Roth IRA contribution limits for 2024 for married couples present a unique opportunity to maximize retirement savings while enjoying tax-free withdrawals in the future. Understanding these limits and how they might affect your contributions is crucial for effectively planning your financial future.

Whether you’re just starting out or have been contributing for years, this guide will provide insights into the intricacies of Roth IRA contributions for married couples.

The maximum amount a married couple can contribute to a Roth IRA in 2024 is $15,500. However, this limit might be impacted by income restrictions, with certain income thresholds reducing or even eliminating eligibility for full contributions. The age of the couple also plays a role, as individuals aged 50 and older are allowed to make additional “catch-up” contributions, increasing their maximum contribution limit.

It’s essential to carefully consider these factors when determining your contribution strategy.

Contents List

Roth IRA Contribution Limits for 2024

For married couples, the Roth IRA offers a valuable opportunity to save for retirement while potentially avoiding taxes on withdrawals in the future. Understanding the contribution limits and any applicable income restrictions is crucial for maximizing your retirement savings potential.

Contribution Limits

The maximum amount a married couple can contribute to Roth IRAs in 2024 is $12,500 per person, totaling $25,000 for the couple. This limit applies regardless of whether both spouses are working or if one spouse is a stay-at-home parent.

Businesses have their own tax deadlines, and October 2024 is no exception. To avoid any penalties, it’s essential to be aware of the deadline for filing your business taxes. You can find all the details in this article: October 2024 tax deadline for businesses.

Staying organized and meeting deadlines is crucial for any business owner.

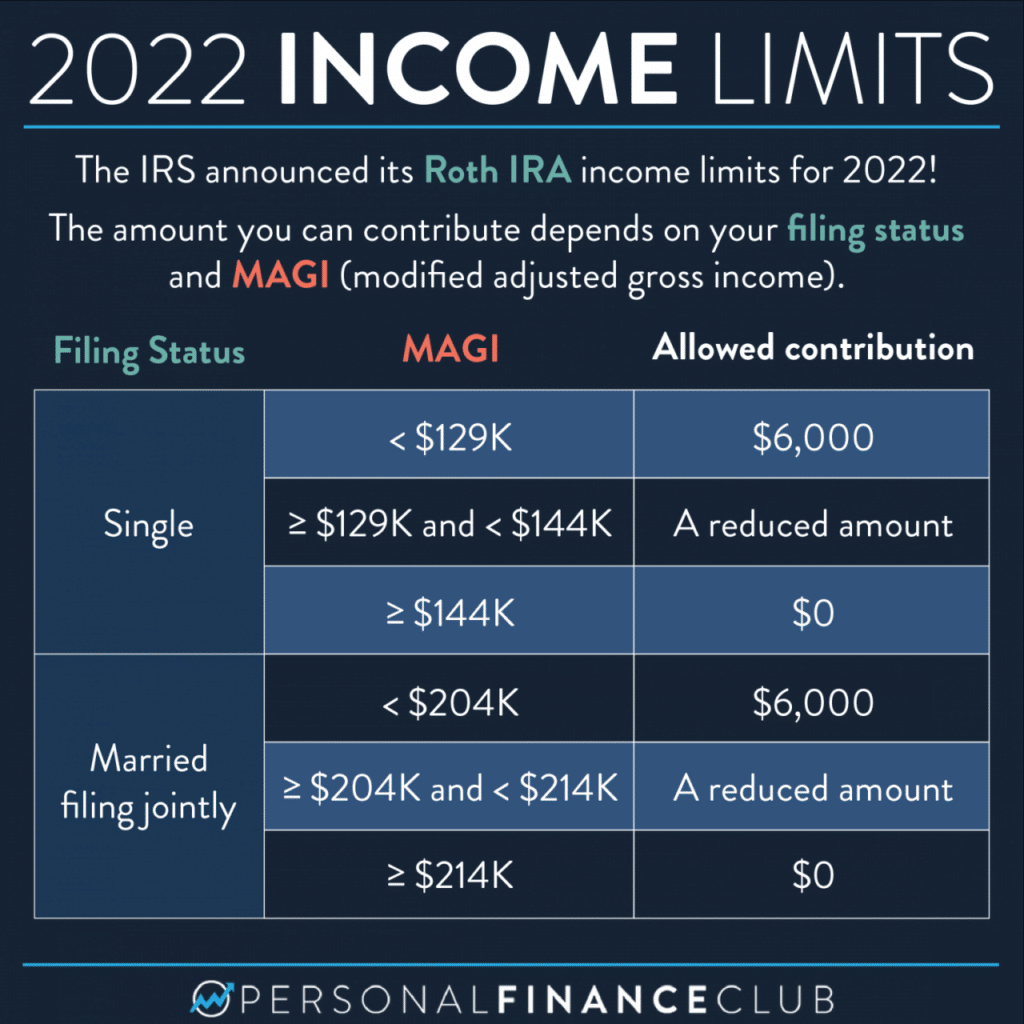

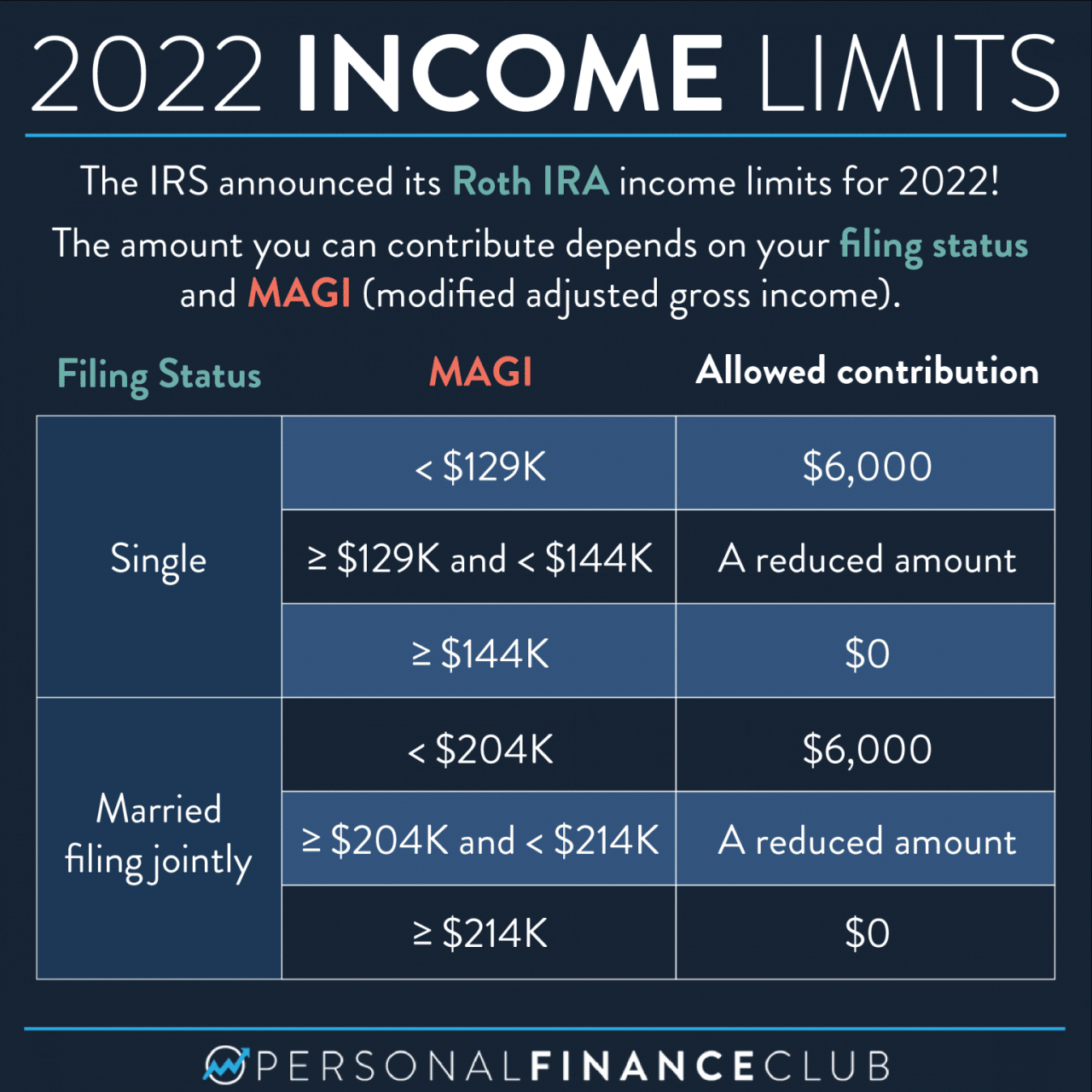

Income Limits

It’s important to note that Roth IRA contributions are subject to income limitations. For 2024, if your modified adjusted gross income (MAGI) as a married couple filing jointly exceeds $228,000, you are phased out of Roth IRA contributions. This means you may not be able to contribute the full amount or may not be eligible to contribute at all.

Contribution Limits Based on Age

While the general contribution limit is $12,500 per person, there are some age-related considerations. If you are 50 years or older in 2024, you can contribute an additional $1,500 per person, known as the “catch-up” contribution. This means you could contribute up to $14,000 per person or $28,000 for the couple.

Saving for retirement is crucial, and a Roth IRA is a great way to do it. But how much can you contribute in 2024? This article will answer that question: How much can I contribute to a Roth IRA in 2024.

Knowing your contribution limit is important for planning your financial future and maximizing your retirement savings.

Rules for Married Couples

Here are some specific rules for married couples contributing to Roth IRAs:

- Each spouse can contribute to their own Roth IRA, up to the annual limit of $12,500 (or $14,000 with the catch-up contribution).

- You can contribute to a Roth IRA even if your spouse doesn’t.

- If one spouse is ineligible for a Roth IRA due to income limitations, the other spouse can still contribute, provided they meet the income requirements.

- You can choose to contribute to a traditional IRA instead of a Roth IRA if your income exceeds the Roth IRA limits.

Benefits of Roth IRA Contributions

A Roth IRA offers a unique advantage in retirement planning by allowing you to contribute after-tax dollars, which then grow tax-free. This means you can withdraw your contributions and earnings tax-free in retirement. This can be particularly beneficial for married couples as they plan for their future financial security.

If you’re over 50, you may be eligible for catch-up contributions to your Roth IRA. This means you can contribute a higher amount than those under 50. To learn more about the catch-up contribution limit for Roth IRAs in 2024, check out this article: How much can I contribute to a Roth IRA in 2024 if I am over 50.

Maximize your retirement savings by taking advantage of these catch-up contributions.

Tax-Free Withdrawals in Retirement

Roth IRA contributions offer the significant advantage of tax-free withdrawals in retirement. This means that when you withdraw your contributions and earnings in retirement, you won’t have to pay any taxes on them. This can save you a considerable amount of money in taxes over your lifetime, especially if you expect to be in a higher tax bracket in retirement.

If you’re considering a Roth IRA, it’s essential to know the income limits for contributions in 2024. These limits can affect your eligibility for a Roth IRA. You can find the latest information on income limits in this article: What are the income limits for Roth IRA contributions in 2024.

Make sure you understand the income limits before making any contributions.

Saving for Retirement as a Married Couple

Roth IRAs can be a powerful tool for married couples looking to save for retirement. Since each spouse can contribute up to the annual limit, a couple can contribute a total of $12,500 in 2024, potentially accumulating a significant nest egg over time.

Corporations also need to be aware of the W9 form deadline. If you’re a corporation, you’ll want to make sure you’re compliant with the deadline for October 2024. This article will provide you with the necessary information: W9 Form October 2024 for corporations.

Stay organized and make sure you meet the deadline to avoid any issues.

Comparison with Traditional IRA Contributions

While both Roth and Traditional IRAs offer tax advantages, the benefits are structured differently. With a Traditional IRA, contributions are tax-deductible, leading to immediate tax savings. However, withdrawals in retirement are taxed. Conversely, Roth IRA contributions are not tax-deductible but grow tax-free, resulting in tax-free withdrawals in retirement.The choice between Roth and Traditional IRA depends on your individual circumstances and financial goals.

If you expect to be in a higher tax bracket in retirement, a Roth IRA may be more beneficial. However, if you expect to be in a lower tax bracket in retirement, a Traditional IRA may be more advantageous.

Planning for your financial future means understanding the contribution limits for your retirement accounts. Knowing how much you can contribute to an IRA in 2024 and 2025 is crucial for making informed decisions about your savings. This article provides the details you need: Ira contribution limits for 2024 and 2025.

Don’t wait to start saving for retirement; the sooner you begin, the better.

Potential Drawbacks or Limitations

While Roth IRAs offer numerous benefits, there are some potential drawbacks to consider:* Income Limits:There are income limitations for contributing to a Roth IRA. If your income exceeds a certain threshold, you may not be able to contribute to a Roth IRA, or your contributions may be limited.

Tax filing deadlines can be confusing, especially when it comes to extensions. If you’re looking for information on tax filing extensions for October 2024, this article will be helpful: Tax filing extensions for October 2024. Plan ahead and make sure you understand your options for extending your tax filing deadline.

Limited Access to Funds

When it comes to your traditional 401k, understanding the contribution limits for 2024 is essential. These limits can vary, so it’s important to stay informed. You can find the latest information in this article: 401k contribution limits for 2024 for traditional 401k.

Knowing the limits will help you plan your retirement savings strategy effectively.

Unlike a traditional IRA, Roth IRA contributions are not tax-deductible, and early withdrawals before age 59 1/2 are subject to taxes and penalties. It’s important to weigh the pros and cons carefully and consult with a financial advisor to determine the best strategy for your retirement savings goals.

Strategies for Maximizing Contributions

Maximizing your Roth IRA contributions as a married couple can significantly enhance your long-term financial security. By strategically planning and prioritizing these contributions, you can benefit from tax-free growth and withdrawals in retirement.

Saving and Budgeting Strategies

Effective saving and budgeting strategies are essential for maximizing Roth IRA contributions. By understanding your income and expenses, you can identify areas where you can reduce spending and allocate more funds towards your retirement savings.

Figuring out your mileage rate for business travel can be a bit of a headache, but thankfully, there’s a resource to help you out. You can find the latest mileage rate for October 2024 by checking out this article: How much is the mileage rate for October 2024?

. It’s important to stay up-to-date on these rates, as they can change throughout the year.

- Create a Realistic Budget:Carefully track your income and expenses to identify areas where you can cut back. This could include reducing dining out, entertainment, or subscription services.

- Set Financial Goals:Define your financial objectives, including retirement savings targets. Having clear goals can motivate you to prioritize contributions and track your progress.

- Automate Savings:Set up automatic transfers from your checking account to your Roth IRA. This ensures consistent contributions without requiring manual effort.

- Consider Side Hustles:Explore additional income sources, such as freelancing, consulting, or part-time work, to increase your contribution capacity.

Tracking Contributions and Meeting Annual Limits, Roth IRA contribution limits for 2024 for married couples

Staying organized and tracking your contributions is crucial to ensure you maximize your contributions within the annual limits.

- Utilize Online Tools:Many financial institutions offer online tools and mobile apps to track contributions and monitor your account balance.

- Maintain a Spreadsheet:Create a simple spreadsheet to track your contributions, including dates, amounts, and any applicable deductions.

- Review Regularly:Periodically review your contributions to ensure you’re on track to meet the annual limit. Consider adjusting your savings plan if necessary.

Effective Financial Management for Prioritizing Roth IRA Contributions

Married couples can effectively manage their finances to prioritize Roth IRA contributions.

Retirement savings plans can change year to year, so it’s crucial to stay up-to-date on the latest contribution limits. This article will help you compare the IRA contribution limits for 2024 and 2023: Ira contribution limits for 2024 vs 2023.

Knowing the differences can help you make informed decisions about your retirement savings.

- Coordinate Financial Goals:Discuss your financial goals and priorities as a couple to align your savings strategies. This includes determining contribution amounts and timelines.

- Prioritize Needs vs. Wants:Differentiate between essential needs and discretionary wants. This can help you allocate more funds towards your Roth IRA.

- Review Expenses Regularly:Periodically review your spending habits to identify potential areas for savings. This could include negotiating bills, finding cheaper alternatives, or reducing unnecessary expenses.

Eligibility Requirements

In 2024, to contribute to a Roth IRA, you must meet specific eligibility requirements. These include income limitations and other factors that may affect your ability to contribute.

Income Limits for Married Couples

For married couples filing jointly in 2024, the ability to contribute to a Roth IRA is based on their modified adjusted gross income (MAGI). If your MAGI exceeds the limit, you may not be able to contribute the full amount or contribute at all.

The income limits for 2024 are:

If your MAGI is below $228,000, you can contribute the full amount to your Roth IRA.

Estates and trusts have their own unique tax obligations. If you’re managing one, you’ll need to be aware of the tax extension deadline for October 2024. This article provides all the details: Tax extension deadline October 2024 for estates and trusts.

It’s important to stay on top of these deadlines to avoid any penalties.

If your MAGI is between $228,000 and $248,000, you can contribute a reduced amount.

If your MAGI is above $248,000, you cannot contribute to a Roth IRA.

If you’re under 50, you’ll want to know the 401k contribution limit for 2024. This limit can help you plan your retirement savings strategy and maximize your contributions. You can find the latest information in this article: 401k contribution limit 2024 for people under 50.

Start planning for your future today and take advantage of these contribution limits.

Impact of Other Retirement Accounts

Your eligibility for Roth IRA contributions may also be affected by your participation in other retirement accounts, such as 401(k)s or traditional IRAs. While contributions to a Roth IRA are not directly affected by other retirement accounts, your income level can be impacted by these contributions.

This is because your MAGI, which is used to determine your Roth IRA eligibility, is calculated after deducting contributions to traditional IRAs and 401(k)s.

The W9 form is a crucial part of tax compliance, especially for businesses. If you’re wondering about the filing deadline for the W9 form in October 2024, this article has the information you need: W9 Form October 2024 deadline for filing.

Stay organized and make sure you meet the deadline to avoid any potential issues.

Eligibility Rules

To be eligible for Roth IRA contributions, you must:

- Have earned income.

- Be under the age of 72.

- Not be claimed as a dependent on someone else’s tax return.

Investment Options within Roth IRAs: Roth IRA Contribution Limits For 2024 For Married Couples

A Roth IRA offers a wide range of investment options, allowing you to tailor your portfolio to your financial goals and risk tolerance. These options include stocks, bonds, mutual funds, exchange-traded funds (ETFs), and real estate investment trusts (REITs).

If you’re self-employed, you might be wondering about the tax extension deadline for October 2024. The good news is that you have some extra time to file. You can find all the details on the extension deadline in this article: Tax extension deadline October 2024 for self-employed individuals.

It’s always a good idea to plan ahead and make sure you’re aware of the deadlines, so you can avoid any penalties.

Understanding Investment Options

Investing within a Roth IRA involves choosing assets that align with your financial goals and risk tolerance.

Stocks

Stocks represent ownership in publicly traded companies.

- Potential Benefits:Stocks have the potential for higher returns over the long term, making them suitable for investors seeking growth. They can also provide diversification within your portfolio.

- Potential Risks:Stocks are volatile and can experience significant price fluctuations, which could lead to losses in the short term.

Bonds

Bonds represent loans to governments or corporations.

- Potential Benefits:Bonds generally provide a steady stream of income through interest payments and are considered less risky than stocks. They can also help diversify your portfolio.

- Potential Risks:Bonds can lose value if interest rates rise.

Mutual Funds

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets.

- Potential Benefits:Mutual funds offer diversification and professional management, making them suitable for investors who prefer a hands-off approach.

- Potential Risks:Mutual funds can have higher fees than other investment options, and their performance may vary depending on the underlying investments.

Exchange-Traded Funds (ETFs)

ETFs are similar to mutual funds, but they trade on stock exchanges like individual stocks.

- Potential Benefits:ETFs offer diversification and professional management, and they are generally more tax-efficient than mutual funds. They are also typically more affordable than mutual funds.

- Potential Risks:ETFs can be volatile and their performance may vary depending on the underlying investments.

Real Estate Investment Trusts (REITs)

REITs are companies that own and operate income-producing real estate, such as apartment buildings, shopping malls, or office towers.

- Potential Benefits:REITs offer diversification and potential for income through dividends. They can also provide exposure to the real estate market.

- Potential Risks:REITs are subject to the same risks as other real estate investments, such as changes in interest rates, economic conditions, and property values.

Investment Strategies for Married Couples

Married couples should consider their individual financial goals, risk tolerance, and time horizon when choosing investment options.

Your 401k is a key part of your retirement savings plan. But with contribution limits changing every year, it’s essential to know how much you can put in for 2024. This article will help you find the answer: How much can I contribute to my 401k in 2024.

Take advantage of the maximum contribution allowed to maximize your retirement savings.

- Conservative Strategy:Couples seeking stability and income may prefer a conservative strategy that focuses on bonds and low-risk stocks. This strategy is suitable for those who have a short time horizon or a low risk tolerance.

- Moderate Strategy:Couples with a moderate risk tolerance and a longer time horizon may choose a balanced strategy that includes a mix of stocks, bonds, and other assets. This strategy provides potential for growth while managing risk.

- Aggressive Strategy:Couples seeking higher returns and willing to take on more risk may choose an aggressive strategy that focuses on stocks and other growth-oriented investments. This strategy is suitable for those with a long time horizon and a high risk tolerance.

Tax Implications

Contributing to and withdrawing from a Roth IRA has specific tax implications that can significantly impact your financial planning. Understanding these implications is crucial for making informed decisions about your retirement savings.

Tax Treatment of Contributions

Roth IRA contributions are made with after-tax dollars, meaning you’ve already paid taxes on the money before contributing it to the account. This makes Roth IRAs unique compared to traditional IRAs, where contributions are tax-deductible, but withdrawals in retirement are taxed.

Roth IRA contributions are not tax-deductible, but withdrawals in retirement are tax-free.

Tax Treatment of Withdrawals

One of the most attractive features of Roth IRAs is the tax-free nature of qualified withdrawals in retirement. This means you won’t have to pay any federal income tax on the money you withdraw from your Roth IRA after age 59 1/2, as long as you’ve met certain requirements, such as holding the account for at least five years.

Qualified withdrawals from a Roth IRA are tax-free in retirement.

Tax Benefits of Roth IRA Contributions

Contributing to a Roth IRA can offer significant tax benefits, particularly for those who expect to be in a higher tax bracket in retirement. By contributing to a Roth IRA, you’re essentially locking in your current tax rate for future withdrawals.

For individuals who anticipate being in a higher tax bracket in retirement, Roth IRAs can offer substantial tax advantages.

Tax Implications for Married Couples

For married couples, Roth IRA contributions can have a significant impact on their tax liability, depending on their individual income levels and tax bracket. For example, if one spouse has a high income and the other has a lower income, contributing to a Roth IRA for the lower-income spouse can be a tax-efficient strategy.

Contributing to a Roth IRA for the lower-income spouse in a married couple can be a tax-efficient strategy.

End of Discussion

Maximizing your Roth IRA contributions for 2024 requires careful planning and consideration of various factors. By understanding the contribution limits, income restrictions, and available investment options, married couples can make informed decisions to ensure they are taking full advantage of the benefits offered by Roth IRAs.

Remember, the goal is to secure a comfortable retirement while minimizing your tax burden, and Roth IRAs can be a powerful tool to achieve this.

FAQ Insights

What happens if my income exceeds the Roth IRA contribution limits?

If your income exceeds the limits, you may not be eligible for a full Roth IRA contribution. You might be able to contribute a reduced amount or be eligible for a traditional IRA instead. It’s important to consult with a financial advisor to determine the best course of action based on your individual circumstances.

Can I contribute to a Roth IRA if I already have a 401(k)?

Yes, you can contribute to both a Roth IRA and a 401(k) simultaneously. However, you need to ensure that your total contributions don’t exceed the annual contribution limits for each account. It’s recommended to discuss this with a financial advisor to create a balanced retirement savings strategy.

Are there any penalties for early withdrawals from a Roth IRA?

Unlike traditional IRAs, withdrawals from a Roth IRA are tax-free and penalty-free if you meet certain conditions, such as being over 59 1/2 years old or using the funds for qualified expenses like education or a first-time home purchase. Early withdrawals for other purposes may be subject to penalties.