the best option for their specific circumstances. Factors to consider include:

- Investment Flexibility:Some annuities may offer more flexibility in choosing investment options.

- Fees and Expenses:The cost of different annuities can vary significantly.

- Guaranteed Income Features:The availability and features of guaranteed minimum income riders can influence the choice of annuity.

- Tax Implications:The tax treatment of withdrawals and other features can vary between products.

Key Features Comparison Table

| Feature | Rava 5 Variable Annuity | Competitor A | Competitor B |

|---|---|---|---|

| Investment Options | Mutual funds, ETFs, individual stocks, bonds | Mutual funds, ETFs, managed accounts | Fixed index annuities, variable annuities |

| Fees and Expenses | Variable fees, annual expenses | Fixed fees, annual expenses | Variable fees, annual expenses |

| Guaranteed Minimum Income | Optional rider | Optional rider | Optional rider |

| Death Benefit | Guaranteed death benefit | Guaranteed death benefit | Guaranteed death benefit |

Considerations for Choosing the Rava 5 Variable Annuity: Rava 5 Variable Annuity 2024

Choosing the right annuity product requires careful consideration of individual circumstances and financial goals. Here are some factors to consider when deciding whether the Rava 5 Variable Annuity is the right choice:

Financial Goals and Risk Tolerance

The Rava 5 Variable Annuity is suitable for individuals with a long-term investment horizon and a moderate to high risk tolerance. It’s important to align the annuity’s investment options with your financial goals, such as retirement income, wealth accumulation, or legacy planning.

Inheriting an annuity can present unique situations. If you’re facing this scenario, you might want to explore the implications and options available to you. You can find information on this topic in What Happens When I Inherit An Annuity 2024.

Tax Implications

The tax implications of investing in the Rava 5 Variable Annuity are crucial to consider. Earnings within the annuity grow tax-deferred, but withdrawals in retirement are taxed as ordinary income. Understanding the tax implications can help you make informed decisions about your investment strategy.

The HMRC provides an annuity calculator that can be useful for understanding the potential implications of annuities. You can find this calculator and learn more about its functionalities on Annuity Calculator Hmrc 2024.

Questions to Ask

Before investing in the Rava 5 Variable Annuity, it’s essential to ask yourself these questions:

- What are my financial goals and investment horizon?

- What is my risk tolerance?

- What are the fees and expenses associated with the annuity?

- What are the investment options available, and how do they align with my goals?

- What are the tax implications of investing in the annuity?

- What are the withdrawal options and surrender charges?

- What are the death benefit features and payout options?

- Do I understand the risks involved with this type of annuity?

Last Word

The Rava 5 Variable Annuity 2024 presents a compelling option for individuals seeking a diversified retirement income strategy. By understanding the nuances of this product, investors can make informed decisions about whether it aligns with their financial objectives and risk appetite.

Variable annuities offer potential for growth, but they also come with risks. If you’re interested in learning more about how variable annuities work and their potential benefits and drawbacks, you can explore What Is A Variable Annuity And How Does It Work 2024.

This guide has provided a comprehensive overview of the Rava 5 Variable Annuity, empowering you to make informed choices for your financial future.

Clarifying Questions

What are the minimum investment requirements for the Rava 5 Variable Annuity?

The minimum investment requirement for the Rava 5 Variable Annuity is typically $5,000, but this can vary depending on the specific issuing company.

Casio calculators can be useful tools for annuity calculations. If you’re interested in learning how to utilize a Casio calculator for these calculations, you can find a guide on How To Calculate Annuity On Casio Calculator 2024. This resource provides step-by-step instructions.

How are the investment options within the Rava 5 Variable Annuity managed?

Variable annuities offer a different approach to retirement planning compared to fixed annuities. Understanding the characteristics of variable annuities is essential for those considering this option. You can explore these characteristics further by visiting Variable Annuity Characteristics 2024.

The investment options within the Rava 5 Variable Annuity are typically managed by professional fund managers who aim to achieve specific investment goals, such as growth, income, or preservation of capital.

What are the tax implications of withdrawing funds from the Rava 5 Variable Annuity?

Withdrawals from the Rava 5 Variable Annuity are generally taxed as ordinary income. However, there may be specific tax-advantaged withdrawal options available depending on the annuity contract.

Is there a surrender charge associated with the Rava 5 Variable Annuity?

Yes, most variable annuities have a surrender charge, which is a fee charged if you withdraw funds before a certain period. The surrender charge typically decreases over time.