Roth 401 K Variable Annuity 2024 – Roth 401(k) Variable Annuity 2024 offers a unique retirement savings strategy combining the tax advantages of a Roth 401(k) with the potential growth of a variable annuity. This approach allows individuals to potentially accumulate a larger nest egg for retirement while enjoying tax-free withdrawals in their golden years.

The Annuity 95-1 2024 refers to a specific type of annuity contract that may offer unique features and benefits. It’s essential to understand the details of this particular contract before making any decisions.

This article delves into the key aspects of this investment strategy, exploring its benefits, risks, and intricacies for potential investors.

A Reversionary Annuity is a type of annuity that pays out a benefit to a designated beneficiary after the primary annuitant passes away. This can be a valuable option for those who want to ensure their loved ones are financially protected.

A Roth 401(k) Variable Annuity 2024 allows contributions to grow tax-deferred, and qualified withdrawals in retirement are tax-free. The variable annuity component provides investment flexibility with options to allocate funds across different asset classes, potentially enhancing returns. However, it’s crucial to understand the potential risks associated with variable annuities, such as market volatility and the possibility of losing principal.

Annuity jokes might seem lighthearted, but they can sometimes highlight important considerations. For instance, Annuity Jokes in 2024 might poke fun at the complexities of annuity contracts, reminding us to carefully review all the details.

This article examines these factors in detail, offering insights to help individuals make informed decisions about whether this strategy aligns with their financial goals.

Contents List

Roth 401(k) Basics

A Roth 401(k) is a retirement savings plan that allows you to contribute after-tax dollars and enjoy tax-free withdrawals in retirement. This type of plan offers several advantages over traditional 401(k)s, including tax-free withdrawals and potential for tax savings.

Rolling over your 401(k) into an annuity can be a strategic move. The Annuity 401(k) Rollover in 2024 offers tax advantages and potential growth opportunities, but it’s important to consider all the factors involved.

Core Features of a Roth 401(k)

- After-Tax Contributions:Unlike traditional 401(k)s, where contributions are made with pre-tax dollars, Roth 401(k) contributions are made with after-tax dollars.

- Tax-Free Withdrawals in Retirement:The primary benefit of a Roth 401(k) is that withdrawals in retirement are tax-free, assuming you meet certain requirements.

- Potential for Tax Savings:While you don’t get a tax deduction for your contributions, you can potentially save on taxes in retirement by avoiding income tax on withdrawals.

Advantages of a Roth 401(k)

- Tax-Free Growth:Your investments grow tax-deferred, and withdrawals in retirement are tax-free.

- Tax Predictability:You can predict your future tax burden on retirement income with certainty, knowing withdrawals will be tax-free.

- Potential for Higher After-Tax Returns:With tax-free growth, your investment returns can potentially be higher than in a traditional 401(k).

Eligibility Requirements for Roth 401(k) Contributions

To contribute to a Roth 401(k), you must be an employee of a company that offers the plan. There are no income limitations for contributing to a Roth 401(k).

An annuity of $30,000 in 2024 can provide a significant source of income during retirement. However, it’s important to factor in inflation and other potential expenses when determining the appropriate amount.

Variable Annuities within Roth 401(k)s

Variable annuities are a type of insurance contract that offers the potential for growth through investment in a variety of sub-accounts. While they can be a part of a Roth 401(k), it’s important to understand their benefits, drawbacks, and potential risks.

Variable annuities often involve investment options, and Variable Annuity AIR in 2024 (Accumulated Interest Rate) is a key factor to consider. It can impact your potential returns and the growth of your annuity.

Benefits and Drawbacks of Variable Annuities in Roth 401(k)s

- Potential for Growth:Variable annuities offer the potential for higher returns than fixed annuities, as they invest in the stock market.

- Tax-Deferred Growth:Your investment earnings grow tax-deferred within the annuity, similar to other Roth 401(k) investments.

- Guaranteed Minimum Death Benefit:Some variable annuities offer a guaranteed minimum death benefit, ensuring a certain amount is paid to your beneficiaries.

- High Fees:Variable annuities often come with high fees, including management fees, mortality charges, and surrender charges.

- Complexity:Variable annuities can be complex financial products, requiring a good understanding of their features and risks.

Potential Risks of Variable Annuities

- Market Volatility:Since variable annuities invest in the stock market, their value can fluctuate based on market performance, potentially leading to losses.

- High Fees:The high fees associated with variable annuities can significantly reduce your investment returns.

- Surrender Charges:If you withdraw your investment before a certain period, you may have to pay surrender charges, which can further reduce your returns.

Tax Implications of Variable Annuities, Roth 401 K Variable Annuity 2024

Within a Roth 401(k), withdrawals from a variable annuity are tax-free, as long as you meet the requirements for Roth 401(k) withdrawals. However, it’s crucial to note that if you withdraw your contributions before age 59 1/2, they may be subject to a 10% penalty, in addition to any applicable state taxes.

As with any financial product, there can be Annuity Issues in 2024. It’s crucial to be aware of potential problems and seek professional advice to mitigate risks.

Roth 401(k) Contribution Limits in 2024

The maximum amount you can contribute to a Roth 401(k) in 2024 is subject to annual limits set by the IRS.

Maximum Contribution Limits

- General Limit:The maximum contribution limit for Roth 401(k)s in 2024 is $22,500. This limit applies to individuals under the age of 50.

- Catch-Up Contributions:Individuals aged 50 and over can make additional “catch-up” contributions. For 2024, the catch-up contribution limit is $7,500, bringing the total maximum contribution to $30,000.

Impact of Income Limitations

While there are no income limitations for contributing to a Roth 401(k), there are income limitations for making contributions to a Roth IRA. If your modified adjusted gross income (MAGI) exceeds a certain threshold, you may not be able to contribute to a Roth IRA.

Variable annuities often offer different investment options, and the Variable Annuity GMIB (Guaranteed Minimum Income Benefit) in 2024 is a popular feature. It provides a guaranteed minimum income stream, regardless of market performance.

For 2024, the MAGI phase-out range for single filers is between $153,000 and $168,000, and for married couples filing jointly, it’s between $228,000 and $243,000.

Understanding the tax implications of annuities is crucial. Whether Annuity Interest is Taxable in 2024 depends on the type of annuity and how it’s structured. It’s best to consult with a financial advisor for personalized guidance.

Withdrawal Strategies for Roth 401(k)s: Roth 401 K Variable Annuity 2024

One of the primary advantages of a Roth 401(k) is the ability to withdraw your contributions and earnings tax-free in retirement. However, it’s essential to understand the rules regarding withdrawals, including early withdrawals and strategies for maximizing tax-free withdrawals.

The Annuity 2000 Basic Mortality Table 2024 is a key tool for calculating annuity payments. It provides actuarial data that helps determine life expectancies and, ultimately, the amount of annuity payments.

Tax-Free Withdrawals in Retirement

To qualify for tax-free withdrawals from a Roth 401(k) in retirement, you must meet the following requirements:

- Age 59 1/2 or Older:You must be at least 59 1/2 years old to withdraw your contributions and earnings tax-free.

- Five Years of Account Ownership:Your Roth 401(k) account must have been open for at least five years.

Early Withdrawals from a Roth 401(k)

If you withdraw your contributions from a Roth 401(k) before age 59 1/2, they will be tax-free, but they may be subject to a 10% penalty. However, there are some exceptions to this penalty, such as for first-time homebuyers, qualified medical expenses, and certain disability payments.

Strategies for Maximizing Tax-Free Withdrawals

- Contribute Early and Often:Start contributing early and consistently to maximize the benefits of tax-free growth.

- Consider Roth Conversions:If you have a traditional IRA or 401(k), you can consider converting it to a Roth IRA or Roth 401(k) to take advantage of tax-free withdrawals in retirement.

- Withdraw Contributions First:When withdrawing from your Roth 401(k) in retirement, withdraw your contributions first, as these are always tax-free.

Comparing Roth 401(k)s to Other Retirement Accounts

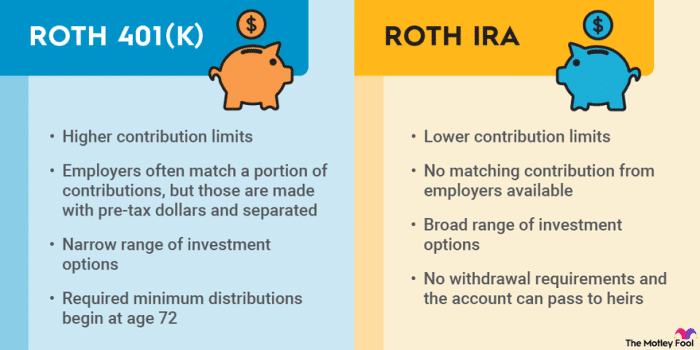

A Roth 401(k) is just one of many retirement savings options available. It’s essential to compare its features to other popular retirement accounts, such as traditional IRAs and Roth IRAs, to determine which option best suits your individual needs.

Annuity contracts can be either qualified or nonqualified. Determining whether an Annuity is Qualified or Nonqualified in 2024 can affect tax treatment and withdrawal options. It’s essential to understand the differences.

Comparison of Roth 401(k)s, Traditional IRAs, and Roth IRAs

| Feature | Roth 401(k) | Traditional IRA | Roth IRA |

|---|---|---|---|

| Contribution Type | After-tax | Pre-tax | After-tax |

| Tax Deduction | No | Yes | No |

| Withdrawals in Retirement | Tax-free | Taxable | Tax-free |

| Income Limitations | No | No | Yes |

| Contribution Limits | $22,500 (2024) | $6,500 (2024) | $6,500 (2024) |

| Catch-Up Contributions | Yes ($7,500) | Yes ($1,000) | Yes ($1,000) |

| Early Withdrawal Penalty | Yes (10%) | Yes (10%) | Yes (10%) |

Conclusive Thoughts

Roth 401(k) Variable Annuity 2024 presents a complex yet potentially rewarding retirement savings strategy. By carefully considering the advantages and risks, individuals can determine if this option aligns with their financial goals and risk tolerance. It’s essential to consult with a financial advisor to gain personalized guidance and explore alternative strategies that may better suit their individual circumstances.

Understanding the nuances of this approach, including its tax implications, withdrawal rules, and investment options, empowers individuals to make informed decisions about their retirement planning.

The Annuity 59.5 Rule 2024 is a popular topic for those approaching retirement, allowing early access to retirement funds under certain conditions. It’s important to understand the nuances of this rule and its implications before making any decisions.

Question & Answer Hub

What are the specific investment options available within a Roth 401(k) Variable Annuity?

Whether a Variable Annuity is a Good Investment in 2024 depends on your individual financial goals and risk tolerance. It’s important to weigh the potential benefits and risks before making a decision.

The investment options within a Roth 401(k) Variable Annuity can vary depending on the provider. Common choices include mutual funds, exchange-traded funds (ETFs), and sub-accounts within the annuity itself. You can typically select from a variety of asset classes, such as stocks, bonds, and real estate.

Can I roll over a traditional 401(k) into a Roth 401(k) Variable Annuity?

You can’t directly roll over a traditional 401(k) into a Roth 401(k) Variable Annuity. However, you can roll it over into a Roth IRA and then invest in a variable annuity within the Roth IRA. This process is subject to tax implications, so consult with a financial advisor.

Are there any fees associated with Roth 401(k) Variable Annuities?

Building an annuity calculator can be a useful tool. The Annuity Calculator Visual Basic 2024 provides a framework for creating a personalized calculator, allowing you to explore different scenarios and make informed decisions.

Yes, there are fees associated with variable annuities. These fees can include administrative fees, investment management fees, and mortality and expense charges. It’s important to carefully review the fee structure before making an investment.

How do I choose the right variable annuity within a Roth 401(k)?

If you’re considering a variable annuity, understanding the Variable Annuity Formula 2024 is crucial. This formula helps determine your potential returns based on market performance and the chosen investment options.

Choosing the right variable annuity depends on your individual needs and risk tolerance. Consider factors such as the investment options available, the fee structure, and the provider’s reputation. Consult with a financial advisor for personalized guidance.