Roth IRA contribution limit 2024 for divorced individuals – Navigating retirement planning after a divorce can be complex, especially when considering Roth IRA contributions. Understanding the 2024 Roth IRA contribution limit for divorced individuals is crucial for maximizing retirement savings and securing a comfortable future. This guide will delve into the intricacies of Roth IRA eligibility, contribution limits, and tax implications specifically for divorced individuals.

While the general Roth IRA contribution limit for 2024 applies to everyone, divorced individuals face unique circumstances that can affect their eligibility and contribution strategies. Alimony payments, divorce settlements, and changes in income can all impact how much a divorced person can contribute to a Roth IRA.

Furthermore, understanding the tax advantages of Roth IRA contributions is essential for divorced individuals seeking to optimize their financial situation.

Contents List

- 1 Roth IRA Contribution Limit for 2024

- 2 Roth IRA Eligibility for Divorced Individuals: Roth IRA Contribution Limit 2024 For Divorced Individuals

- 3 Tax Implications of Roth IRA Contributions for Divorced Individuals

- 4 Strategies for Maximizing Roth IRA Contributions After Divorce

- 5 Retirement Planning for Divorced Individuals

- 6 Outcome Summary

- 7 FAQ Guide

Roth IRA Contribution Limit for 2024

The Roth IRA contribution limit for 2024 is $7,000 for individuals under age 50. This limit applies to most individuals, regardless of their income level. However, the ability to make full contributions may be affected by your modified adjusted gross income (MAGI).

Contribution Limits for Different Age Groups

For individuals who are 50 years or older, the contribution limit for 2024 is $7,500. This additional contribution limit is known as the “catch-up” contribution.

| Age | Contribution Limit |

|---|---|

| Under 50 | $7,000 |

| 50 and over | $7,500 |

Income Limits for Roth IRA Contributions

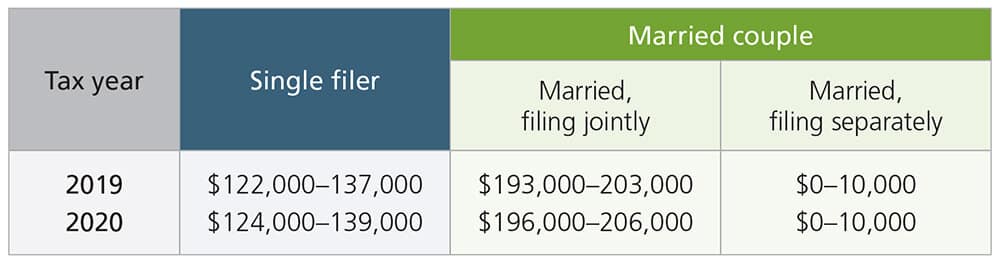

The Roth IRA contribution limit is not subject to income limitations. This means that regardless of your income, you can contribute the full amount to a Roth IRA. However, your ability to make contributions may be limited if your MAGI exceeds certain thresholds.

For 2024, if your MAGI is $153,000 or greater as someone filing as single, married filing separately, or head of household, you are unable to make contributions to a Roth IRA. For those who are married filing jointly or are qualifying widow(er)s, the limit is $228,000.

Roth IRA Eligibility for Divorced Individuals: Roth IRA Contribution Limit 2024 For Divorced Individuals

After a divorce, you may be wondering if you’re still eligible to contribute to a Roth IRA. The good news is that your divorce status doesn’t automatically disqualify you from contributing. However, there are some factors to consider, such as alimony payments and any stipulations in your divorce settlement.

Alimony Payments and Roth IRA Eligibility, Roth IRA contribution limit 2024 for divorced individuals

Alimony payments, also known as spousal support, can affect your Roth IRA eligibility. If you’re receiving alimony, your modified adjusted gross income (MAGI) might be higher, potentially impacting your ability to contribute to a Roth IRA. The MAGI is calculated by adding certain deductions and income to your adjusted gross income (AGI).

Single filers have a specific standard deduction amount. You can find the standard deduction for single filers in 2024 here. Knowing this amount will help you calculate your tax liability accurately.

These include: * Deductible IRA contributions:If you made traditional IRA contributions that you deducted on your tax return, these contributions will be added back to your AGI.

Failing to file an extension by October 2024 can lead to penalties. You can find information about the penalties for not filing an extension by October 2024 here. It’s essential to understand these penalties to avoid any unexpected costs.

Student loan interest

If you’re wondering how much you can contribute to your 401k in 2024, you can find the information here. Knowing this limit will help you plan your retirement savings strategy.

If you deducted student loan interest, it will be added back to your AGI.

Certain other deductions

Corporations often need to file for tax extensions. If you’re a corporation looking for the tax extension deadline in October 2024, you can find it here. This information will help you stay on top of your tax obligations.

Other deductions, such as those for moving expenses, may also be added back to your AGI.For 2024, the Roth IRA contribution limit is $7,500 for individuals under age 50 and $15,000 for those 50 and over. The income limits for contributing to a Roth IRA vary based on your filing status.

If you’re considering a Roth IRA, it’s essential to be aware of the income limits. You can find the Roth IRA income limit for 2024 here. This information will help you determine if you qualify for this retirement savings option.

For single filers, the income limit for 2024 is $160,000. For married couples filing jointly, the limit is $228,000.

Choosing the right tax calculator can be challenging. You can find a comparison of the best tax calculators for October 2024 here. This comparison will help you choose the calculator that best suits your needs.

If your MAGI exceeds these limits, you may not be able to contribute to a Roth IRA or may be subject to a partial contribution limit.

If you’re wondering about the tax rates for each tax bracket in 2024, you can find that information here. Knowing your tax bracket is important for planning your finances and ensuring you pay the right amount of taxes.

Divorce Settlements and Roth IRA Contributions

Your divorce settlement can also impact your Roth IRA eligibility. For example, if your divorce settlement requires you to contribute to a traditional IRA for your ex-spouse, it may affect your ability to contribute to a Roth IRA. This is because you may not have enough income remaining to contribute to both.

The standard deduction is a valuable tax break for many people. To learn who is eligible for the standard deduction in 2024, check out this article here. It explains the criteria and how to claim this deduction.

Always review your divorce settlement carefully to understand any potential limitations on your Roth IRA contributions.

Tax Implications of Roth IRA Contributions for Divorced Individuals

Roth IRA contributions are made with after-tax dollars, meaning you’ve already paid taxes on the money you contribute. This makes Roth IRA contributions attractive for divorced individuals, as they offer tax advantages during retirement.

The tax deadline for October 2024 can be a bit tricky to keep track of. You can find the specific deadline for October 2024 here. This information is crucial for avoiding late penalties.

Tax Advantages of Roth IRA Contributions

The main advantage of Roth IRA contributions is that withdrawals in retirement are tax-free. This means you won’t have to pay any taxes on the money you withdraw, regardless of how much your investment has grown. This is a significant benefit for divorced individuals, as they may be in a higher tax bracket in retirement than they were when they made the contributions.

Self-employed individuals have a specific tax deadline. You can find the October 2024 tax deadline for self-employed individuals here. Make sure to mark this date on your calendar to avoid late penalties.

Comparison of Roth IRA Contributions to Traditional IRA Contributions

Here’s a comparison of the tax implications of Roth IRA contributions and traditional IRA contributions:

| Contribution | Tax Deduction | Tax-Free Withdrawals |

|---|---|---|

| Roth IRA | No | Yes |

| Traditional IRA | Yes | No |

For example, if you contribute $6,500 to a Roth IRA in 2024 and your investment grows to $100,000 by the time you retire, you’ll be able to withdraw the entire $100,000 tax-free. If you had contributed to a traditional IRA, you would have to pay taxes on the $100,000 withdrawal.

If you have rental income, you’ll need to factor that into your taxes. You can find a tax calculator specifically designed for income from rental properties in October 2024 here. This calculator will help you accurately calculate your tax liability related to your rental property.

Strategies for Maximizing Roth IRA Contributions After Divorce

Divorce can be a significant life event that can disrupt your financial plans, including your retirement savings. However, it’s crucial to prioritize your financial future, and a Roth IRA can be a powerful tool for building a secure retirement nest egg.

The tax bracket thresholds for 2024 are important to know when determining your tax liability. You can find a breakdown of these thresholds here. This information will help you understand how your income is taxed.

Here are some strategies to maximize your Roth IRA contributions after a divorce:

Retirement Planning After Divorce

Retirement planning after divorce is essential. You need to create a new financial plan that accounts for your changed circumstances. This may involve adjusting your budget, creating a new savings plan, and updating your retirement goals.

Traditional IRA contributions have limits. You can find the IRA contribution limits for traditional IRAs in 2024 here. This information will help you maximize your retirement savings without exceeding the limits.

A Roth IRA can be a valuable tool for retirement planning after divorce, as it allows you to contribute after-tax dollars and withdraw your earnings tax-free in retirement.

Maximizing Roth IRA Contributions

- Contribute the maximum amount:The annual Roth IRA contribution limit for 2024 is $7,500 for individuals under 50 and $15,000 for those 50 and older. Contributing the maximum amount allows you to maximize your tax-free retirement savings.

- Take advantage of catch-up contributions:If you are 50 or older, you can make catch-up contributions of an additional $1,500 on top of the regular contribution limit. This can significantly boost your retirement savings.

- Contribute early and often:The earlier you start contributing to a Roth IRA, the more time your money has to grow tax-free. Even small, regular contributions can add up over time, thanks to the power of compounding.

Managing Finances After Divorce

- Create a realistic budget:After divorce, you may need to adjust your spending habits. Create a budget that reflects your new financial situation and prioritize essential expenses.

- Review your debt:Evaluate your debt and create a plan to manage or pay it down. Consider consolidating high-interest debt or seeking professional financial advice.

- Build an emergency fund:Having an emergency fund can provide financial security during unexpected life events. Aim to save three to six months’ worth of living expenses.

Retirement Planning for Divorced Individuals

Divorce can be a stressful and life-altering event, and it’s crucial to address financial planning, including retirement, as part of the transition. Retirement planning after a divorce is critical for securing your financial future and ensuring a comfortable lifestyle during your golden years.

Key Retirement Planning Considerations for Divorced Individuals

It is important to consider a variety of factors to ensure your retirement plan is on track.

- Review and Update Retirement Accounts:After a divorce, it is essential to review and update your retirement accounts. This includes reviewing the division of assets, such as 401(k)s, IRAs, and pensions, as agreed upon in the divorce settlement. Consider rolling over assets to individual retirement accounts (IRAs) to simplify management and potentially take advantage of tax benefits.

- Re-evaluate Your Retirement Goals:Divorce can significantly impact your financial situation, including your retirement goals. It is essential to reassess your financial needs and adjust your retirement plan accordingly. Consider factors such as your new living expenses, potential income changes, and the length of time until retirement.

- Estimate Future Income:After divorce, your income may change, potentially affecting your retirement savings needs. Consider your potential income from Social Security, pensions, and any other sources. You may need to adjust your retirement savings strategy to compensate for any income gaps.

If you’re self-employed, you’ll need to figure out your taxes differently. A tax calculator can help simplify this process. Check out this resource for a tax calculator specifically designed for self-employed individuals in October 2024: https://vehicle2025.com/tax-calculator-for-self-employed-individuals-in-october-2024/.

- Consider Your Health Insurance Needs:After divorce, you may need to obtain your own health insurance coverage. Explore options such as individual health insurance plans, COBRA continuation, or employer-sponsored coverage. Health insurance costs can significantly impact your retirement expenses, so it is essential to factor them into your planning.

High earners have specific 401k contribution limits. If you’re in this category, you can find the limits for 2024 here. This information will help you maximize your retirement savings while staying within the IRS guidelines.

- Seek Professional Financial Advice:A financial advisor can provide valuable guidance and support as you navigate retirement planning after a divorce. They can help you develop a personalized retirement plan that aligns with your financial goals and risk tolerance.

Resources for Financial Planning and Retirement Advice for Divorced Individuals

There are various resources available to assist divorced individuals with retirement planning.

- Financial Advisors:A Certified Financial Planner (CFP) or other qualified financial advisor can provide personalized advice tailored to your specific circumstances.

- Retirement Planning Workshops and Seminars:Many community organizations and financial institutions offer workshops and seminars on retirement planning. These can provide valuable information and insights.

- Online Resources:Websites such as the Social Security Administration (SSA), the IRS, and the U.S. Department of Labor provide information on retirement planning, including Social Security benefits and retirement savings strategies.

- Books and Articles:Numerous books and articles are available on retirement planning, including those specifically addressing the needs of divorced individuals.

Outcome Summary

By understanding the intricacies of Roth IRA contributions for divorced individuals, you can create a tailored retirement plan that aligns with your unique circumstances. Whether you’re navigating alimony payments, adjusting to a new income level, or simply seeking to maximize your retirement savings, this guide provides valuable insights to help you make informed financial decisions.

Remember, maximizing your Roth IRA contributions is a powerful strategy for securing a comfortable and financially secure future, especially after a divorce.

FAQ Guide

Can I still contribute to a Roth IRA if I’m receiving alimony?

Yes, alimony payments do not affect your Roth IRA eligibility. However, your income level, which includes alimony, can influence your contribution limit.

What if my divorce settlement includes a lump sum payment? Does that impact my Roth IRA contributions?

A lump sum payment from a divorce settlement can affect your income for the year and, therefore, your Roth IRA contribution limit. Consult with a financial advisor to understand how this might impact your contributions.

Are there any specific resources available for divorced individuals seeking retirement planning advice?

Yes, many financial advisors specialize in retirement planning for divorced individuals. Additionally, organizations like the National Endowment for Financial Education (NEFE) offer resources and guidance on navigating finances after divorce.