Roth IRA contribution limit penalty for exceeding the limit in 2024 is a crucial topic for those seeking tax advantages through retirement savings. Understanding the contribution limit and the potential consequences of exceeding it is essential for maximizing your retirement savings while avoiding penalties.

This guide delves into the details of the Roth IRA contribution limit, the penalty for exceeding it, and how to avoid this situation.

The annual contribution limit for Roth IRAs in 2024 is $7,500 for individuals under 50 and $15,000 for those 50 and older. However, it’s important to remember that this is just the contribution limit. Your ability to contribute the full amount depends on your income, as there are income limits for Roth IRA contributions.

For 2024, if your modified adjusted gross income is $153,000 or higher as a single filer or $228,000 or higher for married couples filing jointly, you can’t contribute to a Roth IRA. If your income falls within these thresholds, you may only be able to contribute a partial amount or not at all.

Contents List

- 1 Roth IRA Contribution Limit for 2024

- 2 Penalty for Exceeding the Contribution Limit: Roth IRA Contribution Limit Penalty For Exceeding The Limit In 2024

- 3 Circumstances Leading to Exceeding the Limit

- 4 Rectifying an Excess Contribution

- 5 Strategies to Avoid Exceeding the Limit

- 6 Final Summary

- 7 FAQ Compilation

Roth IRA Contribution Limit for 2024

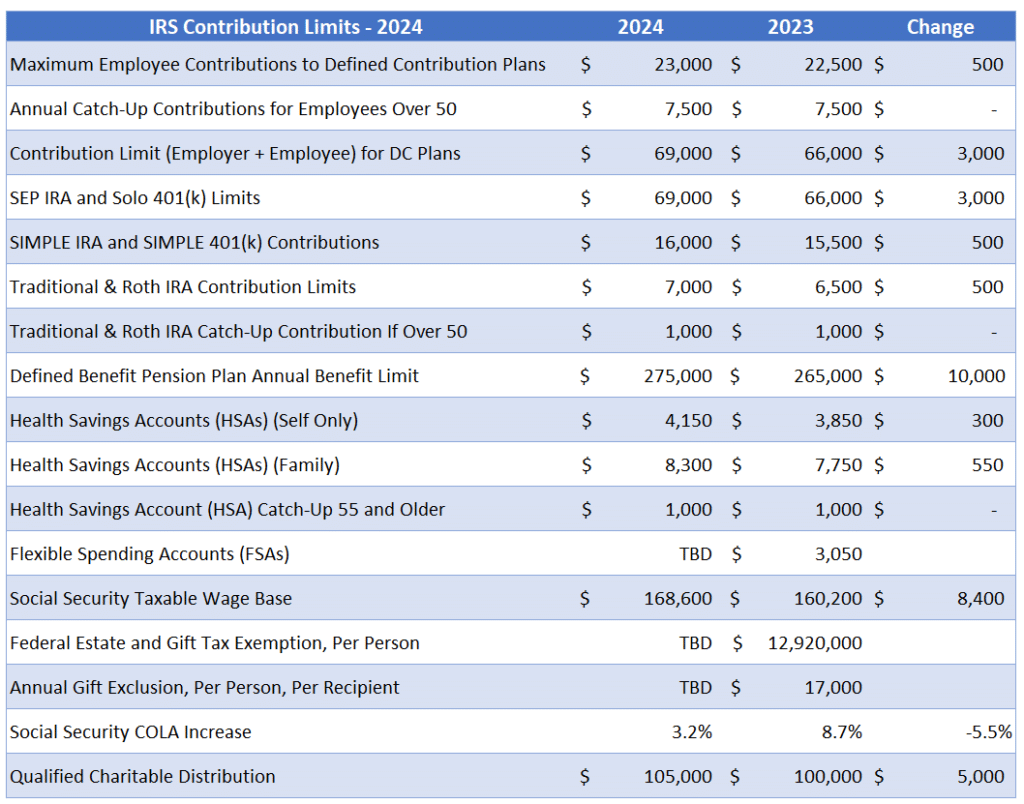

The Roth IRA contribution limit for 2024 is $7,000 for individuals and $14,000 for married couples filing jointly. This limit is the maximum amount you can contribute to a Roth IRA in a given year, regardless of your income.It’s important to distinguish between the contribution limit and the income limit for Roth IRA contributions.

Saving for retirement is a priority, and IRA contributions play a significant role. Learn about the IRA contribution limits for 2024 by age.

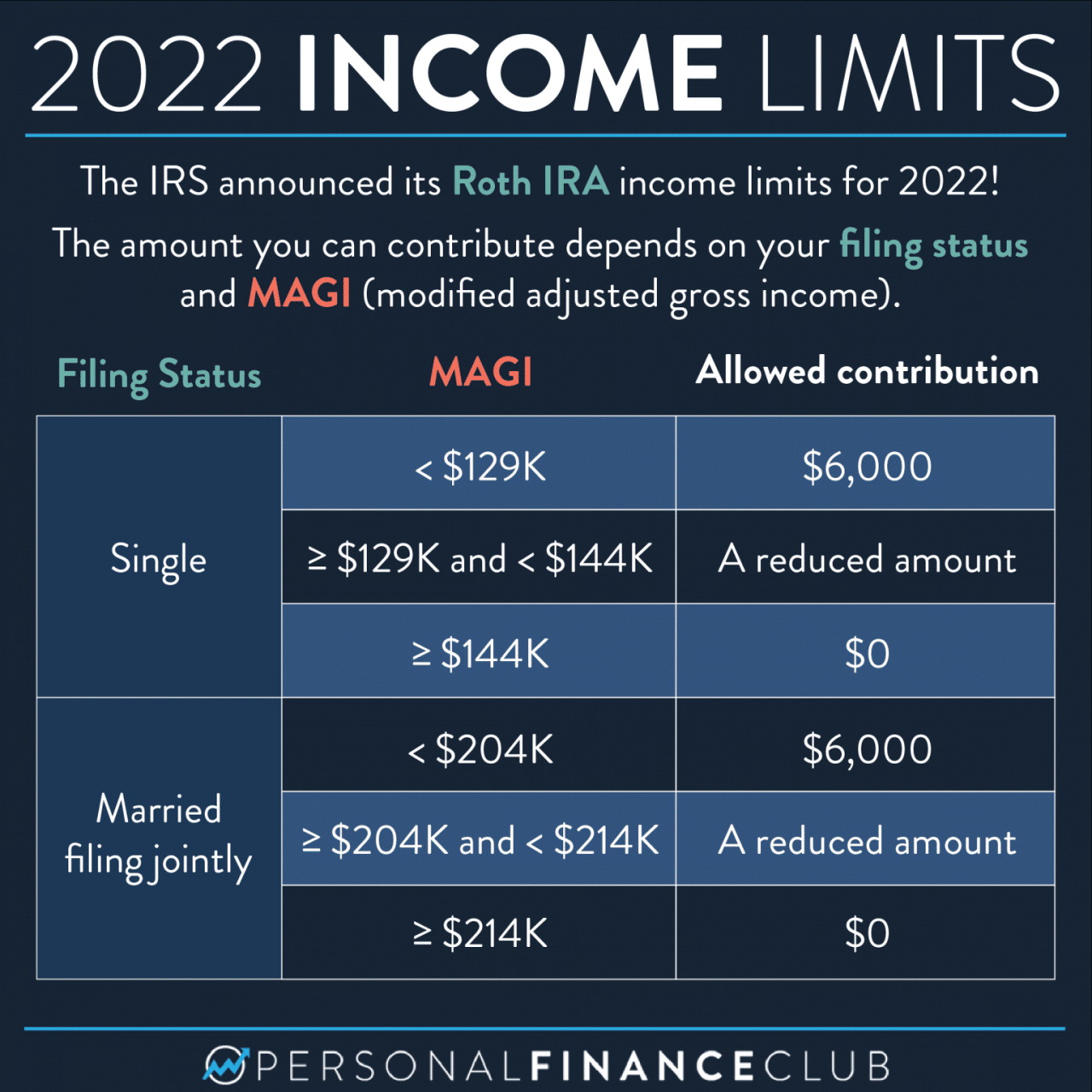

The contribution limit refers to the maximum amount you can contribute, while the income limit refers to the maximum modified adjusted gross income (MAGI) you can have to be eligible to make full contributions. If your income exceeds the income limit, you may not be able to contribute the full amount, or you may not be eligible to contribute at all.

It’s helpful to know your tax bracket to make informed financial decisions. Explore the 2024 federal tax brackets for single filers.

Income Limits for Roth IRA Contributions in 2024

The income thresholds for Roth IRA contributions in 2024 are as follows:

Individuals

If your MAGI is $153,000 or more, you can’t contribute to a Roth IRA.

If you’re over 50, you may be eligible for an increased contribution limit to your 401(k). Check out the 401(k) contribution limit for 2024 for individuals over 50.

Married Couples Filing Jointly

If your MAGI is $228,000 or more, you can’t contribute to a Roth IRA.

Earning rewards for your everyday spending can be a great way to boost your finances. Check out the best credit cards for cash back rewards in October 2024.

If your income falls between the thresholds and the full contribution limit, you may be able to make a partial contribution. For example, if you are an individual with a MAGI of $140,000, you would not be able to contribute the full $7,000, but you may be able to contribute a reduced amount.

If you’re self-employed, it’s essential to know the 401(k) contribution limits for 2024. Explore the 401(k) contribution limits for 2024 for self-employed individuals.

The exact amount you can contribute will depend on your income level and the specific rules for Roth IRA contributions. It’s recommended to consult with a financial advisor or tax professional to determine your eligibility and contribution limit.

Knowing your income tax bracket is important for budgeting and tax planning. Find out the October 2024 income tax brackets for single filers.

Penalty for Exceeding the Contribution Limit: Roth IRA Contribution Limit Penalty For Exceeding The Limit In 2024

If you contribute more than the allowed limit to your Roth IRA in 2024, you will face a penalty. The penalty is applied to the excess contribution amount.

Penalty Percentage, Roth IRA contribution limit penalty for exceeding the limit in 2024

The penalty for exceeding the Roth IRA contribution limit is 6% of the excess contribution. This penalty is applied annually until the excess contribution is removed from your account.

Retirement savings can be a complex topic, especially when considering the differences between Roth IRA contribution limits. Compare the Roth IRA contribution limit for 2024 vs. 2023.

Implications of Exceeding the Contribution Limit

Exceeding the contribution limit can have several implications, including tax consequences and potential penalties.

Saving for retirement is important, and understanding your 401(k) contribution limits is crucial. Learn how much you can contribute to your 401(k) in 2024.

Tax Consequences

The excess contribution is considered taxable income in the year it was made. You will need to report it on your tax return and pay taxes on it at your ordinary income tax rate.

Retirement planning is important, and knowing how taxes affect your retirement income is crucial. Check out this handy tax calculator designed specifically for retirees in October 2024. Get started with the tax calculator for retirees in October 2024.

Potential Penalties

In addition to the 6% penalty, you may also be subject to a 10% early withdrawal penalty if you withdraw the excess contribution before age 59 1/2. This penalty is waived if you meet certain exceptions, such as being disabled or having a first-time home purchase.

Example:You contribute $7,500 to your Roth IRA in 2024, but the contribution limit is $7,000. You have exceeded the limit by $500. You will be penalized 6% of the excess contribution, which is $30. You will also need to report the $500 excess contribution as taxable income on your tax return.

Maximizing your retirement savings requires understanding how much you can contribute to your 401(k). Discover how much you can contribute to your 401(k) in 2024.

Circumstances Leading to Exceeding the Limit

Exceeding the Roth IRA contribution limit can happen for various reasons, often stemming from miscalculations or unforeseen circumstances. Understanding these common scenarios can help you avoid potential penalties and ensure your retirement savings are maximized.

Mistakenly Exceeding the Limit Due to Inaccurate Calculations

Making contributions to a Roth IRA involves careful tracking of your income and contributions. If you miscalculate your income, the amount you can contribute, or the total amount you’ve already contributed, you might inadvertently exceed the limit.

Understanding income tax rates is key to planning your finances. Get up-to-date information on income tax rates for October 2024.

- For example, if you’re self-employed, you might underestimate your adjusted gross income (AGI) and contribute more than allowed.

- Another common mistake is forgetting contributions made in previous years, leading to an overcontribution in the current year.

Making Contributions After Already Reaching the Limit

Even with accurate calculations, it’s possible to exceed the limit if you make contributions after already reaching the maximum. This can happen if you receive a large sum of money, such as a bonus or inheritance, and decide to contribute more to your Roth IRA.

- For instance, if you receive a large tax refund, you might be tempted to contribute the entire amount to your Roth IRA, potentially exceeding the limit.

- Similarly, if you receive a bonus or inheritance, you might decide to allocate a portion of it to your Roth IRA without considering your existing contributions.

Receiving a Large Sum of Money and Making an Excessive Contribution

Sometimes, receiving a large sum of money, like an inheritance or a bonus, can lead to exceeding the Roth IRA contribution limit. This is especially true if you’re not accustomed to managing large amounts of money and make a substantial contribution without considering the limits.

If you’re a business owner, you might be wondering about the tax deadline for October 2024. The good news is that you can get an extension, but you’ll still need to file your taxes by the extended deadline. Learn more about the extension tax deadline for October 2024 for businesses.

- It’s essential to understand the contribution limits and plan your contributions accordingly, especially when receiving significant sums of money.

- Consider consulting a financial advisor to ensure you’re making informed decisions about your retirement savings.

Rectifying an Excess Contribution

If you’ve contributed more than the limit to your Roth IRA in 2024, you’ll need to take steps to rectify the situation. Failing to do so could result in penalties and taxes.

Withdrawing the Excess Contribution

You can generally withdraw the excess contribution, along with any earnings on it, before the tax filing deadline for the year in which the contribution was made. This means you have until April 15, 2025, to withdraw the excess contribution for 2024.

Filing taxes as a married couple filing separately can be a bit complex. It’s essential to understand the standard deduction amount for this filing status. Find out the standard deduction for married filing separately in 2024.

- The withdrawal will be tax-free and penalty-free.

- You can choose to withdraw the earnings first, then the excess contribution.

- This option is best if you need to reduce your taxable income for the year.

Correcting the Excess Contribution through an Amended Tax Return

If you’ve already filed your taxes for the year, you can correct the excess contribution by filing an amended tax return (Form 1040-X).

Sometimes, you need more time to file your taxes. Find out about tax filing extensions for October 2024.

- This option allows you to claim a refund of the excess contribution and any earnings.

- It’s best to consult a tax professional to ensure you file the amended return correctly.

Seeking Guidance from a Qualified Tax Professional

It’s always advisable to seek guidance from a qualified tax professional if you’re unsure how to rectify an excess Roth IRA contribution.

- A tax professional can help you determine the best course of action for your specific situation.

- They can also help you understand the tax implications of your choices.

Strategies to Avoid Exceeding the Limit

Exceeding the Roth IRA contribution limit can lead to penalties, so it’s crucial to stay within the annual limits. Here are some strategies to help you avoid exceeding the limit and manage your contributions effectively.

Self-employed individuals have unique tax considerations, including 401(k) contribution limits. Explore the 401(k) contribution limits for 2024 for self-employed individuals.

Staying Within the Limit

Staying within the annual contribution limit requires careful planning and awareness of your financial situation.

- Track Your Contributions:Keep accurate records of all your Roth IRA contributions throughout the year. This will help you stay informed about your total contributions and avoid exceeding the limit. Use a spreadsheet, a dedicated financial tracking app, or your brokerage account’s contribution tracking feature.

- Estimate Your Income:Before making contributions, estimate your adjusted gross income (AGI) for the year. This will help you determine if you are eligible to contribute the full amount or if you need to adjust your contributions. Remember, the income limits apply to your AGI, not your gross income.

- Consider Making Smaller, More Frequent Contributions:Instead of making a large lump sum contribution at the end of the year, consider spreading out your contributions throughout the year. This will help you stay within the limit and avoid exceeding it. For example, you could make monthly contributions based on your budget.

- Adjust Your Contributions as Needed:If your income changes throughout the year, you may need to adjust your contributions accordingly. For instance, if you receive a bonus or a raise, you may need to reduce your contributions to avoid exceeding the limit.

Managing Contributions Throughout the Year

Managing your contributions throughout the year can help you avoid exceeding the limit and maximize your retirement savings.

- Set a Budget:Determine how much you can afford to contribute to your Roth IRA each year. Factor in your income, expenses, and other financial goals.

- Automate Contributions:Set up automatic contributions from your checking account to your Roth IRA. This will ensure you make regular contributions without having to remember to do it manually.

- Review Your Contributions Regularly:Periodically review your contributions to ensure they are still aligned with your budget and financial goals. You may need to adjust your contribution amount based on changes in your income, expenses, or other financial priorities.

Importance of Accurate Record-Keeping and Staying Informed

Accurate record-keeping and staying informed about contribution limits and eligibility requirements are crucial to avoid exceeding the limit.

- Keep Detailed Records:Maintain detailed records of all your Roth IRA contributions, including the date, amount, and any related documentation. This will help you track your contributions and ensure you are within the limit.

- Stay Updated on Contribution Limits:The Roth IRA contribution limit can change annually, so it’s important to stay updated on the latest limits. You can find this information on the IRS website or through your financial advisor.

- Review Eligibility Requirements:Make sure you understand the income eligibility requirements for Roth IRA contributions. If your income exceeds the limit, you may not be eligible to contribute the full amount or at all.

Final Summary

Exceeding the Roth IRA contribution limit can have significant consequences, including penalties and tax implications. Understanding the contribution limits and income thresholds, and adhering to them, is essential for maximizing your retirement savings and avoiding unwanted financial burdens. By carefully planning your contributions and seeking professional advice when necessary, you can ensure your Roth IRA contributions are made correctly and that you reap the benefits of tax-free withdrawals in retirement.

FAQ Compilation

What happens if I exceed the Roth IRA contribution limit and don’t withdraw the excess contribution?

If you don’t withdraw the excess contribution by the tax filing deadline, you’ll be subject to a 6% penalty on the excess amount each year the excess contribution remains in the account. You’ll also be taxed on the excess contribution as if it were a taxable distribution.

Can I make a Roth IRA contribution if I’m already receiving Social Security benefits?

Yes, receiving Social Security benefits doesn’t affect your eligibility to contribute to a Roth IRA. However, your income may still affect your ability to make full contributions, as mentioned earlier.

What if I’m unsure about my income level and eligibility for Roth IRA contributions?

It’s always best to consult with a qualified tax professional for personalized advice regarding your specific circumstances. They can help you determine your eligibility for Roth IRA contributions and advise on the best strategies for maximizing your retirement savings.