Roth IRA contribution limit 2024 for head of household: Understanding this limit is crucial for maximizing your retirement savings. As a head of household, you have unique tax benefits and financial responsibilities, and navigating the Roth IRA contribution limits can help you optimize your retirement planning strategy.

This guide will break down the specifics of the 2024 contribution limit, eligibility requirements, advantages, and potential disadvantages, equipping you with the knowledge to make informed decisions about your retirement savings.

The Roth IRA contribution limit for 2024 is $7,500 for individuals under age 50 and $15,000 for those 50 and older. Head of household filers fall under the same contribution limits as single filers, offering a valuable opportunity to save for retirement while enjoying tax-free withdrawals in the future.

However, it’s essential to consider your modified adjusted gross income (MAGI), as exceeding certain income thresholds may limit your ability to contribute to a Roth IRA or even disqualify you entirely.

Contents List

- 1 Roth IRA Contribution Limit for Head of Household in 2024

- 2 Eligibility for Roth IRA Contributions

- 3 Advantages of Roth IRA Contributions

- 4 Potential Disadvantages of Roth IRA Contributions: Roth IRA Contribution Limit 2024 For Head Of Household

- 5 Strategies for Maximizing Roth IRA Contributions

- 6 Resources and Additional Information

- 7 Concluding Remarks

- 8 Answers to Common Questions

Roth IRA Contribution Limit for Head of Household in 2024

The Roth IRA contribution limit for head of household filers in 2024 is the same as for all other filing statuses: $6,500. This means that head of household filers can contribute up to $6,500 to a Roth IRA in 2024, regardless of their income level.

If you’re looking to maximize your retirement savings, understanding the IRA contribution limits for 2024 is a good starting point. These limits can help you determine how much you can contribute each year and potentially enjoy tax advantages in retirement.

Roth IRA Contribution Limits for Different Filing Statuses in 2024

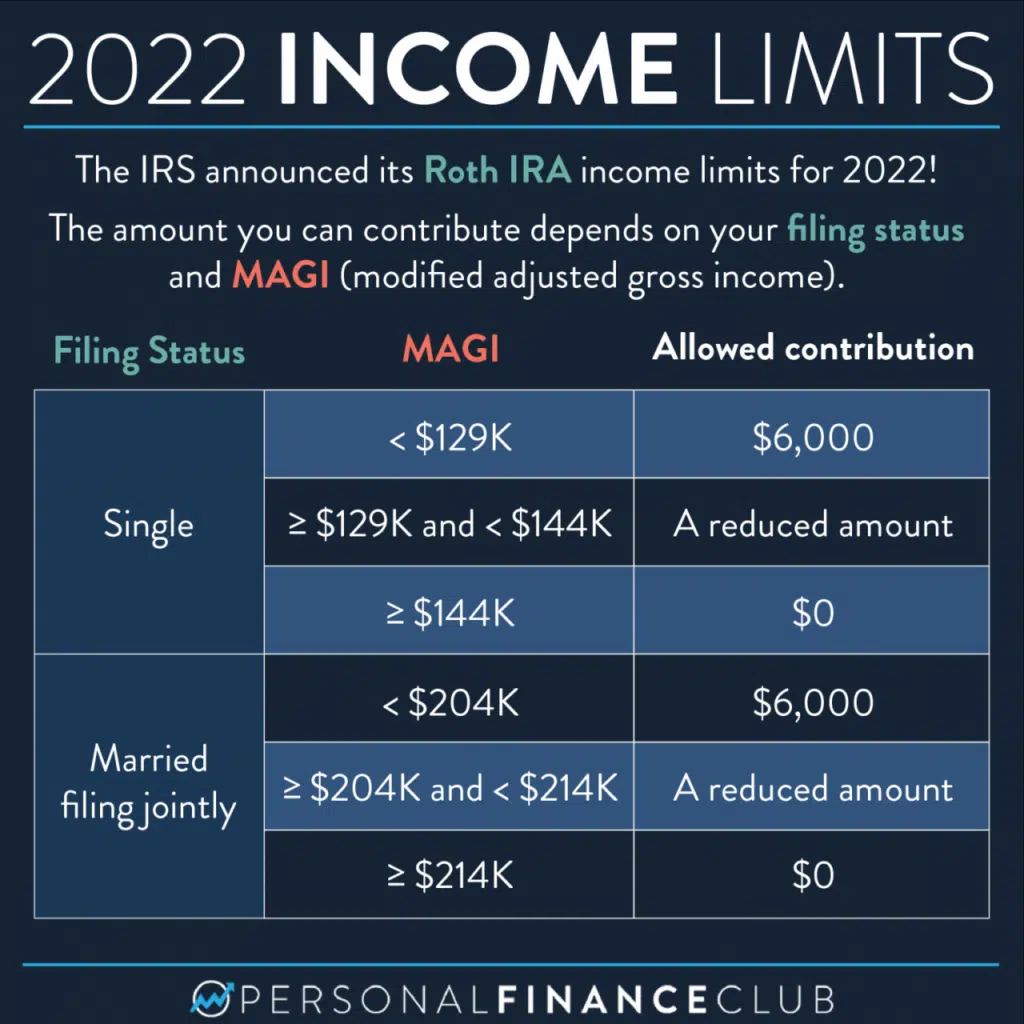

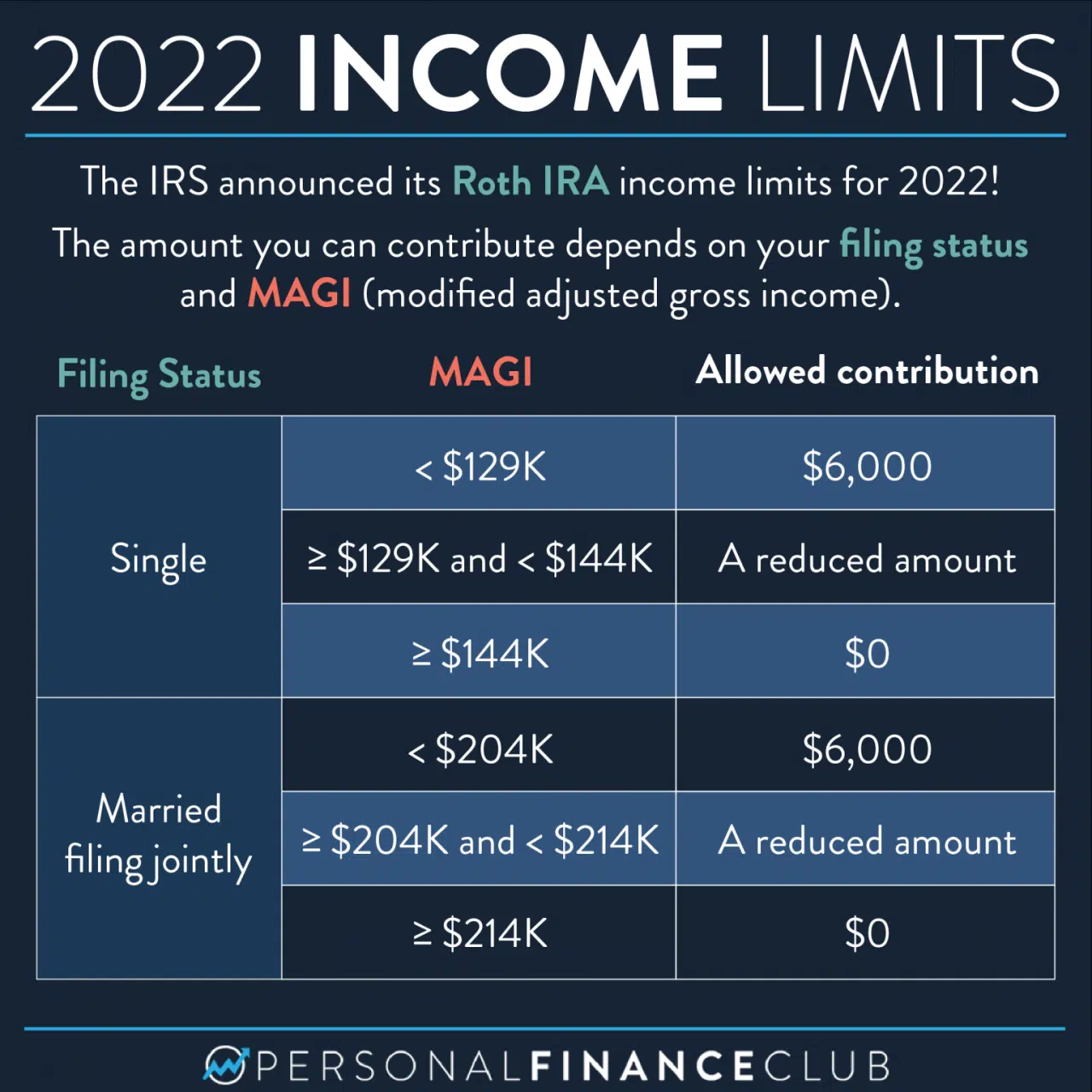

The Roth IRA contribution limit for 2024 is the same for all filing statuses, but there are income limitations that may affect how much you can contribute. The table below shows the Roth IRA contribution limits for different filing statuses in 2024:

| Filing Status | Contribution Limit |

|---|---|

| Single | $6,500 |

| Married Filing Jointly | $6,500 |

| Head of Household | $6,500 |

| Qualifying Widow(er) | $6,500 |

| Married Filing Separately | $6,500 |

Potential Impact of the 2024 Contribution Limit on Head of Household Filers’ Retirement Savings Strategies

The 2024 contribution limit for head of household filers can have a significant impact on their retirement savings strategies. For example, if a head of household filer is approaching retirement and has a high income, they may be able to contribute the full $6,500 to their Roth IRA and enjoy tax-free withdrawals in retirement.

For those who frequently drive for work, it’s helpful to know the mileage rate for October 2024. This rate can be used to deduct business expenses and potentially save you money on your taxes.

However, if a head of household filer is younger and has a lower income, they may not be able to contribute the full $6,500 to their Roth IRA. In this case, they may want to consider contributing to a traditional IRA instead, as they may be able to deduct their contributions from their taxes.

For those interested in Roth contributions, you might be wondering what is the 401k contribution limit for 2024 for Roth. Knowing this limit can help you plan your contributions and potentially benefit from tax-free withdrawals in retirement.

Eligibility for Roth IRA Contributions

To contribute to a Roth IRA in 2024, you must meet certain eligibility requirements. One of the most important factors is your income, as there are income limits that can affect your ability to contribute.

Independent contractors, remember to file your W9 Form by the October 2024 deadline. The W9 Form October 2024 for independent contractors is crucial for ensuring you receive proper tax documentation and payments from clients.

Modified Adjusted Gross Income (MAGI) and Roth IRA Eligibility

The Internal Revenue Service (IRS) uses a measure called Modified Adjusted Gross Income (MAGI) to determine your eligibility for Roth IRA contributions. MAGI is your adjusted gross income (AGI) with some additions and subtractions, such as certain deductions and tax credits.

The MAGI thresholds for Roth IRA contributions in 2024 are based on your filing status.

Married couples filing jointly may be eligible for a higher standard deduction. To find out the exact amount, check the standard deduction for married filing jointly in 2024. Understanding this amount can help you maximize your tax savings.

MAGI Thresholds for Roth IRA Contributions in 2024

The following table Artikels the MAGI thresholds for Roth IRA contributions in 2024, based on filing status:

| Filing Status | MAGI Threshold |

|---|---|

| Single | $153,000 |

| Married Filing Jointly | $228,000 |

| Head of Household | $204,000 |

| Qualifying Widow(er) | $228,000 |

| Married Filing Separately | $114,000 |

If your MAGI is above the threshold for your filing status, you cannot contribute to a Roth IRA. However, you may still be eligible to contribute to a traditional IRA, which offers tax deductions but taxes on withdrawals in retirement.

If you’re a high earner looking to maximize your retirement savings, understanding the 401k contribution limits for 2024 for high earners is crucial. These limits can help you determine how much you can contribute to your 401k each year, ensuring you’re on track for a comfortable retirement.

Advantages of Roth IRA Contributions

The Roth IRA offers several tax advantages that make it a compelling retirement savings option, particularly for head of household filers. Let’s delve into the key benefits of contributing to a Roth IRA.

If you’re considering a Roth 401k, you’ll want to know the 401k contribution limits for 2024 for Roth 401k. This information can help you determine how much you can contribute each year and potentially enjoy tax-free withdrawals in retirement.

Tax-Free Growth and Withdrawals

A significant advantage of Roth IRAs is that your contributions grow tax-free. This means that any earnings from your investments within the Roth IRA are not subject to taxation while they are held within the account. Furthermore, when you withdraw your contributions and earnings in retirement, they are completely tax-free, provided you meet certain requirements.

If you’re considering a Roth IRA, it’s important to be aware of the Roth IRA income limit for 2024. This limit determines whether you’re eligible to contribute to a Roth IRA, so it’s crucial to understand the guidelines.

This tax-free status can be a substantial benefit, especially in retirement when your tax bracket may be lower.

As the year changes, so do the contribution limits. To ensure you’re making the most of your retirement savings, it’s helpful to understand the 401k contribution limits 2024 vs 2023. This comparison can help you see any changes and adjust your contribution strategy accordingly.

Reduced Taxable Income

Contributing to a Roth IRA can also help you reduce your taxable income in the present. While you don’t receive a tax deduction for Roth IRA contributions, the contributions are made with after-tax dollars. This means that the money you contribute to your Roth IRA is already taxed, effectively reducing your taxable income for the year.

This can be especially beneficial for head of household filers, as their tax bracket may be higher due to their dependents.

Tax-Free Withdrawals in Retirement

One of the most attractive features of Roth IRAs is the tax-free nature of withdrawals in retirement. Once you reach age 59 1/2 and have held the account for at least five years, you can withdraw your contributions and earnings tax-free.

This means that you can enjoy your retirement savings without having to pay taxes on them.

For non-profit organizations, the tax extension deadline October 2024 for non-profit organizations provides a valuable opportunity to file taxes later if needed. This extension can be beneficial for organizations that require more time to gather the necessary information.

For example, let’s say you contribute $6,500 to a Roth IRA each year for 30 years, and your contributions grow to $500,000 by the time you retire. If you withdraw this entire amount in retirement, you won’t have to pay any taxes on it. This can be a significant advantage, especially if you are in a higher tax bracket in retirement.

Freelancers, take note! The October 2024 tax deadline for freelancers is approaching. Make sure you have all the necessary information and documents ready to file your taxes on time and avoid any penalties.

Potential Disadvantages of Roth IRA Contributions: Roth IRA Contribution Limit 2024 For Head Of Household

While Roth IRAs offer numerous advantages, it’s essential to consider potential drawbacks before making a decision. These disadvantages may vary depending on your individual circumstances and financial goals.

If you’re single and looking to contribute to an IRA, understanding the IRA contribution limits for 2024 for single filers is essential. This information can help you determine how much you can contribute each year and potentially enjoy tax advantages in retirement.

Potential for Lower Returns Compared to Traditional IRAs

A significant disadvantage of Roth IRA contributions is the potential for lower returns compared to traditional IRAs. This is because Roth IRA contributions are made with after-tax dollars, meaning you’re not receiving the tax deduction that traditional IRA contributions offer.

In the early years of investing, this tax deduction can significantly boost the growth of your traditional IRA, potentially leading to higher overall returns. However, this advantage can be offset by the tax-free nature of Roth IRA withdrawals in retirement.

The standard deduction can help you reduce your tax liability. To find out if you’re eligible, check the who is eligible for the standard deduction in 2024. Understanding the eligibility criteria can help you determine if taking the standard deduction is right for you.

Early Withdrawal Penalties for Roth IRA Contributions

While Roth IRA contributions are generally considered to be non-deductible, there are situations where early withdrawals may be subject to penalties. For example, if you withdraw contributions before age 59 1/2 and haven’t met certain exceptions, you may have to pay a 10% penalty on the earnings portion of your withdrawal, along with any applicable income taxes.

With the October 2024 tax deadline approaching, it’s wise to familiarize yourself with some tax preparation tips for the October 2024 deadline. These tips can help you streamline the process and ensure you’re prepared for a smooth filing experience.

Strategies for Maximizing Roth IRA Contributions

Maximizing your Roth IRA contributions can be a smart move for your retirement savings, especially if you’re a head of household filer. The strategy involves carefully planning your budget and taking advantage of potential tax-saving strategies to ensure you can contribute the maximum amount allowed each year.

Married couples looking to contribute to an IRA should be aware of the IRA contribution limits for 2024 for married couples. These limits can help you determine how much you can contribute each year and potentially enjoy tax advantages in retirement.

Budgeting and Saving for Maximum Roth IRA Contributions

Budgeting is crucial for maximizing your Roth IRA contributions. You can use a budgeting app or spreadsheet to track your income and expenses. Here are some tips for creating a budget that accommodates your Roth IRA contributions:

- Track Your Spending:Identify areas where you can cut back on unnecessary expenses. This could include eating out less, reducing entertainment costs, or finding cheaper alternatives for everyday items.

- Set Financial Goals:Establish clear financial goals, including your Roth IRA contributions. Having specific targets can motivate you to stay on track with your savings plan.

- Automate Your Savings:Set up automatic transfers from your checking account to your Roth IRA account on a regular basis. This ensures that you consistently contribute to your retirement savings without having to manually transfer funds.

Tax-Saving Strategies for Optimizing Roth IRA Contributions

Head of household filers can use several tax-saving strategies to maximize their Roth IRA contributions. These strategies can help you reduce your tax burden and increase your disposable income, making it easier to save for retirement.

- Tax Deductible Expenses:Utilize all eligible tax deductions, such as those for mortgage interest, charitable contributions, and medical expenses. These deductions can lower your taxable income, leaving you with more money to contribute to your Roth IRA.

- Tax Credits:Explore available tax credits, such as the Child Tax Credit or the Earned Income Tax Credit. These credits can directly reduce your tax liability, providing additional funds for your Roth IRA contributions.

- Tax-Efficient Investing:Choose investments within your Roth IRA that have the potential for tax-efficient growth. This can include investments like index funds or ETFs, which generally have lower expense ratios and can help you maximize your long-term returns.

Maximizing Roth IRA Contributions with a Strategy

A strategic approach can help head of household filers maximize their Roth IRA contributions within the 2024 limits. Here’s a step-by-step guide:

- Assess Your Financial Situation:Review your income, expenses, and existing savings to determine your financial capacity for Roth IRA contributions.

- Create a Budget:Develop a realistic budget that includes your Roth IRA contributions. Identify areas where you can reduce expenses to free up funds for retirement savings.

- Set Savings Goals:Establish specific goals for your Roth IRA contributions, such as contributing the maximum amount allowed each year.

- Automate Your Contributions:Set up automatic transfers from your checking account to your Roth IRA to ensure consistent contributions.

- Utilize Tax-Saving Strategies:Explore tax deductions and credits that can reduce your taxable income and increase your disposable income for Roth IRA contributions.

- Invest Tax-Efficiently:Choose investments within your Roth IRA that have the potential for tax-efficient growth.

- Review and Adjust:Regularly review your budget, savings goals, and investment strategy to ensure you’re on track to maximize your Roth IRA contributions.

“Remember, maximizing your Roth IRA contributions can significantly enhance your retirement savings. By following a strategic approach and taking advantage of available tax-saving opportunities, you can make the most of this valuable retirement savings tool.”

Resources and Additional Information

It’s crucial to have access to reliable information and resources when planning your Roth IRA contributions. This section provides a list of government websites, financial institutions, and recommended books and articles to guide you through the process.

Government Websites, Roth IRA contribution limit 2024 for head of household

Government websites are the primary source for official information on Roth IRA contributions. They provide detailed information on eligibility requirements, contribution limits, and tax implications.

- Internal Revenue Service (IRS):The IRS website offers comprehensive information on Roth IRAs, including publications, forms, and FAQs. You can find information on contribution limits, eligibility, and tax treatment of Roth IRA distributions. https://www.irs.gov/

- U.S. Department of Labor:The Department of Labor’s website provides information on retirement savings plans, including Roth IRAs. It offers resources for understanding your retirement savings options and making informed decisions. https://www.dol.gov/

Financial Institutions

Financial institutions offer Roth IRA accounts and provide guidance on investment options and account management.

- Banks:Many banks offer Roth IRA accounts with varying features and fees. They provide investment options and account management tools.

- Brokerage Firms:Brokerage firms offer a wider range of investment options within Roth IRAs, including stocks, bonds, and mutual funds. They provide research tools and investment advice.

- Credit Unions:Credit unions often offer Roth IRA accounts with competitive rates and lower fees. They may provide personalized financial advice and guidance.

Recommended Books and Articles

Numerous books and articles provide insightful information on Roth IRA contributions and retirement planning.

- “The Total Money Makeover” by Dave Ramsey:This book offers a comprehensive guide to personal finance, including strategies for retirement planning and maximizing Roth IRA contributions.

- “The Automatic Millionaire” by David Bach:This book emphasizes the importance of automating savings and investing, including Roth IRA contributions, to build wealth over time.

- “The Bogleheads’ Guide to Investing” by Taylor Larimore, John C. Bogle, and Mel Lindauer:This book provides a practical guide to investing, including strategies for Roth IRA contributions and asset allocation.

Concluding Remarks

Ultimately, understanding the Roth IRA contribution limit for head of household filers in 2024 empowers you to make strategic decisions about your retirement savings. By maximizing your contributions within the limits and taking advantage of the tax benefits offered by Roth IRAs, you can set yourself up for a comfortable and financially secure retirement.

Remember to review your financial situation, consult with a qualified financial advisor, and explore the various resources available to help you make the most of your Roth IRA contributions.

Answers to Common Questions

What is the maximum Roth IRA contribution limit for 2024?

The maximum Roth IRA contribution limit for 2024 is $7,500 for individuals under age 50 and $15,000 for those 50 and older. This limit applies to all filing statuses, including head of household.

What are the income limits for contributing to a Roth IRA in 2024 for head of household filers?

For 2024, the income limits for contributing to a Roth IRA vary based on filing status. For head of household filers, the limit is $153,000. If your modified adjusted gross income (MAGI) exceeds this limit, you may not be able to contribute to a Roth IRA or your contribution amount may be limited.

Can I contribute to a Roth IRA even if I am already participating in a 401(k) plan?

Yes, you can contribute to a Roth IRA even if you participate in a 401(k) plan. Both retirement accounts offer tax advantages and can be used to supplement your retirement savings.

What happens if I withdraw money from my Roth IRA before age 59 1/2?

Withdrawals from a Roth IRA before age 59 1/2 are generally tax-free and penalty-free if the funds have been in the account for at least five years. However, withdrawals of contributions made within the last five years may be subject to a 10% early withdrawal penalty.

Consult with a tax advisor for specific guidance.