Roth IRA contribution limits and tax implications in 2024 are crucial considerations for individuals seeking to maximize their retirement savings. This year brings adjustments to contribution limits and income thresholds, potentially impacting your ability to take advantage of this popular tax-advantaged retirement account.

Understanding these changes is essential to make informed financial decisions and optimize your retirement planning.

The Roth IRA, unlike its traditional counterpart, allows you to contribute after-tax dollars, meaning your earnings grow tax-free. When you withdraw funds in retirement, both your contributions and earnings are tax-free. However, there are income limitations that may restrict your eligibility for full contributions.

This guide will delve into the details of these limits, explore the tax implications, and highlight the key differences between Roth and Traditional IRAs.

Contents List

Tax Implications of Roth IRA Contributions

Roth IRA contributions are made with after-tax dollars, meaning you’ve already paid taxes on the money you contribute. This has significant tax implications, both in the present and in the future.

Thinking about contributing to a Roth IRA? This information details the Roth IRA contribution limits for 2024.

Tax Advantages of Roth IRA Contributions

One of the most significant advantages of Roth IRAs is that you don’t have to pay taxes on withdrawals of earnings in retirement. This is in contrast to traditional IRAs, where withdrawals are taxed as ordinary income. With a Roth IRA, you can enjoy tax-free growth and withdrawals in retirement, making it a powerful tool for long-term wealth accumulation.

Calculating your income tax can seem complicated. This guide provides a step-by-step process for calculating your income tax in October 2024.

Tax Implications of Withdrawing Contributions and Earnings

While Roth IRA contributions are made with after-tax dollars, withdrawals of both contributions and earnings are tax-free in retirement, provided you meet certain requirements. These requirements include being at least 59 1/2 years old and having held the account for at least five years.

Handling an estate can be complex. This article provides information about the W9 Form requirements for estates in October 2024.

Example:If you contribute $6,500 to a Roth IRA in 2024 and the account grows to $20,000 by the time you retire, you can withdraw the entire $20,000 tax-free, assuming you meet the eligibility requirements.

Want to know how the 2024 tax brackets might impact your retirement savings? This article explains how tax brackets can influence your retirement planning.

Tax Implications of Early Withdrawals

While contributions to a Roth IRA are tax-free, early withdrawals of earnings before age 59 1/2 are generally subject to both taxes and a 10% penalty. However, there are some exceptions to this rule, such as:

- First-time homebuyer expenses

- Qualified educational expenses

- Medical expenses exceeding 7.5% of adjusted gross income

- Disability

- Death

It’s important to consult with a financial advisor or tax professional to determine if your specific situation qualifies for any of these exceptions.

Looking for the best credit card to help you consolidate your debt? This guide will walk you through the top balance transfer credit cards available in October 2024.

Eligibility for Roth IRA Contributions

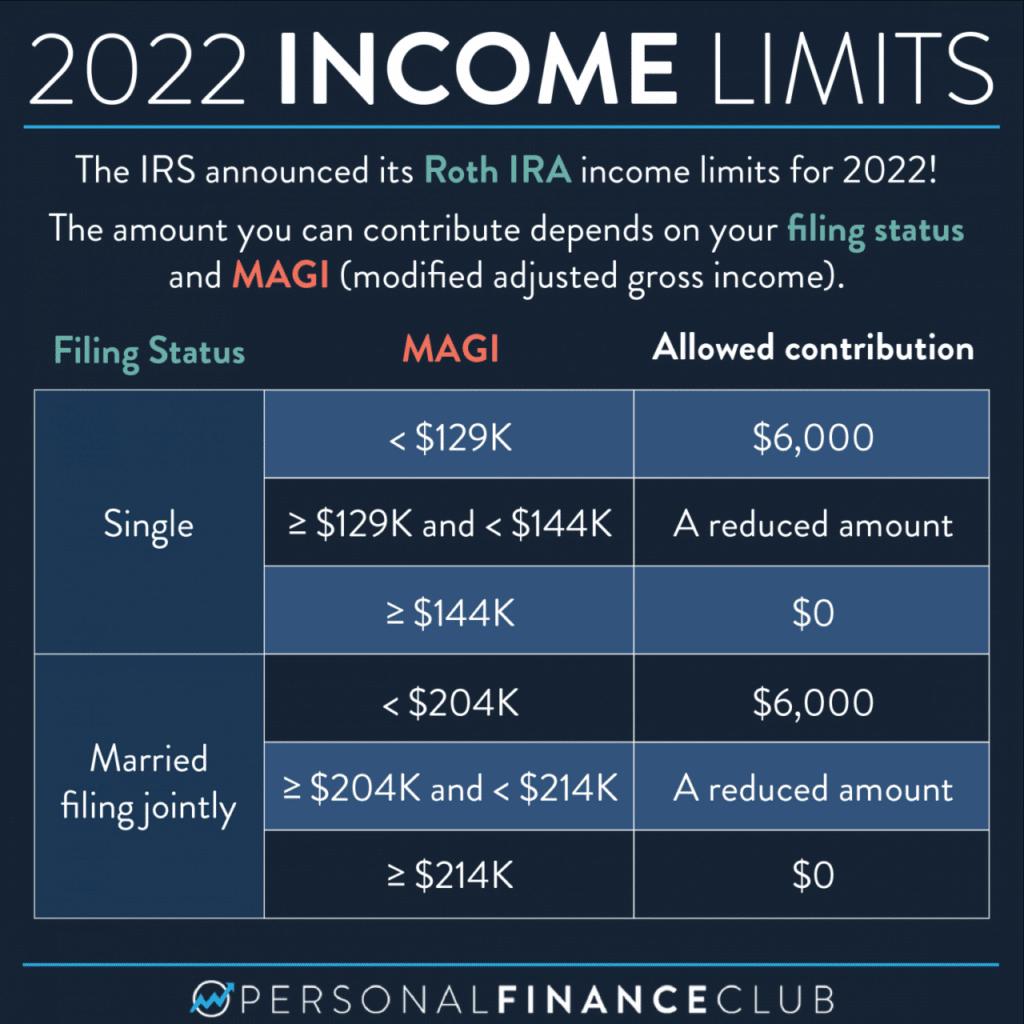

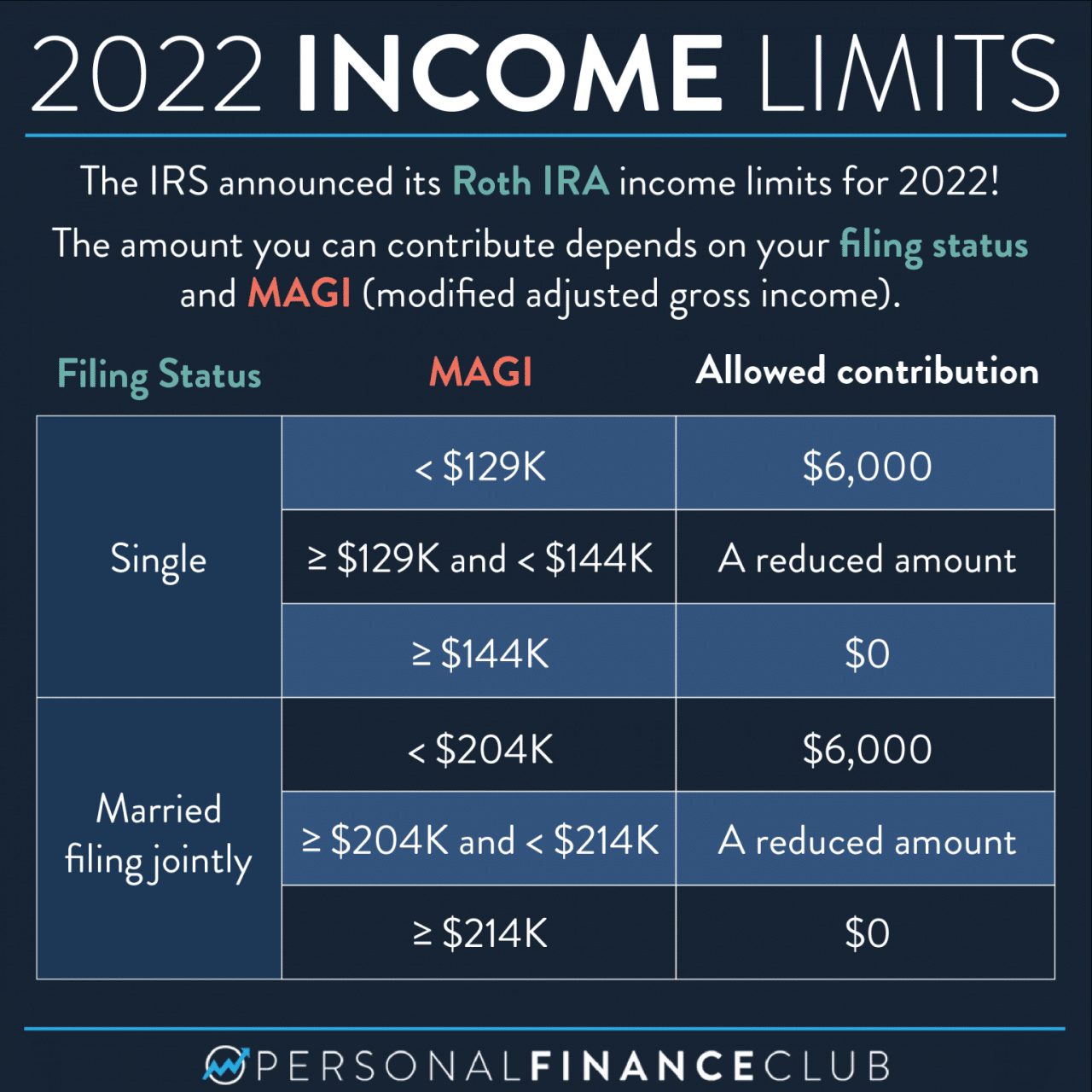

Not everyone is eligible to contribute to a Roth IRA. The IRS has income limitations that determine who can contribute to a Roth IRA. If your income exceeds these limits, you may not be able to contribute to a Roth IRA, or you may be limited in the amount you can contribute.

Got good credit and want to find a credit card that rewards you? This list features the best credit cards for people with good credit in October 2024.

Income Limitations for Roth IRA Contributions

The income limitations for Roth IRA contributions in 2024 are based on your modified adjusted gross income (MAGI). Your MAGI is your adjusted gross income (AGI) plus certain deductions that are not allowed for Roth IRA purposes.

Missed the October 2024 tax extension deadline? Don’t panic! This article explains the consequences of missing the deadline and outlines your options for getting back on track.

The MAGI limits for Roth IRA contributions in 2024 are as follows:

| Filing Status | Single Filers | Married Filing Jointly | Head of Household |

|---|---|---|---|

| Phase-out begins at | $153,000 | $228,000 | $183,000 |

| Phase-out ends at | $168,000 | $243,000 | $208,000 |

These limits mean that if your MAGI is below the phase-out beginning amount, you can contribute the full amount to a Roth IRA. If your MAGI is between the phase-out beginning amount and the phase-out ending amount, you can contribute a reduced amount.

Curious about how the latest tax brackets affect your tax liability? This tax calculator can help you determine your tax bracket and estimate your tax liability in October 2024.

And if your MAGI is above the phase-out ending amount, you cannot contribute to a Roth IRA.

Filing taxes as a married couple filing separately? This article explains the standard deduction for married filing separately in 2024.

Planning for Retirement with a Roth IRA

A Roth IRA can be a powerful tool for building a secure and comfortable retirement. Unlike traditional IRAs, Roth IRA contributions are made with after-tax dollars, allowing you to enjoy tax-free withdrawals in retirement. This means you can enjoy your hard-earned savings without worrying about tax implications.

Filing taxes as a married couple filing separately in 2024? This guide breaks down the tax brackets for married filing separately in 2024.

Benefits of a Roth IRA for Retirement Planning

The Roth IRA offers several advantages that make it an attractive retirement savings option.

Planning a trip and want to maximize your rewards? This list highlights the best credit cards for travel rewards in October 2024.

- Tax-Free Withdrawals in Retirement:One of the most significant benefits of a Roth IRA is the ability to withdraw your contributions and earnings tax-free in retirement. This can be a substantial advantage, especially if you expect to be in a higher tax bracket during retirement.

If you’re a business owner, you need to understand the requirements for the W9 Form in October 2024. This article will provide you with all the information you need to complete the form correctly.

- Potential for Growth:Roth IRA contributions can grow tax-deferred, allowing your investments to compound over time. This can lead to significant wealth accumulation over the long term, potentially exceeding the amount you initially contributed.

- Flexibility:Roth IRAs offer flexibility in terms of withdrawal options. You can withdraw your contributions at any time, tax-free and penalty-free. However, withdrawing earnings before age 59 1/2 generally incurs taxes and a 10% penalty.

Building a Tax-Free Retirement Nest Egg with Roth IRA Contributions

A Roth IRA can be a cornerstone of a tax-free retirement nest egg. By consistently contributing to a Roth IRA throughout your working years, you can accumulate a substantial amount of tax-free savings.

For example, let’s say you start contributing $6,500 annually to a Roth IRA at age 25 and earn an average annual return of 7%. By the time you reach age 65, your Roth IRA balance could grow to over $700,000. This entire amount would be tax-free, allowing you to enjoy a comfortable retirement without worrying about tax bills.

Hypothetical Retirement Plan with Roth IRA Contributions, Roth IRA contribution limits and tax implications in 2024

Here’s a hypothetical retirement plan that incorporates Roth IRA contributions: Scenario:A 30-year-old individual, Sarah, wants to build a comfortable retirement nest egg. She earns an annual salary of $60,000 and is currently contributing $6,500 annually to a Roth IRA. Retirement Plan:

- Roth IRA Contributions:Sarah continues contributing the maximum amount of $6,500 annually to her Roth IRA.

- 401(k) Contributions:Sarah also participates in her employer’s 401(k) plan, contributing 10% of her salary, or $6,000 annually.

- Investment Strategy:Sarah invests her Roth IRA contributions in a diversified portfolio of stocks, bonds, and real estate investment trusts (REITs) with a long-term growth focus.

- Retirement Goal:Sarah aims to retire at age 65 with a retirement nest egg of $1.5 million.

Projected Outcome:

Planning to save for retirement? You might be wondering about the maximum contribution you can make to your 401(k) in 2024. This article can help you understand the contribution limits and make the most of your retirement savings.

- Based on a conservative annual return of 7%, Sarah’s Roth IRA balance could reach approximately $500,000 by age 65. This amount would be tax-free.

- Her 401(k) balance, assuming a similar return, could reach approximately $600,000 by age 65. These withdrawals would be taxed as ordinary income in retirement.

- Combined, Sarah’s retirement savings could reach $1.1 million by age 65, exceeding her retirement goal of $1 million. This demonstrates the power of consistent Roth IRA contributions and a diversified investment strategy.

Last Point: Roth IRA Contribution Limits And Tax Implications In 2024

Navigating the complexities of Roth IRA contribution limits and tax implications can be daunting. By understanding the nuances of this popular retirement savings strategy, you can make informed decisions that align with your financial goals. Remember to consult with a qualified financial advisor to personalize your retirement plan and ensure you’re taking full advantage of the benefits available to you.

The path to a comfortable and financially secure retirement starts with a well-informed approach, and the Roth IRA can play a significant role in achieving your financial aspirations.

Key Questions Answered

What happens if I contribute more than the Roth IRA limit in 2024?

If you contribute more than the limit, you’ll be subject to a 6% penalty on the excess contribution. This penalty applies each year until the excess is removed. It’s crucial to stay within the limits to avoid these penalties.

Can I contribute to a Roth IRA and a Traditional IRA simultaneously?

Yes, you can contribute to both a Roth IRA and a Traditional IRA in the same year. However, there are combined contribution limits. For 2024, the combined limit is $7,500 for individuals and $15,000 for couples filing jointly.

Can I withdraw contributions from a Roth IRA without penalty?

Yes, you can withdraw your contributions from a Roth IRA at any time without penalty. However, you will need to pay taxes on any earnings that have accumulated within the account.

Looking for the maximum contribution limit for your 401(k) in 2024? This information can help you understand the contribution limits for 2024.

Curious about the maximum amount you can contribute to a Roth IRA in 2024? This article provides the Roth IRA contribution limit for 2024.